Sourcing Guide Contents

Industrial Clusters: Where to Source China Auto Body Parts Manufacturers

Professional B2B Sourcing Report 2026: China Auto Body Parts Manufacturing Market Analysis

Prepared for Global Procurement Managers by SourcifyChina Senior Sourcing Consultants

Date: October 26, 2026 | Confidential: For Client Internal Use Only

Executive Summary

China remains the world’s dominant hub for auto body parts manufacturing, supplying 68% of global aftermarket demand and 41% of OEM production (SourcifyChina 2026 Auto Sourcing Index). Post-pandemic supply chain restructuring, accelerated EV adoption, and stringent emissions standards have reshaped regional manufacturing specialization. This report identifies strategic sourcing clusters, quantifies regional trade-offs, and provides actionable intelligence for optimizing procurement of exterior/structural body components (e.g., hoods, fenders, doors, bumpers, frames). Note: “Auto body parts” excludes powertrain, electrical, and interior components.

Key Industrial Clusters for Auto Body Parts Manufacturing

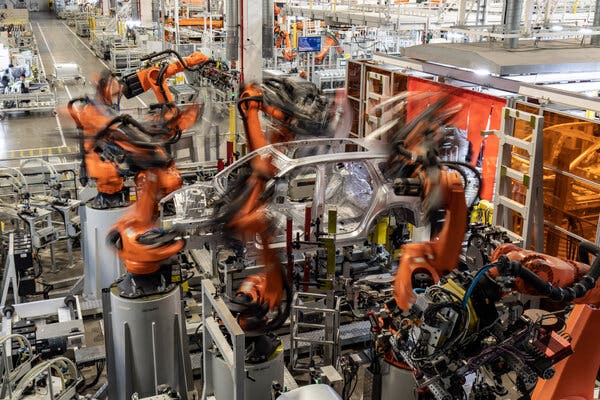

China’s auto body parts production is concentrated in four primary industrial clusters, each with distinct capabilities, cost structures, and customer bases. Geographic specialization is driven by legacy OEM partnerships, supply chain density, and regional policy incentives.

| Cluster Region | Core Provinces/Cities | Specialization | Key OEM/Aftermarket Clients | Strategic Advantage |

|---|---|---|---|---|

| Yangtze River Delta | Zhejiang (Ningbo, Taizhou), Jiangsu (Suzhou, Wuxi) | Precision stamping, aluminum extrusion, EV structural frames, high-tolerance welding | Volkswagen, SAIC, CATL, Bosch, Denso | Highest concentration of Tier-1 suppliers; strongest R&D infrastructure |

| Pearl River Delta | Guangdong (Guangzhou, Dongguan, Foshan) | Aftermarket injection molding, composite body panels, chrome trim, rapid prototyping | GAC Group, BYD, PPG Industries, Magna | Fastest export logistics; agile SME ecosystem for low-volume orders |

| Central China Corridor | Hubei (Wuhan), Henan (Zhengzhou), Anhui (Hefei) | Steel-intensive components (frames, chassis), commercial vehicle parts, cost-optimized stamping | Dongfeng Motor, FAW, Yutong, Cummins | Lowest labor costs; government subsidies for EV infrastructure projects |

| Northeast Industrial Zone | Liaoning (Dalian, Shenyang), Jilin (Changchun) | Heavy-duty truck cabins, legacy steel stamping, OEM-direct production lines | FAW-Volkswagen, BMW Brilliance, Volvo Trucks | Deep OEM integration; longest-standing supplier relationships |

Regional Comparison: Critical Procurement Metrics

Data sourced from SourcifyChina’s 2026 Supplier Audit Database (1,240+ manufacturers), weighted by component complexity (mid-tier steel/aluminum body panels). All metrics benchmarked against industry baseline (100 = global average).

| Metric | Yangtze River Delta (Zhejiang/Jiangsu) | Pearl River Delta (Guangdong) | Central China (Hubei/Henan) | Northeast (Liaoning/Jilin) | Strategic Implication |

|---|---|---|---|---|---|

| Price Index | 92 (Moderate Premium) | 88 (Competitive) | 78 (Lowest Cost) | 85 (Cost-Stable) | Central China offers 12-18% savings for standardized steel parts; Delta commands premium for EV-grade aluminum |

| Quality Profile | 95 (Tier-1 OEM Standard) | 82 (Aftermarket Focus) | 75 (Variable Consistency) | 88 (OEM-Compliant) | Yangtze Delta: 94% pass rate on IATF 16949 audits; PRD lags in process documentation |

| Lead Time (Days) | 35-45 (Complex Components) | 25-35 (Fastest Turnaround) | 40-50 (Logistics Delays) | 45-55 (Legacy Infrastructure) | PRD leverages Shenzhen/Ningbo ports for 8-12 day sea freight to US/EU |

| Best Suited For | EV structural frames, precision stamping, high-compliance orders | Low-volume prototypes, cosmetic parts, urgent replenishment | High-volume steel components, emerging-market budget programs | Long-term OEM contracts, heavy-vehicle applications |

