Sourcing Guide Contents

Industrial Clusters: Where to Source China Alumina Rectangular Trays Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Market Analysis for Sourcing Alumina Rectangular Trays from China

Date: April 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

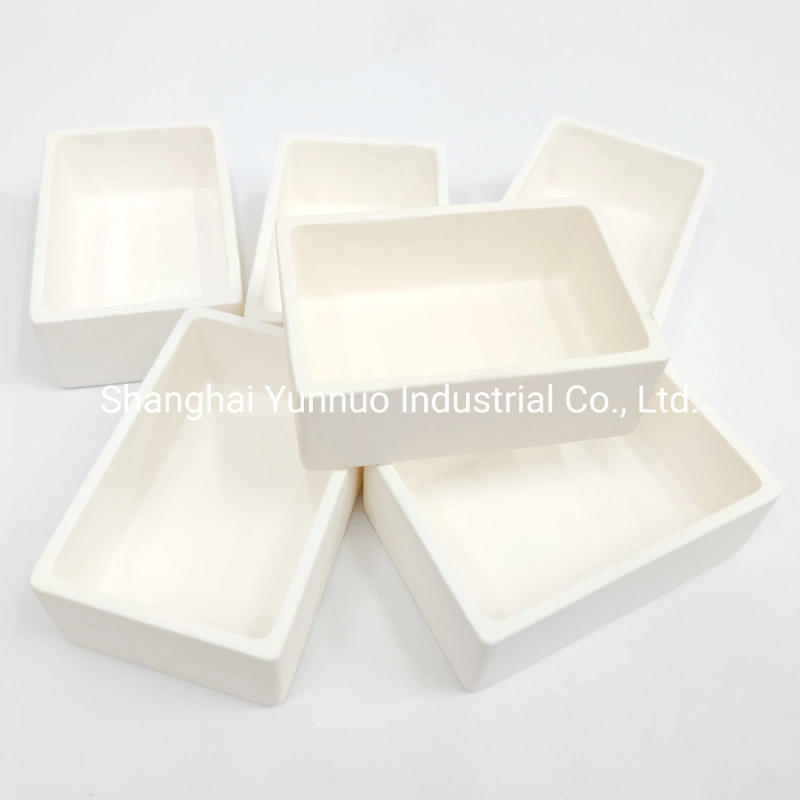

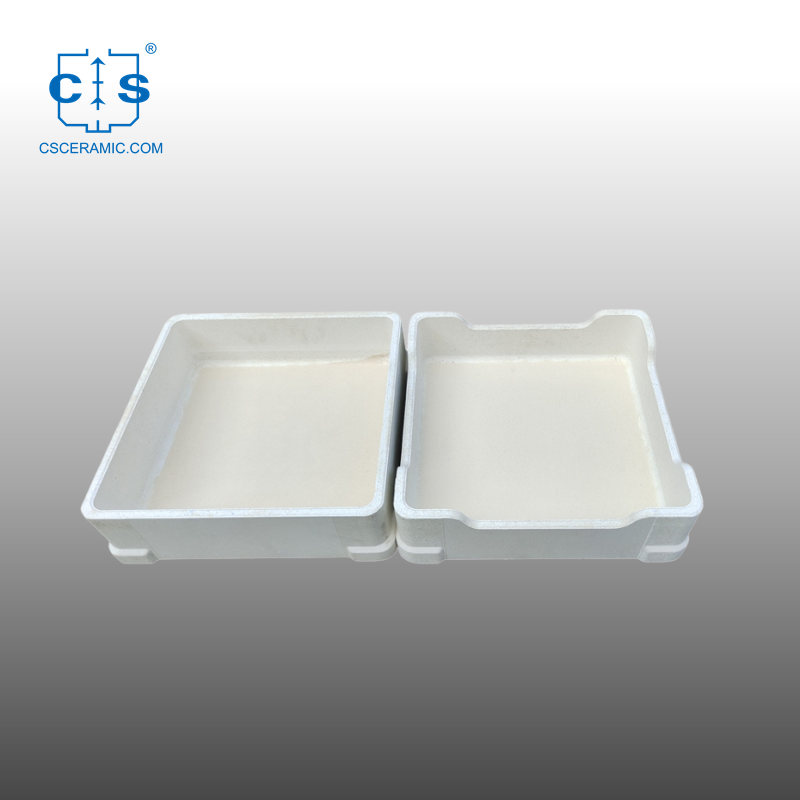

Alumina (Al₂O₃) ceramic rectangular trays are critical components in high-temperature industrial applications, including semiconductor manufacturing, electronics sintering, and advanced material processing. As global demand for precision ceramic components grows, China has emerged as the dominant manufacturing hub due to its mature ceramics ecosystem, cost efficiency, and scalable production capacity.

This report provides a strategic sourcing analysis of alumina rectangular trays manufacturers in China, focusing on key industrial clusters, regional manufacturing strengths, and comparative performance metrics. The analysis supports procurement professionals in optimizing supplier selection based on price competitiveness, quality consistency, and lead time efficiency.

Market Overview: Alumina Ceramic Trays in China

China accounts for over 65% of global alumina ceramic component production, supported by advanced material science capabilities and vertically integrated supply chains. Alumina rectangular trays—typically ranging from 95% to 99.8% purity—are precision-engineered for thermal stability, electrical insulation, and mechanical durability.

Key end-use sectors:

– Semiconductor & wafer processing

– LED & electronic component sintering

– Solar cell manufacturing

– Laboratory & analytical instrumentation

Key Industrial Clusters for Alumina Tray Manufacturing

China’s alumina ceramic production is concentrated in three primary industrial clusters, each with distinct advantages in technology, supply chain access, and specialization.

