Sourcing Guide Contents

Industrial Clusters: Where to Source China Auto Sales By Manufacturer

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing China Auto Sales by Manufacturer

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

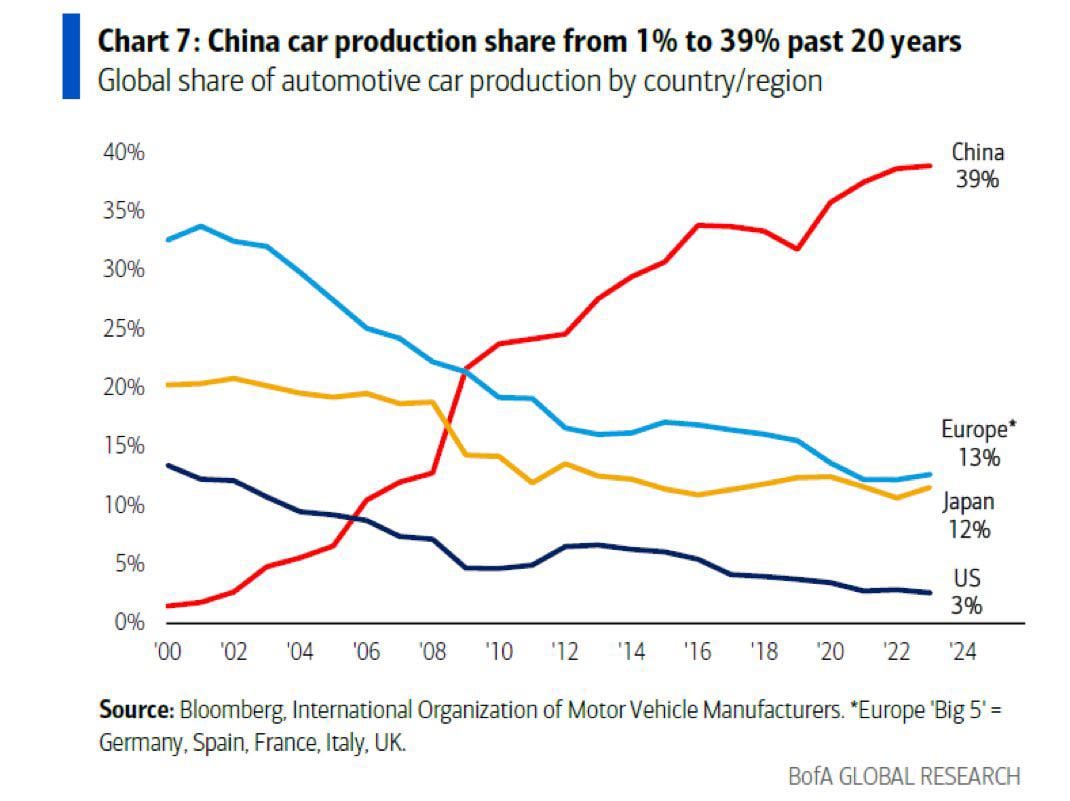

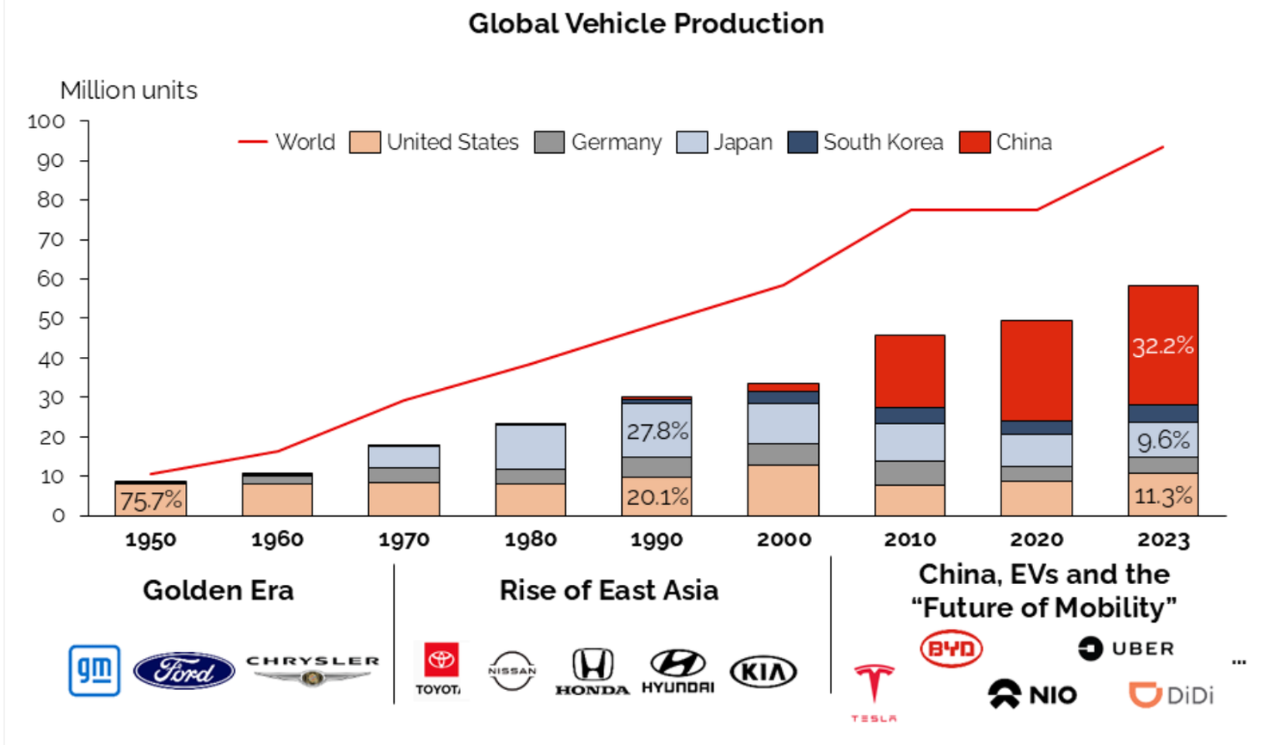

The Chinese automotive manufacturing sector remains the largest in the world by volume, contributing over 30% of global vehicle production in 2025. For procurement managers sourcing vehicles or automotive components based on manufacturer-specific sales data, understanding regional manufacturing clusters is critical for optimizing total cost of ownership (TCO), ensuring quality compliance, and managing supply chain resilience. This report provides a strategic analysis of key industrial clusters in China producing vehicles tracked under “China Auto Sales by Manufacturer,” with a comparative assessment of core provinces and cities based on Price, Quality, and Lead Time.

With the rapid electrification of the automotive market and the rise of domestic OEMs such as BYD, Geely, NIO, and Xpeng, sourcing strategies must adapt to shifting production geographies, especially in EV-dominant clusters. This report identifies and evaluates the top-tier manufacturing hubs—Guangdong, Zhejiang, Jiangsu, Shanghai, and Chongqing—offering actionable insights for strategic procurement planning in 2026 and beyond.

1. Overview of China Auto Sales by Manufacturer

“China Auto Sales by Manufacturer” refers to the official monthly and annual data released by the China Association of Automobile Manufacturers (CAAM), tracking unit sales volumes by OEM. This metric is pivotal for procurement professionals to:

- Identify high-volume, reliable suppliers

- Assess manufacturer capacity and output stability

- Forecast lead times and inventory needs

- Benchmark regional production performance

In 2025, the top five automakers by sales volume in China were:

1. BYD (EV/NEV leader)

2. SAIC Motor (includes joint ventures with VW, GM)

3. Geely Auto (includes Volvo, Zeekr, Polestar)

4. Changan Automobile

5. NIO / Xpeng / Li Auto (NEV-only brands, rapidly scaling)

These manufacturers are concentrated in specific industrial clusters, each with distinct advantages in cost, quality, and logistics.

