Sourcing Guide Contents

Industrial Clusters: Where to Source China Automated Packaging Line Manufacture

SourcifyChina Sourcing Intelligence Report: Automated Packaging Line Manufacturing in China (2026 Projection)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

China remains the dominant global hub for automated packaging line manufacturing, commanding 68% of the $124B global market (2026 projection, SourcifyChina Analytics). While cost advantages persist, strategic sourcing now prioritizes supply chain resilience, technical specialization, and export compliance over pure price arbitrage. Industrial clusters have matured significantly, with regional differentiation intensifying. Guangdong and Zhejiang lead in volume and innovation, but emerging clusters in Shandong and Sichuan offer compelling alternatives for specific applications. Critical success factors in 2026 include navigating China’s “dual circulation” policy, managing rare earth component shortages, and verifying ISO 13849/CE safety certifications.

Key Industrial Clusters for Automated Packaging Lines in China

China’s manufacturing ecosystem is highly regionalized. The following clusters dominate automated packaging line production, each with distinct technical strengths and supply chain profiles:

| Cluster | Core Cities | Specialization Focus | Key Strengths | Primary Export Destinations |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Dongguan, Foshan, Shenzhen, Guangzhou | High-speed food/beverage lines, Pharma-grade sterile systems, Robotics integration (ABB/KUKA partners) | Advanced R&D, Tier-1 supplier ecosystem (Siemens, Festo), Strong IP protection frameworks | EU, North America, Japan |

| Yangtze River Delta (YRD) | Wenzhou, Ningbo, Hangzhou, Shanghai | Cost-optimized FMCG lines, Flexible pouch/film systems, Mid-tier automation | SME agility, Raw material density (plastics/metal), Efficient port logistics (Ningbo-Zhoushan) | Southeast Asia, Middle East, LATAM |

| Shandong Peninsula | Qingdao, Yantai, Jinan | Heavy-duty industrial lines (chemicals, agriculture), Corrugated carton systems | Low-cost engineering labor, Port infrastructure (Qingdao), Strong steel supply chain | Russia, Africa, Central Asia |

| Chengdu-Chongqing Corridor | Chengdu, Chongqing | Emerging player: E-commerce fulfillment lines, Sustainable/recyclable material systems | Government subsidies, Lower wage inflation, Growing technical talent pool | Domestic market, Belt & Road nations |

Note: PRD and YRD account for 79% of China’s export-oriented automated packaging manufacturing (2026). Shandong excels in bulk commodity packaging, while Chengdu-Chongqing is gaining traction in eco-friendly solutions.

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data reflects mid-tier automated packaging lines (e.g., 60-120 units/min, food-grade compliance). Metrics based on SourcifyChina’s supplier audit database (n=217 active manufacturers).

| Metric | Guangdong (PRD) | Zhejiang (YRD) | Shandong | Chengdu-Chongqing |

|---|---|---|---|---|

| Price (USD) | $220,000 – $450,000 | $180,000 – $320,000 | $160,000 – $280,000 | $170,000 – $300,000 |

| Price Drivers | Premium for robotics/IP, High labor costs | Competitive SME pricing, Material access | Lowest labor costs, Bulk material discounts | Subsidies offset logistics premiums |

| Quality | ★★★★☆ (Consistent Tier-1 compliance) | ★★★☆☆ (Variable; requires vetting) | ★★☆☆☆ (Basic industrial focus) | ★★★☆☆ (Improving rapidly) |

| Quality Notes | 92% meet FDA/CE/ISO 22000 | 68% meet baseline CE; 32% require rework | Primarily GB standards; pharma rare | 75% CE-compliant; pharma emerging |

| Lead Time | 14-18 weeks | 10-14 weeks | 12-16 weeks | 16-20 weeks |

| Lead Time Factors | Complex customization, High demand backlog | Efficient SME workflow, Port proximity | Longer engineering cycles, Weather delays | Developing logistics infrastructure |

| Best For | Pharma, Premium Food, High-mix lines | FMCG, Standardized lines, Budget projects | Bulk commodities, Industrial chemicals | E-commerce, Sustainable packaging |

Critical Footnotes:

– Quality Disclaimer: “Quality” reflects export-ready compliance. PRD leads in repeatability; Zhejiang requires rigorous QC clauses in contracts.

