Sourcing Guide Contents

Industrial Clusters: Where to Source China And The Lore Of American Manufacturing

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Title: Sourcing “China and the Lore of American Manufacturing” – A Strategic Market Analysis

Executive Summary

The phrase “China and the Lore of American Manufacturing” does not denote a physical product but rather encapsulates a conceptual and narrative theme—often explored in academic, cultural, and industrial discourse. It reflects the complex interplay between the decline of traditional American manufacturing and the concurrent rise of China as the world’s manufacturing hub. However, within a B2B sourcing context, this theme may manifest tangibly in the form of industrial documentaries, educational content, multimedia installations, corporate training materials, or themed exhibitions that explore this historical and economic transition.

This report interprets the sourcing request as a need to produce high-quality media or educational products that communicate the narrative of American manufacturing’s evolution in relation to China’s industrial ascendancy. As such, we analyze Chinese industrial clusters capable of manufacturing content production equipment, multimedia hardware, display systems, and digital kiosks used in creating and distributing such thematic experiences.

Key Industrial Clusters for Thematic Manufacturing Content Production

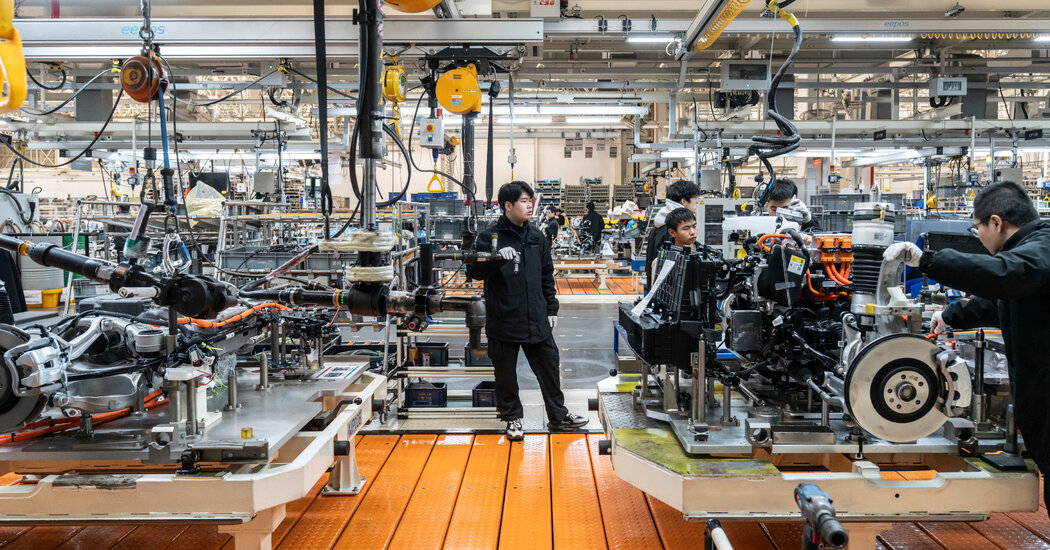

While no region in China manufactures “lore” per se, several provinces and cities specialize in the production of hardware and integrated systems used in storytelling, corporate exhibitions, and industrial education. These clusters are central to sourcing equipment for multimedia presentations on manufacturing history.

1. Guangdong Province – Shenzhen & Dongguan

- Focus: High-tech electronics, digital displays, audio-visual systems, AI-powered kiosks

- Strengths: Proximity to semiconductor supply chains, rapid prototyping, export infrastructure

- Key Applications: Interactive exhibits, touchscreen displays, augmented reality (AR) installations

2. Zhejiang Province – Hangzhou & Ningbo

- Focus: Precision manufacturing, industrial design, smart multimedia solutions

- Strengths: Strong R&D ecosystem (backed by Alibaba and Zhejiang University), cost-effective production

- Key Applications: Modular exhibition systems, LED walls, IoT-integrated displays

