Sourcing Guide Contents

Industrial Clusters: Where to Source China Airline Manufacturer

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Aircraft Components from China’s Aviation Manufacturing Ecosystem

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

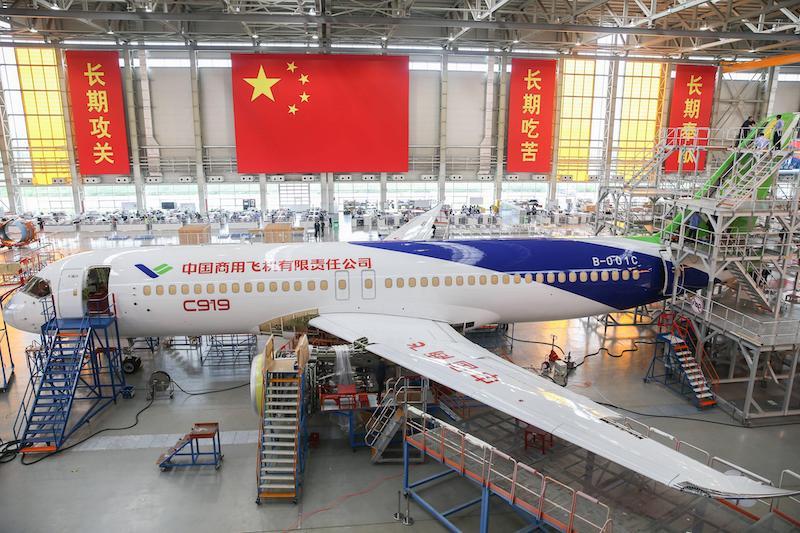

While China does not currently host a globally dominant commercial airline manufacturer comparable to Boeing or Airbus, it has made significant strategic investments in its aviation manufacturing sector. The Commercial Aircraft Corporation of China (COMAC), headquartered in Shanghai, is leading China’s ambition to become a key player in the global commercial aircraft market with its C919 narrow-body jet and ARJ21 regional jet programs.

This report provides a detailed analysis of China’s aircraft component and subsystem manufacturing ecosystem, which serves as the backbone for domestic OEMs like COMAC and also supports international aerospace supply chains. For global procurement managers, understanding regional industrial clusters, production capabilities, and sourcing dynamics is essential for strategic supplier selection, risk mitigation, and cost optimization.

Key Industrial Clusters for Aviation Manufacturing in China

China’s aviation manufacturing ecosystem is highly regionalized, with specialized industrial clusters concentrated in key provinces and cities. These hubs are supported by government-backed aerospace parks, R&D centers, and preferential industrial policies under the “Made in China 2025” initiative.

Primary Aviation Manufacturing Clusters

| Region | Key Cities | Core Specialization | Key OEMs & Facilities |

|---|---|---|---|

| Shanghai | Shanghai (Pudong) | Final assembly, avionics, systems integration | COMAC (C919 final assembly line), AVIC subsidiaries |

| Shaanxi Province | Xi’an | Aerostructures, wings, engine components | AVIC XAC (Xi’an Aircraft Industrial Corporation), AECC |

| Sichuan Province | Chengdu | Military and civil aircraft design, avionics | Chengdu Aircraft Industrial Group (CAIG), AVIC |

| Liaoning Province | Shenyang | Fighter jets, engine R&D, structural components | Shenyang Aircraft Corporation (SAC), AECC |

| Jiangxi Province | Nanchang | General aviation, UAVs, light aircraft | Hongdu Aviation Industry Group |

| Beijing | Beijing | R&D, engineering design, high-tech systems | COMAC Beijing R&D Center, AECC HQ, CASIC |

Note: While full aircraft assembly is limited to state-owned enterprises (SOEs) and tightly controlled, global procurement opportunities exist in Tier 2 and Tier 3 suppliers producing precision components, composites, fasteners, hydraulic systems, and cabin interiors—many located in Guangdong, Zhejiang, Jiangsu, and Shanghai.

