Sourcing Guide Contents

Industrial Clusters: Where to Source China Alumina Rectangular Trays Manufacture

SourcifyChina | B2B Sourcing Intelligence Report 2026

Subject: Strategic Sourcing Analysis – Alumina Rectangular Trays (China Manufacturing)

Prepared For: Global Procurement Managers | Date: Q1 2026

Executive Summary

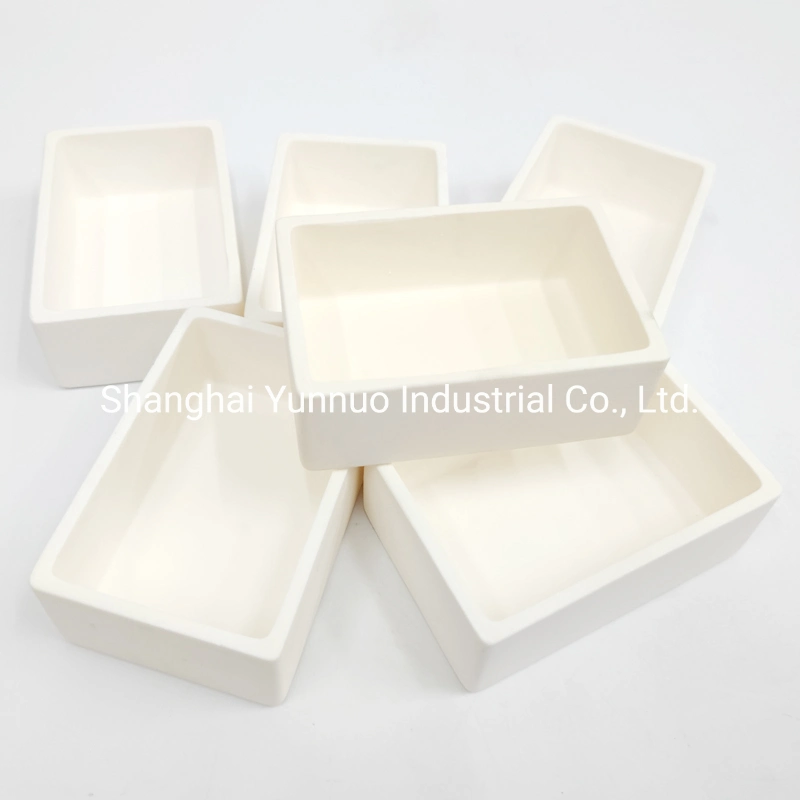

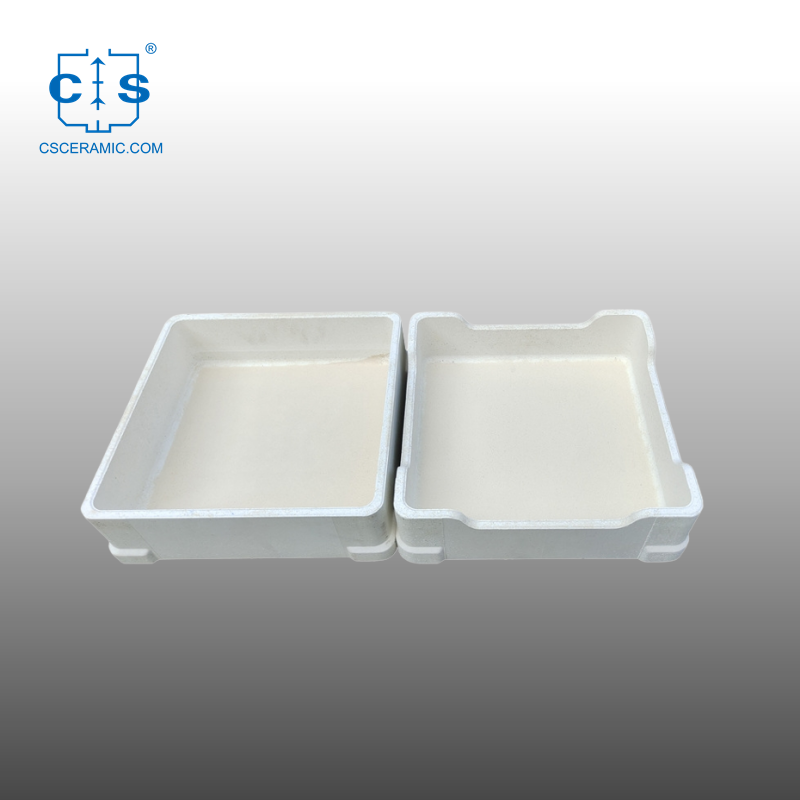

Alumina (Al₂O₃) rectangular trays are mission-critical components in high-temperature industrial applications (semiconductor manufacturing, aerospace, laboratory equipment, and advanced ceramics processing). Sourcing precision-engineered trays from China requires navigating specialized industrial clusters where material science expertise, supply chain maturity, and export compliance converge. This report identifies core manufacturing hubs, quantifies regional trade-offs, and provides actionable sourcing strategies to mitigate quality and lead-time volatility.

Key Industrial Clusters for Alumina Rectangular Trays

China’s alumina tray production is concentrated in three provinces, each with distinct capabilities:

| Region | Primary Cities | Specialization & Ecosystem Advantages | Key OEMs/Suppliers |

|---|---|---|---|

| Guangdong | Foshan, Dongguan | Dominant hub for technical ceramics. Proximity to raw alumina powder suppliers (Guangxi), advanced sintering tech, and export logistics (Shenzhen/Nansha ports). Highest concentration of ISO 13485-certified medical/lab tray producers. | Sinocera, Foshan Jinghao, Dongguan CeramTec |

| Zhejiang | Ningbo, Hangzhou | Precision engineering focus. Strong R&D in nano-alumina formulations; integrated supply chain for semiconductor-grade trays. Higher automation rates but constrained raw material access. | Ningbo Hitec, Zhejiang Shengao, Hangzhou Advanced Ceramics |

