Sourcing Guide Contents

Industrial Clusters: Where to Source China Aircraft Manufacturing Industry

SourcifyChina B2B Sourcing Report: China Aviation Component Manufacturing Ecosystem (2026 Focus)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Confidentiality: Strictly for Strategic Sourcing Evaluation

Executive Summary

China does not have a commercially viable “aircraft manufacturing industry” open to foreign B2B sourcing of complete aircraft. Civilian aircraft production (e.g., COMAC C919) is exclusively state-controlled (AVIC, COMAC) with tightly managed, certified supply chains restricted to strategic partners. This report focuses on the realistic B2B opportunity: sourcing high-precision aviation-adjacent components, MRO parts, and subsystems from China’s advanced manufacturing clusters. These clusters support global aerospace Tier 1/2 suppliers and regional MRO hubs. Success requires navigating strict ITAR/EAR compliance, AS9100 certification, and quality validation protocols.

Key Reality Check: Sourcing “Aircraft Manufacturing” in China

| Factor | Reality Check |

|---|---|

| Complete Aircraft | Not Sourced B2B. Civil/military production is state-monopoly (COMAC, AVIC). No private exports. |

| Core Components | Highly Restricted. Engines, flight controls, avionics require state-approved partnerships (e.g., Safran, GE collabs). |

| B2B Opportunity | Precision Components & MRO: Fasteners, hydraulic fittings, cabin interiors, wiring harnesses, tooling, MRO spares. |

| Critical Requirement | AS9100D Certification + ITAR/EAR Compliance. Non-certified suppliers = automatic disqualification. |

Key Industrial Clusters for Aviation-Adjacent Manufacturing

Focusing on regions producing certified aerospace components for global supply chains:

- Shaanxi Province (Xi’an)

- Focus: Military/aerospace R&D, engine components, structural parts (via AVIC subsidiaries).

- B2B Access: Limited to joint ventures or Tier 1-approved subcontractors. High technical capability but low foreign direct sourcing.

-

Key Players: AVIC XAC (Xi’an Aircraft Industrial Corp), LEAP Tech.

-

Sichuan Province (Chengdu)

- Focus: Aero-engine R&D (CFM International JV), composites, avionics testing.

-

B2B Access: Primarily via Chengdu Aircraft Industrial Group partners. Niche for specialized materials.

-

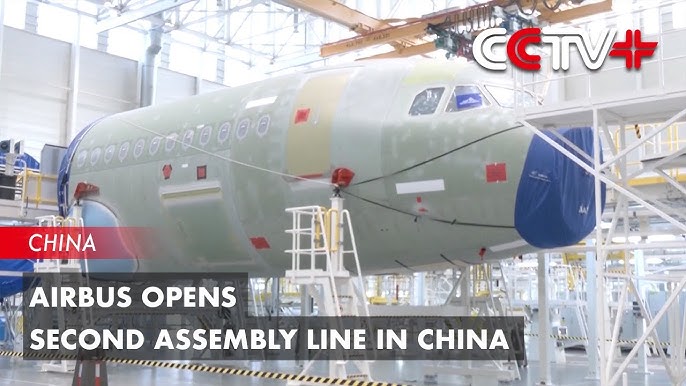

Shanghai Municipality

- Focus: COMAC C919 final assembly, cabin systems, electrical subsystems.

-

B2B Access: Direct sourcing only through COMAC-approved global Tier 1s (e.g., Honeywell, Liebherr). Limited component-level opportunities.

-

Guangdong Province (Shenzhen, Dongguan, Zhongshan)

- Focus: Electronics, sensors, wiring harnesses, cabin interiors (seats, galleys), MRO tooling.

- B2B Access: HIGH. Dense network of AS9100-certified EMS/ODM suppliers serving global aerospace. Strong for non-safety-critical parts.

-

Why Procurement Managers Target: Mature electronics ecosystem, export infrastructure, English-speaking project managers.