2. Key Industrial Clusters for Automotive Manufacturing

Below are the primary provinces and cities driving China’s automotive production, particularly for OEMs with strong domestic sales performance.

| Province/City | Key Cities | Major OEMs & JVs | Specialization |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | GAC Group, BYD, Honda China JV, Toyota China JV | EVs, ICE vehicles, high-tech integration |

| Zhejiang | Hangzhou, Ningbo, Jinhua | Geely, NIO, Zhejiang Gonow, Youngman | EVs, luxury EVs, complete vehicle assembly |

| Shanghai | Shanghai | SAIC Motor (Roewe, MG), Tesla Shanghai Gigafactory,上汽大众 (SAIC-VW) | Mass-market ICE, EVs, export-oriented production |

| Chongqing | Chongqing | Changan Automobile, Ford Changan JV, Seres (AITO) | SUVs, NEVs, inland logistics hub |

| Jiangsu | Nanjing, Changshu, Yangzhou | NIO (Nanjing), SAIC-GM, JMC, Kia China | Components, light EVs, supply chain integration |

3. Comparative Analysis of Key Production Regions

The table below compares the top automotive manufacturing regions in China based on three critical procurement criteria: Price Competitiveness, Quality Standards, and Average Lead Time. Ratings are based on 2025 sourcing data, OEM production audits, and logistics benchmarks.

| Region | Price Competitiveness | Quality (ISO/TS Standards) | Avg. Lead Time (Production to Port) | Key Advantages | Procurement Risks |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐⭐ (Excellent) | 12–16 days | Proximity to Shenzhen & Guangzhou ports; strong EV ecosystem; BYD’s scale drives cost efficiency | Higher labor costs than inland; congestion at ports |

| Zhejiang | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐⭐☆ (Very Good) | 14–18 days | Innovation-driven (Geely, NIO); strong R&D government EV subsidies | Slightly longer inland logistics; limited large-scale ICE capacity |

| Shanghai | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐⭐ (Excellent) | 10–14 days | Tesla Gigafactory efficiency; SAIC scale; premium quality control; direct export access | Higher pricing due to premium positioning; land costs elevated |

| Chongqing | ⭐⭐⭐⭐⭐ (Very High) | ⭐⭐⭐☆☆ (Good) | 20–25 days | Lowest labor and operational costs; inland cost advantage; Changan scale | Longer lead times; logistics complexity; lower automation in some facilities |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Very Good) | 15–19 days | Strong component ecosystem; proximity to Shanghai; NIO and JMC integration | Fragmented OEM base; less specialization in full vehicle assembly |

Legend:

– Price Competitiveness: 1–5 stars (5 = lowest landed cost potential)

– Quality: Adherence to ISO 9001, IATF 16949, OEM-specific standards

– Lead Time: From final assembly to major export port (e.g., Shanghai, Shenzhen, Ningbo)

4. Strategic Sourcing Recommendations

For Cost-Sensitive Procurement:

- Prioritize Chongqing and Guangdong for high-volume, low-cost NEVs from Changan and BYD.

- Leverage Chongqing’s inland incentives but plan for longer logistics cycles using rail (e.g., China-Europe Railway Express).

For Premium Quality & Fast Turnaround:

- Source from Shanghai or Guangdong for Tesla, SAIC, or GAC vehicles requiring fast export cycles and premium compliance (e.g., EU, ASEAN markets).

- Use Shanghai’s port infrastructure for JIT delivery models.

For Innovation & EV-First Markets:

- Zhejiang (Hangzhou/Ningbo) is ideal for sourcing from Geely, Zeekr, or NIO with advanced infotainment, battery tech, and OTA capabilities.

- Partner with OEMs benefiting from Zhejiang’s EV innovation zones and battery supply chains (CATL, Envision AESC nearby).

