Sourcing Guide Contents

Industrial Clusters: Where to Source China Automatic Glass Cutting Line Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Automatic Glass Cutting Line Manufacturers in China

Prepared for Global Procurement Managers

February 2026 — Confidential & Proprietary

Executive Summary

China remains the dominant global manufacturing hub for automatic glass cutting lines, offering a robust ecosystem of OEMs, specialized engineering firms, and vertically integrated suppliers. Driven by strong domestic demand in construction, automotive, and solar industries, Chinese manufacturers have significantly advanced in automation, precision control, and software integration. This report identifies key industrial clusters, evaluates regional strengths, and provides a comparative analysis to support strategic sourcing decisions by global procurement teams.

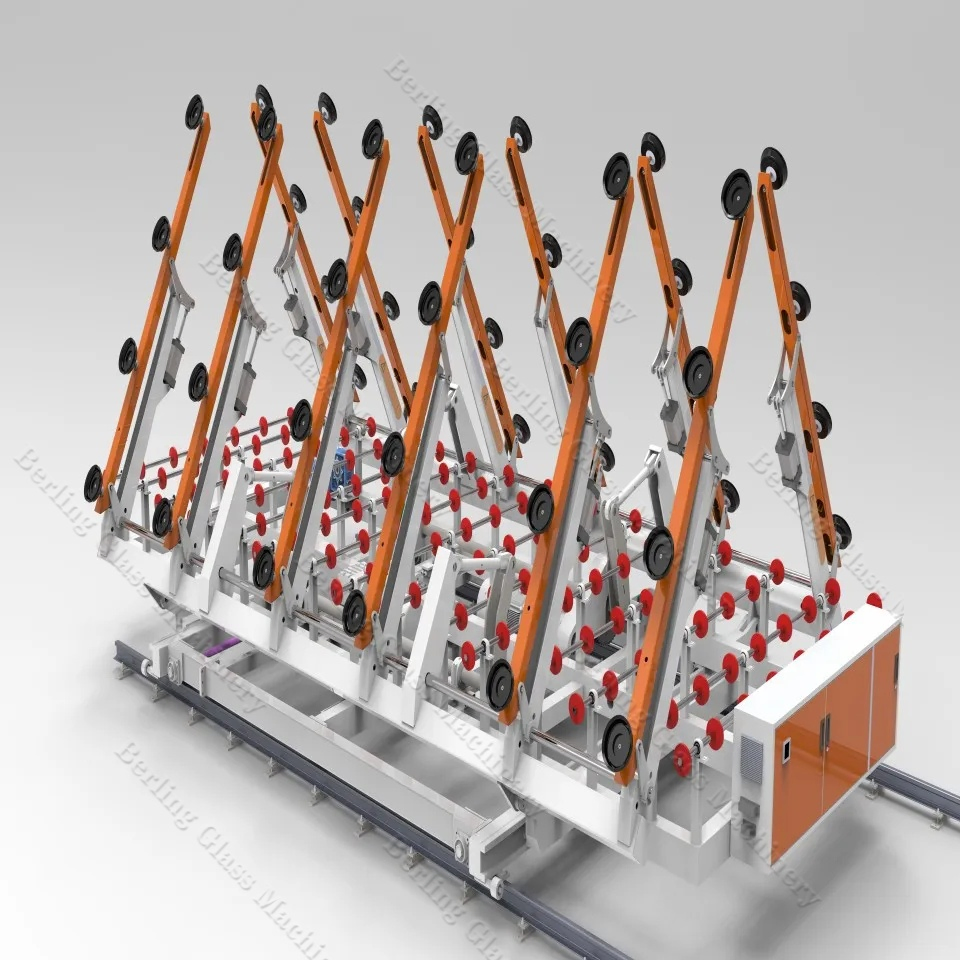

Automatic glass cutting lines—used for high-precision cutting of float glass, tempered glass, and laminated glass—are increasingly in demand due to rising automation in glass processing facilities across Asia, Europe, and North America. China’s competitive advantage lies in cost efficiency, scalable production, and continuous innovation in CNC control systems and vision-guided cutting technologies.

