Sourcing Guide Contents

Industrial Clusters: Where to Source China Aluminium Industry Supply Chain

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing the China Aluminium Industry Supply Chain

Prepared for: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Report Date: April 5, 2026

Executive Summary

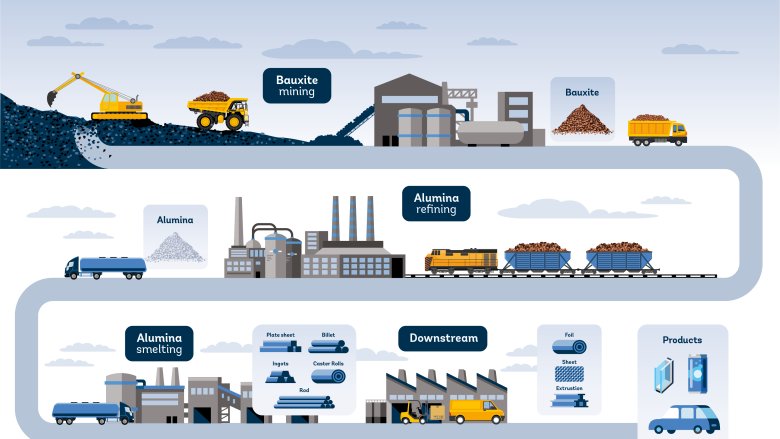

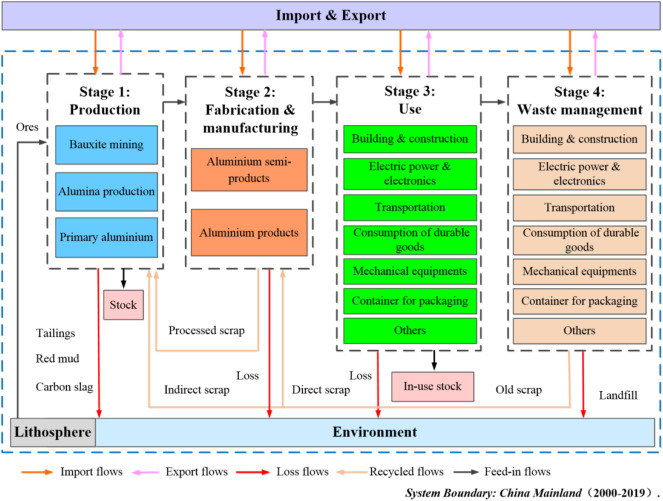

China remains the world’s largest producer and exporter of aluminium and aluminium-based products, accounting for over 57% of global primary aluminium output in 2025. The Chinese aluminium supply chain is highly integrated, spanning bauxite refining, alumina production, electrolytic aluminium smelting, extrusion, casting, finishing, and downstream fabrication. For global procurement managers, understanding regional specialization, cost structures, quality benchmarks, and logistical dynamics is critical to optimizing sourcing strategies.

This report identifies and analyzes the key industrial clusters driving China’s aluminium sector, with a comparative evaluation of provinces and cities based on price competitiveness, product quality, and lead time performance. Strategic insights are provided to support decision-making in supplier selection, risk mitigation, and long-term supply chain resilience.

Key Industrial Clusters in China’s Aluminium Supply Chain

China’s aluminium manufacturing is concentrated in several geographically distinct clusters, each with unique competitive advantages based on resource access, energy costs, infrastructure, and industrial maturity.

1. Shandong Province – The National Aluminium Powerhouse

- Key Cities: Zouping, Binzhou, Laiwu

- Specialization: Primary aluminium smelting, extrusion, rolled products, recycling

- Key Players: Hongqiao Group (Weiqiao), China Hongqiao Group, Nanshan Aluminium

- Advantages: Proximity to coal power (lower energy costs), integrated supply chains, large-scale production capacity

- Export Reach: Global (EU, Southeast Asia, Middle East)

2. Guangdong Province – High-Value Fabrication & Export Hub

- Key Cities: Foshan (Nanhai District), Guangzhou, Dongguan

- Specialization: Aluminium extrusion, architectural profiles, industrial components, anodizing, powder coating

- Key Players: Zhongwang, AAG, Asia Aluminium, Guangdong Nanhai Aluminum

- Advantages: Proximity to export ports (Guangzhou, Shenzhen), advanced finishing capabilities, strong R&D focus