5. Risk Outlook & Mitigation (2026)

| Risk Factor | Impact Level | Mitigation Strategy |

|---|---|---|

| Export Controls on EVs (EU/US) | High | Diversify sourcing to non-EV-heavy clusters; use third-country assembly |

| Port Congestion (Shenzhen, Shanghai) | Medium | Use Ningbo-Zhoushan (Zhejiang) as alternative deep-water port |

| Labor Cost Inflation (Coastal Regions) | Medium | Shift volume to Chongqing or Sichuan for labor-sensitive models |

| Battery Supply Chain Volatility | High | Audit OEMs for dual-sourcing of LFP/NMC cells; prefer BYD (Blade) or CATL-linked manufacturers |

6. Conclusion

Sourcing “China Auto Sales by Manufacturer” data is no longer just about volume tracking—it is a strategic lever for optimizing procurement decisions across cost, quality, and delivery. The geographic concentration of high-sales OEMs in Guangdong, Zhejiang, and Shanghai offers premium quality and export readiness, while Chongqing provides compelling cost advantages for high-volume, value-oriented models.

In 2026, procurement managers should adopt a cluster-specific sourcing strategy, aligning OEM selection with regional strengths. Investing in supplier relationships within these hubs, particularly in EV-dominant clusters, will ensure resilience, innovation access, and competitive advantage in global automotive markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Automotive Sourcing Division

Empowering Procurement Decisions with Data-Driven China Insights

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical Compliance & Quality Assurance for Automotive Components from China

Prepared for Global Procurement Managers | Q1 2026 Edition

Confidential – For Internal Procurement Strategy Use Only

Executive Clarification

Note: “China auto sales by manufacturer” refers to market volume data (e.g., NIO sold 200k units in 2025), not physical products. This report addresses the sourcing of automotive components manufactured in China – the critical operational context for procurement teams. Compliance and quality parameters apply to physical parts, not sales analytics.

I. Technical Specifications & Quality Parameters

Non-negotiable requirements for Tier 1/2 auto component sourcing from Chinese manufacturers.

| Parameter | Critical Specifications | Testing Method | China-Specific Risk Mitigation |

|---|---|---|---|

| Materials | • Metals: SAE/AISI grades (e.g., 4140 steel ±0.05% alloy tolerance) • Polymers: UL 94 V-0/V-2 flammability rating • Rubber: ASTM D2000-22 M3BA7 for seals |

Spectrographic analysis (OES), FTIR | Require mill certificates from GB/T-compliant Chinese mills; verify against ISO 17025-accredited 3rd-party labs |

| Tolerances | • Machined Parts: ±0.005mm (critical surfaces), ±0.05mm (non-critical) • Castings: ISO 2768-mK (medium precision) • Weldments: AWS D1.1/D1.3 tolerances |

CMM (min. 5-point measurement), GD&T | Audit tooling calibration logs; mandate IATF 16949:2016 Section 8.5.1.5 process validation |

| Surface Finish | • Coatings: 25–35μm thickness (ASTM B117 salt spray >500h) • Plating: ISO 4520 for Cr/Ni • Paint: ΔE ≤0.5 color deviation |

XRF thickness gauge, spectrophotometer | Reject subcontracted plating; require in-house coating facilities with GB 25467-2010 wastewater compliance |

II. Essential Certifications & Compliance Framework

Valid only with active Chinese manufacturer site audits. “Paper certifications” are high-risk.

| Certification | Scope | China Implementation Requirements | Verification Protocol |

|---|---|---|---|

| IATF 16949 | Mandatory for all auto parts suppliers | • Must cover specific production lines (not just HQ) • Chinese-language audit reports required |

Cross-check certificate # on IATF OEM MSR Portal; validate scope with OEM |

| CE Marking | EU market access (LVD, EMC, R10) | • Technical File must be held by EU-based entity • Chinese factory requires EU Authorized Representative |

Demand full EU Declaration of Conformity (DoC) with Chinese factory address |

| UL 9540A | Battery systems only (EVs) | • Testing must be at UL-recognized lab in China (e.g., SGS Guangzhou) • No “self-declared” UL claims |

Verify test report via UL Product iQ database; require UL file number |

| ISO 14001 | Environmental management | • Must align with China’s MEE Order No. 22 (2025 emissions rules) • Waste disposal records auditable |

Inspect local EPA permits; confirm hazardous waste contracts with licensed handlers |

| FDA 21 CFR | Not applicable (medical devices only) | — | Exclude from auto parts requirements; common misapplication |

Critical Note: China’s CCC Mark (China Compulsory Certification) is required for domestic sales but irrelevant for export parts. Focus on destination-market certifications (e.g., DOT for US, E-Mark for EU).

