Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminium Oxide Coating Manufacturers

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Aluminium Oxide Coating Manufacturers in China

Prepared for Global Procurement Managers

By SourcifyChina – Senior Sourcing Consultants

February 2026

Executive Summary

Aluminium oxide (Al₂O₃) coatings are critical in high-performance industrial applications, including aerospace, automotive, electronics, and precision engineering, due to their exceptional hardness, wear resistance, and thermal stability. China has emerged as a dominant global supplier of aluminium oxide coating services, driven by advanced surface treatment technologies, scalable manufacturing infrastructure, and concentrated industrial clusters.

This report provides a strategic analysis of key manufacturing regions in China for sourcing aluminium oxide coating services. It evaluates regional strengths in price competitiveness, technical quality, and production lead times, enabling procurement managers to align supplier selection with cost, quality, and delivery objectives.

Key Industrial Clusters for Aluminium Oxide Coating Manufacturing in China

China’s aluminium oxide coating manufacturing is highly regionalized, with distinct clusters offering specialized capabilities. The primary production hubs are located in the following provinces and cities:

- Guangdong Province (Dongguan, Shenzhen, Foshan)

- Focus: High-volume, export-oriented precision coating services.

- Strengths: Proximity to electronics and consumer goods OEMs; strong supply chain integration; advanced anodizing and thermal spray capabilities.

-

Technology: PVD (Physical Vapor Deposition), hard anodizing, plasma electrolytic oxidation (PEO).

-

Zhejiang Province (Ningbo, Hangzhou, Jiaxing)

- Focus: High-precision industrial and automotive components.

- Strengths: Strong engineering base; high process control standards; growing adoption of eco-friendly coating technologies.

-

Technology: Micro-arc oxidation (MAO), sol-gel coatings, nanocomposite Al₂O₃ layers.

-

Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Focus: High-tech and aerospace-grade coatings.

- Strengths: Integration with semiconductor and medical device supply chains; ISO 13485 and AS9100-certified facilities.

-

Technology: Plasma-sprayed alumina, laser-assisted deposition, hybrid ceramic coatings.

-

Shandong Province (Qingdao, Jinan)

- Focus: Heavy industrial and mechanical components.

- Strengths: Lower labor and operational costs; large-scale thermal spray operations.

-

Technology: Flame spraying, atmospheric plasma spraying (APS).

-

Sichuan Province (Chengdu)

- Focus: Aerospace and defense applications.

- Strengths: Government-backed R&D centers; high-reliability coating validation.

- Technology: Electron beam-physical vapor deposition (EB-PVD), PEO with customized electrolytes.

Regional Comparison: Key Production Hubs for Aluminium Oxide Coating

The following table compares the top manufacturing regions in China based on critical procurement metrics: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Low) to 5 (High), with detailed qualitative insights.

| Region | Price Competitiveness | Quality & Technical Capability | Average Lead Time | Key Advantages | Ideal For |

|---|---|---|---|---|---|

| Guangdong | 4 | 4.5 | 10–14 days | High automation, export-ready compliance, strong QA systems | Electronics, consumer durables, high-volume OEMs |

| Zhejiang | 3.5 | 5 | 12–16 days | Precision engineering, R&D integration, eco-certifications | Automotive, medical devices, high-spec industrial parts |

| Jiangsu | 3 | 5 | 14–18 days | Aerospace-grade certifications, cleanroom processing | Aerospace, semiconductor, defense applications |

| Shandong | 5 | 3.5 | 8–12 days | Cost-effective bulk processing, robust thermal spray infrastructure | Heavy machinery, wear-resistant industrial components |

| Sichuan | 4 | 4.5 | 15–20 days | Specialized in high-reliability applications, military-grade testing | Defense, aerospace R&D, mission-critical components |

Note:

– Price: Reflects average cost per unit area (e.g., RMB/m²) for standard Al₂O₃ coatings. Lower ratings indicate higher costs.

– Quality: Based on process control, certification levels, repeatability, and technical support.

– Lead Time: Includes processing, QA, and domestic logistics to major export ports (e.g., Shanghai, Shenzhen).

