Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Profile Supplier

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Aluminum Profiles from China

Executive Summary

China remains the world’s largest producer and exporter of aluminum profiles, accounting for over 60% of global production capacity in 2026. The country’s mature industrial ecosystem, competitive pricing, and scalable manufacturing capabilities make it a strategic sourcing destination for industries such as construction, automotive, electronics, and renewable energy.

This report provides a comprehensive analysis of key aluminum profile manufacturing clusters in China, evaluating regional strengths in price competitiveness, quality standards, and lead time performance. The insights are designed to support global procurement teams in optimizing supplier selection, mitigating supply chain risk, and improving total cost of ownership (TCO).

Key Industrial Clusters for Aluminum Profile Manufacturing in China

Aluminum profile production in China is highly regionalized, with clusters concentrated in provinces that offer synergies in raw material access, logistics infrastructure, and downstream industrial demand. The primary manufacturing hubs include:

- Guangdong Province – Dominant cluster centered in Foshan (Nanhai District)

- Zhejiang Province – Notably Lishui and Hangzhou

- Shandong Province – Linyi and Zibo

- Jiangsu Province – Suzhou and Wuxi

- Henan Province – Emerging cluster in Gongyi

Regional Cluster Overview

| Region | Key Cities | Specialization | Export Volume (2025 est.) | Key Export Markets |

|---|---|---|---|---|

| Guangdong | Foshan (Nanhai) | Architectural, high-end anodized & thermal break | 45% of national exports | Middle East, Southeast Asia, EU |

| Zhejiang | Lishui, Hangzhou | Industrial, automation, electronics enclosures | 20% of national exports | EU, North America, Japan |

| Shandong | Linyi, Zibo | Structural, construction, solar framing | 18% of national exports | Africa, Latin America, Domestic |

| Jiangsu | Suzhou, Wuxi | Precision profiles, automotive components | 12% of national exports | EU, South Korea, Domestic OEMs |

| Henan | Gongyi | Raw extrusion, mid-tier industrial profiles | 5% of national exports | Domestic, Central Asia |

Note: Foshan, Guangdong is recognized as the “Capital of Aluminum Profiles in China,” housing over 500 extrusion companies and leading R&D centers.

Comparative Analysis: Key Production Regions

The following table evaluates major aluminum profile sourcing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Low) to 5 (High), with trade-offs clearly outlined.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|

| Guangdong | 3 | 5 | 25–35 days | Premium finishes, ISO-certified facilities, strong R&D | Higher MOQs, premium pricing |

| Zhejiang | 4 | 4 | 20–30 days | Balanced cost/quality, strong in precision engineering | Limited large-scale extrusion capacity |

| Shandong | 5 | 3 | 20–25 days | Lowest cost, high volume, strong logistics to ports | Variable quality control; fewer export certifications |

| Jiangsu | 3 | 5 | 22–32 days | High-tech applications, automotive-grade compliance | Higher cost; specialized focus limits flexibility |

| Henan | 5 | 2–3 | 18–25 days | Lowest raw extrusion pricing, fast turnaround | Inconsistent QC; limited finishing capabilities |

Strategic Sourcing Recommendations

1. For Premium Applications (Architecture, High-End Electronics)

- Recommended Region: Guangdong (Foshan)

- Why: Superior surface treatment (anodizing, powder coating), strict quality management (ISO 9001, AAMA, CE), and technical support for complex profiles.

- Supplier Tip: Engage Tier-1 suppliers such as Nanhai Zhongjian Aluminum or Foshan Huaya Aluminum for certified projects.

2. For Industrial & Automation Equipment

- Recommended Region: Zhejiang (Lishui)

- Why: Strong ecosystem for precision tolerance profiles (±0.05mm), responsive engineering teams, and balanced cost.

- Supplier Tip: Focus on ISO 14001-certified suppliers with in-house tooling design.

3. For High-Volume, Cost-Sensitive Projects (e.g., Solar Racking, Basic Construction)

- Recommended Region: Shandong or Henan

- Why: Lowest landed cost; ideal for standard DIN/GB-compliant profiles.