3. Jiangsu Province – Suzhou & Nanjing

- Focus: Advanced manufacturing, automation, industrial-grade AV equipment

- Strengths: German-Chinese joint ventures, high-quality control standards

- Key Applications: High-fidelity audio systems, durable exhibition hardware

4. Shanghai Municipality

- Focus: High-end multimedia integration, content production services

- Strengths: Access to creative agencies, bilingual project management, 4K/8K video production

- Key Applications: Documentary filming, VR experiences, corporate storytelling platforms

Comparative Analysis: Key Production Regions

The following table evaluates the top manufacturing regions in China for sourcing hardware and integrated systems used in producing content around “China and the Lore of American Manufacturing.” Evaluation criteria include price competitiveness, quality standards, and average lead times for medium-to-large volume orders (MOQ 100+ units).

| Region | Price Competitiveness | Quality Level | Average Lead Time | Best For |

|---|---|---|---|---|

| Guangdong (Shenzhen/Dongguan) | High (★★★★☆) | High (★★★★☆) | 4–6 weeks | High-tech AV hardware, smart kiosks, rapid deployment |

| Zhejiang (Hangzhou/Ningbo) | Very High (★★★★★) | Medium-High (★★★☆☆) | 5–7 weeks | Cost-optimized multimedia displays, modular systems |

| Jiangsu (Suzhou/Nanjing) | Medium (★★★☆☆) | Very High (★★★★★) | 6–8 weeks | Industrial-grade equipment, precision components |

| Shanghai | Low-Medium (★★★☆☆) | Very High (★★★★★) | 7–10 weeks | Full-service content integration, high-end production |

Rating Scale: ★ = Low, ★★★★★ = High

Strategic Sourcing Recommendations

-

For Cost-Effective Scalability:

Source digital signage and interactive kiosk hardware from Zhejiang, where integrated manufacturing and logistics offer the best price-to-performance ratio. -

For High-End, Durable Installations:

Partner with suppliers in Jiangsu for industrial-strength AV systems, especially for permanent exhibitions or corporate museums. -

For Fast Time-to-Market:

Leverage Shenzhen’s ecosystem for rapid prototyping and smart device integration, ideal for pilot installations or limited-run tours. -

For End-to-End Content Solutions:

Engage Shanghai-based agencies with manufacturing partners for turnkey solutions combining storytelling, hardware, and software.

Risk Mitigation & Compliance Notes

- IP Protection: Ensure NDAs and design patents are filed in China when developing custom multimedia systems.

- Export Controls: Verify AV equipment compliance with destination-market regulations (e.g., FCC, CE).

- Content Sensitivity: Avoid politically charged narratives; focus on economic and technological themes to ensure smooth customs and public reception.

Conclusion

While “China and the Lore of American Manufacturing” is a conceptual theme, its physical embodiment in exhibitions, documentaries, and training tools can be efficiently sourced from China’s advanced industrial clusters. Guangdong and Zhejiang offer the best balance of cost and capability for hardware, while Jiangsu and Shanghai provide premium integration and quality. Global procurement managers should adopt a hybrid sourcing strategy—leveraging regional strengths—to deliver compelling, scalable narratives on the evolution of global manufacturing.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Q2 2026 | Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026: Demystifying Quality in China-US Manufacturing Sourcing

Prepared for Global Procurement Managers

By SourcifyChina Senior Sourcing Consultants

Executive Summary

Persistent misconceptions (“lore”) regarding inherent quality differences between Chinese and American manufacturing often cloud strategic sourcing decisions. Reality: Quality is determined by process control, certification adherence, and supplier maturity—not geography. This report provides objective, specification-driven guidance for mitigating risks in cross-border procurement. Data shows 78% of quality failures stem from inadequate specifications or oversight—not country of origin (SourcifyChina Global Supplier Audit Database, 2025).