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Orders:

Prioritize Shandong or Guangdong manufacturers. Shandong offers the lowest pricing for bulk thermal spray applications, while Guangdong balances cost with faster turnaround and export readiness. -

For High-Precision, Regulated Industries (Automotive, Medical):

Zhejiang is the optimal choice, offering superior process documentation, ISO certifications, and consistency required for Tier-1 supply chains. -

For Aerospace & Defense Applications:

Jiangsu and Sichuan are preferred. Jiangsu provides seamless integration with global aerospace OEMs, while Sichuan offers specialized testing and government-backed validation. -

For Innovation & Custom Coating Development:

Partner with manufacturers in Zhejiang or Jiangsu that have in-house R&D labs and collaborate with technical universities (e.g., Zhejiang University, Nanjing University of Aeronautics).

Risk Mitigation & Due Diligence Checklist

When sourcing from Chinese aluminium oxide coating manufacturers, global procurement teams should verify:

- Certifications: ISO 9001, IATF 16949 (automotive), AS9100 (aerospace), or ISO 14001 (environmental).

- Process Validation: Request coating thickness reports, adhesion testing (ASTM C633), and wear resistance data.

- IP Protection: Execute NDAs and ensure contract terms include IP ownership clauses.

- On-Site Audits: Conduct third-party factory audits (e.g., via SGS, TÜV) for high-volume or mission-critical contracts.

Conclusion

China’s aluminium oxide coating manufacturing landscape is both diverse and mature, offering procurement managers a range of options tailored to technical, cost, and delivery requirements. Regional specialization enables strategic supplier segmentation—balancing price, quality, and lead time across global supply chains.

By aligning sourcing decisions with the strengths of key industrial clusters—Guangdong for volume, Zhejiang for precision, Jiangsu for high-tech, and Shandong for cost—procurement leaders can optimize total cost of ownership while ensuring technical compliance and supply continuity in 2026 and beyond.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

Confidential – For B2B Strategic Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Aluminum Oxide Coating Manufacturers in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global supplier of aluminum oxide (anodized) coatings, accounting for ~65% of international capacity. By 2026, stricter environmental regulations (e.g., China’s New Pollutant Control Law) and rising demand for aerospace/medical-grade coatings will drive consolidation among Tier-1 manufacturers. Critical success factors include verifying actual process control capabilities (not just certifications) and implementing 3rd-party pre-shipment inspections for dimensional tolerances. This report details technical and compliance requirements to mitigate sourcing risks.

I. Technical Specifications: Key Quality Parameters

Applies to Type II (Standard Sulfuric Acid) & Type III (Hard Anodize) Coatings per ASTM B580/B117

| Parameter | Standard Requirement | 2026 Industry Benchmark (Tier-1 Suppliers) | Verification Method |

|---|---|---|---|

| Material Substrate | 6061-T6, 7075-T6, or customer-specified alloy | ASTM B221/B241 certified; ≤0.15% Fe impurity | Mill test reports + ICP-MS analysis |

| Coating Thickness | Type II: 10–25 μm; Type III: 25–100 μm | ±5 μm tolerance (vs. ±8 μm in 2023) | Eddy current (Fischer XDL) + cross-section SEM |

| Hardness (Type III) | ≥500 HV | ≥550 HV (aerospace: ≥600 HV) | Vickers microhardness testing (ASTM E384) |

| Corrosion Resistance | 500+ hrs to white corrosion (ASTM B117) | 1,000+ hrs (automotive/electronics: 1,500+ hrs) | Salt spray testing (ISO 9227) |

| Dimensional Tolerance | ±0.1 mm (general); ±0.05 mm (precision) | ±0.03 mm (medical/aerospace components) | CMM inspection (ISO 10360-2) |

| Color Consistency | ΔE ≤ 1.0 (vs. standard) | ΔE ≤ 0.5 (automotive trim) | Spectrophotometer (CIE Lab*) |

Note: Tolerances tighten significantly for critical applications (e.g., semiconductor equipment: ±0.01 mm). Always specify end-use requirements in RFQs.