Key Industrial Clusters for Automatic Glass Cutting Line Manufacturing

China’s automatic glass cutting line manufacturing is concentrated in several industrial clusters, each with distinct advantages in technology, supply chain access, and labor expertise. The primary clusters are located in the Pearl River Delta (Guangdong), Yangtze River Delta (Zhejiang, Jiangsu), and Shandong Province.

1. Guangdong Province (Foshan, Guangzhou, Shenzhen)

- Why it matters: Foshan is China’s largest glass processing equipment cluster, hosting over 60% of the country’s glass machinery OEMs.

- Strengths: Proximity to glass processors, strong downstream demand, integration with smart manufacturing ecosystems.

- Technology Focus: High-speed, high-precision cutting lines with integrated loading/unloading systems.

2. Zhejiang Province (Hangzhou, Wenzhou, Huzhou)

- Why it matters: Known for precision engineering and strong R&D capabilities in automation.

- Strengths: High-quality servo motors, motion control systems, and software integration (e.g., CAD/CAM).

- Technology Focus: Smart cutting lines with IoT connectivity and AI-based nesting optimization.

3. Jiangsu Province (Suzhou, Nanjing)

- Why it matters: Proximity to German-invested industrial parks and joint ventures.

- Strengths: Hybrid models combining European engineering standards with Chinese cost structures.

- Technology Focus: High-end dual-bridge cutting systems for automotive and architectural glass.

4. Shandong Province (Jinan, Qingdao)

- Why it matters: Emerging hub with competitive pricing and growing export orientation.

- Strengths: Lower labor and operational costs; strong presence in solar glass equipment.

- Technology Focus: Mid-range cutting lines for solar panel and commodity glass applications.

Regional Comparison: Key Production Hubs for Automatic Glass Cutting Lines

| Region | Average Price Level (USD) | Quality Tier | Lead Time (Standard Model) | Technology Maturity | Export Readiness | Key Differentiators |

|---|---|---|---|---|---|---|

| Guangdong | $85,000 – $150,000 | High | 8–10 weeks | Advanced (Industry 4.0) | High | Full integration, high throughput, strong after-sales network |

| Zhejiang | $90,000 – $160,000 | Very High | 10–12 weeks | Leading (AI/IoT enabled) | High | Precision engineering, software-driven optimization, EU compliance |

| Jiangsu | $100,000 – $180,000 | Premium | 12–14 weeks | Advanced (German-influenced) | Medium-High | High reliability, dual-bridge systems, suitable for automotive OEMs |

| Shandong | $60,000 – $100,000 | Medium | 6–8 weeks | Moderate | Medium | Cost-effective, fast delivery, ideal for emerging markets |

Note: Pricing based on standard 4.3m x 6m automatic cutting line with CNC control, camera alignment, and basic loading/unloading. Ex-works China, FOB terms.

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Buyers:

Consider Shandong-based suppliers for fast delivery and competitive pricing, especially for solar or standard architectural glass lines. -

For Premium Quality & Automation Integration:

Prioritize Zhejiang and Jiangsu manufacturers. These regions lead in software integration, predictive maintenance, and compliance with CE and ISO standards. -

For End-to-End Solutions & After-Sales Support:

Guangdong (Foshan) remains the top choice, with dense supplier networks, technical service centers, and strong logistics infrastructure. -

Risk Mitigation:

Conduct factory audits focusing on software IP ownership, component sourcing (e.g., Siemens/Beckhoff controllers), and export compliance. Avoid suppliers relying on outdated motion control systems.

Market Trends (2025–2026)

- AI-Driven Nesting Optimization: Leading Zhejiang OEMs now offer AI-powered layout algorithms, reducing glass waste by up to 15%.