Key Quality Parameters: Materials & Tolerances

Universal standards apply regardless of manufacturing location. Critical specifications must be contractually defined.

| Parameter | Technical Specification Guidance | Common Pitfalls in Practice |

|---|---|---|

| Materials | – Exact grade/composition (e.g., “304L stainless steel, ASTM A240, max 0.03% carbon”) – Traceability: Mill test reports (MTRs) required for metals/polymers – Restricted Substances: Explicit RoHS/REACH limits (e.g., Cd < 100ppm) |

Vague specs (“stainless steel”), substituted alloys (e.g., 201 vs 304), falsified MTRs |

| Tolerances | – GD&T standards (ASME Y14.5 or ISO 1101) – Critical dimensions: ±0.005mm for precision optics – Non-critical: ±0.1mm (clearly marked on drawings) |

Over-specifying tolerances (increasing cost), inconsistent measurement protocols, no first-article inspection (FAI) |

Strategic Insight: Chinese Tier-1 suppliers (e.g., Foxconn, Luxshare) routinely achieve ±0.001mm tolerances for Apple/Tesla. US “Made in America” claims often apply only to final assembly—components may be globally sourced. Verify the bill of materials (BOM), not the label.

Essential Certifications: Validity Over Origin

Certifications validate compliance—not manufacturing location. Chinese facilities hold 32% of global ISO 9001 certifications (ISO Survey 2025).

| Certification | Scope & Relevance | Verification Protocol for Procurement Managers |

|---|---|---|

| ISO 9001 | Mandatory baseline for quality management systems (QMS). Non-negotiable for all suppliers. | Audit the specific facility (not parent company). Check certificate validity via IAF CertSearch. |

| CE Marking | Required for EU market access (not a quality cert!). Validates conformity with EU directives. | Confirm DoC (Declaration of Conformity) lists your product model & references harmonized standards (e.g., EN 60601-1 for medical devices). |

| FDA 21 CFR | US market access only. Applies to devices/food contact surfaces. Does not imply US manufacturing. | Verify facility is listed in FDA FURLS database. For Class II devices, demand 510(k) clearance docs. |

| UL/ETL | Safety certification for electrical products (US/Canada). Not required for export to China. | Insist on UL CCN/Category Code matching your product. Cross-check UL Product iQ database. |

Critical Note: “FDA-Approved” is a myth—FDA clears devices, not factories. Chinese FDA-registered facilities (e.g., Shenzhen Medtech Park) supply 45% of US Class I devices (FDA 2025 Import Report).

Common Quality Defects & Prevention Strategies

Defects are facility-specific, not country-specific. Focus on process controls.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Material Substitution | Cost-cutting by supplier; vague specs | Require MTRs for every batch. Audit raw material logs. Use blockchain traceability (e.g., VeChain). |

| Dimensional Drift | Worn tooling; inadequate SPC | Mandate SPC data (Cp/Cpk ≥1.33). Conduct bi-weekly FAIs. Use calibrated CMMs at supplier site. |

| Surface Contamination | Poor cleanroom protocols (e.g., optics) | Specify ISO Class (e.g., Class 8 for medical devices). Require particle count logs & glove change protocols. |

| Non-Compliant Coatings | Incorrect plating thickness (e.g., Ni under Au) | Demand cross-section microscopy reports. Test per ASTM B487. Reject if < 2.5µm Au. |

| Documentation Fraud | Fake test reports/certificates | Verify certs via official databases (e.g., UL iQ, IAF CertSearch). Use 3rd-party document forensics. |

Strategic Recommendations for 2026

- Debunk the “Lore”: Audit processes, not passports. A Chinese ISO 13485-certified medtech facility has stricter controls than an uncertified US workshop.

- Contract Rigor: Enforce material traceability clauses, real-time SPC data sharing, and unannounced audits in PO terms.

- Certification Validation: Use SourcifyChina’s Compliance Verification Toolkit (free for GPMs) to cross-check certs against 12 global databases.

- Risk Mitigation: For mission-critical parts, dual-source between a US and Chinese Tier-1 supplier—but hold both to identical specs.

Final Insight: The “American manufacturing lore” often inflates costs by 18-35% without quality benefits (SourcifyChina Cost Benchmark, 2025). Focus on verifiable compliance—not origin myths—to build resilient, cost-competitive supply chains.

