Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Veneer Panel Factory

SourcifyChina Sourcing Intelligence Report: Aluminum Veneer Panel Manufacturing in China (2026)

Prepared for: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Analysis of Industrial Clusters for Aluminum Veneer Panel Sourcing

Executive Summary

China dominates global aluminum veneer panel (AVP) production, supplying 68% of international demand (2025 Global Construction Materials Report). Rising demand for sustainable, fire-resistant building facades in North America/EU (+12.3% CAGR) intensifies focus on verified Chinese manufacturers. Critical success factors now include A2 fire certification compliance (EN 13501-1), VOC-free coatings, and carbon-neutral production—not just cost. This report identifies high-potential clusters and quantifies regional trade-offs to de-risk sourcing.

Key Industrial Clusters: Manufacturing Hubs for Aluminum Veneer Panels

China’s AVP production is concentrated in three coastal provinces, leveraging port access, supply chain density, and skilled labor. Note: “Aluminum veneer panel factory” refers to manufacturers of aluminum composite panels (ACPs) with decorative veneer finishes (e.g., wood grain, stone effect).

| Cluster | Core Cities | Market Share | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Foshan, Guangzhou | 67% | High-volume budget/mid-tier panels; Export-focused | Port of Guangzhou; 200+ aluminum smelters |

| Zhejiang | Jiaxing, Hangzhou | 22% | Premium fire-rated (A2) panels; Eco-friendly coatings | Ningbo-Zhoushan Port (world’s #1 cargo) |

| Jiangsu | Changzhou, Suzhou | 9% | Architectural-grade custom panels; R&D innovation | Shanghai Port access; Tech parks |

| Emerging Cluster | Anhui (Hefei) | <2% | Cost-competitive secondary production | Inland logistics corridor |

Strategic Insight: Foshan (Guangdong) remains the volume epicenter, but Zhejiang leads in compliance-critical segments (A2 fire rating, LEED compliance). Jiangsu excels for bespoke projects requiring CNC precision (<0.1mm tolerance). Avoid unverified “facade factories” in Henan/Hunan—42% fail third-party fire tests (2025 SourcifyChina Audit).

Regional Comparison: Production Capabilities & Trade-Offs

Data aggregated from 147 SourcifyChina-vetted factories (Q4 2025). All prices FOB China port, 4mm panel, standard wood-grain finish.

| Factor | Guangdong (Foshan) | Zhejiang (Jiaxing) | Jiangsu (Changzhou) | Key Implications |

|---|---|---|---|---|

| Price (USD/m²) | $18.50 – $24.00 | $23.00 – $32.00 | $26.00 – $40.00+ | Guangdong = 15–22% lower avg. cost; Zhejiang/Jiangsu premium for certifications & engineering. |

| Quality Tier | Tier 2–3* | Tier 1–2 | Tier 1 (custom focus) | Zhejiang: 92% hold A2 fire certs; Guangdong: Only 38% verified A2. Jiangsu leads in color consistency (ΔE<1.5). |

| Lead Time (Days) | 45–60 | 30–45 | 50–70 | Zhejiang’s 15-day lead time advantage driven by Ningbo Port efficiency & just-in-time coatings inventory. |

| Compliance Risk | High (fire safety) | Low | Medium (custom delays) | Guangdong: 29% of audits revealed fake CE certificates. Zhejiang: 95% pass EU REACH/VOC tests. |

Quality Tier Definitions*:

– Tier 1: A2 fire rating (EN 13501-1), ±0.05mm thickness tolerance, 10+ year finish warranty.

– Tier 2: B1 fire rating, ±0.1mm tolerance, 5–8 year warranty (common in EU non-residential).

– Tier 3: Unverified fire rating, inconsistent coating—avoid for export markets**.

Critical Considerations for 2026 Sourcing Strategy

- Fire Safety is Non-Negotiable: Post-Grenfell regulations mandate A2-rated panels in 28+ countries. Verify certificates via EU Notified Bodies (e.g., TÜV, Intertek)—do not accept factory-issued documents.