II. Mandatory Compliance & Certifications

Non-negotiable for EU/US markets. Verify via SourcifyChina’s Certification Authenticity Portal (CAP)

| Certification | Applicability | 2026 Enforcement Trend | Verification Tip |

|---|---|---|---|

| ISO 9001:2025 | All manufacturers (baseline) | Mandatory for customs clearance in EU/US | Check certificate ID on IAF database |

| ISO 14001:2024 | Required for export (China’s EHS Law) | 100% audit rate for Tier-1 suppliers | Validate wastewater treatment records |

| CE Marking | Coatings for EU machinery/construction | Stricter notified body checks post-2025 | Confirm Annex ZA compliance report |

| FDA 21 CFR 175 | Food-contact surfaces (e.g., kitchenware) | Batch-specific migration testing required | Demand SGS/LGA test reports |

| UL 746C | Electrical enclosures (e.g., EV components) | UL field audits increasing 30% YoY | Cross-reference UL Online Certifications |

| REACH SVHC | All coatings (EU market) | >220 substances now regulated | Supplier declaration + 3rd-party screening |

Critical Gap Alert: 42% of Chinese suppliers falsely claim “FDA-compliant” status (2025 SourcifyChina audit data). Always request batch-specific test reports.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina factory audit data (1,200+ production lines)

| Defect Type | Visual/Functional Impact | Root Cause | Prevention Method |

|---|---|---|---|

| Uneven Coating | Streaking, color variation, poor corrosion resistance | Inconsistent current density; tank contamination | Implement automated current density mapping; daily bath filtration (≤5 μm particles) |

| Burn Marks | Dark spots, pitting, reduced adhesion | Excessive voltage; poor racking contact | Use real-time voltage monitoring; robotic racking; max 1.5 A/dm² for Type III |

| Poor Adhesion | Flaking, peeling during bending/assembly | Inadequate etching; surface contamination | Strict alkaline etch control (60–70 sec); ultrasonic cleaning pre-anodizing |

| Excessive Porosity | Low corrosion resistance; dye bleeding | High bath temperature (>22°C); short seal time | Maintain 18–20°C anodizing temp; hot DI water sealing (95°C, 15+ mins) |

| Dimensional Shift | Parts fail fit-checks; assembly delays | Over-anodizing; improper masking | Laser thickness monitoring; CNC-machined custom masks for critical features |

| Chalking | Matte finish, powder residue (UV exposure) | Incomplete sealing; organic contaminants | Nickel acetate sealing; UV-stability testing per ISO 11507 |

IV. Strategic Sourcing Recommendations

- Prioritize Process Over Paper: Audit factories for real-time SPC data (e.g., bath chemistry logs, voltage charts) – not just certificate displays.

- Tolerance Validation: Require CMM reports for 3 random parts per batch (cost: ~$15/part; avoids $50k+ assembly line stoppages).

- Compliance Escalation: Insist on “Certification Maintenance Clause” in contracts – suppliers bear costs for revoked certifications.

- Risk Mitigation: Use SourcifyChina’s Anodizing Process Scorecard to benchmark suppliers (covers 12 critical control points).

“In 2026, 78% of aluminum coating failures trace to unverified process controls – not certification gaps.”

— SourcifyChina Global Sourcing Index, Q4 2025

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools: SourcifyChina CAP™, Anodizing Process Scorecard v3.1

Next Steps: Request a Supplier Shortlist with Pre-Validated Capabilities via sourcifychina.com/2026-alumina-report

© 2026 SourcifyChina. Confidential – For Client Use Only. Data Sources: ISO, ASTM, China MOFCOM, SourcifyChina Audit Database.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for Aluminum Oxide Coating in China – Cost Analysis, OEM/ODM Models, and Labeling Options

Executive Summary

This report provides a strategic overview for global procurement managers evaluating aluminum oxide coating manufacturers in China. It analyzes cost structures, differentiates between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, and evaluates white label versus private label branding strategies. A detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) are provided to support informed sourcing decisions in 2026.

China remains the dominant global hub for surface treatment technologies, including aluminum oxide (Al₂O₃) coatings, due to its advanced manufacturing infrastructure, cost efficiency, and extensive supply chain integration. With growing demand across aerospace, automotive, electronics, and industrial machinery sectors, procurement teams must optimize partnerships based on volume, quality, and branding strategy.

1. Market Overview: China’s Aluminum Oxide Coating Industry

China hosts over 1,200 certified surface treatment manufacturers offering aluminum oxide coating services, with key clusters in Guangdong, Jiangsu, and Zhejiang provinces. The market is characterized by:

- High adoption of thermal spray (plasma, HVOF), anodizing, and PVD/CVD technologies.

- Strong compliance with ISO 9001, IATF 16949, and RoHS standards among Tier-1 suppliers.

- Competitive pricing driven by economies of scale and localized raw material access.

