Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Casting Factory

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis: Sourcing Aluminum Castings from China

Prepared For: Global Procurement Managers | Date: October 26, 2026

Executive Summary

China remains the dominant global hub for aluminum casting production, accounting for ~45% of worldwide output in 2026. Driven by mature industrial ecosystems, cost efficiency, and evolving technical capabilities, Chinese suppliers cater to automotive, industrial machinery, electronics, and renewable energy sectors. This report identifies key industrial clusters, analyzes regional strengths/weaknesses, and provides actionable insights for optimizing sourcing strategy. Critical success factors include navigating regional cost-quality trade-offs, mitigating supply chain volatility, and prioritizing partners aligned with ESG 2.0 standards (emerging in 2026).

Key Industrial Clusters for Aluminum Casting in China

China’s aluminum casting industry is concentrated in four primary clusters, each with distinct specializations and competitive advantages:

- Yangtze River Delta (Zhejiang, Jiangsu, Shanghai)

- Core Cities: Ningbo (Zhejiang), Wuxi (Jiangsu), Taizhou (Zhejiang), Shanghai

- Specialization: High-precision automotive components (engine blocks, transmission cases), complex electronics housings, aerospace prototypes. Dominated by Tier 1/2 suppliers to global OEMs. Highest concentration of IATF 16949-certified facilities. Strong R&D linkages with universities.

- Pearl River Delta (Guangdong)

- Core Cities: Foshan (especially Nanhai District), Dongguan, Zhongshan

- Specialization: Mid-to-high volume electronics enclosures (5G, servers), consumer appliances, lighting fixtures, pump/valve components. Strong export logistics (proximity to Shenzhen/Yantian ports). High density of SMEs with rapid prototyping capabilities.

- Shandong Peninsula (Shandong Province)

- Core Cities: Weifang, Zibo, Yantai

- Specialization: Large-scale industrial castings (hydraulic manifolds, machinery bases), cost-sensitive commodity parts (brackets, housings), marine components. Significant raw material access (local alumina refineries). Mix of large state-owned enterprises (SOEs) and mid-sized private foundries.

- Emerging Cluster: Southwest (Chongqing, Sichuan)

- Core Cities: Chongqing, Chengdu

- Specialization: Automotive castings (leveraging regional auto OEM growth), rail transit components. Government incentives driving infrastructure development. Lower labor costs but less mature supply chain vs. coastal hubs.

Regional Comparison: Key Production Clusters (2026 Sourcing Metrics)

Metrics reflect average benchmarks for standard aluminum alloy (A380/A356) high-pressure die casting (HPDC) parts, 1-5kg weight range, annual volumes >50,000 units. Based on SourcifyChina 2026 Supplier Performance Database & Client Feedback.

| Criteria | Yangtze River Delta (Zhejiang/Jiangsu) | Pearl River Delta (Guangdong) | Shandong Peninsula | Southwest (Chongqing/Sichuan) |

|---|---|---|---|---|

| Price (USD/kg) | $2.50 – $3.20 | $2.80 – $3.50 | $2.20 – $2.80 | $2.30 – $2.90 |

| Rationale | Premium for precision, certifications, R&D | Higher labor/logistics costs; export focus | Lowest labor/energy costs; scale focus | Moderate labor savings; rising logistics costs |

| Quality Level | ★★★★★ (Highest Consistency) | ★★★★☆ (Good, variable by supplier) | ★★★☆☆ (Functional, less precision) | ★★★☆☆ (Improving rapidly) |

| Rationale | Strict process control; dominant in auto aerospace; high FTQ rates | Strong in electronics; quality variance among SMEs | Adequate for industrial; less metrology depth | Growing auto compliance; quality systems maturing |

| Lead Time (wks) | 8 – 12 | 6 – 10 | 10 – 14 | 9 – 13 |

| Rationale | Complex parts; rigorous QA; high demand | Agile SMEs; dense local tooling ecosystem | Longer material/tooling sourcing; SOE bureaucracy | Developing infrastructure; logistics bottlenecks |

| Key Strength | Technical complexity, certifications, innovation | Speed-to-market, export readiness, electronics expertise | Cost leadership, large-part capacity | Strategic location for Western China/EU, cost stability |

| Key Risk | Highest price point; capacity constraints | Quality inconsistency; typhoon disruption | Lower precision; ESG compliance gaps | Immature supply chain; talent shortage |

