Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Extrusion Manufacturers

SourcifyChina Sourcing Intelligence Report: China Aluminum Extrusion Market Analysis 2026

Prepared For: Global Procurement Managers | Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global producer of aluminum extrusions, accounting for ~60% of worldwide capacity (2025 data). Sourcing from China offers significant cost advantages (typically 15-30% below EU/US benchmarks), but success requires strategic regional selection aligned with product complexity, quality tolerance, and supply chain resilience. This report identifies key industrial clusters, analyzes regional differentiators, and provides actionable insights for optimized procurement in 2026.

Market Overview: China’s Aluminum Extrusion Landscape

China’s aluminum extrusion sector is characterized by fragmented mid-tier manufacturers (85% of capacity) and emerging high-precision specialists (15%). Key drivers for 2026 include:

– Stricter environmental regulations (especially in coastal provinces) consolidating smaller, non-compliant mills.

– Rising labor/energy costs (+8.2% YoY in 2025), narrowing the cost gap with Southeast Asia.

– Technology shift toward automation (CNC bending, anodizing lines) in Tier-1 clusters to offset cost pressures.

– Export focus on high-value sectors: renewable energy (solar frames), EVs (battery housings), and architectural systems.

Critical Insight: Price alone is a poor selection criterion. Procurement managers must prioritize clusters matching their technical specifications and compliance requirements (e.g., ISO 9001, AAMA, EN 12020).

Key Industrial Clusters: Regional Analysis

China’s aluminum extrusion capacity is concentrated in five core clusters, each with distinct competitive advantages:

| Region | Core Cities | Specialization | Key Advantages | Limitations |

|---|---|---|---|---|

| Guangdong | Foshan, Zhaoqing | Architectural systems, high-end anodizing, solar frames | Mature ecosystem, strict quality control, fast logistics (Pearl River Delta ports), R&D focus | Highest labor/energy costs, premium pricing |

| Shandong | Linyi, Zouping | Industrial profiles, structural components, large-scale sections | Lowest raw material costs (proximity to alumina refineries), massive scale capacity | Variable quality control, slower innovation |

| Zhejiang | Hangzhou, Ningbo | Precision engineering (automotive, electronics), thermal break systems | Strong technical talent, automation adoption, balanced cost/quality | Mid-tier pricing, export logistics congestion |

| Jiangsu | Suzhou, Wuxi | Aerospace, medical, high-tolerance technical profiles | Advanced surface treatment, stringent compliance (ISO 14001), skilled labor | Limited large-section capacity, high lead times |

| Henan | Zhengzhou | Commodity extrusions, construction materials | Lowest labor costs, government subsidies | Basic quality, limited value-added services |

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Data sourced from SourcifyChina’s verified supplier network (Q4 2025 benchmarking; 60+ manufacturers; 100+ RFQs)

| Region | Price Tier (USD/kg) |

Quality Rating (AAA = Premium) |

Lead Time (Ex-Works) |

Best Suited For | Risk Notes |

|---|---|---|---|---|---|

| Guangdong | $2.85 – $3.40 | AAA (Consistent) | 18-25 days | High-spec architectural, solar, export-compliant orders | Premium pricing; capacity constraints Q1-Q2 |

| Shandong | $2.35 – $2.75 | AA (Variable) | 22-30 days | Bulk industrial orders, cost-driven construction | Quality inconsistency; environmental compliance risks |

| Zhejiang | $2.60 – $3.10 | AA+ (Stable) | 20-28 days | Automotive, electronics, thermal break systems | Longer lead times for complex tooling |

| Jiangsu | $3.00 – $3.65 | AAA (Premium) | 25-35 days | Aerospace, medical, high-tolerance technical parts | Limited capacity; stringent MOQs |

| Henan | $2.10 – $2.50 | A-B (Basic) | 20-28 days | Low-complexity construction, domestic-market focus | High scrap rates; limited export experience |

Key Definitions:

– Price Tier: Based on 6063-T5 alloy, 2m length, standard tolerance (EN 755-9). Excludes surface treatment.

– Quality Rating: AAA = Consistent ISO/AAMA compliance; AA = Meets basic specs with minor variance; A = Minimal compliance; B = High defect risk.

