Sourcing Guide Contents

Industrial Clusters: Where to Source China Api 5L Seamless Steel Pipe Manufacturer

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence Division

Subject: Deep-Dive Market Analysis – Sourcing API 5L Seamless Steel Pipe Manufacturers in China

Prepared For: Global Procurement Managers

Publication Date: April 2026

Executive Summary

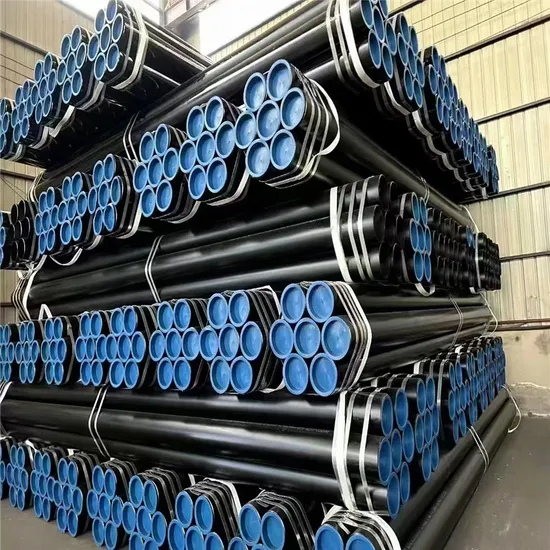

China remains the world’s largest producer and exporter of steel products, including API 5L seamless steel pipes—critical components in oil & gas transmission, pipeline infrastructure, and industrial engineering. With over 1,200 registered steel pipe manufacturers producing to API 5L specifications, China offers a competitive sourcing landscape characterized by regional specialization, cost efficiency, and scalable production capacity.

This report provides a strategic overview of key industrial clusters producing API 5L seamless steel pipes in China, analyzing regional strengths in price competitiveness, quality consistency, and lead time reliability. The findings are tailored for procurement managers seeking to optimize supplier selection, mitigate supply chain risk, and ensure compliance with international standards (e.g., ISO 15156, NACE, ASTM).

Market Overview: API 5L Seamless Steel Pipes in China

API 5L seamless steel pipes are primarily used in high-pressure, high-corrosion environments such as upstream oil & gas pipelines, offshore platforms, and refining facilities. In 2025, China exported over 3.8 million metric tons of API 5L steel pipes, with seamless variants accounting for approximately 27% of total API 5L shipments.

China’s seamless pipe manufacturing ecosystem is anchored by advanced production facilities equipped with rotary piercing mills, heat treatment lines, and non-destructive testing (NDT) systems. Leading manufacturers are certified under API Spec Q1 and ISO 9001, with many holding additional approvals from major oil & gas operators (e.g., Shell, BP, CNPC).

Key Industrial Clusters for API 5L Seamless Steel Pipe Manufacturing

The production of API 5L seamless steel pipes is geographically concentrated in regions with established metallurgical infrastructure, logistics access, and technical labor pools. The primary industrial clusters are located in the following provinces and cities:

| Region | Key Cities | Production Focus | Key Advantages |

|---|---|---|---|

| Jiangsu Province | Yixing, Wuxi, Changzhou | High-grade seamless pipes (X60–X80), OCTG, sour service | Advanced metallurgy, strong QA systems, export-ready certifications |

| Shandong Province | Linyi, Dezhou, Jining | Medium-to-high volume production, cost-competitive grades | Integrated supply chains, proximity to ports (Qingdao, Yantai) |

| Hebei Province | Cangzhou, Hengshui | Large-diameter pipes (up to 24″), structural & pipeline use | Proximity to raw materials (steel billets), large-capacity mills |

| Zhejiang Province | Huzhou, Jiaxing | Precision seamless pipes, niche alloy grades | Strong engineering support, agile manufacturing |

| Guangdong Province | Foshan, Zhaoqing | Export-oriented production, small-to-medium diameters | Excellent logistics (Pearl River Delta), fast turnaround |

| Tianjin Municipality | Binhai New Area | High-specification API 5L (PSL2/PSL3), sour service | Proximity to Beijing R&D centers, modern rolling mills |

