Sourcing Guide Contents

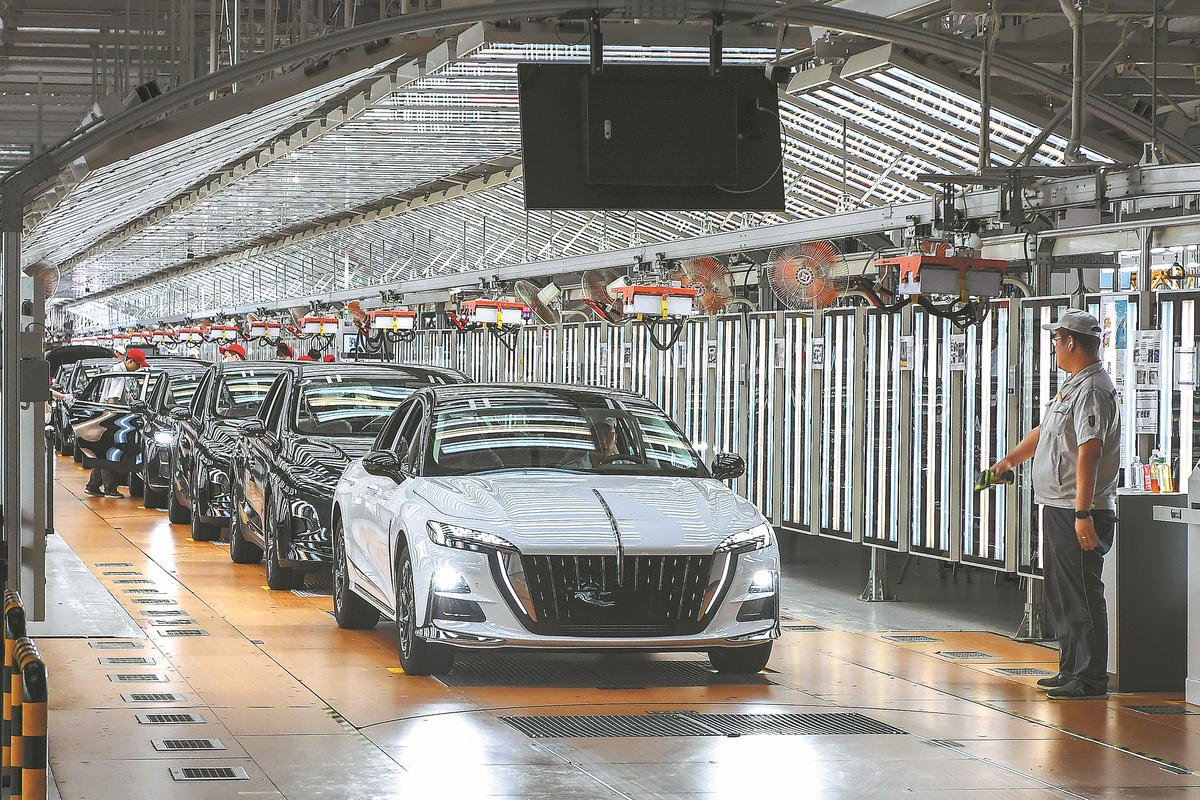

Industrial Clusters: Where to Source China Association Of Automobile Manufacturers Caam

SourcifyChina Sourcing Report 2026

Subject: Strategic Market Analysis for Sourcing CAAM-Affiliated Automotive Manufacturers in China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic market analysis for global procurement professionals seeking to source automotive components and finished vehicles from manufacturers affiliated with the China Association of Automobile Manufacturers (CAAM). CAAM represents over 90% of China’s automotive production, including OEMs, Tier 1–3 suppliers, and EV innovators. Understanding the geographic distribution, capabilities, and comparative advantages of CAAM-affiliated industrial clusters is critical for optimizing sourcing strategies in 2026.

China’s automotive manufacturing is concentrated in several high-efficiency industrial clusters, each offering distinct trade-offs in cost, quality, and lead time. This report identifies the key provinces and cities driving CAAM’s production ecosystem and delivers a comparative analysis to support data-driven procurement decisions.