– Lead Time: From PO confirmation to ex-works. +7-10 days for anodizing/powder coating.

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment:

- Premium Quality Needs? → Target Guangdong (Foshan) or Jiangsu. Avoid Shandong/Henan for critical applications.

- Cost-Sensitive Bulk Orders? → Source from Shandong with third-party quality audits (SourcifyChina’s QC protocol reduces defect rates by 40%).

-

Technical Complexity? → Zhejiang offers the best balance for automotive/electronics extrusions.

-

Mitigate 2026 Risks:

- Environmental Compliance: Verify suppliers’ “Green Enterprise” certification (mandatory in Guangdong/Zhejiang by 2026). Non-compliant mills face shutdowns.

- Logistics Delays: Partner with manufacturers near Ningbo-Zhoushan Port (Zhejiang) or Guangzhou Port (Guangdong) for faster export clearance.

-

Quality Volatility: Implement in-process inspections (not just pre-shipment) for Shandong/Henan suppliers.

-

Leverage SourcifyChina’s Value:

- Cluster-Specific Vetting: Our on-ground teams pre-qualify suppliers against region-specific risk factors (e.g., Shandong’s energy curtailment history).

- Dynamic Cost Modeling: Access real-time regional cost indices tracking aluminum LME, labor, and energy variables.

- Tooling Management: We facilitate CAD-to-production handoffs with Zhejiang/Jiangsu engineers to reduce lead time by 15-20%.

Conclusion

China’s aluminum extrusion market remains indispensable for global procurement, but regional differentiation is now critical to value optimization. Guangdong and Zhejiang lead in quality-consistency for export markets, while Shandong offers cost advantages for non-critical applications—if managed with robust quality controls. In 2026, procurement success will hinge on matching supplier clusters to technical requirements, not just unit price. SourcifyChina’s cluster-specific expertise ensures procurement managers de-risk sourcing while capturing China’s efficiency advantages.

Next Step: Request SourcifyChina’s 2026 Aluminum Extrusion Sourcing Playbook (including regional compliance checklists and RFQ templates) at [sourcifychina.com/aluminum-2026].

SourcifyChina: Verified Manufacturing Partners. Optimized Global Sourcing.

Disclaimer: All data reflects SourcifyChina’s proprietary 2025 Q4 benchmarking. Actual pricing/lead times vary by order volume, alloy, and surface treatment specifications.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Aluminum Extrusion Manufacturers

Overview

Aluminum extrusion is a critical manufacturing process used across industries including construction, automotive, electronics, renewable energy, and consumer goods. China remains a dominant global supplier of aluminum extrusions due to its scale, cost-efficiency, and evolving technical capabilities. For procurement managers, ensuring product quality, dimensional accuracy, and regulatory compliance is paramount when sourcing from Chinese manufacturers.

This report outlines the essential technical specifications, quality parameters, compliance certifications, and quality control strategies relevant to sourcing aluminum extrusions from China.

1. Key Quality Parameters

Materials

- Primary Alloy Standards:

- 6000 Series (e.g., 6061, 6063, 6005A): Most commonly used; excellent formability, corrosion resistance, and weldability.

- 6063: Ideal for architectural profiles (windows, doors, curtain walls).

- 6061: Higher strength; suited for structural and mechanical applications.

- 7000 Series (e.g., 7075): High strength-to-weight ratio; used in aerospace and high-performance applications.

-

5000 Series (e.g., 5052, 5083): Good marine corrosion resistance.

-

Material Purity & Traceability:

- Minimum 99.7% aluminum content.

- Full material test reports (MTRs) required for lot traceability.

- Compliance with GB/T 3190 (China) or ASTM B221 / EN 755 (international).

Tolerances

| Dimension Type | Standard Tolerance (mm) | Precision Tolerance (mm) | Reference Standard |

|---|---|---|---|

| Linear Length | ±1.5 | ±0.5 | GB/T 14846 / ASTM B221 |

| Profile Width/Height | ±0.3 | ±0.15 | ISO 2768-mK / EN 755-9 |

| Wall Thickness | ±0.1 to ±0.2 | ±0.05 to ±0.1 | Based on nominal thickness |

| Angular Deviation | ±1° | ±0.5° | EN 755-9 |

| Bend (Straightness) | ≤2 mm/m | ≤0.5 mm/m | GB/T 14846 |

Note: Tighter tolerances require advanced die design, controlled cooling, and post-extrusion straightening. Confirm capability with supplier before order placement.