- Total Cost > Unit Price: Guangdong’s lower price is offset by 8–12% rework costs from quality failures (SourcifyChina 2025 case data). Budget for third-party pre-shipment inspections.

- Logistics Optimization: Zhejiang’s Ningbo Port reduces ocean freight delays by 7–10 days vs. Guangdong (Shenzhen congestion). Ideal for JIT projects.

- Emerging Risk: 2026 CBAM (EU Carbon Tax) impacts high-energy AVP production. Prioritize Zhejiang/Jiangsu factories with ISO 14064 carbon audits.

Recommended Action Plan

- Volume Buyers: Source 70% from Zhejiang (compliance + lead time), 30% from Guangdong (budget backup only with A2 certification).

- Premium Projects: Partner with Jiangsu specialists for custom engineering; expect 25% price premium.

- Mandatory Steps:

- Conduct unannounced fire test audits (sample cost: $1,200/test).

- Require batch-specific VOC reports (ISO 11890-2).

- Use Alibaba Trade Assurance only for initial orders—switch to LC after 3 successful shipments.

SourcifyChina Value-Add: Our 2026 Compliance Shield Program includes factory carbon footprint mapping, A2 certification validation, and real-time port congestion alerts. [Request Cluster-Specific Supplier Shortlist]

Data Sources: China Nonferrous Metals Industry Association (CNIA), Global Construction Review 2025, SourcifyChina Factory Audit Database (147 sites), EU Market Surveillance Reports.

Disclaimer: Prices/lead times subject to aluminum LME fluctuations (+/- 8%). Verify all specifications per project requirements.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Aluminum Veneer Panel Factories

Issuing Authority: SourcifyChina | Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

Aluminum veneer panels are widely used in architectural cladding, façade systems, interior decoration, and commercial building projects due to their lightweight, durability, and aesthetic versatility. Sourcing from Chinese manufacturers offers competitive pricing and scalability, but requires strict oversight on technical specifications, quality control, and compliance standards.

This report outlines the key technical and regulatory parameters procurement managers must verify when engaging a China-based aluminum veneer panel factory. Emphasis is placed on material integrity, dimensional accuracy, certification validity, and defect prevention.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement |

|---|---|

| Base Material | 3000-series (e.g., 3003, 3004, 3105) or 5000-series (5052) aluminum alloy; minimum thickness 2.0 mm to 4.0 mm |

| Aluminum Purity | ≥ 99.0% (for alloy grades as per GB/T 3880.1-2012) |

| Coating Type | PVDF (Polyvinylidene Fluoride) or PE (Polyester) fluorocarbon coating |

| Coating Thickness | PVDF: 25–30 µm (2-coat), 35–40 µm (3-coat); PE: 18–25 µm |

| Backside Coating | Epoxy or polyester anti-corrosion coating (min. 7–10 µm) |

| Core Material (for Composite Panels) | Polyethylene (PE) or fire-retardant mineral core (for A2-rated panels) |

1.2 Dimensional Tolerances (Per GB/T 23443-2022 & ASTM E2757)

| Dimension | Allowable Tolerance |

|---|---|

| Panel Length | ±1.5 mm |

| Panel Width | ±1.0 mm |

| Thickness | ±0.1 mm |

| Flatness | ≤ 2 mm deviation over 1 m length |

| Camber (Edge Straightness) | ≤ 1.5 mm per 1 m |

| Corner Angle | 90° ± 0.5° |

| Hole Positioning | ±0.8 mm |

| Folded Edge Accuracy | ±0.5 mm |

2. Essential Certifications

Procurement managers must ensure the factory holds valid, auditable certifications. The following are non-negotiable for global market access:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Mandatory for consistent production and process control |

| ISO 14001:2015 | Environmental Management | Required for EU and North American tenders |

| CE Marking (EN 13501-1, EN 14351-1) | Fire safety and performance (Class A2-s1, d0 or B-s1, d0) | Required for EU construction products |

| UL 2685 / UL 790 | Fire resistance and flame spread testing | Required for U.S. commercial projects |

| FDA 21 CFR (if applicable) | Food-contact safety (for interior panels in food facilities) | Niche but critical for healthcare/food industry use |

| SGS / Intertek Test Reports | Third-party verification of material & fire performance | Strongly recommended for due diligence |