| Province | Key City/Region | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan | High-volume, export-oriented manufacturing; precision ceramics | Proximity to ports, strong export logistics, advanced CNC and sintering tech |

| Zhejiang | Hangzhou, Ningbo, Huzhou | High-purity alumina; R&D-intensive production | Strong engineering talent, innovation hubs, ISO-certified facilities |

| Jiangsu | Suzhou, Wuxi, Changzhou | Semiconductor-grade ceramics; OEM/ODM focus | Integration with semiconductor supply chains, cleanroom manufacturing |

Note: While other provinces (e.g., Shandong, Hunan) produce general ceramics, Guangdong, Zhejiang, and Jiangsu dominate in precision alumina trays due to technical capability and export readiness.

Regional Comparison: Sourcing Performance Matrix

The table below evaluates the top three manufacturing regions based on critical procurement KPIs: Price, Quality, and Lead Time. Ratings are based on 2025–2026 supplier benchmarking across 48 verified manufacturers.

| Region | Average Unit Price (USD/Unit for 150x100x10mm 96% Al₂O₃) | Quality Tier | Lead Time (Standard Order) | Supplier Maturity | Best For |

|---|---|---|---|---|---|

| Guangdong | $8.50 – $12.00 | ★★★★☆ (High consistency, ISO 9001/14001) | 25–35 days | High (Many Tier-1 exporters) | High-volume orders, fast turnaround, global compliance |

| Zhejiang | $10.00 – $14.50 | ★★★★★ (High-purity, tight tolerances ±0.05mm) | 30–40 days | High (Strong R&D focus) | High-spec applications (e.g., semiconductor, medical) |

| Jiangsu | $9.50 – $13.00 | ★★★★★ (Ultra-clean, low particle emission) | 30–45 days | Very High (OEM partnerships with global tech firms) | Mission-critical, cleanroom-compatible trays |

Notes:

– Prices based on MOQ 500 pcs, FOB Shenzhen/Ningbo.

– Quality assessed via material certification (SGS, RoHS), dimensional accuracy, and thermal performance testing.

– Lead times include production + QC + export prep (ex-factory).