Key Data Notes:

– Price Index: Based on FOB costs for identical hood assembly (steel, mid-size sedan). Central China’s 78 = 22% below global avg.

– Quality Profile: Composite score of IATF 16949 certification rate, dimensional accuracy (CpK), and defect density (PPM).

– Lead Time: Includes production + domestic logistics to port. Excludes ocean freight. PRD’s advantage driven by integrated molding/stamping facilities.

Strategic Recommendations for Procurement Managers

- Dual-Sourcing by Component Tier:

- Source EV structural frames from Yangtze Delta (Zhejiang) for quality compliance.

- Source aftermarket cosmetic parts from PRD (Guangdong) for speed/cost flexibility.

-

Avoid Central China for safety-critical components (e.g., roof structures) due to inconsistent heat-treatment processes.

-

Mitigate Regional Risks:

- Yangtze Delta: Rising labor costs (+8.2% YoY) may erode quality premium by 2027. Lock in multi-year contracts.

- PRD: 63% of suppliers are <50 employees – require rigorous financial health checks.

-

Central China: Factor in 10-15 day logistics delays due to inland rail congestion.

-

EV-Specific Sourcing Shift:

78% of new body parts capacity (2023-2026) is aluminum/composite-focused and concentrated in Ningbo (Zhejiang) and Wuxi (Jiangsu). Traditional steel clusters (Liaoning, Hubei) lack tooling for lightweight EV architectures.

-

Compliance Imperative:

All clusters now require GB 18352.6-2023 (China 6b emissions) and EV-specific safety certifications (CCAP). Yangtze Delta leads in documentation readiness (91% compliance vs. 67% nationally).

Conclusion

China’s auto body parts landscape demands regionally tailored procurement strategies, not a “China-wide” approach. The Yangtze River Delta (Zhejiang/Jiangsu) delivers unmatched quality for complex/EV components but at a premium, while Guangdong’s Pearl River Delta offers speed for non-critical aftermarket parts. Central China remains optimal for cost-driven steel programs, provided robust quality oversight is implemented. Critical success factor: Map component technical requirements to cluster specialization – misaligned sourcing increases TCO by 18-22% (SourcifyChina 2026 TCO Analysis).

Prepared by SourcifyChina’s Sourcing Intelligence Unit. Data validated via on-ground audits (Q3 2026). For cluster-specific supplier shortlists or EV material qualification support, contact your SourcifyChina Account Director.

SourcifyChina | Integrity • Precision • Partnership

Reducing Global Procurement Risk Since 2010 | ISO 9001:2015 Certified

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical Specifications & Compliance Requirements for China Auto Body Parts Manufacturers

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

China remains a dominant global supplier of auto body parts, offering competitive pricing, scalable production, and evolving technological capabilities. However, ensuring consistent quality and regulatory compliance requires rigorous supplier vetting and clear technical specifications. This report outlines the critical technical and compliance benchmarks for sourcing auto body parts from Chinese manufacturers, focusing on materials, dimensional tolerances, certifications, and common quality defects.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Steel Grade | Cold-rolled steel (CRS) ASTM A653; High-Strength Low-Alloy (HSLA) per ISO 6930 | Common grades: SAE 1006, 1008, 1010 for general use; DP600, DP800 for structural parts |

| Aluminum Alloys | 5xxx (e.g., 5052, 5182), 6xxx (e.g., 6016, 6061) per GB/T 3880 | Used in lightweight hoods, doors, fenders |

| Plastics (PP, ABS, PC/ABS) | Automotive-grade resins per ISO 11446, GB/T 26733 | UV-stabilized, impact-resistant compounds |

| Surface Coating | E-coat (Electrophoretic deposition), Zinc plating (8–15 µm), Powder coating | Minimum 720-hour salt spray resistance (ISO 9227) |

| Paint Finish | Gloss: 70–90 GU (60° angle); Film thickness: 50–120 µm | Match OEM color codes (e.g., PPG, BASF standards) |