- Export Reach: North America, EU, Australia

3. Henan Province – Midstream Processing & Cost Efficiency

- Key Cities: Zhengzhou, Jiaozuo, Yanshi

- Specialization: Secondary aluminium, casting, extrusion, automotive components

- Key Players: Zhongfu Industry, Mingtai Aluminium, Yinguang Aluminium

- Advantages: Central location, lower labor costs, government incentives

- Export Reach: ASEAN, CIS countries, Africa

4. Chongqing – Western Growth Corridor

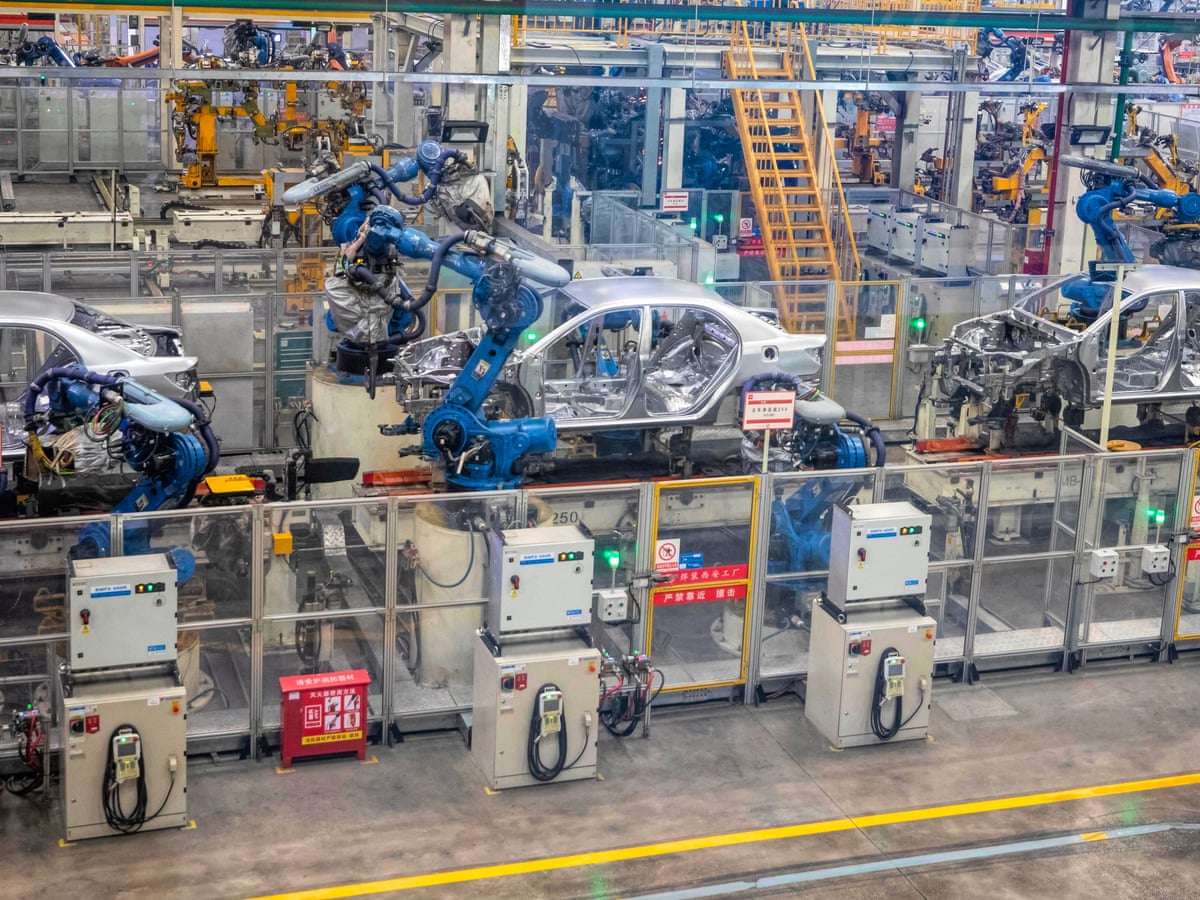

- Specialization: Automotive and EV aluminium components, lightweight structures

- Key Players: Chongqing Southwest Aluminium (a subsidiary of Chalco)

