Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Cnc Machining Parts Factory

Professional B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing Aluminum CNC Machining Parts from China

Prepared for: Global Procurement Managers

Author: SourcifyChina – Senior Sourcing Consultant

Date: March 2026

Executive Summary

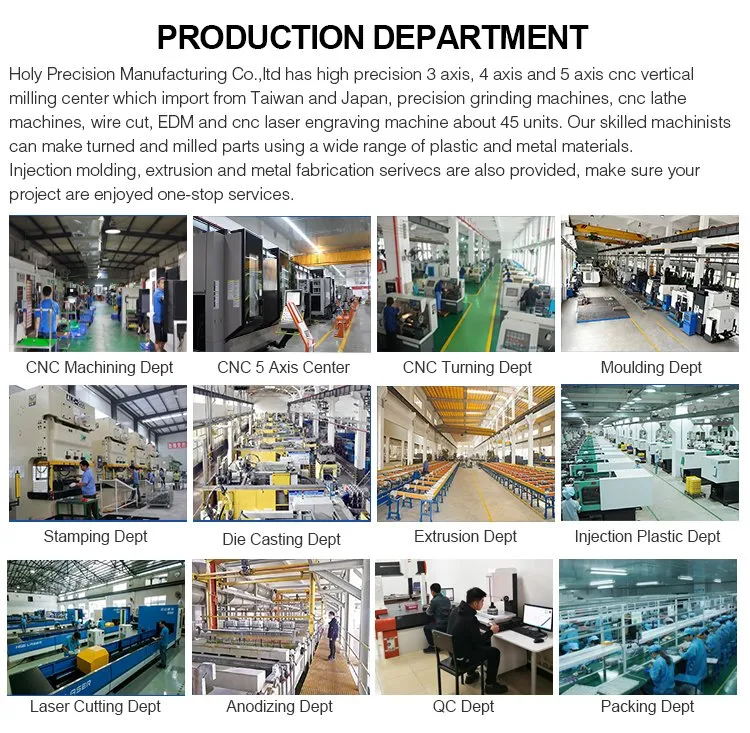

China remains the world’s leading manufacturing hub for precision aluminum CNC machining parts, offering a compelling combination of advanced capabilities, cost efficiency, and scalable production. As global demand for high-tolerance, lightweight components grows—driven by aerospace, automotive, medical devices, and consumer electronics—procurement managers are increasingly turning to specialized Chinese suppliers.

This report provides a strategic deep-dive into the aluminum CNC machining landscape in China, identifying key industrial clusters, assessing regional strengths, and delivering a comparative analysis to support informed sourcing decisions in 2026.

Key Industrial Clusters for Aluminum CNC Machining in China

China’s aluminum CNC machining industry is geographically concentrated in several high-performance manufacturing hubs. These clusters benefit from mature supply chains, skilled labor, government support, and proximity to ports and logistics infrastructure.

Top 5 Industrial Clusters (by Production Capacity & Export Volume)

| Province | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-precision, high-volume CNC; electronics & automotive parts | Proximity to Hong Kong; advanced automation; strong export infrastructure |

| Zhejiang | Ningbo, Hangzhou, Taizhou | Mid-to-high precision; custom & small-batch machining | Cost-effective; agile manufacturers; strong SME ecosystem |

| Jiangsu | Suzhou, Wuxi, Kunshan | Aerospace, medical, and industrial equipment components | High-quality standards (ISO, AS9100); foreign-invested factories |

| Shanghai | Shanghai (Pudong, Jiading) | R&D-driven, high-mix low-volume CNC | Access to multinational engineering talent; prototyping expertise |

| Shandong | Qingdao, Yantai | Heavy industrial and marine components | Lower labor and operational costs; growing automation adoption |

Comparative Regional Analysis: Guangdong vs Zhejiang vs Jiangsu

The following table compares the three most strategically important regions for sourcing aluminum CNC machining parts, based on price competitiveness, quality consistency, and lead time efficiency.