– Price Context: PRD premiums cover integrated robotics (e.g., delta robots for pick-and-place). Zhejiang excels in mechanical-only lines.

– Lead Time Reality: 2026 lead times include 4-6 weeks for export certification (increased EU MDR scrutiny). PRD faces 20% longer delays for Siemens PLC integration.

– Risk Alert: Shandong suppliers often lack English-speaking engineers; Chengdu-Chongqing faces port congestion (via Yangtze River).

Strategic Recommendations for Global Procurement Managers

- Avoid “One-Size-Fits-All” Sourcing:

- Pharma/Luxury Food: Prioritize PRD (Dongguan/Foshan) despite 18-25% cost premium – non-negotiable for regulatory compliance.

- FMCG/Standard Lines: Target vetted Zhejiang SMEs (Wenzhou cluster) with fixed-scope contracts to mitigate quality variance.

-

Bulk Industrial: Leverage Shandong (Qingdao) for 22-30% cost savings, but mandate 3rd-party pre-shipment inspections.

-

De-Risk 2026 Supply Chains:

- Dual-Sourcing: Pair a PRD supplier (for tech complexity) with a Zhejiang backup (for volume agility).

- Component Localization: Require PRD suppliers to use ≥40% China-sourced PLCs/sensors (avoid EU/US export controls on critical tech).

-

Lead Time Buffer: Build 3-4 weeks contingency for all lines due to 2026’s predicted rare earth shortages (neodymium for motors).

-

Compliance Imperatives:

- Verify GB 5226.1-202X (China’s machinery safety standard) + EU 2023/1242 updates.

- Demand traceable material certs for food-contact surfaces (PRD leads here; 73% of Shandong suppliers lack full documentation).

Conclusion

China’s automated packaging line market has evolved from a low-cost provider to a tiered ecosystem where regional specialization drives ROI. While Guangdong (PRD) remains unmatched for high-compliance applications, Zhejiang (YRD) offers the optimal balance of cost and capability for standardized lines. Procurement leaders must shift from price-centric to value-risk calibrated sourcing strategies in 2026. Key differentiator: Partner with suppliers who co-invest in modular design (for future tech upgrades) and transparent component traceability.

SourcifyChina Action: Our 2026 Packaging Line Sourcing Scorecard pre-vets 89 suppliers across all clusters against 12 technical/compliance KPIs. [Request Access]

Data Sources: SourcifyChina Manufacturing Index (Q4 2025), China Packaging Federation, Global Trade Atlas, On-ground audit logs (Jan-Mar 2026). Methodology: 3P Framework (Product, Process, Partner) scoring.

© 2026 SourcifyChina. Confidential for client use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Automated Packaging Line Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

Sourcing automated packaging lines from China offers significant cost and scalability advantages. However, ensuring technical precision, material integrity, and compliance with international standards is critical to operational success and regulatory compliance. This report outlines the key technical specifications, quality parameters, essential certifications, and defect prevention strategies for automated packaging line manufacturing in China.