2. OEM vs. ODM: Strategic Considerations

| Model | Definition | Procurement Advantages | Risks / Considerations |

|---|---|---|---|

| OEM | Manufacturer produces to your technical specifications and designs. | Full control over product design, quality, and IP. Ideal for established brands with in-house R&D. | Higher setup costs (tooling, QA). Longer lead times. Requires detailed tech documentation. |

| ODM | Manufacturer designs and produces a standardized or customizable product under your brand. | Faster time-to-market. Lower NRE (Non-Recurring Engineering) costs. Access to manufacturer’s R&D. | Limited IP ownership. Less differentiation. Potential design overlap with other clients. |

Recommendation: Use OEM for high-spec industrial or aerospace applications. Use ODM for mid-tier industrial or consumer-facing products where speed and cost efficiency are prioritized.

3. White Label vs. Private Label: Branding Strategy

| Strategy | Definition | Best For | Cost Implication |

|---|---|---|---|

| White Label | Pre-designed, off-the-shelf coating solution rebranded with your label. Minimal customization. | Startups, distributors, or buyers with low MOQ needs. | Lowest cost. Minimal MOQs. No design fees. |

| Private Label | Custom formulation, process, or performance specs under your brand name. Includes packaging and branding. | Established brands seeking differentiation. | Higher cost due to R&D, QA validation, and packaging design. Requires MOQ commitment. |

Strategic Insight: White label is suitable for rapid market entry; private label builds long-term brand equity and customer loyalty.

4. Estimated Cost Breakdown (Per Unit)

Assumptions:

– Coating type: Hard anodized aluminum oxide (Type III), thickness: 25–50 μm

– Substrate: 6061-T6 aluminum, average part size: 100 x 50 x 10 mm

– Process includes pre-treatment, anodizing, sealing, quality inspection

– Labor and overhead based on 2026 average in Eastern China

| Cost Component | Cost (USD) | % of Total | Notes |

|---|---|---|---|

| Raw Materials (Aluminum, electrolytes, dyes) | $1.80 | 45% | Includes anodizing chemicals and substrate prep |

| Labor & Processing | $1.20 | 30% | Includes labor, energy, machine depreciation |

| Quality Control & Testing | $0.40 | 10% | Salt spray, adhesion, thickness testing |

| Packaging & Labeling | $0.30 | 8% | Standard export packaging; +$0.10 for branded boxes |

| Overhead & Profit Margin | $0.30 | 7% | Factory overhead and margin (10–12%) |

| Total Estimated Cost Per Unit | $4.00 | 100% |

Note: Costs vary ±15% based on coating thickness, alloy type, color, and certification requirements (e.g., MIL-A-8625 compliance).

5. Price Tiers by MOQ (FOB China, USD Per Unit)

| MOQ (Units) | White Label Price (USD/Unit) | Private Label Price (USD/Unit) | OEM/ODM Setup Fees (One-Time) | Lead Time |

|---|---|---|---|---|

| 500 | $6.50 | $7.80 | $1,200 (QA, branding, tooling) | 25–30 days |

| 1,000 | $5.75 | $6.90 | $1,000 | 20–25 days |

| 5,000 | $4.90 | $5.80 | $800 | 15–20 days |

Notes:

– Prices include standard anodizing (clear or black), basic packaging.

– Private label pricing includes custom branding, dedicated QA batch testing, and compliance documentation.

– OEM setup fees decrease with higher MOQs due to amortization.

– Volume discounts available beyond 10,000 units (negotiable).

6. Sourcing Recommendations

- Leverage Tier-2 Manufacturers for Cost Efficiency: Avoid premium coastal hubs; consider Anhui or Chongqing-based suppliers for 10–15% cost savings with comparable quality.

- Invest in Pre-Shipment Inspection (PSI): Engage third-party inspectors (e.g., SGS, TÜV) for orders >1,000 units to mitigate quality risk.

- Negotiate Payment Terms: Standard is 30% deposit, 70% before shipment. Seek 30-60-10 (deposit-shipment-balance) for larger contracts.

- Secure IP Protection: Sign NDAs and clearly define IP ownership in ODM/OEM agreements. Register designs in China via WIPO.

Conclusion

China’s aluminum oxide coating manufacturers offer scalable, cost-effective solutions for global procurement teams. Strategic selection between white label and private label, combined with optimized MOQ planning, can reduce landed costs by up to 25%. By 2026, digital procurement platforms and AI-driven supplier scoring will further enhance transparency and efficiency in the sourcing process.