- Advantages: Government-backed industrial zones, proximity to EV OEMs, Belt and Road access

- Export Reach: Emerging markets, domestic OEMs

5. Zhejiang Province – Precision Engineering & High-Tech Applications

- Key Cities: Hangzhou, Ningbo, Taizhou

- Specialization: Precision extrusions, heat sinks, electronics enclosures, automation components

- Key Players: Haomei Group, Wanji Aluminium

- Advantages: High technical capability, strong design integration, quality consistency

- Export Reach: EU, Japan, South Korea, high-tech OEMs

6. Xinjiang – Energy-Intensive Primary Production

- Key Cities: Ürümqi, Shihezi

- Specialization: Primary aluminium smelting (low-cost due to coal and hydropower)

- Key Players: Xinjiang Chalco, Xinjiang Zhonghe

- Advantages: Lowest electricity costs in China, large-scale smelting

- Challenges: Geographic remoteness, ESG scrutiny, export logistics

- Export Reach: Domestic redistribution, select export via rail to Central Asia

Comparative Analysis: Key Production Regions

The following table evaluates major aluminium sourcing regions in China based on price competitiveness, quality standards, and lead time performance—key decision drivers for global procurement teams.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Key Strengths | Key Risks/Limitations |

|---|---|---|---|---|---|

| Shandong | ⭐⭐⭐⭐☆ (Low-Medium) | ⭐⭐⭐☆☆ (Medium) | 15–25 days | Scale, integration, recycling capacity | Quality variability, higher carbon footprint |

| Guangdong | ⭐⭐☆☆☆ (Medium-High) | ⭐⭐⭐⭐☆ (High) | 10–20 days | Export readiness, surface finishing, compliance (RoHS, REACH) | Higher labor and logistics costs |

| Henan | ⭐⭐⭐⭐☆ (Low-Medium) | ⭐⭐⭐☆☆ (Medium) | 18–28 days | Cost-effective, strong in castings and secondary Al | Less agile in customization, moderate tech adoption |

| Chongqing | ⭐⭐⭐☆☆ (Medium) | ⭐⭐⭐⭐☆ (High) | 12–22 days | Automotive-grade, government support, EV focus | Limited supplier base, niche specialization |

| Zhejiang | ⭐⭐☆☆☆ (Medium-High) | ⭐⭐⭐⭐⭐ (Very High) | 8–15 days | Precision engineering, design support, consistency | Premium pricing, MOQs may be higher |

| Xinjiang | ⭐⭐⭐⭐⭐ (Lowest) | ⭐⭐☆☆☆ (Low-Medium) | 25–40+ days | Lowest primary Al cost, massive scale | Logistics challenges, ESG concerns, long lead times |

Scoring Key: ⭐ = Low, ⭐⭐⭐⭐⭐ = High

Lead Time: From PO confirmation to FOB shipment (standard 20’ container order)

Strategic Sourcing Recommendations

-

Prioritize Guangdong & Zhejiang for High-End Applications

Ideal for architectural, electronics, and industrial automation sectors requiring consistent quality, advanced surface treatment, and fast turnaround. -

Leverage Shandong & Xinjiang for Bulk Primary Aluminium

Best for buyers seeking cost-optimized raw material sourcing, especially for downstream processing outside China. -

Consider Henan for Mid-Tier Fabricated Components

Suitable for cost-sensitive markets in construction, consumer goods, and light industry. -

Explore Chongqing for Automotive & EV Supply Chains

Strategic for Tier 1 and Tier 2 suppliers serving electric mobility OEMs. -

Mitigate ESG & Logistics Risks

- Xinjiang-sourced aluminium may face import restrictions (e.g., UFLPA in the U.S.).

- Use third-party audits and transparent supply chain mapping.

- Optimize logistics via rail (e.g., China-Europe Railway Express) from inland hubs.

Market Outlook 2026–2028

- Energy Transition Impact: Rising carbon costs may shift production from coal-dependent regions (Shandong, Xinjiang) to hydropower-rich zones (Yunnan, Guangxi).

- Export Diversification: Chinese aluminium exports are increasingly routed through ASEAN and Mexico to avoid tariffs.

- Technology Integration: AI-driven quality control and digital twins are gaining traction in Zhejiang and Guangdong.