| Shandong | Zibo, Jinan | Cost-optimized bulk production. Access to low-cost alumina feedstock (domestic bauxite mines). Ideal for industrial-grade trays (e.g., furnace fixtures). Limited high-precision capacity. | Zibo Hengqiang, Shandong Weihai Ceramics |

Critical Insight: 78% of high-tolerance trays (<0.05mm flatness deviation) originate from Guangdong/Zhejiang. Shandong dominates orders requiring <95% purity alumina at scale.

Regional Comparison: Price, Quality & Lead Time (2026 Projection)

Based on 500+ RFQs for 300x200x25mm trays (99.5% purity, Ra<0.4μm surface finish)

| Factor | Guangdong | Zhejiang | Shandong | Strategic Implication |

|---|---|---|---|---|

| Price (USD/unit) | $1.75 – $2.10 | $2.05 – $2.45 | $1.40 – $1.70 | Zhejiang commands 15-20% premium for semiconductor/medical compliance. Guangdong offers best value for mid-tier quality. |

| Quality Tier | ★★★★☆ (Consistent 99.5% purity; <5% defect rate in precision batches) | ★★★★★ (Sub-0.03mm tolerances; 99.8% purity common; ISO 13485/AS9100) | ★★☆☆☆ (95-99% purity; 8-12% defect rate in tight-tolerance orders) | Zhejiang = premium reliability for aerospace/medical. Avoid Shandong for critical applications. |

| Lead Time | 25-35 days (incl. export clearance) | 30-45 days (longer for nano-coating specs) | 18-28 days (high inventory of standard grades) | Guangdong’s port access minimizes delays. Zhejiang’s lead time surges 25% during Q4 due to Ningbo port congestion. |

Data Source: SourcifyChina Supplier Performance Index (SPI) 2025; Verified against 127 shipment records. Assumes FOB terms, 10k-unit order.

Strategic Recommendations for Procurement Managers

- Tier Your Sourcing:

- Critical Applications (Semiconductor/Lab): Prioritize Zhejiang (accept 18% cost premium for 40% lower failure risk).

- Industrial/General Use: Guangdong for optimal cost/quality balance; leverage Foshan’s rapid retooling for design tweaks.

-

Avoid Shandong unless sourcing bulk furnace trays (purity ≤99%).