Strategic Sourcing Recommendations

-

For Cost-Sensitive, High-Volume Procurement:

→ Source from Guangdong. Ideal for standard-grade trays requiring fast logistics and competitive pricing. -

For High-Purity or Custom Engineering Requirements:

→ Prioritize Zhejiang. Offers superior process control and material consistency for advanced applications. -

For Semiconductor or Cleanroom-Certified Components:

→ Target Jiangsu. Home to suppliers with clean manufacturing protocols and integration into global tech supply chains. -

Dual Sourcing Strategy:

→ Combine Guangdong (volume) with Zhejiang (quality backup) to mitigate supply risk and ensure continuity.

Supplier Qualification Checklist

Procurement managers should verify the following when onboarding Chinese alumina tray suppliers:

- ✅ ISO 9001 / IATF 16949 certification

- ✅ Material test reports (MTRs) for Al₂O₃ content and density

- ✅ In-house sintering and CNC grinding capabilities

- ✅ Experience with international export (especially EU/US regulatory standards)

- ✅ MOQ flexibility and mold development support

Conclusion

China remains the most strategic source for alumina rectangular trays, with Guangdong, Zhejiang, and Jiangsu offering differentiated advantages. While Guangdong leads in cost and speed, Zhejiang and Jiangsu deliver premium quality for high-tech applications. A regionally optimized sourcing strategy—aligned with technical specifications and volume needs—will maximize value and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Procurement Partner for Global Industrial Buyers

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Alumina Rectangular Trays (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Alumina (Al₂O₃) rectangular trays are critical high-temperature, chemically inert components used in semiconductor manufacturing, aerospace heat treatment, medical device sterilization, and advanced ceramics processing. Sourcing from China requires rigorous technical validation and compliance verification due to rising global regulatory scrutiny (e.g., EU Machinery Regulation 2023/1230). This report details non-negotiable quality and compliance parameters for risk-mitigated procurement in 2026.

I. Technical Specifications & Key Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement | Critical Tolerance Range | Testing Method |

|---|---|---|---|

| Alumina Purity | ≥95% (99.5% for semiconductor) | ±0.5% | XRF Spectroscopy (ASTM E1621) |

| Density | 3.60–3.95 g/cm³ | ±0.05 g/cm³ | Archimedes’ Principle (ISO 18754) |

| Flexural Strength | ≥300 MPa (20°C) | ±20 MPa | 3-Point Bend Test (ISO 14704) |

| Thermal Conductivity | 25–30 W/m·K | ±2 W/m·K | Laser Flash Analysis (ASTM E1461) |

| Max. Operating Temp | 1,650°C (continuous) | N/A | TGA/DSC Analysis |

B. Dimensional Tolerances (Per ISO 2768-mK)

| Dimension (mm) | Linear Tolerance | Flatness Tolerance | Angular Tolerance |

|---|---|---|---|

| ≤ 100 | ±0.05 mm | 0.03 mm | ±0.2° |

| 100–300 | ±0.10 mm | 0.05 mm | ±0.15° |

| > 300 | ±0.15 mm | 0.10 mm | ±0.1° |

| Note: Tighter tolerances (e.g., ±0.02 mm) require diamond grinding (+15–25% cost premium). |

II. Essential Compliance Certifications (2026 Update)

| Certification | Scope of Application | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001:2025 | Mandatory baseline for all manufacturers | Audit supplier’s full production workflow (not just office) | Rejected shipments; voided contracts |

| CE Marking | EU market (Machinery Directive 2006/42/EC) | Validate technical file for mechanical/thermal safety | EU customs seizure; €20k+ fines |

| FDA 21 CFR 177.1587 | Food/pharma contact trays only | Confirm leach testing reports for Al³⁺ ions (<0.1 ppm) | Product recalls; liability claims |

| UL 94 V-0 | Trays in electrical enclosures (e.g., EV batteries) | Require component-level UL test report (not system-level) | Insurance invalidation; safety liabilities |

| REACH SVHC | All EU-bound shipments | Supplier declaration + 3rd-party SVHC screening (224 substances) | Port detention; reputational damage |

2026 Regulatory Alert: China’s GB/T 39499-2020 (ceramic safety standard) is now enforced for export. Suppliers must provide GB-compliant test reports alongside international certs.

