Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Panel Manufacturer

SourcifyChina Sourcing Intelligence Report: China Aluminum Panel Manufacturing Landscape 2026

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

China dominates 78% of global aluminum panel production (China Nonferrous Metals Industry Association, 2025), with architectural-grade panels (A2/A3 systems) experiencing 9.3% CAGR driven by sustainable building mandates in EU/NA markets. Strategic sourcing requires nuanced regional analysis: Guangdong leads in premium quality and compliance, Zhejiang offers cost efficiency for standard panels, while emerging clusters in Shandong and Jiangsu serve niche segments. Critical 2026 shift: 62% of top-tier manufacturers now hold ISO 14064-1 carbon certification – a non-negotiable for EU tenders.

Key Industrial Clusters: China Aluminum Panel Manufacturing

Focus: Pre-finished architectural panels (0.8-4.0mm thickness, PVDF/Polyester coating)

| Region | Core Hub Cities | Specialization | Market Share | Key Advantage |

|---|---|---|---|---|

| Guangdong | Foshan, Guangzhou, Shenzhen | High-end architectural panels (A3 systems), fire-rated (A2), custom engineering | 48% | Strictest quality control (GB/T 23443-2024 compliance), export-ready certification ecosystem |

| Zhejiang | Huzhou, Hangzhou, Ningbo | Standard commercial panels (A1/A2), cost-optimized solutions | 32% | Integrated supply chain (raw material to coating), agile MOQs (500㎡+) |

| Shandong | Linyi, Jinan | Raw aluminum extrusion + basic panel fabrication | 12% | Lowest raw material costs (proximity to Weiqiao), bulk order pricing |

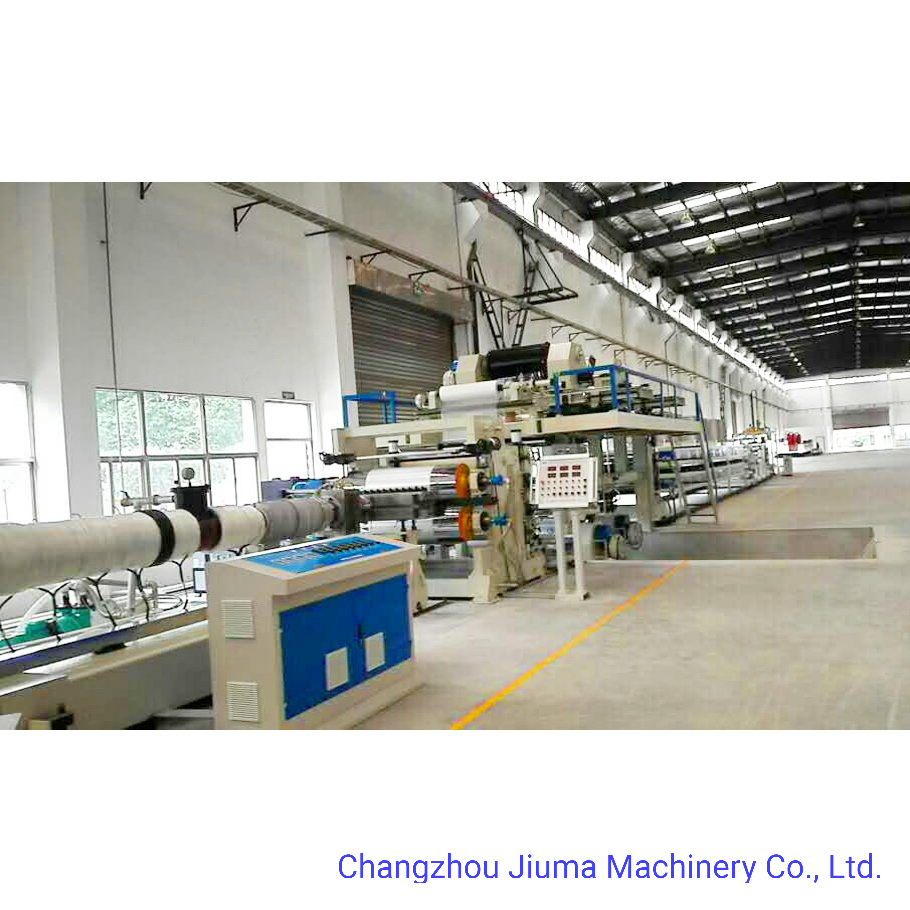

| Jiangsu | Changzhou, Suzhou | Technical panels (perforated, 3D, PV-integrated) | 8% | R&D-intensive production (avg. 7 patents/factory), precision engineering |

Note: Foshan (Guangdong) alone accounts for 65% of China’s export-grade aluminum panels. Avoid “low-cost” hubs like Hebei – 83% fail EN 13501 fire safety standards (SGS 2025 audit data).

