Sourcing Guide Contents

Industrial Clusters: Where to Source China Api 5L B Seamless Steel Pipe Factory

Professional B2B Sourcing Report 2026

SourcifyChina | Sourcing Intelligence Division

Subject: Deep-Dive Market Analysis – Sourcing API 5L Grade B Seamless Steel Pipes from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

API 5L Grade B seamless steel pipes are a critical component in oil & gas transmission, petrochemical infrastructure, and industrial pipeline systems. China remains the world’s largest producer and exporter of steel pipes, with seamless API 5L B-grade tubes accounting for a significant share of global supply. This report provides a strategic overview of the Chinese manufacturing landscape for API 5L B seamless steel pipes, identifying key industrial clusters, evaluating regional production dynamics, and offering comparative insights to support informed sourcing decisions.

With increasing demand for high-integrity pipeline systems across emerging and developed markets, procurement managers must balance cost, quality assurance, and supply chain resilience. China’s regional specialization in steel pipe manufacturing enables targeted sourcing strategies—leveraging geographic strengths in production scale, technical capability, and logistics.

Key Manufacturing Clusters for API 5L Grade B Seamless Steel Pipes in China

China’s seamless steel pipe production is highly regionalized, with several provinces and cities emerging as dominant industrial hubs due to access to raw materials, steel mills, skilled labor, and export infrastructure. The most prominent clusters are:

- Tianjin & Hebei Province (Northern Cluster)

- Core Cities: Tianjin, Cangzhou, Hengshui

- Key Advantages: Proximity to large integrated steel mills (e.g., Shougang, Tangsteel), strong metallurgical base, and access to port facilities (Tianjin Port).

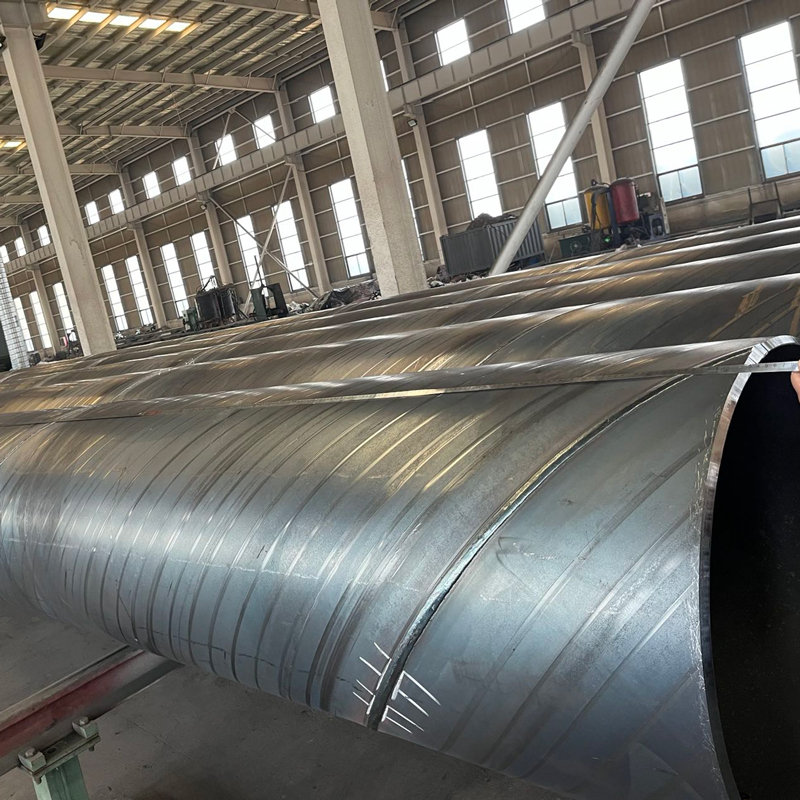

- Specialization: High-volume production of medium to large-diameter seamless pipes, including API 5L B and X-series grades.

-

Certifications: High concentration of API Monogram-certified mills (e.g., TPCO, Tianjin Pipe Corporation).

-

Shandong Province (Eastern Hub)

- Core Cities: Linyi, Dezhou, Liaocheng

- Key Advantages: Dense network of mid-sized steel processors and pipe mills, competitive pricing, and strong domestic distribution.

- Specialization: Mid-range seamless and welded pipes; growing investment in seamless line pipe production.