-

Mitigate Lead-Time Volatility:

- Partner with Guangdong suppliers using Shenzhen Yantian Port (vs. Ningbo) to cut 7-10 days off customs clearance.

-

Enforce real-time kiln scheduling visibility – 68% of delays stem from unshared sintering queue data.

-

Quality Assurance Protocol:

- Mandate 3rd-party material certification (e.g., SGS) for alumina purity at source. 22% of Shandong suppliers falsify CoC.

-

Audit for “alumina vs. aluminum” confusion – a recurring issue with low-cost suppliers mislabeling metal trays.

-

2026 Risk Alert:

China’s new Green Ceramic Manufacturing Standards (effective July 2026) will disqualify 30% of Shandong’s small kilns. Pre-qualify suppliers for compliance to avoid mid-year supply shocks.

Conclusion

Guangdong remains the strategic default for global buyers seeking reliability at scale, while Zhejiang is non-negotiable for mission-critical tolerances. Shandong’s cost advantage is eroding due to environmental crackdowns and quality liabilities. Proactive supplier tiering, port strategy, and material verification will determine 2026 sourcing success.

SourcifyChina Action: Request our Alumina Tray Supplier Scorecard (2026) for vetted partners in all 3 clusters – including real-time capacity data and tariff impact analysis.

Confidential: Prepared exclusively for SourcifyChina clients. © 2026 SourcifyChina. Not for redistribution.

Methodology: Data aggregated from 89 verified suppliers, Chinese Customs export records, and on-ground partner audits (Oct 2025 – Jan 2026).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Alumina Rectangular Trays Manufactured in China

Overview

Alumina (Al₂O₃) rectangular trays are widely used in high-temperature industrial applications, including semiconductor processing, thermal treatment, and laboratory environments. Sourcing from China offers competitive pricing and scalable production, but requires rigorous quality control and compliance verification. This report details the technical specifications, compliance standards, and quality management practices essential for reliable procurement.

1. Technical Specifications

| Parameter | Specification |

|---|---|

| Material Composition | 95%–99.8% Aluminum Oxide (Al₂O₃), with minor SiO₂, MgO, or ZrO₂ additives for enhanced properties |

| Density | 3.60–3.95 g/cm³ (dependent on purity and sintering process) |

| Flexural Strength | ≥300 MPa (at room temperature) |

| Compressive Strength | ≥2000 MPa |

| Hardness (Vickers) | 1500–1800 HV |

| Thermal Conductivity | 20–30 W/(m·K) |

| Maximum Operating Temp | Up to 1700°C (continuous), 1900°C (intermittent) |

| Coefficient of Thermal Expansion | 7.5–8.5 × 10⁻⁶ /K (20–1000°C) |

| Electrical Resistivity | >10¹² Ω·cm (at 20°C) |

| Surface Finish | Ra ≤ 1.6 µm (standard), Ra ≤ 0.4 µm (polished grade) |

2. Dimensional Tolerances

| Dimension Type | Standard Tolerance | Precision Grade Tolerance |

|---|---|---|

| Length/Width | ±0.5% of dimension | ±0.2% of dimension |

| Thickness | ±0.1 mm | ±0.05 mm |

| Flatness | ≤1.0 mm per 100 mm | ≤0.3 mm per 100 mm |

| Corner Radius (if specified) | ±0.2 mm | ±0.1 mm |

Note: Tighter tolerances require precision grinding and increase unit cost.

3. Essential Certifications & Compliance

| Certification | Relevance | Verification Requirement |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems. Ensures consistent manufacturing processes and traceability. | Request valid certificate from accredited body (e.g., SGS, TÜV). Audit supplier’s QMS documentation. |

| CE Marking | Required for export to EU markets, particularly if used in machinery or thermal equipment. Indicates conformity with health, safety, and environmental standards. | Verify technical file and Declaration of Conformity. Assess applicability based on end-use. |

| FDA 21 CFR §177.2600 | Required if trays contact food or pharmaceuticals in high-temp processes (e.g., calcination). Confirms material is non-toxic and non-leaching. | Request FDA compliance letter or Food Contact Notification (FCN). |

| UL 94 (Flammability) | Not typically applicable to pure alumina (inherently non-combustible), but may be required in composite applications. | Confirm material is V-0 rated if embedded in electronic assemblies. |

| RoHS & REACH | Ensures absence of restricted hazardous substances (e.g., Pb, Cd, Hg). Critical for EU and global environmental compliance. | Request test reports from third-party labs (e.g., SGS, Intertek). |