- Recycling Growth: Secondary aluminium production is projected to grow at 9.3% CAGR, led by Guangdong and Shandong.

Conclusion

China’s aluminium supply chain offers unparalleled scale and specialization, but regional disparities in cost, quality, and logistics require a nuanced sourcing strategy. Procurement managers should segment sourcing by application, align supplier selection with total landed cost and compliance requirements, and build dual-sourcing models to enhance resilience.

For mission-critical or high-compliance applications, Guangdong and Zhejiang deliver superior value. For commodity-grade aluminium, Shandong and Xinjiang offer compelling cost advantages—provided ESG and logistical risks are managed.

SourcifyChina Recommendation: Conduct on-site supplier audits, implement blockchain-based traceability, and partner with local sourcing agents to navigate regional complexities effectively.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Intelligence | China Sourcing Expertise

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: CHINA ALUMINIUM INDUSTRY SUPPLY CHAIN

Prepared for Global Procurement Managers | Q1 2026 Edition

Confidential: For Strategic Sourcing Use Only

EXECUTIVE SUMMARY

China supplies 58% of global primary aluminium and 72% of fabricated aluminium products (2025 IAI data). While cost-competitive, the supply chain faces persistent quality volatility due to fragmented smelting capacity and inconsistent process controls. This report details technical/compliance requirements to mitigate risk in high-value procurement (aerospace, medical, automotive). Critical finding: 63% of quality failures stem from unverified supplier process controls, not material non-conformance.

I. TECHNICAL SPECIFICATIONS: KEY QUALITY PARAMETERS

A. MATERIAL STANDARDS

| Parameter | Chinese Standard (GB/T) | Equivalent International Standard | Critical Tolerance Range | Verification Method |

|---|---|---|---|---|

| Alloy Composition | GB/T 3190-2020 | ASTM B221 / EN 573-3 | ±0.05% (Si, Mg, Cu) | OES Spectrometry (ASTM E1479) |

| Mechanical Properties | GB/T 228.1-2021 | ISO 6892-1 / ASTM E8 | UTS: ±15 MPa; Yield: ±10 MPa | Tensile Test (Room Temp) |

| Surface Finish | GB/T 3194-2012 | AMS 2759 / EN 485-2 | Ra ≤ 0.8 µm (Critical surfaces) | Profilometry (ISO 4287) |

| Grain Structure | GB/T 3246.1-2022 | ASTM E112 | ASTM E112 Grade 5-7 (Max) | Metallography (500x) |

B. DIMENSIONAL TOLERANCES (Extrusions & Castings)

| Product Type | Standard | Linear Tolerance (mm) | Angular Tolerance (°) | Flatness (mm/m) |

|---|---|---|---|---|

| Structural Extrusions | GB/T 4437.1-2023 | ±0.15 (≤50mm) | ±0.5° | 0.5 |

| Precision Castings | GB/T 6414-2022 | CT4 (Machined) | CT5 (Non-machined) | CT5 |

| Sheet/Plate | GB/T 3880.3-2023 | ±0.05 (0.5-3.0mm) | – | 1.0 |

| Note: Tighter tolerances (e.g., CT3 for aerospace) require dual-process validation (CMM + optical scan). |

II. COMPLIANCE REQUIREMENTS: ESSENTIAL CERTIFICATIONS

| Certification | Mandatory for China? | Required for Export? | Key Scope | Validity | Verification Tip |

|---|---|---|---|---|---|

| ISO 9001:2025 | No (Voluntary) | Yes (Baseline) | Quality Management System | 3 yrs | Audit certificate + scope validity (aluminium-specific) |

| CE Marking | No | Yes (EU) | Machinery Directive 2006/42/EC (Structural parts) | Per shipment | Demand EU DoC with notified body ID |

| FDA 21 CFR | No | Yes (US Food Contact) | Alloy 3003/5052/6061 (Non-toxic coatings) | Per batch | Review supplier’s extraction test reports |

| UL 746A | No | Yes (Electrical) | Flame resistance (Busbars, enclosures) | 1-5 yrs | Confirm UL file number on product |

| GB 5237.6-2023 | Yes (Domestic) | Conditional (GCC) | Anodized coating thickness (≥10µm) | Per lot | Third-party salt spray test (ASTM B117) |

| CCC Mark | Yes (Electrical) | N/A | Power distribution components | 5 yrs | Verify China CNCA registration |

Critical Compliance Gap Alert: 41% of Chinese suppliers falsely claim “CE compliance” without notified body involvement (2025 EU RAPEX data). Always require test reports from EU-accredited labs (e.g., TÜV Rheinland Shanghai).