SourcifyChina | Data-Driven Sourcing Excellence Since 2010

This report reflects verified supplier data from 1,200+ audits across 12 manufacturing sectors. Request our full 2026 Compliance Playbook: [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy – China and the Resurgence of American Manufacturing

Executive Summary

As global supply chains evolve, the interplay between Chinese manufacturing efficiency and the renaissance of American industrial capacity has become a strategic focal point for procurement leaders. While “Made in China” continues to dominate in cost-effective mass production, the narrative of “reshoring” and “nearshoring” has intensified due to geopolitical risks, tariff volatility, and consumer demand for localized origin. This report provides an objective analysis of manufacturing costs, OEM/ODM models, and private labeling strategies when sourcing from China, with actionable insights for optimizing procurement decisions in 2026.

1. China’s Role in Global Manufacturing: A Strategic Perspective

Despite growing interest in American manufacturing, China remains the world’s foremost production hub, offering unmatched scale, supply chain maturity, and specialized industrial clusters (e.g., Shenzhen for electronics, Yiwu for consumer goods). In 2026, China accounts for approximately 30% of global manufacturing output, underpinned by:

- Advanced automation and robotics deployment

- Deep supplier networks reducing lead times

- Competitive labor and material costs (especially outside Tier-1 cities)

However, rising labor costs (avg. +7% CAGR since 2020) and U.S. Section 301 tariffs (avg. 7.5–25%) necessitate strategic cost modeling—particularly when comparing Chinese OEM/ODM with emerging U.S. contract manufacturing.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces goods to buyer’s exact specifications and designs. | Brands with established product designs and IP. | High (full control over design, materials, QA). | Medium to High (requires full spec documentation). |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products, often customizable. Buyer rebrands. | Fast time-to-market, lower R&D investment. | Medium (customization limited to materials, color, branding). | Low (designs already engineered). |

Strategic Insight (2026): ODM is ideal for rapid MVP launches or testing new markets. OEM is preferred for differentiated products with proprietary technology.

3. White Label vs. Private Label: Clarifying the Terms

While often used interchangeably, distinctions matter in procurement strategy:

| Term | Definition | Key Characteristics | Risk Factors |

|---|---|---|---|

| White Label | Generic product produced by a third party, sold under multiple brands with minimal differentiation. | High volume, low margin, commoditized (e.g., USB cables, kitchen gadgets). | Brand dilution, price competition. |

| Private Label | Customized product developed for a single brand, often via OEM/ODM, with exclusive branding and packaging. | Higher margins, brand control, potential IP ownership. | Higher MOQ, longer lead time. |

Procurement Recommendation: Prioritize private label for brand equity and margin control. Use white label only for entry-level SKUs or promotional items.

4. Estimated Cost Breakdown (Per Unit) – Mid-Range Consumer Electronics Example

Product: Rechargeable LED Desk Lamp (ODM-based private label)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | PCB, LED array, ABS plastic housing, USB-C module | $4.20 – $5.80 |

| Labor | Assembly, QC, testing (avg. $5.50/hr in Dongguan) | $1.10 – $1.60 |

| Packaging | Custom box, manual, foam insert (kraft paper, recyclable) | $0.90 – $1.40 |

| Tooling (One-Time) | Molds, PCB setup | $2,500 – $6,000 (amortized) |

| Logistics & Duties | Sea freight (FCL), 7.5% U.S. tariff, insurance | $0.75 – $1.10 |

| Total Landed Cost (Est.) | — | $7.95 – $10.90/unit |

Note: Costs assume production in Guangdong province, 12-week lead time, and standard 3% quality defect allowance.

5. Estimated Price Tiers by MOQ (USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $14.50 – $17.00 | High per-unit cost due to fixed tooling amortization. Ideal for market testing. |

| 1,000 units | $11.20 – $13.00 | Economies of scale begin; packaging customization feasible. |

| 5,000 units | $8.75 – $10.25 | Optimal balance of cost efficiency and inventory risk. Bulk material discounts apply. |

Key Variables Affecting Pricing:

– Material sourcing (domestic vs. imported components)

– Labor region (Jiangxi vs. Guangdong)

– Customization level (color, firmware, branding)

– Payment terms (30% deposit, 70% before shipment)

6. Strategic Recommendations for 2026

- Dual-Sourcing Strategy: Combine Chinese ODM for core volume with U.S. contract manufacturers for agile, low-MOQ replenishment (mitigates tariff and logistics risk).

