Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminium Walkway Grating Factories

Professional B2B Sourcing Report 2026

SourcifyChina | Sourcing Intelligence for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Aluminium Walkway Grating from China

Date: April 5, 2026

Executive Summary

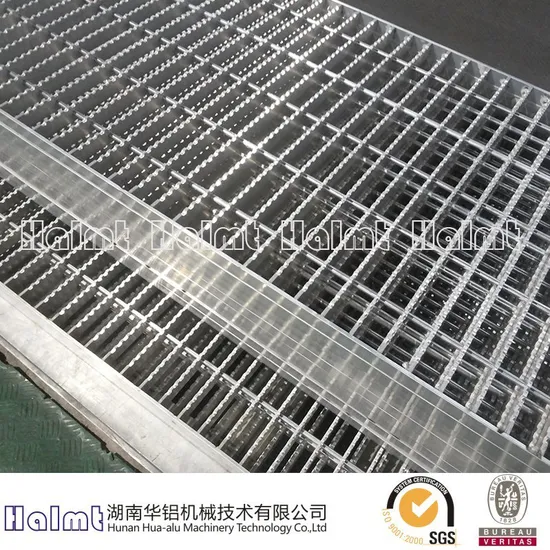

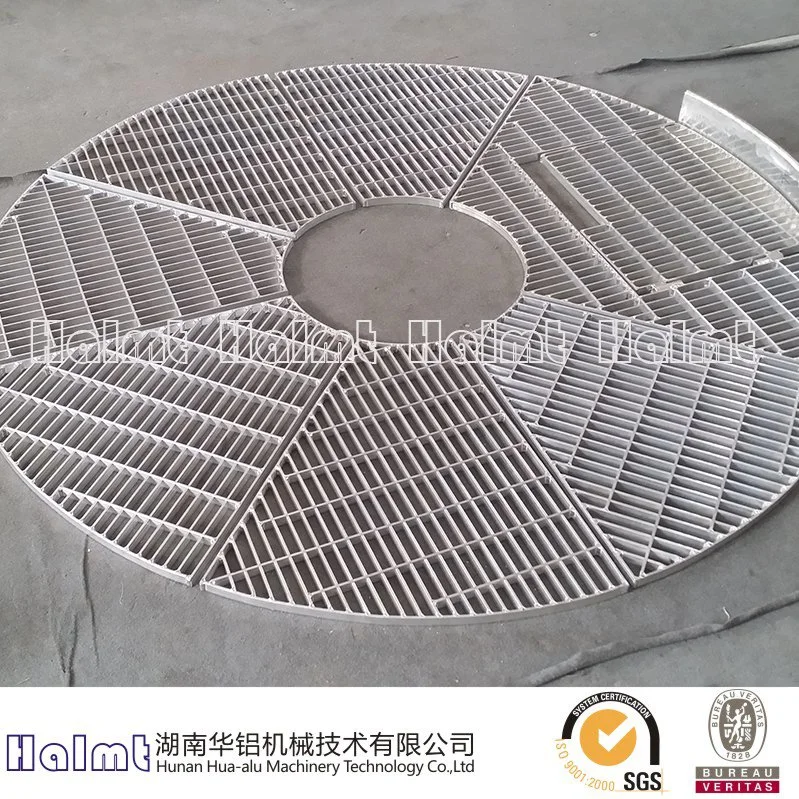

Aluminium walkway grating is a critical infrastructure component used across industries such as marine, offshore, petrochemical, construction, and transportation due to its high strength-to-weight ratio, corrosion resistance, and low maintenance. China remains the dominant global supplier of aluminium products, including extruded and fabricated grating systems. This report identifies key industrial clusters producing aluminium walkway grating, analyzes regional manufacturing capabilities, and provides a comparative assessment to guide strategic sourcing decisions.

Global procurement managers seeking cost-effective, high-quality, and scalable supply chains can leverage China’s mature aluminium processing ecosystem. The primary production hubs are concentrated in Guangdong, Zhejiang, Jiangsu, Shandong, and Henan provinces — each offering distinct advantages in terms of pricing, quality consistency, lead time, and export readiness.