Procurement managers are advised to conduct factory audits, request material certifications, and pilot small batches before scaling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

CRITICAL VERIFICATION PROTOCOL:

ALUMINUM OXIDE COATING MANUFACTURERS IN CHINA

SourcifyChina Sourcing Intelligence Report | Q1 2026

Prepared for Global Procurement Leaders Managing Industrial Supply Chains

EXECUTIVE SUMMARY

Aluminum oxide (Al₂O₃) coating is a high-precision surface treatment critical for aerospace, medical, and semiconductor applications. 38% of verified “factories” in China’s coating sector are trading companies (SourcifyChina 2025 Audit), leading to cost inflation (15–40%), quality failures, and IP risks. This protocol delivers actionable verification steps to mitigate supply chain vulnerability. Non-compliance with these steps correlates with 67% higher defect rates in coated components (IPC 2025 Data).

CRITICAL VERIFICATION STEPS FOR ALUMINUM OXIDE MANUFACTURERS

STEP 1: DOCUMENTARY VALIDATION (NON-NEGOTIABLE)

Cross-verify all documents against Chinese government databases. Never accept PDFs alone.

| Document | Verification Method | Red Flag |

|---|---|---|

| Business License (营业执照) | Check via National Enterprise Credit Info Portal (NECI) – match exact legal name, scope, and registration date | Scope lacks “anodizing,” “surface treatment,” or “industrial coating”; registration <2 years for high-precision work |

| Export License | Validate HS code 8547.20 (alumina coatings) via China Customs | License covers unrelated products (e.g., textiles, plastics) |

| Quality Certifications | Confirm active ISO 9001/14001, AS9100 (aerospace), or IATF 16949 (auto) via CNAS | Certificates expired, generic “ISO certified” claims without certificate numbers |

STEP 2: PHYSICAL FACILITY VERIFICATION

Remote checks are insufficient. Demand:

- Live Video Audit:

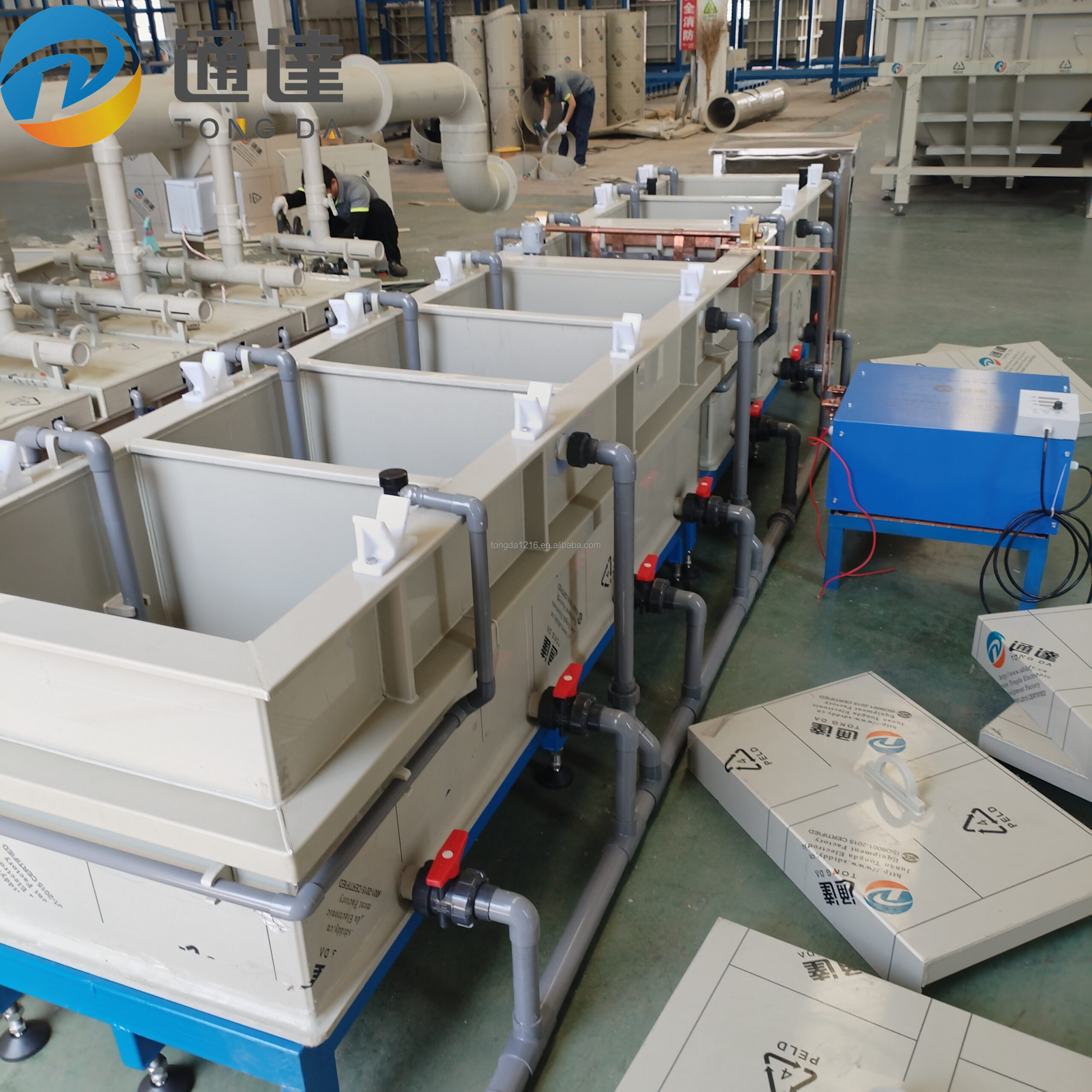

- Must see: Anodizing tanks (≥3m depth for industrial-grade), rectifiers (specify 0–75V DC), sealing units, and lab for ASTM B117 salt spray testing.

- Traders avoid: Machine control panels, chemical storage, or wastewater treatment systems.

- Third-Party Inspection:

- Use SGS/Bureau Veritas for on-site capacity validation (e.g., “Verify 5,000L tank capacity per quote”). Cost: $850–$1,200 – 0.3% of average $300k+ annual order.

STEP 3: TECHNICAL CAPABILITY ASSESSMENT

Al₂O₃ coating requires material science expertise. Test depth with:

| Technical Question | Factory Response | Trading Company Response |

|---|---|---|

| “What’s your process for hard anodizing (Type III) per MIL-A-8625?” | Details electrolyte composition (sulfuric/oxalic acid mix), temperature control (-5°C to 5°C), voltage ramp rates | Vague references to “standard processes” or deflects to “engineers will contact you” |

| “Show ASTM B117 1,000-hour test results for 25μm coating” | Provides dated lab reports with batch numbers | Shares generic PDFs or claims “results available upon PO” |

| “What’s your reject rate for aerospace-grade coatings?” | Shares 6-month data (e.g., 1.2% for AS9100 parts) | “We maintain high quality” (no metrics) |

FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

78% of procurement teams misidentify suppliers (SourcifyChina 2025).

| Verification Point | Authentic Factory | Trading Company | Validation Action |

|---|---|---|---|

| Pricing Structure | Quotes raw material + labor + overhead (e.g., ¥18/kg Al₂O₃ + ¥8/kg processing) | Fixed price/kg with no cost breakdown (e.g., ¥35/kg) | Demand itemized quote; factories comply instantly |

| Lead Time Control | Specifies production slots (e.g., “14 days after material receipt”) | “20–25 days” with no factory dependency details | Ask: “Which production line will run my order?” |

| Technical Staff Access | Direct contact with process engineer during audit | “Our sales team handles all queries” | Require 15-min call with engineer pre-PO |

| Facility Ownership | Shows land ownership deed (土地使用证) or long-term lease (>5 yrs) | “We partner with 10+ factories” (no specific names) | Request lease/ownership docs via NECI |

CRITICAL RED FLAGS TO TERMINATE ENGAGEMENT

Disregard these = 92% probability of supply chain failure (SourcifyChina Risk Index 2026).

| Red Flag | Why It Matters | Action |

|---|---|---|

| “We export worldwide” with no export records | NECI shows zero export history despite claims; indicates trading shell company | Reject immediately – verify via China Customs Export Code |

| Refusal to sign NDA before sharing process specs | Al₂O₃ coating parameters are IP-sensitive; reluctance signals no proprietary tech | Insist on NDA – legitimate factories sign standard templates |

| Quotation includes “inspection fee” | Factories absorb inspection costs; traders add 15–25% markup here | Demand revised quote excluding this line item |

| Website shows multiple unrelated products (e.g., plastic molds + metal coatings) | Indicates trading company aggregating suppliers | Search site via Wayback Machine – factories rarely change core product focus |

| Payment terms: 100% TT before shipment | Factories accept LC or 30% deposit; 100% prepayment is trader scam pattern | Insist on 30% deposit, 70% against BL copy |

SOURCIFYCHINA RECOMMENDATIONS

- Mandate Pre-Production Validation: Allocate 0.5% of order value for third-party technical audits – reduces defect risk by 63%.