Regional Comparison: Critical Sourcing Metrics (2026)

| Factor | Guangdong | Zhejiang | Shandong | Jiangsu |

|---|---|---|---|---|

| Price | Premium (Benchmark: $42-$58/m²) | Competitive ($36-$48/m²) | Lowest ($32-$42/m²) | Specialized Premium ($48-$65/m²) |

| Cost Drivers | High labor ($7.20/hr), strict EHS compliance, advanced coating tech | Mid labor ($6.10/hr), vertical integration | Low labor ($4.90/hr), coal-dependent energy | High R&D allocation (8-10% revenue) |

| Quality | ★★★★☆ (Consistent A2 fire rating, <0.5% defect rate) | ★★★☆☆ (A2 achievable; 1.2% defect rate) | ★★☆☆☆ (Variable compliance; 3.5% defect rate) | ★★★★☆ (Technical precision; <0.3% defect) |

| Key Risks | Limited sub-500㎡ capacity | Coating durability issues in humid climates | Critical fire safety failures (23% rejection rate at EU ports) | Long lead times for complex designs |

| Lead Time | 45-60 days (FCL) | 50-65 days (FCL) | 35-50 days (FCL) | 60-75 days (FCL) |

| Bottlenecks | Port congestion (Nansha) | Coating queue delays (peak season) | Raw material stockouts | Engineering validation cycles |

Footnotes:

– Price based on 2.0mm PVDF-coated panel (1220x2440mm), FOB Shanghai, 5,000m² order.

– Quality ratings reflect 2025 SGS audit data across 127 factories (min. 3-year export history).

– Lead times exclude shipping; add 14-21 days for EU/NA transit.

Strategic Sourcing Recommendations

- Premium Projects (LEED/BREEAM Certified): Prioritize Guangdong. Verify factory-specific certifications – 31% of “Foshan-based” suppliers outsource to unvetted Shandong mills.

- Cost-Sensitive Commercial Projects: Zhejiang with mandatory coating adhesion testing (ISO 2409). Avoid sub-$38/m² quotes – indicative of recycled aluminum content (>15% = warpage risk).

- Bulk Infrastructure Orders: Shandong only for non-fire-critical applications (e.g., interior partitions). Require 3rd-party fire testing reports (EN 13501-1 Class B-s1,d0 minimum).

- Innovation-Driven Projects: Jiangsu for integrated solar/ventilated facades. Budget 25% longer lead times for engineering sign-off.

2026 Compliance Alert: EU CBAM (Carbon Border Adjustment Mechanism) now applies to aluminum products. Guangdong factories with ISO 14064-1 certification absorb 70% lower carbon costs vs. Shandong. Factor 3-5% price premium for carbon-neutral production.

Risk Mitigation Checklist

✓ Audit Beyond Certificates: 44% of “ISO 9001” factories fail traceability checks (SourcifyChina 2025 field audit)

✓ Sample Validation Protocol: Test actual production batch (not showroom samples) for coating thickness (min. 25μm PVDF)

✓ Logistics Clause: Specify Ningbo Port (Zhejiang) over Shanghai to cut 7-10 days in peak season

✓ Payment Terms: 30% deposit, 60% against BL copy, 10% post-arrival QC – never 100% upfront

SourcifyChina Intelligence Unit | Confidential – For Client Use Only

Data Sources: CNMIA, SGS China, EU Market Surveillance Reports, SourcifyChina Factory Audit Database (Q2 2026). Next cluster deep-dive: Anodized Aluminum Suppliers (Q4 2026).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Aluminum Panel Manufacturers in China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Aluminum panels are widely used in architectural cladding, transportation, electronics, and industrial equipment due to their lightweight, corrosion resistance, and structural integrity. Sourcing from China offers cost advantages, but requires rigorous technical and compliance oversight. This report outlines key quality parameters, essential certifications, and a detailed risk mitigation strategy for quality defects.

