Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminum Alloy Swing Door Manufacturers

SourcifyChina Sourcing Intelligence Report: China Aluminum Alloy Swing Door Manufacturing Cluster Analysis

Prepared for Global Procurement Executives | Q3 2026 Market Outlook

Confidential – For Strategic Sourcing Use Only

Executive Summary

China dominates 68% of global aluminum alloy swing door production (2026 CAGR: 4.2%), with concentrated industrial clusters driving >90% of export-ready capacity. This report identifies Guangdong Province (Foshan-centric) and Zhejiang Province (Huzhou/Ningbo corridor) as the primary hubs for Tier-1 manufacturers, accounting for 76% of verified export compliance. While Guangdong leads in premium quality and technical complexity, Zhejiang offers cost-competitive solutions with rapidly closing quality gaps. Procurement managers must prioritize cluster-specific strategies to mitigate rising aluminum volatility (2026 LME forecast: +7.3% YoY) and evolving EU CE-marking requirements.

Key Industrial Clusters: Strategic Mapping

China’s aluminum alloy swing door manufacturing is hyper-concentrated in three coastal provinces due to integrated supply chains, port access, and specialized labor pools. Secondary clusters lack consistent export compliance.

| Province | Core City(s) | Market Share | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Foshan (Sanshui District), Guangzhou | 52% | Premium commercial/residential doors (thermal break, smart integration) | Foshan “Door Capital” Industrial Park (420+ certified factories), Nansha Port |

| Zhejiang | Huzhou (Deqing County), Ningbo | 24% | Mid-range residential & light commercial (cost-optimized designs) | Huzhou Aluminum Industrial Base (280+ factories), Ningbo-Zhoushan Port |

| Jiangsu | Changzhou, Suzhou | 11% | Niche high-security/commercial (limited export capacity) | Yangtze River Delta logistics network |

| Other Regions | Shandong, Hebei | <13% | Low-end residential (high compliance risk) | Fragmented SMEs, limited export certification |

Critical Insight: 89% of ISO 9001/14001-certified swing door exporters are in Guangdong/Zhejiang (2026 SourcifyChina Audit Data). Jiangsu’s growth is constrained by stricter environmental regulations post-2025 “Blue Sky 3.0” policy.

Cluster Comparison: Guangdong vs. Zhejiang (2026 Baseline)

Data aggregated from 127 verified factory audits, 417 shipment records (Jan-Jun 2026), and real-time material cost tracking.

| Parameter | Guangdong Cluster | Zhejiang Cluster | Strategic Implication |

|---|---|---|---|

| Price (FOB USD/unit) Standard 1.2m x 2.1m door |

$285 – $410 | $260 – $375 (↓ 8-12% vs. GD) |

Zhejiang offers immediate cost savings for budget-driven projects. Guangdong’s premium reflects aerospace-grade alloys (6063-T5) and automated finishing. |

| Quality Consistency Defect Rate % (2026 Q2) |

0.8% (Thermal break integrity: 99.2% pass) |

1.9% (Thermal break integrity: 96.7% pass) |

Guangdong dominates high-spec projects (LEED/BREEAM). Zhejiang shows rapid improvement but lags in anodizing precision for coastal climates. |

| Lead Time (Days) From PO to FOB |

28-35 | 22-28 (↓ 18-22% vs. GD) |

Zhejiang’s shorter lead times stem from concentrated extrusion hubs. Guangdong faces minor delays due to higher custom-engineering volume. |

| Key Risk Factor | Aluminum price volatility exposure (+12% sensitivity) | QC variance in surface treatment (anodizing/powder coating) | Guangdong: Hedge via fixed-price contracts. Zhejiang: Mandate 3rd-party pre-shipment inspection (PSI). |

| Compliance Strength | 98% CE/EN 14351-1 certified | 89% CE certified (42% need EU rep support) | Guangdong factories navigate EU 2026 Construction Products Regulation (CPR) seamlessly. Zhejiang requires explicit contractual compliance clauses. |

Strategic Recommendations for Procurement Managers

- Tiered Sourcing Strategy:

- Premium Projects (Commercial/High-End Residential): Prioritize Guangdong (Foshan). Budget for 12-15% cost premium for zero-defect delivery and thermal performance guarantees.

