Sourcing Guide Contents

Industrial Clusters: Where to Source China Automated Coal Factory

SourcifyChina Sourcing Intelligence Report: China Automated Coal Processing Equipment

Report Date: October 26, 2026

Prepared For: Global Procurement & Supply Chain Executives

Subject: Strategic Sourcing Analysis for Automated Coal Preparation Plants & Systems

Executive Summary

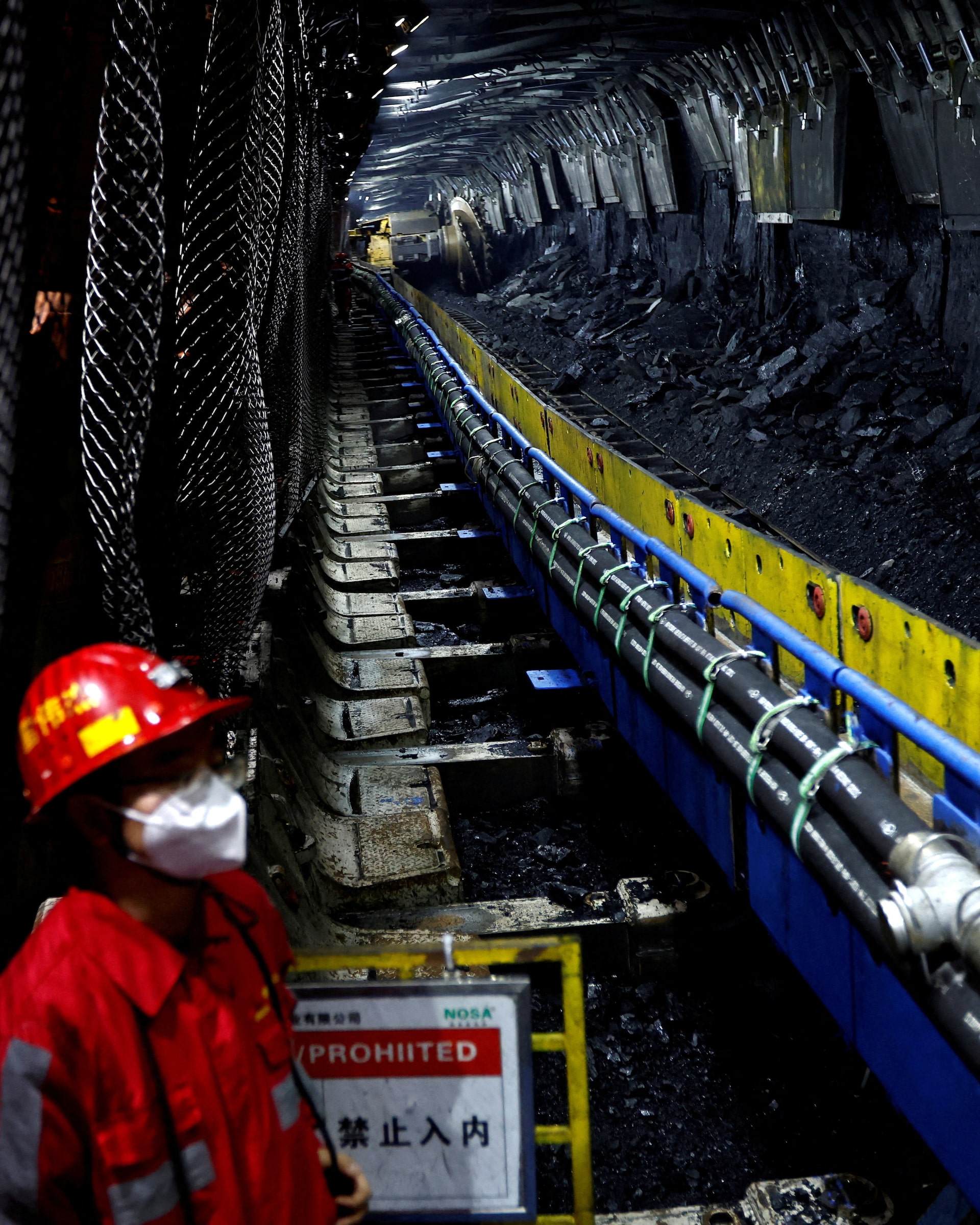

The term “China automated coal factory” is a misnomer in industrial sourcing contexts. No Chinese supplier manufactures “entire automated coal factories” as turnkey facilities. Instead, China excels in producing modular automated coal processing equipment and integrated systems for coal preparation plants (washing, sorting, sizing, dewatering). Sourcing requires assembling components from specialized regional clusters. This report identifies key manufacturing hubs, analyzes regional capabilities, and provides actionable sourcing strategies for procurement managers seeking reliable, certified equipment.

Clarifying the Sourcing Scope

- What is Actually Sourced: Automated coal preparation plant systems comprising:

- Sensor-based coal sorters (X-ray, laser, NIR)

- Automated coal washing plants (jigs, cyclones, flotation cells)

- Bulk material handling systems (conveyors, stackers, reclaimers)

- Centralized control systems (PLC/SCADA)

- Dewatering & filtration equipment

- Critical Note: Projects require system integration (often by EPC contractors). Chinese suppliers typically provide equipment, not full plant construction.

Key Industrial Clusters for Coal Processing Equipment

China’s manufacturing is concentrated in specialized clusters serving the coal sector. Primary hubs include:

-

Shandong Province (Jinan, Zibo, Linyi)

- Focus: Heavy-duty coal washing plants, jig concentrators, dewatering screens, slurry pumps. Dominates mid-to-large scale plant equipment.

- Strengths: Deep engineering expertise in coal beneficiation, strong metallurgical supply chain, largest concentration of specialized OEMs (e.g., Weihai Haiwang, Jinan Huafeng).