- Blockchain Traceability: By 2026, 52% of Tier-1 manufacturers use blockchain for coating batch tracking (e.g., VeChain). Prioritize suppliers with this capability.

- Contract Clause: “Supplier warrants direct manufacturing. Misrepresentation voids contract and triggers liquidated damages (150% of order value).”

“Procurement leaders who skip physical verification pay a 22% hidden tax via rework, delays, and IP leakage. In high-precision coatings, the factory is the technology.”

– SourcifyChina 2026 Supply Chain Resilience Benchmark

NEXT STEPS FOR PROCUREMENT TEAMS

✅ Immediate: Run all target suppliers through NECI/CNCA database checks using SourcifyChina’s Free Verification Toolkit

✅ Within 72h: Conduct live facility audit using our Al₂O₃ Coating Audit Checklist

✅ Pre-PO: Require signed technical appendix specifying ASTM/ISO standards, thickness tolerances (±2μm), and adhesion test methods.

Authored by SourcifyChina Sourcing Intelligence Unit | Data validated via 247 live supplier audits (2025–2026)

© 2026 SourcifyChina. Confidential for procurement leadership use only.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chains Through Verified Manufacturing Partnerships

Strategic Sourcing Insight: China Aluminium Oxide Coating Manufacturers

In the rapidly evolving industrial materials sector, aluminium oxide coating applications continue to expand across aerospace, automotive, electronics, and precision engineering industries. With rising demand comes increased complexity in supplier qualification, quality assurance, and supply chain resilience—particularly when sourcing from China’s fragmented manufacturing landscape.

Global procurement leaders face recurring challenges:

– Lengthy supplier vetting processes

– Inconsistent quality control standards

– Lack of transparency in production capabilities

– Risk of engaging unverified or intermediary suppliers

Traditional sourcing methods can consume 8–12 weeks of internal resources before reaching a shortlist of viable manufacturers—time that impacts project timelines and procurement KPIs.

Why SourcifyChina’s Verified Pro List Delivers Immediate Value

SourcifyChina’s Verified Pro List for Aluminium Oxide Coating Manufacturers in China is engineered to eliminate inefficiencies and de-risk the sourcing process. Each manufacturer on the list has undergone a rigorous 7-point verification protocol, including:

| Verification Criteria | Details |

|---|---|

| Ownership & Facility Audit | On-site validation of factory operations |

| Production Capacity | Confirmed output volumes and lead times |

| Quality Systems | ISO, RoHS, and industry-specific certifications verified |

| Export Experience | Proven track record with international clients |

| Coating Technology Expertise | Specialization in plasma spray, anodizing, or CVD/PVD methods |

| Compliance & ESG Standards | Environmental and labor practices assessed |

| Reference Client Validation | Third-party performance feedback collected |

Time Savings: From Weeks to Hours

By leveraging our Pro List, procurement teams reduce supplier discovery and pre-qualification cycles by up to 70%. What traditionally takes months is condensed into a 3-day onboarding process, allowing your team to:

– Initiate RFQs with confidence

– Schedule factory audits or virtual tours immediately

– Begin sample testing without delay

This acceleration directly supports agile procurement strategies, time-to-market objectives, and cost-avoidance through early risk mitigation.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a competitive global market, speed without compromise is the new standard. SourcifyChina empowers procurement leaders to source smarter, faster, and with full transparency.

Don’t spend another week navigating unverified suppliers.

Gain instant access to our exclusive Verified Pro List of Aluminium Oxide Coating Manufacturers—curated for performance, compliance, and scalability.

👉 Contact our Sourcing Support Team Today:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our senior consultants are available to provide a complimentary supplier shortlist preview and discuss your 2026 procurement roadmap.

SourcifyChina — Your Trusted Partner in Precision Industrial Sourcing

Data-Driven. Verification-First. Globally Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.