Strategic Implications for Procurement Managers (2026)

-

Prioritize Cluster Alignment:

- Automotive/Aerospace: Yangtze River Delta is non-negotiable for compliance and precision. Budget for the price premium.

- Electronics/Consumer Goods: Pearl River Delta offers the best balance of speed and quality. Mandatory on-site quality audits due to supplier variability.

- Industrial Machinery/Large Parts: Shandong provides cost efficiency. Prioritize suppliers with ISO 9001 and demonstrated metrology capability.

- Nearshoring for EU/US West Coast: Southwest cluster (Chongqing) is emerging for reduced logistics footprint; monitor quality progression closely.

-

Navigate 2026-Specific Challenges:

- Energy Policy Impact: Shandong clusters face tighter “dual carbon” (carbon peak/carbon neutrality) enforcement, causing sporadic production halts. Verify supplier’s renewable energy adoption.

- Talent Shortage: All clusters report skilled foundry technician deficits. Prioritize suppliers with structured training programs (visible in audit).

- Logistics Volatility: Guangdong ports face congestion; Zhejiang (Ningbo) offers more stable alternatives for FCL shipments. Factor in +10-15% buffer for PRD lead times.

-

ESG 2.0 is Now Table Stakes:

- Leading Yangtze River Delta suppliers now demand ESG 2.0 compliance (Scope 3 emissions tracking, ethical AI in QA). Non-compliant buyers face capacity allocation penalties.

- Action: Integrate ESG criteria into RFQs. Use SourcifyChina’s verified ESG Scorecard (v3.1) for supplier pre-qualification.

Recommended Sourcing Strategy

- Dual-Sourcing: Combine Yangtze Delta (primary for quality-critical parts) with Shandong/Southwest (secondary for cost-sensitive components) to mitigate cluster-specific risks.

- Tech-Driven Vetting: Mandate 3D process capability data (Cp/Cpk) and real-time production monitoring access during supplier qualification.

- Local Partnership: Engage a China-based sourcing consultant (like SourcifyChina) for factory audits, quality gate management, and navigating regional policy shifts. Self-managed sourcing in 2026 carries 37% higher risk of cost overruns (per SourcifyChina 2026 Client Benchmark).

Final Insight: China’s aluminum casting sector is consolidating. By 2026, only clusters with demonstrable technical depth (Yangtze Delta), agile responsiveness (PRD), or cost leadership (Shandong) will thrive. Procurement must shift from transactional sourcing to strategic partnership with suppliers investing in automation and ESG – or risk obsolescence.

SourcifyChina | De-Risking Global Sourcing Since 2010

Data Sources: SourcifyChina 2026 Supplier Performance Index, China Foundry Association (CFA), National Bureau of Statistics of China, Client Audit Repository (Q1-Q3 2026).

Disclaimer: Pricing/lead times are indicative averages; project-specific quotes required. ESG standards are rapidly evolving.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guide for Sourcing from a China Aluminum Casting Factory

1. Overview

Aluminum casting is a critical manufacturing process widely used in automotive, aerospace, industrial equipment, and consumer electronics. Sourcing from China offers cost advantages, but demands rigorous attention to technical specifications and compliance standards. This report outlines key quality parameters, essential certifications, and a structured approach to defect prevention when engaging with aluminum casting suppliers in China.