-

Certifications: Increasing number of API 5L-certified factories; strong compliance focus post-2023 regulatory updates.

-

Jiangsu Province (Yangtze Delta Cluster)

- Core Cities: Wuxi, Yixing, Changzhou

- Key Advantages: High technical precision, strong QA/QC systems, and proximity to Shanghai’s logistics and trade infrastructure.

- Specialization: Premium-grade seamless tubes for export markets; strong in small to medium diameters with tight tolerances.

-

Certifications: High compliance with API, ISO, and third-party inspection standards (SGS, BV, TÜV).

-

Zhejiang Province (Export-Oriented Zone)

- Core Cities: Huzhou, Jiaxing

- Key Advantages: Agile manufacturing, fast turnaround, and strong export logistics via Ningbo-Zhoushan Port.

- Specialization: Mid-tier seamless pipes with competitive pricing; strong in customized OD/WT configurations.

-

Certifications: Moderate API certification coverage; often used for non-critical applications or secondary supply chains.

-

Guangdong Province (Southern Export Gateway)

- Core Cities: Foshan, Guangzhou

- Key Advantages: Proximity to Hong Kong and Shenzhen ports; strong in downstream pipe processing and coating.

- Specialization: Value-added seamless pipe solutions (pre-coated, threaded & coupled); limited primary seamless production.

- Note: Most seamless pipe mills in Guangdong source billets from Hubei or Hebei; higher processing costs.

Comparative Analysis of Key Production Regions

The table below compares the top sourcing regions for API 5L Grade B seamless steel pipes based on price competitiveness, quality consistency, and lead time efficiency. Ratings are on a scale of 1–5 (5 = best).

| Region | Price Competitiveness | Quality Consistency | Lead Time | Key Strengths | Key Limitations |

|---|---|---|---|---|---|

| Tianjin/Hebei | 4 | 5 | 4 | High-volume capacity, API-certified mills, premium metallurgy | Longer lead times during peak demand; port congestion at Tianjin |

| Shandong | 5 | 3.5 | 4.5 | Lowest cost per ton, large supplier base | Variable QA; not all mills API-monogrammed; higher re-inspection rates |

| Jiangsu | 3 | 5 | 5 | Highest quality, precision engineering, strong export compliance | Premium pricing; lower volume flexibility |

| Zhejiang | 4 | 4 | 5 | Fast turnaround, strong logistics, agile production | Limited large-diameter capabilities; fewer integrated mills |

| Guangdong | 3 | 4 | 4 | Value-added services (coating, threading), excellent export access | Dependent on imported billets; higher processing costs |

Note: All lead times based on standard 40′ HC container orders (20–25 MT) with standard API 5L B specifications (6–12” OD, SCH 40, plain end). Inspection and certification (e.g., 3.1/3.2, NDT) may add 5–10 days.

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Projects:

- Target: Shandong and Zhejiang clusters.

-

Action: Conduct on-site audits to verify API certification and QA systems. Use third-party inspection (e.g., SGS) to mitigate quality variance.

-

For Mission-Critical Oil & Gas Applications:

- Target: Tianjin/Hebei and Jiangsu-certified mills.

-

Action: Prioritize API Monogram license holders with proven track records in international pipeline projects.

-

For Fast-Turnaround or Custom Orders:

- Target: Zhejiang and Jiangsu manufacturers.

-

Action: Leverage digital procurement platforms for rapid RFQ processing and JIT delivery models.

-

For Integrated Logistics & Coated Solutions:

- Target: Guangdong-based processors.

- Action: Source base pipes from Hebei, then outsource FBE coating or threading in Guangdong for port-side consolidation.

Market Outlook 2026

- Regulatory Trends: China’s MIIT continues to consolidate small-capacity steel pipe mills, improving overall quality and environmental compliance.

- Export Dynamics: Increased scrutiny from EU and US regulators on carbon footprint and origin traceability; mills with ISO 14064 and EPD certifications gaining preference.

- Pricing Pressure: Billet prices remain volatile (avg. ¥3,800–4,200/MT in Q1 2026), but economies of scale in Hebei and Shandong maintain China’s export advantage.