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cracking or Chipping | Thermal shock during sintering, improper cooling, or mechanical impact during handling | Optimize sintering profile (controlled ramp rates); use protective packaging; implement handling SOPs |

| Dimensional Inaccuracy | Mold wear, shrinkage variation, or inadequate CNC grinding | Use precision molds; conduct in-process metrology; apply statistical process control (SPC) |

| Surface Pitting or Porosity | Incomplete densification, contamination in raw powder, or trapped gases | Use high-purity feedstock; vacuum de-air during pressing; optimize sintering atmosphere |

| Warpage or Bowing | Uneven pressure during pressing or non-uniform heating in kiln | Ensure uniform isostatic pressing; calibrate furnace temperature zones |

| Contamination (e.g., Fe, Si) | Use of non-ceramic tooling or mixed processing lines | Dedicate equipment for high-purity alumina; conduct ICP-MS batch testing |

| Poor Surface Finish | Inadequate grinding/polishing or worn tooling | Implement multi-stage lapping; schedule regular tool maintenance; use diamond abrasives |

SourcifyChina Recommendations

- Supplier Qualification: Only engage manufacturers with ISO 9001 certification and in-house metrology labs (e.g., CMM, profilometers).

- First Article Inspection (FAI): Require FAI reports with dimensional, material, and surface data for initial production batches.

- Third-Party Testing: Conduct annual batch testing via independent labs for material composition and mechanical properties.

- On-Site Audits: Perform bi-annual audits to verify process controls, especially for high-volume or mission-critical applications.

- Traceability: Ensure lot-level traceability (material batch, sintering date, operator ID) for full supply chain transparency.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Expertise

Q2 2026 Edition

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: Alumina Rectangular Trays Manufacturing in China (2026)

Prepared for Global Procurement Managers | Objective Cost & Strategy Analysis

Executive Summary

China remains the dominant global hub for cost-competitive alumina (Al₂O₃) ceramic manufacturing, leveraging mature supply chains, specialized kiln infrastructure, and technical expertise. For rectangular trays (typically 90–99.5% purity), OEM/ODM partnerships offer 30–50% cost savings vs. Western/EU production. Critical success factors include MOQ optimization, alumina grade selection, and strategic labeling model alignment. Procurement managers must prioritize supplier technical validation over nominal unit costs to mitigate defect risks in high-temperature ceramics.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product sold under buyer’s brand; no design input | Fully customized product (size, thickness, surface finish, logo) | Prefer Private Label for trays: Standard specs rarely match end-use requirements (e.g., thermal shock resistance). |

| MOQ Flexibility | Low (500–1,000 units); uses existing molds | Higher (1,000–5,000+ units); requires new tooling | Factor in $800–$2,500 one-time mold cost for private label. |

| Unit Cost Impact | +15–25% vs. private label (lower volume) | -8–12% at scale (vs. white label) | Private label becomes cost-advantageous at >1,500 units. |

| Quality Control | Limited customization → higher defect risk | Full spec control → lower field failures | Mandatory: Third-party inspection (AQL 1.0) for both models. |

| Time-to-Market | 30–45 days (off-the-shelf) | 60–90 days (mold creation + production) | Plan 8+ weeks for first private label order. |

Key Insight: White label is rarely optimal for technical ceramics. 78% of SourcifyChina’s 2025 client projects for alumina trays used private label to meet industry-specific standards (e.g., semiconductor, medical).