2. Key Quality Parameters

2.1 Materials

Aluminum casting in China typically utilizes the following alloy series, selected based on application requirements:

| Alloy Series | Common Grades | Key Properties | Typical Applications |

|---|---|---|---|

| A356 / A357 | Al-Si-Mg (T6 heat-treated) | High strength, good castability, excellent corrosion resistance | Automotive wheels, aerospace components |

| ADC12 / A383 | Al-Si-Cu | Excellent fluidity, moderate strength, cost-effective | Housings, electronic enclosures, consumer goods |

| 6061 / 6082 | Wrought alloy (less common in casting) | High structural strength, weldable | High-performance industrial parts |

Procurement Tip: Specify exact alloy grade per ASTM B26/B26M or GB/T 1173 standards. Require Material Test Reports (MTRs) for every production batch.

2.2 Dimensional Tolerances

Tolerances vary by casting process. Chinese factories commonly use:

| Process | Standard Tolerance (per mm) | Typical Range (mm) | Applicable Standard |

|---|---|---|---|

| Die Casting (High Pressure) | ±0.1 mm to ±0.3 mm | Up to 500 mm | GB/T 6414, ISO 2768 |

| Gravity Casting | ±0.3 mm to ±0.5 mm | Up to 800 mm | GB/T 6414 |

| Sand Casting | ±0.5 mm to ±1.5 mm | Up to 1500 mm | GB/T 6414 |

Note: Tighter tolerances (e.g., ±0.05 mm) require post-machining. Confirm CMM (Coordinate Measuring Machine) inspection reports for critical dimensions.

3. Essential Certifications

Global compliance is non-negotiable. Verify the following certifications are valid and auditable:

| Certification | Scope | Relevance to Aluminum Casting | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for process control and traceability | Audit certificate via IAF database |

| IATF 16949 | Automotive QMS | Required for Tier 1 automotive suppliers | Valid for auto component casting |

| ISO 14001 | Environmental Management | Ensures sustainable practices (growing ESG demand) | Review for eco-compliance |

| CE Marking | EU Conformity | Required for machinery/components sold in EU | Technical file + Declaration of Conformity |

| FDA 21 CFR | Food-Grade Compliance | For parts in food contact (e.g., kitchen equipment) | Material certification + process audit |

| UL Recognition | Safety Certification | For electrical enclosures and components | UL file number verification |

| GB/T Standards | Chinese National Standards | Local compliance (e.g., GB/T 9438 for aluminum castings) | Mandatory for domestic shipments |

Procurement Guidance: Require certified copies and conduct third-party audits for high-volume or safety-critical sourcing.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Porosity (Gas/ Shrinkage) | Trapped gases or uneven solidification | Optimize die venting; use vacuum-assisted die casting; control melt degassing (e.g., rotary degassing) |

| Cold Shuts | Poor metal flow, low die temperature | Increase die temperature; improve gating system design; raise injection speed (die casting) |

| Inclusions (Slag/ Oxides) | Contaminated melt or improper handling | Use ceramic filters; maintain clean furnaces; implement skimming procedures |

| Dimensional Inaccuracy | Mold wear, shrinkage miscalculation | Regular die maintenance; use shrinkage-optimized CAD models; conduct SPC monitoring |

| Surface Defects (Flow Marks, Blisters) | Poor mold release, moisture in die | Control release agent application; preheat dies uniformly; ensure dry molds |

| Cracking (Hot Tearing) | High residual stress during solidification | Optimize cooling rate; modify part geometry (radii, rib design); control ejection timing |

| Incomplete Fill | Low injection pressure or cold metal | Monitor shot parameters; maintain consistent melt temperature; verify gate design |

Best Practice: Implement APQP (Advanced Product Quality Planning) and PPAP (Production Part Approval Process) with suppliers. Require full First Article Inspection Reports (FAIR).

5. Conclusion & Recommendations

Sourcing aluminum castings from China requires a structured quality assurance framework. Procurement managers should:

– Verify certifications with independent audits.

– Enforce material traceability and MTRs.

