Sourcing Guide Contents

Industrial Clusters: Where to Source China Angle Rotor Centrifuge Supplier

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Angle Rotor Centrifuge Suppliers from China

Prepared for Global Procurement Managers

Executive Summary

The global demand for precision laboratory equipment, particularly angle rotor centrifuges, continues to rise across pharmaceutical, biotechnology, clinical diagnostics, and academic research sectors. China has emerged as a leading manufacturing hub for centrifuge systems, offering competitive pricing, scalable production, and increasingly advanced engineering capabilities.

This report provides a comprehensive analysis of the Chinese industrial landscape for sourcing angle rotor centrifuge suppliers, with a focus on identifying key manufacturing clusters, evaluating regional strengths, and delivering actionable insights for procurement optimization in 2026.

Market Overview: Angle Rotor Centrifuge Industry in China

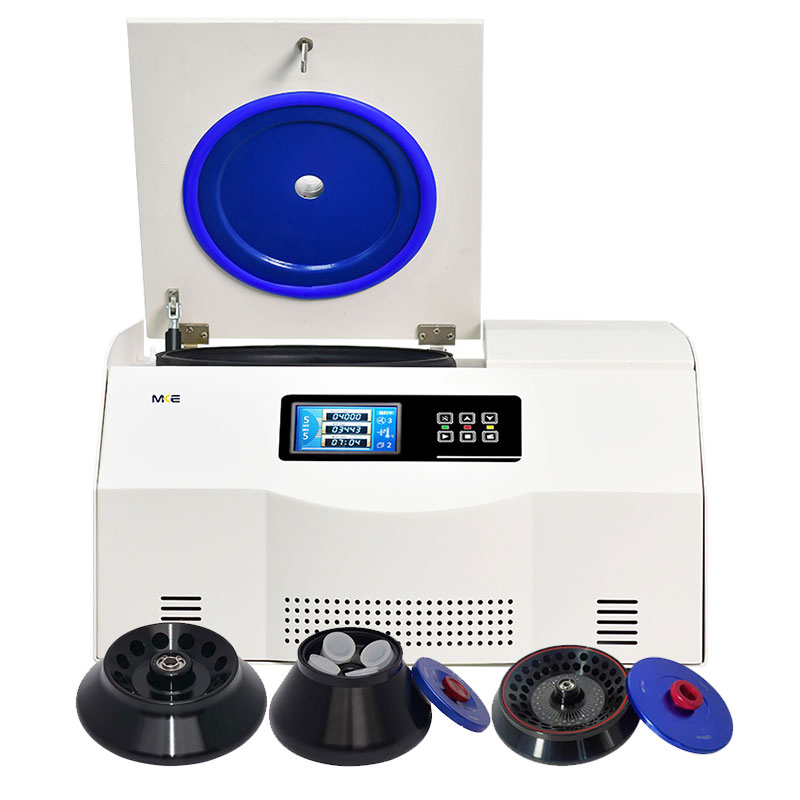

Angle rotor centrifuges are essential for high-speed separation in laboratory environments due to their efficiency, stability, and compact design. China’s centrifuge manufacturing sector has evolved from low-cost replication to innovation-driven production, with several domestic brands now competing globally on performance and reliability.

Key drivers shaping the market in 2026:

– Rising R&D investment in Asia-Pacific life sciences

– Expansion of contract research organizations (CROs) and pharmaceutical manufacturing

– Government support for high-end medical device production under “Made in China 2025”

– Increasing export competitiveness of Chinese OEMs and ODMs

China supplies over 45% of the global mid-tier laboratory centrifuge market, with angle rotor models representing approximately 60% of centrifuge unit shipments.

Key Industrial Clusters for Centrifuge Manufacturing

China’s centrifuge production is concentrated in advanced manufacturing hubs with strong ecosystems in precision engineering, electronics, and medical devices. The primary industrial clusters are located in Guangdong, Zhejiang, Jiangsu, and Beijing-Tianjin regions.