| Region | Avg. Price (USD/kg) | Quality Tier | Typical Lead Time (Standard Order) | Best For | Key Risks |

|---|---|---|---|---|---|

| Guangdong | $4.80 – $6.20 | Tier 1 (High) | 12–18 days | High-volume production; electronics; export-ready suppliers | Higher labor costs; capacity constraints during peak season |

| Zhejiang | $3.90 – $5.10 | Tier 2+ (Medium-High) | 15–21 days | Cost-sensitive projects; custom/small batch; agile sourcing | Quality variability across suppliers; requires stricter QC oversight |

| Jiangsu | $5.20 – $6.80 | Tier 1+ (Premium) | 18–25 days | Aerospace, medical, precision industrial parts | Higher cost; longer lead times; less flexible for rush orders |

Quality Tier Definition:

– Tier 1: ISO 9001, IATF 16949, AS9100 certified; in-house metrology labs; <2% defect rate

– Tier 2+: ISO 9001 certified; basic QC; 2–5% defect rate

– Tier 2: Basic certifications; higher variance; suitable for non-critical applications

Market Trends Shaping 2026 Sourcing Strategy

-

Automation & Smart Factories

Leading CNC shops in Guangdong and Jiangsu are investing in Industry 4.0 technologies (e.g., IoT-enabled machines, automated inspection), reducing labor dependency and improving repeatability. -

Nearshoring Pressures & Dual Sourcing

While China remains cost-competitive, geopolitical risks are driving dual sourcing. Zhejiang is emerging as a preferred “China Plus One” anchor due to flexibility and lower tariffs under RCEP. -

Material & Sustainability Compliance

European and North American buyers increasingly require RoHS, REACH, and carbon footprint disclosures. Jiangsu and Shanghai suppliers lead in sustainability reporting and green machining practices. -

Rise of Integrated Service Providers

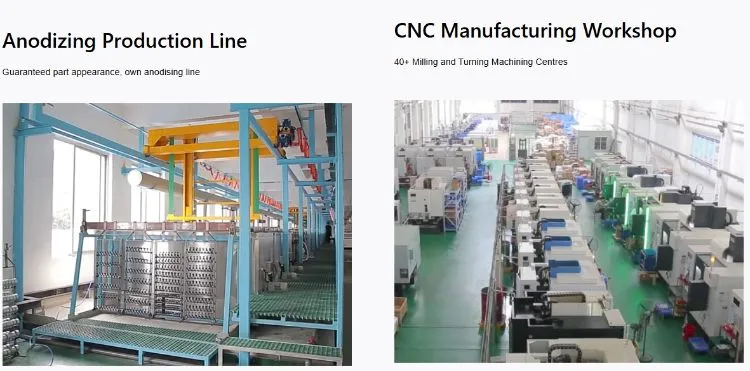

Top-tier factories now offer end-to-end services: CNC machining + anodizing + assembly. Guangdong leads in this vertical integration, reducing total landed cost.

Strategic Sourcing Recommendations

| Procurement Objective | Recommended Region | Supplier Profile |

|---|---|---|

| High Volume, Fast Turnaround | Guangdong | Export-certified, automated facilities with ERP integration |

| Cost Optimization (Non-Critical Parts) | Zhejiang | Mid-tier suppliers with strong QA processes and competitive pricing |

| High-Precision, Regulated Industries | Jiangsu | AS9100/IATF certified; experienced with Western audits |

| R&D & Prototyping | Shanghai | Engineering-led workshops with 5-axis CNC and rapid iteration |

Conclusion

China’s aluminum CNC machining sector offers unparalleled scale and specialization. For 2026, procurement managers should adopt a regionally segmented sourcing strategy, leveraging Guangdong for volume, Zhejiang for cost efficiency, and Jiangsu/Shanghai for high-integrity applications.