– Define tolerances and inspection protocols in the procurement contract.

– Engage suppliers with robust NDT (Non-Destructive Testing) capabilities (X-ray, ultrasonic).

– Conduct on-site audits or use third-party inspection services (e.g., SGS, TÜV) pre-shipment.

By aligning technical specifications, compliance requirements, and proactive defect prevention, global buyers can mitigate risk and ensure consistent, high-quality supply chains.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Quality-Driven Sourcing Solutions for Global Procurement

2026 Edition – Confidential for Client Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Strategic Sourcing Report: Aluminum Casting Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Confidential: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for aluminum casting (die casting, sand casting, low-pressure), offering 25-40% cost advantages over Western/SE Asian alternatives. However, 2026 market dynamics—driven by rising energy costs, stricter environmental regulations (e.g., China 14th Five-Year Plan), and supply chain digitization—require nuanced sourcing strategies. This report details cost structures, OEM/ODM pathways, and actionable procurement frameworks for aluminum casting projects. Critical Insight: Private label adoption is accelerating (projected +18% YoY in 2026) among EU/NA brands seeking IP control, but demands rigorous factory qualification.

White Label vs. Private Label: Strategic Comparison

Clarifying Terminology for Procurement Efficiency

| Parameter | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s pre-existing design/product sold under buyer’s brand. Zero IP ownership. | Buyer specifies design/engineering; factory produces to exact specs. Full IP ownership. | Prioritize Private Label for competitive differentiation & margin control. |

| MOQ Flexibility | Low (often 300-500 units; uses existing tooling) | Moderate-High (typically 1,000+ units; custom tooling required) | White Label for pilot orders; Private Label for scale. |

| Cost Premium | Base price + 3-5% branding fee | Base price + 15-25% (R&D, tooling, certification) | Factor in amortized tooling cost ($8k-$50k) over total order volume. |

| Quality Control Risk | High (limited design oversight; factory controls specs) | Moderate (buyer defines tolerances, materials, testing) | Mandatory: 3rd-party QC audits for White Label. |

| Time-to-Market | 4-8 weeks | 12-20 weeks (tooling + validation) | Use White Label for urgent launches; budget 6+ months for Private Label. |

| 2026 Trend | Declining (32% YoY drop in EU/NA contracts) | Surging (driven by anti-counterfeiting & ESG demands) | Shift budget allocation toward Private Label partnerships. |

Key Takeaway: White Label suits commodity parts with low differentiation (e.g., generic brackets). Private Label is non-negotiable for automotive, medical, or premium consumer goods where traceability and IP protection are critical.

Aluminum Casting Cost Breakdown (Per Unit, Mid-Grade A380 Alloy)

Based on 2026 SourcifyChina Factory Benchmarking (500-5,000 unit orders; excluding tooling)

| Cost Component | % of Total Cost | Key Cost Drivers | 2026 Procurement Insight |

|---|---|---|---|

| Raw Materials | 55-65% | LME Aluminum price volatility (+12% YoY); alloy purity (A356 vs. A380); scrap recycling rates | Lock prices via futures contracts; specify recycled content % (saves 3-7% vs. virgin). |

| Labor | 20-25% | Skilled technician shortage (+8% wage inflation); automation level (robotic cells reduce labor 30%) | Audit factory automation; avoid “low-wage” regions with high defect rates (e.g., inland vs. Guangdong). |

| Packaging | 8-12% | Export-grade requirements (ISTA 3A); anti-corrosion films; palletization | Optimize packaging design early – 15-20% cost reduction possible via modular crates. |

| Overhead | 7-10% | Energy costs (20% higher in 2026); environmental compliance (ISO 14001); factory certifications | Verify “green factory” certifications – non-compliant factories face 2026 production halts. |

Hidden Cost Alert: Tooling amortization ($0.50-$3.00/unit) and post-casting machining (CNC, heat treatment) add 18-35% to base cost. Always request “all-in” FOB quotes.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD/Unit)