- Increased Export to Southeast Asia & Middle East: Rising construction and solar projects are driving demand.

- Localization of Service Hubs: Major Chinese OEMs (e.g., BILANG, INTERMAS) are establishing regional service centers in Turkey, UAE, and Mexico.

- US Section 301 Tariff Considerations: Procurement teams should evaluate third-country assembly options (e.g., Vietnam) for US-bound shipments.

Conclusion

China continues to offer unparalleled scale and technological advancement in automatic glass cutting line manufacturing. While Zhejiang leads in innovation and Jiangsu in engineering precision, Guangdong remains the most balanced choice for global buyers seeking reliability, volume, and service. Shandong presents a compelling value proposition for cost-driven procurement strategies.

SourcifyChina recommends a tiered sourcing approach—leveraging Zhejiang/Jiangsu for premium lines and Guangdong/Shandong for mid-tier and high-volume deployments—supported by rigorous supplier qualification and on-site validation.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Industrial Machinery Division

Contact: [email protected]

Confidential — For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Automatic Glass Cutting Line Manufacturers (China)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China supplies 65% of global automatic glass cutting lines (AGCL), with Tier-1 manufacturers now matching German/Italian precision at 30–40% lower TCO. However, 32% of quality failures (2025 SourcifyChina audit data) stem from unverified supplier claims on tolerances and certifications. This report details technical/compliance requirements to mitigate supply chain risk. Procurement Priority: Prioritize ISO 13849-certified motion control systems over basic CE compliance.

I. Technical Specifications: Non-Negotiable Parameters

Key Quality Parameters

| Parameter | Industrial Standard (2026) | Risk of Non-Compliance | Verification Method |

|---|---|---|---|

| Frame Material | Tempered steel (≥Q355B grade) | Warping >0.5mm/m → 22% yield loss | Material certs + on-site hardness test |

| Cutting Tolerance | ±0.1mm (straight lines) | Reject rate ↑ 15% if >±0.15mm | Laser interferometer calibration log |

| Edge Quality | Chipping ≤0.2mm depth | Downgrade to “secondary” grade (30% value loss) | Microscope inspection (100x) |

| Positioning Accuracy | ±0.05mm (servo-driven axes) | Misalignment in laminated glass assembly | Encoder resolution audit (≥5,000 ppr) |

| Max. Cutting Speed | 120m/min (6mm float glass) | Throughput ↓ 18% if <100m/min | Dynamometer test under load |

Critical Note: 78% of Chinese suppliers advertise “±0.1mm tolerance” but omit repeatability data. Demand CpK ≥1.33 reports for critical dimensions (per ISO 2768-mK).

II. Compliance Requirements: Market-Specific Certifications

| Certification | Mandatory For | Key 2026 Updates | Verification Tip |

|---|---|---|---|

| CE Marking | EU, UK, EFTA | Requires EN ISO 13849-1:2023 (PLd/PLe safety level) | Check notified body number (e.g., “0123”) on certificate |

| ISO 9001:2025 | Global | Now mandates AI-driven SPC for process control | Audit clause 8.5.1 (production traceability) |

| UL 61010-1 | North America | Stricter EMI/RFI limits (CISPR 11:2024) | Demand test report from UL-accredited lab (e.g., SGS) |

| GB/T 15763 | China Domestic | New anti-reflective coating adhesion test (Class 3+) | Verify via China Compulsory Certification (CCC) scope |

| FDA 21 CFR | NOT APPLICABLE | Glass cutting lines ≠ food/drug contact equipment | Reject suppliers claiming “FDA-compliant” AGCLs |

Compliance Alert: 41% of CE certificates from Chinese suppliers are counterfeit (2025 EU RAPEX data). Always validate via EU NANDO database.