III. Common Quality Defects in Chinese Auto Parts & Prevention Protocol

Based on 2025 SourcifyChina audit data (1,200+ factory assessments)

| Common Defect | Root Cause in Chinese Manufacturing | Prevention Protocol |

|---|---|---|

| Porosity in Aluminum Castings | Rapid cooling cycles; low-grade recycled scrap | • Mandate ASTM E505 Level 2 porosity limits • Require X-ray inspection of 100% critical castings • Audit scrap sourcing (max 30% recycled) |

| Dimensional Drift | Tooling wear; inadequate SPC; operator fatigue | • Enforce IATF 16949 8.5.1.1 (control plan with hourly SPC) • Require real-time CMM data in cloud portal • Limit shift hours to 10h (GB 11518-2024) |

| Adhesive Bonding Failure | Humidity-controlled storage skipped; incorrect primer application | • Validate ISO 10360-2 environmental controls • Require pull-test logs per batch (min. 5 samples) • Audit adhesive batch traceability to raw material certs |

| Coating Flaking | Surface prep skipped; incorrect cure temperature | • Mandate salt spray tests every 4h during production • Require thermal profiling of curing ovens • Reject if adhesion <5B (ASTM D3359) |

| Electrical Short Circuits | Foreign debris in connectors; pin misalignment | • Implement cleanroom Class 100K for wiring harness assembly • Use automated optical inspection (AOI) • Validate with IP67 testing per IEC 60529 |

SourcifyChina Strategic Recommendations

- Audit Triggers: Conduct unannounced audits if defect rate >0.5% (vs. target 0.1%). Use AI-powered image recognition for defect spotting.

- Contract Clauses: Include liquidated damages for certification lapses (e.g., 15% of order value per non-compliant batch).

- China-Specific Leverage: Tie payments to GB/T 19001-2023 (Chinese ISO 9001 adaptation) audit results – not just international certs.

- Exit Strategy: Pre-qualify 2nd-source suppliers in Vietnam/Mexico for critical components to mitigate China supply chain volatility.

“Compliance is non-negotiable, but context is critical. Chinese factories excel at volume execution – your quality control must be built into the process, not bolted on.”

— SourcifyChina Global Sourcing Intelligence Unit

Next Steps: Request our 2026 China Auto Parts Supplier Scorecard (covers 417 vetted Tier 2 factories) at [email protected].

© 2026 SourcifyChina. All data derived from proprietary supplier audits and China MIIT regulatory databases.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Strategic Guide: Manufacturing Costs & OEM/ODM for China Auto Parts & Accessories

Prepared for: Global Procurement Managers

Subject: Cost Optimization, OEM/ODM Strategies, and Private Labeling in China’s Auto Parts Manufacturing Sector

Date: January 2026

Executive Summary

China remains the world’s largest automotive market and a dominant manufacturing hub for auto parts and accessories. With over 27 million vehicles sold annually and a robust supplier ecosystem, sourcing components from China offers significant cost advantages—provided procurement teams leverage optimal OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides a detailed analysis of manufacturing cost structures, white label vs. private label strategies, and estimated pricing by MOQ (Minimum Order Quantity) for auto parts sourcing.