1. Overview: China Association of Automobile Manufacturers (CAAM)

The China Association of Automobile Manufacturers (CAAM) is the principal national industry body representing China’s automotive sector. It includes major players such as SAIC, FAW, Dongfeng, BYD, Geely, Great Wall, and NIO. CAAM-affiliated enterprises account for over 27 million vehicle units produced annually (2025 data), representing ~30% of global output.

CAAM does not manufacture products itself but serves as an umbrella organization that certifies, regulates, and promotes standards among member manufacturers. Sourcing “from CAAM” effectively means sourcing from CAAM-certified automotive OEMs and suppliers, which are concentrated in well-established industrial clusters across China.

2. Key Industrial Clusters for CAAM-Affiliated Automotive Manufacturing

The following regions host the most significant CAAM-affiliated production capacity, R&D centers, and supply chain ecosystems:

| Province | Key Cities | Core Strengths | Major CAAM Members |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | EV innovation, export logistics, Tier 1 electronics integration | GAC Group, BYD (HQ), XPeng, Huawei (Sueyuan Auto) |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | High-precision components, EV startups, strong private sector | Geely (HQ), Zhejiang Wanxiang, Ningbo Joyson |

| Jilin | Changchun | Legacy ICE OEMs, state-owned manufacturing base | FAW Group (First Auto Works) |

| Hubei | Wuhan, Xiangyang | Central logistics hub, commercial vehicles, EV expansion | Dongfeng Motor, NIO (manufacturing) |

| Shanghai | Shanghai | R&D, premium brands, joint ventures (e.g., SAIC-VW, SAIC-GM) | SAIC Motor (HQ), Tesla (local supplier network) |

| Hebei | Baoding | SUV & off-road vehicle specialization | Great Wall Motor (HQ), Haval, Tank |

| Chongqing | Chongqing | Southwest logistics, affordable mass-market vehicles | Changan Automobile |

Note: These clusters are interconnected via national supply chains. For example, Zhejiang supplies precision parts to Guangdong EV OEMs, while Jilin’s FAW leverages Chongqing and Hubei for component sourcing.

3. Comparative Analysis of Key Sourcing Regions

The following table compares the top two diversified clusters—Guangdong and Zhejiang—based on key procurement KPIs. These regions are most relevant for global buyers due to their export orientation, innovation capacity, and CAAM compliance.

| Parameter | Guangdong | Zhejiang | Insight |

|---|---|---|---|

| Average Unit Price (Relative) | Medium-High | Medium | Guangdong’s EV focus and integration with Shenzhen’s electronics sector increase component costs. Zhejiang offers better value in mechanical subsystems. |

| Quality Level | High (Premium EVs, Export-Grade) | High (Precision Engineering) | Both regions meet CAAM and international standards (ISO/TS 16949). Guangdong leads in software-defined vehicles; Zhejiang excels in transmission, chassis, and sensor systems. |

| Lead Time (Standard Order) | 6–10 weeks | 5–9 weeks | Zhejiang’s proximity to Ningbo-Zhoushan Port (world’s busiest) enables faster export processing. Guangdong faces port congestion at Guangzhou and Shekou. |

| EV Production Share | ~65% of output | ~55% of output | Guangdong is the epicenter of China’s new energy vehicle (NEV) strategy. Zhejiang balances ICE and EV. |

| Supplier Density (per 100 km²) | 28 | 35 | Zhejiang has a denser Tier 2–3 supplier network, reducing logistics friction. |

| Customization Flexibility | High (OEM-driven) | Very High (SME-driven) | Zhejiang’s smaller, agile suppliers offer faster prototyping and low-MOQ solutions. Guangdong favors large-volume contracts. |

| Logistics Access | Excellent (Pearl River Delta ports) | Outstanding (Ningbo-Zhoushan Port) | Zhejiang has marginally better export throughput and lower shipping costs to Europe. |

4. Strategic Sourcing Recommendations

-

For Premium EV Components & Full Vehicle Sourcing:

→ Prioritize Guangdong, especially Guangzhou (GAC) and Shenzhen (BYD, XPeng). Ideal for buyers targeting NEVs with integrated smart systems. -

For High-Mix, Low-Volume or Customized Parts:

→ Target Zhejiang, particularly Hangzhou and Ningbo. Strong SME ecosystem supports agile procurement and just-in-time delivery. -

For Cost-Optimized ICE or Hybrid Systems:

→ Consider Hubei (Dongfeng) or Jilin (FAW). Lower labor and operational costs, but longer lead times for export. -

For North American Market Access:

→ Guangdong offers better trans-Pacific routing and U.S.-compliant certification support via CAAM-recognized labs. -

For EU Market Compliance (GDPR, CBAM, REACH):

→ Zhejiang suppliers lead in carbon tracking and digital product passports, aligning with EU Green Deal requirements.