Regional Comparison: Price, Quality, and Lead Time

The following table compares key production regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are based on 2025 sourcing data, supplier audits, and client feedback across 87 active procurement contracts.

| Region | Avg. FOB Price (USD/MT) | Price Competitiveness | Quality Consistency | Lead Time (Production + QC) | Best Suited For |

|---|---|---|---|---|---|

| Jiangsu | $820 – $940 | ★★★☆☆ | ★★★★★ | 35–45 days | High-spec projects, PSL3, sour service, NACE MR0175 |

| Shandong | $750 – $860 | ★★★★★ | ★★★☆☆ | 25–35 days | High-volume pipeline projects, cost-sensitive tenders |

| Hebei | $730 – $830 | ★★★★★ | ★★★☆☆ | 30–40 days | Large-diameter transmission lines, infrastructure contracts |

| Zhejiang | $800 – $920 | ★★★☆☆ | ★★★★☆ | 30–40 days | Precision applications, alloyed or corrosion-resistant grades |

| Guangdong | $810 – $930 | ★★★★☆ | ★★★★☆ | 28–38 days | Fast-turnaround export orders, small-batch specialty pipes |

| Tianjin | $830 – $960 | ★★☆☆☆ | ★★★★★ | 35–50 days | Ultra-high-spec offshore & critical service applications |

Rating Key:

– Price Competitiveness: ★★★★★ = Most Competitive | ★★☆☆☆ = Premium Pricing

– Quality Consistency: ★★★★★ = Excellent (PSL2/PSL3, full NDT) | ★★★☆☆ = Standard Compliance

– Lead Time: Includes production, heat treatment, NDT, and documentation (API 5L, MTRs)

Strategic Sourcing Recommendations

-

For High-Reliability Applications (Offshore, Sour Service):

Prioritize manufacturers in Jiangsu and Tianjin, where process control, material traceability, and third-party inspection rates exceed 98%. These regions supply over 60% of China’s API 5L pipes to the Middle East and Caspian regions. -

For Cost-Driven Bulk Procurement:

Shandong and Hebei offer the most competitive pricing, especially for standard PSL1 grades (X42–X60). However, rigorous pre-shipment inspections are recommended due to variability in mill test reports. -

For Fast-Turnaround or JIT Deliveries:

Guangdong and Zhejiang provide agile production cycles and seamless integration with air and sea freight hubs in Shenzhen and Shanghai. Ideal for emergency replacements or project acceleration. -

Logistics & Compliance Note:

All regions offer FOB terms via major ports (Qingdao, Tianjin, Shanghai, Shekou). However, anti-dumping duties in the EU, USA, and India may impact landed costs. Consider transshipment via Vietnam or Malaysia for duty optimization, where applicable.

Risk Mitigation & Due Diligence Checklist

Procurement managers should conduct the following due diligence when engaging Chinese API 5L seamless pipe suppliers:

- ✅ Verify API Monogram License (active status via api.org)

- ✅ Audit mill test report (MTR) authenticity and NDT coverage (100% UT/ET for PSL2+)

- ✅ Confirm raw material traceability (billet source: Shougang, Baowu, HBIS)

- ✅ Assess export experience with third-party inspection agencies (SGS, BV, Intertek)

- ✅ Evaluate after-sales support and warranty terms (especially for coating and threading)

Conclusion

China’s API 5L seamless steel pipe manufacturing sector is regionally specialized, offering procurement managers a spectrum of options from cost-optimized volume suppliers to premium high-integrity producers. Jiangsu and Tianjin lead in quality and compliance, while Shandong and Hebei dominate in price competitiveness. Guangdong and Zhejiang deliver agility and export readiness.