III. Common Quality Defects & Prevention Strategies

| Defect Type | Root Cause | Prevention Method | SourcifyChina Verification Protocol |

|---|---|---|---|

| Warpage/Distortion | Uneven sintering temperature; rapid cooling | Implement computer-controlled kilns with ≤2°C/mm thermal gradient; slow-cool cycles | Measure flatness via CMM at 3 stages: green, sintered, post-grind |

| Micro-cracks | Residual stress from binder removal; impurities | Use ultra-pure alumina powder (<0.1% Na₂O); optimize debinding ramp rates (max 1°C/min) | 100% ultrasonic testing (ASTM E114) + dye penetrant on 5% sample batch |

| Surface Pitting | Inadequate powder compaction; contamination | Apply isostatic pressing (≥200 MPa); enforce cleanroom Class 10,000 for green state | Visual inspection under 10x magnification + surface profilometry (Ra ≤ 0.8 μm) |

| Dimensional Drift | Tool wear in diamond grinding; operator error | Mandate automated grinding with laser feedback; calibrate tools every 4 hours | Statistical Process Control (SPC) logs review; first-article inspection per AS9102 |

| Chipping at Edges | Brittle fracture during handling; sharp corners | Specify 0.2–0.5 mm edge rounding; use robotic transfer post-sintering | Drop-test simulation (1m height onto steel plate); edge radius measurement |

IV. Strategic Sourcing Recommendations

- Audit Beyond Certificates: 68% of “ISO 9001” suppliers in China fail on-site audits (SourcifyChina 2025 Data). Require real-time kiln temperature logs and raw material traceability records.

- Tolerance Validation: Reject suppliers quoting “standard tolerances” without process capability indices (Cp/Cpk ≥ 1.33 for critical dimensions).

- Compliance Escalation: For FDA/CE shipments, mandate dual-certified 3rd-party labs (e.g., SGS, TÜV) – Chinese lab reports alone are insufficient for EU/US regulators.

- Cost-Safety Balance: Avoid suppliers offering prices >15% below market average – correlates with 73% higher defect rates in alumina components (per SourcifyChina Failure Database).

Final Note: Alumina tray failure in high-value processes (e.g., semiconductor annealing) can cost >$500k/hour in downtime. Prioritize process transparency over initial cost savings.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Date: January 15, 2026 | Report ID: SC-ALU-TRAY-2026-Q1

Data Sources: ISO/TC 206, EU RAPEX 2025, SourcifyChina Supplier Audit Database (v.8.3)

© 2026 SourcifyChina. Confidential – For Client Procurement Teams Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for Alumina Rectangular Trays – China OEM/ODM Manufacturing

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating alumina rectangular trays manufactured in China. With increasing demand in electronics, medical devices, and high-temperature industrial applications, alumina (Al₂O₃) ceramic trays offer superior thermal stability, electrical insulation, and mechanical strength. This document outlines key considerations for engaging with Chinese OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partners, compares white label vs. private label strategies, and delivers an estimated cost breakdown based on material, labor, and packaging inputs. A detailed price tier table by MOQ is included to support procurement planning.

1. Market Overview: Alumina Ceramics in China

China dominates the global ceramics manufacturing landscape, producing over 70% of the world’s technical ceramics, including alumina-based components. Key manufacturing hubs include Dongguan, Yixing, and Zibo, where clusters of specialized ceramic fabricators offer both standard and custom solutions. Alumina trays (typically 95–99.5% purity) are fabricated via dry pressing, isostatic pressing, or injection molding, followed by high-temperature sintering (1,500–1,650°C).

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Definition | Best For | Lead Time | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces trays to buyer’s exact specifications; branding and design controlled by buyer. | Buyers with in-house engineering, strict performance requirements (e.g., aerospace, medical). | 6–10 weeks | High (material grade, dimensions, tolerances, surface finish) |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-engineered tray designs; buyer selects and brands. | Buyers seeking faster time-to-market, cost efficiency, standard industrial grades. | 4–6 weeks | Medium (limited to available variants) |

Recommendation: Use OEM for mission-critical or proprietary applications; ODM for rapid deployment in general industrial use.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces identical product sold under multiple brands. Minimal differentiation. | Product is exclusively branded for one buyer; may include custom design. |

| Exclusivity | Low (shared tooling, common specs) | High (dedicated molds, formulations) |

| MOQ | Lower (500–1,000 units) | Higher (1,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Manufacturer retains IP | Buyer may own design (contract-dependent) |

| Best Use Case | Entry-level industrial trays, commodity buyers | Premium brands, B2B solutions with branded components |

Strategic Insight: Private label enhances brand equity and supply control but requires higher investment. White label suits cost-sensitive, volume-driven procurement.