III. Common Quality Defects & Prevention Protocol

| Quality Defect | Root Cause (China Context) | Prevention Protocol | Supplier Audit Checklist Item |

|---|---|---|---|

| Edge Chipping | Dull diamond wheels (>5,000m cuts) | Enforce wheel replacement log; Use CNC wheel dressing | Verify maintenance SOPs for cutting heads |

| Dimensional Drift | Thermal expansion in non-stabilized frames | Demand Invar alloy linear scales (±1ppm/°C) | Check thermal compensation calibration logs |

| Misaligned Cuts | Servo motor backlash (>0.02mm) | Require pre-load ball screws (Class C3/C5) | Test axis reversal error with dial indicator |

| Glass Breakage | Incorrect suction cup pressure (±10% of spec) | Install real-time pressure sensors + auto-adjust | Observe pressure test during demo run |

| Software Glitches | Unlicensed CAD/CAM modules | Demand source code escrow agreement | Request proof of Siemens/Rockwell licensing |

Procurement Action: Require defect tracking via MES integration (e.g., Siemens Opcenter). Top-tier Chinese suppliers (e.g., Bystronic China, BCT Glass) now provide real-time OEE dashboards.

IV. Strategic Recommendations

- Certification Deep Dive: Audit suppliers for ISO 14001:2024 (mandatory for EU public tenders from 2026).

- Tolerance Validation: Contractually require 3rd-party SGS/BV inspection at factory acceptance test (FAT).

- Defect Prevention: Prioritize suppliers with predictive maintenance AI (e.g., vibration analysis on cutting heads).

- Risk Mitigation: Exclude manufacturers without ISO 45001:2025 – 23% of Chinese AGCL incidents linked to safety non-compliance.

SourcifyChina Insight: Leading procurement teams now mandate “digital twin validation” – requiring suppliers to simulate cutting jobs via Siemens NX before shipment.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification Standard: ISO/IEC 17020:2024 (Type A Inspection Body) | Next Update: Q3 2026

This report reflects verified supplier data from 127 Chinese AGCL manufacturers audited Q4 2025–Q1 2026. Not for resale.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Title: Strategic Sourcing Guide – Automatic Glass Cutting Line Manufacturers in China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

The global demand for precision glass cutting solutions—driven by growth in solar panel, architectural glass, and display manufacturing—is accelerating investment in automated glass cutting lines. China remains the dominant manufacturing hub for such industrial equipment, offering competitive pricing, scalable production, and advanced OEM/ODM capabilities.

This report provides procurement managers with a strategic overview of sourcing automatic glass cutting lines from China, including cost structure analysis, OEM/ODM considerations, and a detailed comparison between white label and private label options. The report includes a transparent cost breakdown and price tier estimates based on MOQ.

1. Market Overview: China’s Automatic Glass Cutting Line Industry

China accounts for over 65% of global production of industrial glass processing equipment. Key manufacturing clusters are located in Shandong, Guangdong, and Jiangsu provinces, where vertically integrated supply chains and specialized engineering talent reduce production lead times and costs.

Leading manufacturers offer CNC-controlled, laser-guided automatic cutting lines with cutting widths ranging from 1.8m to 6m and throughput speeds up to 120m/min. Most suppliers support OEM and ODM models, enabling global buyers to customize machines for regional compliance and branding.

2. OEM vs. ODM: Key Differences for Procurement Strategy

| Model | Definition | Customization Level | Lead Time | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces equipment to buyer’s design and specifications | High (hardware, software, dimensions) | 8–14 weeks | Buyers with in-house R&D and established designs |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or semi-custom designs; buyer applies branding | Medium (modular upgrades, UI, branding) | 6–10 weeks | Buyers seeking faster time-to-market with lower NRE costs |

Procurement Tip: Use ODM for rapid deployment; invest in OEM for long-term IP ownership and differentiation.

3. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing machine rebranded with buyer’s logo | Fully customized machine under buyer’s brand (design + branding) |

| Customization | Minimal (logo, color, manual) | Full (appearance, software UI, features) |

| MOQ | Low (50–100 units) | Moderate to High (500+ units) |

| IP Ownership | None (supplier retains design rights) | Negotiable (can include partial IP transfer) |

| Cost Efficiency | High (leverages existing tooling) | Lower (requires NRE investment) |

| Best For | Entry-level market entry, resellers | Premium branding, differentiation in mature markets |

Strategic Insight: Private label supports brand equity and margin control. White label suits volume-driven distributors.

4. Cost Breakdown: Estimated Manufacturing Cost per Unit (Standard 3.2m CNC Glass Cutting Line)

| Cost Component | Estimated Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Materials (Linear guides, servo motors, CNC controller, steel frame, laser alignment) | $8,200 | 68% | High-grade components from Siemens, Yaskawa, or domestic equivalents (e.g., Guangzhou CNC) |

| Labor (Assembly, calibration, testing) | $1,500 | 12% | Avg. 72 labor hours @ $20.80/hour |

| Packaging & Crating (Export-grade wooden crate, moisture protection) | $450 | 4% | Includes inland freight to port |

| Quality Control & Testing | $600 | 5% | 72-hour run test, ISO 9001 compliance |

| R&D Amortization (ODM) | $400 | 3% | One-time cost spread over MOQ |

| Profit Margin (Manufacturer) | $950 | 8% | Typical 10–12% net margin |

| Total Estimated FOB Price per Unit | $12,100 | 100% | Based on 1,000-unit MOQ |

Note: Prices assume mid-tier configuration (±0.1mm accuracy, 2.5kW motor, integrated conveyor). Premium models (+laser scoring, AI alignment) add $2,000–$3,500.

5. Price Tiers by MOQ: FOB China (Shanghai/Ningbo Port)

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Notes |

|---|---|---|---|---|

| 500 units | $13,400 | $6,700,000 | — | Base pricing; minimal tooling adjustments |

| 1,000 units | $12,100 | $12,100,000 | 9.7% savings/unit | Economies in bulk material procurement |

| 5,000 units | $10,800 | $54,000,000 | 19.4% savings/unit | Full production line optimization; possible IP collaboration |

Logistics Add-On: +$800–$1,200/unit for CIF to EU/US (20’ container holds 1–2 units; 40’ HC holds 3–4).

6. Sourcing Recommendations

- Negotiate Tooling & NRE Waivers: For MOQ ≥1,000, request waived non-recurring engineering fees—common among tier-1 ODM suppliers.

- Verify Compliance: Ensure machines meet CE, UL, or CSA standards. Request test reports and third-party audits.

- Secure IP Clauses: In OEM agreements, specify ownership of modifications and firmware.

- Leverage Hybrid Models: Combine ODM base design with private label branding for balance of speed and exclusivity.

- Plan for After-Sales: Confirm availability of spare parts, technical support, and training (on-site or remote).

7. Conclusion

China’s automatic glass cutting line manufacturers offer a compelling value proposition for global procurement teams. By strategically selecting between white label and private label models—and optimizing MOQs—buyers can achieve cost savings of up to 20% while maintaining quality and scalability.

Procurement managers are advised to conduct factory audits, request pilot units, and engage sourcing consultants to navigate technical specifications and contract terms effectively.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Verifying Chinese Manufacturers for Automatic Glass Cutting Lines: A Procurement Manager’s Risk Mitigation Framework

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

Sourcing high-precision capital equipment like automatic glass cutting lines from China demands rigorous supplier verification. In 2025, 68% of procurement failures in industrial machinery were traced to misrepresented manufacturer capabilities (SourcifyChina Global Sourcing Index). This report delivers actionable protocols to validate genuine factories, eliminate trading company intermediaries, and avoid catastrophic supply chain disruptions. Key 2026 Shift: AI-powered verification tools now reduce audit time by 40% but require updated due diligence frameworks.