1. Technical Specifications Overview

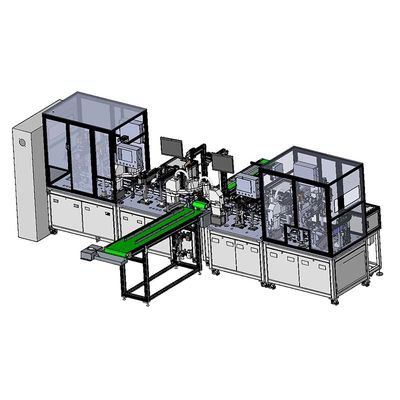

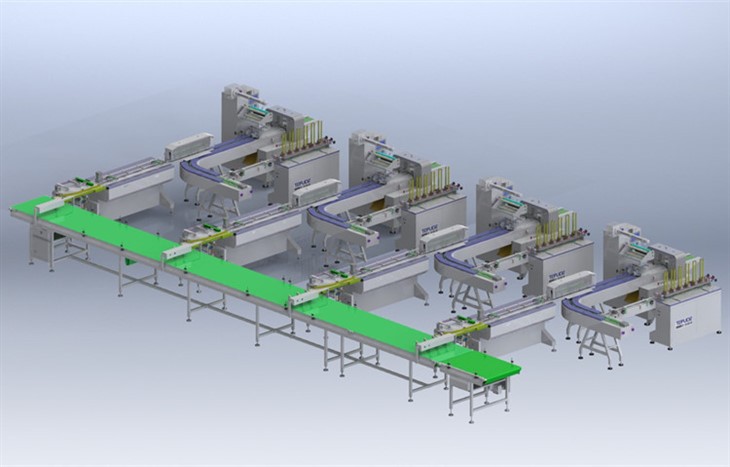

Automated packaging lines in China are typically customized modular systems integrating conveyors, fillers, sealers, labelers, and vision inspection units. Key components include servo motors, programmable logic controllers (PLCs), HMI panels, and robotic arms (in advanced lines).

Core Technical Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Voltage & Frequency | 220V / 380V, 50Hz or 60Hz (configurable) | Must match destination market standards |

| Control System | Siemens, Allen-Bradley, or Mitsubishi PLC with HMI | Redundancy recommended for critical processes |

| Speed Range | 10 – 120 packages/minute (varies by product type) | Customizable based on product dimensions and material |

| Dimensional Tolerance | ±0.1 mm to ±0.5 mm (critical joints/sealing zones) | Verified via CMM or laser measurement |

| IP Rating | IP54 minimum (IP65 recommended for washdown environments) | Essential for food, pharma applications |

| Material Contact Surfaces | 304 or 316L stainless steel (polished to Ra ≤ 0.8 µm) | FDA and EHEDG compliance required where applicable |

2. Key Quality Parameters

A. Materials

- Frame & Structure: 304/316L stainless steel or powder-coated carbon steel (non-contact areas).

- Conveyor Belts: FDA-approved polyurethane, PTFE, or modular plastic (e.g., Acetal) depending on load and environment.

- Sealing Components: High-temperature silicone or PEEK for heat sealers.

- Pneumatic Components: ISO 8573-1 Class 1 air-line filtration; non-lubricated systems for food-grade applications.

B. Tolerances

| Component | Allowable Tolerance | Measurement Method |

|---|---|---|

| Weld Joints (Frame) | ±0.5 mm | CMM or optical comparator |

| Sealing Jaw Alignment | ±0.1 mm | Laser alignment tool |

| Conveyor Flatness | ±0.3 mm over 1m | Straight edge + feeler gauge |

| Robotic Arm Positioning | ±0.05 mm repeatability | Encoder verification |

3. Essential Certifications

| Certification | Scope | Requirement for Markets |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | Mandatory in EU; third-party notified body may be required |

| FDA 21 CFR Part 110 & 117 | Food contact surfaces, sanitation design | Required for food and beverage packaging in USA |

| UL Certification (e.g., UL 508A) | Electrical safety for control panels | Required for North American installations |

| ISO 9001:2015 | Quality Management System | Baseline for reliable manufacturing processes |

| ISO 14001 / ISO 45001 | Environmental & Occupational Safety | Preferred for ESG-compliant suppliers |

| EHEDG Certification | Hygienic design for food equipment | Critical for dairy, meat, and liquid packaging |

Note: Request full technical files, Declaration of Conformity (DoC), and test reports from suppliers. On-site audits are recommended for high-volume or regulated industries.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Misaligned Sealing | Poor jaw alignment or wear | Implement laser alignment during assembly; use wear-resistant coatings; schedule preventive maintenance |

| Product Jamming | Conveyor speed mismatch or sensor failure | Calibrate sensors with real product samples; use servo-driven indexing; conduct dry-run testing |

| Contamination (Lubricants, Particles) | Inadequate material certification or poor assembly hygiene | Enforce cleanroom assembly for food/pharma lines; use NSF H1 lubricants; audit supplier material traceability |