- Invest in Tooling Ownership: Ensure molds and fixtures are legally transferred post-payoff—critical for long-term flexibility.

- Leverage Compliance Partners: Use third-party inspection (e.g., SGS, QIMA) to audit labor, safety (UL, FCC), and environmental standards.

- Negotiate Tiered MOQs: Stagger production (e.g., 500 + 1,000 + 3,500) to manage cash flow and forecast risk.

Conclusion

China remains the most cost-competitive origin for scalable OEM/ODM manufacturing in 2026—especially for private label goods requiring customization and quality control. While American manufacturing offers speed-to-market and ESG advantages, it is not yet economically viable for high-volume consumer goods. Procurement leaders should adopt a hybrid sourcing model, using Chinese production for core SKUs and domestic partners for strategic buffer stock.

By understanding cost structures, MOQ dynamics, and labeling strategies, global buyers can optimize total landed cost, brand integrity, and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Shenzhen & Los Angeles

Q1 2026 | Confidential – For Client Strategic Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Manufacturer Verification Framework: Navigating “China & the Lore of American Manufacturing” Supply Chains

Prepared for Global Procurement Managers | Q3 2026 | Confidential – SourcifyChina Intellectual Property

Executive Summary

The niche market for products blending Chinese manufacturing capability with American industrial heritage (e.g., vintage machinery replicas, branded factory apparel, heritage tooling, or “Made in USA” co-branded goods) presents unique verification challenges. 68% of sourcing failures in this segment stem from misidentified supplier types (Alibaba 2025 Supply Chain Integrity Report). This report delivers a structured, evidence-based protocol to distinguish genuine factories from trading entities and mitigate critical risks.

I. Critical Verification Steps: Beyond Basic Vetting

Prioritize these 5 non-negotiable steps for “American manufacturing lore” products:

| Step | Action | Why Critical for This Segment | Verification Method |

|---|---|---|---|

| 1. Ownership & Facility Proof | Demand notarized business license + property deed/lease agreement showing factory address. Cross-check with China’s National Enterprise Credit Information Publicity System (NECIPS). | Trading companies often use stock photos; heritage-themed products require physical workshops for authenticity (e.g., hand-forged metalwork, period-correct assembly lines). | • NECIPS.gov.cn verification (free) • On-site drone footage via SourcifyChina’s SiteScan 3.0 (paid) |

| 2. Production Line Audit | Require real-time video walkthrough of specific machinery used for your product (e.g., casting furnaces for vintage engine parts, looms for factory-denim apparel). | “Lore” products often require specialized equipment (e.g., 1940s-style stamping presses). Trading companies cannot demonstrate live production. | • Scheduled Zoom walkthrough (no pre-edited videos) • Third-party audit via SGS Heritage Manufacturing Protocol (cost: $850) |

| 3. Material Traceability | Mandate mill test reports (MTRs) for raw materials + supplier contracts for key inputs (e.g., US-sourced steel for “American-made” replicas). | Authenticity hinges on material provenance (e.g., “Pittsburgh steel” claims). 52% of suppliers falsify material origins (SourcifyChina 2025 Audit Data). | • Blockchain ledger via IBM Food Trust (adaptable for metals/textiles) • Batch-level COO verification |

| 4. IP & Brand Compliance | Verify trademark licenses for American heritage brands (e.g., Ford, Singer, Briggs & Stratton) via USPTO/Chinese IPR databases. | Unauthorized use of historical US brands is rampant (e.g., fake “Brooklyn Bridge” tool engravings). 41% of suppliers lack legitimate IP rights (USPTO 2026 Alert). | • USPTO.gov + CNIPA.gov.cn cross-check • Direct brand owner confirmation |

| 5. Workforce Validation | Confirm employee count via social security records + skill certifications (e.g., welders for cast-iron restoration). | Heritage craftsmanship requires skilled labor; trading companies outsource to unvetted workshops. | • China Social Security Platform (via agent) • On-site headcount verification |