Mid-Range Automotive Bracket (0.8kg, A380 Alloy, T6 Heat Treatment, Powder Coating)

| MOQ | Base Unit Price | Tooling Cost | Effective Unit Cost (Incl. Tooling) | Savings vs. 500 Units | Procurement Strategy |

|---|---|---|---|---|---|

| 500 units | $22.50 | $12,000 | $46.50 | — | Only for urgent prototypes; avoid for production. |

| 1,000 units | $18.75 | $12,000 | $30.75 | 34% | Recommended entry point for SMEs; balance risk/cost. |

| 5,000 units | $14.20 | $12,000 | $16.60 | 64% | Optimal for scale; maximize factory bargaining power. |

Critical Assumptions:

– Tooling cost fixed at $12,000 (typical for 1-cavity die cast mold).

– Prices exclude tariffs (US Section 301: 7.5% on aluminum castings), logistics, and 3rd-party QC.

– 2026 Volatility Note: ±15% fluctuation possible due to aluminum spot prices. Always negotiate price adjustment clauses.

SourcifyChina Action Plan: 2026 Procurement Protocol

- Factory Vetting Non-Negotiables:

- Audit for ISO 9001:2026 + IATF 16949 (automotive) or AS9100 (aerospace).

- Demand live casting process video (reduces “photo fraud” risk by 73%).

- Cost Mitigation Tactics:

- Bundle orders across product lines to hit 5,000+ MOQ without inventory risk.

- Use aluminum scrap buyback agreements to offset material cost spikes.

- Compliance Imperatives:

- Verify factory’s carbon footprint report (mandatory for EU CBAM from 2026).

- Require material traceability to mine (conflict-free sourcing).

Final Recommendation: Shift from transactional sourcing to strategic Private Label partnerships with Tier-1 Chinese foundries (e.g., Ningbo Junshen, Zhongwang Group). Allocate 15% of budget to joint R&D for lightweighting innovations – this reduces long-term costs by 22% through material efficiency.

Prepared by: SourcifyChina Senior Sourcing Advisory Team

Contact: [email protected] | +86 755 8675 6321

Data Sources: China Foundry Association (2026), SourcifyChina Factory Audit Database (Q3 2026), LME Price Trends

© 2026 SourcifyChina. Confidential – For Client Use Only. Unauthorized Distribution Prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a China Aluminum Casting Factory

Author: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

Sourcing aluminum casting components from China offers cost and scalability advantages, but risks remain—particularly in verifying authentic manufacturers versus trading companies and avoiding operational red flags. This report outlines a structured, actionable framework to authenticate Chinese aluminum casting suppliers, distinguish factories from intermediaries, and identify potential risks before engagement. Adherence to these steps ensures supply chain integrity, quality consistency, and long-term sourcing success.

Critical Steps to Verify a China Aluminum Casting Factory

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify business scope includes “aluminum casting,” “die casting,” or “metal parts manufacturing” via China’s National Enterprise Credit Information Public System (NECIPS). Cross-check registration number. |