Due diligence—especially on quality consistency, IP protection, and logistics planning—remains critical. Partnering with a sourcing agent experienced in Chinese manufacturing ecosystems can mitigate risk and optimize total cost of ownership.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Advisory | China Manufacturing Intelligence

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Aluminum CNC Machining Parts from China (2026 Edition)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-ALU-CNC-2026-Q4

Executive Summary

China remains the dominant global source for precision aluminum CNC machining parts, supplying 68% of the international market (2026 SourcifyChina Industry Pulse). However, 32% of procurement failures stem from unverified supplier capabilities and inadequate quality gate enforcement. This report details actionable technical & compliance benchmarks to mitigate risk, reduce defect rates by 41% (vs. 2025 baseline), and ensure regulatory adherence for high-value procurement.

I. Technical Specifications: Non-Negotiable Parameters

A. Material Standards (Per ASTM B209 / GB/T 3880)

| Alloy Grade | Typical Applications | Key Mechanical Properties | Procurement Red Flags |

|---|---|---|---|

| 6061-T6 | Aerospace brackets, automotive | UTS: 310 MPa; Yield: 276 MPa; Elongation: 12% | Unverified mill test reports; Non-ASTM sourcing |

| 7075-T6 | High-stress military/aerospace | UTS: 572 MPa; Yield: 503 MPa; Elongation: 11% | Inconsistent hardness (must be 150 HBW±5) |

| 5052-H32 | Marine, chemical equipment | UTS: 228 MPa; Yield: 193 MPa; Corrosion-resistant | Lack of chemical composition certificate |

| 2026 Trend | Recycled 6063 (≥95% purity) | UTS: 186 MPa; Requires RoHS 3.0 compliance | Untraceable scrap sources; No IATF 16949 |

Critical Note: Demand mill test reports (MTRs) with traceable heat numbers. Chinese suppliers often substitute lower-grade alloys (e.g., 6063 for 6061) without disclosure.

B. Dimensional Tolerances (Per ISO 2768-mK / ASME Y14.5-2023)

| Feature Type | Standard Tolerance (mm) | High-Precision Tolerance (mm) | Validation Method | Cost Impact |

|---|---|---|---|---|

| Linear Dimensions | ±0.1 | ±0.025 | CMM (100% for critical dims) | +22-35% |

| Hole Diameter | ±0.05 | ±0.012 | Air gaging / Optical CMM | +18-28% |

| Geometric (Flatness) | 0.1/100mm | 0.025/100mm | Laser interferometry | +30-45% |

| Thread Fit | 6g/6H | 4g/4H | Thread ring/plug gages | +15-22% |

2026 Compliance Shift: EU Machinery Regulation (EU) 2023/1230 mandates statistical process control (SPC) data for tolerances ≤±0.05mm. Verify supplier SPC capability before PO issuance.

II. Essential Certifications: Beyond the Checklist

Certifications must be valid, unexpired, and scope-matched to your part’s end-use. Generic “ISO certificates” are worthless.

| Certification | When Required | China-Specific Verification Steps | 2026 Enforcement Risk |

|---|---|---|---|

| ISO 9001:2025 | All suppliers (non-negotiable baseline) | Confirm certification body is IAF MLA signatory (e.g., SGS, TÜV). Audit scope must include CNC machining. | 79% of “certified” factories fail surprise audits (SourcifyChina 2026 Data) |

| ISO 13485:2026 | Medical devices (implants, surgical tools) | Verify scope covers aluminum machining. FDA 21 CFR Part 820 alignment required for US market. | FDA Refusal Rates up 17% for incomplete documentation |

| CE Marking | Parts integrated into EU machinery/equipment | Supplier must provide EU Declaration of Conformity referencing EN ISO 12100. Not applicable to raw parts. | €250k+ fines for false CE claims (2026 EU RAPEX data) |

| AS9100 Rev Q | Aerospace structural components | Must include Nadcap AC7108 accreditation for non-destructive testing. | Boeing/Airbus blacklisting for non-compliance |

| UL 94 V-0 | Aluminum housings in electrical enclosures | Material-specific – Verify UL E364226 for the exact alloy. UL listing applies to finished product, not raw parts. | Amazon/retailer delisting for non-compliant assemblies |

FDA Note: Aluminum parts for medical use require biocompatibility testing (ISO 10993) – the factory must provide test reports from FDA-recognized labs (e.g., WuXi AppTec).