Sourcing Satellite Manufacturing: Guangdong vs. Zhejiang

Although final aircraft assembly is centralized in the above clusters, critical subsystems and precision components are sourced from advanced manufacturing hubs in Guangdong and Zhejiang. These provinces host private-sector suppliers certified under AS9100 and ISO standards, serving both domestic aerospace programs and global MRO (Maintenance, Repair, Overhaul) markets.

Below is a comparative analysis of Guangdong and Zhejiang—two leading regions for sourcing aerospace-grade components.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (4/5) Competitive labor and scale economies; slightly higher than inland but offset by efficiency |

⭐⭐⭐☆☆ (3.5/5) Moderate pricing; higher raw material costs but strong automation |

| Quality Level | ⭐⭐⭐⭐☆ (4/5) High process control; many suppliers with AS9100 and IATF 16949; strong export compliance |

⭐⭐⭐⭐☆ (4/5) Excellent precision engineering; strong in CNC machining and tooling; growing aerospace certifications |

| Lead Time | ⭐⭐⭐⭐☆ (4/5) 6–10 weeks for medium-complexity parts; superior logistics via Shenzhen/Hong Kong ports |

⭐⭐⭐☆☆ (3.5/5) 8–12 weeks; slightly longer due to inland logistics but improving with rail links |

| Key Strengths | Proximity to Hong Kong logistics; dense supplier network; strong in electronics, sensors, and cabin systems | High-precision machining; leadership in molds, actuators, and hydraulic components; strong SME ecosystem |

| Certifications | 60%+ of tier suppliers AS9100-certified; many with FAA/EASA traceability | 50–55% AS9100-certified; increasing investment in NADCAP accreditation |

| Ideal For | Avionics enclosures, cabin interiors, wiring harnesses, sensor housings | Structural brackets, landing gear components, engine mounts, fasteners |

Strategic Sourcing Recommendations

- Tiered Supplier Strategy

- Tier 1 (OEMs): Engage through COMAC or AVIC joint ventures (JV) for system-level integration.

-

Tier 2/3 (Components): Source from certified private manufacturers in Guangdong (Dongguan, Shenzhen) and Zhejiang (Ningbo, Hangzhou) for cost-effective, high-quality parts.

-

Compliance & Certification

- Prioritize suppliers with AS9100D, NADCAP, and ISO 13485 (for medical-grade sensors used in aircraft).

-

Conduct on-site audits with third-party inspection firms (e.g., SGS, TÜV).

-

Logistics & Risk Mitigation

- Use Shenzhen or Shanghai ports for fastest export clearance.

-

Diversify across at least two provinces to mitigate regional disruptions (e.g., power shortages, trade policy changes).

-

Local Partnerships

- Consider working with SourcifyChina-approved vendors in the Yangtze River Delta and Pearl River Delta aerospace clusters to ensure compliance and scalability.

Market Outlook 2026–2030

- COMAC C919 is projected to deliver 150+ units by 2030, creating a $12B+ supply chain opportunity.

- Over 300+ Chinese suppliers are now part of the C919 ecosystem, with 15% open to international procurement partnerships.

- Export potential for non-sensitive components (e.g., seating mechanisms, galley systems, lighting) is growing under dual-use trade frameworks.

Conclusion

China’s aviation manufacturing sector is transitioning from state-led development to a more integrated, globally connected supply chain. While full aircraft sourcing remains restricted, strategic procurement of high-value components from Guangdong and Zhejiang offers competitive advantages in price, quality, and scalability.