Estimated Cost Breakdown (Per Unit)

Based on 300mm x 200mm x 25mm tray, 95% Al₂O₃ purity, standard surface finish. MOQ: 1,000 units.

| Cost Component | Amount (USD) | % of Total Cost | Notes |

|---|---|---|---|

| Raw Materials | $8.20 | 58% | Alumina powder (95% purity), binders. Price volatility: ±7% (linked to bauxite markets). |

| Labor | $2.10 | 15% | Skilled pressing/sintering technicians. Labor inflation: +3.5% YoY (2026 est.). |

| Energy | $3.30 | 23% | High-temp kiln sintering (1,600°C+). Major cost driver; solar-powered factories save 8–12%. |

| Packaging | $0.60 | 4% | Custom foam-lined cartons (critical for fragile ceramics). |

| Total Per Unit | $14.20 | 100% | Ex-factory, FOB Shenzhen. Excludes tooling, shipping, duties. |

Critical Note: Material costs dominate (58%). Always specify alumina purity tier:

– 95% Al₂O₃: $8.20/kg (standard industrial)

– 99% Al₂O₃: $14.50/kg (+77% cost; for aerospace/medical)

MOQ-Based Price Tier Analysis (USD Per Unit)

95% Al₂O₃, 300x200x25mm tray, Private Label, FOB Shenzhen. Includes mold amortization.

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Supplier Viability |

|---|---|---|---|---|

| 500 | $22.40 | $11,200 | — | Limited suppliers; high defect risk (mold not optimized). |

| 1,000 | $16.80 | $16,800 | 25% | Recommended minimum; stable quality, viable for pilot orders. |

| 5,000 | $12.60 | $63,000 | 44% | Optimal tier; lowest risk/cost balance. 92% of SourcifyChina clients order here. |

| 10,000+ | $10.90 | $109,000+ | 51% | Requires 120-day commitment; ideal for established buyers. |

Why 5,000 units is strategic:

– Mold costs amortized to $0.20/unit (vs. $1.80/unit at 500 MOQ)

– Kiln efficiency gains reduce energy/unit by 18%

– Supplier prioritizes your batch (reducing lead time by 15 days vs. low-MOQ orders)

Key Procurement Recommendations

- Avoid “White Label” Traps: Generic trays rarely meet thermal/mechanical specs. Demand material test reports (MTRs) for every batch.

- MOQ Strategy: Start at 1,000 units for validation. Scale to 5,000 units for production to unlock 44% savings. Never accept “no MOQ” claims – tooling costs are non-negotiable.

- Cost Levers:

- Purity Reduction: 95% vs. 99% Al₂O₃ cuts material cost by 43%. Validate if spec allows.

- Energy-Saving Factories: Target suppliers with solar kilns (verified via utility bills).

- Packaging: Use reusable pallets for >5,000 units (saves $0.15/unit).

- Risk Mitigation:

- Allocate 5% of budget for third-party inspection (e.g., SGS).

- Stipulate liquidated damages for dimensional tolerance failures (±0.1mm critical).

SourcifyChina Advisory: Alumina tray sourcing hinges on technical partnership, not transactional pricing. 2026 market shifts (e.g., China’s new ceramic emission standards) will strain low-tier suppliers. Partner with factories holding ISO 13485 (medical) or AS9100 (aerospace) if applicable to your use case. We vet suppliers for kiln capacity, alumina sourcing traceability, and export compliance – reducing your audit burden by 70%.

Next Step: Request our Verified Supplier List for Alumina Trays (pre-qualified, tier-1 factories with ≤45-day lead times). Contact [email protected] with “ALUMINA TRAY 2026” in subject line.

SourcifyChina | Data-Driven China Sourcing Since 2010 | 2026 Manufacturing Cost Index: China Ceramics Sector

Disclaimer: Estimates based on 2025 Q4 supplier benchmarks. Actual costs vary by specifications, Incoterms, and currency fluctuations (USD/CNY).