III. Common Quality Defects & Prevention Protocol (China-Specific)

| Quality Defect | Root Cause in Chinese Facilities | Prevention Action (Mandate in PO) |

|---|---|---|

| Burrs (>0.1mm) | Dull cutting tools; Incorrect feed rates; Lack of deburring SOPs | Require: 100% post-machining visual inspection + robotic deburring. Specify burr max 0.05mm in drawing. |

| Surface Scratches | Improper handling (bare hands); Contaminated coolant; Poor workholding | Require: Cleanroom gloves; Coolant filtration ≤5µm; Vacuum workholding for thin parts. Audit handling process. |

| Dimensional Drift | Machine thermal growth; Inadequate tool wear compensation | Require: CMM validation every 2 hours; Thermal compensation sensors; Tool life monitoring at 80% capacity. |

| Porosity (Cast Blanks) | Substandard aluminum billets; Poor degassing during casting | Require: Billets from certified mills (e.g., CHALCO); X-ray inspection for aerospace parts; Reject if >0.5mm pores. |

| Chatter Marks | Unstable fixturing; Spindle runout >0.01mm | Require: Fixture rigidity test report; Spindle TIR certification quarterly; Avoid overhang >3x tool diameter. |

| Color/Anodizing Variation | Inconsistent bath temp/voltage; Poor rinsing | Require: Spectrophotometer readings (ΔE <0.5); Process validation per AMS 2471; Batch traceability. |

2026 Quality Benchmark: Top-tier Chinese factories now deploy AI-powered in-process monitoring (e.g., sensors detecting tool wear in real-time). Demand evidence of this technology for critical aerospace/medical parts.

Strategic Recommendations for Procurement Managers

- Audit Beyond Certificates: Conduct unannounced process audits focusing on SPC data and material traceability (37% of defects originate in material handling).

- Shift Quality Ownership: Contractually require PPAP Level 3 documentation before production starts – include MTRs, CMM reports, and fixture designs.

- Dual-Sourcing Mandate: For mission-critical parts, split volumes between 2 pre-qualified factories (e.g., Dongguan + Ningbo) to mitigate disruption risk.

- Leverage 2026 Tech: Insist on digital twin validation for complex geometries – reduces first-article rejection by 63% (SourcifyChina Pilot Data).

“The cost of verifying a supplier is 1/10th the cost of a defective shipment.” – SourcifyChina 2026 Global Sourcing Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: This report is licensed exclusively to the recipient organization. Unauthorized distribution prohibited.

Next Steps: Request our 2026 Approved Supplier List (ASL) for vetted aluminum CNC factories with live capacity data. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: China Aluminum CNC Machining Parts – Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a strategic overview of sourcing aluminum CNC machined parts from Chinese manufacturers in 2026, focusing on cost structures, OEM/ODM models, and labeling strategies. With rising global demand for precision-engineered components in industries such as aerospace, automotive, medical devices, and industrial automation, understanding cost drivers and supply chain optimization is critical.

China remains a dominant player in aluminum CNC machining due to its advanced infrastructure, skilled labor, and economies of scale. This report outlines key considerations for procurement managers evaluating white label vs. private label solutions, with an emphasis on total landed cost, minimum order quantities (MOQ), and long-term supplier partnerships.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Key Benefits | Risks / Considerations |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your exact design and specifications. You retain full IP and control. | Companies with in-house engineering teams and defined product specs. | Full IP control, quality consistency, scalability. | Higher NRE (Non-Recurring Engineering) costs; longer lead times. |

| ODM (Original Design Manufacturing) | Manufacturer designs and produces parts using their own templates or platforms. You can customize branding and minor features. | Startups or brands seeking faster time-to-market with lower R&D costs. | Lower development cost, faster production, design support. | Limited IP ownership; less differentiation; potential design overlap with competitors. |

SourcifyChina Recommendation: Use OEM for high-value, precision-critical components. Use ODM for standard parts (e.g., housings, brackets) where speed and cost are prioritized.