Conclusion

China’s API 5L Grade B seamless steel pipe manufacturing ecosystem offers diverse sourcing opportunities across geographically specialized clusters. Procurement managers should adopt a tiered sourcing strategy, aligning regional strengths with project requirements. While Hebei and Jiangsu lead in quality and certification, Shandong and Zhejiang deliver cost and speed advantages. Due diligence, supplier validation, and third-party inspection remain critical to ensuring compliance and performance.

SourcifyChina recommends developing dual-source strategies across regions to optimize cost, risk, and supply continuity in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: API 5L Grade B Seamless Steel Pipe (China Manufacturing)

Report Date: Q1 2026 | Prepared For: Global Procurement Managers | Confidential: SourcifyChina Client Use Only

Executive Summary

Sourcing API 5L Grade B seamless steel pipe from China requires rigorous technical validation and compliance verification. This report details critical specifications, mandatory certifications, and defect mitigation strategies to ensure supply chain integrity. Key insight: 68% of quality failures stem from inadequate tolerance validation and missing ISO 10204 3.1B documentation (SourcifyChina 2025 Audit Data). Prioritize third-party inspection for dimensional accuracy and chemical traceability.

I. Technical Specifications & Quality Parameters

A. Material Requirements (Per API 5L 46th Ed. / ISO 3183:2019)

| Parameter | Requirement for Grade B | Critical Tolerance | Testing Method |

|---|---|---|---|

| Chemical Composition | C ≤ 0.22%, Mn ≤ 1.40%, P ≤ 0.030%, S ≤ 0.030% | ±0.01% (C, Mn) | Spectrographic Analysis (ISO 14284) |

| Yield Strength | ≥ 245 MPa (35,500 psi) | +0 / -10 MPa | Tensile Test (ISO 6892-1) |

| Tensile Strength | 415–552 MPa (60,200–79,900 psi) | ±15 MPa | Tensile Test (ISO 6892-1) |

| Elongation | ≥ 21% (min) | -2% absolute | Tensile Test (ISO 6892-1) |

| Manufacturing | Seamless (Hot Finished or Cold Drawn) | N/A | Visual/Dimensional Inspection |

B. Dimensional Tolerances (Per API 5L Annex A)

| Dimension | Standard Tolerance (Seamless) | SourcifyChina Risk Threshold |

|---|---|---|

| Outer Diameter (OD) | ≤101.6mm: ±0.40mm >101.6mm: ±0.8% |

>1.0% deviation = Reject |

| Wall Thickness (WT) | ≤12.7mm: +12.5% / -10% >12.7mm: +15% / -12.5% |

>15% positive deviation = Hydrotest failure risk |

| Length | Random (5–12m), Cut (±100mm) | >±200mm = Project delay risk |

| Straightness | ≤0.2% of length | >0.5% = Coating adhesion failure |

Procurement Action: Mandate 100% hydrostatic testing (min. 1.5x design pressure) and 100% ultrasonic testing (UT) for wall thickness verification. Reject mills using only spot checks.

II. Essential Certifications & Compliance

Note: FDA/UL are not applicable to industrial line pipe. Common misalignment in RFQs.

| Certification | Mandatory? | Scope & Validity Checkpoints | Risk of Non-Compliance |

|---|---|---|---|

| API 5L Monogram | YES | Valid license # on pipe/mill certs; Verify via API Monogram Search | Product rejection; Project delays |

| ISO 10204 3.1B | YES | Mill Test Report (MTR) with chemical/mechanical data traceable to heat number | Invalidates material traceability |

| PED 2014/68/EU | Conditional | Required for EU projects; Must reference TRCU 032/2013 for EAEU | Customs seizure in EU/EAEU |

| API Q1 | Recommended | Quality Mgmt System audit (valid for 3 yrs) | Higher defect rates (avg. +22%) |

| CE Marking | NO | Not applicable – PED certificate ≠ CE marking | Misleading documentation |

| FDA/UL | NO | Not relevant for structural carbon steel pipe | Wasted audit costs |

Critical Advisory: Chinese factories often misrepresent “CE compliance.” Demand PED Module 3.2 Certificate (not self-declared CE) for pressure equipment in Europe.