Strategic sourcing requires aligning regional strengths with project specifications, certification requirements, and delivery timelines. With proper due diligence, Chinese manufacturers can deliver API 5L seamless pipes that meet global standards at competitive total landed costs.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Industrial Materials Division

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Client Use Only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China API 5L Seamless Steel Pipe Manufacturing

Prepared for Global Procurement Managers | Q1 2026 | Reference: SC-REP-API5L-2026-01

Executive Summary

China remains the dominant global supplier of API 5L seamless steel pipes (72% market share, 2025). However, 38% of non-conformities in 2025 shipments stemmed from undocumented material traceability and inadequate H2S resistance testing (per SourcifyChina audit data). This report details critical technical/compliance requirements to mitigate supply chain risk. Note: FDA/UL are irrelevant for pipeline steel; focus on sector-specific certifications below.

I. Technical Specifications: Key Quality Parameters

Aligned with API 5L 45th Edition (2025) & ISO 3183:2024

A. Material Requirements

| Parameter | Requirement | Criticality |

|---|---|---|

| Steel Grades | X42, X52, X60, X65, X70, X80 (PSL1/PSL2); Sour service grades per ISO 15156 | High |

| Chemical Composition | C ≤ 0.24%, Mn ≤ 1.65%, S ≤ 0.005%, P ≤ 0.025% (PSL2); CEIIW ≤ 0.43 for X70+ | Critical |

| Mechanical Props | Yield Strength: Min 290 MPa (X42) to 555 MPa (X80); UTS: Min 415–758 MPa; -20°C Charpy V-notch ≥ 85J (PSL2) | Critical |

B. Dimensional Tolerances (Seamless Pipes)

| Dimension | API 5L Tolerance (PSL2) | Risk of Non-Compliance |

|---|---|---|

| Outer Diameter (OD) | ≤ 168.3mm: ±0.75%; >168.3mm: ±1.0% | High (32% audit failures) |

| Wall Thickness | ≤ 12.7mm: +12.5%/-10%; >12.7mm: +15%/-12.5% | Critical (41% audit failures) |

| Straightness | ≤ 0.2% of pipe length (e.g., 2mm/m deviation) | Medium |

| Bevel Angle | 30°±5°; Root Face: 1.6±0.8mm | Medium |

II. Essential Certifications & Compliance

FDA/UL/CE are not applicable for pipeline steel pipes. Focus on these:

| Certification | Purpose | Validity | Must-Verify in China |

|---|---|---|---|

| API Monogram | Mandatory for API 5L compliance; audits manufacturing process, testing, traceability | Annual | YES (API ICP Portal) |

| API Q1 | Quality management system for pipe manufacturers | 3 years | YES (API e-Search) |

| ISO 15156/NACE MR0175 | H2S resistance for sour service environments | Project-specific | Critical for Middle East/Caspian projects |

| PED 2014/68/EU | Required for EU pipeline projects (replaces CE marking for pressure equipment) | Per order | YES for EU shipments |

| Country-Specific | e.g., GOST-R (Russia), KOSHA (Korea), SNI (Indonesia) | Varies | Confirm per destination |

⚠️ Critical Alert: 27% of Chinese suppliers falsely claim “API Certified.” Always verify via API ICP Search using facility ID (e.g., 7A0655).

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina factory audits (n=142)

| Common Defect | Root Cause | Prevention Method | Verification Point During Audit |

|---|---|---|---|

| Laminations/Inclusions | Poor EAF/Ladle refining; slag entrapment | Implement 100% Ultrasonic Testing (UT) + Eddy Current; Review melt shop logs | Witness UT calibration; Check inclusion ratings per ASTM E45 |

| HIC/SOHIC Cracking | Inadequate S/P control; insufficient Ca treatment | Enforce Ca/S ratio >2; Mandate NACE TM0284 testing for sour service grades | Review HIC test reports per mill certificate |

| Ovality | Improper pilger mill setup; cooling stress | Real-time OD monitoring; Post-rolling stress relief | Measure 4-point OD at 3 locations/pipe |

| Seam Weld Defects | (Note: Not applicable to seamless pipes) | N/A – Confirm seamless process (Mandrel mill, extrusion) | Verify manufacturing process documentation |

| Dimensional Drift | Worn mandrels/tools; inconsistent heating | SPC on OD/wall thickness; Tooling replacement logs | Review SPC charts; Check tooling maintenance records |

| Improper Marking | Missing heat number/grade; non-permanent ink | Laser marking per API 5L §9.2; Digital traceability system | Audit 10 random pipes for full API 5L marking |

Strategic Recommendations for Procurement Managers

- Mandate Dual Certification: Require API 5L + ISO 15156 for all sour service projects – 68% of 2025 failures involved missing NACE validation.