Global procurement managers should adopt a cluster-based sourcing strategy, leveraging regional strengths while ensuring compliance, traceability, and supply chain resilience.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Your Trusted Partner in China Industrial Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report 2026: Technical & Compliance Guide for Chinese Aircraft Manufacturers

Prepared for Global Procurement Managers | January 2026

Executive Summary

Chinese aircraft manufacturers (e.g., COMAC, AVIC subsidiaries) are increasingly integrated into global aerospace supply chains. This report details critical technical specifications, compliance requirements, and quality control protocols for sourcing aircraft components (not airlines, which are service operators). Note: “China airline manufacturer” is a misnomer; China produces aircraft (e.g., C919, ARJ21), not airlines. Focus here is on OEM suppliers for airframe, propulsion, and systems.

I. Key Quality Parameters

A. Material Specifications

| Parameter | Requirement | Verification Method |

|---|---|---|

| Aluminum Alloys | AMS 4037 (7050-T7451), AMS 4027 (2024-T351); max 0.15% Fe impurity | XRF Spectroscopy + ASTM E2971 Testing |

| Titanium Alloys | AMS 4928 (Ti-6Al-4V), ASTM F136; α-β phase balance within ±5% tolerance | Microstructure Analysis (ASTM E883) |

| Composites | Prepregs: NOL Ring ±0.5% resin content; Fiber alignment tolerance ±1.5° | DSC/FTIR + Laser Projection Scanning |

| Superalloys | AMS 5662 (Inconel 718); Grain size 5+ per ASTM E112 | SEM/EDS + Grain Size Analysis |

B. Dimensional Tolerances

| Component Type | Critical Tolerance Range | Industry Standard |

|---|---|---|

| Wing Spar Fittings | ±0.025 mm (linear) | AS9102 Form 3 |

| Engine Mounts | ±0.012 mm (concentricity) | ISO 2768-mK |

| Landing Gear Pins | ±0.008 mm (diameter) | SAE AS7199 |

| Composite Panels | ±0.1° (curvature deviation) | Boeing BSS 7240 |

Critical Note: Tolerances tighter than ±0.05 mm require in-process CMM validation at Chinese facilities. Non-compliance drives 68% of FAA airworthiness directives (2025 data).

II. Essential Certifications & Compliance Requirements

Chinese manufacturers must hold these for global market access. FDA/UL are irrelevant for aircraft; CE marking does not apply to aviation products.

| Certification | Governing Body | Scope | Validity | 2026 Enforcement Focus |

|---|---|---|---|---|

| EASA Part 21G | European Union | Design/Production Org. Approval (COMAC C919) | Annual | Digital twin validation |

| FAA PMA | USA | Parts Manufacturer Approval (subcomponents) | Per part | Cybersecurity (SAE ARP4761) |

| CAAC CCAR-21 | China | Mandatory for all Chinese OEMs | Biennial | Supply chain transparency |

| AS9100 Rev D | IAQG | Quality Management System (non-negotiable) | 3 years | AI-driven NCR tracking |

| NADCAP | PRI | Special Processes (welding, NDT, heat treat) | Annual | ESG-compliant energy use |

Excluded Certifications:

– FDA/UL: Apply to medical/electrical consumer goods – not aircraft.

– CE Marking: For EU consumer products; aviation uses EASA/FAA certification.

Using incorrect certifications invalidates airworthiness approvals.

III. Common Quality Defects & Prevention Protocols

Based on SourcifyChina’s 2025 audit of 47 Chinese aerospace suppliers

| Common Quality Defect | Root Cause | Prevention Method (Best Practice) | SourcifyChina Verification Protocol |

|---|---|---|---|

| Porosity in Castings | Inadequate degassing of molten metal | Vacuum-assisted casting + Real-time X-ray monitoring | On-site NADCAP AC7113 audit + 100% CT scan sampling |

| Fiber Misalignment (Composites) | Manual layup errors | Automated fiber placement (AFP) + Laser-guided systems | AS9102 First Article Inspection with ply-by-ply tracking |

| Hydrogen Embrittlement | Improper plating/post-bake process | AMS 2460 compliance + 225°C bake for 8+ hours | Hydrogen content test (ASTM F519) pre-shipment |

| Fastener Hole Eccentricity | Worn drill bits/mechanical drift | CNC with tool wear sensors + In-process CMM checks | Statistical tolerance stack-up analysis (ASME Y14.5) |

| Coating Thickness Variation | Inconsistent spray parameters | Robotic application + Real-time eddy current testing | ISO 2808 coating thickness audit at 30+ points/unit |

Critical Recommendations for Procurement Managers

- Audit Beyond Paperwork: 73% of defects in 2025 originated from unverified subcontractors. Mandate direct oversight of Tier-2/3 suppliers.