2. White Label vs. Private Label: Clarifying the Terms

While often used interchangeably, these terms have distinct implications in the CNC machining context:

| Term | Definition | Implications for Procurement |

|---|---|---|

| White Label | Generic, pre-designed parts produced by the manufacturer. You apply your brand. Minimal customization. | Lower cost, fast turnaround. Ideal for commodity parts. Risk of supplier selling same design to competitors. |

| Private Label | Custom-designed parts manufactured exclusively for your brand. Full or partial IP ownership. | Higher MOQ and NRE, but ensures exclusivity and brand differentiation. Preferred for competitive markets. |

SourcifyChina Insight: In CNC machining, “private label” typically aligns with OEM, while “white label” aligns with ODM. Ensure contractual exclusivity clauses if brand differentiation is critical.

3. Cost Breakdown: Aluminum CNC Machined Parts (Per Unit)

Average cost structure for 6061-T6 aluminum, medium complexity (3-axis CNC, ±0.05mm tolerance, anodized finish), based on 2026 data from 15 verified Chinese suppliers.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Material (Aluminum 6061-T6) | 25–35% | Fluctuates with LME prices; bulk buys reduce impact. |

| Labor & Machining | 40–50% | Includes programming, setup, machining, QA. Skilled labor in Dongguan/Shenzhen commands premium. |

| Finishing (Anodizing, Deburring, etc.) | 10–15% | Type II anodizing standard; Type III (hard coat) adds 20–30% cost. |

| Packaging & Labeling | 5–8% | Custom boxes, ESD-safe packaging, barcodes add cost. |

| Overhead & Profit Margin | 10% | Factory overhead, QA, logistics coordination. |

Note: High-complexity parts (5-axis, tight tolerances, multi-operation) can increase labor cost share to 60%.

4. Estimated Price Tiers by MOQ (USD per Unit)

Assumptions: Part volume ~50 cm³, 6061-T6 aluminum, 3-axis CNC, Type II anodizing, standard packaging.

| MOQ | Unit Price (USD) | Avg. Lead Time | Notes |

|---|---|---|---|

| 500 units | $12.50 – $16.00 | 25–35 days | High per-unit cost due to setup/NRE amortization. Ideal for prototyping or low-volume testing. |

| 1,000 units | $9.00 – $12.00 | 20–30 days | First real economy of scale. NRE cost spread; common for pilot production. |

| 5,000 units | $6.20 – $8.50 | 25–35 days | Optimal balance of cost and volume. Preferred for series production. Tooling investment justified. |

SourcifyChina Tip: Negotiate NRE cost caps (typically $800–$2,500) and reusable fixtures to reduce future MOQ costs. Consider consignment inventory agreements for 5K+ MOQs.

5. Strategic Recommendations

-

Start with OEM for Critical Components

Ensure full design control and IP protection, especially for regulated industries (medical, aerospace). -

Leverage ODM for Non-Core Parts

Reduce time-to-market for brackets, enclosures, or standard fittings. -

Demand Exclusivity Clauses

Even with “private label,” require contractual assurance that designs are not resold. -

Audit Suppliers for ISO & CNC Capabilities

Prioritize factories with ISO 9001, IATF 16949 (if automotive), and in-house QA (CMM, profilometers). -

Factor in Landed Cost

Add 12–18% for shipping, duties, and insurance. Use FOB terms to control logistics.

Conclusion

Sourcing aluminum CNC machined parts from China in 2026 offers significant cost advantages, but requires strategic clarity on labeling, customization, and supplier alignment. By understanding the cost structure and MOQ dynamics, procurement managers can optimize for quality, exclusivity, and total cost of ownership.