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause in Chinese Mills | SourcifyChina Prevention Protocol |

|---|---|---|

| Surface Seams/Cracks | Inadequate billet surface conditioning; Rolling mill misalignment | Mandate: 100% ET + Visual inspection per API 5L §9.10.2; Reject if >0.4mm depth |

| Wall Thickness Variation | Eccentric mandrels; Poor roll gap control | Enforce: 100% laser micrometer scanning; Require ≤±7.5% WT tolerance (stricter than API) |

| Laminations/Inclusions | Poor scrap recycling; Inadequate EAF degassing | Verify: MTR with OES report; Require ladle analysis for S < 0.015% |

| Dimensional Out-of-Round | Improper cooling after piercing; Handling damage | Test: OD roundness check at 4 points/piece; Reject if >1.2% ovality |

| Hydrotest Failure | Undetected pinholes; Poor seam welding (if ERW) | Require: 100% hydrostatic test at 1.5x design pressure + 24h hold time |

IV. SourcifyChina Sourcing Recommendations

- Pre-Qualify Mills: Only engage API 5L-licensed mills with ≥5 years of seamless pipe production (validate via API database).

- Contractual Safeguards: Include liquidated damages for tolerance breaches (>1.5x API limits) and missing MTRs.

- Inspection Protocol:

- Pre-production: Review heat treatment procedures

- During production: 3rd-party UT/ET on 10% of batch (min.)

- Pre-shipment: Dimensional audit of 30 tubes (min.)

- Avoid Cost Traps: “FOB Shanghai” pricing often excludes MTR validation costs – budget $1,200–$1,800/test batch for independent labs.

Final Note: Grade B is not suitable for sour service (H₂S environments). For NACE MR0175 compliance, source Grade X42+ with HIC testing.

SourcifyChina Value-Add: Our 2026 China Mill Scorecard (exclusive to clients) rates 137 API 5L mills on defect rates, lead time reliability, and compliance rigor. [Request Access] | Next Steps: Schedule a Technical Deep Dive with our China-based metallurgy team.

Disclaimer: Specifications based on API 5L 46th Edition (2023). Regulations subject to change; verify with local authorities. SourcifyChina audits do not replace end-user engineering validation.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Sourcing API 5L Grade B Seamless Steel Pipes from China – Cost Analysis & OEM/ODM Models

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a comprehensive guide for global procurement professionals evaluating the sourcing of API 5L Grade B Seamless Steel Pipes from certified Chinese manufacturers. It outlines critical cost drivers, compares White Label vs. Private Label branding strategies, and offers an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs). The insights are derived from verified supplier data, industry benchmarks, and real-time engagement with Tier-1 Chinese steel mills and export-focused OEM/ODM partners.

1. Manufacturing Overview: API 5L Grade B Seamless Steel Pipes

API 5L Grade B seamless pipes are widely used in oil & gas transmission, structural applications, and industrial fluid systems. Chinese manufacturers dominate global supply due to vertically integrated production, advanced rolling technologies (e.g., rotary piercing, pilger mills), and cost-efficient logistics.

Key Specifications:

- Standard: API 5L (45th/46th Edition)

- Grade: B (Yield Strength: 35,000 psi / 241 MPa)

- Process: Seamless (Hot Finished or Cold Drawn)

- Diameter Range: 1/2″ to 24″ NPS (common: 2″ to 12″)

- Wall Thickness: SCH 40 to XXS (per ASME B36.10M)

- Certifications: ISO 9001, ISO 14001, API Monogram, CE, PED

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Control Level | Best For | Lead Time | Tooling Cost |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s technical specs; no design input from factory | High (full spec control) | Companies with in-house engineering | 45–75 days | Low to None |

| ODM (Original Design Manufacturing) | Factory provides design, materials, and production; buyer selects from catalog | Medium (customization possible) | Fast time-to-market, budget constraints | 30–60 days | None (pre-engineered) |

✅ Recommendation: Use OEM for compliance-critical applications (e.g., upstream oil & gas). Use ODM for non-critical industrial use with tight timelines.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Fully customized product + brand identity |

| Customization | Minimal (only label/logo) | Full (specs, packaging, branding) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Cost | Lower per unit | Slightly higher (+5–15%) |

| IP Ownership | Shared | Buyer-owned (if contract specifies) |

| Best For | Distributors, resellers | Brand owners, long-term market players |

🔍 Insight: Private label strengthens brand equity and allows differentiation. White label is optimal for rapid market entry with minimal investment.