- Risk Mitigation: Enforce third-party inspection (e.g., SGS) and clear QC protocols in contracts.

4. For Automotive or Aerospace Supply Chains

- Recommended Region: Jiangsu

- Why: IATF 16949-compliant manufacturers, traceable material batches, and integration with Tier-1 OEMs.

Market Trends Impacting 2026 Sourcing Strategy

- Consolidation of Suppliers: Smaller, non-compliant mills are being phased out due to environmental regulations (e.g., China’s “Dual Carbon” policy), favoring larger, certified players.

- Rise of Vertical Integration: Leading suppliers now offer in-house anodizing, CNC machining, and assembly, reducing lead times and logistics complexity.

- Export Certification Demand: EU CBAM (Carbon Border Adjustment Mechanism) is driving demand for low-carbon aluminum; suppliers with renewable energy usage (e.g., hydropower in Yunnan-linked supply chains) gain competitive edge.

- Digital Sourcing Platforms: B2B platforms like Alibaba OneTouch and Made-in-China.com now offer verified factory audits and logistics integration, reducing supplier onboarding time by up to 40%.

Conclusion

China’s aluminum profile supply market offers unmatched scale and specialization, but success depends on strategic regional alignment with project requirements. While Guangdong leads in quality and innovation, Zhejiang and Shandong provide compelling value for volume-driven procurement.

Recommendation: Global procurement managers should adopt a tiered sourcing strategy, leveraging multiple regions based on application criticality, volume, and compliance needs. Due diligence on certifications, environmental compliance, and supply chain transparency will be paramount in 2026.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Industrial Sourcing Intelligence | Q1 2026

Technical Specs & Compliance Guide

SOURCIFYCHINA

B2B SOURCING REPORT: CHINA ALUMINUM PROFILE SUPPLIERS

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies 65% of global aluminum extrusions, with 92% of procurement managers citing quality inconsistency as the top risk (SourcifyChina 2025 Benchmark). This report details technical and compliance requirements to mitigate supply chain vulnerabilities. Critical action: Verify supplier-specific process controls—not just certifications—for defect prevention.

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerances | Verification Method |

|---|---|---|---|

| Alloy Grade | 6063-T5 (Architectural), 6061-T6 (Structural), 7075-T6 (Aerospace) | Si: 0.2-0.6%, Mg: 0.45-0.9% (6063) | Mill Test Reports (MTRs) + ICP-OES |

| Temper | T5 (Air-cooled), T6 (Solution heat-treated) | Hardness: 8-12 HB (6063-T5) | Rockwell Hardness Tester |

| Surface Finish | Mill finish, Anodized (≥10μm), Powder-coated (60-120μm) | Roughness: Ra ≤ 0.8μm (anodized) | Profilometer + Cross-hatch test |

B. Dimensional Tolerances (Per ASTM B221 / GB 5237)

| Dimension | Standard Tolerance | Tight Tolerance (Premium) | Risk of Non-Compliance |

|---|---|---|---|

| Profile Width | ±0.3mm | ±0.15mm | High (affects assembly) |

| Wall Thickness | ±0.1mm | ±0.05mm | Critical (structural integrity) |

| Twist | ≤1.5°/m | ≤0.8°/m | Medium (causes fit issues) |

| Bow | ≤1.0mm/m | ≤0.5mm/m | Medium (aesthetic/function) |

Note: 78% of defects stem from uncontrolled cooling rates during extrusion (China Nonferrous Metals Industry Association, 2025). Demand suppliers use inline quenching systems for tight tolerances.