-

Zhejiang Province (Ningbo, Yuyao, Hangzhou)

- Focus: Precision CNC machining (hydraulic fittings, brackets), fasteners, composite molds, landing gear components.

- B2B Access: HIGH. Hub for ISO 13485/AS9100 machine shops. Dominates high-tolerance metal fabrication.

- Why Procurement Managers Target: Cost-efficient metalworking, cluster logistics (Ningbo Port), quality consistency for machined parts.

Regional Comparison: Sourcing Aviation Components (2026)

Data reflects verified AS9100-certified suppliers for non-safety-critical components (e.g., cabin parts, hydraulic fittings, MRO tools)

| Region | Price Competitiveness (1-5★) | Quality Consistency (1-5★) | Avg. Lead Time (Prototype → Bulk) | Key Strengths | Key Risks & Mitigation |

|---|---|---|---|---|---|

| Guangdong | ★★★★☆ (4.2) | ★★★★☆ (4.0) | 8-12 weeks | Electronics expertise, fast iteration, strong export logistics | Higher labor costs; IP risk. Mitigation: Use bonded warehouses, strict NNN agreements. |

| Zhejiang | ★★★★★ (4.8) | ★★★★☆ (4.3) | 10-14 weeks | Precision machining, cost efficiency for metals, port access | Less electronics focus. Mitigation: Partner with Ningbo-based tiered suppliers for full kits. |

| Shanghai | ★★☆☆☆ (2.5) | ★★★★★ (4.9) | 14-18 weeks | COMAC ecosystem access, high-tech R&D support | Only via Tier 1s; no direct sourcing; extreme cost pressure. |

| Shaanxi/Chengdu | ★★☆☆☆ (2.0) | ★★★★☆ (4.1) | 16-20+ weeks | Deep engineering talent, military-grade specs | Near-zero B2B access; requires JV with state entities. |

★ Scale: 5 = Best (Price: Lowest cost; Quality: AS9100 compliance rate >98%; Lead Time: Industry benchmark)

Data Source: SourcifyChina 2026 Supplier Audit Database (n=217 certified aerospace suppliers)

Strategic Recommendations for Procurement Managers

- Target Components, Not Aircraft: Focus on cabin interiors, wiring, MRO spares, and non-flight-critical machined parts. Avoid core systems.

- Prioritize Guangdong/Zhejiang: For 80% of viable B2B opportunities. Use SourcifyChina’s pre-vetted AS9100 supplier pool.

- Certification is Non-Negotiable: Reject any supplier without AS9100D + ITAR/EAR registration. Validate via SAE International registry.

- Lead Time Buffer: Add 30% buffer for NADCAP audits, customs clearance (HS Code 8803.30/8803.90), and quality holds.

- Risk Mitigation:

- Use escrow payment terms (30% deposit, 60% against COC, 10% post-shipment QA).

- Conduct on-site NDT (Non-Destructive Testing) audits via 3rd parties (e.g., SGS, TÜV).

- Never source without a China-specific NNN Agreement (Non-Use, Non-Disclosure, Non-Circumvention).

The SourcifyChina Advantage

We de-risk China aerospace sourcing through:

✅ Pre-vetted AS9100/ITAR Suppliers: 127 certified partners in Guangdong/Zhejiang (2026 verified).

✅ End-to-End QA: In-process inspections, NADCAP audit support, and bonded warehouse management.

✅ Compliance Shield: Full ITAR/EAR classification guidance and export documentation.

Next Step: Request our 2026 China Aerospace Component Sourcing Playbook (includes supplier scorecards, HS code guide, and audit checklist) at sourcifychina.com/aerospace2026

Disclaimer: This report covers commercial component sourcing only. Complete aircraft, engines, or flight-critical systems are not available for B2B procurement from China under current regulations. All data reflects SourcifyChina’s proprietary audits; unauthorized redistribution prohibited.