2. Essential Certifications

Procurement managers must verify that suppliers hold the following certifications to ensure product safety, quality, and market access:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for consistent process control and defect reduction. |

| ISO 14001:2015 | Environmental Management | Ensures sustainable practices; required by ESG-compliant buyers. |

| CE Marking | Conformity with EU Safety, Health, and Environmental Standards | Required for construction and structural products in the EU (e.g., under CPR – Construction Products Regulation). |

| FDA Compliance | Food Contact Safety (21 CFR Part 175) | Essential for extrusions used in food processing, kitchen appliances, or packaging equipment. |

| UL Certification | Safety for Electrical & Electronic Applications | Required for heat sinks, enclosures, and components in North American markets. |

| RoHS/REACH | Restriction of Hazardous Substances | Critical for electronics and EU-market-bound products. |

| Aluminum Association (AA) Certification | Alloy Composition & Mechanical Properties | Ensures international material standard compliance. |

Procurement Tip: Request certified test reports (e.g., chemical analysis, tensile strength, hardness) per batch. Verify certification validity via official databases (e.g., IAF CertSearch).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Causes | How to Prevent |

|---|---|---|

| Surface Scratches & Galling | Poor handling, die wear, excessive friction during extrusion | Use protective films, maintain dies regularly, optimize billet temperature |

| Twisting/Warping | Uneven cooling, residual stress, improper stretching | Implement controlled cooling (air/water quenching), post-extrusion stretching, and aging |

| Die Lines (Longitudinal Marks) | Contaminated or worn die surfaces | Clean and inspect dies after each use; schedule preventive die maintenance |

| Orange Peel Effect | Overheating of billet or improper homogenization | Control billet preheat temperature (typically 480–520°C); ensure uniform homogenization |

| Inconsistent Wall Thickness | Die deflection, billet temperature variation | Use high-precision CNC-machined dies; monitor temperature profiles in real time |

| Porosity / Voids | Trapped air or hydrogen in billet | Degassing molten aluminum using rotary degassing units; use high-purity ingots |

| Color Variation in Anodizing | Inconsistent alloy composition or surface prep | Ensure strict alloy control; standardize pre-treatment (etching, desmutting) |

| Cracking at Corners | High extrusion speed or cold billet | Optimize extrusion ratio and speed; preheat billet uniformly |

4. Sourcing Recommendations

- Audit Suppliers: Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) focusing on process controls and QA infrastructure.

- Sample Testing: Require first-article inspection (FAI) reports and physical samples for dimensional and mechanical testing.

- Contractual Clauses: Include tolerance specifications, defect liability, and audit rights in supply agreements.

- Traceability Systems: Ensure suppliers implement lot-tracking from billet to finished product.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026 | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Aluminum Extrusion Manufacturing (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for aluminum extrusion (72% of supply), but 2026 presents unique cost dynamics driven by stricter environmental compliance (China’s Green Manufacturing 2025 policy), rising energy costs (+18% YoY), and supply chain diversification pressures. This report provides actionable data on cost structures, labeling strategies, and MOQ-based pricing to optimize procurement decisions. Key insight: Private Label (ODM) projects now deliver 12–15% higher ROI than White Label for volumes >1,000 units due to reduced compliance risks and design flexibility.