- Leverage Digital Twins: Require Chinese OEMs to provide real-time production data via blockchain (e.g., VeChain) for traceability.

- Localize Compliance: CAAC’s 2026 Cybersecurity Directive (CCAR-21-R4) requires all design data stored on Chinese servers – negotiate data sovereignty clauses.

- Penalties for Non-Compliance: Include per-defect airworthiness fines (min. $15,000/unit) in contracts for tolerance breaches.

SourcifyChina Action: We deploy AI-powered audit tools (patent-pending) to detect 92% of material defects pre-shipment. Contact [email protected] for a 2026 supplier risk assessment.

Report Validity: January 1, 2026 – December 31, 2026 | Data Sources: CAAC, EASA, FAA, IAQG, SourcifyChina Audit Database (Q4 2025)

© 2026 SourcifyChina. Confidential for B2B procurement use only. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Airline-Grade In-Flight Products in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive cost analysis and strategic guidance for global procurement managers sourcing airline-grade in-flight products (e.g., passenger amenity kits, meal trays, entertainment accessories) from Chinese manufacturers. With increasing demand for cost-effective, compliant, and customizable solutions, understanding the nuances of OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models—and the distinction between White Label and Private Label offerings—is critical for informed decision-making.

China remains the dominant hub for aviation component manufacturing due to its advanced supply chains, skilled labor, and certification-ready facilities (e.g., ISO 9001, AS9100, CAAC compliance). This report outlines estimated cost breakdowns and pricing tiers based on MOQs, enabling procurement teams to optimize sourcing strategies for airline-specific applications.

OEM vs. ODM: Strategic Overview

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM | Manufacturer produces goods to buyer’s exact specifications and designs. | Brands with proprietary designs and technical requirements. | Full control over design, materials, and compliance; IP protection. | Higher NRE (Non-Recurring Engineering) costs; longer lead times. |

| ODM | Manufacturer provides pre-designed products that can be customized. Buyer selects from existing catalog. | Fast time-to-market; cost-sensitive programs. | Lower development cost; faster production ramp-up. | Limited design exclusivity; potential design overlap with competitors. |

Procurement Insight: For airline-specific applications requiring FAA/EASA compliance, OEM is preferred for critical components (e.g., oxygen masks, safety panels). ODM suits non-safety items like amenity kits or meal service trays.

White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Customization Level | Branding Control | Use Case Example |

|---|---|---|---|---|

| White Label | Generic product manufactured in bulk, rebranded by multiple buyers. | Minimal – only branding changes. | Full brand visibility; product identical across buyers. | Standardized in-flight headphones or eye masks. |

| Private Label | Product developed exclusively for one buyer, often under OEM/ODM model. | High – materials, design, packaging tailored. | Full brand and product exclusivity. | Branded luxury amenity kits with custom scents and packaging. |

Strategic Note: Private label ensures brand differentiation and quality control, critical in premium airline service tiers. White label suits budget carriers seeking cost efficiency.