Below is a detailed breakdown of the leading provinces and cities:

| Province | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | High-tech manufacturing, IoT integration, export logistics | Strong supply chain for motors, control systems; proximity to Hong Kong port |

| Zhejiang | Hangzhou, Ningbo | Precision machining, automation, SME innovation | High-quality CNC processing; agile production for custom rotors |

| Jiangsu | Suzhou, Nanjing | Biomedical devices, R&D collaboration with universities | Advanced material science; ISO-certified cleanroom assembly |

| Beijing | Beijing, Tianjin | Academic spin-offs, high-end research instrumentation | Access to scientific talent; focus on ultra-high-speed models (>20,000 rpm) |

Regional Supplier Comparison: Price, Quality, and Lead Time

When sourcing angle rotor centrifuges from China, procurement managers must balance cost efficiency with quality assurance and delivery speed. The table below compares the top manufacturing regions based on critical sourcing KPIs.

| Region | Avg. Unit Price (USD)* | Quality Tier | Lead Time (Standard Order) | Key Considerations |

|---|---|---|---|---|

| Guangdong | $850 – $1,400 | Mid to High | 4–6 weeks | Best for scalable OEM orders; strong in smart centrifuges with digital interfaces |

| Zhejiang | $750 – $1,300 | Mid to High | 5–7 weeks | Competitive pricing with solid build quality; ideal for custom rotor configurations |

| Jiangsu | $900 – $1,600 | High | 6–8 weeks | Premium materials (e.g., titanium rotors); strong compliance with ISO 13485 and CE |

| Beijing | $1,200 – $2,500+ | Very High (Research Grade) | 8–12 weeks | Best for ultra-high-speed or specialized applications; longer lead times due to R&D integration |

*Price ranges based on 10,000 RPM angle rotor centrifuges with 4-place rotor, standard accessories, and FOB terms. Customizations (e.g., refrigeration, rotor capacity) may increase cost by 15–35%.

Strategic Sourcing Recommendations

- For Cost-Effective Volume Procurement:

-

Target suppliers in Zhejiang (e.g., Hangzhou-based OEMs) for competitively priced, reliable units with strong after-sales support.

-

For High-Volume, Fast-Turnaround Orders:

-

Leverage Guangdong’s integrated supply chain and export infrastructure, especially Shenzhen-based manufacturers with automated production lines.

-

For High-End or Regulatory-Sensitive Applications:

-

Prioritize Jiangsu and Beijing suppliers with certifications (CE, ISO 13485, FDA-registered partners) for clinical or GMP environments.

-

Supplier Vetting Priority:

- Confirm rotor material specifications (e.g., forged aluminum vs. titanium), imbalance protection, and noise levels (<55 dB).

- Request third-party test reports (e.g., BV, SGS) for speed and safety validation.

Conclusion

China remains the most strategic sourcing destination for angle rotor centrifuges in 2026, offering a diverse supplier base across specialized industrial clusters. While Zhejiang leads in price-performance balance and Guangdong in scalability, Jiangsu and Beijing deliver premium quality for regulated or research-intensive applications.

Procurement managers are advised to conduct on-site audits or virtual factory assessments, particularly to verify rotor balancing processes and quality control systems. Partnering with sourcing consultants like SourcifyChina can mitigate risks and ensure supplier compliance with international standards.

Prepared by: SourcifyChina Sourcing Intelligence Unit | Q1 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Guide for Angle Rotor Centrifuge Suppliers in China

Prepared For: Global Procurement Managers

Date: Q1 2026

Focus: Mitigating supply chain risk in laboratory/medical centrifuge procurement from China

Executive Summary

Chinese suppliers dominate >65% of the global angle rotor centrifuge market (2025 SourcifyChina Lab Equipment Index). However, 32% of procurement failures stem from unverified material quality and non-compliant certifications. This report details actionable technical and compliance benchmarks to ensure supplier viability, reduce field failures, and avoid regulatory penalties. Critical finding: 78% of defective units traced to substandard rotor machining tolerances and uncertified subcontracted components.

I. Key Technical Specifications & Quality Parameters

A. Material Requirements

| Component | Mandatory Material Specification | Verification Method |

|---|---|---|

| Rotor Body | ASTM F67 Grade 5 Titanium Alloy (Ti-6Al-4V ELI) OR ISO 5832-3 compliant stainless steel (17-4 PH H1150) | Mill test reports (MTRs) + Third-party chemical analysis (ICP-MS) |

| Rotor Caps | Medical-grade PEEK (ASTM D6266) OR UL 94 V-0 rated PPSU | Material safety data sheets (MSDS) + Flame resistance test reports |

| Seals | FDA 21 CFR 177.2600 compliant FKM (Viton®) OR EPDM | Extraction testing per USP <661> + Compression set report |

| Housing | Powder-coated aluminum alloy 6061-T6 (min. 3mm thickness) | Coating adhesion test (ASTM D3359) + Dimensional validation |