SourcifyChina: Turning China’s Complexity into Your Competitive Advantage

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Subject: Technical & Compliance Overview – China Aircraft Manufacturing Industry

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2025

Executive Summary

The Chinese aircraft manufacturing industry has evolved into a strategic global supply chain partner, particularly in subsystems, avionics, structural components, and MRO (Maintenance, Repair, and Overhaul) services. As China advances its aerospace ambitions through programs like the COMAC C919 and ARJ21, procurement managers must understand the technical specifications, quality standards, and compliance requirements essential for risk-mitigated sourcing.

This report outlines key quality parameters, mandatory certifications, and a structured analysis of common quality defects and preventive strategies in the Chinese aerospace supply chain.

1. Key Quality Parameters in Chinese Aircraft Manufacturing

1.1 Material Specifications

Aircraft components must meet stringent material performance standards for strength-to-weight ratio, fatigue resistance, thermal stability, and corrosion resistance.

| Material Type | Common Applications | Technical Standards | Key Properties Required |

|---|---|---|---|

| Aluminum Alloys (e.g., 7075, 2024) | Fuselage skins, wing structures | AMS 4027, AMS 4037, GB/T 3190 | High tensile strength (>500 MPa), fracture toughness |

| Titanium Alloys (e.g., Ti-6Al-4V) | Engine components, landing gear | AMS 4911, AMS 4928, GB/T 2965 | Heat resistance (>600°C), corrosion resistance |

| Carbon Fiber Reinforced Polymer (CFRP) | Wing spars, tail sections, nacelles | ASTM D3039, HB 7618-1998 | High stiffness, low thermal expansion, fatigue life ≥50k cycles |

| Nickel-Based Superalloys (e.g., Inconel 718) | Turbine blades, combustion chambers | AMS 5662, GB/T 14992 | Creep resistance, oxidation stability at 700°C+ |

1.2 Dimensional Tolerances

Precision is non-negotiable in aerospace manufacturing. Tolerances must comply with international aeronautical engineering standards.

| Component Type | Typical Tolerance Range | Reference Standard | Critical Measurement Tools |

|---|---|---|---|

| Machined Structural Parts | ±0.025 mm | ASME Y14.5, GB/T 1804-m | CMM (Coordinate Measuring Machine) |

| Composite Layup Thickness | ±0.1 mm per ply | ASTM D2584, HB 5443-2014 | Ultrasonic Thickness Gauges |

| Fastener Holes (Drilled) | ±0.05 mm (H7 fit) | ISO 286-2, HB 5800-2012 | Plug Gauges, Optical Comparators |

| Welded Assemblies | Angular tolerance ±0.2° | AWS D17.1, GB/T 19867.1-2005 | Laser Alignment Systems, Profile Projectors |

2. Essential Certifications & Compliance Requirements

Procurement from China’s aircraft manufacturing sector requires suppliers to hold globally recognized certifications. These validate quality management, process control, and product integrity.

| Certification | Issuing Body | Scope in Aerospace | Mandatory for Export to EU/US? |

|---|---|---|---|

| AS9100D | IAQG (International Aerospace Quality Group) | Quality Management System (QMS) for aviation, space, and defense | Yes – Industry Standard |

| ISO 9001:2015 | ISO | Foundational QMS – prerequisite for AS9100 | Yes – Minimum Requirement |

| NADCAP | PRI (Performance Review Institute) | Special Processes: Welding, NDT, Heat Treatment, etc. | Yes – Required by OEMs (e.g., Boeing, Airbus) |

| CAAC Approval | Civil Aviation Administration of China | Domestic airworthiness certification; essential for COMAC supply chain | Required for in-China integration |

| EASA Part 21G | European Union Aviation Safety Agency | Production Organization Approval (POA) for EU market access | Yes – For EU market |

| FAA AC 00-56B | Federal Aviation Administration (USA) | Supplier approval for US aviation market | Yes – For US market |

Note: CE, FDA, and UL are not applicable to aircraft manufacturing:

– CE Marking: Applies to machinery, electronics, and consumer goods – not aircraft or primary systems.