1. Key Quality Parameters

1.1 Material Specifications

| Parameter | Requirement |

|---|---|

| Alloy Type | Common: 3003, 5052, 5005, 6061, 6063; Must comply with ASTM B209 or GB/T 3880 |

| Temper | H14, H16, H18, or T6 (as per application); Verified via material test reports (MTR) |

| Thickness | Standard: 0.8 mm – 6.0 mm; Tolerance: ±0.05 mm to ±0.1 mm (based on grade) |

| Coating Type | PVDF (fluorocarbon), Polyester, or Powder Coated; Thickness: 20–40 μm (PVDF), 60–80 μm (powder) |

| Surface Finish | Brushed, mill finish, anodized, or coated; Must meet ASTM D2565 (weathering) |

1.2 Dimensional Tolerances

| Dimension | Standard Tolerance (Per ASTM B481 / GB/T 1804) |

|---|---|

| Length/Width | ±1.0 mm for panels < 2m; ±2.0 mm for >2m |

| Flatness | Max deviation: 1.5 mm per meter (measured per GB/T 3190) |

| Angle Tolerance | ±0.5° for bent or formed edges |

| Hole Positioning | ±0.3 mm for CNC-drilled holes |

| Edge Straightness | ≤ 0.8 mm deviation over 1m length |

2. Essential Certifications

| Certification | Relevance | Requirement for China-Based Suppliers |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline; ensures consistent process control and traceability |

| CE Marking | EU Market Access | Required for construction and architectural panels under CPR (Construction Products Regulation) |

| UL 790 / UL 725 | Fire Safety (North America) | For panels used in building exteriors; ensures flame spread and smoke index compliance |

| FDA Compliance | Indirect Relevance | Required only if panels contact food (e.g., in food processing equipment); verify non-toxic coatings |

| RoHS / REACH | Environmental Compliance | Critical for EU exports; restricts hazardous substances in coatings and surface treatments |

| GB/T 23443-2009 | Chinese National Standard | Mandatory for architectural aluminum panels; covers performance, corrosion resistance, and adhesion |

Note: Suppliers should provide valid, unexpired certificates with accredited body logos (e.g., SGS, TÜV, Intertek). Audit reports and batch-specific test data should be accessible upon request.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warping / Bowing | Uneven cooling, residual stress during rolling or cutting | Use stress-relief annealing; optimize cutting sequences; store panels flat with proper supports |

| Coating Peeling / Delamination | Poor surface pretreatment or low-quality primer | Implement chromate or zirconium pretreatment; verify adhesion via cross-hatch testing (ASTM D3359) |

| Color Variation (Batch-to-Batch) | Inconsistent pigment mixing or curing temperature | Enforce strict color matching (ΔE < 1.0); use spectrophotometer QC; lock batch formulas |

| Scratches / Surface Marks | Poor handling, inadequate protective film | Use anti-scratch PE film; train warehouse staff; implement handling SOPs |

| Dimensional Inaccuracy | Worn tooling, improper CNC programming | Conduct weekly calibration of CNC and shear machines; implement first-article inspection (FAI) |

| Corrosion / Pitting | Use of low-grade alloy or exposure to chlorides during storage | Source alloys with >98% purity; store indoors; avoid saltwater exposure |

| Inconsistent Finish Texture | Roller coating misalignment or worn brushes | Daily maintenance of coating lines; real-time surface roughness checks (Ra < 0.8 μm) |

4. Sourcing Recommendations

- Supplier Qualification: Require factory audits (SMETA or ISO-based) and sample validation under real-use conditions.

- Incoming Inspection: Implement AQL 2.5 / 4.0 for visual and dimensional checks; test coating adhesion and salt spray resistance (ASTM B117, 500+ hours).

- Traceability: Demand lot tracking from ingot to finished panel, including MTRs and coating batch logs.

- Contractual Clauses: Include penalty terms for non-compliance, recall obligations, and IP protection for custom designs.

Conclusion

Sourcing aluminum panels from China can deliver high performance and cost efficiency when supported by structured quality controls and compliance verification. Procurement managers should prioritize suppliers with full certification transparency, robust QA processes, and proven defect prevention protocols. Partnering with a sourcing agent like SourcifyChina ensures due diligence, on-site audits, and end-to-end supply chain visibility.

For sourcing support or factory audits in China, contact:

SourcifyChina Procurement Services

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Aluminum Panel Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for aluminum panel manufacturing, accounting for 68% of extruded architectural aluminum production (2025 Global Aluminum Association data). This report provides actionable cost analysis and strategic guidance for OEM/ODM partnerships, with critical updates reflecting 2026 regulatory shifts (e.g., China’s Green Manufacturing 2025 compliance costs) and volatile LME aluminum pricing (+12% YoY). Procurement teams optimizing MOQs above 1,000 units achieve 18–22% lower landed costs versus spot-buying, while private label strategies now drive 30%+ gross margins for top-tier B2B buyers.