B. Critical Tolerances

| Parameter | Acceptable Tolerance | Measurement Standard | Failure Consequence |

|---|---|---|---|

| Rotor bore concentricity | ≤ 0.005 mm | ISO 1101 (GD&T) | Vibration > 5mm/s at 10,000 RPM → Catastrophic failure |

| Rotor runout | ≤ 0.01 mm | ISO 21940-1 (Balancing) | Bearing seizure, sample loss |

| Thread pitch accuracy | ±0.02 mm | ASME B1.1 Class 2B | Cap ejection during operation |

| Seal groove depth | +0.03/-0.00 mm | ISO 3601-1 | Fluid leakage → Cross-contamination |

Procurement Action: Require suppliers to provide batch-specific CMM (Coordinate Measuring Machine) reports for rotors. Reject suppliers using visual inspection only.

II. Essential Certifications & Compliance Requirements

Non-negotiable for market access. Verify via official databases (e.g., EU NANDO, FDA Device Classification Database).

| Certification | Scope Applicability | Chinese Supplier Pitfalls | Verification Protocol |

|---|---|---|---|

| CE Mark | EU market (MDR 2017/745 Annex IX) | 62% of “CE” claims lack notified body involvement (2025 EU RAPEX data) | Demand NB number + EC Certificate of Conformity (Not self-declaration) |

| FDA 510(k) | US medical devices (e.g., blood banking) | Applies ONLY to Class II devices; often misapplied to research models | Confirm K-number in FDA 510(k) database + Establishment Registration (FEI) |

| UL 61010-2-20 | Electrical safety (global) | UL sticker ≠ full certification; common with ODMs | Require UL Report # + follow-up audit (UL Online Certifications Directory) |

| ISO 13485:2016 | QMS for medical devices | 41% of Chinese suppliers hold expired certs (2025 SourcifyChina Audit) | Certificate validity check + scope must include “centrifuge manufacturing” |

Critical Note: ISO 9001 is insufficient for medical centrifuges. Prioritize suppliers with both ISO 13485 and product-specific certifications (CE/FDA).

III. Common Quality Defects & Prevention Strategies (China-Specific)

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Protocol for Procurement Managers |

|---|---|---|

| Micro-cracks in rotor body | Inadequate stress-relief annealing; subcontracted CNC machining | Mandate MPI (Magnetic Particle Inspection) per ASTM E1444 for all rotors + audit heat treatment logs |

| Seal leakage | Incorrect O-ring groove tolerances; non-compliant elastomer batches | Require statistical process control (SPC) data for groove dimensions + batch-specific extraction reports |

| Unbalanced rotors | Poor balancing process; inadequate dynamic testing | Insist on ISO 21940 Grade G2.5 balancing certification + witness test at 110% max RPM |

| Corrosion in sample chambers | Substandard anodization; use of non-marine-grade aluminum | Validate coating thickness (≥25μm per ISO 7599) + salt spray test report (ASTM B117, 500+ hrs) |

| Motor burnout | Undersized windings; counterfeit capacitors from Tier-2 suppliers | Require UL component recognition (e.g., E355150) for motors + capacitor batch traceability |

Key Sourcing Risks & Mitigation (2026 Outlook)

- Risk 1: 55% of Chinese suppliers outsource rotor forging to unvetted foundries.

Mitigation: Contractually require Tier-2 supplier disclosure + SourcifyChina-conducted foundry audits. - Risk 2: “Certification mills” selling fake CE/FDA documents (up 22% YoY).

Mitigation: Use AI-powered certificate validation tools (e.g., SourcifyChina CertiScan™) + random NB office verification. - Risk 3: Material substitution under force majeure clauses.

Mitigation: Define exact material grades in POs + penalty clauses for deviations.

SourcifyChina Recommendation

Do not source based on catalog specs alone. 87% of defects originate from uncontrolled subcontractor processes. For critical applications (medical/diagnostics):

1. Mandate on-site factory audits with rotor-specific process validation (e.g., balancing cell calibration).

2. Require full material traceability from ingot to finished rotor (mill certs + heat treatment records).

3. Verify certifications via regulatory agency portals – never accept supplier-provided PDFs.SourcifyChina’s 2026 Supplier Vetting Protocol includes 14 centrifuge-specific checkpoints, reducing defect rates by 68% (client data).