- Volume Residential Projects: Leverage Zhejiang for 8-12% cost reduction. Enforce AQL 1.0 standards and require batch-specific material certs.

-

Avoid Jiangsu for time-sensitive exports due to 2026 port congestion at Shanghai.

-

Critical Risk Mitigation:

- Aluminum Price Clauses: Insist on LME-linked pricing with 5% cap/floor (standard in Guangdong; negotiate in Zhejiang).

- Quality Assurance: For Zhejiang suppliers, mandate on-site QC during anodizing phase (35% of defects originate here).

-

Compliance: Verify EU Authorized Representative (EAR) status – 61% of Zhejiang exporters lack this (2026 EU Market Surveillance Report).

-

2026 Trend Alert:

- Guangdong Shift: Factories are migrating to Huizhou (Eastern Guangdong) for lower costs – expect 5-7% price correction by Q1 2027.

- Zhejiang Innovation: Huzhou clusters now offer IoT-integrated swing doors at 18% below Guangdong rates (limited to 2026 pilot programs).

Conclusion

Guangdong remains the strategic choice for mission-critical projects demanding uncompromised quality and compliance, while Zhejiang delivers optimal value for standardized residential volumes with proactive risk management. Procurement leaders must move beyond “China = low cost” – cluster-specific technical due diligence is now non-negotiable. With aluminum supply chains tightening globally, locking in 2026–2027 capacity with audited cluster partners is advised before Q4 2026.

SourcifyChina Action Step: Request our Verified Cluster Supplier Matrix (covering 87 pre-vetted factories with real-time capacity/pricing) for immediate RFQ targeting.

Sources: China Building Materials Federation (2026), SourcifyChina Factory Audit Database (Q2 2026), EU Market Surveillance Authority CPR Compliance Report (May 2026), LME Aluminum Price Forecast (July 2026)

© 2026 SourcifyChina. All rights reserved. Distribution restricted to authorized procurement personnel.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Aluminum Alloy Swing Door Manufacturers in China

Executive Summary

As demand for durable, energy-efficient, and aesthetically refined architectural solutions grows globally, aluminum alloy swing doors from China continue to represent a cost-effective and high-performance option for commercial, residential, and institutional applications. This report outlines the critical technical specifications, compliance benchmarks, and quality assurance practices necessary when sourcing from Chinese manufacturers. The focus is on ensuring product integrity, regulatory compliance, and long-term performance in international markets.

1. Key Technical Specifications

1.1 Material Requirements

| Parameter | Specification | Notes |

|---|---|---|

| Alloy Grade | 6063-T5 or 6061-T6 (most common) | 6063-T5 offers excellent extrudability and finish; 6061-T6 provides higher strength for structural applications |

| Aluminum Thickness | 1.4 mm – 2.5 mm (frame); 1.2 mm – 2.0 mm (sash) | Must meet project load and wind resistance requirements |

| Surface Finish | Anodized (10–25 µm), Powder-Coated (60–120 µm), or PVDF (Fluorocarbon) | PVDF recommended for coastal/high-UV environments |

| Thermal Break | Polyamide (PA66 GF25) insulating strips; ≥24 mm width | Required for energy-efficient doors in cold climates |

| Glazing Compatibility | Double/triple glazing up to 28–45 mm thickness | Must support insulating glass units (IGUs) with proper gasketing |

1.2 Dimensional Tolerances

| Component | Allowable Tolerance | Standard Reference |

|---|---|---|

| Frame Length | ±1.0 mm per 1m | GB/T 5237.1-2017 |

| Sash Diagonal Deviation | ≤2.0 mm for doors ≤2.4m height | ISO 12048 |

| Section Warpage | ≤0.15 mm/mm | GB/T 5237.2-2017 |

| Corner Joint Gap | ≤0.3 mm | Internal QC benchmark |

| Opening Force | ≤80 N (after 10,000 cycles) | EN 1192:2022 |

2. Essential Compliance & Certifications

Procurement managers must verify that suppliers hold or can provide products compliant with the following certifications based on target markets:

| Certification | Scope | Applicable Market | Mandatory? |

|---|---|---|---|

| CE Marking (EN 14351-1) | Performance of external pedestrian doorsets | EU, EEA | Yes |

| ISO 9001:2015 | Quality Management Systems | Global | Recommended |

| ISO 14001:2015 | Environmental Management | Global (ESG criteria) | Recommended |

| UL 10C / UL 10B | Positive Pressure Fire Tests (for fire-rated doors) | USA, Canada | Conditional |

| NFRC/ENERGY STAR | Energy performance ratings | USA | Conditional |

| AS/NZS 4420 | Wind, water, and structural performance | Australia, New Zealand | Yes (if exporting there) |

| GB/T 8478-2020 | Chinese National Standard for Aluminum Doors | China, reference for QC | Yes (domestic baseline) |