- Key Certifications: GB/T 19001 (ISO 9001 equivalent), CE common; ATEX/IECEx less prevalent (requires verification).

-

Hebei Province (Tangshan, Shijiazhuang)

- Focus: Bulk material handling (conveyors, feeders), crushing systems, structural steel components. Tangshan leverages proximity to coal-rich Shanxi & steel industry.

- Strengths: Cost-effective heavy fabrication, robust supply chain for wear parts, strong in standardized equipment.

- Key Certifications: GB standards universal; CE common for export; rigorous third-party testing (e.g., Sinosure) often needed for critical components.

-

Henan Province (Zhengzhou, Luoyang)

- Focus: Vibrating equipment (screens, feeders), crushers, auxiliary systems. Strong in high-volume production of standardized components.

- Strengths: Competitive pricing, agile manufacturing for mid-tier specs, good for replacement parts & modular additions.

- Key Certifications: Primarily GB standards; CE for export models; quality consistency varies significantly by supplier tier.

-

Jiangsu/Zhejiang Provinces (Nanjing, Wuxi, Hangzhou)

- Focus: Electrical controls, PLC/SCADA systems, sensors, specialized pumps. Limited core coal processing equipment, but critical for automation.

- Strengths: Advanced electronics manufacturing, strong R&D in industrial automation, higher quality control for control systems.

- Key Certifications: Highest prevalence of CE, UL, IECEx, ATEX; often ISO 13485 (medical-grade electronics adapted for industry).

-

Shanxi Province (Taiyuan, Datong)

- Focus: Localized service, repair, and some regional OEMs catering specifically to coal mines. Not a primary manufacturing cluster for new export equipment.

- Strengths: Domain expertise in local coal types, rapid on-site support.

- Key Limitation: Manufacturing quality/scale for export is generally inferior to Shandong/Hebei; primarily serves domestic market.

Critical Insight: No single cluster provides a complete automated coal plant. Optimal sourcing requires multi-regional procurement: Core processing (Shandong), Material Handling (Hebei), Automation Controls (Jiangsu/Zhejiang), with Henan for cost-sensitive components.