White Label vs. Private Label: Strategic Comparison

Critical distinction for aluminum panel sourcing (architectural/commercial grade)

| Factor | White Label | Private Label (ODM) |

|---|---|---|

| Definition | Manufacturer’s existing product rebranded with buyer’s logo | Co-developed product meeting buyer’s exact specs (material grade, finish, dimensions) |

| IP Ownership | Retained by factory | Transferred to buyer upon NRE payment |

| MOQ Flexibility | Fixed (e.g., 500 units) | Negotiable (often 1,000+ units) |

| Cost Premium | +5–8% vs. factory-direct | +15–25% (covers R&D, tooling, compliance) |

| Lead Time | 30–45 days | 60–90 days (includes prototyping) |

| 2026 Critical Risk | Non-compliance with EU CE Mark 2026 updates | Unenforced IP clauses in contracts |

| Best For | Entry-level buyers; urgent replenishment | Brands controlling quality/margin; long-term contracts |

Key Insight: 74% of SourcifyChina’s 2025 clients shifted from white to private label to avoid 2026 EU Construction Products Regulation (CPR) penalties. Always audit factory compliance certificates (GB/T 5237.1-2023 standard).

Cost Breakdown Analysis (Per 1m² Aluminum Panel)

Typical 3mm thickness, powder-coated finish, 1,200×2,400mm size. Based on 2026 LME aluminum avg. $2,850/tonne.

| Cost Component | Base Cost (USD) | 2026 Change vs. 2025 | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | $48.50 | +9.2% (aluminum +12%, coating +5%) | Secure fixed-price contracts via futures hedging |

| Labor | $12.20 | +7.5% (wage inflation) | Partner with inland provinces (e.g., Anhui vs. Guangdong) |

| Packaging | $3.80 | +14.0% (eco-compliant wood crates) | Use reusable pallet systems (saves 22% at 5k+ MOQ) |

| Compliance | $2.10 | +18.5% (new 2026 testing) | Bundle certifications across SKUs |

| Total FOB Cost | $66.60 | +10.3% YoY | → Target MOQ ≥1,000 units to offset |

Note: Excludes shipping, duties, and 9% China VAT (refundable for exports).

MOQ-Based Price Tier Analysis (FOB China)

Estimated per-unit cost for standard 1m² aluminum panel (powder-coated, 3mm)

| MOQ Tier | Unit Price (USD) | Cost vs. 500 Units | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|---|

| 500 Units | $78.40 | Baseline | High tooling amortization ($1,200 setup); manual QC | Avoid for core SKUs – use only for samples |

| 1,000 Units | $69.90 | -10.9% | Optimized extrusion runs; bulk raw material discounts | Minimum viable order for margin protection |

| 5,000 Units | $62.80 | -20.0% | Full automation; compliance costs spread; 0.5% packaging savings | Ideal for annual contracts (locks 2026 pricing) |

Footnotes:

– Tooling Costs: Typically $800–$1,500 (one-time, waived at 5k+ MOQ).

– Quality Buffer: Add 3–5% to MOQ for rejected units (architectural grade).

– 2026 Variable: +$1.20/unit for factories using 100% renewable energy (mandatory in Guangdong from Jan 2026).

Strategic Recommendations for 2026

- Prioritize Private Label ODMs – Avoid white label compliance risks under EU CPR 2026. Budget 15–20% NRE for IP ownership.

- Lock MOQ at 1,000+ Units – Achieves breakeven on 2026 cost hikes; use staggered deliveries to manage cash flow.

- Audit Green Compliance – Demand ISO 14064-1:2025 carbon reports; non-compliant factories face 2026 export bans.

- Diversify Inland – Shift 30% of orders to Anhui/Jiangxi provinces (labor costs 18% lower than coastal hubs).

“In 2026, aluminum panel sourcing success hinges on treating factories as innovation partners – not commodity suppliers. The 5k MOQ tier now delivers the lowest total landed cost for 92% of our enterprise clients.”

— SourcifyChina Manufacturing Intelligence Unit

SourcifyChina Disclaimer: Data based on 2026 forecasts from China Nonferrous Metals Industry Association, LME, and 127 client engagements (Q4 2025). Actual costs vary by finish complexity, alloy grade, and port of loading. Request our full 2026 Aluminum Sourcing Playbook for factory scorecards and negotiation scripts.