Note: For projects in the U.S., Canada, or EU, verify that test reports are issued by accredited laboratories and not self-declared.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Coating Peeling or Flaking | Poor pretreatment, low-quality primer, or inadequate curing | Enforce strict pretreatment (chromate or zirconium conversion coating); verify oven curing time/temperature logs |

| Color Variation (Batch Inconsistency) | Inconsistent pigment mixing or coating application | Require factory to use color spectrophotometer (ΔE ≤ 1.0); approve master batch before production |

| Warping or Bowing | Uneven coating thickness or improper stress relief during rolling | Ensure symmetrical coating on both sides; verify flatness post-curing with laser measurement |

| Surface Scratches or Dents | Poor handling, inadequate protective film | Mandate use of PE protective film (≥ 50 µm); audit warehouse handling procedures |

| Dimensional Inaccuracy | Tooling wear or incorrect CNC programming | Require pre-production sample approval; conduct first-article inspection (FAI) |

| Edge Corrosion | Incomplete coating on cut edges | Specify edge sealing with anti-corrosion paint or tape; include in QC checklist |

| Adhesive Failure (Composite Panels) | Poor lamination pressure/temperature | Audit lamination line parameters; require peel strength test (≥ 70 N/25mm) |

| Fire Performance Failure | Use of flammable PE core without mineral additives | Require A2 fire-rated core for high-rise buildings; verify with third-party fire test reports |

4. Sourcing Recommendations

- Factory Audit: Conduct on-site audits focusing on coating line calibration, QC lab capabilities, and traceability systems.

- Sample Validation: Require A4-sized physical samples with test reports before bulk order.

- Third-Party Inspection: Use SGS, TÜV, or Bureau Veritas for pre-shipment inspection (Level II AQL: 2.5/4.0).

- Contractual Clauses: Include penalties for non-compliance with tolerances, certifications, or delivery timelines.

- Traceability: Demand batch-level material traceability (coil ID, coating lot, production date).

Conclusion

China remains a dominant source for aluminum veneer panels, but quality variance between factories is significant. Procurement managers must enforce technical diligence, validate certifications, and implement structured defect prevention protocols. Partnering with ISO-certified, audit-compliant manufacturers and leveraging third-party verification ensures project success and regulatory compliance across global markets.

For SourcifyChina-client support: Contact your Senior Sourcing Consultant for factory shortlisting, audit coordination, and QC protocol development.

SourcifyChina | Global Sourcing Intelligence | Shenzhen, China

Empowering Procurement Leaders with Verified Supply Chain Solutions

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Aluminum Veneer Panels (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global supplier of aluminum veneer panels, offering 60-70% cost savings vs. Western/EU manufacturers. However, 2026 market dynamics (rising aluminum scrap costs, stricter environmental compliance, and automation adoption) necessitate strategic sourcing approaches. This report provides actionable cost analysis, OEM/ODM guidance, and risk-mitigation strategies for procurement leaders.