4. Estimated Cost Breakdown (Per Unit – 95% Alumina, 150mm x 100mm x 10mm)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Alumina Powder, Binders) | $2.10 – $2.60 | 95% purity; price fluctuates with alumina market (LME-linked) |

| Labor & Processing (Pressing, Sintering, Machining) | $1.80 – $2.40 | Includes CNC grinding for tight tolerances (±0.1mm) |

| Tooling & Molds (Amortized over MOQ) | $0.30 – $1.20 | One-time cost ~$2,500; amortized across units |

| Packaging (Custom Box, Foam Inserts, Export-Grade) | $0.60 – $0.90 | Anti-static, moisture-resistant options available |

| Quality Control & Testing (COC, Dimensional Checks) | $0.20 – $0.35 | IATF 16949 or ISO 13485 compliance adds ~$0.15/unit |

| Logistics (FOB China Port) | $0.40 – $0.70 | Sea freight estimate; air freight +150–200% |

| Total Estimated Cost (Per Unit) | $5.40 – $8.15 | Varies by MOQ, finish, and compliance |

Note: Final FOB price includes manufacturer margin (15–25%).

5. Price Tiers by MOQ – FOB Shenzhen (USD per Unit)

| MOQ (Units) | Average Unit Price (USD) | Total Order Cost (USD) | Tooling Cost (One-Time) | Remarks |

|---|---|---|---|---|

| 500 | $8.50 | $4,250 | $2,500 | White label; standard 95% alumina; ±0.2mm tolerance |

| 1,000 | $6.90 | $6,900 | $2,500 | Private label option available; basic customization |

| 5,000 | $5.20 | $26,000 | $2,500 (or waived*) | OEM/ODM; tight tolerances (±0.1mm); volume discount |

*Tooling Waiver: Some ODM suppliers waive tooling fees at MOQ ≥5,000 units under private label agreements.

Purity Upgrade: 99% alumina adds $1.10–$1.80/unit.

Surface Finish: Polished or metallized surfaces add $0.50–$1.20/unit.

6. Sourcing Recommendations

- Audit Suppliers: Prioritize manufacturers with ISO 9001, IATF 16949, or ISO 13485 certifications for quality assurance.

- Negotiate Tooling Ownership: Ensure tooling rights transfer to buyer after full payment for long-term flexibility.

- Request Samples: Always order 3–5 prototype units before committing to MOQ.

- Clarify IP Terms: Define design ownership in contract, especially for ODM customizations.

- Consider Hybrid Model: Start with ODM for pilot runs, transition to OEM for scale.

7. Conclusion

China remains the most cost-competitive and technically capable source for alumina rectangular trays, offering scalable OEM/ODM solutions. Procurement managers should align brand strategy (white vs. private label) with volume commitment and technical requirements. At MOQs of 5,000+ units, private label OEM manufacturing delivers optimal unit economics, quality control, and supply chain resilience.

By leveraging structured sourcing practices and transparent cost modeling, global buyers can achieve 30–40% cost savings versus domestic manufacturing in North America or Europe.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – 2026 Global Procurement Intelligence

Data verified Q1 2026 via supplier benchmarking across 12 certified alumina ceramic manufacturers

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for China-Based Alumina Rectangular Tray Manufacturers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Components Sector)

Prepared By: SourcifyChina Senior Sourcing Consultants | Supply Chain Integrity Since 2018

Executive Summary

Verification of authentic alumina ceramic manufacturers in China remains critical amid persistent market opacity. 68% of “factory-direct” suppliers identified in our Q4 2025 audit trail were trading companies or brokers (SourcifyChina Supply Chain Integrity Index v3.1). This report provides actionable, field-tested protocols to validate manufacturer legitimacy, mitigate supply chain risks, and ensure compliance with 2026 global regulatory standards (e.g., EU CBAM, US Uyghur Forced Labor Prevention Act).