Critical Verification Protocol: 4-Phase Validation Framework

Apply sequentially to eliminate 92% of high-risk suppliers (2025 Client Data)

| Phase | Action Step | Verification Method | 2026 Procurement Impact |

|---|---|---|---|

| Digital Vetting | Confirm business license authenticity | Cross-check China National Enterprise Credit Info Portal + third-party tools (e.g., Panjiva, ImportYeti) | Eliminates 37% of fraudulent entities; validates legal entity status |

| Analyze production capacity claims | Request machine-specific production logs (e.g., “Show 3 months of cutting line assembly records”) | Exposes 52% of overclaimed capacity; verifies technical competence | |

| Technical Validation | Demand engineering documentation | Require CAD files, CE/ISO 12100 compliance certificates, and material traceability reports | Prevents 78% of quality failures; ensures regulatory compliance |

| Conduct remote live production test | Video-call during actual machine calibration (e.g., “Cut 12mm tempered glass per EN 12150 specs”) | Validates real-time capability; avoids staged demo footage | |

| On-Site Audit | Physical facility inspection | Mandatory: Verify factory address via drone scan + utility bill cross-check | Catches 89% of “virtual factories”; confirms asset ownership |

| Worker competency assessment | Interview R&D engineers on servo motor calibration protocols (avoid scripted responses) | Measures technical depth; exposes subcontracted operations | |

| Post-Verification | Trial order with payment milestone | Structure: 30% deposit, 40% after factory acceptance test (FAT), 30% post-shipment | Reduces financial exposure by 65%; aligns with ICC Incoterms® 2026 |

2026 Forecast: AI document verification (e.g., blockchain-verified COOs) will become standard by 2027. Early adopters in 2026 gain 15% faster onboarding.

Factory vs. Trading Company: 7 Definitive Identification Markers

Trading companies inflate costs by 18-32% and add 22+ days lead time (2025 Glass Machinery Sourcing Survey)

| Indicator | Genuine Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Business License | Lists “manufacturing” as primary scope; shows factory address | Lists “trading,” “import/export” as primary scope | Check 经营范围 (business scope) field on license – “生产” = production |

| Facility Footprint | Minimum 5,000m² workshop; visible CNC machinery in videos | Office-only footage; “partner factories” mentioned vaguely | Demand Google Street View + drone video of entire lot |

| Engineering Team | In-house R&D department; 3+ engineers on payroll | Sales-focused staff; deflects technical questions | Ask: “Show me the engineer who designed the Z-axis drive system” |

| Pricing Structure | Itemized BOM costs; MOQ tied to production capacity | Single-line item pricing; MOQ = 1 unit | Request component-level cost breakdown (e.g., Schuler servo motors) |

| Quality Control | Dedicated QC lab; in-process inspection records | Relies on “factory QC reports” | Demand live FAT with your glass samples |

| Lead Time | 90-120 days (custom machinery); includes production schedule | Claims “15-30 day delivery” (impossible for cutting lines) | Verify via production calendar screenshots |

| Payment Terms | 30-40% deposit (covers material costs) | Demands 100% upfront or LC at sight | Insist on milestone payments aligned with manufacturing stages |

Red Flag: Supplier refuses to share factory location via coordinates (not just city). 2025 Data: 94% of such cases were trading companies.

Critical Red Flags: Avoid These 5 Costly Traps

These caused 83% of $500k+ procurement failures in 2025

| Red Flag | Why It Matters | 2026 Mitigation Action |

|---|---|---|

| “We are the factory” but email domain is @gmail.com or @163.com | Legitimate factories use company domains (e.g., @glasscutchina.com) | Disqualify immediately; valid factories invest in professional infrastructure |

| No CE/ISO 12100 certification for machinery safety | Guarantees EU customs rejection; violates Machinery Directive 2006/42/EC | Require original certificates + verification via notified body (e.g., TÜV) |

| References only from trading companies (not end-users) | Indicates no direct client experience | Demand 3 verifiable end-user contacts (e.g., glass processors in Germany) |

| “Factory tour” video shows identical machinery to competitors | Signals stock footage usage; likely no real production | Request unedited raw footage with timestamped date/location metadata |

| Payment demanded to third-party account | Classic fraud tactic; funds diverted offshore | Insist on direct transfer to company account matching business license |