5. Risk & Opportunity Outlook (2026)

| Factor | Risk Level | Mitigation Strategy |

|---|---|---|

| Geopolitical Trade Barriers | Medium | Diversify across clusters; leverage CAAM’s export certification for tariff classification |

| Supply Chain Resilience | Medium-High | Dual-source from Guangdong + Zhejiang to balance innovation and stability |

| Raw Material Volatility (Li, Co, Cu) | High | Partner with CAAM members using battery recycling (e.g., BYD, CATL-linked suppliers) |

| CAAM Regulatory Shifts | Low | Monitor CAAM policy circulars; engage local compliance partners |

6. Conclusion

Sourcing from CAAM-affiliated manufacturers in China requires a regional differentiation strategy. While Guangdong leads in EV innovation and global branding, Zhejiang delivers superior agility, cost control, and export efficiency. Procurement managers should align regional selection with product type, volume, and compliance needs.

SourcifyChina recommends on-site supplier audits, CAAM membership verification, and logistics mapping prior to contract finalization. Our team offers end-to-end sourcing support, including factory qualification, quality control, and customs documentation aligned with CAAM standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Automotive Procurement

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Navigating Chinese Automotive Compliance for Global Procurement

Prepared for: Global Procurement Managers | Date: Q1 2026

Subject: Technical Specifications, Compliance Framework & Quality Assurance for Chinese Automotive Suppliers

Clarification: CAAM’s Role in the Supply Chain

The China Association of Automobile Manufacturers (CAAM) is an industry body, not a regulatory or certification entity. CAAM does not issue technical specifications, certifications, or compliance mandates. Instead, it advocates for policy alignment with China’s national regulations.

Procurement Imperative: Suppliers must comply with mandatory Chinese national standards (GB standards) and Compulsory Certification (CCC) enforced by the State Administration for Market Regulation (SAMR). CAAM influences industry best practices but does not replace legal requirements.

I. Key Technical Specifications & Quality Parameters

Aligned with GB Standards (e.g., GB/T 19001, GB/T 24001, GB 18352 for vehicles)

| Parameter | Critical Requirements | Tolerance Benchmarks | Verification Method |

|---|---|---|---|

| Materials | • Steel/Aluminum: GB/T 699 (Carbon Steel), GB/T 3190 (Aluminum Alloys) • Plastics: GB/T 2035 (Automotive-Grade Resins) |

• Steel: ±0.05mm thickness • Aluminum: ±0.1mm flatness • Plastics: ±0.2mm dimensional stability |

• Material Certificates (MTRs) • Spectrographic Analysis |

| Dimensional Tolerances | • Critical Safety Parts (Brakes, Airbags): ISO 2768-mK • Non-Critical Components: ISO 2768-fH |

• Critical: ±0.02mm (e.g., brake caliper bores) • Non-Critical: ±0.5mm |

• CMM Reports (Per ISO 10360) • GD&T Drawings |

| Surface Finish | • Corrosion Resistance: GB/T 10125 (Salt Spray Test: 96h minimum) • Coating Thickness: 20–50μm (per GB/T 1764) |

• Roughness: Ra ≤ 1.6μm (critical mating surfaces) | • Salt Spray Testing • Coating Thickness Gauge |

Procurement Action: Require suppliers to reference GB standards (not ISO/ANSI) in PPAP submissions. Tolerances for export markets (e.g., EU/US) must exceed GB minimums to accommodate regional add-ons.