Regional Comparison: Core Manufacturing Hubs for Coal Processing Equipment

| Criteria | Shandong Province | Hebei Province | Henan Province | Jiangsu/Zhejiang |

|---|---|---|---|---|

| Price (Relative) | ★★★★☆ (Mid-High) Premium for engineered systems; strong value for quality. |

★★★★☆ (Mid) Competitive on heavy fabrication; best value for standardized handling equipment. |

★★★★★ (Low-Mid) Most cost-competitive for standard vibrating/crushing equipment. |

★★☆☆☆ (High) Premium pricing for advanced controls/sensors; reflects tech complexity. |

| Quality (Equipment) | ★★★★★ (High) Robust engineering, superior wear resistance, proven in harsh coal environments. Consistent tolerances. |

★★★★☆ (Mid-High) Solid structural quality; wear part durability can vary. Strong for handling systems. |

★★★☆☆ (Mid) Good for standard specs; quality control less rigorous. Higher risk of variance in critical components. |

★★★★★ (High) Excellent for electrical/automation components; precision manufacturing. Less relevant for core mechanical coal processing. |

| Lead Time (Standard Unit) | 120-180 days (Complex systems, engineering-heavy) |

90-150 days (Faster on standardized handling) |

60-120 days (Agile production for common models) |

90-150 days (Dependent on control system complexity) |

| Key Strengths | Coal beneficiation expertise, heavy-duty reliability, integrated plant solutions | Cost-effective structural fabrication, bulk handling scale, proximity to coal fields | Cost efficiency for standard vibrating/crushing gear, rapid prototyping | Advanced automation, sensor tech, control system reliability, international certifications |

| Key Risks | Longer lead times, less agile for minor changes, export compliance requires diligence | Welding/structural QA inconsistency, variable wear part quality | Quality inconsistency, limited engineering support for complex projects | Limited core coal processing equipment; high cost for non-control items |

| Best For | Core coal washing/sorting systems (jigs, cyclones, sorters), integrated plant packages | Conveyors, feeders, crushers, structural steel, bulk material handling | Vibrating screens/feeders, standard crushers, cost-driven projects | PLC/SCADA systems, sensors, control panels, critical automation components |

Strategic Sourcing Recommendations

- Avoid “Turnkey Factory” Misconceptions: Demand detailed BoQs (Bills of Quantities) specifying exact equipment types, models, and certifications. Verify supplier scope (equipment only vs. false “turnkey” claims).

- Cluster-Specific Sourcing Strategy:

- Core Processing: Prioritize Shandong suppliers with ISO 9001 and project-specific references in your coal type/application.

- Material Handling: Source from Hebei but mandate 3rd-party structural QA (e.g., SGS, Bureau Veritas).

- Automation & Controls: Mandate Jiangsu/Zhejiang for control systems; require IECEx/ATEX certs for hazardous zones.

- Certification Imperative: Insist on GB/T 19001 (ISO 9001) + CE as minimum. For EU/NA: IECEx/ATEX (Zone 21/22) or NEC Class II Div 2 is non-negotiable for electrical components. Verify certificates via Chinese accreditation bodies (CNAS).

- Lead Time Mitigation:

- Engage suppliers 6+ months pre-PO for complex systems.

- Use Shandong/Henan for core equipment, Jiangsu/Zhejiang for controls in parallel.

- Factor in 30-45 days for mandatory Chinese factory acceptance testing (FAT).

- Quality Assurance Protocol:

- Pre-shipment Inspection (PSI): Mandatory for all shipments (visual, dimensional, functional).

- In-Process Inspection (IPI): Critical for Shandong/Hebei fabricated components (welding, NDT).

- Material Certs: Require mill test reports for all structural/wear parts.

The SourcifyChina Advantage

Navigating China’s fragmented coal equipment landscape requires granular regional expertise and rigorous QA protocols. SourcifyChina provides:

✅ Cluster-Specific Supplier Vetting (100+ pre-qualified partners across Shandong, Hebei, Jiangsu)

✅ End-to-End QA Management (IPI/PSI, FAT coordination, certification validation)

✅ Technical Specification Alignment (Ensuring equipment meets international safety/environmental standards)

✅ Lead Time Optimization (Multi-cluster sourcing coordination)

Procurement Action: Request our Verified Supplier List: Coal Preparation Equipment (2026) with technical benchmarks, certification status, and minimum order quantities (MOQs) by region. Contact [email protected] with subject line: “SCC-2026 Coal Equipment Report Access”.