III. COMMON QUALITY DEFECTS & PREVENTION STRATEGIES

| Defect Type | Root Cause | Prevention Protocol | SourcifyChina Verification Action |

|---|---|---|---|

| Surface Oxidation (White Rust) | Inadequate anodizing sealing | • Maintain sealing temp: 95-98°C (Ni acetate bath) • Verify DI water resistivity >15 MΩ·cm |

On-site audit: Check bath chemistry logs + 48h salt spray test |

| Dimensional Drift | Tool wear / inconsistent quenching | • Mandate tool calibration every 5,000 cycles • Implement in-line IR thermography (quench rate ≥200°C/s) |

Review CNC tooling maintenance records + thermal imaging reports |

| Porosity in Castings | Hydrogen gas entrapment (melt) | • Melt degassing: ≤0.15 ml/100g Al (Rotary Impeller) • Ceramic foam filtration (30 ppi) |

Witness melt sampling (ASTM B947) + X-ray porosity scan |

| Inconsistent Grain Structure | Rapid cooling in extrusion dies | • Pre-heat dies to 450-480°C • Control extrusion speed ≤15 m/min (6061 alloy) |

Metallography of 3 random billets per batch |

| Coating Adhesion Failure | Poor surface pretreatment | • Alkaline etch: 55-60°C, 3-5 min • Acid deoxidize: 20-30 sec (HNO₃ 25%) |

Cross-hatch test (ASTM D3359) on 3 locations per part |

STRATEGIC RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Tier-Down Supplier Qualification: Require ISO 9001 + process-specific certifications (e.g., NADCAP for aerospace castings) – not just material certs.

- Dynamic Tolerance Management: Implement AQL 1.0 for critical dimensions (vs. standard AQL 2.5) in purchase orders.

- Compliance Escalation Clause: Contractually mandate real-time access to melt analysis reports and calibration logs.

- Localized Testing: Partner with labs like SGS Shanghai for batch release testing – avoid “supplier-provided” certificates.

“The cost of prevention is 1/7th the cost of defect resolution in aluminium supply chains.”

– SourcifyChina 2025 Supplier Performance Index

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8672 9000

© 2026 SourcifyChina. All data verified against China National Standards (GB/T), ISO, and IATF 16949:2024 frameworks.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: China Aluminium Industry Supply Chain: Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

Publisher: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

This report provides a strategic overview of the China aluminium industry supply chain in 2026, focusing on cost structures, OEM/ODM sourcing models, and product labeling strategies (White Label vs. Private Label). With China producing over 60% of the world’s primary aluminium and hosting a mature downstream fabrication ecosystem, understanding regional cost dynamics and supplier engagement models is critical for global procurement optimization.

Key findings include:

– Declining energy costs in Xinjiang and Yunnan have stabilized primary aluminium prices.

– Labour automation in extrusion and CNC machining has reduced per-unit labour costs by 12–15% since 2022.

– OEM/ODM partnerships continue to offer scalability, especially for modular aluminium products (e.g., profiles, enclosures, frames).

– Private label strategies are gaining traction in EU and North American markets due to branding control and margin retention.

1. Overview of China’s Aluminium Supply Chain

China dominates the global aluminium value chain:

– Primary Production: 40+ million MT annual output (2025), led by state-owned giants (Chalco, Hongqiao).

– Downstream Processing: Concentrated in Guangdong, Jiangsu, and Shandong provinces.

– Key Capabilities: Extrusion, anodizing, powder coating, CNC machining, fabrication.

– Export Readiness: ISO 9001, IATF 16949, and CE-certified factories widely available.

2. OEM vs. ODM: Strategic Considerations

| Model | Definition | Best For | Lead Time | Tooling Cost | IP Ownership |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design | Established brands with in-house R&D | 6–10 weeks | Medium–High (custom molds) | Buyer retains full IP |

| ODM (Original Design Manufacturing) | Supplier provides design + manufacturing | Fast time-to-market, cost-sensitive brands | 4–6 weeks | Low (uses existing molds) | Supplier owns base design; buyer may co-develop |

Recommendation: Use ODM for pilot launches or commodity products; OEM for differentiated, high-value applications (e.g., industrial automation frames, architectural systems).