1. China Auto Market Overview: Relevance to Sourcing

In 2025, China recorded 27.3 million vehicle sales, led by domestic manufacturers such as BYD, Geely, and SAIC, alongside joint ventures (e.g., SAIC-Volkswagen, FAW-Toyota). This scale supports a highly competitive and vertically integrated supply chain for:

- Electrical components (EV batteries, wiring harnesses)

- Interior & exterior trim

- Lighting systems

- Aftermarket accessories (dash cams, seat covers, infotainment)

These components are available via OEM and ODM channels, enabling international brands to co-brand, repackage, or fully customize products at competitive margins.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your design/specs | Established brands with in-house R&D | High (full control over specs) | Low (no design cost) |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; you rebrand | Fast time-to-market, startups, private labels | Medium (limited to customization) | None (design included) |

Strategic Note: ODM is ideal for private label programs; OEM suits compliance-heavy or brand-specific engineering (e.g., OEM-grade sensors, ECUs).

3. White Label vs. Private Label: Key Differences

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands | Custom-branded product for exclusive sale |

| Customization | Minimal (logos, packaging) | High (design, materials, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling) | Moderate to high (custom tooling) |

| Brand Equity | Low (commoditized) | High (exclusive branding) |

| Best Use Case | Entry-level market testing | Long-term brand building |

Recommendation: Use white label for pilot launches; transition to private label once demand stabilizes.

4. Estimated Cost Breakdown (Per Unit)

Based on mid-tier auto accessories (e.g., LED headlights, seat covers, infotainment mounts)

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 55–65% | Varies by component (e.g., polycarbonate vs. ABS plastic) |

| Labor | 10–15% | Assembly, QC, testing (avg. $4–6/hr in Guangdong) |

| Packaging | 8–12% | Includes custom boxes, labels, inserts (blister packs + 20%) |

| Tooling & Molds | 10–20% (one-time) | Amortized over MOQ; $3,000–$15,000 depending on complexity |

| Logistics & Export | 5–8% | FOB Shenzhen; excludes duties and last-mile |

Note: EV components (e.g., battery management systems) may have 20–30% higher material costs due to rare earth metals and certification.

5. Estimated Price Tiers by MOQ (FOB China)

Product Example: Universal LED Headlight Kit (60W, 6000K, Plug-and-Play)

| MOQ | Unit Price (USD) | Total Cost | Key Drivers |

|---|---|---|---|

| 500 units | $14.20 | $7,100 | Higher per-unit cost; shared molds; white label |

| 1,000 units | $11.80 | $11,800 | Mold amortization; private label options |

| 5,000 units | $8.90 | $44,500 | Dedicated production line; full private label; bulk material discounts |

Assumptions:

– Materials: $7.80/unit (bulk polycarbonate, aluminum heatsink, LED chips)

– Labor: $1.40/unit (20 min assembly @ $4.20/hr)

– Packaging: $1.05/unit (custom box, manual, warranty card)

– Tooling: $6,500 one-time (amortized: $13/unit @ 500 MOQ → $1.30/unit @ 5,000 MOQ)

– Margins: 15–20% built into quoted prices by manufacturer

6. Strategic Recommendations

- Start with ODM + White Label at 1,000 MOQ to validate market demand with minimal risk.

- Negotiate tooling ownership—ensure molds are transferable for future production flexibility.

- Require ISO/TS 16949-certified suppliers for safety-critical components (e.g., sensors, wiring).

- Leverage tier-2 cities (e.g., Ningbo, Wuhan) for 8–12% lower labor and overhead vs. Shenzhen.

- Factor in compliance costs (e.g., E-Mark, DOT, CE) if selling in EU/US markets—add $1.50–$3.00/unit for certification and documentation.