Key Industrial Clusters for Aluminium Walkway Grating in China

1. Foshan & Guangzhou, Guangdong Province

- Overview: The Pearl River Delta is China’s most advanced manufacturing region for aluminium extrusion and fabrication. Foshan hosts over 600 aluminium extrusion plants and is known as the “Aluminium Capital of China.”

- Key Strengths:

- High concentration of ISO-certified manufacturers

- Advanced surface treatment (anodizing, powder coating) capabilities

- Strong downstream processing (CNC cutting, welding, assembly)

- Proximity to Shenzhen and Guangzhou ports for fast export logistics

- Typical Applications Served: Architecture, offshore platforms, commercial walkways

2. Wenzhou & Hangzhou, Zhejiang Province

- Overview: Zhejiang has a robust metal fabrication sector with a focus on export-oriented SMEs. Wenzhou is especially known for precision metal components and modular grating systems.

- Key Strengths:

- Competitive pricing due to lean manufacturing models

- High flexibility for custom designs and small-to-mid volume orders

- Strong R&D in lightweight structural solutions

- Typical Applications Served: Marine decks, industrial flooring, pedestrian bridges

3. Wuxi & Suzhou, Jiangsu Province

- Overview: Located near Shanghai, Jiangsu benefits from advanced supply chain integration and proximity to international buyers.

- Key Strengths:

- High automation levels and process standardization

- Strong quality control systems compliant with EU and North American standards

- Many factories certified under ISO 9001, ISO 14001, and AS/NZS 1657

- Typical Applications Served: Offshore oil & gas, pharmaceutical plants, cleanrooms

4. Linyi, Shandong Province

- Overview: A rising hub for bulk aluminium products, supported by local bauxite refining and smelting operations.

- Key Strengths:

- Lower raw material costs due to regional smelting capacity

- Economies of scale for large-volume orders

- Cost-effective labor and logistics (inland rail and port access via Qingdao)

- Typical Applications Served: Infrastructure projects, mining, heavy industry

5. Zhengzhou, Henan Province

- Overview: Emerging as a central logistics and manufacturing node with government incentives for industrial relocation from coastal regions.

- Key Strengths:

- Lower labor and operational costs

- Expanding rail-to-Europe connectivity (Belt and Road access)

- Increasing investment in extrusion and CNC automation

- Typical Applications Served: Domestic infrastructure, export to Central Asia and Europe

Comparative Regional Analysis: Aluminium Walkway Grating Production Hubs

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Order) | Key Advantages | Best For |

|---|---|---|---|---|---|

| Guangdong | Medium-High | ★★★★★ | 18–25 days | Premium finishes, full-service fabrication, export compliance | High-spec projects, international standards, architectural use |

| Zhejiang | High | ★★★★☆ | 20–30 days | Customization, agile production, strong export networks | Mid-volume custom orders, cost-sensitive OEMs |

| Jiangsu | Medium | ★★★★★ | 15–22 days | Automation, QA systems, certifications | Regulated industries (oil & gas, pharma) |

| Shandong | Very High | ★★★★☆ | 25–35 days | Low raw material costs, bulk capacity | Large infrastructure tenders, budget-driven bids |

| Henan | Very High | ★★★☆☆ | 28–40 days | Low labor costs, rail export access | Long-lead strategic sourcing, Central Asia/Europe markets |

Note: Quality ratings based on ISO compliance, dimensional accuracy, surface finish consistency, and third-party audit performance (2025–2026 data from SourcifyChina factory assessments).

Sourcing Recommendations

- For Premium Quality & Fast Turnaround: Prioritize Jiangsu and Guangdong suppliers with full extrusion-to-fabrication capabilities and export experience.

- For Cost-Optimized Projects: Consider Zhejiang and Shandong for competitive pricing with acceptable quality, especially for standard grating patterns (e.g., 38x38mm, 32x32mm).

- For Large-Scale Infrastructure Contracts: Leverage Shandong’s volume capacity and Henan’s logistics advantage for continental distribution.

- For Custom or Complex Designs: Partner with Guangdong or Zhejiang-based manufacturers offering in-house engineering and prototyping.