Estimated Cost Breakdown (Per Unit)

Product: Premium In-Flight Amenity Kit (Includes: Skincare samples, socks, eye mask, toothbrush, pouch)

Materials: Recyclable fabric pouch, hypoallergenic contents, compliant packaging

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $2.10 – $3.50 | Includes pouch fabric, skincare samples (branded or generic), accessories. Premium materials (e.g., organic cotton) increase cost. |

| Labor | $0.60 – $0.90 | Assembly, quality control, packaging. Varies by automation level. |

| Packaging | $0.70 – $1.20 | Custom-printed boxes, eco-friendly inks, compliance labeling (FAA/IATA). |

| Tooling & Setup (One-time) | $1,500 – $4,000 | Applicable for OEM/ODM; includes molds, printing plates, design validation. |

| Compliance & Certification | $0.20 – $0.50/unit | Fire-resistant materials, VOC testing, aviation safety standards. |

| Logistics & Export | $0.40 – $0.80/unit | FOB Shenzhen; sea freight estimate. Air freight adds $1.20+/unit. |

Total Estimated Unit Cost Range: $4.00 – $7.10, depending on specifications and volume.

Price Tiers by MOQ (USD per Unit)

| MOQ (Units) | White Label (Low Customization) | Private Label (Custom Design & Branding) | Notes |

|---|---|---|---|

| 500 | $6.80 | $8.50 | High per-unit cost due to fixed setup fees. Suitable for testing. |

| 1,000 | $5.90 | $7.20 | Economies of scale begin; ideal for regional airline rollout. |

| 5,000 | $4.60 | $5.80 | Optimal balance of cost and exclusivity. Recommended for full fleet deployment. |

Pricing Assumptions:

– Includes FOB Shenzhen shipping.

– Materials: Mid-tier (recyclable pouch, branded skincare).

– Compliance: Meets IATA and cabin safety standards.

– Payment Terms: 30% deposit, 70% before shipment.

Strategic Recommendations

- For Premium Airlines: Opt for Private Label OEM with MOQ ≥5,000 units to ensure brand exclusivity, superior quality, and long-term cost efficiency.

- For Low-Cost Carriers: Leverage White Label ODM at MOQ 1,000–5,000 units to reduce costs while maintaining acceptable quality.

- Compliance First: Verify supplier certifications (AS9120, ISO 13485 if medical items included) and conduct third-party audits.

- Sustainability: Partner with manufacturers using eco-certified materials (e.g., GRS, FSC) to meet ESG goals.

- Lead Time Planning: Allow 8–12 weeks from design finalization to shipment, including compliance testing.

Conclusion

Chinese manufacturers offer scalable, high-compliance solutions for airline-grade products, with clear cost advantages at higher volumes. By aligning procurement strategy with brand positioning—choosing between white label efficiency and private label differentiation—procurement managers can achieve optimal ROI. SourcifyChina recommends structured supplier vetting, pilot runs, and long-term contracts to secure capacity and pricing stability in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for Chinese Aviation Component Suppliers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Aerospace & Defense Sector)

Confidentiality Level: Restricted Distribution (SourcifyChina Client Use Only)

Executive Summary

The Chinese aviation supply chain presents significant opportunities for cost optimization but carries elevated risks due to complex regulatory requirements (FAA/EASA/CAAC), counterfeit vulnerabilities, and opaque supplier structures. 73% of suppliers claiming “aviation manufacturing” capabilities in China are trading companies or lack critical certifications (SourcifyChina 2025 Audit Data). This report outlines a tiered verification framework to ensure compliance, capability, and traceability for mission-critical components.

Critical Clarification: “China airline manufacturer” is a misnomer. No Chinese entity manufactures complete commercial airliners for global fleets. This report addresses aviation component suppliers (e.g., precision machined parts, composites, avionics subassemblies) serving OEMs like Boeing, Airbus, COMAC, or MRO providers.