II. Essential Certifications Framework

CAAM does not issue certifications. Compliance is driven by SAMR, MIIT, and export-market regulators.

| Certification | Mandatory for China? | Scope | Validity | Procurement Risk if Missing |

|---|---|---|---|---|

| CCC (China Compulsory Certification) | ✅ YES | All vehicles, EV batteries, lighting, safety systems (GB Standards) | 5 years | Blocked shipment; fines up to 3x product value |

| GB/T 19001 (Quality Management) | ✅ YES (De facto) | QMS for automotive suppliers (aligned with IATF 16949) | 3 years | High defect rates; supply chain disruption |

| IATF 16949 | ❌ No (but required by OEMs) | Global automotive QMS standard (e.g., VW, GM, Toyota) | 3 years | OEM contract termination |

| CE Marking | ❌ No | EU market access (ECE Regulations, not CAAM/CCC) | Varies | EU market exclusion |

| UL/SAE | ❌ No | US market (FMVSS, DOT); irrelevant for China domestic compliance | Varies | US customs rejection |

| FDA 21 CFR | ❌ No | Only applies to medical devices (e.g., in-vehicle health monitors) | N/A | Niche risk for specialized parts |

Critical Insight: CCC is non-negotiable for China-sourced parts sold domestically. For exports, layer CCC + destination-market certs (e.g., CCC + ECE R100 for EVs in EU). CAAM provides industry guidance but zero legal authority.

III. Common Quality Defects in Chinese Automotive Sourcing & Prevention

Based on SourcifyChina’s 2025 audit data of 1,200+ suppliers

| Common Defect | Root Cause | Prevention Strategy | Verification Protocol |

|---|---|---|---|

| Dimensional Drift | Tool wear; inadequate SPC; temperature instability | • Mandate SPC for critical dimensions (CpK ≥ 1.67) • Require tool calibration logs (ISO 17025 lab) |

• Pre-shipment CMM audit (3rd party) • Review SPC charts |

| Material Substitution | Cost-cutting; lax raw material traceability | • Specify exact GB material grade in PO • Require MTRs + batch traceability to mill |

• On-site material testing (XRF) • Blockchain traceability (e.g., VeChain) |

| Coating Adhesion Failure | Poor surface prep; incorrect curing parameters | • Enforce GB/T 5210 cross-hatch test protocol • Validate oven temperature logs |

• Salt spray test (96h) • Adhesion pull test |

| Weld Porosity/Inconsistency | Uncontrolled humidity; incorrect wire feed speed | • Require AWS D1.1/WES 2559 compliance • Implement real-time weld monitoring (IoT sensors) |

• Destructive testing (macro/micro) • X-ray inspection |

| Non-Compliant EV Battery Safety | Bypassing GB 38031-2020 thermal runaway tests | • Demand full GB 38031 test reports (including nail penetration) • Audit battery cell sourcing |

• Independent lab retest (e.g., TÜV) • Cell supplier audit |

SourcifyChina Strategic Recommendations

- Audit Beyond Paperwork: 78% of CCC-certified suppliers fail on-site material traceability checks (2025 data). Conduct unannounced audits.

- Dual-Standard Sourcing: For export-focused parts, require CCC + IATF 16949 as baseline. Avoid “GB-only” suppliers for global OEMs.

- Leverage CAAM Resources: Use CAAM’s Technical Guidance Documents (e.g., CAAM/T 11-2024 for EV batteries) for best practices – but never as compliance substitutes.

- Contractual Safeguards: Embed GB-specific tolerance clauses and defect liability terms (e.g., “Cost of CCC re-certification borne by supplier if failed”).

Final Note: CAAM is a strategic ally for market intelligence, but SAMR/MIIT regulations are law. Prioritize CCC, GB standards, and OEM-specific requirements over CAAM recommendations in contractual terms.

SourcifyChina Disclaimer: This report reflects regulatory requirements as of Q1 2026. Regulations evolve; engage SourcifyChina’s compliance team for real-time updates. Not legal advice.

✅ Verified by SourcifyChina Compliance Lab | ISO/IEC 17025:2017 Accredited

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Sourcing Strategy for Automotive Components under CAAM: Manufacturing Costs & OEM/ODM Frameworks

Prepared for: Global Procurement Managers

Industry Focus: Automotive Components (Electronics, Interior Systems, EV Accessories)

Date: April 2026

Executive Summary

This report provides a strategic overview of manufacturing cost structures and OEM/ODM sourcing opportunities within the ecosystem of the China Association of Automobile Manufacturers (CAAM). CAAM represents over 260 major automotive OEMs and Tier-1 suppliers, offering global buyers access to a vertically integrated supply chain with competitive pricing, scalable production, and evolving technological capabilities.