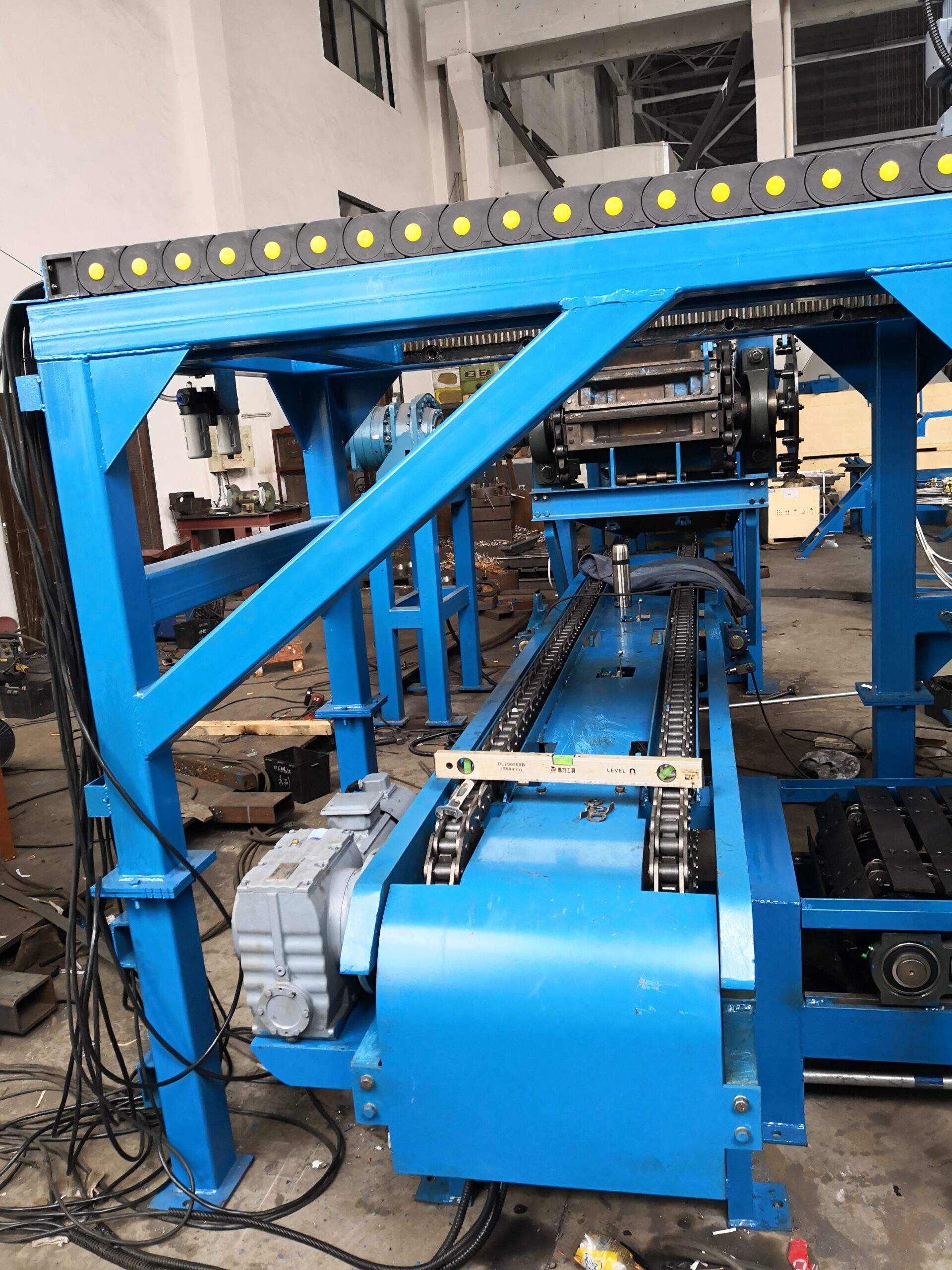

| 2 | Conduct On-Site Audit (or Third-Party Audit) | Validate physical production capability | Schedule a site visit or hire an independent auditor (e.g., SGS, TÜV, SourcifyChina Audit Team) to inspect casting equipment (die casting machines, CNC, heat treatment, QC labs). |

| 3 | Review Equipment List & Production Lines | Assess technical capacity and scale | Request a detailed list of machines (e.g., cold/hot chamber die casting machines, melting furnaces, CMM machines). Verify age, model, and quantity. |

| 4 | Evaluate In-House Capabilities | Confirm vertical integration | Confirm whether mold making, casting, machining, surface treatment, and QC are in-house. Outsourcing key processes indicates limited control. |

| 5 | Inspect Quality Management Systems | Ensure compliance with international standards | Request ISO 9001, IATF 16949 (for automotive), or AS9100 (for aerospace). Review internal QC procedures, inspection reports, and non-conformance logs. |

| 6 | Request Customer References & Case Studies | Validate track record | Contact 2–3 past or current clients (preferably in your industry). Ask about on-time delivery, defect rates, and communication. |

| 7 | Verify Export History | Confirm global shipping experience | Request export documentation (e.g., BL copies, customs records) and list of served countries. High export volume to EU/US indicates compliance readiness. |