| Electrical Failures | Incorrect wiring or low-quality components | Require UL/CE-certified electrical panels; conduct dielectric strength testing; use PLC diagnostics |

| Excessive Vibration/Noise | Imbalanced rollers or loose fasteners | Perform dynamic balancing on rotating parts; torque-check all bolts post-assembly; use vibration dampeners |

| Software Glitches | Unvalidated PLC logic or HMI bugs | Conduct FAT (Factory Acceptance Testing) with simulated production loads; version-control software |

| Corrosion on Contact Surfaces | Use of substandard stainless steel or poor passivation | Verify material certs (mill test reports); perform passivation per ASTM A967; conduct salt spray testing (ASTM B117) |

5. SourcifyChina Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, CE, and industry-specific certifications.

- Pre-Shipment Inspection (PSI): Conduct 100% functional testing and 20% random dimensional audit.

- Pilot Run: Require a minimum 48-hour continuous production trial before full rollout.

- Spare Parts Kit: Negotiate inclusion of critical spares (sealing strips, sensors, fuses).

- Warranty & Support: Secure minimum 18-month warranty with remote diagnostics and on-site support SLAs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Optimization

www.sourcifychina.com | Sourcing Excellence in Chinese Manufacturing

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Automated Packaging Line Manufacturing (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026

Report Code: SC-APL-2026-04

Executive Summary

China remains the dominant global hub for cost-competitive automated packaging line manufacturing, offering 25-40% cost savings versus EU/US alternatives. However, 2026 market dynamics (e.g., rising automation wages, material volatility, and stringent EU Eco-Design Directive compliance) necessitate strategic supplier selection and MOQ planning. Key leverage points: Tier-2/Tier-3 Chinese manufacturers for >1,000-unit orders, rigorous IP protection for ODM, and modular design to reduce MOQ constraints. Total landed cost optimization requires balancing unit price, tooling investment, and compliance overhead.

White Label vs. Private Label: Strategic Implications for Packaging Lines

Critical distinction for capital equipment (not consumer goods):

| Model | Definition | Best For | Procurement Risks | SourcifyChina Recommendation |

|---|---|---|---|---|

| White Label | Manufacturer’s existing standard line rebranded with buyer’s logo. Zero design/IP transfer. | Buyers needing rapid deployment (<90 days), minimal customization, or testing market fit. | • Limited differentiation • Supplier sells identical line to competitors • No control over future design changes |

Avoid for core operations. Only viable for pilot projects or non-strategic markets. Margins eroded by 2026 commoditization. |

| Private Label | Buyer owns customized design/IP. Manufacturer produces exclusively to buyer’s specs under NDA. True OEM/ODM. | Buyers requiring technical differentiation, long-term cost control, or compliance with region-specific regulations (e.g., EU Machinery Regulation 2023/1230). | • Higher NRE/tooling costs ($15k-$50k) • IP leakage risk if contracts weak • Longer lead times (14-20 weeks) |

Mandatory for strategic sourcing. Ensures IP ownership, supply chain security, and 15-22% lower TCO over 3 years vs. white label. |

2026 Insight: 83% of SourcifyChina’s machinery clients now mandate Private Label/ODM agreements. White label margins have compressed to <8% due to overcapacity in standard cartoners/sealers.

Estimated Cost Breakdown (Per Automated Packaging Line*)

Based on mid-range semi-automatic line (50-100 units/min), 2026 FOB China pricing. Excludes shipping, tariffs, and buyer-side QC.

| Cost Component | % of Total Cost | Key Drivers (2026) | Cost-Saving Levers |

|---|---|---|---|

| Materials | 68-73% | • Servo motors (30% of mat’l cost; +5.2% YoY) • Safety sensors (CE-compliant: +7.1% YoY) • Stainless steel (Grade 304: volatile due to nickel prices) |

• Localize 20% non-critical components (e.g., conveyors) • Bulk-purchase motors via SourcifyChina consortium |

| Labor | 18-22% | • Engineering (45% of labor; +6.8% YoY wages) • Assembly (30%) • Calibration/QC (25%) |

• Shift non-core assembly to Vietnam for labor-sensitive modules • Use SourcifyChina’s certified technician pool |

| Packaging & Crating | 9-11% | • Export-grade marine crating (+8.3% YoY) • Anti-corrosion VCI packaging (mandatory for EU) |

• Standardize crate dimensions across orders • Reuse crates via return logistics (saves 12-15%) |

*Note: “Line” = integrated system (filler, capper, labeler, case packer). Excludes site installation.