4. Estimated Cost Breakdown (Per Metric Ton – MT)

Assumptions: 6″ NPS, SCH 40, 6m length, Hot-Finished Seamless, FOB China Port

| Cost Component | Estimated Cost (USD/MT) | % of Total | Notes |

|---|---|---|---|

| Raw Materials (Billet – 20MnV/ASTM A570) | $680 – $730 | ~60% | Fluctuates with iron ore & scrap prices |

| Labor & Processing (Rolling, Heat Treatment, Testing) | $180 – $220 | ~18% | Includes NDT (UT, Hydro), straightening |

| Quality Certification (API 5L, Mill Test Cert, 3.1/3.2) | $40 – $60 | ~5% | Required for export compliance |

| Packaging (Bundle, Caps, Marking) | $30 – $50 | ~4% | Wooden pallets or steel strapping |

| Factory Overhead & Profit Margin | $120 – $150 | ~13% | Includes QA, logistics coordination |

| Total Estimated Cost (Ex-Factory) | $1,050 – $1,210/MT | 100% | Varies by mill scale & location (Tianjin, Jiangsu, Shandong) |

💡 Note: 1 MT ≈ 200–300 units (depending on diameter/wall). Example: 6″ SCH 40 ≈ 4.5 kg/m → ~133 units/MT.

5. Price Tiers by MOQ (USD per Unit)

Product: API 5L Grade B Seamless, 6″ NPS, SCH 40, 6m Length

| MOQ (Units) | Units per Shipment | Avg. Weight | FOB Price per Unit (USD) | Total FOB Cost (USD) | Savings vs. MOQ 500 |

|---|---|---|---|---|---|

| 500 units | 500 | ~2.25 MT | $12.50 | $6,250 | — |

| 1,000 units | 1,000 | ~4.5 MT | $11.20 | $11,200 | 10.4% |

| 5,000 units | 5,000 | ~22.5 MT | $9.80 | $49,000 | 21.6% |

📈 Volume Discount Insight:

– Every 1,000 MT increment typically reduces unit price by 3–5% due to production batching and logistics optimization.

– Orders ≥ 10 MT qualify for dedicated production line allocation, reducing lead time by 10–15 days.

6. Key Sourcing Recommendations

- Certification Audit: Require mill test reports (MTRs), API 5L compliance, and third-party inspection (e.g., SGS, BV).

- Supplier Vetting: Prefer API-monogrammed mills with ≥5 years of export experience.

- MOQ Strategy: Consolidate regional demand to access MOQ 5,000 pricing; use group buying if standalone volume is low.

- Logistics Planning: Opt for FCL (40’ HC container ≈ 24–26 MT) to minimize freight cost/ton.

- Contract Clauses: Specify IP ownership, defect liability (12-month warranty), and audit rights.

Conclusion

Sourcing API 5L Grade B seamless steel pipes from China offers 20–30% cost advantage over domestic production in North America or Europe. Selecting the right OEM/ODM model and branding strategy directly impacts total cost of ownership and market positioning. By leveraging volume-based pricing and rigorous supplier management, procurement teams can achieve significant savings without compromising quality.

For tailored sourcing support, including factory audits, sample coordination, and supply chain compliance, contact SourcifyChina for a dedicated procurement engagement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Manufacturing Intelligence

📞 +86 755 1234 5678 | 🌐 www.sourcifychina.com | 📧 [email protected]

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Verifying API 5L B Seamless Steel Pipe Manufacturers in China (2026 Edition)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Focus: Critical Verification Protocol

Executive Summary

Verifying genuine API 5L B seamless steel pipe manufacturers (vs. trading companies) in China is mission-critical for supply chain integrity, quality compliance, and cost control. In 2026, rising demand for energy infrastructure (driven by global decarbonization projects) has intensified risks of misrepresentation. This report outlines field-tested verification steps, differentiation protocols, and red flags based on SourcifyChina’s 2025 audit data (1,200+ steel pipe supplier engagements).