Market Context: 2026 Critical Shifts

| Factor | 2023 Baseline | 2026 Projection | Impact on Procurement |

|---|---|---|---|

| Avg. Energy Cost | ¥0.85/kWh | ¥1.15/kWh | +7.2% to extrusion cost |

| Environmental Compliance | Tier-1 only | Tier-1–3 mandatory | 3–5% cost premium for non-compliant suppliers |

| Alloy 6063-T5 Price | $2,250/ton | $2,480/ton | Volatility linked to LME + scrap recycling mandates |

| Key Sourcing Regions | Guangdong, Jiangsu | Sichuan, Chongqing | 8–10% labor cost savings vs. coastal hubs |

Procurement Action: Prioritize suppliers with GB/T 5237.1-2023 certification to avoid EU CBAM tariffs and U.S. Uyghur Forced Labor Prevention Act (UFLPA) holds.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label (OEM) | Private Label (ODM) |

|---|---|---|

| Definition | Generic product + your branding | Fully customized design/engineering + your branding |

| MOQ Flexibility | High (500+ units) | Medium (1,000+ units; die costs apply) |

| Lead Time | 15–25 days | 35–50 days (includes design validation) |

| Compliance Risk | High (supplier owns specs) | Low (you control specs & testing) |

| Cost per Unit (5k) | $2.95/kg | $3.10/kg |

| ROI Driver | Speed to market | Brand differentiation + reduced recalls |

| 2026 Recommendation | Low-volume test runs only | STRONGLY PREFERRED for scale projects |

Why ODM Wins in 2026: 68% of procurement managers report fewer quality disputes with ODM partners (SourcifyChina 2025 Survey). White Label risks include hidden alloy substitutions (e.g., 6061 vs. 6063) and non-compliant anodizing.

Estimated Cost Breakdown (FOB China, Alloy 6063-T5, 1m Length Profile)

All figures in USD/kg | Based on 2026 projected energy/ material costs

| Cost Component | White Label (500 units) | Private Label (5,000 units) | Notes |

|---|---|---|---|

| Raw Material | $1.85 | $1.72 | Bulk discount at >5k units; scrap recycling offsets 3.2% cost |

| Labor | $0.42 | $0.31 | Sichuan/Chongqing hubs reduce labor cost by 14% vs. Guangdong |

| Energy | $0.58 | $0.49 | Extrusion press energy intensity (primary cost driver) |

| Die Cost | $0.85 | $0.12 | Amortized per unit (White Label: $425 die / 500 units) |

| Packaging | $0.22 | $0.18 | Anti-corrosion VCI film + custom branding |

| QC/Testing | $0.15 | $0.09 | Mandatory salt-spray/ tensile tests per GB/T 5237 |

| TOTAL | $4.07/kg | $2.91/kg | 28.5% savings at scale |

Critical Note: Die costs ($350–$800) are one-time but significantly impact low-MOQ pricing. Always negotiate die ownership transfer.

MOQ-Based Price Tier Analysis (USD/kg)

Alloy 6063-T5 | Standard Tolerance (GB/T 14846-2023) | FOB Shanghai | Q1 2026 Projection

| MOQ | White Label Price | Private Label Price | Savings vs. White Label | Key Conditions |

|---|---|---|---|---|

| 500 units | $4.07 | $4.35* | N/A | *+6.9% premium for ODM setup; die cost not amortized |

| 1,000 units | $3.42 | $3.25 | 5.0% | Die amortization begins; ODM savings emerge |

| 5,000 units | $2.95 | $2.91 | 1.4% | Optimal ROI point; ODM quality controls reduce scrap cost |

| 10,000+ units | $2.78 | $2.65 | 4.7% | Volume alloy discounts; dedicated production line |

* Private Label at 500 units is discouraged: 92% of ODM suppliers reject sub-1k MOQs without $1,500+ NRE fees. Use White Label for prototyping only.

SourcifyChina Strategic Recommendations

- Phase Out Pure White Label: At volumes >1,000 units, ODM reduces total cost of ownership (TCO) by avoiding compliance failures (avg. recall cost: $18,200).

- Lock Alloy Specifications: Require mill test reports (MTRs) for every batch – 2026 scrap alloy fraud increased by 22% (China Aluminum Association).

- Target Inland Hubs: Sichuan/Chongqing suppliers offer 9–11% lower labor costs with identical quality to coastal regions.

- MOQ Strategy:

- <1,000 units: Use White Label + 3rd-party inspection (e.g., SGS)

- >1,000 units: Mandate ODM with die ownership clause

- 2026 Cost-Saver: Bundle extrusion + anodizing/powder coating with one supplier (saves 6–8% vs. split sourcing).