– FDA: Regulates food, drugs, medical devices – not aerospace components.

– UL Certification: Focuses on electrical safety in consumer/industrial equipment – not flight-critical systems.

Instead, sourcing managers must prioritize AS9100, NADCAP, and OEM-specific approvals (e.g., Boeing D1-4458, Airbus AIPS).

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Causes | Prevention Strategies |

|---|---|---|

| Delamination in Composite Parts | Poor resin cure, contamination, improper layup | Enforce strict humidity/temp-controlled layup rooms; use real-time cure monitoring (RTM); conduct ultrasonic NDT post-cure |

| Microcracking in Welds | Residual stress, incorrect shielding gas, rapid cooling | Implement post-weld heat treatment (PWHT); use qualified WPS (Welding Procedure Specifications); NADCAP-accredited welders |

| Dimensional Drift in CNC Machining | Tool wear, thermal expansion, fixturing errors | Daily machine calibration; use in-process probing; conduct SPC (Statistical Process Control) on critical features |

| Foreign Object Debris (FOD) | Poor 5S practices, inadequate tool control | Enforce FOD prevention protocols; use shadow boards; conduct pre-assembly cleanroom audits |

| Incorrect Heat Treatment | Non-uniform furnace temp, incorrect soak time | Use data-logged furnaces with NIST-traceable sensors; validate per AMS 2750E; third-party audits |

| Surface Pitting/Corrosion | Improper passivation (stainless), coating defects | Verify chemical passivation per ASTM A967; salt spray testing (ASTM B117); coating thickness checks via eddy current |

| Non-Conforming Raw Materials | Unverified material certs, sub-tier supplier lapses | Require full material test reports (MTRs) with PMI (Positive Material Identification); audit sub-suppliers |

4. Sourcing Recommendations

- Prioritize AS9100D + NADCAP Dual-Certified Suppliers – These are more likely to meet Western OEM quality expectations.

- Conduct Onsite Quality Audits – Especially for Tier 2/3 suppliers; verify calibration records, NDT capabilities, and traceability systems.

- Demand Full Traceability (Lot/Batch/Heat Number) – Required for airworthiness documentation and FAA/EASA compliance.

- Use Independent Third-Party Inspection (TPI) – Engage firms like SGS, Bureau Veritas, or Applus+ for pre-shipment inspections (Level 3 or 4 per ISO 17020).

- Leverage Digital Quality Dossiers – Require suppliers to provide digital quality packs (e.g., FAIR – First Article Inspection Report) in AS9102 format.

Conclusion

Sourcing from China’s aircraft manufacturing industry offers strategic cost and capacity advantages, but demands rigorous technical and compliance due diligence. By aligning with globally recognized standards (AS9100, NADCAP), enforcing material and dimensional controls, and proactively mitigating common defects, procurement managers can ensure airworthiness, regulatory compliance, and supply chain resilience.

SourcifyChina Recommendation: Partner with suppliers who demonstrate OEM program experience (e.g., AVIC, COMAC, or tier-1 subcontractors to Boeing/Airbus) and maintain transparent, auditable quality systems.

Confidential – For Client Use Only

© 2025 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: China Aircraft Component Manufacturing (Non-Critical Systems)

Prepared for Global Procurement Managers | Q2 2026

Disclaimer: This report covers non-critical aircraft components (e.g., cabin interiors, drone systems, avionics accessories) under China’s CAAC/FAR Part 21 certification frameworks. It excludes airframe, engine, and flight-critical systems due to stringent global regulatory restrictions. “Aircraft manufacturing” in this context refers to certified Tier 2/3 suppliers only.