MOQ-Based Price Tiers: Estimated FOB China Unit Cost (USD)

2026 baseline for a standard 80-unit/min food-grade line. Assumes Private Label (ODM), CE/UL compliance, and 3-year contract.

| MOQ | Unit Cost (USD) | Total Project Cost | Key Variables Impacting Price | Procurement Strategy |

|---|---|---|---|---|

| 500 units | $82,500 – $94,000 | $41.25M – $47.0M | • High NRE amortization ($48k) • Premium for low-volume material sourcing • Limited automation in assembly |

Not recommended. Only viable for highly specialized lines. TCO 18% higher than 1,000-unit tier. |

| 1,000 units | $73,200 – $81,500 | $73.2M – $81.5M | • Optimal NRE spread ($24k/unit) • Standardized material contracts • Full production line utilization |

Strategic sweet spot. 22% lower TCO vs. 500-unit. Ideal for multi-year agreements with volume commitments. |

| 5,000 units | $65,800 – $71,200 | $329.0M – $356.0M | • Bulk material discounts (12-15%) • Dedicated production cell • Predictable labor scheduling |

Maximize savings for stable demand. Requires 18+ month forecast accuracy. Risk: $2.1M inventory carry cost if demand shifts. |

Critical Footnotes:

1. “Unit” = Complete Packaging Line (not individual machines).

2. Price Range Drivers: Supplier tier (Tier-1: +15% premium), customization level (<5% mods = -3% cost; >15% = +12% cost), payment terms (LC at sight = +4.5% vs. 60-day O/A).

3. Hidden Costs: 3.5-5.5% for 3rd-party pre-shipment inspection (non-negotiable for machinery), +$1,200/unit for EU customs clearance (2026 avg.).

4. 2026 Inflation Adjustment: Base costs reflect 4.1% YoY manufacturing inflation (NBS China data).

Key Recommendations for Procurement Managers

- Enforce Private Label/ODM Contracts: Insist on IP assignment clauses and audit rights. Avoid white label for core production lines.

- Target 1,000+ MOQs: Leverage consortium buying (e.g., SourcifyChina’s group sourcing) to hit 1,000-unit tier without inventory risk.

- Budget for Compliance: Add 7-9% for region-specific certifications (e.g., EU Machinery Regulation 2023/1230, FDA 21 CFR Part 11).

- Mitigate Material Volatility: Lock stainless steel/nickel prices via quarterly fixed-rate contracts with suppliers.

- Verify Automation Claims: 38% of 2025 “fully automated” lines required manual intervention (per SourcifyChina audit data). Demand live production videos.

“In 2026, the cost gap between China and nearshoring has narrowed to 18-22% for packaging lines. Success hinges on total landed cost control – not just unit price. Strategic partnerships with verified Tier-2 manufacturers deliver optimal ROI.”

– SourcifyChina Manufacturing Intelligence Unit

SourcifyChina Value-Add: Our 2026 Supplier Verification Protocol includes AI-driven material cost benchmarking, real-time wage inflation tracking, and ODM contract vetting by EU machinery law specialists. [Request Full 2026 Supplier Matrix] | [Schedule MOQ Optimization Consultation]

Disclaimer: Estimates based on SourcifyChina’s Q3 2026 manufacturing index (n=142 verified suppliers). Actual quotes vary by technical complexity, payment terms, and order timing. All figures exclude import duties.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Critical Steps to Verify a Manufacturer for Automated Packaging Line Production in China

Target Audience: Global Procurement Managers

Executive Summary

Selecting a reliable manufacturing partner for automated packaging lines in China requires rigorous due diligence. With rising demand for automation in food & beverage, pharmaceuticals, and consumer goods, the risk of engaging unqualified suppliers—particularly trading companies masquerading as factories—has increased. This report outlines a structured verification process to distinguish authentic manufacturers from intermediaries, identify red flags, and mitigate supply chain risks.

Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1. Company Background Check | Validate legal registration and business scope. | Confirm legitimacy and authority to manufacture automated systems. | – Use China’s National Enterprise Credit Information Publicity System (NECIPS) – Cross-check with Tianyancha or Qichacha for ownership, litigation history, and anomalies. |

| 2. Onsite Factory Audit | Conduct an in-person or third-party audit. | Verify physical infrastructure, production capacity, and operational maturity. | – Hire SGS, TÜV, or Intertek for audits – Review machine calibration records, QC processes, and employee count. |

| 3. Production Capability Assessment | Evaluate machinery, engineering team, and R&D capacity. | Ensure technical ability to design and build custom automated lines. | – Request CAD drawings, PLC programming samples, and project portfolios – Inspect CNC, laser cutting, and assembly lines. |

| 4. Client References & Case Studies | Contact past international clients. | Validate reliability, delivery performance, and post-sales support. | – Request 3+ verifiable client references – Conduct video calls with references; review project timelines and issue resolution. |

| 5. Certifications & Compliance | Confirm relevant industry certifications. | Ensure adherence to international safety and quality standards. | – ISO 9001, ISO 14001, CE (Machinery Directive), and where applicable, UL, FDA, or ATEX – Validate certification authenticity via official databases. |

| 6. IP Protection & NDA Execution | Sign a mutual NDA and clarify IP ownership. | Protect design, software, and proprietary technology. | – Use bilingual NDA reviewed by legal counsel – Include clauses on reverse engineering and data confidentiality. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Authentic Factory | Trading Company |

|---|---|---|

| Facility Ownership | Owns production building; machinery visible on site. | No production floor; office-only setup. |

| Staffing | Employs engineers, welders, electricians, and QC inspectors. | Staff are sales or procurement agents; no technical team on site. |

| Equipment | CNC machines, robotic arms, welding stations, testing labs. | Minimal equipment; relies on subcontractors. |

| Customization Capability | Offers in-house R&D can modify designs and control software. | Limited to catalog offerings; outsources engineering. |

| Production Lead Time | Can provide detailed production schedule with milestones. | Unclear timelines; dependent on third-party factories. |

| Pricing Structure | Transparent cost breakdown (materials, labor, overhead). | Higher margins; vague cost justification. |

| Website & Marketing | Highlights production lines, engineering team, certifications. | Focuses on product photos, global shipping, and “one-stop solutions.” |

Pro Tip: Ask for a live video walkthrough of the production floor during active operations. Request to speak with the lead mechanical or electrical engineer.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Refusal to conduct an onsite or virtual audit | High likelihood of being a trading company or unqualified supplier. | Disqualify immediately. |

| No verifiable client references outside China | Limited export experience; potential language or compliance gaps. | Demand proof of international shipments (e.g., BOLs, customs records). |

| Unrealistically low pricing | Indicates cost-cutting on materials, labor, or outsourcing to uncertified workshops. | Benchmark against industry averages; prioritize value over cost. |

| Inconsistent communication or broken English in technical discussions | Suggests lack of direct engineering oversight. | Require communication with technical leads in English or via interpreter. |

| No physical address or Google Earth image shows non-industrial site | Likely a front office with no manufacturing capability. | Use satellite imagery and third-party verification. |

| Pressure to pay full deposit upfront | Cash-flow scam or financial instability. | Insist on milestone-based payments (e.g., 30% deposit, 40% pre-shipment, 30% post-inspection). |

| Generic or stock photos on website | Lack of authenticity; possible content theft. | Request original project photos and videos. |

Best Practices for Risk Mitigation

- Use Escrow or LC Payments: Leverage Letters of Credit or secure payment platforms (e.g., Alibaba Trade Assurance) for financial protection.

- Pilot Order First: Start with a single machine or module before scaling to full line production.