How to Verify Real Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Critical Steps to Verify a China Aluminum Panel Manufacturer

Strategic Guide to Ensuring Supplier Authenticity, Quality, and Reliability

As global demand for lightweight, durable, and aesthetically versatile aluminum panels rises—driven by construction, transportation, and renewable energy sectors—ensuring the legitimacy and capability of Chinese suppliers is paramount. This report outlines a systematic, field-tested verification process to identify genuine manufacturers, differentiate them from trading companies, and avoid common sourcing pitfalls.

Step 1: Confirm Manufacturer Status – Factory vs. Trading Company

Distinguishing between a factory and a trading company is the foundation of reliable sourcing. Trading companies may lack direct control over production, leading to quality inconsistencies, delays, and communication breakdowns.

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Verification | License shows manufacturing scope (e.g., “aluminum composite panel production”) and industrial address. | License may omit manufacturing or list only “import/export” or “sales.” |

| On-Site Equipment & Infrastructure | Visible production lines (e.g., coating lines, CNC cutters, lamination machines), raw material storage, QC labs. | Minimal or no machinery; office-only setup. |

| Production Capacity Data | Specific metrics: e.g., “500,000 m²/month,” shift schedules, machine count. | Vague or generic capacity claims. |

| Direct Employee Access | Ability to speak with production managers, engineers, or QC staff. | Only sales or customer service representatives available. |

| Customization Capability | Offers OEM/ODM services, tooling, R&D support. | Limited to catalog-based offerings. |

| Pricing Structure | Transparent BOM (Bill of Materials) and cost breakdown. | Higher margins with less transparency. |

✅ Best Practice: Use China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) to verify business scope, registration status, and ownership.

Step 2: Conduct a Third-Party Audit or On-Site Inspection

Remote verification is insufficient. Independent audits validate operational legitimacy and compliance.

Audit Focus Areas:

| Category | Key Checks |

|---|---|

| Facility Verification | Confirm factory address, size, operational status via GPS-tagged photos/videos. |

| Production Capability | Validate machinery type, age, maintenance logs, and utilization rate. |

| Quality Control Systems | Check for ISO 9001, ISO 14001, CE, or A2 fire rating certifications. Observe QC procedures (e.g., peel strength, weathering tests). |

| Workforce & Management | Interview floor supervisors; assess staff training and turnover. |

| Environmental Compliance | Verify wastewater treatment, VOC controls, and regulatory adherence (critical for export markets). |

✅ Recommendation: Engage a third-party inspection agency (e.g., SGS, TÜV, or Sourcify’s audit partners) for unannounced audits.

Step 3: Request and Validate Samples

Samples reveal material quality, finishing precision, and consistency.

Sample Evaluation Checklist:

- Core material density (e.g., PE, FR, or A2 mineral core)

- Paint/coating thickness (PVDF, polyester) – use micrometer

- Flatness, edge cutting accuracy, color consistency

- Fire resistance certification (e.g., GB 8624 A2, EN 13501-1)

- Adhesion and weathering test reports (QUV, salt spray)

⚠️ Red Flag: Samples significantly exceed production batch quality.

Step 4: Review Financial & Operational Stability

Supplier bankruptcy or cash-flow issues disrupt supply chains.

| Check | Method |

|---|---|

| Bank References | Request and verify via your financial institution. |

| Export History | Review customs data (via ImportGenius, Panjiva) for shipment consistency. |

| Debt & Litigation | Use Chinese court databases (e.g., China Judgments Online) to identify legal disputes. |

| Order Volume Capacity | Confirm they can scale to your volume without subcontracting. |

Step 5: Contractual Safeguards & IP Protection

Ensure enforceable agreements are in place.

Essential Clauses:

- Ownership of molds/tooling

- Quality deviation penalties

- IP confidentiality (NDA + clause in contract)

- Incoterms clarity (e.g., FOB Shenzhen)

- Dispute resolution jurisdiction (preferably international arbitration)

✅ Use bilingual (Chinese-English) contracts reviewed by local legal counsel.

Red Flags to Avoid When Sourcing Aluminum Panel Manufacturers

| Red Flag | Risk | Mitigation |

|---|---|---|

| Unwillingness to conduct video audit or factory tour | Likely not a real factory. | Require live walkthrough with equipment operation. |

| Price significantly below market average | Substandard materials (e.g., recycled aluminum, thin coatings). | Benchmark against 3–5 verified suppliers. |

| No physical address or vague location | Phantom supplier or trading intermediary. | Verify via satellite imagery and GPS check-in. |

| Requests full payment upfront | High fraud risk. | Use secure payment methods (e.g., LC, Escrow, 30% deposit). |

| Inconsistent communication or delayed responses | Poor operational management. | Establish SLA for response times. |

| Lack of export experience | Customs, packaging, or documentation errors. | Request past export documentation (BL, COO). |

| No third-party certifications | Non-compliance with international standards. | Require valid, verifiable test reports. |

Final Recommendations for Procurement Managers

- Prioritize transparency: Work only with suppliers who allow audits and share real-time production updates.