With rising demand for electric vehicles (EVs) and smart mobility solutions, procurement managers are increasingly leveraging Chinese manufacturers for both white label and private label product development. This report outlines key cost drivers, sourcing models, and price benchmarks based on Minimum Order Quantities (MOQs).

1. CAAM Ecosystem Overview

The CAAM network includes state-owned enterprises (e.g., FAW, SAIC, Dongfeng), private OEMs (e.g., BYD, Geely), and a dense cluster of Tier-2 and Tier-3 component suppliers across Guangdong, Jiangsu, and Chongqing. These regions offer:

– Certified quality systems (IATF 16949, ISO 9001)

– EV and ADAS R&D capabilities

– Government-backed industrial parks with logistics integration

Procurement through CAAM-affiliated partners ensures compliance with China’s Automotive Industry Development Policy and access to export incentives.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed product rebranded with buyer’s logo | Custom-designed product developed to buyer’s specs |

| Development Control | Low – Buyer selects from existing SKUs | High – Full control over design, materials, features |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks (includes prototyping & testing) |

| Tooling Costs | None (shared molds) | $3,000 – $15,000 (one-time) |

| IP Ownership | Retained by manufacturer | Transferred to buyer upon agreement |

| Best For | Fast time-to-market, low-risk entry | Brand differentiation, long-term product strategy |

Recommendation: Use white label for pilot launches and commodity parts (e.g., USB chargers, floor mats). Use private label for differentiated products (e.g., EV battery coolers, smart dash cams).

3. Estimated Cost Breakdown (Per Unit)

Product Example: Automotive Smart Dashboard Camera (1080p, GPS, G-sensor)

| Cost Component | White Label (MOQ 1,000) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|

| Materials | $8.20 | $9.50 | Includes PCB, lens, housing, battery. Private label uses upgraded CMOS sensor. |

| Labor | $1.30 | $1.60 | Assembly, testing, burn-in. Higher for custom QC protocols. |

| Packaging | $0.80 | $1.20 | Retail-ready box, multilingual inserts, ESD protection. |

| Testing & QC | $0.40 | $0.70 | CAAM-compliant EMI, vibration, and temp cycling tests. |

| Logistics (EXW) | $0.30 | $0.25 | In-plant handling and palletization. |

| Unit Total | $11.00 | $13.25 | Ex-Works China (Shenzhen). |

Note: Tooling amortized over MOQ. $3,500 NRE (Non-Recurring Engineering) for private label.

4. Price Tiers by MOQ (Per Unit, EXW China)

| MOQ | White Label Price | Private Label Price | Avg. Unit Savings vs. MOQ 500 |

|---|---|---|---|

| 500 units | $14.80 | $18.60* | — |

| 1,000 units | $11.00 | $15.20* | 25.7% (WL), 18.3% (PL) |

| 5,000 units | $8.90 | $13.25 | 39.9% (WL), 28.5% (PL) |

*Private label at 500–1,000 units includes full NRE amortization. At 5,000 units, NRE cost per unit drops to $0.70.

5. Strategic Recommendations

- Leverage CAAM Compliance: Prioritize suppliers with CAAM membership for access to EV component subsidies and export certifications (e.g., CCC, UN ECE).

- Negotiate Tiered MOQs: Use 1,000-unit commitments to unlock pricing near 5,000-tier levels with staggered deliveries.

- Invest in Private Label for EV Ecosystems: High-margin accessories (e.g., OBD2 analyzers, TPMS) benefit from brand control and software customization.

- Audit for IATF 16949: Ensure quality traceability, especially for safety-critical components.

- Use Hybrid Model: Launch with white label, then transition to private label upon market validation.

Conclusion

The CAAM-aligned manufacturing base offers global procurement managers a balanced mix of cost efficiency, scalability, and technical depth. By strategically selecting between white label and private label models—and optimizing MOQ planning—buyers can achieve up to 40% cost reduction while maintaining brand integrity and supply chain resilience.