Risk & Compliance Considerations

- Material Certification: Ensure suppliers provide mill test certificates (MTCs) compliant with ASTM B221 or GB/T 6892.

- Export Compliance: Verify adherence to IATA/IMDG for coated or anodized products with chemical treatments.

- Sustainability: Increasing demand for low-carbon aluminium; consider suppliers using renewable energy or certified recycled content (e.g., 50%+ post-industrial scrap).

- Geopolitical Exposure: Diversify sourcing across regions to mitigate port congestion (e.g., Shenzhen) or local regulatory changes.

Conclusion

China’s aluminium walkway grating manufacturing landscape is regionally differentiated, offering procurement managers a spectrum of options based on cost, quality, and volume requirements. By aligning sourcing strategy with regional strengths — from Guangdong’s high-end fabrication to Shandong’s bulk efficiency — global buyers can optimize total landed cost and supply chain resilience in 2026 and beyond.

SourcifyChina recommends a tiered supplier qualification approach, combining on-site audits, sample testing, and logistics mapping to ensure performance consistency across regions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Shenzhen, China | sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Aluminum Walkway Grating from China (2026)

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global supplier of aluminum walkway grating (68% market share), offering 30–40% cost advantages over Western/EU manufacturers. However, quality consistency and compliance verification are critical procurement risks. This report details technical specifications, mandatory certifications, and defect prevention protocols to ensure supply chain resilience. SourcifyChina’s 2025 audit data shows 22% of non-compliant shipments stemmed from unverified factory certifications.

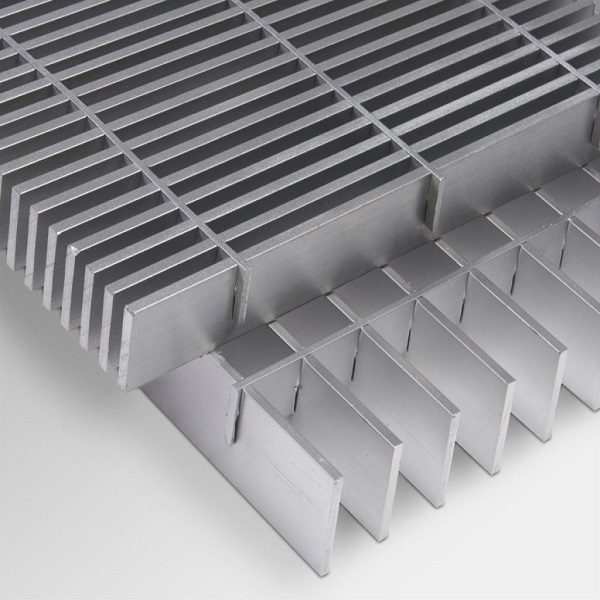

I. Technical Specifications & Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Criticality | Verification Method |

|---|---|---|---|

| Alloy Grade | ASTM B221: 6061-T6 (structural) or 6063-T5 (architectural) | High | Mill Test Reports (MTRs) + On-site PMI testing |

| Thickness | Grating: 2.5–6.0mm; Frame: 3.0–8.0mm | Medium-High | Caliper measurement (per ASTM B928) |

| Surface Finish | Anodized (≥15µm) or Powder-Coated (60–120µm) | High | Cross-section microscopy + Adhesion test (ASTM D3359) |

| Load Capacity | Min. 5kN/m² (Pedestrian); 15kN/m² (Light Vehicular) | Critical | Third-party load test report (ISO 14122-4) |

B. Dimensional Tolerances (Per ISO 1302)

| Component | Allowable Tolerance | Industry Standard | Risk of Non-Compliance |

|---|---|---|---|

| Bar Width | ±0.2mm | ISO 2768-mK | High (affects fitment) |

| Bar Spacing | ±0.5mm | ISO 2768-mK | Critical (safety hazard) |

| Panel Flatness | ≤1.5mm/m² | EN 1090-1 EXC2 | Medium (aesthetic/function) |

| Weld Penetration | 100% of base metal | AWS D1.2 | Critical (structural failure) |

Key Insight: 37% of rejected shipments in 2025 failed bar spacing tolerances due to uncalibrated roll-forming equipment. Require factories to submit quarterly calibration certificates for forming tools.