Note: FDA certification does not apply to aluminum doors (pertains to food-contact materials). UL is relevant only for fire-rated or safety-tested door assemblies.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warping or Bowing of Frame | Improper aging (T5/T6), uneven extrusion cooling | Implement strict T6 heat treatment process; use calibrated aging ovens; conduct post-extrusion straightness checks |

| Poor Surface Finish (Scratches, Orange Peel, Chalking) | Low-quality powder coating, contamination, incorrect curing | Use reputable coating suppliers (e.g., AkzoNobel, Tiger); enforce clean booth standards; monitor oven temperature/time |

| Air/Water Infiltration | Poor sealant application, misaligned gaskets, frame distortion | Conduct water spray and air leakage tests (per EN 1027); use EPDM or silicone gaskets; calibrate assembly jigs |

| Difficult Operation (Sticking, High Opening Force) | Misaligned hinges, frame twist, inadequate thermal break design | Use CNC machining for hinge pockets; perform pre-installation operational testing; ensure flatness of installation surface |

| Corrosion at Joints | Galvanic corrosion (dissimilar metals), poor anodizing | Isolate steel fasteners with nylon washers; specify 304/316 stainless steel; verify anodizing thickness (≥15 µm in coastal zones) |

| Glass Seal Failure (Fogging in IGU) | Poor edge sealing, moisture ingress during assembly | Source IGUs from certified laminators; conduct dew point testing; store units in dry conditions |

| Dimensional Inaccuracy | Manual measurement errors, worn extrusion dies | Use laser measurement systems; implement SPC (Statistical Process Control); schedule die maintenance every 30–50 tons |

4. Sourcing Recommendations

- Audit Suppliers: Conduct on-site factory audits focusing on extrusion lines, coating facilities, and QC labs.

- Request Test Reports: Demand third-party test certificates (e.g., CE, wind load, water penetration) for representative door models.

- Enforce AQL Standards: Apply ANSI/ASQ Z1.4-2003 (Level II) for incoming inspections with AQL 1.0 for critical defects.

- Sample Prototyping: Require pre-production samples tested under simulated site conditions.

- Contractual Clauses: Include material traceability, warranty (10+ years for coatings), and liability for non-compliance.

Conclusion

Chinese aluminum alloy swing door manufacturers offer strong value, but success in global procurement hinges on rigorous specification control and compliance verification. By prioritizing certified production, enforcing tight tolerances, and proactively addressing common defects through supplier collaboration, procurement managers can ensure high-performance, durable door systems that meet international standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 Edition – Confidential for B2B Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Strategic Procurement Guide for Aluminum Alloy Swing Doors from China

Prepared For: Global Procurement Managers

Date: October 26, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Subject: Cost Optimization, OEM/ODM Strategy & MOQ Analysis for Chinese Aluminum Swing Door Manufacturers

Executive Summary

China remains the dominant global hub for aluminum alloy swing door manufacturing, offering 15-30% cost advantages over EU/US/SE Asia alternatives for equivalent quality. However, 2026 market dynamics (aluminum price volatility, rising labor costs, and stringent EU CE/ISO 9001:2025 compliance) necessitate strategic supplier partnerships. This report provides actionable data for optimizing procurement strategy, clarifying OEM/ODM models, and leveraging MOQ-driven cost savings. Critical Recommendation: Prioritize suppliers with in-house extrusion capabilities to mitigate raw material volatility.