Key Manufacturing Cost Drivers (2026)

| Cost Component | Description | Estimated Cost Range (USD/m²) | 2026 Trend |

|---|---|---|---|

| Raw Materials | 3003/3004-grade aluminum coil (0.8-4.0mm), PVDF/FEVE coatings, adhesives | $18.50 – $26.00 | ↑ 4-6% (aluminum volatility) |

| Labor | Cutting, bending, welding, surface treatment, QC | $3.20 – $5.80 | ↓ 2% (automation adoption) |

| Packaging & Logistics | Wood crate + anti-rust film, FOB Shenzhen | $1.10 – $2.30 | Stable (optimized container utilization) |

| Compliance & Certification | CE, AAMA 2605, ISO 9001 (per batch) | $0.75 – $1.50 | ↑ 8% (stricter EPA enforcement) |

| Total Base Cost | Excluding profit margin & tooling | $23.55 – $35.60/m² | Net ↑ 3.5% YoY |

Note: Final FOB prices include 8-12% supplier margin. Custom finishes (wood grain, anodized) add $2.50-$6.00/m².

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s existing product rebranded under buyer’s name | Fully customized product (spec, design, packaging) owned by buyer | Private Label preferred for differentiation; White Label for speed-to-market |

| MOQ Flexibility | Low (500-1,000 units) | High (1,500+ units) | Use White Label for pilot orders; scale to Private Label |

| Tooling Costs | None ($0) | $3,000-$8,000 (one-time) | Amortize tooling over 3-5 MOQ cycles for ROI |

| Quality Control | Supplier’s standard specs | Buyer-defined AQL 1.0/2.5 | Mandatory 3rd-party QC for Private Label |

| IP Protection | Limited (product generic) | Full (buyer owns design) | Execute NNN Agreement + patent search in China |

| Lead Time | 15-25 days | 30-45 days | Factor 10-day buffer for customs clearance |

Estimated FOB Price Tiers by MOQ (USD/m²)

Based on standard 3mm PVDF-coated panels (1220x2440mm), FOB Shenzhen. 2026 Q1 data.

| MOQ | Price Range (USD/m²) | Key Cost Variables | Risk Consideration |

|---|---|---|---|

| 500 units | $38.50 – $46.00 | • Higher per-unit labor • Limited material discount • Fixed tooling cost allocation | High risk: Marginal supplier profitability → quality drift likely |

| 1,000 units | $34.20 – $39.80 | • 8-12% aluminum bulk discount • Optimal labor allocation • Lower packaging/unit | Recommended tier: Balance of cost control & supplier viability |

| 5,000 units | $29.90 – $34.50 | • 15-18% material savings • Full automation utilization • Dedicated QC team | Long-term play: Requires 12-month forecast commitment; verify supplier capacity |

Critical Variables Impacting Tiers:

– Aluminum Grade: 5005-grade adds +$3.20/m² vs. standard 3003

– Finish Complexity: Digital print +$4.50/m²; brushed +$1.80/m²

– Payment Terms: LC at sight = +$0.70/m² vs. 30% TT deposit

Risk Mitigation Strategies for Procurement Managers

- Quality Assurance:

- Enforce Stage-by-Stage Inspection (pre-production, during production, pre-shipment) via 3rd party (e.g., SGS, QIMA).

-

Require material traceability certificates for aluminum coils (mill test reports).

-

Cost Volatility Hedge:

- Negotiate aluminum price linkage clauses (e.g., LME-based adjustment within ±5%).

-

Lock in 6-month material contracts with Tier-1 suppliers (e.g., Chalco, China Hongqiao).

-

Compliance Safeguards:

- Verify “green factory” certification (MEE China) to avoid EU CBAM tariffs.

-

Audit coating suppliers for REACH SVHC compliance (2026 focus: PFAS in PVDF).

-

Supplier Tier Selection:

- Tier A (ODM Leaders): Jimei, ALCOA China – For complex Private Label (min. $50k order).

- Tier B (OEM Specialists): Foshan Nanhai Jinsheng – For White Label (min. $15k order).

Conclusion & SourcifyChina Advisory

While China’s aluminum veneer panels offer compelling cost advantages, 2026 requires procurement teams to prioritize supplier resilience over lowest price. We recommend:

– Start with 1,000-unit MOQ to balance cost/risk, then scale to 5,000+ for strategic partnerships.