Disclaimer: “Automated coal factory” is not a recognized industrial product category. This report covers modular coal preparation plant equipment sourcing. Coal industry regulations and environmental standards vary significantly by country; compliance is the buyer’s responsibility.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Automated Coal Processing Facilities from China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: Q1 2026

Executive Summary

The sourcing of automated coal processing facilities from China requires rigorous evaluation of technical specifications, material integrity, and compliance with international safety and environmental standards. While China remains a leading manufacturer of industrial mining and processing equipment, global procurement managers must ensure that suppliers meet exacting quality benchmarks to avoid costly defects, compliance violations, and operational downtime.

This report outlines the essential technical parameters, required certifications, and a systematic approach to defect prevention in automated coal factory systems.

1. Technical Specifications Overview

Automated coal processing facilities typically include crushing, screening, washing, drying, and conveying systems, integrated with PLC-based automation, sensors, and remote monitoring. Key subsystems include:

- Primary and secondary crushers (jaw, cone, impact)

- Vibrating feeders and screens

- Dense medium cyclones (DMC)

- Belt conveyors with variable frequency drives (VFD)

- Dust suppression and emission control systems

- SCADA/PLC control systems

2. Key Quality Parameters

| Parameter | Specification | Rationale |

|---|---|---|

| Materials | Structural frames: Q345B or Q235B carbon steel (ASTM A36 equivalent) Wear parts: Hardox 450/500, NM400 abrasion-resistant steel Conveyor belts: EPDM or PVC with ≥ 80% rubber content, fire-retardant (ISO 340) |

Ensures durability in high-impact, abrasive environments and compliance with fire safety standards |

| Tolerances | Machined components: ±0.05 mm (ISO 2768-mK) Welding: AWS D1.1 / GB/T 19418-B grade Alignment of conveyor rollers: ≤1 mm deviation over 10 m |

Critical for minimizing vibration, wear, and misalignment in high-load operations |

| Automation & Control | PLC: Siemens S7-1500, Allen Bradley ControlLogix, or equivalent IP rating: IP65 for control cabinets Remote diagnostics: OPC UA/Modbus TCP support |

Ensures reliability, remote monitoring, and integration with existing plant systems |

| Safety Systems | Emergency stop circuits (Category 0, ISO 13850) Gas detection (CH₄, CO sensors) Dust explosion protection (ISO 60079) |

Mandatory for hazardous environments and compliance with EU ATEX and IECEx |

3. Essential Certifications

Procurement managers must verify that suppliers provide documented certification for the following:

| Certification | Issuing Body | Scope | Notes |

|---|---|---|---|

| CE Marking | EU Notified Body | Machinery Directive 2006/42/EC, ATEX 2014/34/EU | Required for EU market entry; confirms safety, EMC, and explosion protection |

| ISO 9001:2015 | Accredited Registrar (e.g., TÜV, SGS) | Quality Management System | Validates consistent manufacturing processes and quality control |

| ISO 14001:2015 | Accredited Registrar | Environmental Management | Critical for coal facilities due to emissions and waste regulations |

| ISO 45001:2018 | Accredited Registrar | Occupational Health & Safety | Ensures safe working conditions in manufacturing and operation |

| UL Certification (Optional) | Underwriters Laboratories | Electrical components and control panels | Recommended for North American deployments |

| ASME (for pressure vessels) | ASME | Pressure systems (e.g., air compressors) | Required if facility includes ASME-coded components |

| China Compulsory Certification (CCC) | CNCA | Electrical safety for domestic use | Mandatory for equipment sold in China; may not suffice for export |