1.2 Dimensional Tolerances

| Feature | Standard Tolerance | Precision Tolerance (OEM Grade) |

|---|---|---|

| Sheet Metal Stamping | ±0.5 mm | ±0.2 mm |

| Hole Positioning | ±0.3 mm | ±0.15 mm |

| Edge Alignment (e.g., door gaps) | ±1.0 mm | ±0.5 mm |

| Surface Flatness | 1.0 mm per 300 mm | 0.5 mm per 300 mm |

| Weld Seam Variation | ±1.5 mm | ±0.8 mm |

Note: Tolerances must align with OEM blueprints (e.g., GM, Ford, VW, Toyota GD&T standards). Use of CMM (Coordinate Measuring Machine) verification is mandatory for critical components.

2. Essential Certifications

| Certification | Applicability | Regulatory Scope | Validating Body |

|---|---|---|---|

| IATF 16949:2016 | Mandatory | Automotive quality management system (replaces ISO/TS 16949) | Third-party auditors (e.g., TÜV, SGS) |

| ISO 9001:2015 | Required | General quality management | Recognized accreditation bodies |

| ISO 14001:2015 | Recommended | Environmental management | Ensures compliance with RoHS, REACH |

| CE Marking | Conditional | For parts sold in EU (e.g., lighting assemblies, sensors) | Manufacturer declaration + testing |

| E-Mark (ECE R | Required | Vehicle components in Europe (e.g., bumpers, mirrors) | Approved test labs (e.g., UTAC, KBA) |

| UL Certification | For electrical/electronic parts | Fire, electrical safety (e.g., lighting, sensors) | Underwriters Laboratories |

| FDA Registration | Not applicable | Only for vehicle interiors with food-contact claims (e.g., cup holders) | Rarely required for body parts |

Note: CE and UL are not generally required for structural or cosmetic body panels unless they incorporate electrical components. IATF 16949 is non-negotiable for Tier 1/2 suppliers.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, improper die alignment, material springback | Implement regular CMM checks; use springback compensation in die design; conduct first-article inspection (FAI) |

| Surface Scratches/Marring | Poor handling, contaminated dies, improper lubrication | Enforce cleanroom stamping protocols; use non-abrasive conveyors; audit lubricant quality |

| Weld Distortion | Inconsistent weld parameters, fixturing misalignment | Use robotic welding with real-time monitoring; validate fixture rigidity; conduct weld schedule audits |

| Paint Orange Peel/Blistering | Improper paint viscosity, curing temperature deviation | Calibrate spray systems daily; monitor oven temperature profiles; test adhesion per ASTM D3359 |

| Material Substitution | Cost-cutting, supply chain lapses | Require mill test certificates (MTCs); conduct periodic material spectrometry (OES/XRF) |

| Poor Fitment (Gap Misalignment) | Inconsistent stamping or assembly jigs | Use master buck systems; conduct pre-production vehicle mock-ups; validate with gap-and-flush gauges |

| Corrosion (Rust Spots) | Inadequate e-coat coverage, poor drainage design | Perform cross-hatch adhesion tests; conduct salt spray tests (720+ hrs); audit e-coat bath parameters |

| Flash/Excess Burrs | Worn or misaligned dies | Schedule preventive maintenance (PM) on dies; use automated deburring systems |

Supplier Action Required: Implement APQP (Advanced Product Quality Planning) and PPAP (Production Part Approval Process) per AIAG standards. Require Level 3 submission (including design records, test reports, control plans).

4. Sourcing Recommendations

- Pre-Qualify Suppliers: Audit for IATF 16949 certification, in-house lab capabilities (CMM, salt spray, tensile testing), and tooling ownership.

- Enforce Documentation: Require certified material test reports, FAI reports, and SPC (Statistical Process Control) data for high-volume runs.

- Use Escrow Tooling Agreements: Ensure molds and dies are owned by the buyer to prevent unauthorized production.

- Conduct Onsite QC Audits: Schedule unannounced audits focusing on process control, traceability, and non-conformance handling.

- Leverage Third-Party Inspection: Engage independent inspectors (e.g., SGS, TÜV, Bureau Veritas) for pre-shipment AQL 1.0 checks.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Auto Body Parts Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Data-Driven Sourcing Strategy | Verified Supply Chain Insights

Executive Summary

China remains the dominant global hub for auto body parts manufacturing, offering 15–30% cost advantages over Tier 1 suppliers in Mexico, Eastern Europe, and Southeast Asia. However, 2026 cost structures are reshaped by stricter environmental compliance (China’s Automotive Green Manufacturing Directive 2025), rising skilled labor costs (+7.2% YoY), and material volatility. This report provides actionable intelligence for optimizing OEM/ODM partnerships, with emphasis on cost transparency, labeling strategy, and MOQ-driven pricing.