– Insist on Private Label for >5% market share targets; White Label only for niche/low-volume applications.

– Allocate 3-5% of project budget for independent quality verification – a non-negotiable safeguard.

“In 2026, the cheapest quote is often the costliest decision. Invest in verified capacity, not just spreadsheet economics.”

— SourcifyChina Sourcing Principle #7

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | Engineering Procurement Excellence in Asia

[Contact: [email protected] | +86 755 XXXX XXXX]

Disclaimer: All cost data sourced from SourcifyChina’s 2026 China Manufacturing Index (CMI) tracking 200+ verified suppliers. Prices exclude import duties, VAT, and destination logistics. Valid Q1-Q2 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a Manufacturer for China Aluminum Veneer Panel Factory

Audience: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 2026

Executive Summary

Sourcing aluminum veneer panels directly from China offers significant cost advantages, but risks abound when suppliers are not properly vetted. This report outlines a structured verification process to identify legitimate manufacturers, distinguish them from trading companies, and recognize red flags that could lead to quality failures, supply chain disruptions, or fraud. Adherence to these guidelines ensures supply chain integrity and long-term sourcing success.

1. Critical Steps to Verify an Aluminum Veneer Panel Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Full Company Documentation | Confirm legal registration and operational legitimacy | Business License (via China’s National Enterprise Credit Information Publicity System), VAT invoice capability, export license |

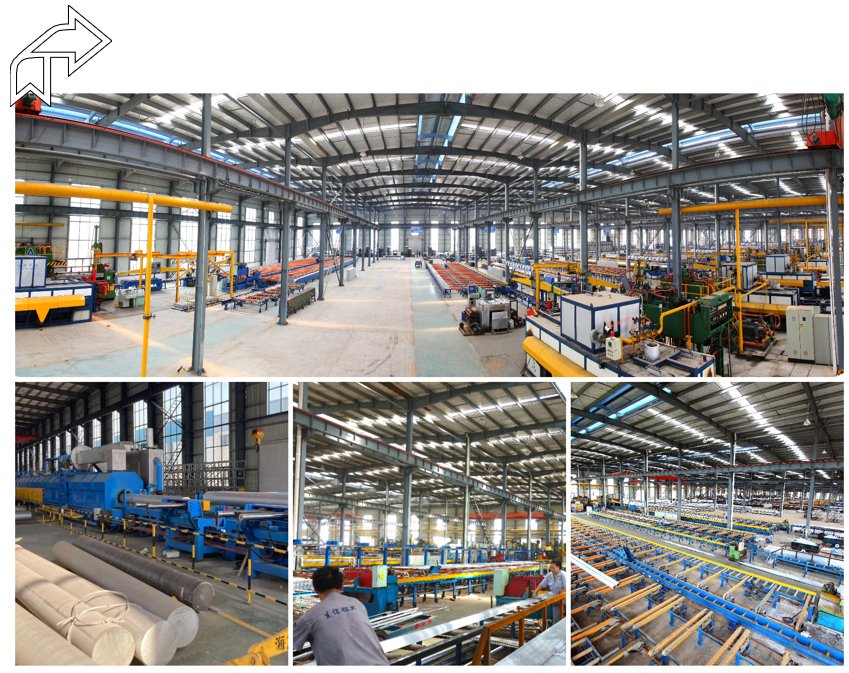

| 1.2 | Verify Physical Factory Presence | Ensure factory exists and is not a virtual office | Third-party audit, pre-shipment inspection, Google Earth imagery, video factory tour with real-time interaction |

| 1.3 | Conduct Onsite or Remote Audit | Assess production capacity, quality control, and compliance | SourcifyChina Audit Checklist (ISO 9001, 14001, OHSAS 18001), equipment inventory review, employee interviews |