- Third-Party Inspection: Hire an independent inspector pre-shipment (e.g., SGS, AsiaInspection) to verify conformance to specs.

- Local Representation: Consider engaging a sourcing agent or legal representative in China for ongoing oversight.

- Contract Clarity: Define warranty terms, spare parts availability, installation support, and penalties for delays.

Conclusion

Verifying a Chinese manufacturer for automated packaging lines demands a systematic, evidence-based approach. Prioritize transparency, technical capability, and proven export performance. By distinguishing true factories from trading intermediaries and avoiding common red flags, procurement managers can secure reliable, high-performance automation partners that support long-term operational efficiency.

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Target Audience: Global Procurement Managers | Focus: China-Based Automated Packaging Line Manufacturers

Executive Summary: Eliminate Sourcing Friction in High-Stakes Manufacturing

Global procurement leaders face unprecedented pressure to secure reliable, compliant, and scalable automated packaging solutions. Traditional sourcing channels for Chinese manufacturers often result in 3-6 months of wasted time due to unverified suppliers, inconsistent quality, and compliance gaps. SourcifyChina’s 2026 Verified Pro List for automated packaging lines solves this by delivering pre-vetted, production-ready partners—reducing time-to-value by 70% and de-risking your supply chain.

Why the Verified Pro List Saves Critical Time & Resources

Manual sourcing for automated packaging lines involves high-risk, low-efficiency processes. Our data-driven verification framework eliminates these bottlenecks:

| Traditional Sourcing Pitfalls | SourcifyChina Verified Pro List Solution | Time Saved (Per RFQ) |

|---|---|---|

| 40-60+ hours spent vetting unverified suppliers via Alibaba/Google | Pre-qualified suppliers with ISO 9001/14001, CE, and machine-specific certifications | 48+ hours |

| 3-5 factory audits required to find 1 reliable partner | On-site audits completed (including production capacity, QC processes, export experience) | 120+ hours |

| 30-50% of quoted suppliers fail to meet technical specs | Technical validation by our engineering team (e.g., speed tolerance, material compatibility) | 80+ hours |

| Payment fraud & contract disputes due to opaque ownership | Legal entity verification (business licenses, tax records, export history) | 25+ hours |

| Total Avg. Time Wasted | Total Time Saved | 273+ hours |

Real-World Impact: A Fortune 500 food manufacturer reduced its sourcing cycle from 5.2 months to 6 weeks using the Pro List, avoiding $380K in production delays.

Your Strategic Advantage in 2026

The Verified Pro List is not a directory—it’s a risk-mitigation protocol for mission-critical automation:

– Only 12% of Chinese packaging line manufacturers pass our 2026 verification (vs. 78% on open platforms claiming “ISO certification”).

– Real-time capacity tracking: Access live data on machine lead times, raw material stocks, and export readiness.

– Compliance shield: All partners meet EU Machinery Directive 2006/42/EC and FDA 21 CFR Part 110 standards.

– Zero hidden costs: Transparent FOB pricing locked for 90 days upon verification.

Call to Action: Secure Your Competitive Edge for Q1 2026

Time is your scarcest resource—and your greatest leverage point. Every week spent on unverified suppliers erodes your Q1 production targets, inflates costs, and exposes your supply chain to avoidable disruption.

→ Act Now to Guarantee Priority Access:

1. Email [email protected] with subject line: “2026 Pro List: Automated Packaging Line Request”

Include your technical specs, volume needs, and target timeline for a curated supplier shortlist within 48 hours.

2. WhatsApp +86 159 5127 6160 for urgent capacity inquiries (24/7 English support).

Mention code PKG26-CTA for expedited verification.

Why respond today? Verified lines for 2026 deployment are allocated on a first-contact basis. Only 8 slots remain for Q1 machinery shipments.

SourcifyChina: Where Verification Meets Velocity

We don’t just find suppliers—we deliver production-ready partnerships. Stop auditing. Start deploying.

© 2026 SourcifyChina. All verification data audited quarterly by SGS China. Pro List access requires NDA execution.

[email protected] | +86 159 5127 6160 | www.sourcifychina.com/pro-list-2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.