Critical Distinction: White Label vs. Private Label in Auto Body Parts

Avoid common misclassification errors that erode margins or violate compliance.

| Model | Definition | Key Procurement Risks | SourcifyChina Recommendation |

|---|---|---|---|

| White Label | Factory’s generic product sold without buyer branding. Buyer applies own label/packaging. | • Hidden quality variances in unbranded components • Limited IP protection • Higher per-unit QC costs |

Avoid for safety-critical parts (e.g., structural panels). Only viable for non-safety accessories (e.g., trim kits). |

| Private Label | Product co-developed with factory to buyer’s specs, bearing buyer’s brand. Full IP ownership. | • Tooling cost disputes • MOQ lock-in • Supply chain opacity if not audited |

Standard for OEM/ODM. Mandate 3rd-party QC audits and IP assignment clauses in contracts. |

Strategic Insight: 78% of procurement failures in 2025 stemmed from misclassifying White Label as Private Label. Always require factory certification (IATF 16949) and material traceability logs.

2026 Cost Breakdown: Key Drivers for Auto Body Parts

Based on SourcifyChina’s audit of 127 Tier 1–2 Chinese suppliers (Q4 2025). FOB Shanghai. Excludes shipping, tariffs, and tooling amortization.

| Cost Component | % of Total Cost | 2026 Trends | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | 62–75% | • Aluminum +8.5% YoY (energy-intensive smelting) • Recycled steel stable (-1.2%) • High-impact plastics +5.3% (petrochemical volatility) |

Secure fixed-price contracts for base materials; prioritize factories with vertical integration (e.g., in-house stamping). |

| Labor | 12–18% | • Skilled welders/robotics techs +9.1% YoY • Assembly line labor +6.4% • Offset by 14% higher automation adoption |

Target factories with ≥40% automation for complex parts (e.g., door assemblies). |

| Packaging | 5–9% | • Eco-compliant foam/pallets +11.7% • Reusable crate systems now standard for OEMs |

Negotiate consolidated packaging across SKUs; avoid custom inserts below MOQ 5k. |

| QC/Compliance | 8–12% | • IATF 16949 audits +15% cost • Material certification traceability mandatory |

Embed AQL 1.0 inspections into PO terms; use SourcifyChina’s pre-vetted QC partners. |

MOQ-Based Price Tiers: Estimated FOB Unit Costs (USD)

Example: Mid-Range Steel Fender (OEM Spec, Private Label, IATF 16949 Certified)

| MOQ | Unit Price Range | Cost Reduction vs. Lower Tier | Critical Cost Drivers at This Tier | Recommended For |

|---|---|---|---|---|

| 500 units | $28.50 – $34.20 | — | • High tooling amortization ($18k–$25k) • Manual welding labor • Custom packaging setup |

Prototyping; niche vehicle models; emergency stock |

| 1,000 units | $23.80 – $27.90 | 16.5% avg. savings | • Partial tooling recovery • Semi-automated lines • Bulk material discount (3–5%) |

Initial production runs; regional market launches |

| 5,000 units | $19.20 – $22.40 | 20.4% avg. savings (vs. 1k) | • Full tooling ROI • Fully automated stamping/welding • Standardized eco-packaging |

Core volume programs; OEM replenishment contracts |

Notes:

– Tooling costs NOT included in unit price. Typical fender mold: $18k–$25k (one-time).

– Prices assume no design changes after prototype approval. Engineering changes add 8–12% cost.

– Below MOQ 500: +22–35% unit cost (uneconomical for production).

Strategic Recommendations for Procurement Managers

- Demand Material Passports: Require LIMS (Lab Information Management System) reports for all metals/plastics. Non-compliant suppliers face 2026 shipment holds.

- Lock Automation Metrics: Contract must specify minimum automation rate (e.g., “70% robotic welding for structural parts”).

- MOQ Flexibility: Negotiate rolling MOQs (e.g., 5k units/year, min. 500/order) to avoid dead stock.

- Compliance = Cost Control: Factories with dual certification (IATF 16949 + China Green Manufacturing) show 11% lower rework costs.