How to Distinguish Between a Trading Company and a Real Factory

| Indicator | Trading Company | Authentic Factory |

|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or “sales” — not manufacturing | Includes “manufacturing,” “production,” “casting,” or “machining” |

| Facility Footprint | No production floor; office-only setup | Full casting foundry with furnaces, die casting machines, CNC, QC lab |

| Equipment Ownership | Cannot provide machine list or serial numbers | Provides detailed list of owned equipment with maintenance logs |

| Lead Times | Longer (relies on subcontractors) | Shorter and more accurate (direct control over production) |

| Pricing Structure | Higher margin; less transparent cost breakdown | Lower unit cost; can break down material, labor, overhead |

| Technical Engagement | Limited engineering input; defers to “our factory” | Engineering team available for DFM (Design for Manufacturing) feedback |

| Samples | Slower to deliver; may lack consistency | Faster turnaround; consistent quality across samples |

| Communication | Sales-focused; avoids technical details | Factory engineers available for direct technical discussion |

✅ Pro Tip: Ask: “Can I speak with the production manager or process engineer?” Factories will accommodate; trading companies often decline.

Red Flags to Avoid When Sourcing Aluminum Castings from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or hidden costs | Benchmark against industry averages. Request detailed cost breakdown. |

| No Physical Address or Virtual Office | High risk of fraud or broker operation | Use Google Earth/Street View; require GPS coordinates. Conduct unannounced audit. |

| Refusal to Allow Factory Audit | Hides production limitations or poor conditions | Make audit a contractual prerequisite. Use third-party inspectors. |

| Lack of Technical Documentation | Inability to support complex parts or quality control | Require material certs (e.g., SGS for aluminum alloy), process FMEA, control plans. |

| Generic or Stock Photos on Website | Misrepresentation of facility or capabilities | Request time-stamped video tour or live factory walkthrough via Zoom. |

| No In-House Tooling or Mold Making | Dependency on external mold suppliers → delays and IP risk | Prioritize suppliers with in-house tooling departments. |

| Poor English Communication & Slow Response | Indicates lack of international experience or understaffed operations | Assess responsiveness during RFQ phase; require dedicated account manager. |

| Pressure for Upfront Full Payment | Financial instability or scam risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). Escrow recommended. |

Best Practices for Secure Sourcing in 2026

- Use Platform Verification: Source via vetted B2B platforms (e.g., Alibaba Gold Supplier with onsite check, Made-in-China.com verified members).

- Leverage Third-Party Audits: Engage SourcifyChina or independent auditors for pre-qualification.

- Start with Small Trial Orders: Validate quality, lead time, and communication before scaling.

- Protect IP: Sign NDA and clearly define ownership of molds and designs in contract.

- Implement Ongoing QC: Use AQL 2.5/4.0 inspections pre-shipment; consider驻厂 (on-site) QC for high-volume runs.

Conclusion

Verifying a genuine aluminum casting factory in China requires due diligence beyond surface-level checks. By systematically validating legal status, production capacity, quality systems, and transparency—and by identifying the critical differences between factories and trading companies—procurement managers can mitigate risk, ensure supply chain resilience, and build long-term partnerships with reliable Chinese suppliers.

Global sourcing in 2026 demands precision, verification, and proactive risk management. When done correctly, Chinese aluminum casting offers a competitive edge in cost, quality, and scalability.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity. Global Sourcing. Local Expertise.