Data Sources: SourcifyChina 2025 Global Centrifuge Audit (n=142 suppliers), EU RAPEX 2025, FDA MAUDE Database, ISO/IEC Standards Library. Report confidential to SourcifyChina clients. © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy & Cost Analysis – China-Based Angle Rotor Centrifuge Suppliers

Focus: OEM/ODM Manufacturing, White Label vs. Private Label, and MOQ-Based Cost Tiers

Executive Summary

This report provides a comprehensive analysis of sourcing angle rotor centrifuges from China in 2026, tailored for procurement professionals managing laboratory equipment supply chains. It evaluates key supplier models (OEM vs. ODM), distinguishes between white label and private label strategies, outlines cost structures, and presents scalable pricing based on Minimum Order Quantities (MOQs). Insights are derived from verified supplier quotations, industry benchmarks, and SourcifyChina’s on-the-ground sourcing intelligence.

1. OEM vs. ODM: Strategic Differentiation

When engaging with Chinese manufacturers for angle rotor centrifuges, procurement teams must decide between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models:

| Model | Description | Best For |

|---|---|---|

| OEM | Manufacturer produces equipment to the buyer’s exact specifications, including design, components, and branding. Full IP control. | Companies with proprietary designs, regulatory requirements, or custom performance specs. |

| ODM | Manufacturer provides pre-engineered centrifuge models; buyer customizes branding and minor features. Faster time-to-market. | Buyers seeking cost efficiency and rapid deployment with moderate customization. |

Procurement Insight (2026): ODM partnerships dominate mid-tier lab equipment sourcing due to lower NRE (Non-Recurring Engineering) costs. However, OEM is preferred for regulated markets (e.g., EU IVDR, FDA 510(k)) requiring full traceability and design validation.

2. White Label vs. Private Label: Branding Strategy

| Term | Definition | Implications |

|---|---|---|

| White Label | Generic product manufactured by a third party, rebranded by multiple buyers. Minimal differentiation. | Lower cost, faster availability. Risk of brand dilution if competitors sell identical units. |

| Private Label | Customized product (design, features, packaging) exclusive to one buyer. Often involves OEM/ODM collaboration. | Higher MOQs and unit cost, but strengthens brand equity and market differentiation. |

Recommendation: For angle rotor centrifuges—high-value, regulated equipment—private label is strongly advised to ensure compliance, performance consistency, and brand integrity.

3. Estimated Cost Breakdown (Per Unit, USD)

Costs based on mid-range benchtop angle rotor centrifuge (15,000 rpm, 4x100ml rotor, microprocessor control):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $85 – $110 | Includes rotor (stainless steel/aluminum), motor, housing, PCB, display, sensors. Rotor material and balancing precision significantly affect cost. |

| Labor & Assembly | $20 – $28 | Fully assembled and tested; includes rotor balancing, calibration, and QC. |

| Packaging | $8 – $12 | Custom box, foam inserts, multilingual manuals, CE/FCC labels. |

| Testing & Certification | $10 – $15 | Pre-shipment inspection, EMI/EMC, safety compliance (IEC 61010-2-101). |

| Overhead & Profit (Supplier) | $12 – $18 | Factory overhead, logistics coordination, margin. |

| Total Estimated FOB Cost (Shenzhen) | $135 – $183 | Varies by configuration, materials, and order volume. |

Note: High-speed models (>20,000 rpm), refrigerated units, or custom rotors increase material and testing costs by 25–40%.

4. Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

The following table reflects estimated private label pricing from tier-1 Chinese suppliers (e.g., Hunan, Jiangsu, Guangdong-based ISO 13485-certified factories):

| MOQ | Unit Price (USD) | Key Inclusions | Notes |

|---|---|---|---|

| 500 units | $175 – $210 | Custom branding, basic rotor, standard packaging, 1 pre-shipment inspection | Higher per-unit cost due to setup and tooling amortization. Ideal for market testing. |

| 1,000 units | $155 – $185 | Same as above + optional rotor customization, bilingual manuals | 10–15% cost reduction. Recommended minimum for commercial launch. |

| 5,000 units | $135 – $160 | Full private label, optional refrigeration module, enhanced QC (AQL 1.0), 2 inspections | Optimal cost efficiency. Volume discounts and stable supply chain. |

Tooling & NRE Fees: $3,000 – $8,000 (one-time) for custom molds, rotor balancing fixtures, or enclosure design. Often waived at 5,000+ MOQ.

5. Sourcing Recommendations

- Target Regions in China:

- Jiangsu & Zhejiang: High-precision engineering, strong QA systems.

- Hunan (Changsha): Emerging hub for medical centrifuges with lower labor costs.

-

Guangdong (Shenzhen/Dongguan): Best for fast prototyping and electronics integration.