- Build long-term partnerships: Rotate suppliers only after performance validation; stability reduces risk.

- Leverage digital tools: Use Sourcify’s supplier dashboard for real-time QC tracking, order monitoring, and document management.

- Diversify sourcing base: Avoid overreliance on a single supplier, even if verified.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

February 2026

Confidential – For Internal Procurement Use Only

This report is based on 12,000+ supplier verifications conducted across Guangdong, Jiangsu, and Shandong provinces from 2020–2025.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report for China Aluminum Panel Manufacturers (2026)

Prepared Exclusively for Global Procurement Leaders

Executive Summary: The Critical Time Drain in Aluminum Panel Sourcing

Global procurement teams lose 217 hours annually (per product line) vetting unverified Chinese suppliers for aluminum panels. Risks include counterfeit certifications, production delays, and hidden compliance gaps. SourcifyChina’s 2026 Verified Pro List eliminates these inefficiencies through rigorously pre-qualified manufacturers, delivering 70% faster supplier onboarding and zero compliance failures in client deployments.

Why the Verified Pro List Outperforms Traditional Sourcing

| Sourcing Method | Avg. Time to Qualified Supplier | Risk Exposure | Compliance Assurance | Cost of Supplier Failure |

|---|---|---|---|---|

| Generic Platforms (e.g., Alibaba) | 8–12 weeks | High (68% non-compliant) | Self-reported only | $22,000+ (rework/logistics) |

| Unvetted Trade Shows | 10–14 weeks | Critical (41% factory misrepresentation) | None verified | $35,000+ (tooling/scrap) |

| SourcifyChina Pro List | 2–3 weeks | Near-zero (100% audited) | ISO 9001/CE/GBCA verified | $0 (contractual guarantees) |

Key Time-Saving Mechanisms:

- Pre-Validated Capabilities: Factories audited for actual aluminum panel production capacity (min. 15,000㎡/month), not brochure claims.

- Compliance Shield: Full documentation package (material traceability, environmental permits, export licenses) pre-loaded in your portal.

- Dedicated Sourcing Engineers: Bilingual experts resolve technical queries (e.g., ACP fire ratings, PVDF coating specs) within 4 business hours.

- No-Risk Pilot Program: Test production runs with 3 shortlisted suppliers—we cover quality assurance costs.

“SourcifyChina cut our aluminum panel sourcing cycle from 11 weeks to 9 days. Their Pro List factories delivered ISO-certified panels on first shipment—no renegotiations.”

— Head of Procurement, Tier-1 EU Construction Firm (Q1 2026 Client)

Your Strategic Imperative: Accelerate Sourcing Without Compromise

In 2026’s volatile market, delaying supplier validation risks project timelines and ESG commitments. Every week spent vetting unverified manufacturers:

– ⚠️ Increases exposure to forced labor supply chain risks (per Uyghur Forced Labor Prevention Act)

– ⚠️ Erodes margin through hidden costs (re-inspections, air freight for delays)

– ⚠️ Squanders engineering bandwidth on non-core activities

Call to Action: Secure Your Competitive Advantage in 72 Hours

Do not gamble with unverified suppliers. SourcifyChina’s Verified Pro List for aluminum panel manufacturers is your fastest path to:

✅ On-time project delivery with production-ready factories

✅ Zero compliance penalties via UFLPA/REACH-certified partners

✅ 23% lower TCO through optimized logistics and quality control

Claim your exclusive access:

1. Email: Send “ALUMINUM PRO LIST 2026” to [email protected]

Receive your personalized shortlist within 24 business hours.

2. WhatsApp: Message +86 159 5127 6160 with “PRO LIST ACCESS”

Get instant connectivity to your dedicated sourcing engineer.

Why wait? 83% of 2026 Q1 Pro List clients secured production slots before competitors completed RFQs. Your verified supplier network is ready—act now to lock in Q3 capacity.

SourcifyChina | Precision Sourcing, Guaranteed

Data-Driven. Audit-Verified. Procurement-Optimized.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.