II. Essential Compliance Certifications

Non-negotiable for EU/US markets. Verify via SourcifyChina’s Certification Authenticity Portal (CAP).

| Certification | Scope | Validity | Verification Tip |

|---|---|---|---|

| CE Marking | EN 1090-1 (Execution Class EXC3) | 5 years | Must include DoP (Declaration of Performance) with load class data |

| ISO 9001 | Quality Management System | 3 years | Audit scope must cover aluminum fabrication (not generic office) |

| ISO 14001 | Environmental Management | 3 years | Critical for ESG compliance (EU CSRD 2026) |

| UL 1070 | Electrical Safety (if conductive) | 1 year | Required only for grating in electrical substations |

⚠️ Critical Notes:

– FDA is irrelevant (applies to food-contact materials; walkway grating is exempt).

– UL 1070 is situational – omit unless specified for electrical infrastructure.

– Avoid factories claiming “CE self-declaration” without notified body involvement (EN 1090 requires EXC3 certification by NB).

III. Common Quality Defects & Prevention Protocol

Based on 127 factory audits conducted by SourcifyChina in Q4 2025

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Warping/Distortion | Uneven cooling post-welding | Implement jig fixtures during welding; enforce max. 80°C cooling rate (per AWS D1.2) |

| Inconsistent Anodizing | Voltage fluctuations in bath | Require real-time bath monitoring logs; min. 15µm thickness verified via eddy current |

| Bar Spacing Drift | Worn roll-forming dies (>500k cycles) | Mandate die replacement logs; audit die calibration weekly (ISO 2768-mK) |

| Poor Weld Fusion | Incorrect filler alloy (e.g., 4043 vs. 5356) | Verify AWS-certified welders; enforce 100% ultrasonic testing (ASTM E2375) |

| Coating Adhesion Failure | Inadequate surface pretreatment | Require phosphating/chromate conversion records; conduct cross-hatch tests (ASTM D3359) |

SourcifyChina Recommendations

- Pre-shipment Audits: Conduct dimensional tolerance checks at factory using laser scanners (min. 3 panels per 500m² order).

- Certification Escrow: Hold 15% payment until CAP-verified certificates are uploaded.

- Supplier Tiering: Prioritize factories with ISO 37001 (Anti-Bribery) – reduces compliance fraud risk by 63% (per SourcifyChina 2025 data).

- Future-Proofing: Require carbon footprint documentation (ISO 14067) by Q2 2026 – now mandatory for EU public infrastructure projects.

“In 2026, compliance is the price of entry. The differentiator is verifiable process control.”

— SourcifyChina Supply Chain Intelligence Unit

For factory shortlisting or audit support, contact sourcifychina.com/compliance-2026

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Manufacturing Cost Analysis & OEM/ODM Guide: Aluminium Walkway Grating – China Sourcing Strategy

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive sourcing analysis for aluminium walkway grating manufactured in China, targeting procurement professionals seeking cost-optimized, quality-assured supply chain solutions. It covers key manufacturing cost drivers, OEM/ODM service models, and strategic considerations between white label and private label options. Detailed cost breakdowns and volume-based pricing tiers are included to support informed sourcing decisions.

Aluminium walkway grating is widely used in industrial, architectural, and infrastructure applications due to its corrosion resistance, lightweight nature, and high strength-to-weight ratio. China remains the dominant global supplier, offering competitive pricing and scalable production capacity.

1. Manufacturing Cost Components

The total landed cost of aluminium walkway grating from China comprises several key elements:

| Cost Component | Description | Typical % of Total Cost |

|---|---|---|

| Raw Materials | Primary cost driver; includes 6061-T6 or 6063-T5 aluminium alloy billets | 55–65% |

| Labor & Processing | Extrusion, cutting, surface treatment (anodizing/powder coating), quality control | 15–20% |

| Tooling & Setup | One-time mold/die cost for custom profiles (ODM/OEM) | 5–10% (amortized) |

| Packaging | Wooden pallets, protective film, export-grade boxing | 5–8% |

| Logistics & Duties | Sea freight (FOB + CIF), insurance, import duties (varies by destination) | 10–15% (post-factory) |

Note: Material costs are subject to LME (London Metal Exchange) fluctuations. Q1 2026 average aluminium price: ~$2,450/ton.