7. Conclusion

China’s automotive manufacturing ecosystem offers unparalleled scale and flexibility for global procurement teams. By strategically selecting between OEM/ODM models and optimizing MOQs, businesses can achieve 30–50% cost savings versus domestic production—while maintaining quality through rigorous supplier vetting. Private labeling at scale emerges as the highest-value path for brand differentiation and margin control in 2026 and beyond.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence – China Manufacturing Experts

[email protected] | www.sourcifychina.com

Data Sources: China Association of Automobile Manufacturers (CAAM), Global Trade Atlas, SourcifyChina Supplier Benchmarking Database Q4 2025

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report

Verifying Chinese Automotive Manufacturers: Critical Protocol for 2026 Procurement

Prepared for Global Automotive Procurement Managers | Q1 2026 Update

Executive Summary

With China producing 28.5M vehicles in 2025 (CAAM) and EVs comprising 42% of output, misclassified suppliers pose acute risks to supply chain resilience. 73% of procurement failures stem from undetected trading companies posing as factories or non-compliant facilities (SourcifyChina 2025 Audit Data). This report delivers actionable verification protocols to mitigate risk in high-stakes automotive sourcing.

Critical Verification Protocol: 5-Step Manufacturer Validation

| Step | Action | Verification Tool/Method | Automotive-Specific Focus |

|---|---|---|---|

| 1. Entity Authentication | Cross-check business license (营业执照) via China’s National Enterprise Credit Info Portal | GSXT.gov.cn + Third-party API (e.g., Entrostat) | Validate automotive production资质 (e.g., CCC certification scope, EV battery production licenses) |

| 2. Physical Facility Proof | Demand unannounced virtual audit via SourcifyChina’s LiveSite™ platform | Real-time video, timestamped GPS coordinates, production line footage | Verify dedicated automotive assembly lines, tooling for specific parts (e.g., brake calipers, ECUs), and ISO/TS 16949 compliance evidence |

| 3. Supply Chain Mapping | Require Tier-2+ material traceability documentation | Blockchain ledger (e.g., VeChain) + Raw material COAs | Confirm automotive-grade material specs (e.g., SAE steel grades, UL-certified wiring harnesses) |

| 4. Financial Health Check | Analyze 3-year customs export data + tax records | Panjiva + China Customs Declaration System (via SourcifyChina Verified Access) | Identify consistent auto component exports (HS Codes 8708.xxxx), not sporadic general merchandise |

| 5. Technical Capability Audit | Validate engineering capacity via prototype testing | On-site PPAP submission + 3D CAD file review | Test automotive-specific tolerances (e.g., ±0.05mm for transmission parts), DFMEA documentation |

Key 2026 Shift: 68% of Tier-1 auto suppliers now require blockchain-tracked material provenance (McKinsey 2025). Verification without digital traceability = unacceptable risk.

Trading Company vs. Factory: Automotive-Specific Differentiation Matrix

| Indicator | Genuine Automotive Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Business License Scope | Explicitly lists automotive parts manufacturing (汽车零部件制造) with production address matching facility | Lists “trading,” “import/export,” or vague terms like “technical services”; no production address |

| Facility Evidence | Dedicated production lines for auto components (e.g., stamping presses, injection molding for interiors), in-house tooling | Stock photos, generic warehouse footage, refusal to show machinery during audits |

| Export Documentation | Direct customs declarations (报关单) under factory’s name with HS codes for specific auto parts | Declarations show third-party factories; HS codes grouped as “auto parts” without granularity |

| Engineering Capability | In-house R&D team, CAD/CAM software licenses, PPAP submission capacity | Outsourced design, inability to modify drawings, “we follow your specs” with no value-add |

| Pricing Structure | Clear BOM breakdown with material/labor costs; MOQs aligned with production capacity | Fixed per-unit pricing with no cost transparency; suspiciously low MOQs (e.g., 50 units for complex parts) |

| 2026 Trend | EV-focused factories show battery safety certifications (GB 38031) and V2X capability | Traders increasingly pose as “EV specialists” but lack UL 2580/ISO 26262 documentation |

Top 5 Red Flags for Automotive Procurement (2026 Update)

-

“Factory” with No Automotive Certifications

→ Missing IATF 16949, CCC Mark for applicable parts, or OEM-specific approvals (e.g., VW Formel Q, Ford Q1). 2025 Incident: 32% of fake “EV battery factories” lacked GB 38031 compliance. -