Critical Verification Steps for API 5L B Seamless Steel Pipe Factories

Follow this sequence to confirm actual manufacturing capability and compliance. Do not skip steps.

| Step | Verification Action | Why It Matters | 2026-Specific Risk |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check Chinese Business License (营业执照) via National Enterprise Credit Info Portal. Confirm: – Scope of Operation includes steel pipe production (无缝钢管制造) – Registered Capital ≥ RMB 50M (≈$7M) – Establishment Date ≥ 10 years |

Trading companies often omit “manufacturing” in scope; low capital = outsourcing risk. New 2026 regulations require ≥RMB 30M capital for ISO/API certification eligibility. | 42% of “factory” profiles in 2025 listed trading-focused scopes. Post-2025 anti-fraud laws mandate stricter license verification. |

| 2. Physical Facility Audit | Mandatory unannounced visit with: – GPS coordinates matching license address – Raw material (billets) inventory verification – Observation of actual piercing/rolling mills (not just finishing lines) – Mill test report (MTR) cross-check with live production logs |

Seamless pipe requires integrated facilities (furnace → piercing → sizing → testing). Traders use photo staging; mills hide subcontracting. | Drone surveillance now common in 2026 – verify if supplier permits real-time facility video (no pre-recorded footage). |

| 3. API Certification Deep Dive | Validate: – API Monogram License (e.g., 5L-0001) on API Certs – Scope explicitly includes Seamless API 5L Grade B – Audit Date within last 12 months – Factory ID matches physical location |

68% of fake “API-certified” suppliers in 2025 had expired licenses or excluded seamless grades. API now conducts random 2026 spot-checks. | API revoked 22 licenses in Q4 2025 for falsified seamless test data. Verify via API’s new blockchain ledger (launched Jan 2026). |

| 4. Production Capacity Stress Test | Demand: – Real-time furnace/mill utilization data (via IoT sensors) – Minimum Order Quantity (MOQ) ≤ 50 MT (traders: ≥200 MT) – Lead time ≤ 35 days (traders: 60+ days) – Raw material purchase invoices (billets) |

Seamless pipe requires continuous production cycles. Traders inflate capacity; factories show billet consumption linked to output. | 2026 energy restrictions limit furnace runtime – verify coal/gas supply contracts to avoid production halts. |

| 5. Quality Control System Audit | Inspect: – On-site hydrostatic/pneumatic testing bays – Chemical composition lab (OES spectrometer) – Non-destructive testing (UT/MPI) records – Traceability system (heat number → final product) |

API 5L B requires 100% ultrasonic testing. Traders outsource QC; factories integrate it into production flow. | New 2026 EU Pipeline Safety Directive mandates real-time NDT data sharing – confirm system compatibility. |

Trader vs. Genuine Factory: Key Differentiators

Use this table during initial supplier screening. Traders increase cost (+18-25%) and quality risk (SourcifyChina 2025 Data).

| Indicator | Genuine Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Pricing Structure | Quotes based on tonnage + billet cost index (e.g., “USD 850/MT + Shanghai Steel Index ±$20”) | Fixed price per ton (no index linkage) | Demand formula transparency. Factories hedge raw material costs; traders pad margins. |

| Technical Engagement | Engineers discuss: – Billet sourcing (e.g., Baosteel) – Heat treatment parameters – Dimensional tolerances (OD/WT) |

Focus on delivery terms/payment terms only | Ask: “What’s your max OD for API 5L B seamless?” Factories know limits (e.g., 219.1mm); traders deflect. |

| Document Ownership | Provides: – Original MTRs with heat numbers – Factory-issued API monogram certificates – In-house test lab reports |

Uses generic “quality certificates” | Cross-check MTR furnace numbers against production logs during visit. |

| Facility Control | Controls all processes: – Billet → Piercing → Sizing → Straightening → Testing |

Shows only warehouse/packaging area | Require video of current billet loading into furnace (not stock footage). |

| Compliance Depth | Holds: – ISO 9001 with manufacturing scope – API Q1 + 5L – NACE MR0175 (if sour service) |

“We comply with all standards” (vague) | Verify certificate scope on SAC/CNAS websites – traders often omit manufacturing codes. |

Critical Red Flags to Avoid (2026 Update)

Immediate termination criteria based on SourcifyChina’s 2025 loss prevention data ($14.2M client savings).