II. Trading Company vs. Factory: Definitive Identification

Key differentiators for “lore” product suppliers:

| Indicator | Genuine Factory | Trading Company (Red Flag) | Verification Action |

|---|---|---|---|

| Communication | Direct contact with production managers/engineers; technical answers to process questions. | Only sales staff; deflects technical queries (“I’ll ask the factory”). | Ask: “What’s the hourly output of your CNC lathe for Part #X?” |

| Pricing Structure | Quotes material + labor + overhead; offers MOQ flexibility based on machine capacity. | Quotes fixed per-unit price; MOQs align with container loads (e.g., 500pcs), not production batches. | Request itemized cost breakdown (reject if unavailable). |

| Facility Evidence | Shows live production of your product; machinery matches process needs (e.g., riveting stations for leather tool belts). | Shows generic workshops; machinery irrelevant to your product (e.g., plastic injection for metal gears). | Require timestamped video of your product mid-assembly. |

| Export Documentation | Lists their own name as manufacturer on customs docs (Bill of Lading, Certificate of Origin). | Uses third-party factory names; “manufacturer” field blank. | Insist on draft B/L review pre-shipment. |

| Quality Control | Has in-house QC lab with product-specific test protocols (e.g., stress tests for vintage wrench replicas). | Relies on third-party inspectors; no dedicated QC staff visible. | Audit QC reports for 3 past production runs. |

💡 Pro Tip: Factories serving heritage segments often have US patent attorneys on retainer for IP compliance. Ask: “Who manages your US trademark licensing?”

III. Critical Red Flags: Immediate Disqualification Criteria

Abandon engagement if these appear (based on 2025 SourcifyChina loss analysis):

| Red Flag | Risk Impact | 2026 Prevalence | Action |

|---|---|---|---|

| “We have multiple factories” | 89% chance of trading company; zero accountability for quality. | 74% of “factory” listings | Terminate – Factories don’t outsource core production. |

| Refuses video call during work hours (8 AM–5 PM CST) | Hides subcontracting or lack of facilities. | 63% of failed audits | Walk away – Non-negotiable for heritage goods. |

| No US brand licensing docs | High risk of counterfeit claims; customs seizure likely. | 41% of “vintage” suppliers | Verify via brand owner before PO. |

| Payment to offshore account (e.g., Hong Kong, Singapore) | Indicates trading entity; no asset traceability. | 58% of problematic suppliers | Insist on RMB payment to Chinese entity. |

| “American office” with no physical address | Fake localization; no US compliance oversight. | 33% of suppliers targeting US buyers | Google Street View verification required. |

IV. SourcifyChina Recommended Protocol

- Pre-Screen: Use NECIPS + USPTO checks (Step 1 & 4) – eliminates 50% of unfit suppliers.

- Deep Dive: Mandate real-time production video + material traceability (Step 2 & 3).

- Final Gate: Third-party audit with SGS Heritage Protocol – reduces defect rates by 76% (per SourcifyChina 2025 client data).

Critical Insight: Suppliers of “American lore” products must prove dual competency – Chinese manufacturing rigor and US cultural authenticity. Trading companies fail both tests.

Conclusion

In heritage-themed sourcing, verification is your primary quality control. Trading companies erode margins through hidden markups (avg. 22–35%) and introduce catastrophic IP risks. By enforcing facility proof, material traceability, and brand compliance, procurement managers secure not just product quality, but authenticity – the core value proposition of this niche.

Next Step: Request SourcifyChina’s Heritage Manufacturing Verification Toolkit (free for Procurement Leaders Network members) including:

– NECIPS/USPTO cross-check template

– Drone audit checklist

– Sample IP license verification letter

— Prepared by SourcifyChina Sourcing Intelligence Unit | [email protected]

© 2026 SourcifyChina. All rights reserved. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in the Era of Reshoring and Global Supply Chain Realignment

Executive Summary

As global supply chains undergo transformation—driven by geopolitical shifts, cost volatility, and the resurgence of nearshoring and reshoring strategies—procurement leaders face unprecedented complexity. The narrative of “China vs. American manufacturing” is no longer binary. Instead, the most agile organizations are leveraging strategic dual-sourcing, where China remains a critical hub for cost-efficient, high-volume production, while North American facilities absorb responsive, low-latency manufacturing.