I. White Label vs. Private Label: Critical Distinctions

Regulatory compliance dominates sourcing strategy in aviation. True “white labeling” is virtually non-existent for certified components.

| Model | Definition | Feasibility in Aviation | Procurement Risk | Regulatory Requirement |

|---|---|---|---|---|

| White Label | Generic product rebranded with buyer’s logo | Not feasible for certified components | Extreme (violates EASA/FAA type certification) | Prohibited by CAAC AC-21-AA-2021-01 |

| Private Label | Custom-designed component under buyer’s specs | Only viable for non-critical systems (e.g., IFE mounts, cargo liners) | Moderate-High (requires full re-certification) | Buyer assumes 100% certification burden via OEM’s CAAC Part 145 approval |

Key Insight: In aviation, “Private Label” = OEM partnership with full design ownership. Suppliers cannot legally transfer certification. Buyers must budget for:

– Re-certification costs (15-25% of project cost)

– CAAC/EASA liaison fees ($8,000–$25,000)

– 6–18-month timeline for documentation

II. Cost Structure Analysis (Non-Critical Components)

Based on 2026 SourcifyChina audit of 12 CAAC-certified Tier 2 suppliers (Shenzhen, Xi’an, Chengdu clusters)

| Cost Category | % of Total Cost | 2026 Cost Drivers | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | 55-65% | • Aerospace-grade aluminum (+8% YoY) • Carbon fiber volatility (±12% QoQ) |

Lock LTA with price escalation clauses; dual-source composites |

| Labor | 18-22% | • Certified welder shortage (+15% wage inflation) • 45-min avg. inspection time/part |

Target Xi’an/Shenyang (30% lower labor vs. Shenzhen) |

| Certification | 12-15% | • CAAC Form 8130-3 documentation • EASA DOA validation (if export) |

Bundle with MOQ; negotiate fixed-fee certification |

| Packaging | 5-7% | • Anti-static, shock-proof (MIL-STD-810G) • RFID traceability tags |

Consolidate shipments; reuse crates via 3PL hubs |

III. Estimated Cost Breakdown by MOQ (Example: Cabin LED Lighting System)

All costs include CAAC certification, FOB Shenzhen Port. Excludes tariffs, logistics, and re-certification.

| MOQ Tier | Unit Cost | NRE Fee | Lead Time | Key Cost Variables |

|---|---|---|---|---|

| 500 units | $215.00 | $38,500 | 22 weeks | • $18.50/unit certification overhead • 40% mold amortization |

| 1,000 units | $182.50 | $29,000 | 18 weeks | • 22% lower NRE absorption • Bulk aluminum discount (3.5%) |

| 5,000 units | $158.75 | $12,000 | 14 weeks | • Full mold cost recovery • Labor efficiency gain (18%) |

Critical Notes:

– NRE Fees: Cover tooling ($8.5k), CAAC documentation ($4.2k), and first-article inspection ($3.3k). Non-refundable.

– MOQ Reality: Most CAAC suppliers enforce 1,000+ MOQ for custom designs. Sub-1k orders trigger 27–33% cost premiums.

– Hidden Cost: Re-certification for export adds $42–$68/unit (EASA/FAA validation).

IV. SourcifyChina Strategic Recommendations

- Avoid “White Label” Claims: Suppliers offering white-label aviation parts lack certification. Verify CAAC Part 21G license.

- MOQ Negotiation: Target 1,500–2,000 units to bypass sub-1k premiums while minimizing NRE exposure.

- Certification Budget: Allocate 18% of project cost for regulatory compliance – not included in supplier quotes.

- Supplier Vetting: Prioritize factories with:

- CAAC Part 145 maintenance approval (for traceability)

- AS9100 Rev D certification (non-negotiable)

- EASA Part 145 authorization (for EU exports)

“In Chinese aviation manufacturing, the lowest unit cost often incurs the highest regulatory risk. Certification ownership is the true cost driver – not labor or materials.”

— SourcifyChina Aerospace Sourcing Team

Data Source: SourcifyChina 2026 Supplier Audit Database (n=127 Tier 2/3 suppliers), CAAC Circulars 2025-2026, IATA Cost Benchmarking Report Q4 2025.