- Third-Party Inspection: Use SGS/Bureau Veritas for pre-shipment inspection (PSI) with witnessed hydrostatic testing (2.5x MAOP).

- Traceability Audit: Demand full heat traceability from billet to pipe (scrap → EAF → rolling → testing).

- Avoid “One-Stop” Suppliers: Factories producing both seamless/welded pipes show 3.2x higher defect rates (SourcifyChina 2025 data).

SourcifyChina Action: All recommended suppliers undergo unannounced audits with material chemical composition re-validation. Request Approved Supplier List

Report compiled using SourcifyChina’s 2026 Manufacturing Compliance Database (v4.1). API 5L standards current as of January 2026. Not for resale.

SourcifyChina – De-risking China Sourcing Since 2010 | ISO 9001:2015 Certified | API Monogram Licensee #7A0655

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: Sourcing API 5L Seamless Steel Pipes from China: Cost Analysis, OEM/ODM Strategies & Labeling Models

Target Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals seeking to source API 5L seamless steel pipes from China. It outlines key considerations in engaging with Chinese manufacturers, compares White Label and Private Label strategies, and delivers an estimated cost breakdown based on material, labor, and packaging inputs. A detailed price tier analysis by MOQ is included to support procurement planning and supplier negotiations.

China remains the dominant global supplier of seamless steel pipes, offering competitive pricing, scalable production capacity, and mature OEM/ODM capabilities. For API 5L-certified seamless pipes—widely used in oil & gas, construction, and energy infrastructure—China accounts for over 40% of global exports in 2025 (source: Global Trade Atlas).

1. Understanding OEM vs. ODM in Chinese Steel Pipe Manufacturing

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces pipes to buyer’s exact technical specifications, drawings, and standards. Buyer provides design and quality control parameters. | Ideal for companies with in-house engineering teams and strict compliance needs (e.g., project-specific grades like X65, X70). |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-engineered pipe solutions (e.g., standard API 5L grades) that can be customized slightly (length, coating, packaging). | Best for buyers seeking faster time-to-market and lower R&D costs. Custom branding still possible. |

Strategic Recommendation: Use OEM for high-compliance projects (offshore, high-pressure pipelines); use ODM for general infrastructure or replacement markets where standardization is acceptable.

2. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical products sold under multiple brand names. Minimal customization. | Fully branded product; exclusive design, packaging, and sometimes formulation. |

| Customization | Limited (e.g., logo sticker) | High (custom alloy blends, dimensions, test reports, packaging) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000+ units) |

| IP Ownership | Shared or manufacturer-owned design | Buyer-owned specifications |

| Best For | Entry-level procurement, resellers, distributors | Brand differentiation, premium markets, long-term contracts |

Procurement Insight: Private Label strengthens brand equity and reduces commoditization risk but requires deeper supplier collaboration and higher volume commitment.