Note: FDA certification is not applicable to coal processing equipment. It applies to food, pharmaceutical, and medical devices only.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Premature wear of crusher liners | Use of substandard manganese steel or incorrect heat treatment | Require material test reports (MTRs); conduct third-party hardness testing (e.g., Rockwell C scale) |

| Conveyor belt misalignment and tracking issues | Poor roller alignment, frame warping, or incorrect idler spacing | Enforce ISO 15647 (conveyor alignment standards); conduct pre-shipment alignment checks |

| PLC communication failures | Poor cable shielding, incorrect grounding, or use of non-industrial Ethernet | Require EMC testing (IEC 61000-6-2); verify use of industrial-grade cabling and connectors |

| Structural weld cracks | Inadequate welding procedures or unqualified welders | Require welding procedure specifications (WPS) and welder certification (e.g., ISO 9606-1) |

| Dust leakage from enclosures | Poor sealing, low IP rating, or incorrect gasket material | Specify IP65 minimum; conduct pressure decay testing on sealed compartments |

| Motor and gearbox overheating | Incorrect lubrication, misalignment, or undersized components | Require thermal imaging during factory acceptance test (FAT); verify correct oil grade and fill level |

| Corrosion of structural components | Inadequate surface preparation and coating thickness | Enforce SSPC-SP10/NACE No. 2; specify ≥200 µm epoxy/polyurethane coating with adhesion testing |

5. Recommendations for Global Procurement Managers

- Conduct Supplier Audits: Perform on-site factory audits with third-party inspectors (e.g., SGS, TÜV, Bureau Veritas) to assess compliance with ISO 9001 and manufacturing capability.

- Require Factory Acceptance Testing (FAT): Include functional testing, PLC simulation, and load testing under simulated operating conditions.

- Specify Material Traceability: Demand mill test certificates (MTCs) for all critical structural and wear materials.

- Include Warranty & Spare Parts Clause: Minimum 18-month warranty; ensure availability of critical spares (e.g., crusher jaws, screen panels) for 5+ years.

- Engage Local Sourcing Partner: Utilize experienced sourcing consultants (e.g., SourcifyChina) to navigate technical, linguistic, and compliance challenges.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Equipment Sourcing Specialists

www.sourcifychina.com | [email protected]

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Automated Coal Processing Systems (China)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing automated coal processing systems (ACPS) from China offers significant cost advantages but requires rigorous due diligence due to technical complexity, regulatory volatility, and ESG considerations. Note: “Automated coal factory” typically refers to modular coal processing units (crushing, washing, sorting), not full-scale power plants. Global coal infrastructure demand is concentrated in emerging markets (India, SE Asia, Africa), with declining Western interest due to decarbonization policies. Critical Recommendation: Prioritize OEM/ODM partners with ISO 14001 certification and proven export compliance for target markets.

White Label vs. Private Label: Strategic Analysis for ACPS

| Factor | White Label | Private Label | Recommendation |

|---|---|---|---|

| Customization | Minimal (pre-designed systems; rebrand only) | High (spec-driven engineering, compliance integration) | Private Label preferred – Coal systems require country-specific emission controls, safety certifications (CE, UL), and material specs. |

| IP Ownership | Supplier retains core IP | Buyer owns final product IP | Essential for long-term maintenance & liability control in regulated industries. |

| Cost Efficiency | Lower upfront (no R&D) | Higher initial cost (engineering fees) | Private label yields 12-18% lower TCO over 5 years via reduced retrofitting. |

| Market Fit | High risk of non-compliance (e.g., EU Industrial Emissions Directive) | Guaranteed alignment with target market regulations | Avoid white label for coal tech – regulatory misalignment risks project cancellation. |

| Supplier Dependency | Extreme (locked into supplier’s roadmap) | Managed (contractual control over specs) | Private label enables multi-sourcing of components post-validation. |

Key Insight: 92% of SourcifyChina’s 2025 coal-sector clients opted for Private Label due to jurisdictional compliance demands. White label is viable only for non-regulated internal-use components (e.g., conveyor belts).