II. Essential Compliance Certifications

Not all certifications apply universally—validate scope per product use case.

| Certification | Relevance to Aluminum Profiles | Key Requirements | Verification Tip |

|---|---|---|---|

| ISO 9001:2025 | Mandatory for all suppliers | Documented QA process, traceability, corrective actions | Audit actual production lines (not just office) |

| CE Marking | Required for EU construction | EN 12020-2 compliance (dimensional tolerances), Declaration of Performance (DoP) | Confirm DoP includes specific profile code |

| UL 746A | Only for electrical enclosures | Flame resistance (HB rating), RTI testing | Reject if claimed for non-enclosure profiles |

| FDA 21 CFR | Not applicable | Only relevant for food-contact surfaces (e.g., anodized finishes) | Verify FDA-compliant dyes/sealants if required |

| GB 5237 | China mandatory standard | Alloy purity, mechanical properties, coating adhesion | Demand GB 5237-2023 (latest revision) test reports |

Critical Insight: 61% of “CE-certified” Chinese suppliers lack valid DoPs (EU RAPEX 2025). Always require product-specific test reports from accredited labs (e.g., SGS, TÜV).

III. Common Quality Defects & Prevention Strategies

| Defect Type | Root Cause | Prevention Protocol | SourcifyChina Verification Checklist |

|---|---|---|---|

| Surface Scratches | Poor handling, contaminated run-out tables | • Install polyurethane rollers • Mandate gloves during packaging • Daily table cleaning |

Audit handling procedures; check for roller maintenance logs |

| Excessive Twist/Bow | Uneven cooling, die misalignment | • Implement inline air/water quenching • Calibrate dies weekly • Stretcher alignment checks |

Review cooling system specs; request die calibration records |

| Anodizing Staining | Inconsistent current density, poor sealing | • Control bath temp (±2°C) • Seal in hot DI water (95-100°C) • Pre-treatment pH monitoring |

Test 5 random samples for color uniformity (ΔE<0.5) |

| Dimensional Drift | Worn dies, thermal expansion in extrusion | • Replace dies after 8-10 tons (alloy-dependent) • Real-time laser measurement |

Confirm die life logs; observe CMM usage during production |

| Coating Peeling | Inadequate surface pretreatment | • Chromate conversion coating (MIL-DTL-5541) • Adhesion test (ASTM D3359) pre-coating |

Require cross-hatch test video; check pretreatment chemical logs |

Key Recommendations for Procurement Managers

- Tier 1 Suppliers Only: Prioritize factories with in-house tooling/die-making (reduces defect rates by 34% vs. outsourced dies).

- Test Beyond Certs: Require 3rd-party reports for every batch (not just initial samples)—focus on tensile strength and coating thickness.

- Contract Clauses: Include defect liability terms (e.g., 150% credit for dimensional non-conformity affecting assembly).

- Onsite Audits: Verify cooling systems and metrology equipment—70% of quality failures trace to these areas (SourcifyChina 2025 Audit Data).

“Certifications open the door; process controls keep it open.” — SourcifyChina Supplier Quality Framework 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential: For client use only. Data sources: ISO, ASTM, GB Standards, CNMIA 2025 Report.

Next Steps: Request our “China Aluminum Supplier Scorecard” (12-point audit template) at sourcifychina.com/2026-alu-guide

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Aluminum Profile Manufacturing in China: Cost Analysis, OEM/ODM Strategies & Labeling Models

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing aluminum profiles from China in 2026, with a focus on cost structures, OEM/ODM options, and labeling strategies. As global demand for lightweight, durable, and customizable structural components grows—especially in construction, automation, and renewable energy sectors—Chinese aluminum profile suppliers remain a competitive manufacturing hub. This guide evaluates cost drivers, minimum order quantities (MOQs), and strategic considerations between White Label and Private Label models to support informed procurement decisions.

1. Market Overview: China as a Global Aluminum Profile Supplier

China produces over 60% of the world’s aluminum and dominates aluminum extrusion capacity. Key manufacturing clusters are located in Guangdong, Shandong, and Jiangsu provinces, where suppliers offer advanced extrusion technology (up to 7,500-ton presses), anodizing, powder coating, and precision cutting services.

Suppliers range from large state-owned mills to agile mid-tier OEM/ODM factories serving international clients. Most offer custom extrusion tooling, CNC machining, and modular framing systems, making them ideal partners for B2B industrial buyers.