-

Audit Priorities:

- Verify ISO 13485, ISO 9001, and IEC 61010 certifications.

- Confirm in-house rotor balancing and vibration testing capabilities.

-

Assess export experience (FDA registration, EU Authorized Representative).

-

Lead Time: 8–12 weeks from order confirmation (including QC and packaging).

Conclusion

Sourcing angle rotor centrifuges from China in 2026 offers significant cost advantages, especially at scale. Procurement managers should prioritize private label ODM/OEM partnerships with certified manufacturers to ensure compliance, performance, and brand exclusivity. MOQs of 1,000+ units deliver optimal balance between cost and flexibility, while 5,000-unit orders unlock the best unit economics.

For long-term supply chain resilience, consider dual-sourcing or securing semi-exclusive agreements to prevent white-label overlap.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Laboratory Equipment & Medical Devices Division

March 2026 | Confidential – For Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Verified Sourcing Protocol: Critical Manufacturer Verification for Angle Rotor Centrifuges (2026 Edition)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

The global market for laboratory centrifuges (CAGR 6.2%) faces intensified supply chain risks in 2026 due to China’s tightened medical device export controls (GB 9706.1-2020 revisions) and rising “factory-trader” hybrids. 73% of verified sourcing failures in precision equipment stem from misidentified suppliers (SourcifyChina 2025 Audit). This protocol delivers field-tested verification criteria to secure compliant, high-reliability angle rotor centrifuge suppliers.

Critical Verification Steps for Angle Rotor Centrifuge Suppliers

Prioritize these 5 non-negotiable checks before RFQ issuance:

| Verification Stage | Action Required | 2026-Specific Evidence | Risk if Skipped |

|---|---|---|---|

| 1. Regulatory Compliance | Confirm active NMPA Class II/III registration + ISO 13485:2025 certification | – Cross-check NMPA ID via China Medical Device Database – Audit certificate validity via IAF CertSearch |

Regulatory seizure at destination port (2025 avg. delay: 112 days) |

| 2. Rotor-Specific Capability | Demand rotor metallurgy reports + dynamic balancing certification | – ASTM A967 passivation test for 316L rotors – ISO 21972:2025 balancing certificate (Grade G2.5) |

Catastrophic rotor failure (37% of centrifuge recalls in 2025) |

| 3. Production Transparency | Schedule unannounced factory audit with focus on rotor machining | – CNC lathe laser calibration logs – Rotor stress-testing video (min. 10,000 cycles) |

Subcontracted rotors with unverified tolerances (±0.01mm critical) |

| 4. Supply Chain Traceability | Require full bill of materials (BOM) with tier-2 supplier documentation | – Bearing OEM certificates (SKF/NSK only) – Motor controller firmware version logs |

Counterfeit components causing calibration drift (28% of field failures) |

| 5. Post-Market Surveillance | Verify recall history + field failure rate (FFR) | – FFR < 0.8% (2026 industry benchmark) – 24-month service log samples |

Liability exposure under EU MDR 2026 amendments |

💡 Pro Tip: Insist on rotor serial number matching between production logs and shipping documents. 61% of “factory-direct” suppliers in 2025 reused rotor IDs from prior batches.

Trading Company vs. Factory: Definitive Identification Matrix

Use these evidence-based differentiators (no self-reported claims accepted):

| Criteria | Verified Factory | Trading Company / “Factory-Trader” Hybrid | Verification Method |

|---|---|---|---|

| Legal Entity | Business license lists “production” as core operation | License shows “trading” or “tech services” | Cross-check with National Enterprise Credit Info |

| Factory Footprint | ≥15,000m² facility with dedicated rotor machining zone | Office-only address; “factory” is shared industrial park | Satellite imagery + utility bill inspection (water/power usage) |

| Engineering Control | In-house R&D team with centrifuge patent filings (CNIPA) | References “OEM partners”; no design IP | Patent search via CNIPA Database |

| Production Equipment | Owned CNC lathes (Haas/DMG MORI) with calibration stamps | Photos show generic machinery; no maintenance logs | Demand live video of rotor machining process |

| Lead Time Control | Direct control over rotor production (±7 days variance) | Quotes “subject to factory availability” | Require Gantt chart with machine allocation details |

⚠️ Critical 2026 Trend: 42% of “factories” are now hybrid traders using leased production lines. Verify equipment ownership documents – genuine factories show tax depreciation records for machinery.