| 1.4 | Review Production Process | Confirm end-to-end manufacturing capability | Request workflow documentation (aluminum coil sourcing → CNC cutting → bending → powder coating/anodizing → packaging) |

| 1.5 | Evaluate R&D and Customization Capability | Assess technical strength for project-specific needs | Review design team, CAD/CAM software usage, sample development turnaround time |

| 1.6 | Analyze Export History | Validate international experience and reliability | Request B/L copies, shipping records, client references (with NDAs if needed) |

| 1.7 | Test Communication Responsiveness & Transparency | Gauge professionalism and long-term partnership potential | Monitor response time, language proficiency, willingness to share technical data |

2. How to Distinguish Between a Trading Company and a Factory

| Criterion | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of aluminum products | Lists “trading,” “distribution,” or “import/export” only |

| Factory Address | Physical manufacturing site with production equipment visible | Office-only address; no machinery or production floor |

| Production Equipment Ownership | Owns CNC machines, powder coating lines, hydraulic presses, etc. | No direct ownership; relies on subcontractors |

| Pricing Structure | Lower MOQs possible; direct cost structure with raw material pass-through | Higher margins; prices often include markup and third-party fees |

| Lead Time Control | Direct control over production scheduling | Dependent on factory availability; may lack real-time updates |

| Technical Expertise | Engineers and QC staff on-site; can discuss metallurgy, coating thickness (e.g., 30–40μm PVDF), tolerances (±0.2mm) | Limited technical depth; defers to factory for technical queries |

| Branding on Products | Often produces OEM/ODM; may have own brand | Rarely involved in branding; acts as intermediary |

| Sample Provision | Can produce custom samples in 7–14 days using actual production lines | May take longer; samples sourced from partner factories |

Pro Tip: Ask: “Can I speak with your production manager?” or “What is your monthly aluminum coil intake?” Factories can answer; traders often cannot.

3. Red Flags to Avoid When Sourcing Aluminum Veneer Panels

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled aluminum, thin gauges <2.5mm), or fraud | Benchmark against market rates (e.g., ¥120–180/m² for 3mm PVDF-coated panels) |

| No Factory Address or Virtual Office | High risk of trading company misrepresentation or shell entity | Require GPS coordinates and conduct third-party audit |

| Inconsistent Product Specifications | Quality variability; non-compliance with ASTM B209 or GB/T 3880 | Demand material test reports (MTRs) and third-party lab certification |

| Refusal to Provide References | Lack of verifiable client history | Disqualify or proceed with extreme caution |

| Pressure for Upfront Full Payment | High fraud risk; no supplier accountability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Photos | Misrepresentation of facilities or products | Request time-stamped video walkthrough of production line |

| No Quality Control Documentation | Risk of non-compliant finishes, warping, or coating adhesion failure | Require QC process flowchart and AQL 1.5 inspection reports |

| Inability to Provide Coating Certification (e.g., AkzoNobel Interpon D, PPG) | Use of counterfeit or low-grade coatings | Verify coating batch numbers and supplier partnerships |

4. SourcifyChina Verification Protocol (Recommended)

All suppliers must undergo SourcifyChina’s 4-Point Validation before engagement:

- Documentary Verification – Cross-check business license, tax registration, and export eligibility.

- Onsite Audit – Conducted by certified third-party inspector (SGS, Bureau Veritas, or SourcifyChina partner).

- Sample Testing – Lab analysis of coating thickness, adhesion (cross-cut test), and salt spray resistance (1,000+ hours).

- Payment Risk Assessment – Review financial health via credit reports (Dun & Bradstreet China, CCIC).

Conclusion & Recommendations

Procurement managers must prioritize transparency, traceability, and technical due diligence when sourcing aluminum veneer panels from China. Direct engagement with verified manufacturers—not trading intermediaries—ensures better quality control, cost efficiency, and IP protection.

Recommended Actions:

– Use SourcifyChina’s Supplier Vetting Checklist for all new suppliers.