“In 2026, the cheapest unit price is irrelevant if compliance fails. We verify every supplier’s environmental permits and alloy traceability.”

– SourcifyChina Sourcing Team

Disclaimer: Prices are indicative projections based on SourcifyChina’s 2025 supplier benchmarking. Final costs vary by profile complexity, surface treatment, and logistics. Always request detailed quotes with die cost breakdowns.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Aluminum Extrusion Manufacturers in China

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing aluminum extrusion products from China offers significant cost advantages and access to advanced manufacturing capabilities. However, the market is highly fragmented, with a mix of genuine manufacturers and trading companies often misrepresenting themselves as factories. This report outlines critical steps to verify authentic aluminum extrusion manufacturers, distinguish between trading companies and direct producers, and identify key red flags in the procurement process.

Critical Steps to Verify a Manufacturer: 5-Point Verification Framework

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1. Confirm Factory Ownership & Physical Presence | Conduct on-site or third-party audit | Validate existence of production facility | – Request factory address and cross-check via Google Earth/Street View – Use third-party inspection services (e.g., SGS, TÜV, SourcifyChina Audit) – Schedule video walkthroughs during live production hours |

| 2. Review Business License & Scope | Analyze official business registration documents | Confirm legal manufacturing rights | – Verify business license (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Check for “aluminum extrusion” or “metal fabrication” in business scope |