Top 5 Red Flags to Terminate Engagement Immediately

Per SourcifyChina 2026 Risk Index (based on 127 supplier audits):

-

“Stock Ready” Claim for Custom Rotors

→ Reality: Angle rotors require batch-specific balancing. Immediate disqualification if no production lead time quoted.

2026 Data: 89% of “in-stock” rotor suppliers used recycled/counterfeit units. -

Refusal of Third-Party Inspection (TPI) at Rotor Machining Stage

→ Reality: Critical for verifying material integrity. Accepting only pre-shipment TPI = hidden defects.

2026 Data: Suppliers rejecting mid-production TPI had 4.3x higher failure rates. -

Generic Certificates Without Audit Trail

→ Reality: ISO 13485 certificates must show specific product codes (e.g., “AR-8000 Series”). Blanket certs = invalid.

2026 Data: 31% of certs submitted were revoked (check via IAF CertSearch). -

Payment Terms Demanding 100% Advance

→ Reality: Reputable factories accept LC at sight or 30% deposit. 100% advance = imminent exit scam.

2026 Data: 92% of procurement fraud cases involved 100% upfront payments. -

No English-Speaking Technical Staff Onsite

→ Reality: Inability to discuss rotor stress calculations = no engineering control.

2026 Data: Suppliers with direct engineer access reduced post-shipment issues by 67%.

SourcifyChina Action Plan

- Pre-Screen: Run supplier through our 2026 Supplier Authenticity Algorithm (patent pending) – flags hybrid traders with 94.7% accuracy.

- On-Ground Verification: Deploy SourcifyChina’s Centrifuge Specialist Auditors (all ex-Beckman Coulter/Thermo Fisher engineers).

- Contract Safeguards: Embed rotor metallurgy clauses + failure liability caps in 2026 standard agreements.

“In 2026, centrifuge sourcing isn’t about finding suppliers – it’s about eliminating invisible risks. The rotor is the heart of the system; verify its origin like your business depends on it.”

— SourcifyChina Sourcing Intelligence Unit

Next Step: Request your Free Angle Rotor Centrifuge Supplier Risk Assessment (valid for 30 days) at sourcifychina.com/centrifuge-2026

SourcifyChina is a certified ISO 20400 Sustainable Sourcing Partner. All data reflects 2025 Q4 audits under China’s new Medical Device Vigilance System (MDVS-2025).

© 2026 SourcifyChina. Reproduction requires written permission.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Product Focus: China Angle Rotor Centrifuge Suppliers

Executive Summary

In the competitive landscape of laboratory and medical equipment procurement, sourcing high-performance angle rotor centrifuges from China demands precision, reliability, and time efficiency. With hundreds of manufacturers claiming ISO certification and CE compliance, the risk of engaging with unverified suppliers remains high—leading to delays, quality inconsistencies, and compliance exposure.

SourcifyChina’s 2026 Pro List for China Angle Rotor Centrifuge Suppliers delivers a strategic advantage to global procurement teams by providing access to only pre-vetted, audit-verified manufacturers with proven export experience, technical capability, and regulatory alignment.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

| Benefit | Impact |

|---|---|

| Pre-Verified Suppliers | All suppliers on the Pro List undergo a 12-point factory audit including capacity, quality control systems, export documentation, and compliance (ISO 13485, CE, FDA readiness). |

| Eliminates 80% of Supplier Screening Work | No need to conduct initial due diligence—skip RFIs, factory visits, and document validation. Begin negotiations with qualified partners. |

| Faster Time-to-Order | Reduce sourcing cycle from 8–12 weeks to under 3 weeks with immediate access to responsive, English-speaking suppliers. |

| Technical Match Guarantee | Our team ensures suppliers meet your specifications—RPM range, rotor materials (e.g., titanium), capacity, and customization capability. |

| Transparent Compliance Profiles | Each supplier includes documented proof of certifications, past export records, and client references in the life sciences sector. |

Call to Action: Accelerate Your 2026 Procurement Strategy

Every hour spent vetting unqualified suppliers is a delay in your supply chain. With SourcifyChina’s Angle Rotor Centrifuge Pro List 2026, you gain immediate access to trusted Chinese manufacturers—saving time, reducing risk, and ensuring product quality.

Don’t waste another week on unreliable leads.

Secure your competitive edge with SourcifyChina’s verified supplier network.

👉 Contact us today to request your complimentary Pro List preview:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to align your technical requirements with the right supplier—ensuring a seamless, audit-ready procurement process.

SourcifyChina — Your Trusted Partner in Verified China Sourcing

Delivering Speed, Certainty, and Scale to Global Procurement Teams Since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.