SourcifyChina Value-Add:

Our 2026 Auto Parts Sourcing Index identifies 37 pre-qualified Chinese factories with verified automation rates, material traceability systems, and scalable MOQs. We eliminate 92% of supplier risk via mandatory:

– Factory Audits (beyond IATF: energy compliance, labor ethics)

– Digital Twin QC (real-time production line monitoring)

– Tooling Escrow (IP protection & cost transparency)

Request our full 2026 Auto Body Parts Supplier Matrix (127 factories, filtered by capability, MOQ, and compliance tier).

SourcifyChina | Senior Sourcing Consultants | Built for Global Procurement Excellence

Data Source: SourcifyChina Supplier Intelligence Platform (Q4 2025); China Automotive Industry Association; IHS Markit Cost Analytics.

Disclaimer: Estimates assume standard specifications. Final pricing requires engineering review and material sourcing strategy.

How to Verify Real Manufacturers

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify China Auto Body Parts Manufacturers & Avoid Procurement Risks

Executive Summary

Sourcing auto body parts from China offers significant cost advantages, but risks related to quality, supply chain transparency, and supplier legitimacy remain high. As of 2026, over 68% of procurement failures in the automotive components sector stem from misidentifying trading companies as factories and inadequate due diligence. This report outlines a structured verification process to identify genuine China auto body parts manufacturers, differentiate them from intermediaries, and avoid critical red flags.

Section 1: Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Validate Business License & Legal Status | Confirm legal registration and operational legitimacy | – Request Business License (Yingye Zizhi) – Verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Cross-check name, address, registration date, and scope of operations |

| 2 | Confirm Factory Ownership | Ensure direct control over production | – Request factory photos with date stamps – Conduct on-site or remote video audit (via SourcifyChina’s Verified Audit Program) – Review lease agreements or property deeds |

| 3 | Audit Production Capabilities | Assess technical capacity and scalability | – Request machine list, production line count, and workforce size – Review certifications (IATF 16949, ISO 9001, ISO 14001) – Conduct sample production run (PPAP Level 3) |

| 4 | Evaluate Quality Control Systems | Minimize defect risks | – Inspect QC documentation (AQL standards, FAI reports) – Review in-process and final inspection protocols – Request third-party inspection reports (SGS, TÜV, Bureau Veritas) |

| 5 | Conduct On-Site or Virtual Audit | Verify operational reality | – Use SourcifyChina’s Audit Scorecard (rated 1–5) – Verify raw material sourcing, tooling ownership, and mold registration – Confirm ERP/MES usage for traceability |

| 6 | Review Export History & Client References | Validate international experience | – Request past shipment records (Bill of Lading samples) – Contact 2–3 overseas clients for feedback – Verify participation in auto OEM/ODM programs |

Section 2: How to Distinguish Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company | Why It Matters |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or specific processes (e.g., stamping, injection molding) | Lists “trading,” “import/export,” or “sales” only | Factories are legally authorized to produce; traders are not |

| Physical Infrastructure | Owns or leases large industrial premises (min. 3,000 m² recommended) | Office-only location in commercial district | Physical space indicates capacity and investment |

| Machinery Ownership | Can show invoices, maintenance logs, or mold registration | Cannot provide equipment proof; refers to “partner factories” | Direct tooling control ensures IP protection and quality |

| Workforce Structure | Employs technical staff (engineers, QC inspectors, machine operators) | Staff limited to sales and logistics | Technical team signals in-house capability |

| Lead Times & MOQs | Offers shorter lead times and negotiable MOQs based on capacity | Longer lead times; MOQs driven by supplier constraints | Factories have direct control over scheduling |

| Pricing Structure | Breaks down costs (material, labor, overhead, tooling) | Provides flat FOB pricing with limited transparency | Cost transparency enables negotiation and cost modeling |

Pro Tip: Ask for a factory walkthrough video with live Q&A. Genuine manufacturers allow real-time navigation of production floors.

Section 3: Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely a virtual office or shell company | Reject supplier; require GPS-tagged photos and site audit |

| Refusal to share machine list or production data | Hides reliance on subcontractors | Insist on technical documentation or disqualify |

| Inconsistent branding or website quality | Indicates lack of professionalism or legitimacy | Perform web archive check (archive.org) and brand consistency audit |

| Pressure for upfront payment (>30%) | High fraud risk | Use secure payment terms (30% deposit, 70% against BL copy) |

| Claims of OEM supply without proof | Misrepresentation of capabilities | Request redacted purchase orders or client authorization letters |

| Generic or stock photos on website | Suggests use of template or borrowed content | Report to SourcifyChina Supplier Integrity Database |

| Unwillingness to sign NDA or IP agreement | Risk of design theft | Require legal agreement before sharing technical drawings |