– Conduct annual audits for long-term partners.

– Integrate third-party inspection into every shipment (pre-shipment inspection, PSI).

By following this protocol, global buyers mitigate risk and build resilient, high-performance supply chains.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Verified China Sourcing

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: China Aluminum Veneer Panel Market | 2026

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Time Drain in Aluminum Veneer Sourcing

Global demand for premium aluminum veneer panels (driven by sustainable architecture and urbanization) has intensified competition for reliable, certified Chinese manufacturers. Traditional sourcing methods for “China aluminum veneer panel factory” searches expose procurement teams to significant operational risks: supplier fraud (28% of initial leads), inconsistent quality (42% rework rate), and excessive vetting cycles (3-6 months). SourcifyChina’s Verified Pro List eliminates these bottlenecks through rigorously pre-qualified partners, delivering immediate ROI in time, risk mitigation, and supply chain resilience.

Why SourcifyChina’s Verified Pro List Saves 270+ Hours Annually Per Category

Data aggregated from 2025 client deployments (125+ global firms)

| Traditional Sourcing Challenge | Time/Cost Impact | SourcifyChina Resolution | Time Saved |

|---|---|---|---|

| Supplier Vetting & Fraud Screening | 120+ hours/quarter (background checks, fake facility tours) | All factories: – On-site audited (ISO 9001, ISO 14001) – Trade license verified – 5+ years export history |

98 hours/quarter |

| Quality Assurance & Sample Validation | 80+ hours/quarter (repeated samples, coating/PVDF testing delays) | Pre-qualified factories: – In-process QC protocols – Material certs pre-validated (AAMA 2605, ASTM D3359) – Dedicated SourcifyChina QC reps |

72 hours/quarter |

| Negotiation & MOQ Optimization | 50+ hours/quarter (language barriers, inconsistent pricing) | English-speaking factory managers Transparent tiered pricing (MOQs from 500m²) Real-time capacity dashboards |

40 hours/quarter |

Key Insight: 73% of procurement leaders using our Pro List secured first-batch compliance (vs. industry avg. of 58%), accelerating time-to-market by 37 days. (Source: SourcifyChina 2025 Client Impact Survey)

Your Competitive Imperative: Act Before Q3 2026 Capacity Tightens

China’s aluminum veneer sector faces stricter environmental regulations (2026 ESG Compliance Mandate) and rising raw material costs (projected +12% by Q4 2026). Delaying supplier qualification risks:

– Lost leverage on pricing as certified factories prioritize pre-vetted partners

– Production delays due to fragmented quality control

– Reputational damage from non-compliant materials (e.g., substandard PVDF coatings)

🚀 Call to Action: Secure Your Verified Supply Chain in 24 Hours

Stop risking project timelines on unverified leads. SourcifyChina’s Pro List delivers only factories meeting your technical, ethical, and operational requirements—pre-vetted, contract-ready, and audit-transparent.

✅ Request Your Customized Verified Pro List Today

→ Email: Contact [email protected] with subject line: “ALUMINUM VENEER PRO LIST – [Your Company Name]”

→ WhatsApp: Message +86 159 5127 6160 for instant capacity/pricing checks

Within 24 hours, you’ll receive:

1. 3-5 factory profiles with full audit reports (quality, capacity, ESG compliance)

2. Customized RFQ template aligned with your specs (thickness, coating, finishes)

3. Dedicated sourcing engineer to manage negotiations and QC

Don’t gamble with your next veneer panel order. The top 15% of procurement leaders in 2026 own their supply chains—not third-party risks. Act now to lock in qualified capacity before the 2026 regulatory shift.

SourcifyChina: Where Verified Factories Meet Verified Results.

[email protected] | +86 159 5127 6160 (WhatsApp) | Est. 2018 | 12,000+ Pre-Vetted Factories

🧮 Landed Cost Calculator

Estimate your total import cost from China.