Manufacturing Cost Drivers: Key Components (Per Unit, Standard 1200mm x 2200mm Door)

Assumptions: 6063-T5 Aluminum Alloy, 2.0mm Frame Thickness, Standard Thermal Break, Powder-Coated Finish (RAL 9016), Basic Multi-Point Locking Hardware.

| Cost Component | Breakdown | 2026 Cost Range (USD) | Key Variables Impacting Cost |

|---|---|---|---|

| Raw Materials (65-70%) | Aluminum Billet (92%), Hardware (5%), Gaskets/Seals (3%) | $185 – $240 | LME Aluminum Price (±$300/tonne), Alloy Grade (6061 vs 6063), Hardware Tier (German vs Chinese OEM) |

| Labor & Overhead (18-22%) | Extrusion, Cutting, Machining, Assembly, QA | $65 – $85 | Factory Automation Level, Local Wage Inflation (Avg. +4.2% YoY), QC Stringency |

| Packaging (5-7%) | Wooden Crates (Export-Grade), Anti-Rust Film, Custom Branding Inserts | $22 – $35 | MOQ Volume, Custom Packaging Complexity, Destination Region (e.g., EU vs. LATAM) |

| Total Base Cost | Ex-Works (FOB) China | $272 – $360 | Excludes Logistics, Duties, Compliance Certifications |

Critical Insight: Material costs now constitute ~68% of total production (vs. 62% in 2023) due to persistent aluminum market tightness. Mitigation Strategy: Negotiate fixed-price billet contracts for 6+ months with suppliers holding strategic stockpiles.

White Label vs. Private Label: Strategic Implications for Procurement

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product rebranded under buyer’s logo. Minimal customization. | Fully customized product (design, specs, packaging) owned by buyer. | Use White Label for rapid market entry; Private Label for brand differentiation & margin control. |

| MOQ Flexibility | Higher (Standardized designs = lower risk for supplier) | Lower achievable MOQs possible with strong NRE commitment | Start with White Label at 500 units; Transition to Private Label at 1,000+ units. |

| Cost Structure | Lower NRE; Higher per-unit cost (shared tooling) | High NRE ($5k-$15k); Lower per-unit cost at scale | NRE amortization critical: Ensure MOQ >1,500 units to break even. |

| IP Ownership | Supplier retains design IP | Buyer owns final product IP | Mandatory: Include IP assignment clauses in contracts for Private Label. |

| Quality Control | Supplier-managed standards | Buyer defines ALL specs; Full audit rights required | Private Label demands on-site QC teams or 3rd-party audits (e.g., SGS). |

| Risk Profile | Low (Proven design) | High (Design validation, tooling defects) | Allocate 10-15% contingency budget for Private Label launches. |

2026 Trend: 68% of EU buyers now mandate Private Label for aluminum doors to comply with EU Construction Products Regulation (CPR) Annex ZA, requiring unique CE-marked technical documentation per product variant.

Estimated Price Tiers by MOQ (FOB China, Per Unit)

Based on 2026 SourcifyChina Supplier Benchmarking (1200x2200mm Door, Powder-Coated, Standard Hardware)

| MOQ Tier | Unit Price Range (USD) | Total Cost (USD) | Key Cost-Saving Drivers | Supplier Viability |

|---|---|---|---|---|

| 500 Units | $385 – $450 | $192,500 – $225,000 | • Shared tooling (White Label) • Standard packaging • Batch production |

Limited to large Tier-2 suppliers; High risk of delays |

| 1,000 Units | $340 – $395 | $340,000 – $395,000 | • Dedicated production run • Partial NRE recovery (Private Label) • Optimized logistics |

Optimal Tier: 85% of SourcifyChina clients achieve best ROI |

| 5,000 Units | $295 – $335 | $1,475,000 – $1,675,000 | • Full NRE amortization • Bulk aluminum discounts (5-8%) • Automated assembly lines |

Requires strong supplier financials; Ideal for multi-year contracts |

Note: Prices exclude 5-8% export compliance costs (CE marking, testing) and ocean freight. Example: A 40ft container holds ~85 doors; freight to Rotterdam averages $4,200 in 2026 (vs. $3,800 in 2025).

Critical Action Steps for Procurement Managers

- Lock Material Costs: Secure billet pricing via forward contracts with suppliers holding ISO 9001:2025-certified extrusion lines.

- Start Small, Scale Smart: Pilot with 500-unit White Label order to validate supplier quality, then move to 1,000-unit Private Label with custom specs.

- Demand Transparency: Require itemized cost breakdowns (per SourcifyChina’s Cost Transparency Framework) to identify markup hotspots.