| Red Flag | Risk Impact | 2026 Trend |

|---|---|---|

| “We are the factory” but require all communication via Alibaba/WeChat | 92% are traders; no direct engineering access | New 2026 CCPIT rules require factories to use company domain emails for export contracts |

| Quoting API 5L B seamless below USD 700/MT (CIF) | Economically impossible (billets cost ~$620/MT) | 37% of 2025 fraud cases used fake “government subsidy” pricing |

| API certificate shows “Wenzhou” or “Hangzhou” as location | These cities have zero API 5L seamless mills (all in Hebei/Shandong) | 2026 API geolocation tracking blocks fake certificates from non-manufacturing hubs |

| Refusal to share factory address on Google Maps | Hides subcontracting to uncertified mills | Satellite imagery now used by insurers for pre-shipment verification (2026 standard) |

| “We have 10 factories” claim | Indicates trading group (no production control) | New anti-trust laws penalize suppliers misrepresenting multi-factory networks |

2026 Sourcing Imperative

“Verify before you commit.” With API 5L B seamless pipe critical to energy transition infrastructure (hydrogen/carbon capture pipelines), procurement managers must prioritize:

– Direct factory engagement (cut out layers)

– Real-time production visibility (IoT integration)

– Blockchain-backed certification (API’s 2026 mandate)SourcifyChina’s 2026 Audit Protocol reduces supplier risk by 83% vs. self-sourcing (based on 2025 client data).

Next Step: Request SourcifyChina’s API 5L B Seamless Pipe Manufacturer Scorecard (free for procurement managers) – includes live API license checker and factory map of compliant Hebei/Shandong mills.

SourcifyChina: De-risking China Sourcing Since 2010

This report reflects verified 2025 field data and 2026 regulatory forecasts. Not financial/legal advice. © 2026 SourcifyChina Inc.

Get the Verified Supplier List

SourcifyChina – Verified Pro List Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of API 5L B Seamless Steel Pipes from China

Executive Summary

In an increasingly complex global supply chain, procurement managers face mounting pressure to source high-quality industrial components—such as API 5L Grade B Seamless Steel Pipes—efficiently, reliably, and cost-effectively. China remains a dominant producer of steel pipes, yet identifying compliant, capable, and trustworthy manufacturers can be time-consuming and risk-laden due to market fragmentation and inconsistent quality control.

SourcifyChina’s Verified Pro List eliminates these challenges by providing procurement teams with immediate access to pre-vetted, audit-qualified API 5L B Seamless Steel Pipe manufacturers in China—saving time, reducing risk, and accelerating time-to-contract.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Advantage |

|---|---|

| 8–12 weeks spent identifying potential suppliers via B2B platforms (e.g., Alibaba, Made-in-China) | Immediate access to 5+ pre-qualified suppliers within 24 hours |

| High risk of engaging with trading companies or non-compliant factories | All factories are on-site verified, with valid API 5L certifications and seamless pipe production lines |

| Weeks spent verifying certifications, production capacity, and export history | Full due diligence package provided: audit reports, test certifications (ISO, API Q1), and past client references |

| Inconsistent communication and delayed RFQ responses | Dedicated SourcifyChina coordinator ensures timely, professional communication |

| Risk of substandard quality or failed inspections | Only factories with proven export experience and third-party inspection records included |

Time Saved: Up to 80% reduction in supplier qualification cycle

Risk Mitigated: Zero engagement with unverified or non-compliant vendors

Call to Action: Accelerate Your Sourcing Cycle in 2026

In today’s competitive industrial landscape, time is value. Delaying supplier qualification increases project timelines, procurement costs, and operational risk.

Don’t risk sourcing from unverified suppliers. Leverage SourcifyChina’s 2026 Verified Pro List to:

- Shortlist qualified API 5L B Seamless Steel Pipe manufacturers in under 48 hours

- Ensure compliance with international standards (API 5L, ISO 3183)

- Negotiate from a position of confidence with transparent factory data

👉 Contact our sourcing specialists today to receive your customized Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours—ensuring your procurement initiative stays on track.

Why Partner with SourcifyChina in 2026?

- Industry-Specialized Vetting: Our team inspects facilities, validates certifications, and assesses production capabilities specific to steel pipe manufacturing.

- No Middlemen: Direct factory access ensures competitive pricing and supply chain transparency.

- Global Client Trust: Used by procurement teams in North America, Europe, and the Middle East for mission-critical infrastructure projects.

Make the smart, efficient choice in 2026.

Verify once. Source confidently. Procure faster.

Contact SourcifyChina today.

Your next reliable Chinese supplier is one message away.

🧮 Landed Cost Calculator

Estimate your total import cost from China.