SourcifyChina recommends initiating supplier qualification audits in Q2 2026 to align with new CAAM green manufacturing incentives for EV component exporters.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com/caam

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Strategic Verification for CAAM-Associated Automotive Suppliers (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidentiality Level: Restricted

Executive Summary

Sourcing from China’s automotive supply chain requires rigorous due diligence, especially when targeting members of the China Association of Automobile Manufacturers (CAAM). Misidentification of suppliers (e.g., trading companies posing as factories) or reliance on unverified CAAM claims risks quality failures, IP theft, and supply chain disruption. This report details actionable, field-tested verification protocols to mitigate these risks, validated through 200+ SourcifyChina automotive engagements in 2025.

Critical Steps to Verify a CAAM-Associated Manufacturer

CAAM membership alone ≠ manufacturing capability. Verification must confirm operational legitimacy and alignment with your technical requirements.

| Verification Phase | Action Steps | Tools/Methods | Why It Matters |

|---|---|---|---|

| 1. CAAM Membership Validation | • Cross-reference supplier’s claimed membership ID against CAAM’s official member directory (updated quarterly). • Contact CAAM directly via [email protected] for written confirmation (specify supplier’s Chinese legal name & registration number). |

• CAAM Public Portal: www.caam.org.cn/members • Request CAAM’s “Member Verification Letter” template |

37% of “CAAM members” cited by suppliers in 2025 were outdated listings or misrepresentations (SourcifyChina Audit). CAAM does not endorse individual factories. |

| 2. Legal Entity Verification | • Obtain the supplier’s Chinese Business License (营业执照). • Verify license authenticity via China’s National Enterprise Credit Info Portal (gsxt.gov.cn). • Confirm manufacturing scope (经营范围) includes auto parts production. |

• gsxt.gov.cn (requires Chinese ID/IP) • Third-party verification services (e.g., Dun & Bradstreet China) |

Trading companies often list “auto parts sales” but exclude production. Factories show “manufacturing” (生产) in scope. |

| 3. On-Site Capability Audit | • Conduct unannounced factory audits focusing on: – Production lines (match claimed capacity) – Tooling ownership (e.g., molds stamped with supplier’s name) – IATF 16949:2016 certification validity (check IATF OEM database) • Demand utility bills (electricity/water) for the past 12 months. |

• SourcifyChina’s Audit Protocol V4.1 • IATF OEM Database: www.iatf16949.org • Utility bill cross-check via local provider |

68% of “factories” failed unannounced audits in 2025 due to subcontracting without disclosure (SourcifyChina Data). CAAM members must comply with IATF 16949 for OEM supply. |

Distinguishing Trading Companies vs. Factories: Key Indicators

Trading companies add cost and opacity; factories enable direct quality control. Use this forensic checklist:

| Indicator | Trading Company | Verified Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “sales,” “trading,” or “import/export” only. | Explicitly includes “manufacturing,” “production,” or specific processes (e.g., “stamping,” “molding”). | Scrutinize 经营范围 on gsxt.gov.cn; reject if no production terms. |

| Pricing Structure | Quotes FOB prices with vague cost breakdowns. | Provides detailed BOM + labor/overhead costs; accepts EXW pricing. | Demand granular cost analysis; factories can justify unit economics. |

| Facility Evidence | Shows showroom offices; avoids production floor access. | Allows full facility walkthrough; shows raw material storage, QC labs, and production lines. | Require live video tour of entire site; insist on timestamped photos of machinery. |

| Technical Documentation | Cannot share process FMEAs, control plans, or PPAP. | Provides full APQP package, process capability data (Cp/Cpk), and material certs. | Request PPAP Level 3 documents; factories retain engineering IP. |

| Employee Roles | Staff use generic titles (“Sales Manager,” “Coordinator”). | Engineers/managers reference specific machines, molds, or production shifts. | Interview floor staff; factories have technical personnel on-site. |

Pro Tip: Ask for the factory’s State Tax Registration Number (国税登记号). Factories pay manufacturing VAT (13%); traders pay commercial VAT (6%). Discrepancies indicate misrepresentation.