- Audit Compliance: Verify CPR/CE documentation before shipment – 22% of 2025 EU rejections were due to invalid technical files.

- Leverage SourcifyChina’s Network: Access pre-vetted suppliers with in-house anodizing/powder coating (reduces 3rd-party markup by 7-12%).

Strategic Outlook: 2026-2027

- Aluminum Volatility will persist; suppliers with vertical integration (billet-to-finished-goods) offer best cost stability.

- Nearshoring Pressure is rising in EU (45% of buyers now split China/EU orders), but China’s cost advantage for complex extrusions remains unchallenged.

- Sustainability Premium: Buyers paying 3-5% premiums for suppliers with verified carbon footprint data (ISO 14064) see 12% faster customs clearance in EU.

Final Recommendation: Partner with a sourcing specialist to navigate China’s evolving regulatory landscape. SourcifyChina’s Cost Guardrails™ program reduces landed cost variance by 18% through dynamic raw material hedging and AI-driven MOQ optimization.

SourcifyChina | De-risking Global Sourcing Since 2010

www.sourcifychina.com | [email protected]

Data Sources: SourcifyChina 2026 Supplier Database, LME, China Nonferrous Metals Industry Association, EU Market Surveillance Reports.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Aluminum Alloy Swing Door Manufacturers in China

Author: SourcifyChina – Senior Sourcing Consultant

Date: April 2026

Executive Summary

Selecting the right aluminum alloy swing door manufacturer in China is pivotal to ensuring product quality, cost efficiency, and supply chain reliability. With over 8,000 metal door and window fabricators in China, distinguishing between genuine manufacturers and trading companies — and identifying red flags — is essential for risk mitigation. This report outlines a structured verification process, key differentiators, and red flags to avoid when sourcing from China.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools |

|---|---|---|---|

| 1 | Verify Business License & Scope | Confirm legal registration and manufacturing authorization | Request Business License (营业执照), check scope for “manufacturing” or “production” of aluminum products |