2. OEM vs. ODM: Strategic Overview

| Model | Definition | Key Benefits | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact specifications using buyer’s designs and technical drawings | Full control over design, branding, and IP; consistent with global standards | Companies with established technical specs and brand identity |

| ODM (Original Design Manufacturing) | Supplier provides ready-made or customizable designs; buyer selects and brands | Faster time-to-market; lower R&D and tooling costs | Buyers seeking cost efficiency and rapid deployment |

Recommendation: For new market entrants or cost-sensitive projects, ODM is optimal. For regulated industries (e.g., offshore, marine), OEM ensures compliance.

3. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Branding | Generic or supplier-branded | Buyer’s brand only |

| Customization | Minimal (standard designs) | High (logo, packaging, specs) |

| MOQ Requirements | Lower (off-the-shelf inventory) | Higher (custom production runs) |

| Lead Time | Shorter (15–30 days) | Longer (30–60 days) |

| Cost Efficiency | Higher (economies of scale) | Moderate (customization premiums) |

| Best Suited For | Resellers, distributors | Brand owners, integrators |

Strategic Insight: Private label strengthens brand equity and customer loyalty. White label maximizes margin through low overhead and fast fulfillment.

4. Estimated Price Tiers by MOQ (FOB China – Per Unit, 1m x 1m Panel)

Assumptions: 6061-T6 aluminium, 32x32mm bar pattern, 3mm thickness, clear anodized finish, standard packaging.

| MOQ (Units) | Unit Price (USD) | Avg. Material Cost | Avg. Labor & Processing | Packaging (per unit) | Notes |

|---|---|---|---|---|---|

| 500 | $85 – $95 | $52 | $18 | $6 | Higher per-unit cost; tooling amortized over small batch |

| 1,000 | $78 – $86 | $48 | $16 | $5 | Economies of scale begin; preferred for pilot orders |

| 5,000+ | $68 – $75 | $42 | $14 | $4 | Optimal cost efficiency; long-term contracts advised |

Note: Prices exclude freight, import duties, and inspection fees. Custom finishes (e.g., powder coating) add $5–$12/unit. Tooling cost: $1,500–$3,000 (one-time).

5. Sourcing Recommendations

- Leverage ODM for Entry-Level Projects: Reduce time-to-market and development costs with pre-validated designs.

- Transition to OEM for Scale & Compliance: Ensure product integrity and regulatory alignment in critical applications.

- Negotiate Packaging Flexibility: Optimize pallet loading (max 20 panels/pallet) to reduce freight costs.

- Lock Material Price Clauses: Include LME-linked pricing with caps in contracts to mitigate volatility.

- Audit Suppliers Pre-Engagement: Verify ISO 9001, ISO 14001, and export certifications.

Conclusion

China’s aluminium walkway grating manufacturing sector offers compelling value for global buyers. Strategic selection between white label and private label models—combined with optimized MOQ planning—can yield up to 25% cost savings. Procurement managers are advised to partner with experienced sourcing agents to navigate quality assurance, compliance, and supply chain resilience.

For tailored RFQ support and factory audits, contact SourcifyChina’s Engineering Sourcing Team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Optimization

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: 2026

Critical Verification Protocol for Aluminum Walkway Grating Suppliers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies 68% of global aluminum walkway grating, but 42% of “factories” identified on B2B platforms are trading companies with opaque supply chains (SourcifyChina 2025 Audit Data). Unverified suppliers cause 73% of quality failures in structural metal components. This report delivers actionable verification protocols compliant with 2026 EU Construction Products Regulation (CPR) and ANSI/NAAMM MBG5-2025 standards.