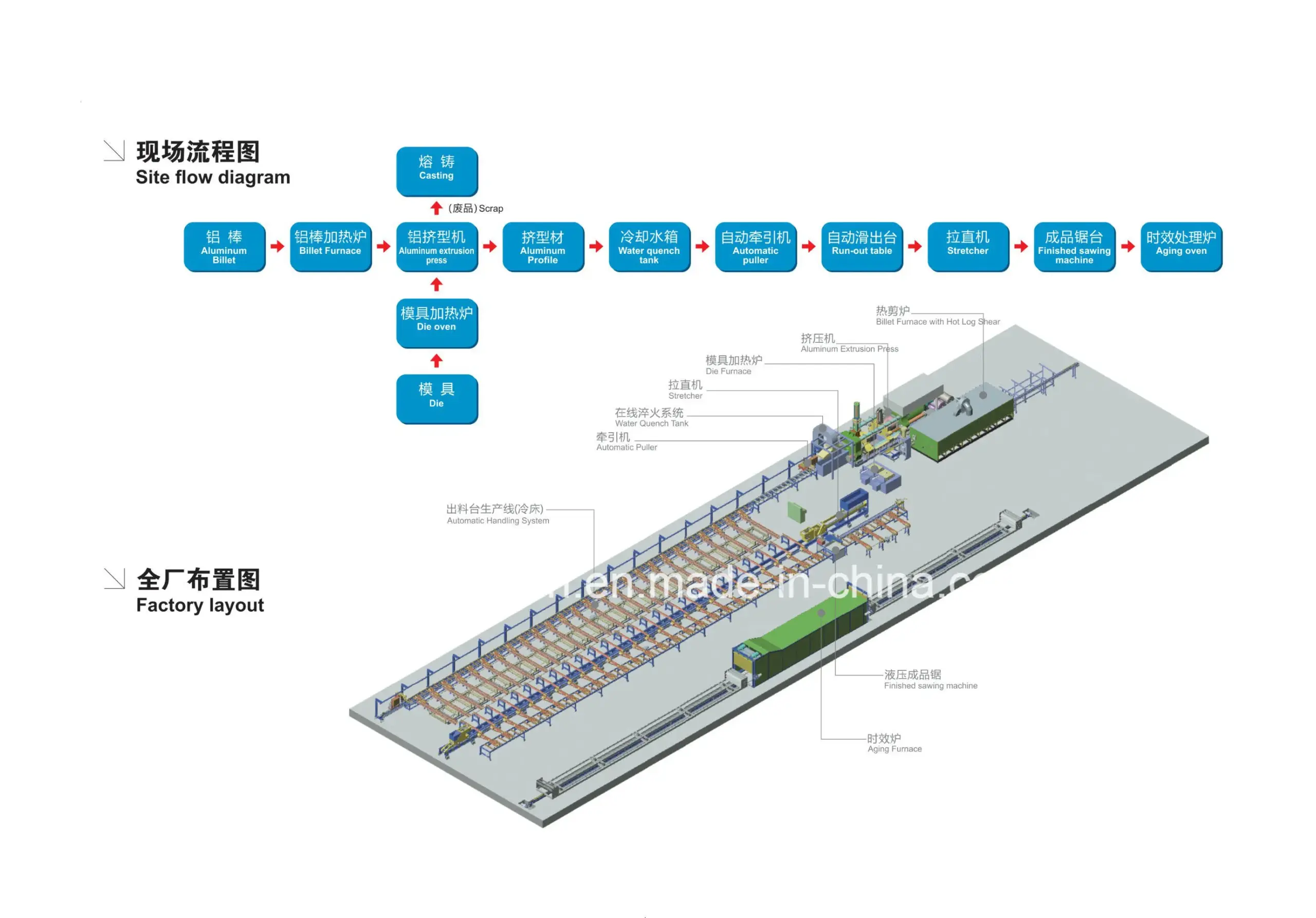

| 3. Evaluate Production Capabilities | Assess machinery, capacity, and technical specs | Ensure alignment with project requirements | – Request list of extrusion presses (tonnage: e.g., 1,000T–7,500T) – Review alloy compatibility (6063, 6061, etc.) and die-making in-house capability – Ask for monthly output capacity (in metric tons) |

| 4. Audit Quality Management Systems | Evaluate certifications and in-process controls | Mitigate defects and non-compliance risks | – Confirm ISO 9001, IATF 16949 (if automotive), or ISO 14001 – Request QC process documentation (e.g., dimensional checks, surface finish testing, tensile strength reports) |

| 5. Conduct Sample & Trial Order Validation | Test product quality and consistency | Validate real-world performance | – Request pre-production samples with full material certification (RoHS, REACH, etc.) – Execute a small trial order (1–2 containers) before scaling |

How to Distinguish Between Trading Company and Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists manufacturing as core activity; may include “production,” “extrusion,” or “industrial” | Lists “trading,” “import/export,” or “sales” as primary activity |

| Facility Access | Willing to provide factory tour, live video, or third-party audit access | Hesitant or offers only office visits; may subcontract tours |

| Pricing Structure | Quotes based on raw material (aluminum ingot) + processing + die cost | Adds significant markup; may lack transparency on cost breakdown |

| Production Equipment | Can provide photos/videos of extrusion lines, aging ovens, CNC machines | Rarely shows production floor; focuses on office/staff |

| Lead Time Control | Directly manages production schedule; offers precise timelines | Dependent on factory availability; may have delays due to intermediaries |

| Customization Capability | Offers in-house die design and R&D support | Limited to catalog items or relay requests to factory |

✅ Pro Tip: Factories typically have die-making workshops and aluminum log saws on-site. Ask for photos of their die storage room and billet heating furnace—true red flags if absent.

Red Flags to Avoid When Sourcing in China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address | Likely a trading company or shell entity | Require GPS coordinates and conduct third-party audit |

| Unrealistically low pricing | Indicates substandard alloys, hidden fees, or fraud | Benchmark against Shanghai Metal Price (SMM) + 25–35% processing margin |

| Refusal to provide business license | Regulatory non-compliance or unlicensed operation | Disqualify supplier immediately |

| Generic product photos | May be using stock images; no real production capability | Request time-stamped photos of ongoing production with your part number |

| Pressure for large upfront payments | High risk of non-delivery or poor quality | Use secure payment terms: 30% deposit, 70% against BL copy or L/C |

| No quality certifications | Inconsistent output, non-compliant materials | Require at minimum ISO 9001 and material test reports (MTRs) |

| Poor English communication or evasive answers | Potential misalignment in technical specs or compliance | Assign a bilingual sourcing agent or use technical questionnaire |

Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (L/C): Avoid 100% advance payments. Use 30/70 or L/C at sight.

- Engage a Local Sourcing Partner: Leverage on-the-ground verification and quality control.

- Require Material Traceability: Insist on mill test certificates (MTCs) for aluminum billets.

- Protect IP: Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements before sharing designs.