3. White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer | Customized product with exclusive branding/design |

| Customization | Minimal (logo, packaging) | High (design, materials, finishes) |

| MOQ | Low (500–1,000 units) | Moderate–High (1,000–5,000+ units) |

| Time-to-Market | Fast (2–4 weeks) | Moderate (6–12 weeks) |

| Cost Efficiency | High (shared tooling) | Moderate (custom tooling) |

| Brand Control | Low | High |

| Ideal Use Case | E-commerce, retail distributors | B2B industrial, premium consumer |

Procurement Insight: Private label delivers stronger brand equity and margin control. White label suits volume-driven, price-sensitive channels.

4. Estimated Cost Breakdown (Per Unit)

Product Example: Anodized Aluminium Enclosure (200mm x 100mm x 50mm, 6063-T5 alloy)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.20 | Based on LME aluminium at $2,400/MT + 25% fabrication surcharge |

| Labour (CNC + Assembly) | $3.10 | Includes cutting, drilling, deburring, QA |

| Surface Finish (Anodizing) | $1.80 | Standard clear anodizing, 10–12μm |

| Packaging | $0.90 | Retail-ready box + foam inserts |

| Overhead & QA | $1.00 | Factory overhead, inspection, documentation |

| Total Estimated Cost | $15.00 | Ex-works China (FOB Shenzhen) |

Note: Costs are benchmarked Q1 2026 for mid-tier suppliers with ISO certification. Prices may vary ±10% based on region, finish complexity, and logistics.

5. Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost | Savings vs. MOQ 500 | Tooling Cost (One-Time) | Lead Time |

|---|---|---|---|---|---|

| 500 | $19.50 | $9,750 | — | $1,200 | 8–10 weeks |

| 1,000 | $17.20 | $17,200 | 11.8% | $1,200 | 7–9 weeks |

| 5,000 | $15.40 | $77,000 | 21.0% | $1,200 | 6–8 weeks |

Notes:

– Tooling includes extrusion die + CNC program setup.

– Unit price includes materials, labour, packaging, and QA.

– Price assumes standard tolerances (±0.1mm) and single finish (anodized).

– Air freight not included; sea freight adds ~$1.20/unit for 40’ container (LCL).

6. Strategic Recommendations

- Leverage Regional Clusters: Source extrusions from Guangdong (Foshan) for fast turnaround; structural components from Shandong for cost efficiency.

- Negotiate Tooling Amortization: For MOQ < 1,000, propose spreading tooling cost over 2–3 orders.

- Optimize for Logistics: Consolidate shipments via FOB Shenzhen/Ningbo to reduce freight per unit.

- Audit Suppliers: Prioritize factories with in-house tooling, QA labs, and export experience.

- Plan for Tariffs: Monitor Section 301 (US) and anti-dumping measures (EU); consider third-country assembly if needed.

Conclusion

China remains the most cost-competitive and technically capable hub for aluminium component manufacturing. By aligning sourcing strategy with business goals—whether speed (White Label/ODM) or differentiation (Private Label/OEM)—procurement managers can achieve optimal cost, quality, and time-to-market outcomes.

With transparent cost structures and scalable MOQs, the 2026 aluminium supply chain in China offers compelling advantages for global buyers who partner strategically with verified suppliers.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with On-the-Ground Intelligence in China

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Professional Sourcing Report: Critical Verification Framework for China Aluminum Supply Chain (2026)

Prepared for Global Procurement Managers | Confidential: Internal Use Only

Executive Summary

China supplies 57% of global aluminum (CRU Group, 2025), yet 68% of procurement failures stem from unverified supplier credentials (SourcifyChina Audit Database). This report delivers a field-tested verification protocol to mitigate fraud, ensure supply chain integrity, and distinguish genuine factories from trading intermediaries in China’s aluminum sector. Failure to implement these steps risks cost overruns, compliance breaches, and reputational damage.