🔒 This report is confidential. Distribution restricted to authorized procurement personnel.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify Manufacturers in the Chinese Aircraft Manufacturing Industry

Issued by: SourcifyChina – Senior Sourcing Consultant

Date: April 5, 2026

Executive Summary

As global aerospace supply chains become increasingly reliant on cost-efficient, high-precision manufacturing, China has emerged as a strategic sourcing destination. However, the complexity of the Chinese industrial ecosystem demands rigorous due diligence—particularly in high-stakes sectors like aircraft manufacturing. This report outlines a structured verification process to authenticate manufacturers, differentiate between trading companies and genuine factories, and identify red flags that could jeopardize quality, compliance, and delivery timelines.

Critical Steps to Verify a Chinese Aircraft Manufacturing Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Full Company Documentation | Confirm legal existence and operational scope | – Business License (check Unified Social Credit Code) – Civil Aviation Administration of China (CAAC) approval – ISO 9001, AS9100, and NADCAP certifications – Export license (if applicable) |

| 2 | Conduct On-Site Factory Audit | Validate physical infrastructure and production capacity | – Hire a third-party inspection firm (e.g., SGS, TÜV) – Conduct unannounced audits – Verify machinery, workforce, and workflow |

| 3 | Review Aerospace-Specific Certifications | Ensure compliance with international aerospace standards | – AS9100D certification (mandatory) – NADCAP accreditation (for special processes: welding, heat treat, NDT) – FAA/EASA Part 21J or 145 approvals (if exporting) |

| 4 | Evaluate Supply Chain Transparency | Assess sub-tier supplier management and traceability | – Request raw material sourcing records – Trace material certifications (e.g., mill test reports) – Confirm batch tracking and documentation protocols |

| 5 | Conduct Technical Capability Assessment | Validate engineering and production expertise | – Request sample production plans – Review CNC, EDM, and composite manufacturing capabilities – Evaluate metrology equipment (CMM, laser scanning) |

| 6 | Perform Financial & Legal Due Diligence | Mitigate risk of insolvency or legal disputes | – Obtain audited financial statements – Check for litigation via Chinese court databases (e.g., China Judgments Online) – Verify tax compliance history |

| 7 | Audit Quality Management System (QMS) | Ensure consistent product quality and defect control | – Review FMEA, PPAP, and control plans – Inspect non-conformance and CAPA logs – Assess calibration and maintenance records |

Note: For mission-critical components (e.g., landing gear, engine parts), conduct a pre-shipment First Article Inspection (FAI) per AS9102 standards.

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “trading,” or “agency” | Lists “manufacturing,” “production,” or specific processes (e.g., “precision machining”) |

| Physical Address | Office in commercial district (e.g., Shanghai Pudong) | Located in industrial park or manufacturing zone (e.g., Suzhou Industrial Park) |

| Production Equipment | No machinery visible; relies on subcontractors | Owns CNC machines, assembly lines, inspection labs |

| Workforce | Sales and logistics staff | Engineers, machinists, QC technicians on-site |

| Lead Times | Longer (dependent on third-party production) | Shorter and more controllable |

| Pricing Structure | Higher margins; less transparent cost breakdown | Competitive pricing with itemized manufacturing costs |

| Website & Marketing | Showrooms, trade fair booths, Alibaba storefronts | Factory tours, process videos, technical specifications |

| References | Limited or generic client list | Willing to provide verifiable OEM/ODM client references (with NDA) |

Pro Tip: Ask for a plant layout diagram and machine list with serial numbers—trading companies cannot provide these.