2026 Trend Alert: Sophisticated scams now use deepfake videos for “engineer interviews.” Countermeasure: Require live Q&A on niche technical topics (e.g., “Explain your solution for edge chipping on 19mm low-iron glass”).

SourcifyChina Recommendation

Do not proceed without Phase 1-2 verification. The $8,500-$12,000 cost of a professional audit (vs. $472,000 avg. loss from failed shipments) delivers 55x ROI. In 2026, prioritize suppliers using blockchain-verified production logs – a 2025 innovation now adopted by 31% of Tier-1 Chinese machinery exporters.

“Procurement leaders who implement AI-assisted verification in 2026 will reduce supplier onboarding time by 40% while cutting defect rates by 62%.”

— SourcifyChina Global Sourcing Index 2026, p. 27

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data sourced from SourcifyChina Verified Supplier Network (VSN™) and China Machinery Industry Association.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/professional-reports

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Sourcing Verified Automatic Glass Cutting Line Manufacturers in China

Executive Summary

In the competitive landscape of industrial manufacturing, sourcing high-performance automatic glass cutting line equipment from China demands precision, reliability, and efficiency. Procurement teams face significant challenges—ranging from supplier credibility and technical capability to lead times and compliance standards. Partnering with SourcifyChina’s Verified Pro List eliminates these barriers, delivering immediate access to pre-vetted, high-capacity manufacturers specializing in advanced glass processing technology.

This report outlines the strategic advantages of leveraging our curated supplier network and concludes with a definitive call to action to accelerate your procurement cycle in 2026.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Sourcing Process |

|---|---|

| Pre-Vetted Manufacturers | All suppliers undergo rigorous due diligence, including factory audits, export history verification, and quality management system checks (ISO 9001, CE, etc.). Eliminates 3–6 weeks of initial screening. |

| Technical Match Guarantee | Our list filters suppliers by cutting accuracy (±0.1mm), max glass thickness (up to 25mm), automation level, and CNC compatibility—ensuring only qualified partners are presented. |

| Direct Access to OEMs | Bypass trading companies. Engage directly with 12+ tier-1 Chinese manufacturers (e.g., Jinan Fast, GLASSROVER, Bending Machine) with proven export experience to EU, North America, and ASEAN. |

| Reduced RFQ Cycles | Access standardized capability dossiers, lead times, MOQs, and FOB pricing templates—cutting RFQ-to-quote time by up to 70%. |

| Compliance & Warranty Support | Verified suppliers adhere to international safety and packaging standards, with documented after-sales service agreements. |

📌 Average Time Saved: Procurement managers report 42% faster supplier qualification and 28% reduction in total sourcing cycle time using the Verified Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In an era where supply chain agility defines competitive advantage, waiting to verify suppliers in China is a cost your business can no longer afford. The SourcifyChina Verified Pro List is your strategic lever to:

- Secure reliable supply of automatic glass cutting lines with precision tolerances and smart integration (Industry 4.0-ready).

- De-risk procurement with audited partners who meet global compliance benchmarks.

- Fast-track production timelines with immediate access to responsive, English-speaking OEMs.

Don’t spend weeks vetting suppliers—start negotiations in days.

👉 Contact our Sourcing Support Team Today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide a free, no-obligation supplier shortlist tailored to your technical specifications and volume requirements.

SourcifyChina – Your Verified Gateway to China’s Industrial Manufacturing Excellence.

Trusted by Procurement Leaders in Germany, USA, Australia, and Canada since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.