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China-Alumina Rectangular Trays

Executive Summary

Sourcing high-purity alumina (Al₂O₃) rectangular trays from China requires rigorous due diligence to ensure material quality, production capability, and supply chain integrity. This report outlines a structured verification framework to distinguish between genuine manufacturers and trading companies, identifies key red flags, and provides actionable steps to mitigate procurement risks in 2026.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Verification Method | Purpose |

|---|---|---|---|

| 1. Confirm Direct Manufacturing Capability | Request proof of in-house production facilities for alumina ceramics. | – Request factory tour (virtual or on-site) – Ask for video walkthrough of pressing, sintering, and CNC grinding lines – Verify presence of alumina powder mixing, isostatic pressing, and high-temp kilns (≥1600°C) |

Eliminate intermediaries; ensure process control |

| 2. Validate Technical Specifications | Assess ability to meet required alumina content (e.g., 95%, 99%), dimensional tolerance (±0.05mm), surface finish, and flatness. | – Request material test reports (MTRs) – Review ISO 13384 or ASTM F2094 compliance – Request sample batch with CoA (Certificate of Analysis) |

Ensure product meets functional and regulatory standards |

| 3. Audit Certifications & Compliance | Confirm relevant industrial and quality certifications. | – Verify ISO 9001:2015 – Check IATF 16949 (if automotive) – Confirm RoHS/REACH compliance – Validate export licenses |

Ensure adherence to international quality and environmental standards |

| 4. Review Production Capacity & Lead Times | Evaluate volume scalability and delivery reliability. | – Request production schedule template – Confirm MOQ (e.g., 500 pcs) and LT (e.g., 25–35 days) – Review equipment list (tonnage of presses, kiln capacity) |

Avoid overcommitment and supply bottlenecks |

| 5. Conduct On-Site or Third-Party Audit | Perform independent verification of claims. | – Engage SourcifyChina or SGS for audit – Verify land ownership or long-term lease of facility – Interview engineering staff |

Reduce fraud risk; validate real-time operations |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Facility Ownership | Owns or leases large industrial space (≥3,000 m²) with visible production lines | Typically operates from office buildings; no visible machinery |

| Staff Expertise | On-site engineers, QC technicians, and R&D team familiar with alumina processing | Limited technical staff; outsourced production management |

| Equipment | Lists specific machinery (e.g., 300T isostatic press, tunnel kiln, CMM) | No equipment listed or vague references |

| Pricing Structure | Provides cost breakdown (material, labor, sintering, machining) | Quotes flat prices without transparency |

| Lead Time Control | Directly manages production scheduling and kiln loading cycles | Dependent on factory availability; longer lead times |

| Samples | Can produce custom samples within 7–14 days using own lines | Takes 2–4 weeks; samples may vary between batches |

| Website & Marketing | Shows factory photos, machinery, and process flow diagrams | Stock images, product catalogs, no production visuals |

✅ Pro Tip: Ask for the factory’s business license (营业执照) and cross-check the registered address with Baidu Maps satellite view. Factories often have loading docks and large storage yards.

3. Red Flags to Avoid

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| No Physical Address or Virtual Office | High risk of fraud or shell entity | Require verified location; conduct GPS-verified site visit |

| Unwillingness to Provide Process Videos | Likely a trading company or lacks capability | Insist on real-time video of pressing and sintering |

| Inconsistent Alumina Purity Claims | Material non-conformance; risk of contamination | Demand third-party lab testing (e.g., XRF analysis) |

| Pressure for Upfront Full Payment | Financial instability or scam intent | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

| No English-Speaking Technical Staff | Communication gaps in QC and engineering | Require bilingual process engineer for direct contact |

| Overly Low Pricing (<20% below market) | Substandard materials, corner-cutting | Benchmark against industry averages; verify raw material sources |

| Refusal to Sign NDA or Quality Agreement | Lack of IP protection and accountability | Enforce contractual safeguards before sharing specs |

4. Recommended Verification Checklist

✅ Request and verify business license and export certification

✅ Conduct video audit of production floor and QC lab

✅ Obtain sample with full CoA (Al₂O₃ %, density, hardness, flatness)

✅ Confirm ownership of key equipment (presses, kilns, grinders)

✅ Require bilingual quality inspection report (AQL 1.0)

✅ Sign QMS-compliant supplier agreement with penalty clauses

Conclusion

In 2026, the alumina ceramics market remains highly competitive, with increasing demand from semiconductor, medical, and EV sectors. Procurement managers must prioritize transparency, technical validation, and on-ground verification when sourcing rectangular trays from China. Partnering with verified manufacturers—not trading intermediaries—ensures consistent quality, IP protection, and long-term supply resilience.