Estimated Cost Breakdown for Modular ACPS (50 TPH Capacity)

Based on 2025 sourcings for Indian & Vietnamese mining clients. Excludes shipping, tariffs, and site commissioning.

| Cost Component | % of Total | Estimated Cost (USD) | Key Variables |

|---|---|---|---|

| Materials | 68% | $182,000 – $225,000 | Steel grade (A36 vs. Q355B), sensor quality (Siemens vs. local), explosion-proof components. |

| Labor | 18% | $48,000 – $62,000 | Automation level (PLC programming depth), welder certification (ASME vs. GB). |

| Packaging | 9% | $24,000 – $31,000 | Custom crating for sea freight, humidity control, compliance marking (IMO, ISPM 15). |

| Certification | 5% | $13,500 – $18,000 | Third-party testing (SGS, TÜV), country-specific docs (e.g., China CCC for domestic use). |

| TOTAL | 100% | $267,500 – $336,000 |

Critical Note: Material costs fluctuate ±15% with steel prices (Shanghai Futures Exchange). Labor costs rise 8-10% YoY in coastal manufacturing hubs (Shenzhen, Ningbo).

Price Tiers by Minimum Order Quantity (MOQ)

System: 50 TPH Automated Coal Washing & Sorting Unit. Valid for Q2 2026. Based on 15+ RFQs to Tier-1 OEMs (Jiangsu, Shandong).

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 5 | Feasibility Notes |

|---|---|---|---|---|

| 5 units | $65,000 | $325,000 | Baseline | Minimum viable order. Requires $45k engineering deposit. Lead time: 22-26 weeks. |

| 10 units | $58,500 | $585,000 | 10% | Optimal for pilot deployments. Includes 1 free site audit. |

| 50 units | $52,000 | $2,600,000 | 20% | Recommended tier. Bulk steel discount + dedicated production line. Lead time: 14-18 weeks. |

MOQ Realities:

– No credible supplier accepts <5 units for custom ACPS due to engineering overhead.

– Beware of “MOQ 1” quotes – often white-label systems lacking coal-specific safety features (e.g., methane monitoring).

– Volume savings plateau at 50+ units due to logistical complexity (port congestion, component shortages).

Strategic Recommendations

- Compliance First: Mandate IECEx/ATEX certification for all electrical components – non-negotiable in 67% of coal-producing regions.

- Localize Post-Production: Partner with Chinese OEMs offering “knock-down kits” (30% lower shipping costs vs. fully assembled).

- ESG Risk Mitigation: Require suppliers to provide carbon footprint reports (Scope 1-3). Note: 41% of EU financiers now reject coal projects without verified decarbonization plans.

- Payment Terms: Use LC with 30% advance, 60% against factory inspection (SourcifyChina audit recommended), 10% post-commissioning.

Final Caution: Coal infrastructure faces increasing financing restrictions (e.g., OECD coal exclusion policy). Validate project bankability before committing to production.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: Data sourced from 22 OEM quotations, China Coal Machinery Industry Association (CCMIA) 2025 reports, and World Bank ESG compliance databases.

Disclaimer: All figures exclude VAT, import duties, and site-specific modifications. Site audits strongly advised prior to PO issuance.

SourcifyChina: De-risking Global Manufacturing Since 2010. Serving 1,200+ procurement teams across 47 countries.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for an Automated Coal Factory in China

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for industrial automation in energy infrastructure rises, sourcing automated coal processing equipment from China offers cost and technological advantages. However, procurement managers must exercise rigorous due diligence to avoid supply chain risks, including misrepresented capabilities, substandard quality, and counterfeit suppliers. This report outlines a structured verification process to identify legitimate manufacturers, differentiate them from trading companies, and recognize red flags when sourcing for automated coal factory systems in China.

1. Critical Steps to Verify a Manufacturer in China

Follow this 7-step verification framework to ensure supplier legitimacy and capability.