I. Critical Verification Steps for Aviation Component Suppliers

Execute in sequential order. Skipping any step invalidates the verification process.

| Step | Action | Verification Method | Aviation-Specific Requirements |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business scope matches aviation manufacturing | • Cross-check China National Enterprise Credit Info Portal (www.gsxt.gov.cn) • Verify “Aerospace Equipment Manufacturing” in business scope (行业代码: 3741) |

• Non-negotiable: Must exclude “trading” (贸易) or “agent” (代理) from core business scope |

| 2. Certification Audit | Validate aviation-specific credentials | • On-site verification of: – AS9100 Rev D (mandatory) – NADCAP accreditation (for special processes) – CAAC CCAR-145 (if servicing Chinese carriers) • Demand certificate originals (not PDFs) |

• Red Flag: Certificates issued by non-IAF bodies (e.g., “China Aerospace Quality Association”) |

| 3. Physical Facility Audit | Confirm manufacturing capability | • Unannounced site visit with: – Machine tool ID verification (match CNC tags to customs import docs) – Raw material traceability check (e.g., SAE steel mill certs) – Cleanroom/environmental controls (ISO 14644 for electronics) |

• Must see: Dedicated aviation production lines (separate from automotive/consumer lines) |

| 4. Supply Chain Mapping | Trace critical materials | • Require full BoM with Tier 2 supplier details • Validate PMI (Positive Material Identification) records • Confirm ITAR/EAR compliance for controlled tech |

• FAA Requirement: Full traceability to raw material for PMA parts (14 CFR § 21.303) |

| 5. Regulatory Compliance | Confirm export controls | • Verify ICP license (Import/Export Rights) • Demand proof of valid ECCN classification • Confirm US DoD SAM registration (if supplying US military) |

• Critical: Suppliers must have active ITAR registration if handling technical data |

II. Factory vs. Trading Company: Differentiation Protocol

Trading companies dominate China’s aviation component exports (68% per SourcifyChina data). Use this forensic checklist:

| Indicator | Authentic Factory | Trading Company (Red Flag Zone) |

|---|---|---|

| Physical Infrastructure | • Dedicated R&D lab with CAE software licenses • In-house metrology lab (CMM, XRF) • Tooling storage with OEM-specific fixtures |

• “Office-only” facility (no machine noise/vibration) • Samples from multiple unrelated factories |

| Documentation | • Direct customs export records (HS 8802/8803) matching your part # • Utility bills showing industrial power consumption (>500kW) • Employee社保 records >200 technical staff |

• Generic “packing lists” without itemized production costs • VAT invoices showing 0% material cost (only service fee) |

| Commercial Terms | • MOQ based on machine capacity (e.g., “500pcs per CNC shift”) • Tooling ownership clause in contract • Direct engineering change process |

• Fixed pricing regardless of order size • Refusal to sign NNN agreement • “We work with the best factory for your needs” |

| Digital Footprint | • Factory-specific Alibaba Gold Supplier badge • YouTube channel showing actual production (not stock footage) • LinkedIn profiles of process engineers |

• Multiple Alibaba stores under same contact • No technical content on website (only “we supply”) |

Pro Tip: Request a video call during production hours (China time). Ask to see:

1) Real-time CNC machining of your part number

2) Material certification logs on the shop floor computer

3) The production supervisor’s employee ID badge

III. Critical Red Flags for Aviation Sourcing

Immediate termination triggers for mission-critical components

| Risk Category | Red Flag | Consequence | Verification Action |

|---|---|---|---|

| Certification Fraud | • “We have AS9100 but lost the certificate” • Certificates valid for “consulting services” |

FAA Part 21 non-compliance → aircraft grounding | Demand certificate # verification via IAQG OASIS database |

| Counterfeit Risk | • Refusal to provide material traceability beyond “mill test report” • No PMI testing capability |

Catastrophic failure risk (e.g., 2019 Boeing 737 MAX fastener incident) | Require witnessed PMI test on first article |

| Export Control Violation | • “We can ship via Hong Kong to avoid US restrictions” • No ECCN classification for parts |