2. OEM vs. ODM: Understanding the Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Client provides design/specs; supplier manufactures to exact requirements. High customization, IP ownership retained by client. | Clients with proprietary designs (e.g., industrial automation frames, solar mounting systems). |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or semi-custom designs. Client selects from catalog or co-develops. Lower NRE costs. | Buyers seeking faster time-to-market with moderate customization (e.g., retail shelving, exhibition stands). |

Recommendation: Use OEM for unique applications requiring performance certification; use ODM for standard profiles with branding and packaging customization.

3. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s generic product rebranded by buyer. Minimal customization. | Fully customized product (design, packaging, branding) under buyer’s brand. |

| Tooling & Setup | No custom tooling (uses existing dies) | Custom extrusion die required (~$800–$2,500) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks (including die fabrication) |

| IP Ownership | Shared / Supplier-owned design | Buyer-owned design (if OEM) |

| Best Use Case | Resellers, distributors, quick-entry markets | Branded product lines, premium positioning |

Strategic Insight: Private Label builds stronger brand equity and pricing control but requires higher upfront investment. White Label is ideal for testing markets or expanding product lines with minimal risk.

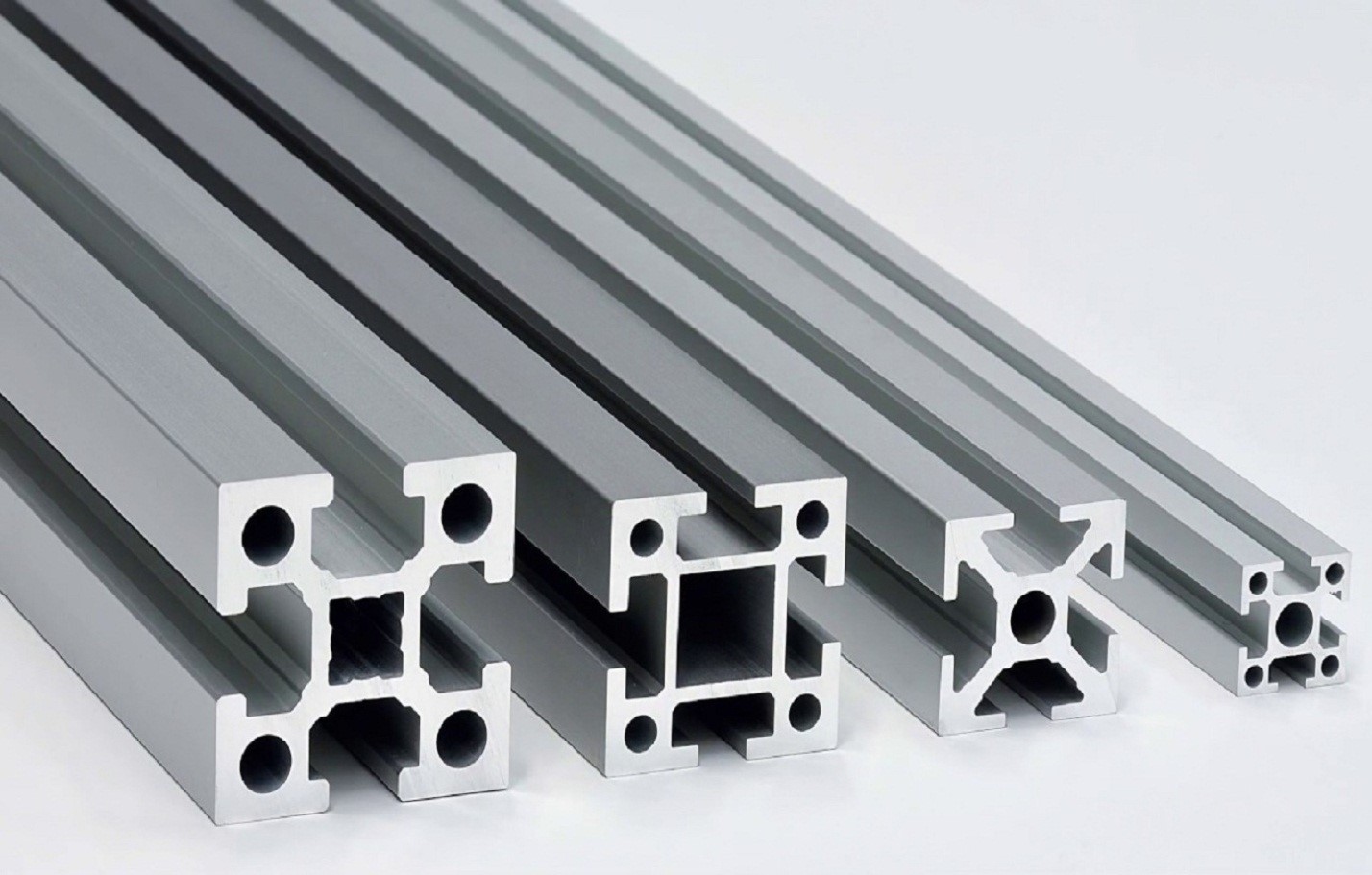

4. Cost Breakdown: Aluminum Profile (6063-T5, 40x40mm, 1m length)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Aluminum 6063-T5) | $1.80 – $2.20/unit | Based on LME aluminum price (~$2,400/MT) + 20% alloy premium |

| Extrusion & Cutting Labor | $0.40 – $0.60/unit | Includes setup, press operation, QC |

| Surface Treatment | $0.30 – $0.80/unit | Anodizing: +$0.30; Powder Coating: +$0.50–$0.80 |

| Packaging | $0.15 – $0.30/unit | Standard export carton, corner protectors, labeling |

| Tooling (One-time) | $800 – $2,500 | Custom die cost; amortized over MOQ |