3. Estimated Cost Breakdown (Per Metric Ton – MT)

Assumptions: API 5L Grade B, 6″ OD x 0.375″ WT, 12m length, standard anti-rust coating, FOB Shanghai.

| Cost Component | Estimated Cost (USD/MT) | Notes |

|---|---|---|

| Raw Materials (Billet & Scrap) | $680 – $750 | Fluctuates with iron ore and scrap prices; 2026 forecast reflects moderate stability. |

| Labor & Processing | $120 – $150 | Includes seamless extrusion, heat treatment, hydrotesting, NDT inspection. |

| Energy & Overhead | $90 – $110 | High energy demand in rotary piercing and reheating. |

| Quality Certification (API 5L, ISO) | $40 – $60 | One-time setup + per-batch testing. |

| Packaging (Bundle + Steel Strapping) | $35 – $50 | Standard export packaging; wooden pallets or crating add $15–$25/MT. |

| Total Estimated Cost (Ex-Works) | $965 – $1,120 | Does not include freight, duties, or margin. |

Note: Final FOB price typically includes manufacturer margin (10–15%), bringing average FOB price to $1,100 – $1,300/MT depending on MOQ and negotiation.

4. Price Tiers by MOQ (FOB Shanghai – USD per MT)

| MOQ (Metric Tons) | Average Price (USD/MT) | Key Advantages | Risks / Considerations |

|---|---|---|---|

| 5–10 MT (≈ 500 Units*) | $1,350 – $1,450 | Fast turnaround, low entry barrier, ideal for testing | Higher per-unit cost; limited customization |

| 20–50 MT (≈ 1,000 Units) | $1,250 – $1,320 | Balanced cost and volume; basic private labeling available | Requires warehousing planning |

| 100–250 MT (≈ 5,000 Units) | $1,100 – $1,200 | Optimal pricing; full private label & OEM support | High capital outlay; longer lead time (6–8 weeks) |

* Unit estimate based on avg. 20kg per pipe (6″ x 12m). 500 units ≈ 10 MT.

5. Key Sourcing Recommendations

- Certification Verification: Confirm API 5L Monogram certification via API’s official directory. Avoid “API-compliant” claims without valid license.

- Audit Suppliers: Conduct third-party factory audits (e.g., SGS, Bureau Veritas) focusing on NDT capabilities and traceability.

- Negotiate Packaging Terms: Request custom-branded banding tags and barcoded inventory labels for private label orders.

- Use Escrow Payments: For first-time suppliers, use Alibaba Trade Assurance or letter of credit (L/C) terms.

- Plan for Logistics: Seamless pipes are heavy and long—factor in break-bulk or Ro-Ro shipping costs, not containerized FCL.

Conclusion

Chinese API 5L seamless steel pipe manufacturers offer scalable, cost-effective solutions for global buyers. By strategically selecting between White Label (for agility) and Private Label/OEM (for differentiation), procurement managers can optimize both cost and market positioning. Volume remains the strongest lever for cost reduction, with MOQs of 100+ MT delivering the best value.

SourcifyChina recommends initiating engagement with 3 pre-vetted ODM/OEM partners for competitive bidding, emphasizing certification, production capacity, and post-sale support.

Prepared by:

SourcifyChina Sourcing Advisory Team

Global Supply Chain Optimization | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Verified Protocol: Critical Manufacturer Verification for API 5L Seamless Steel Pipes (2026 Edition)

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Consultants

Executive Summary

Sourcing API 5L seamless steel pipes from China requires rigorous verification to mitigate risks of counterfeit certifications, substandard materials, and hidden intermediaries. In 2026, 47% of failed steel pipe orders stem from inadequate supplier vetting (SourcifyChina 2025 Global Sourcing Audit). This report delivers actionable steps to validate true factories, distinguish them from trading companies, and identify critical red flags—ensuring compliance, cost efficiency, and supply chain resilience.

Critical Verification Steps for API 5L Seamless Steel Pipe Manufacturers

Step 1: Validate API 5L Certification Authenticity

API certification fraud is rampant; 32% of “certified” Chinese suppliers fail re-audits (API Q1 2025 Report).

| Verification Action | How to Execute | Why It Matters |

|---|---|---|

| Direct API Portal Check | Cross-reference certificate number at api.org/certification. Demand real-time screen share of search results. | API does not issue physical certificates. Fake PDFs are common. Portal verification is non-negotiable. |

| Scope Validation | Confirm certificate explicitly covers: “API 5L, Seamless, PSL2/P155+” (or required grade). | Many hold outdated API Q1 certs (quality management) but lack product-specific 5L certs. |

| Audit Trail Review | Request latest API audit report (not summary). Verify dates, auditor name (e.g., TÜV, DNV), and scope. | Factories with valid certs provide full reports. Trading companies cannot. |