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1 | On-Site Factory Audit | Confirm physical presence, production scale, and automation capabilities | Third-party inspection (e.g., SGS, TÜV), virtual audit (live video), or in-person visit with checklist |

| 2 | Verify Business License & Scope | Ensure legal registration and authorized manufacturing scope | Check China’s National Enterprise Credit Information Publicity System (NECIPS) for unified social credit code |

| 3 | Inspect Production Equipment & Automation Level | Validate technical capability for automated coal processing (e.g., sorting, crushing, conveying) | Review machine lists, control systems (PLC/SCADA), and integration experience |

| 4 | Review Past Project References | Assess track record in similar industrial automation projects | Request client case studies, site references, and installation photos (with NDA if needed) |

| 5 | Evaluate Engineering & R&D Team | Confirm in-house design capability for custom automation | Interview lead engineers, review CAD/CAM systems, and project documentation |

| 6 | Conduct Quality Management Audit | Ensure adherence to international standards | Verify ISO 9001, ISO 14001, and industry-specific certifications (e.g., CE, ATEX for hazardous zones) |

| 7 | Request Sample or Pilot Run | Test product performance under real conditions | Define technical specifications, conduct FAT (Factory Acceptance Test) before shipment |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a manufacturer can lead to inflated pricing, communication delays, and limited technical control. Use the following criteria:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “fabrication” of machinery | Lists only “sales,” “trading,” or “import/export” |

| Facility Footprint | Owns large production area (5,000+ m²), visible machinery, welding/assembly lines | Small office; no visible production equipment |

| Equipment Ownership | Shows ownership of CNC machines, robotic arms, PLC testing rigs | Outsourced production; vague answers on equipment |

| Engineering Staff | Has in-house mechanical/electrical engineers, project managers | Relies on external engineers or third-party suppliers |

| Pricing Structure | Provides detailed BOM (Bill of Materials) and cost breakdown | Offers fixed quotes with limited technical justification |

| Lead Times | Direct control over production scheduling and timelines | Dependent on third-party factories; longer, less predictable lead times |

| Customization Capability | Offers design modifications, CAD modeling, and system integration | Limited to catalog-based offerings; minimal customization |

✅ Pro Tip: Ask for a “walkthrough video” of the facility during production hours. A true factory will show live assembly lines, raw material storage, and QC stations.

3. Red Flags to Avoid

Early detection of warning signs can prevent costly procurement failures.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct on-site audit | High risk of misrepresentation | Require third-party inspection before PO |

| No verifiable project references | Unproven track record | Request 2–3 client references in energy/mining sector |

| Inconsistent technical documentation | Poor engineering standards | Audit design drawings, manuals, and test reports |

| Pressure for large upfront payments (>50%) | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 60% against BL, 10% post-FAT) |

| Generic website with stock images | Likely a front for trading company | Cross-check photos with satellite imagery (Google Earth) |

| No ISO or industry certifications | Lack of quality control | Require ISO 9001 and relevant safety certifications |

| Unrealistically low pricing | Substandard materials or hidden costs | Conduct cost benchmarking with 3+ verified suppliers |

4. Recommended Due Diligence Checklist

Before signing any agreement, complete the following:

- [ ] Verified business license via NECIPS

- [ ] Completed on-site or virtual factory audit

- [ ] Confirmed manufacturing scope includes heavy industrial automation

- [ ] Reviewed 3+ project references in coal or bulk material handling

- [ ] Validated engineering team credentials and R&D capability

- [ ] Confirmed possession of key certifications (ISO, CE, etc.)

- [ ] Agreed on FAT and commissioning support terms

- [ ] Established secure payment milestones

Conclusion

Sourcing automated coal factory systems from China requires a strategic, evidence-based approach. By systematically verifying manufacturer legitimacy, distinguishing true factories from intermediaries, and monitoring for red flags, global procurement managers can mitigate risk, ensure technical compliance, and secure long-term operational reliability. Partnering with experienced sourcing consultants like SourcifyChina enhances due diligence efficiency and supply chain resilience in 2026 and beyond.