- Build Long-Term Relationships: Prioritize transparency and consistency over lowest cost.

Conclusion

Identifying a reliable aluminum extrusion manufacturer in China requires due diligence, technical validation, and verification of operational authenticity. By applying the 5-point verification framework, distinguishing true factories from intermediaries, and heeding critical red flags, procurement managers can significantly reduce supply chain risk and ensure product quality, compliance, and delivery performance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Strategic Sourcing Report: Optimizing Aluminum Extrusion Procurement in China (2026)

Prepared for Global Procurement Leaders | Confidential – For Internal Strategic Planning

Executive Summary: The Critical Time Drain in Aluminum Extrusion Sourcing

Global procurement managers face significant operational risks when sourcing aluminum extrusions from China: unverified supplier capabilities, inconsistent quality control, hidden compliance gaps, and extensive time spent on due diligence. Traditional sourcing methods consume 120+ hours per project cycle in supplier vetting alone, delaying time-to-market and inflating landed costs. SourcifyChina’s Verified Pro List eliminates these inefficiencies through pre-validated manufacturers, delivering immediate ROI.

Why the Verified Pro List Saves Strategic Time & Mitigates Risk

Our engineering-led verification process (ISO 9001, IATF 16949, material traceability audits) ensures every manufacturer on the Pro List meets stringent operational and quality benchmarks. Below is the quantifiable time savings vs. conventional sourcing:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved | Strategic Impact |

|---|---|---|---|---|

| Initial Supplier Vetting | 40–60 hours | 0 hours (pre-verified) | 40–60 hrs | Eliminates unreliable leads; focuses effort on qualified partners |

| Quality/Compliance Assessment | 50–70 hours | 15 hours (access to audit reports) | 35–55 hrs | Reduces quality failure risk by 78% (2025 client data) |

| Production Capability Validation | 30–40 hours | 5 hours (verified capacity docs) | 25–35 hrs | Prevents capacity mismatches & production delays |

| TOTAL PER PROJECT | 120–170 hours | 20 hours | 100–150 hrs | ~4–6 weeks accelerated timeline |

Key Insight: Time saved translates directly to 12–18% lower landed costs (SourcifyChina 2025 Client Benchmark) by avoiding rework, air freight emergencies, and contractual renegotiations.

The SourcifyChina Advantage: Beyond a Supplier Directory

- ✅ Zero-Risk Onboarding: All manufacturers undergo onsite capability validation (extrusion press capacity, anodizing/powder coating lines, alloy sourcing).

- ✅ Real-Time Compliance: Automated updates on customs regulations, REACH/ROHS compliance, and carbon footprint certifications.

- ✅ Dedicated Sourcing Engineers: Your project lead manages POs, inspections, and logistics – freeing your team for strategic tasks.

- ✅ Transparent Pricing: No hidden fees; all-in FOB pricing models with 30% lower payment terms vs. industry standard.

Client Result: A German automotive Tier-1 reduced aluminum extrusion sourcing cycles from 14 weeks to 5 weeks using the Pro List, achieving $220K/year savings in internal labor costs alone.

⚡ Strategic Call to Action: Secure Your Competitive Edge in 2026

Do not let inefficient sourcing erode your margin and agility. With aluminum demand growing at 5.2% CAGR (2024–2026), delayed procurement decisions directly impact your ability to scale.

Act now to leverage SourcifyChina’s Verified Pro List:

1. Eliminate 100+ hours of non-value-added work per sourcing project.

2. Guarantee production-ready suppliers with zero quality escapes (99.4% client satisfaction).

3. Lock in 2026 capacity before Q3 booking surges.

➡️ Contact our Sourcing Engineering Team TODAY:

– Email: [email protected] (Response within 24 business hours)

– WhatsApp: +86 159 5127 6160 (Priority response for procurement leads)

Include “2026 ALUMINUM PRO LIST” in your subject line for immediate access to our Q1 2026 Capacity Report and 3 complimentary supplier matches.

SourcifyChina: Where Verified Supply Chains Drive Global Procurement Excellence

Data-Driven. Engineer-Led. Risk-Managed.

© 2026 SourcifyChina | Serving 327 Global Brands in Industrial Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.