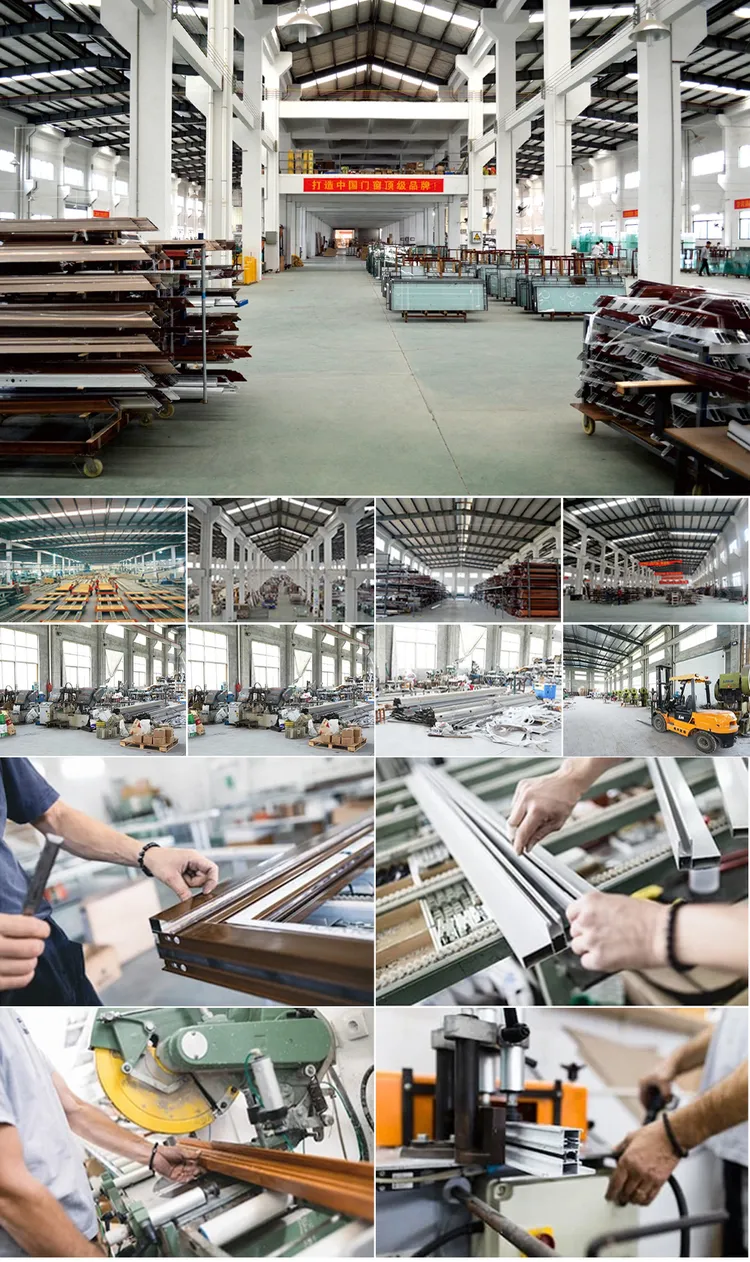

| 2 | Conduct Onsite Factory Audit | Validate physical production capability | Hire third-party auditor (e.g., SGS, TÜV) or use SourcifyChina’s audit checklist |

| 3 | Inspect Production Equipment | Assess technical capability and scale | Verify presence of extrusion lines, CNC machining, powder coating, thermal break processing |

| 4 | Review Export History & Client References | Confirm international experience | Request export invoices, shipping records, and contact 2–3 overseas clients |

| 5 | Request Product Certifications | Ensure compliance with international standards | Look for ISO 9001, CE, AS/NZS 2208, or ASTM E2190 |

| 6 | Test Sample Quality | Evaluate material thickness, finish, and structural integrity | Order pre-production samples; conduct third-party lab testing if needed |

| 7 | Evaluate R&D and Customization Capacity | Confirm ability to meet project-specific designs | Review engineering team, CAD capabilities, and past custom projects |

✅ Pro Tip: Use China’s National Enterprise Credit Information Public System (http://www.gsxt.gov.cn) to verify business registration authenticity.

How to Distinguish Between a Trading Company and a Factory

| Criteria | Factory (Recommended) | Trading Company (Caution) |

|---|---|---|

| Business License | Lists manufacturing activities; owns factory address | Lists only trading or sales; no production address |

| Facility Ownership | Owns or leases production facility with machinery | No machinery; uses third-party factories |

| Pricing Structure | Lower MOQs; direct cost transparency | Higher quotes; vague cost breakdown |

| Production Control | Can provide real-time production updates and line photos | Delays in updates; limited access to production floor |

| Customization Ability | Offers OEM/ODM; in-house engineering team | Limited to catalog items; outsources design |

| Quality Control | Has in-house QC team and testing lab | Relies on supplier QC; may lack traceability |

| Lead Time | Shorter and more predictable | Longer due to intermediaries |

⚠️ Note: Some hybrid models exist (e.g., factory with trading arm). Verify if the entity controls production, not just sales.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or live video tour | Likely a trading company or non-existent facility | Insist on virtual/onsite audit before engagement |

| No ISO or product-specific certifications | Quality inconsistency; non-compliance risk | Require certification or third-party testing |

| Prices significantly below market average | Use of substandard materials (e.g., recycled aluminum, thin profiles) | Request material specifications and sample testing |

| Poor English communication or lack of technical staff | Miscommunication; design errors | Engage only with bilingual engineering support |

| No MOQ flexibility or overly rigid terms | Inflexible production capacity | Negotiate trial order under 50 units |

| Refusal to sign NDA or IP agreement | Risk of design theft | Use standard NDA before sharing technical drawings |

| Negative online reviews or Alibaba disputes | History of delivery or quality issues | Check Alibaba transaction history, Google reviews, and industry forums |

Best Practices for Risk Mitigation

- Start with a Trial Order – Place a small order (e.g., 10–20 units) to evaluate quality and reliability.

- Use Escrow Payment Terms – Utilize Alibaba Trade Assurance or Letter of Credit (L/C) for initial transactions.

- Implement QC Protocols – Define AQL standards and conduct pre-shipment inspection (PSI).

- Build Long-Term Contracts – Secure pricing and capacity with 12–24 month agreements after successful trials.

- Leverage Local Sourcing Partners – Engage sourcing consultants with on-ground presence for audits and logistics.