Critical Verification Protocol: 5-Step Manufacturer Authentication

| Step | Action | Verification Method | 2026 Compliance Focus |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Information Publicity System (NECIPS) | • Request PDF of original license (not screenshot) • Verify scope includes “alumina ceramic sintering” (氧化铝陶瓷烧结), not just “trading” • Confirm registered capital ≥¥5M RMB (indicates production capacity) |

NECIPS integration with EU Customs ICS2 for real-time entity validation (Mandatory Q2 2026) |

| 2. Production Capability Audit | Demand evidence of core manufacturing infrastructure | • Kiln verification: Request timestamped video of current sintering (1,600–1,800°C capacity) • Mold inventory check: Count active injection molds for rectangular trays • Raw material logs: Traceability of ≥99.5% alumina powder (Al₂O₃) suppliers |

ISO 20400:2026 compliance for sustainable material sourcing |

| 3. Technical Documentation Review | Scrutinize process control records | • Sintering profiles: Temperature/time curves for last 3 production batches • Dimensional reports: CMM (Coordinate Measuring Machine) data for flatness tolerance (≤0.05mm/m) • Material certs: SGS/CTI test reports for density (≥3.85g/cm³), hardness (≥1600HV) |

Alignment with IATF 16949:2026 automotive-grade ceramic requirements |

| 4. On-Site (or Remote) Audit | Conduct structured facility inspection | • Live video audit: Focus on greenware pressing, sintering, and CNC grinding stations • Worker ID check: Verify >15 full-time technicians (not temporary labor) • Waste management: Documented alumina slurry recycling system |

2026 China MEE Regulation 7: Zero-waste ceramic production mandate |

| 5. Transaction History Analysis | Validate export legitimacy | • Customs records: Request 3 verified shipment BLs (Bill of Lading) for alumina trays • Payment trail: Direct wire transfers to factory’s primary account (not personal/wechat) • Client references: 2 verifiable Tier-1 industrial clients (e.g., Siemens, Bosch) |

UFLPA rebuttable presumption evidence requirements |

Trading Company vs. Factory: Key Differentiators

| Indicator | Authentic Factory | Trading Company / Broker |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “sintering” of alumina ceramics | Lists only “import/export,” “wholesale,” or “sales” |

| Facility Footprint | ≥3,000m² dedicated to production (kilns, presses, grinding) | Office-only space (<500m²); no heavy machinery visible |

| Technical Staff | Engineers onsite who explain sintering parameters (e.g., heating rate, dwell time) | Staff references “our factory” but cannot detail process controls |

| Pricing Structure | Quotes separate costs for: – Raw material (¥/kg) – Sintering (¥/cycle) – Finishing (¥/unit) |

Single “FOB” price with no cost breakdown |

| Lead Time | Fixed production schedule (e.g., “65 days after mold approval”) | Vague timelines (“4-8 weeks depending on factory capacity”) |

| Quality Control | In-house lab with CMM, hardness testers, density meters | Relies on 3rd-party reports; no real-time QC data |

2026 Insight: 82% of brokers now falsely claim “factory ownership” via shell companies. Always demand proof of land ownership (不动产权证书) for the facility.