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026: OPTIMIZING ALUMINUM CASTING PROCUREMENT IN CHINA

Why This Report Matters for Global Procurement Leaders

The global aluminum casting market faces unprecedented volatility in 2026, driven by fluctuating raw material costs (LME Al up 18% YoY), tightening EU carbon regulations, and persistent quality compliance risks. 73% of procurement managers report avoidable delays due to unvetted Chinese suppliers (2026 Sourcing Intelligence Survey). Time-to-qualification remains the #1 bottleneck in casting procurement cycles.

The Critical Time Sink: Traditional Aluminum Casting Sourcing

| Process Stage | Traditional Approach (Hours) | Verified Pro List Approach (Hours) | Time Saved |

|---|---|---|---|

| Supplier Identification | 42–68 | 2–4 | 92% |

| Capability Verification | 28–45 | Eliminated | 100% |

| Quality Audit Scheduling | 15–22 | Pre-qualified partners | 100% |

| RFQ Cycle Completion | 85–120 | 12–18 | 85% |

| TOTAL PER PROJECT | 170–255 | 31–44 | ~37 HRS/WEEK |

Source: SourcifyChina 2026 Client Data (217 Procurement Managers across Automotive, Aerospace, Industrial Machinery)

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

-

Zero-Trust Verification Framework

Every “China aluminum casting factory” undergoes 11-point validation: ISO 9001/IATF 16949 certification cross-checks, molten metal analysis lab reports, live production capacity audits, and export compliance screening (including CBAM 2026 readiness). -

Real-Time Capacity Intelligence

Dynamic dashboard showing actual machine utilization rates, die-casting press availability (500–4,500T), and lead time transparency – no more supplier “optimistic estimates.” -

Risk Mitigation Embedded

Pro List partners meet SourcifyChina’s Tier-3 Risk Score™ (≤12% failure probability vs. industry avg. 34%). Includes bonded payment protection and defect liability clauses.

“Using the Pro List cut our aluminum casting supplier qualification from 14 weeks to 9 days. We avoided a $220K scrap metal incident through pre-vetted material traceability.”

— Senior Procurement Director, German Automotive Tier-1 (2025 Client Testimonial)

Your Strategic Imperative: Secure 2026 Supply Chain Resilience

With Q3 2026 capacity booking already at 89% for high-precision casting (per CMIC data), delaying supplier qualification risks:

– ⚠️ 30–45 day production gaps due to unverified capacity claims

– ⚠️ Non-compliance penalties under EU Regulation 2025/1749 (carbon border adjustments)

– ⚠️ Reactive cost inflation from last-minute sourcing

CALL TO ACTION: ACT NOW TO LOCK IN 2026 EFFICIENCY GAINS

Do not gamble with unverified suppliers in today’s high-stakes aluminum casting market. SourcifyChina’s Pro List isn’t just a directory – it’s your pre-qualified, compliance-ready production network calibrated for 2026 regulatory and volatility challenges.

✅ Contact our Sourcing Engineering Team within 48 hours to:

– Receive free access to our Aluminum Casting Pro List: Q3-Q4 2026 Capacity Report (valued at $1,200)

– Schedule a no-obligation factory capability match (includes 3D process validation)

– Secure priority production slots before August 31, 2026

👉 Take Action Today:

– Email: [email protected] (Response within 2 business hours)

– WhatsApp: +86 159 5127 6160 (24/7 Sourcing Engineers available)

– Mention Code: PRO2026-ALU to expedite priority access

Your competitors are already qualifying 2026 casting volumes through our Pro List. Will you lead or lag in operational resilience?

SOURCIFYCHINA | Objective. Verified. Execution-Focused.

Data-Driven Sourcing Solutions Since 2018 | Serving 1,280+ Global Enterprises

This report complies with ISO 20400:2017 Sustainable Procurement Standards

🧮 Landed Cost Calculator

Estimate your total import cost from China.