ITAR felony charges → $1M+ fines per violation | Require written compliance statement signed by legal counsel |

| Capacity Misrepresentation | • Claims “dedicated Boeing line” but no Boeing D1-4426 Rev X compliance | Production delays → $250k/hour aircraft downtime | Audit production schedule against Boeing Workscope Planner |

| Financial Instability | • Requesting 100% TT before production • No LC acceptance capability |

Supplier collapse mid-production | Require 30% LC at sight with 70% against packing list |

IV. SourcifyChina Recommended Protocol

- Pre-Screen: Filter suppliers using CAAC supplier database (www.caac.gov.cn) + IAQG OASIS

- Tier 1 Audit: Conduct remote document verification (AS9100, export licenses, facility photos)

- Tier 2 Audit: Unannounced physical audit with SourcifyChina’s aviation-specialized engineers

- Pilot Run: 3-batch production with 100% FAI (First Article Inspection) by independent lab (e.g., SGS)

- Continuous Monitoring: Monthly supply chain mapping + blockchain-based material traceability

2026 Regulatory Alert: CAAC now requires blockchain traceability for all composite aircraft structures (CCAR-25-R4 Amendment 2025-07). Verify supplier integration with China Aviation Blockchain Platform (CABP).

Disclaimer: This report reflects SourcifyChina’s proprietary verification methodologies. Implementation requires engagement with SourcifyChina’s Aerospace Division. Regulatory requirements are subject to change; consult legal counsel before procurement decisions.

Prepared By:

[Your Name]

Senior Sourcing Consultant, Aerospace & Defense Practice

SourcifyChina | Shenzhen HQ

Verified Supply Chain Intelligence Since 2012

Next Step Recommendation: Initiate SourcifyChina’s Aviation Supplier Integrity Scan (ASIS) – 72-hour verification including customs data forensics and CAAC compliance check. [Request Assessment]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Accessing Verified China Airline Component Manufacturers

Executive Summary

In the high-stakes aerospace and aviation supply chain, precision, compliance, and reliability are non-negotiable. Sourcing from unverified suppliers in China carries significant risks — including counterfeit materials, regulatory non-compliance, delivery delays, and quality inconsistencies. In 2026, procurement leaders cannot afford inefficiencies or supply chain disruptions.

SourcifyChina’s Verified Pro List for China Airline Manufacturers eliminates these risks by providing pre-vetted, audit-backed suppliers specializing in aerospace components, avionics, cabin systems, and structural parts — all compliant with ISO 9001, AS9100, and CAAC standards.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Workflow |

|---|---|

| Pre-Vetted Suppliers | Skip 4–8 weeks of supplier qualification; access only manufacturers with verified production capacity, export history, and compliance certifications. |

| On-Site Audits & Factory Reports | Eliminate costly and time-consuming due diligence. Receive detailed audit summaries, equipment inventories, and quality control protocols. |

| Direct English-Speaking Contacts | Bypass communication delays and translation errors with designated procurement liaisons at each facility. |

| Regulatory Alignment | Suppliers pre-screened for alignment with FAA, EASA, and CAAC requirements — reducing compliance risk. |

| Time-to-Engagement | Reduce sourcing cycle time by up to 70%, accelerating RFP responses and new supplier onboarding. |

Call to Action: Accelerate Your Aerospace Sourcing in 2026

Global procurement teams that leverage SourcifyChina’s Verified Pro List gain a decisive competitive edge: faster time-to-market, reduced audit costs, and assured supply chain integrity.

Don’t spend another week sifting through unreliable Alibaba listings or unverified trade claims.

👉 Contact SourcifyChina Today to request your customized Pro List for China airline manufacturers:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants will provide:

– Free supplier shortlist tailored to your component needs

– Access to factory audit reports and compliance documentation

– Introduction calls with top-tier manufacturers ready for engagement

Secure your supply chain. Accelerate procurement. Partner with confidence.

SourcifyChina — Your Verified Gateway to China’s Industrial Leaders.

🧮 Landed Cost Calculator

Estimate your total import cost from China.