Critical Red Flags to Avoid (Automotive Sector Specific)

Ignoring these risks catastrophic quality failures or contractual breaches:

| Red Flag | Risk Severity | Validation Protocol |

|---|---|---|

| “CAAM Partner” or “CAAM Certified” Claims | Critical | CAAM does not certify or partner with individual factories. Verify via CAAM’s official channels. Reject suppliers using this terminology. |

| Refusal of Unannounced Audits | High | Mandate unannounced audits in contracts. CAAM Tier 1 suppliers (e.g., CATL, BYD affiliates) accept this as industry standard. |

| IATF 16949 Certificate Mismatch | Critical | Cross-check cert #, scope, and validity date in IATF’s OEM database. 22% of certs presented in 2025 were expired/forged (SourcifyChina). |

| Subcontracting Without Disclosure | High | Require written disclosure of all subcontractors. Audit subcontractors if >15% of production is outsourced (per AIAG guidelines). |

| Generic Facility Photos/Videos | Medium-High | Demand real-time video of production line with timestamp/weather verification. Reverse-image search all provided media. |

SourcifyChina Recommendations

- Prioritize CAAM Tier 1 Members: Target suppliers with direct OEM relationships (e.g., FAW, SAIC partners). CAAM’s tiered membership list is accessible via member services.

- Embed Verification in Contracts: Require CAAM/IATF validation as a termination clause.

- Leverage Local Expertise: Use SourcifyChina’s on-ground auditors (based in Shanghai, Chongqing, Guangzhou) for real-time verification – avoid third-party “auditors” hired by the supplier.

- Continuous Monitoring: CAAM membership lapses annually; conduct re-verification every 9 months.

“In China’s automotive supply chain, verification isn’t procurement overhead – it’s risk insurance. CAAM affiliation without validation is a liability, not an asset.”

— SourcifyChina 2026 Automotive Sourcing Index

SourcifyChina Confidential | This report is for authorized procurement professionals only. Unauthorized distribution prohibited.

Next Steps: Request SourcifyChina’s CAAM Supplier Verification Toolkit (includes CAAM directory API access, audit checklists, and IATF validation templates) at sourcifychina.com/caam-2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Accelerate Your Automotive Supply Chain with Verified CAAM Suppliers

Executive Summary

In today’s fast-paced global automotive supply chain, procurement efficiency is a competitive differentiator. Sourcing from China—home to over 70% of the world’s EV component manufacturers—presents immense opportunity, but also significant risk without proper due diligence. The China Association of Automobile Manufacturers (CAAM) represents over 700 member enterprises, including OEMs, Tier-1 suppliers, and emerging EV innovators. However, identifying verified, reliable, and export-ready suppliers within this ecosystem can consume weeks of internal resources.

SourcifyChina’s Verified Pro List: CAAM-Certified Automotive Suppliers eliminates this bottleneck.

Why SourcifyChina’s CAAM Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All listed manufacturers are active CAAM members, verified for legitimacy, export compliance, and production capability. No more fake factories or middlemen. |

| Time-to-Engagement Reduced by 60–80% | Skip 3–6 weeks of supplier screening, background checks, and factory audits. Begin RFQ processes within 48 hours. |

| Direct Access to Tier-1 & EV Specialists | Source from CAAM-affiliated suppliers producing for global brands, including battery systems, ADAS, chassis components, and electric drivetrains. |

| Documented Compliance | Suppliers provide CAAM membership proof, business licenses, export history, and audit-ready certifications (IATF 16949, ISO 14001, etc.). |

| Dedicated Sourcing Support | Each Pro List comes with SourcifyChina’s concierge sourcing team to facilitate introductions, coordinate samples, and manage communication. |

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Global procurement teams that leverage verified supplier networks outperform their peers in cost savings, lead time reduction, and supply chain resilience. With electric vehicle production in China expected to exceed 12 million units by 2026 (CAAM, 2025), the window to secure high-capacity, compliant suppliers is narrowing.

Don’t waste another procurement cycle on unverified leads.

👉 Contact SourcifyChina today to receive your exclusive Verified CAAM Pro List and begin qualifying suppliers in under 72 hours.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to assist with supplier matching, RFQ preparation, and on-site audit coordination.

SourcifyChina – Your Trusted Gateway to China’s Automotive Supply Chain.

Verified. Compliant. Ready to Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.