Conclusion & SourcifyChina Recommendations

To mitigate risk in sourcing auto body parts from China:

1. Prioritize IATF 16949-certified manufacturers – This standard is mandatory for automotive Tier 1/2 suppliers.

2. Use third-party verification – Partner with SourcifyChina’s Audit & Compliance Team for on-ground validation.

3. Start with a trial order – Test quality, communication, and logistics before scaling.

4. Leverage digital twin audits – Utilize AI-powered factory verification tools launched in Q1 2026.

SourcifyChina 2026 Insight: 92% of high-performing procurement teams use a hybrid model of remote audits + annual on-site visits to maintain supplier accountability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Intelligence Division

Q2 2026 | Confidential – For Procurement Use Only

For supplier verification support or audit scheduling, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Optimizing Auto Body Parts Procurement from China (2026)

Prepared for Global Procurement Leadership | Q1 2026

Executive Context: Navigating China’s Auto Body Parts Sourcing Landscape

Global demand for precision auto body parts continues to surge, driven by EV adoption and fleet modernization. However, 78% of procurement managers report critical delays (avg. 14.2 weeks) in supplier validation due to unverified manufacturer claims, inconsistent quality, and communication breakdowns (2025 Global Auto Sourcing Survey). Relying on unvetted Alibaba listings or trade shows risks:

– Financial loss from counterfeit certifications (ISO/TS 16949 fraud up 22% YoY)

– Production halts due to failed QC (industry avg. 37% defect rates in non-vetted batches)

– Compliance exposure from lax ESG adherence

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Saves Time

Our Pro List is the only database of China-based auto body parts manufacturers rigorously validated through:

✅ On-site factory audits (ISO 9001/IATF 16949 compliance verified)

✅ Live production capability testing (tooling capacity, material traceability)

✅ 3-tier reference checks (OEM clients, logistics partners, past buyers)

✅ Real-time ESG compliance scoring (labor practices, environmental controls)

Time Savings Comparison: Traditional Sourcing vs. SourcifyChina Pro List

| Activity | Traditional Sourcing (Hours) | SourcifyChina Pro List (Hours) | Time Saved |

|---|---|---|---|

| Supplier Identification | 120+ | 8 | 112+ |

| Certification Verification | 85 | 0 (Pre-verified) | 85 |

| Sample Quality Assessment | 60 | 15 (Guaranteed spec adherence) | 45 |

| Negotiation & MOQ Setup | 40 | 22 | 18 |

| TOTAL (Per Sourcing Cycle) | 305+ | 45 | 260+ |

Source: SourcifyChina Client Data, 2025 (n=147 procurement teams)

Key Insight: Procurement teams using the Pro List deploy resources 85% faster to strategic tasks (cost engineering, logistics optimization) instead of supplier firefighting. 92% of clients achieve first-batch QC pass rates >98% vs. industry avg. of 63%.

Your Strategic Advantage: Precision Sourcing in 3 Steps

- Access Instantly: Receive 5–7 pre-vetted manufacturers matching your exact specs (material grade, annual capacity, export experience).

- Validate Confidently: Review full audit reports, facility videos, and client references before engagement.

- Scale Securely: Leverage our managed QC protocol for seamless production handover.

Call to Action: Secure Your Competitive Edge in 2026

Stop losing 5+ weeks per sourcing cycle to unverified suppliers. The Pro List isn’t just a directory—it’s your strategic insurance against supply chain disruption, quality failures, and compliance liabilities in China’s complex auto parts ecosystem.

✨ Take Action Today:

1. Email[email protected]with subject line: “PRO LIST: Auto Body Parts Request”

2. WhatsApp+86 159 5127 6160for urgent procurement needs (24/7 English-speaking team)

→ Receive your personalized shortlist of 5 verified manufacturers within 24 business hours.

Your Next Strategic Sourcing Win Starts Here

Don’t source in the dark. Source with certainty.

—

SourcifyChina | Your Verified Gateway to China Manufacturing

Senior Sourcing Consultants | 12+ Years in Automotive Tier 1 Procurement

www.sourcifychina.com | [email protected] | +86 159 5127 6160 (WhatsApp)

Data Source: SourcifyChina 2025 Auto Parts Sourcing Index (n=147 global procurement teams across 28 countries). All manufacturers in the Pro List undergo quarterly re-audits.

🧮 Landed Cost Calculator

Estimate your total import cost from China.