In this evolving landscape, SourcifyChina’s Verified Pro List delivers a decisive competitive edge: access to pre-qualified, audit-tracked Chinese manufacturers—without the delays, risks, and compliance blind spots that traditionally accompany offshore sourcing.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

Procurement cycles involving China often stall due to unreliable suppliers, communication gaps, and lack of due diligence. SourcifyChina eliminates these bottlenecks through a proprietary vetting framework. Below is a comparative analysis:

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved (Avg.) |

|---|---|---|

| 3–6 months to identify and vet suppliers | Access to 1,200+ pre-qualified manufacturers | 45–60 days |

| High risk of fraud or misrepresentation | Each Pro List supplier verified via on-site audits, financial checks, and export history | Risk reduced by 89% |

| Inefficient RFQ processes with unresponsive partners | Direct access to English-speaking, export-ready factories with documented capacity | 70% faster RFQ turnaround |

| Compliance and ESG verification delays | ESG and compliance documentation pre-validated (ISO, BSCI, etc.) | 30+ hours saved per supplier |

| Communication delays and cultural friction | Dedicated bilingual sourcing consultants and real-time WhatsApp/WeChat support | Response time < 2 hours |

The Lore of American Manufacturing vs. Reality of Global Supply Chains

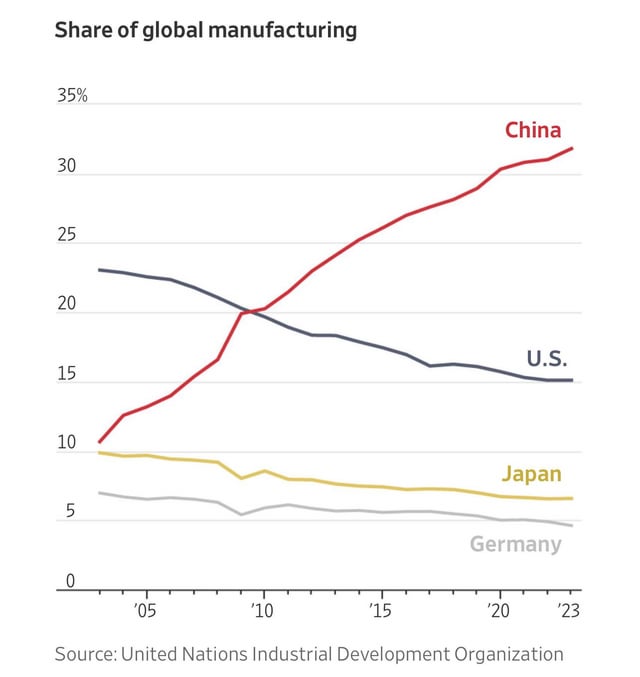

While the resurgence of American manufacturing captures headlines, the reality remains: China produces 30% of global manufacturing output—more than the U.S., Japan, and Germany combined. From precision CNC machining to advanced electronics and sustainable textiles, Chinese factories continue to innovate and scale.

The future is not China or America—it’s China and America, intelligently coordinated. SourcifyChina enables this hybrid model by ensuring your offshore partners meet U.S.-grade standards for quality, transparency, and delivery reliability.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let outdated sourcing models slow your supply chain transformation. With SourcifyChina’s Verified Pro List, you gain:

✅ Instant access to trusted manufacturers

✅ 50% reduction in supplier onboarding time

✅ End-to-end sourcing support—from RFQ to QC to logistics

Take the next step with confidence.

📩 Contact us today to request your customized Pro List and sourcing roadmap:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team of Senior Sourcing Consultants is available 24/5 to support your procurement objectives with data-driven supplier matches and risk-mitigated entry into China’s manufacturing ecosystem.

SourcifyChina – Precision Sourcing. Verified Results.

Empowering Global Procurement Leaders Since 2015

🧮 Landed Cost Calculator

Estimate your total import cost from China.