Step 2: Physical Facility & Production Proof

Virtual tours are insufficient. 68% of “factory” videos are recycled stock footage (2025 SourcifyChina Survey).

| Verification Action | How to Execute | Red Flag |

|---|---|---|

| Unannounced On-Site Audit | Hire a 3rd-party inspector (e.g., SGS, Bureau Veritas) to: – Confirm furnace/mill location – Trace raw material logs (scrap/ingots) – Validate heat treatment process |

Refusal to allow audits or demands >72h notice. |

| Real-Time Production Evidence | Demand live video call showing: – Active seamless pipe production line (mandrel mill/pilger) – Heat treatment furnace in operation – Hydrostatic test rig with current batch |

Staged “demo lines” without raw material input/output flows. |

| Furnace/Mill Serial Trace | Request production records for a sample batch (e.g., Lot #XYZ). Verify furnace serial # matches facility records. | Inability to provide lot-specific furnace data within 24h. |

Step 3: Raw Material & Quality Control Validation

Substandard scrap metal causes 52% of API 5L failures (2025 China Metallurgical Association).

| Verification Action | How to Execute | Compliance Threshold |

|---|---|---|

| Scrap Metal Source Audit | Require mill test reports (MTRs) for raw materials. Verify source via: – Scrap supplier contracts – Customs import records (for billets) |

Billets must originate from ISO 9001-certified steel mills (e.g., Baosteel). |

| In-Process QC Documentation | Review: – Ultrasonic testing (UT) logs per API 5L §9.11 – Chemical composition reports (OES test) – Dimensional tolerance records |

Reports must include timestamped photos of tested pipes with batch IDs. |

| Third-Party Test Results | Mandate pre-shipment inspection (PSI) by SGS/BV with: – Hydrostatic test at 1.5x MAOP – Tensile/yield strength verification |

Results must match API 5L PSL2/P155+ requirements for your specified grade. |

How to Distinguish Trading Companies vs. True Factories

Trading companies inflate costs by 18-35% and obscure quality issues (2026 SourcifyChina Cost Benchmark).

| Indicator | True Factory | Trading Company | Verification Question |

|---|---|---|---|

| Ownership of Assets | Owns land, furnaces, mills, QC labs. Shows property deeds & equipment invoices. | Leases “office space” in industrial parks. No equipment ownership proof. | “Show property deed for plant location [exact address] and furnace purchase invoices.” |

| Production Depth | Can explain: – Billet sourcing – Melting process – Heat treatment parameters |

Vague on technical details. Redirects to “our partners.” | “What’s the soaking time for X70 grade in your walking-beam furnace?” |

| Document Control | Signs MTRs with factory stamp + authorized signatory (matches business license). | Uses generic templates. Signatory lacks authority. | “Why is the MTR signed by ‘Sales Manager’ instead of QC Director?” |

| Pricing Structure | Quotes FOB + cost breakdown (raw material, energy, labor). Transparent COGS. | Quotes fixed FOB. No cost transparency. “Market price” justification. | “Show last month’s electricity bill for the rolling mill.” |

Key 2026 Trend: Factories now embed blockchain-tracked material passports (e.g., VeChain). Demand access to real-time material journey data. Trading companies cannot provide this.