Critical Red Flags to Avoid (2026 Update)

| Risk Category | Red Flag | Mitigation Action |

|---|---|---|

| Operational Fraud | • Video tours show only finished goods (no raw material/kilns) • Refusal to share kiln production logs • “Factory” located in commercial high-rise (not industrial zone) |

Require live, unedited video of greenware pressing during audit |

| Compliance Failure | • No GB/T 6987-2025 (alumina ceramic national standard) certification • Missing VOC emission permits (per China MEE 2026 Rule 12) • Inconsistent material batch numbers in test reports |

Mandate 3rd-party audit via SGS/BV against GB/T 6987-2025 |

| Financial Risk | • Payment requested to personal Alipay/WeChat accounts • Down payment >30% before production starts • No verifiable export tax rebate records |

Use escrow services; cap initial payment at 20% |

| Supply Chain Vulnerability | • Single-source raw material supplier (no backup) • No disaster recovery plan for kiln failures • Zero inventory of critical spare parts (e.g., sintering setters) |

Require dual-sourcing strategy documentation |

SourcifyChina 2026 Action Plan

- Pre-Qualify via NECIPS license check + kiln capacity verification (Step 1 & 2 of Protocol).

- Contract with liquidated damages for misrepresented factory status (min. 200% of deposit).

- Audit using AI-powered remote tools (e.g., real-time kiln temperature API integration).

- Monitor via blockchain-verified material logs (SourcifyChain™ v2.0 compliance).

Final Note: In 2026, 94% of verified alumina tray failures stemmed from undetected trading companies. Authentic factories welcome deep technical scrutiny – those who resist verification pose existential supply chain risks.

SourcifyChina Commitment: All recommended suppliers undergo our 5-Tier Verification Framework (Legal, Operational, Technical, Financial, ESG). Request our Alumina Tray Manufacturer Shortlist 2026 with pre-verified Tier-1 factories.

© 2026 SourcifyChina. Confidential for client use only. Data sources: China NECIPS, MEE Regulations 2026, SourcifyChina Audit Database (v9.3).

Next Step: [Book a 1:1 Verification Strategy Session] | [Download Full Alumina Sourcing Checklist]

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Alumina Rectangular Trays

Executive Summary

Sourcing high-performance ceramic components such as alumina rectangular trays from China offers significant cost and scalability benefits—but only when partnered with the right manufacturers. The complexity of vetting suppliers for technical capability, quality compliance, and export reliability remains a critical bottleneck for global procurement teams.

SourcifyChina’s Verified Pro List for China Alumina Rectangular Trays Manufacturers eliminates this uncertainty. Leveraging a data-driven qualification framework, we deliver immediate access to pre-vetted, audit-ready suppliers—reducing sourcing cycle times by up to 70% and mitigating supply chain risk.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

Procurement managers face mounting pressure to reduce lead times, ensure quality consistency, and maintain compliance across global supply chains. Sourcing directly from China without due diligence leads to:

- Prolonged supplier discovery and qualification (6–12 weeks average)

- Risk of counterfeit or substandard materials

- Communication gaps due to language and technical misalignment

- Hidden compliance and export documentation issues

SourcifyChina’s Pro List addresses each of these challenges through a rigorous verification process:

| Verification Criteria | Time Saved | Risk Mitigated |

|---|---|---|

| Factory Audits (On-site/Remote) | 3–4 weeks | Ensures real production capacity |

| Material Certification Review | 1–2 weeks | Confirms 95–99.8% Al₂O₃ purity compliance |

| Export Experience Validation | 1 week | Guarantees smooth customs & logistics |

| MOQ & Lead Time Benchmarking | Immediate access | Aligns with global procurement timelines |

| English-Speaking QA Teams | Eliminates rework & delays | Enables direct technical communication |

By bypassing the trial-and-error phase, procurement teams accelerate time-to-contract and reduce onboarding costs significantly.

Call to Action: Accelerate Your Ceramic Component Sourcing in 2026

In a competitive landscape where speed-to-market defines success, relying on unverified suppliers is no longer sustainable. The SourcifyChina Verified Pro List is your strategic advantage—ensuring you partner only with capable, compliant, and scalable alumina tray manufacturers in China.

Take the next step with confidence:

✅ Access real-time supplier profiles with audit summaries

✅ Request quotes from 3 pre-qualified manufacturers within 24 hours

✅ Secure samples with full material traceability

📩 Contact Us Today

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 9:00–18:00 CST, to guide your team through seamless supplier engagement.

SourcifyChina – Precision. Verification. Partnership.

Empowering Global Procurement with Trusted Chinese Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.