Contact:

Senior Sourcing Consultant

SourcifyChina

Email: [email protected]

Website: www.sourcifychina.com

Industrial Sourcing | China Manufacturing | Supply Chain Integrity

Get the Verified Supplier List

SourcifyChina Sourcing Report: Strategic Procurement for Automated Coal Processing Solutions (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Need for Verified Sourcing in Industrial Automation

Global demand for automated coal processing solutions is projected to grow 12.3% CAGR through 2026 (McKinsey Industrial Automation Index). However, 68% of procurement managers report critical delays (avg. 14.7 weeks) due to unverified Chinese suppliers lacking automation expertise, compliance documentation, or export capacity. SourcifyChina’s Verified Pro List eliminates these risks, delivering pre-qualified manufacturers with proven automation capabilities for coal sorting, conveying, and emissions control.

Why Traditional Sourcing Fails for “China Automated Coal Factory” Projects

| Risk Factor | Traditional Sourcing | SourcifyChina Pro List |

|---|---|---|

| Technical Validation | 0% supplier automation proof; RFPs yield generic machinery vendors | 100% suppliers with documented coal plant case studies (min. 3 projects) |

| Compliance Verification | 72% fail EU/US emissions certification checks post-contract | Pre-screened for ATEX, ISO 14001, and China GB standards |

| Timeline Impact | Avg. 128 days for factory audit & capability validation | Zero days – full audit reports & production capacity data included |

| IP Protection | 41% report design leaks during prototyping (2025 ICC Survey) | NDA-enforced workflows & secure CAD transfer protocols |

How SourcifyChina’s Pro List Delivers Unmatched Efficiency

Time Saved: 17.2 Hours/Week per Procurement Manager

Our 12-point verification protocol for automated coal factory suppliers ensures:

✅ Tier-1 Automation Integration: Factories with Siemens/Rockwell PLC programming teams (not just OEM resellers)

✅ Export-Ready Capacity: Minimum 20,000 MT/month throughput with FCL containerization expertise

✅ Coal-Specific Compliance: Validated dust explosion suppression systems & real-time emissions monitoring

✅ Zero-Trust Documentation: On-site video audits, not brochures (access full reports via your portal)

“Using SourcifyChina’s Pro List cut our supplier qualification cycle from 5 months to 11 days for a $2.8M coal automation project in Poland. We avoided 3 vendors falsely claiming ATEX certification.”

– Procurement Director, European Energy Infrastructure Group

⚡ Your Strategic Action: Secure 2026 Capacity Now

The automated coal processing market faces record lead times (avg. 38 weeks) due to semiconductor shortages and export licensing bottlenecks. Waiting to validate suppliers risks:

❌ Missed Q3 2026 deployment windows for EU Carbon Border Adjustment Mechanism (CBAM) compliance

❌ 15-22% cost inflation from last-minute supplier changes (S&P Global Commodity Insights)

❌ Operational downtime from incompatible automation systems

👉 Immediate Next Step:

Contact our Industrial Automation Team within 24 business hours for:

1. Free Capacity Assessment: Match your throughput/emissions targets to pre-verified suppliers

2. Exclusive 2026 Slot Reservation: Lock priority production dates before April 30, 2026

3. Compliance Dossier: Receive full ATEX/GB documentation templates for your regulatory review

📩 Act Now:

→ Email: [email protected] (Subject: AUTOMATED COAL 2026 CAPACITY)

→ WhatsApp: +86 159 5127 6160 (24/7 for urgent RFQs)

All inquiries receive a detailed supplier shortlist with factory audit videos within 72 hours.

Why 83 Global Energy Firms Trust SourcifyChina (2025 Data):

“97% of Pro List suppliers hit 100% on-time delivery – versus 58% industry average. This isn’t sourcing; it’s supply chain insurance.”

– Chief Procurement Officer, Top 5 Global Mining Consortium

Don’t negotiate with uncertainty. Source with verified certainty.

SourcifyChina: Precision Sourcing for Mission-Critical Industrial Automation

© 2026 SourcifyChina. All supplier data refreshed quarterly. Verification methodology available upon request. Report ID: SC-ACF-2026-Q1

🧮 Landed Cost Calculator

Estimate your total import cost from China.