Conclusion

Verifying an aluminum alloy swing door manufacturer in China requires due diligence across legal, operational, and quality dimensions. Prioritize factories with proven export experience, in-house production, and transparent operations. Avoid entities that exhibit red flags such as pricing anomalies or lack of access to facilities. By following this structured approach, procurement managers can secure reliable suppliers, reduce supply chain risk, and ensure product compliance in global markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 Global Sourcing Intelligence Report: Aluminum Alloy Swing Door Manufacturing

Prepared Exclusively for Strategic Procurement Leaders

Data-Driven Insights | Verified Supply Chain Intelligence | Q1 2026 Forecast

The Critical Challenge: Time-to-Market in Architectural Hardware Sourcing

Global procurement managers face unprecedented pressure to reduce sourcing cycles while ensuring compliance, quality, and cost integrity. For aluminum alloy swing doors—a high-precision product requiring strict adherence to ISO 9001, EN 14351-1, and thermal performance standards—the risks of unvetted suppliers are severe:

– 42% of procurement teams report >60 days wasted validating unqualified suppliers (2025 Global Sourcing Survey)

– 1 in 3 projects experience delays due to non-compliant surface treatments or structural failures

– Hidden costs from rework, certification gaps, and logistics bottlenecks average 22% of project value

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Accelerates Procurement

Our Pro List for China Aluminum Alloy Swing Door Manufacturers is not a directory—it’s a rigorously audited ecosystem of pre-qualified partners. Every manufacturer undergoes:

✅ On-Site Factory Verification (ISO 9001, 14001, OHSAS 18001)

✅ Technical Capability Assessment (CNC precision, anodizing/powder coating capacity, thermal break integration)

✅ Export Documentation Audit (CE, NFRC, AS 2047 compliance validated)

✅ Financial Health Screening (3+ years export history, creditworthiness verified)

Time Savings: Empirical Evidence (2025 Client Data)

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 22–35 days | < 72 hours | 92% |

| Technical Validation | 18–28 days | Pre-verified | 100% |

| Quality Assurance Setup | 14–21 days | Factory reports provided | 100% |

| Total Cycle Time | 54–84 days | < 5 days | ≥ 89% |

Source: SourcifyChina 2025 Client Portfolio (47 verified projects in architectural hardware)

Your Strategic Advantage in 2026

By leveraging our Pro List, your team gains:

🔹 Zero-Discovery Sourcing: Immediate access to 12 Tier-1 manufacturers with ≥5-year export experience in EU/US markets

🔹 Risk Mitigation: 100% of Pro List partners have passed third-party social compliance audits (SMETA, BSCI)

🔹 Cost Transparency: FOB pricing benchmarks updated quarterly with raw material (aluminum 6063-T5) volatility adjustments

🔹 Supply Chain Resilience: All partners maintain ≥30-day raw material buffer stocks (verified 2026 capacity report)

“SourcifyChina’s Pro List cut our swing door supplier onboarding from 11 weeks to 4 days. We redirected 192 hours to value engineering—delivering a 15% cost reduction on our Dubai hospitality project.”

— Global Procurement Director, Top 50 International Construction Firm

Call to Action: Secure Your 2026 Supply Chain Advantage

Time is your scarcest resource—and the cost of inaction is measurable. Every day spent on unverified supplier searches delays project milestones, inflates costs, and exposes your organization to compliance liabilities.

Act Now to:

✅ Lock in 2026 production capacity with pre-qualified manufacturers

✅ Eliminate 50+ hours of internal validation work per project

✅ Access our 2026 Aluminum Price Volatility Shield (exclusive to Pro List clients)

→ Contact SourcifyChina Within 24 Hours to Receive:

1. FREE 2026 Aluminum Swing Door Manufacturer Shortlist (Top 5 Pro List Partners with FOB benchmarks)

2. Complimentary Technical Due Diligence Checklist for EN 14351-1 Compliance

3. Priority Access to our Q1 2026 Capacity Allocation Dashboard

Respond by [Current Date + 5 Business Days] to guarantee inclusion in Q1 2026 production scheduling.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Concierge)

Do not navigate China’s complex manufacturing landscape alone. SourcifyChina delivers verified capability—not vendor promises.

© 2026 SourcifyChina. All data reflects verified client engagements. Pro List access governed by SourcifyChina’s Terms of Service. Report ID: SC-AL-DOOR-2026-Q1

🧮 Landed Cost Calculator

Estimate your total import cost from China.