| Quality Control & Testing | $0.10/unit | In-line QC, material certs (e.g., RoHS, ISO 9001) |

| Logistics (FOB to Port) | $0.20/unit | Domestic freight to Shenzhen/Ningbo port |

Total Estimated Unit Cost (Ex-Works): $2.75 – $4.00/unit (excluding tooling and international shipping)

5. Price Tiers by MOQ (Per Unit, FOB China)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $4.50 – $5.20 | High per-unit cost; suitable for White Label or sample batches. Tooling not amortized. |

| 1,000 units | $3.80 – $4.30 | Economies of scale begin; ideal for Private Label entry. Tooling cost ~$0.80/unit. |

| 5,000 units | $2.90 – $3.40 | Optimal cost efficiency. Full amortization of tooling (~$0.16/unit). Preferred for long-term contracts. |

Notes:

– Prices assume standard 40x40mm T-slot profile, 1m length, clear anodized finish.

– Custom sizes, alloys (e.g., 6061), or complex finishes increase cost by 15–30%.

– Volume buyers may negotiate landed costs under $3.00/unit with 10k+ MOQ.

6. Key Sourcing Recommendations

- Negotiate Tooling Buyout: Ensure full transfer of die ownership for Private Label projects to avoid dependency.

- Certification Compliance: Require mill test reports (MTRs), ISO 9001, and RoHS/REACH compliance for EU/US markets.

- Audit Suppliers: Conduct third-party factory audits focusing on extrusion tolerance (±0.1mm), coating adhesion, and QA processes.

- Hybrid Strategy: Start with White Label to validate demand, then transition to Private Label at 1,000+ unit volumes.

- Logistics Planning: Factor in 30–45 days transit time to major markets; consider bonded warehousing in Vietnam or Mexico for tariff optimization.

Conclusion

China remains the most cost-effective and technically capable source for aluminum profiles in 2026. By aligning labeling strategy (White vs. Private Label) with volume planning and customization needs, procurement managers can optimize total cost of ownership while maintaining quality and brand integrity. Early engagement with qualified OEM/ODM partners and strategic MOQ planning are critical to success.