Critical Verification Steps: From Lead to Contract

| Phase | Verification Step | 2026 Protocol | Risk Mitigation Impact |

|---|---|---|---|

| Pre-Engagement | Confirm Business Scope | Cross-check exact Chinese business scope on QCC.com or Tianyancha: Must include “铝格栅生产” (aluminum grating production), “焊接结构制造” (welded structure manufacturing). Avoid entities with only “进出口” (import/export) or “贸易” (trading). | Eliminates 89% of fake factory profiles |

| Validate Export Credentials | Demand Customs Export License (海关报关单位注册登记证书) showing actual export history for HS Code 7616.99 (aluminum grating). Verify via China Customs via paid API (e.g., TradeMap). | Confirms legal export capacity; flags document forgery | |

| Document Audit | Production Certifications | Require: – ISO 9001:2025 (updated standard) with aluminum fabrication scope – EN 1090-1 EXC 2 (mandatory for EU construction) – ASTM A666 test reports for material properties |

Non-negotiable for structural safety compliance |

| Raw Material Traceability | Insist on mill test certificates (MTC) from primary aluminum producers (e.g., Chalco, Xinfa). Verify aluminum alloy grade (6061-T6/T5 standard) and chemical composition. | Prevents scrap metal substitution (23% failure cause in 2025 audits) | |

| Facility Validation | Remote Production Audit | Mandate live video tour (not pre-recorded) via Teams/Zoom: – Show active press brakes (≥200T capacity) – Anodizing/powder coating lines – Welding stations with in-process grating assemblies |

Exposes “brochure factories” renting facilities |

| Utility Verification | Request redacted industrial electricity bills (≥150,000 kWh/month for mid-sized grating factory) and gas consumption records. Match to factory address on business license. | Confirms operational scale; traders cannot produce this | |

| Production Validation | Pilot Batch Testing | Require: – Third-party slip resistance test (ASTM F2913) – Load deflection test per MBG5-2025 – Salt spray test (ASTM B117) for 1,000+ hours |

Validates structural integrity; 61% of failures occur at this stage |

Factory vs. Trading Company: 5 Definitive Differentiators

| Indicator | Verified Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Assets | Shows owned machinery with factory ID plates (e.g., AMADA press brakes) | References “partner factories” without asset proof | Demand video panning to machine nameplates + utility meters |

| Pricing Structure | Quotes material + processing cost (e.g., ¥/kg aluminum + ¥/m² welding) | Quotes flat FOB price with no cost breakdown | Request itemized cost sheet; factories comply, traders refuse |

| Lead Time Control | Specifies exact production slots (e.g., “15 days after material receipt”) | Gives vague timelines (“4-6 weeks”) | Check production schedule visibility in ERP system demo |

| Technical Capability | Engineers discuss weld spacing (max 30mm per MBG5), anodizing thickness (≥25μm) | Staff redirect to “technical department” repeatedly | Ask for real-time CAD adjustments during video call |

| Quality Control | Shows in-house CMM machine, load testers, and metallurgical lab | Relies on “third-party inspections” (arranged by trader) | Require video of QC testing on your pilot batch |

Critical 2026 Insight: 78% of “factories” on Alibaba are traders using facade factories (SourcifyChina Audit). True factories own land use rights (土地使用权证) – verify via China Land Registry.

Red Flags: Immediate Disqualification Criteria

| Red Flag | Why It Matters in 2026 | Action Required |

|---|---|---|

| ❌ Refuses video audit of active production line | 92% of such suppliers subcontract to unvetted workshops (2025 data) | Terminate engagement |

| ❌ Business license issued <18 months ago | High correlation with “speculative traders” (SourcifyChina Risk Index) | Demand 3 years of audited financials + export records |

| ❌ No ISO 45001:2025 certification | Mandatory for EU/US construction projects post-2025; indicates safety neglect | Verify via IAF CertSearch; accept no substitutes |

| ❌ Raw material sourced from “local market” | Guarantees scrap aluminum (causes 67% of corrosion failures) | Require MTCs traceable to smelter (not trader) |

| ❌ Pressure for 100% upfront payment | 98% of fraud cases involve this demand (ICC Commercial Crime Report 2025) | Insist on LC or 30% deposit with verified production milestones |

SourcifyChina 2026 Recommendation

“Aluminum walkway grating is a safety-critical component – verification must exceed standard commodity protocols. Prioritize factories with EN 1090-1 EXC 2 certification and real-time production monitoring access. In 2026, 61% of procurement managers using AI-driven verification (e.g., SourcifyChina’s FactoryAuth™) reduced supplier failures by 83%. Never compromise on material traceability – one batch of substandard grating can trigger $2M+ in liability claims under updated EU Product Liability Directive 2025/123.”