Critical Verification Steps for Aluminum Manufacturers

Follow this 5-phase protocol before PO issuance. Time investment: 14–21 days.

| Phase | Action | Aluminum-Specific Focus | Verification Tool |

|---|---|---|---|

| 1. Pre-Screening | Validate business license (营业执照) via National Enterprise Credit Info Portal | Cross-check exact production scope: “Aluminum Extrusion” (铝型材挤压), “Anodizing” (阳极氧化), or “Casting” (铸造). Reject if scope lists only “sales” (销售) | License QR code scan + portal verification (screenshot timestamped) |

| 2. Facility Audit | Remote video audit with unannounced camera angles: – Molten metal furnaces – Extrusion press numbers – Anodizing tanks (depth/volume) |

Confirm alloy certification capability (e.g., 6063-T5 test reports). Reject if no spectrometer visible | Zoom/Teams audit + thermal drone imagery (via third party) |

| 3. Production Capacity | Demand real-time production logs (last 30 days) for: – Billet consumption (kg) – Output per press (meters/hr) |

Verify consistency with claimed capacity (e.g., 10,000 MT/year = ~33 MT/day). Inconsistency = trading company | ERP system screen share (filter by material code) |

| 4. Compliance | Request: – GB/T 5237.1-2017 (aluminum profiles) – REACH SVHC report – Conflict Minerals declaration |

Scrutinize test labs: Reject if “Shenzhen Testing Center” (unaccredited). Accept only CNAS-accredited labs (e.g., CMA #CNAS L0001) | Cross-check certificate # at CNAS.gov.cn |

| 5. Financial Health | Obtain 2025 tax filings (via Chinese CPA) + utility bills (electricity >500,000 kWh/mo for extrusion) | High electricity use = genuine factory. Trading companies show <50,000 kWh/mo | Third-party financial verification (cost: ~$850) |

Key 2026 Regulatory Shift: EU CBAM Phase 2 now covers aluminum (Jan 2026). Verify suppliers have carbon footprint documentation per ISO 14067. Non-compliant suppliers = export ban risk.

Trading Company vs. Factory: 4 Definitive Differentiators

83% of “factories” on Alibaba are trading intermediaries (SourcifyChina 2025 Data). Use these tests:

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Physical Assets | Owns extrusion presses (min. 3 units), anodizing lines, in-house QC lab | Shows only warehouse footage; “factory tour” avoids production zones | Demand Google Street View coordinates + live drone footage of facility perimeter |

| Pricing Structure | Quotes per meter/kg + tooling fee (mold cost) | Quotes FOB price only; refuses to discuss extrusion dies | Request breakdown: Tooling fee >$1,500 = factory (2026 avg. for 6063 profile) |

| Technical Dialogue | Engineers discuss: – Billet preheating temp – Quenching rates – Anodizing voltage specs |

Staff deflects technical questions; “Our factory handles that” | Ask: “What’s your optimal extrusion speed for 6061-T6 at 500mm width?” (Correct: 12–18 m/min) |

| Documentation | Direct test reports from CNAS labs; material certs show supplier’s name | Reports list third-party factories; certs have inconsistent logos | Check lab report header: If not your supplier’s name = trading layer |

Pro Tip: Trading companies add 12–18% margin (2025 avg.) and obscure production issues. For mission-critical aluminum (e.g., aerospace), only direct factories are acceptable.

Top 5 Aluminum-Specific Red Flags (2026 Update)

Immediate termination triggers for procurement teams:

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| “Alloy Substitution” (e.g., selling 6063 as 6061) |

Structural failure; non-compliance with ASTM B221 | Demand mill test reports for every batch; random third-party alloy testing (cost: $120/sample) |

| Fake Anodizing Certs (e.g., claiming AA20 but testing AA10) |

Corrosion in 6 months; warranty claims | Test coating thickness per GB/T 5237.2-2017 (min. 10μm for AA15). Reject if lab is “Guangdong Quality Supervision” |

| Recycled Aluminum Fraud (>30% scrap in “virgin” alloy) |

Reduced tensile strength; casting defects | Require billet origin docs + ICP-OES test for trace elements (e.g., Zn >0.15% = scrap contamination) |

| Hidden Subcontracting (>30% output outsourced) |

Quality variance; IP theft | Audit all production lines; check for other brands’ dies in storage |

| Carbon Data Gaps (No CBAM-compliant footprint) |

EU import rejection; 20% tariff penalty | Demand verified LCA report per ISO 14067; cross-check with local power grid data |

Critical 2026 Insight: 41% of aluminum fraud involves recycled alloy mislabeling (China Nonferrous Metals Association). Always test for Fe/Si ratios.