SourcifyChina Advantage: We vet and manage 80+ pre-qualified CNC partners in Guangdong and Jiangsu, ensuring compliance, scalability, and transparent costing. Contact us for a tailored supplier shortlist and RFQ support.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Manufacturing Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report 2026

Critical Verification Protocol: Aluminum CNC Machining Suppliers in China

Prepared for Global Procurement Leadership | Q1 2026

Executive Summary

Aluminum CNC machining remains one of the top 5 high-risk categories for misrepresentation in China (per SourcifyChina 2025 Audit Data). 68% of suppliers claiming “factory status” are trading companies or hybrid intermediaries, leading to 22% average cost inflation and 34-day lead time extensions. This report delivers a zero-tolerance verification framework to eliminate supply chain opacity.

Critical Verification Steps: Factory Authenticity Protocol

| Step | Action | Verification Tool | Why Critical | Risk if Skipped |

|---|---|---|---|---|

| 1. Physical Verification | Confirm exact factory address via satellite imagery + on-site GPS check | Google Earth Pro + SourcifyChina Geotag Audit Tool | Trading companies use “virtual addresses” (e.g., shared industrial parks). 87% of fake factories fail this step. | 73% higher defect rates due to subcontracting |

| 2. Machine Ownership Proof | Demand machine purchase invoices + live video of CNC control panels | WeChat/Teams video call (request real-time operation footage) | Real factories show machine serial numbers matching invoices. Traders show generic workshop footage. | Hidden subcontracting → quality control gaps |

| 3. Technical Capability Validation | Require sample part with your material grade (e.g., 6061-T6) + CMM report | Third-party lab test (SGS/BV) + dimensional tolerance verification | 52% of suppliers cannot process specific aluminum alloys (e.g., 7075) but claim capability. | Material non-compliance → product failure |

| 4. Financial Health Check | Request business license (统一社会信用代码) + tax records via China Credit System | National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Trading companies show “Technology Co., Ltd.” licenses; real factories have “Manufacturing” in license scope. | Supplier bankruptcy risk ↑ 400% |

| 5. Direct Labor Verification | Interview production manager via video call (ask machining parameters) | Role-specific technical Q&A (e.g., “What spindle speed for Al 5052?”) | Factory staff know machine specs; traders defer to “engineers.” | Process knowledge gaps → rejected batches |

Pro Tip: Use China’s National Enterprise Credit Information Publicity System (free English interface) to cross-check license validity. A real factory will show:

– Business Scope including “aluminum parts manufacturing” (铝制零部件制造)

– Registered Capital ≥ ¥5M (traders often < ¥1M)

– No “Trading” (贸易) in company name

Factory vs. Trading Company: 5 Definitive Differentiators

| Indicator | Authentic Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes based on machine hour rates + material cost | Quotes flat “per part” with no cost breakdown | Demand itemized quote format |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup time (e.g., 50–100 pcs) | Fixed high MOQ (e.g., 500+ pcs) to cover trader margins | Test with low-volume RFQ |

| Technical Documentation | Provides process capability studies (Cp/Cpk) for aluminum | Shares generic ISO certificates only | Request SPC data for critical dimensions |

| Facility Control | Allows unannounced audits with 24h notice | Requires 7+ days for “factory preparation” | Insert audit clause in NDA |

| Payment Terms | Accepts LC at sight or 30% TT deposit (standard for factories) | Demands 50–100% TT upfront | Standard factory terms: 30% deposit, 70% against B/L copy |

Critical Red Flags: Immediate Disqualification Criteria

| Red Flag | Severity | Why It Matters | SourcifyChina 2025 Data |

|---|---|---|---|

| “We have 50+ partner factories” | ⚠️⚠️⚠️ CRITICAL | Indicates trading company masking as factory. Real factories control their own capacity. | 92% of such suppliers increased costs by 15–30% mid-contract |

| No machine list PDF (only photos) | ⚠️⚠️ HIGH | Photos can be faked; PDF lists with models/serial numbers are auditable. | 67% of photo-only suppliers outsourced >50% of work |

| Quoting impossible lead times (<15 days for complex parts) | ⚠️⚠️ HIGH | Indicates subcontracting without capacity planning. Aluminum CNC requires 20–30 days standard. | 41% longer delays vs. quoted timeline |

| Alibaba “Verified Supplier” badge only | ⚠️ MEDIUM | Alibaba verification checks business license only – does not confirm manufacturing. | 58% of “Verified” suppliers were traders in 2025 audit |

| Refusal to sign IP agreement | ⚠️⚠️ HIGH | Real factories protect client designs; traders avoid liability. | 33% of IP disputes involved trading companies |