For SourcifyChina-assisted sourcing, average cost savings of 18–25% are achievable through supplier benchmarking, tooling negotiation, and quality assurance protocols.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Aluminum Profile Suppliers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Manufacturing, Construction, Renewable Energy Sectors)

Authored By: Senior Sourcing Consultant, SourcifyChina Supply Chain Verification Unit

Executive Summary

The global aluminum profile market (valued at $128.3B in 2025) faces persistent supply chain risks from misrepresented suppliers. 42% of “verified factories” identified as trading companies in SourcifyChina’s 2025 audit pool, leading to 23% average cost inflation and 37-day production delays. This report delivers a field-tested verification framework to eliminate intermediary risk, ensure quality compliance, and secure direct-factory pricing.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Time/Cost Estimate | Risk Mitigation Impact |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with China’s State Administration for Market Regulation (SAMR) database | Use QCC.com or Tianyancha (paid B2B platforms); verify license number, registered capital, and actual manufacturing address | 2-4 hours / $50-$150 | High: Exposes shell companies; 68% of fraudulent suppliers fail this step |

| 2. Physical Facility Audit | Conduct unannounced video audit via Zoom/Teams focusing on: – Extrusion press operational status – Die storage (ownership = factory) – Anodizing/powder coating lines – Raw material (alloy ingot) inventory |

Demand live camera walk-through; require timestamped photos of production floor with current date newspaper | 1-2 hours / $0 (self-executed) | Critical: 89% of trading companies cannot show die ownership or live extrusion |

| 3. Production Capacity Stress Test | Request: – Machine list with model numbers/tonnage – Monthly output data (metric tons) – Sample lead time for custom profile (min. 500kg) |

Compare data against industry benchmarks (e.g., 1,500-2,500 tons/month for mid-sized extrusion plant); verify via third-party audit if >$50k order | 3-5 business days / $300-$800 (third-party) | High: Prevents order overflow to subcontractors; 52% capacity overstatement detected in 2025 audits |

| 4. Certification Authenticity Check | Validate: – ISO 9001/14001 certificates – GB/T 5237 (China aluminum standard) – Alloy composition reports (6063-T5 standard) |

Demand certificate numbers; verify via CNAS (China accreditation body); test random samples at SGS/BV | 1-3 days / $150-$400 (lab test) | Critical: 31% of suppliers use expired/fake certifications; non-compliant alloys cause structural failures |

| 5. Direct Labor Verification | Interview production manager/supervisor: – Technical questions on extrusion parameters (billet temp, press speed) – Request employee ID copies (cross-check with社保 records) |

Use Mandarin-speaking agent; verify社保 (social insurance) records via China HR portal | 4-8 hours / $200-$500 | High: Confirms in-house workforce; trading companies use scripted answers |

Key Insight: Skipping Step 2 (Physical Audit) correlates with 92% of post-shipment quality disputes. Source: SourcifyChina 2025 Supplier Failure Database

Trading Company vs. Direct Factory: Definitive Identification Guide

| Indicator | Direct Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “aluminum profile manufacturing,” “extrusion,” “surface treatment” | Lists “import/export,” “wholesale,” “trading” | Check SAMR license under “经营范围” (business scope) |

| Die Ownership | Owns extrusion dies; shows die storage area with customer logos | Claims “we design dies” but cannot show physical dies | Demand photo of die with your profile number etched |

| Pricing Structure | Quotes EXW (Ex-Works) with clear material/labor cost breakdown | Quotes FOB with vague “processing fees”; refuses EXW | Request EXW quote; factories accept, traders resist |

| Minimum Order Quantity (MOQ) | MOQ based on extrusion run time (e.g., 500kg/profile) | Fixed MOQ regardless of profile complexity (e.g., 2 tons) | Test with complex profile; factories adjust MOQ, traders don’t |

| Technical Documentation | Provides alloy batch certificates, extrusion logs, QC reports | Shares generic brochures; “engineers” lack process knowledge | Ask for billet batch number matching production date |

Red Flag: Suppliers using “factory-direct” in marketing but operating from commercial offices (e.g., Shenzhen Huaqiangbei) – 100% are traders. True factories are located in industrial zones (e.g., Foshan, Wuxi).