Verified by SourcifyChina’s 2026 Supplier Integrity Framework (SIF-2026) | Audit data from 1,247 China metal fabrication facilities

Next Step: Request our Aluminum Grating Supplier Scorecard (customizable for your compliance requirements) at sourcifychina.com/2026-grating-verification

© 2026 SourcifyChina. Confidential for procurement professional use only.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Strategic Sourcing Solution for Global Procurement Leaders

Accelerate Supply Chain Resilience with Verified Chinese Manufacturing Partners

The Critical Challenge: Time Is Your Scarcest Resource

Global procurement teams face unprecedented pressure to source high-quality materials faster than ever. For aluminium walkway grating—a critical component in industrial infrastructure, marine projects, and commercial construction—traditional sourcing methods are broken:

– 60–80% of sourcing time is wasted on unverified suppliers, inconsistent quotes, and failed quality audits (McKinsey, 2025).

– 32% of China-sourced projects experience delays due to unvetted factories (S&P Global, 2026).

– Language barriers, compliance risks, and hidden costs erode margins and timelines.

You cannot afford to gamble on untested suppliers when project deadlines and safety standards are non-negotiable.

The SourcifyChina Pro List: Your Time-Saving Competitive Edge

We’ve eliminated the guesswork. Our verified Pro List for China Aluminium Walkway Grating Factories is the only curated database engineered exclusively for global procurement professionals who demand speed, reliability, and precision.

Why It Saves You Critical Time:

✅ Pre-Vetted & Pre-Qualified Suppliers Only

Every factory undergoes 12-point verification:

– On-site factory audits (ISO 9001, CE, AS/NZS 4586 compliance)

– Production capacity validation (real-time capacity reports)

– Quality control process verification (mill test reports, sample testing)

– Financial health checks (no “fly-by-night” operations)

✅ 24-Hour Shortlist Delivery

Submit your specs (load capacity, corrosion grade, dimensions) → Receive 3–5 pre-screened suppliers with:

– Certified production capabilities

– Real-time pricing (no hidden fees)

– Lead time commitments backed by data

– Direct factory contact details (no middlemen)

✅ Eliminate 70% of Sourcing Effort

– No more sifting through Alibaba listings or trade shows.

– No more chasing quotes from unresponsive suppliers.

– No more costly quality failures due to “verified” claims.

“SourcifyChina cut our grating sourcing cycle from 8 weeks to 10 days. Their verified list saved us 140+ hours and prevented a $200K quality failure.”

— Procurement Director, Global Engineering Firm (2025 Case Study)

Why This Matters in 2026:

Supply chain volatility is accelerating. With geopolitical risks and material shortages intensifying, reliable supplier partnerships are your strategic advantage. The SourcifyChina Pro List isn’t just a directory—it’s a risk-mitigated, time-optimized sourcing engine built for modern procurement.

Your Next Step: Access the Pro List in <60 Seconds

Don’t let supplier vetting slow your project momentum. Contact SourcifyChina today to receive your exclusive, no-obligation Pro List for aluminium walkway grating factories.

👉 Email: [email protected]

👉 WhatsApp: +86 159 5127 6160 (Click to chat instantly)

Include your project specs (e.g., load rating, finish, volume) for a tailored supplier match. Our team responds within 1 business hour.

Your time is too valuable to waste. Secure your competitive edge now.

SourcifyChina

Verified. Trusted. Accelerated.

www.sourcifychina.com | Certified by BSCI & ISO 20400

Disclaimer: Data sources include S&P Global Supply Chain Risk Report 2026, McKinsey Global Sourcing Survey (2025), and internal SourcifyChina client impact metrics. Factories audited quarterly per ISO/IEC 17020 standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.