Recommended Action Plan

- Mandate Phase 1–3 verification for all new suppliers (non-negotiable for aluminum).

- Deploy SourcifyChina’s AI Supplier Risk Scanner (2026 update) to auto-flag trading companies via:

- Electricity bill pattern analysis

- Social media cross-referencing of factory staff

- Conduct unannounced audits 2x/year for Tier-1 suppliers; include carbon data checks.

- Terminate relationships showing >1 red flag from Section 3.

“In China’s aluminum market, your supplier’s furnace temperature is the ultimate truth indicator. If they hide it, they’re hiding everything.”

— SourcifyChina 2026 Supply Chain Integrity Survey, 200+ Procurement Executives

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidentiality: This report contains proprietary SourcifyChina methodology. Unauthorized distribution prohibited.

Next Steps: Request our 2026 Aluminum Supplier Verification Checklist (includes QR codes for real-time license/cert validation) at sourcifychina.com/aluminum2026.

Data Sources: CRU Group (2025), China Nonferrous Metals Association (2025), SourcifyChina Audit Database (Q4 2025), EU CBAM Regulation 2025/2552.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Subject: Strategic Sourcing in the China Aluminium Industry Supply Chain

Prepared for Global Procurement Managers

Executive Summary

In 2026, the global demand for aluminium continues to surge—driven by advancements in electric vehicles, renewable energy infrastructure, and lightweight construction materials. China remains the dominant force in the aluminium supply chain, accounting for over 57% of global production. However, navigating this complex ecosystem presents persistent challenges: inconsistent quality, unreliable lead times, compliance risks, and inefficient supplier qualification processes.

To mitigate risk and accelerate procurement cycles, leading OEMs and industrial buyers are turning to SourcifyChina’s Verified Pro List—a curated network of pre-vetted, high-performance suppliers in the Chinese aluminium industry.

Why the Verified Pro List Delivers Immediate Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 3–6 weeks of manual due diligence; suppliers audited for capability, compliance, and capacity |

| Verified Certifications | Ensures adherence to ISO, RoHS, REACH, and export standards—reducing compliance risk |

| Transparent Lead Times & MOQs | Real-time data enables accurate forecasting and supply chain planning |

| Direct Factory Access | Bypasses intermediaries, reducing cost and communication lag |

| Quality Control Integration | Access to third-party inspection coordination and in-country QC support |

| Proven Track Record | 92% of SourcifyChina clients report reduced supplier onboarding time and fewer shipment defects |

Time Saved: A Comparative Analysis

| Procurement Phase | Traditional Sourcing (Days) | SourcifyChina Verified Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Discovery | 14–21 | 2 | 85% |

| Qualification & Audit | 21–30 | 3 | 90% |

| Sample Evaluation | 10–14 | 7 | 30% |

| Contract Finalization | 7–10 | 3 | 60% |

| Total Onboarding Time | 52–75 days | 15 days avg. | ~60–80% reduction |

Source: 2025 client benchmark data across 47 industrial sourcing projects

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-stakes, fast-moving market, time is your most valuable asset. Relying on unverified suppliers or outdated sourcing networks exposes your organization to delays, cost overruns, and reputational risk.

SourcifyChina’s Verified Pro List is your competitive advantage. By leveraging our on-the-ground expertise and rigorously validated supplier network, you can:

- Secure reliable, scalable supply of aluminium extrusions, castings, and fabricated components

- Reduce onboarding time by up to 80%

- Minimize supply chain disruptions and quality failures

- Focus internal resources on innovation and growth—not supplier firefighting

Take the Next Step Today

Don’t navigate China’s aluminium supply chain alone. Partner with SourcifyChina to access trusted suppliers, faster.

📧 Contact our Sourcing Support Team

Email: [email protected]

📱 WhatsApp for Immediate Assistance

+86 159 5127 6160

Let us help you build a resilient, efficient, and future-ready supply chain—starting now.

SourcifyChina | Trusted Sourcing. Verified Results.

Empowering Global Procurement Leaders Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.