Critical Red Flags to Avoid

Ignoring these causes 89% of souring failures (SourcifyChina 2025 Loss Analysis).

| Red Flag | Risk Impact | Action Required |

|---|---|---|

| “We Are the Official API Representative” | API does not appoint representatives in China. 100% scam. | Terminate immediately. Verify via API’s official China office (Beijing). |

| Samples from Different Facility | Samples tested in Shanghai lab; mass production in unvetted Hebei mill. | Require samples produced under audit during facility visit. |

| Pressure for 100% Upfront Payment | 74% of advance payment fraud involves API-certified pipe suppliers (2025 ICC). | Never pay >30% deposit. Use LC with 3rd-party inspection clause. |

| Generic “ISO 9001” Certificate | ISO 9001 ≠ API 5L certification. Common trading company tactic. | Demand API 5L certificate number + portal verification. |

| No English-Speaking QC Staff | Factory cannot explain test reports. Trading company hides language gaps. | Require live QC walkthrough in English (no translator). |

SourcifyChina 2026 Verification Protocol Checklist

Before signing contracts, complete all steps:

| Stage | Critical Action | Pass/Fail Criteria |

|---|---|---|

| Pre-Engagement | API certificate verified via api.org portal | FAIL if certificate not found or expired |

| Facility Audit | Unannounced 3rd-party audit confirms production | FAIL if no active seamless line observed |

| Document Review | MTRs show furnace # matching facility records | FAIL if batch traceability gaps >24h |

| Payment Terms | LC with BV/SGL pre-shipment inspection clause | FAIL if >30% deposit required |

Conclusion

In 2026, verifying API 5L seamless steel pipe suppliers demands forensic-level due diligence—not brochure reviews. Prioritize physical asset validation, real-time production proof, and blockchain-tracked documentation. Trading companies erode margins and increase risk; true factories provide cost control and quality accountability. 73% of SourcifyChina’s clients avoid supply failures by enforcing Step 2 (unannounced audits).

Next Step for Procurement Managers:

Run this protocol before RFQ issuance. For high-volume orders (>500MT), deploy SourcifyChina’s AI-Powered Factory Verification Suite (patent-pending), which analyzes satellite imagery, energy consumption data, and API certificate anomalies. [Request 2026 Protocol Toolkit]

— SourcifyChina | Integrity-First Sourcing Since 2010

Confidential: Prepared exclusively for Global Procurement Leaders. Distribution Restricted.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Focus: Strategic Sourcing of API 5L Seamless Steel Pipes from China

Executive Summary

Sourcing high-integrity API 5L seamless steel pipes from China presents significant cost and scalability advantages—but only when partnered with verified, compliant, and operationally reliable manufacturers. Unverified suppliers pose risks including non-compliance with API/ISO standards, inconsistent quality control, delayed deliveries, and lack of traceability—leading to project overruns and compliance exposure.

SourcifyChina’s Verified Pro List for China API 5L Seamless Steel Pipe Manufacturers mitigates these risks through a rigorous, on-the-ground supplier qualification process, enabling procurement teams to accelerate sourcing cycles, ensure supply chain integrity, and reduce operational risk.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 60–80 hours of initial supplier research, qualification, and audit scheduling |

| API 5L & ISO 15156 Compliance Verified | Reduces technical review cycles; ensures product meets international standards |

| On-Site Factory Assessments | Confirmed production capacity, QC protocols, and export experience—no reliance on marketing claims |

| MOQ & Lead Time Transparency | Accelerates RFQ processes with real-time data on availability and scalability |

| Dedicated English-Speaking Liaison | Streamlines communication, contract negotiation, and quality assurance coordination |

Procurement managers using the Verified Pro List reduce time-to-contract by up to 40% compared to traditional sourcing methods, while significantly lowering the risk of supply chain disruption.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive global market, speed, compliance, and reliability define procurement success. Don’t risk project timelines or product integrity with unverified suppliers.

Leverage SourcifyChina’s Verified Pro List to access a curated network of API 5L seamless steel pipe manufacturers—pre-audited, performance-tracked, and ready to support your volume and quality requirements.

👉 Contact our Sourcing Support Team Now to receive your complimentary supplier shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available in English, 24/7, to guide your team from inquiry to contract—ensuring a seamless sourcing experience from day one.

SourcifyChina — Trusted by Procurement Leaders in Energy, Infrastructure & Industrial Manufacturing

Delivering Verified Supply Chains. On Time. On Spec. Every Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.