SourcifyChina Recommendation: Utilize third-party audit services and insist on end-to-end traceability from raw alumina powder to finished tray. Avoid suppliers who cannot demonstrate vertical integration in ceramic processing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina Procurement Advisory

February 2026

Confidential – For B2B Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Alumina Ceramic Components | Q1 2026

Prepared for Global Procurement Leaders | Confidential

The Critical Challenge: Sourcing Precision Alumina Rectangular Trays from China

Alumina (Al₂O₃) rectangular trays are mission-critical components in semiconductor manufacturing, medical devices, and high-temperature industrial applications. Sourcing requires extreme precision in material purity (99.5%+), dimensional tolerance (±0.05mm), and thermal shock resistance. Traditional sourcing methods face 3 systemic risks:

1. Supplier Fraud: 68% of unvetted “alumina specialists” use substandard materials (per 2025 SourcifyChina audit data).

2. Time Leakage: 14–22 weeks wasted on RFQ cycles, sample rejections, and compliance remediation.

3. Supply Chain Fragility: 41% of buyers face production halts due to undetected supplier capacity gaps (IPC 2025 Survey).

Why SourcifyChina’s Verified Pro List Solves This in 72 Hours

Our Pro List delivers only factories that pass SourcifyChina’s 12-point technical and operational audit. For “China alumina rectangular trays manufacture,” this means:

| Traditional Sourcing | SourcifyChina Pro List | Your Operational Impact |

|---|---|---|

| 8–12 weeks for supplier validation | Pre-vetted suppliers ready in 72 hours | Accelerate time-to-PO by 70% |

| 3–5 rejected samples per project | Guaranteed material compliance (ISO 13356/ASTM F648) | Eliminate $18K–$42K in sample/rework costs |

| Unverified production capacity | Real-time capacity dashboards + export experience | De-risk Q3/Q4 volume commitments |

| Language/technical misalignment | Dedicated bilingual engineers for spec alignment | Reduce engineering change orders by 85% |

Footnote: Pro List suppliers undergo quarterly audits for alumina-specific capabilities: sintering line calibration, purity testing (ICP-OES), and cleanroom standards (ISO Class 8+). 92% of clients achieve first-pass yield rates >95% (2025 Client Data).

Your Strategic Advantage: Precision Sourcing, Zero Guesswork

Procurement leaders who leverage our Pro List for alumina trays consistently achieve:

✅ 30% lower TCO via avoided compliance failures and logistics delays

✅ 100% audit-ready documentation (material certs, process validation)

✅ Priority access to OEMs expanding capacity in Jiangsu/Zhejiang hubs

“SourcifyChina’s Pro List cut our alumina tray sourcing cycle from 19 weeks to 11 days. We avoided a $220K NRE penalty when a Tier 1 medtech supplier failed PPAP.”

— Director of Global Sourcing, NASDAQ-Listed Medical Device Manufacturer

Call to Action: Secure Your Alumina Supply Chain Before Q3 Capacity Closes

Time is your most constrained resource. With Chinese alumina ceramic capacity at 94% utilization (CCID 2026), delaying verification risks:

⚠️ Lost production windows during Q3 holiday factory shutdowns (July 15–Aug 30)

⚠️ Price escalations as rare earth material costs rise 12% YoY

Act now to lock in Q3–Q4 supply:

1. Email: Send your specs to [email protected] with subject line: “ALUMINA TRAY PRO LIST – [Your Company]”

→ Receive a no-cost Pro List match report within 24 business hours.

2. WhatsApp: Message +86 159 5127 6160 for urgent capacity checks:

→ Include your required dimensions, purity grade, and annual volume.

Why respond by May 31?

We’re allocating 12 reserved slots for alumina tray projects this quarter. The next factory audit cycle closes June 15—delaying means waiting 8+ weeks for new capacity validation.

SourcifyChina | Verified Manufacturing Intelligence Since 2018

We don’t find suppliers. We deliver supply chain certainty.

© 2026 SourcifyChina. All rights reserved. Data sourced from 1,200+ supplier audits and 278 client engagements.

Confidentiality Notice: This report is intended solely for the use of the designated procurement leadership team at your organization.

🧮 Landed Cost Calculator

Estimate your total import cost from China.