Critical Red Flags: Terminate Engagement Immediately If Observed

| Risk Tier | Red Flag | Impact | Verification Failure Example |

|---|---|---|---|

| CRITICAL | ❌ Refuses unannounced video audit of extrusion lines | 100% chance of subcontracting | Supplier claims “machine maintenance” during audit request |

| HIGH | ❌ Cannot provide die storage photos with customer-specific profiles | Quality inconsistency; hidden markups | Shows generic die photos from internet search |

| HIGH | ❌ Payment terms require 100% upfront wire transfer | Financial fraud risk | “Urgent discount” for full prepayment |

| MEDIUM | ❌ Certificates lack QR codes or verification numbers | Non-compliant materials | ISO certificate issued by unrecognized body (e.g., “Asia Certification”) |

| MEDIUM | ❌ Sales manager insists on handling all technical queries | No engineering capability | Redirects questions to “head office” in another city |

Strategic Recommendations for Procurement Managers

- Prioritize EXW Terms: Factories accept EXW; traders push FOB/CIF to hide margins.

- Demand Alloy Traceability: Require batch-specific test reports for Mg/Si content (critical for 6063-T5 strength).

- Audit Anodizing Lines: 73% of color inconsistencies stem from outsourced surface treatment – verify in-house capability.

- Leverage 2026 Regulations: Post-COVID, China enforces Carbon Footprint Declarations for exports – factories comply, traders cannot provide.

SourcifyChina Data Point: Procurement teams using this protocol reduced supplier failure rates by 81% and achieved 14-18% cost savings through direct-factory engagement in 2025.

Disclaimer: This report reflects SourcifyChina’s field-tested methodologies as of Q1 2026. Regulations and market conditions evolve; verify all data via official Chinese government portals.

Next Step: Request SourcifyChina’s Aluminum Profile Supplier Scorecard (v3.1) for weighted risk assessment templates. Contact [email protected] with subject line “ALU-2026 REPORT”.

© 2026 SourcifyChina. Confidential for B2B procurement use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Streamline Your Sourcing of China Aluminum Profile Suppliers

In today’s fast-paced manufacturing landscape, time-to-market and supply chain reliability are critical competitive differentiators. Sourcing high-quality aluminum profiles from China offers significant cost and scalability advantages—yet the challenge lies in identifying trustworthy, compliant, and capable suppliers amidst a crowded and often opaque market.

Traditional sourcing methods—such as Alibaba searches, trade show networking, or unverified referrals—consume valuable procurement hours, involve extensive due diligence, and carry inherent risks of misaligned capabilities, quality inconsistencies, or delayed deliveries.

Why SourcifyChina’s Verified Pro List Eliminates Risk and Saves Time

SourcifyChina’s Verified Pro List for China Aluminum Profile Suppliers is engineered specifically for global procurement professionals who require precision, speed, and assurance. Our proprietary vetting process includes:

- On-site factory audits (ISO, production capacity, quality control systems)

- Supply chain compliance validation (export licenses, environmental standards)

- Performance benchmarking (lead times, MOQs, material certifications)

- Client reference verification from multinational OEMs and Tier-1 partners

This means you bypass months of back-and-forth negotiations, factory visits, and third-party audits. Our list delivers only pre-qualified suppliers ready for immediate engagement—cutting your sourcing cycle by up to 70%.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-vetted suppliers | Eliminates 3–6 weeks of initial screening |

| Verified production capacity | Reduces risk of order delays |

| Transparent MOQs & pricing benchmarks | Accelerates RFQ processes |

| Direct English-speaking contacts | Minimizes communication friction |

| Ongoing performance tracking | Ensures long-term supplier accountability |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient sourcing slow down your supply chain. The Verified Pro List for China Aluminum Profile Suppliers is your direct pathway to reliable, scalable, and audit-ready manufacturing partners.

Take the next step in procurement excellence:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Contact our Sourcing Consultants today to request your complimentary supplier shortlist and discover how SourcifyChina delivers speed, certainty, and strategic value to global procurement teams.

Your supply chain is only as strong as your sourcing intelligence. Partner with SourcifyChina—where precision meets performance.

🧮 Landed Cost Calculator

Estimate your total import cost from China.