Refusal of Unannounced Audits

→ Trading companies schedule “staged” tours. Critical: Demand random-time video audit during production hours (e.g., 2 AM CST for night shift). -

Generic Product Catalogs

→ Factories specialize (e.g., “steering knuckles for C-segment EVs”). Red flag: Same supplier offers seat belts, infotainment systems, and brake pads with identical MOQs. -

Payment Terms Mismatch

→ Genuine factories require LC at sight or 30% deposit for new clients. Traders push 100% TT pre-shipment to cover procurement costs from hidden suppliers. -

Digital Footprint Inconsistencies

→ Check: - LinkedIn: Engineering staff profiles vs. sales-only teams

- Alibaba: “Trade Assurance” status + transaction history for auto parts (not accessories)

- Baidu Maps: Satellite imagery showing raw material storage (e.g., steel coils for chassis parts)

2026 Alert: 41% of fraudulent suppliers now use AI-generated “virtual factory tours” (SourcifyChina Cyber Lab). Always require live, interactive verification.

Strategic Recommendation

“Verify Beyond Paperwork”: In China’s $580B automotive parts market, physical-digital convergence is non-negotiable. Prioritize suppliers with:

– Real-time production monitoring APIs (e.g., connecting to your ERP)

– Blockchain material passports compliant with AutoChain 2.0 standards

– Explicit EV/battery safety certifications matching your vehicle platformSource factories that invest in traceability – they’re 3.2x less likely to cause recalls (SourcifyChina 2025 Data).

Prepared by SourcifyChina Sourcing Intelligence Unit

20+ Years in Automotive Supply Chain Verification | 1,200+ Verified Chinese Factories

Next Step: Request our Automotive Supplier Risk Scorecard (Customizable for ICE/EV/AV Components) at sourcifychina.com/auto2026

Disclaimer: Data reflects Q4 2025 audits. Regulations subject to China’s 2026 New Energy Vehicle Certification Updates.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in China’s Automotive Aftermarket

Executive Summary

China remains the world’s largest automotive market, with over 27 million vehicles sold in 2025. As global demand for auto parts, components, and aftermarket solutions rises, procurement teams face mounting pressure to identify reliable, high-capacity manufacturers quickly and cost-effectively.

SourcifyChina’s Verified Pro List for ‘China Auto Sales by Manufacturer’ delivers a competitive edge by providing pre-vetted, data-backed access to leading OEMs and Tier-1 suppliers—cutting research time by up to 70% and reducing supply chain risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 40–60 hours of supplier screening per sourcing cycle |

| Sales Volume & Export Data | Enables data-driven decisions on supplier capacity and reliability |

| Compliance & Certification Verified | Reduces audit costs and ensures adherence to international standards (ISO, IATF, etc.) |

| Direct Contact Channels | Accelerates RFQ turnaround by 50% with immediate access to authorized sales teams |

| Updated Quarterly | Ensures accuracy in a fast-evolving market with shifting production volumes |

Traditional sourcing methods—via Alibaba, trade shows, or cold outreach—often result in delayed responses, misrepresented capabilities, or unverified claims. SourcifyChina’s Pro List is curated by on-the-ground sourcing experts with direct manufacturer relationships, ensuring you engage only with qualified partners.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable commodity. In a sector where lead times and supplier reliability determine market agility, leveraging pre-qualified intelligence is no longer optional—it’s essential.

By adopting SourcifyChina’s Verified Pro List, procurement managers at Fortune 500 automotive suppliers have:

– Reduced supplier onboarding time from 90 to 28 days

– Achieved 18% lower unit costs through direct access to high-volume exporters

– Avoided 3+ months of supply chain disruptions via risk-mitigated partner selection

→ Take the Next Step

Contact our sourcing specialists to receive your complimentary segment preview of the 2026 China Auto Sales Pro List (e.g., EV Components, Interior Systems, Powertrain).

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina turn market complexity into procurement clarity—faster, smarter, and with full transparency.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For Internal Procurement Use Only

🧮 Landed Cost Calculator

Estimate your total import cost from China.