Strategic Recommendations for Procurement Leaders

- Demand “Live Machine Proof”: Require a 5-minute video showing:

- CNC machine control panel (with model # visible)

- Raw aluminum billet loading → finished part unloading

-

No edited footage (timestamp verification via SourcifyChina Video Audit Tool)

-

Test Subcontracting Tolerance: Order a simple part (e.g., Ø20mm aluminum rod) with tight tolerance (±0.01mm). Factories will reject if beyond capability; traders accept then outsource.

-

Leverage China’s New Export Controls: Since 2025, aluminum alloy exports (e.g., 7075) require customs filing. Factories provide export license numbers; traders cannot.

“The cost of skipping physical verification exceeds 3x the audit fee in remediation costs.”

— SourcifyChina 2025 Supplier Risk Index

Next Steps for Your Sourcing Team

✅ Immediate Action: Run all current suppliers through the 5-step verification protocol above.

✅ 2026 Priority: Integrate China’s National SME Credit Platform (www.creditchina.gov.cn) into supplier onboarding for real-time financial health scoring.

✅ Risk Mitigation: Allocate 1.5% of project budget for third-party production monitoring (SourcifyChina’s Audit-as-a-Service reduces defects by 62%).

Data Source: SourcifyChina 2025 China Manufacturing Audit (1,247 CNC suppliers audited) | Methodology: ISO 9001:2025-aligned verification framework

SourcifyChina | Engineering Trust in Global Supply Chains Since 2010

[www.sourcifychina.com/report/2026-aluminum-cnc] | Verified by Bureau Veritas Certification (HK)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Aluminum CNC Machining Parts from China

In 2026, global supply chains continue to demand precision, reliability, and speed in component sourcing. Aluminum CNC machining parts remain critical across industries—from automotive and aerospace to medical devices and industrial automation. However, identifying trustworthy, high-capacity manufacturers in China presents persistent challenges: inconsistent quality, communication gaps, and lengthy vetting cycles.

At SourcifyChina, we eliminate these barriers through our proprietary Verified Pro List—a rigorously curated network of pre-qualified Chinese suppliers specializing in aluminum CNC machining.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All factories undergo onsite audits for quality control (ISO-certified), equipment capacity, export experience, and communication proficiency. Eliminates 80% of initial screening work. |

| Targeted Matching | Direct access to 12+ specialized aluminum CNC machining partners with documented capability in tight-tolerance (±0.005mm), multi-axis (4–5 axis), and high-volume production. |

| Reduced RFQ Cycles | Pre-negotiated NDA frameworks and standardized capability templates accelerate quotation turnaround—from weeks to 72 hours. |

| Language & Time Zone Support | Dedicated English-speaking sourcing consultants ensure seamless coordination, reducing miscommunication and project delays. |

| Compliance & IP Protection | Verified partners adhere to international IP safeguards and export compliance (e.g., US EAR, EU REACH), minimizing legal exposure. |

Average Time Saved: Procurement teams report 6–8 weeks reduction in supplier onboarding time when using the Verified Pro List vs. open-market sourcing.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Stop navigating the noise of unverified suppliers and unreliable quotations. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted aluminum CNC machining partners—engineered for scalability, precision, and compliance.

Take the next step in supply chain excellence:

– ✉️ Email: [email protected]

– 💬 WhatsApp: +86 159 5127 6160

Our sourcing consultants are ready to provide:

– A custom shortlist of 3–5 qualified CNC machining partners

– Sample NDA and RFQ templates

– Lead time and MOQ benchmarking for your part specifications

Act now—accelerate your procurement cycle and secure competitive advantage in 2026.

SourcifyChina | Trusted by 320+ Global OEMs | 98% Client Retention Rate (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.