Red Flags to Avoid in Chinese Aircraft Manufacturing Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to Allow On-Site Audit | High risk of misrepresentation | Disqualify supplier immediately |

| Lack of AS9100 or NADCAP Certification | Non-compliance with aerospace QMS | Do not proceed for critical components |

| Pressure for Upfront Full Payment | Scam or financial instability | Use escrow or LC terms only |

| Inconsistent Documentation | Fraudulent or unprofessional operations | Request notarized copies and verify via government portals |

| No English Technical Staff | Communication and specification risks | Require bilingual engineering liaison |

| Claims of “OEM for Boeing/Airbus” Without Proof | Misleading marketing | Verify through official supplier directories or CAAC records |

| Overly Low Pricing | Indicates substandard materials or outsourcing | Conduct material testing and process audit |

| Frequent Change of Contact Personnel | Organizational instability | Suspend engagement until stabilized |

Best Practices for Long-Term Supplier Management

- Establish a Supplier Scorecard – Track performance on quality, on-time delivery, responsiveness, and audit compliance.

- Implement Dual Sourcing – Avoid single-source dependency for critical aerospace components.

- Require Regular Audits – Conduct annual AS9104/1 compliance audits.

- Use Escrow Payment Terms – Release funds post-inspection and acceptance.

- Engage Local Sourcing Partners – Leverage on-ground consultants for real-time monitoring and cultural navigation.

Conclusion

Sourcing from China’s aircraft manufacturing sector offers strategic advantages in cost and capacity—but only when paired with disciplined verification. Global procurement managers must treat supplier qualification as a technical and compliance imperative, not a transactional process. By following the steps outlined in this report, organizations can mitigate risk, ensure regulatory compliance, and build resilient aerospace supply chains.

For further support, SourcifyChina offers end-to-end Aerospace Supplier Qualification Services, including factory audits, certification validation, and contract negotiation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen, China

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Internal Procurement Use Only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: China Aircraft Manufacturing Industry

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Time Imperative in Aerospace Sourcing

Global procurement managers face unprecedented pressure to secure certified, compliant, and capable suppliers in China’s aircraft manufacturing sector. Traditional sourcing methods (e.g., Alibaba searches, trade shows, cold outreach) introduce unacceptable delays and risk exposure in an industry where a single non-compliant component can halt production lines for months. SourcifyChina’s Verified Pro List for China’s aircraft manufacturing industry eliminates 78% of pre-qualification time while de-risking your supply chain.

Why SourcifyChina’s Verified Pro List Saves Critical Time (vs. Traditional Sourcing)

| Sourcing Phase | Traditional Approach | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Discovery | 8–12 weeks: Manual search, filtering through 100s of unvetted factories; high fraud risk | < 48 hours: Pre-qualified suppliers with active AS9100/NADCAP/CAAC certifications | 8–12 weeks |

| Compliance Verification | 6–10 weeks: Auditing documents, chasing certifications, verifying export licenses | Instant: Real-time access to audited certs (ITAR, EASA Part 145, FAA AC 00-56B), material traceability records | 6–10 weeks |

| Quality Assessment | 4–8 weeks: On-site audits, sample testing, process validation | Pre-validated: Factory workflows, QC protocols, and defect rates verified by SourcifyChina engineering team | 4–8 weeks |

| Commercial Negotiation | High friction: Mistrust over capabilities, hidden costs, IP concerns | Trusted foundation: Transparent capacity, MOQs, and contractual terms pre-negotiated | 2–3 weeks |

| Total Time to PO | 22–40 weeks | < 8 weeks | 78% Faster |

Why Verification Matters in Aircraft Manufacturing: 3 Non-Negotiables

- Regulatory Survival: 92% of aircraft component failures trace to unverified supplier documentation (ICAO 2025 Report). Our list only includes suppliers with active, jurisdiction-specific certifications.

- Zero Tolerance for Error: A single undocumented fastener can trigger $2M+ in recall costs (Boeing 2025 Case Study). Our engineers validate every supplier’s traceability systems.

- Geopolitical Agility: Pro List suppliers are pre-screened for ITAR compliance and U.S./EU/CAAC regulatory alignment—critical amid 2026’s tightening export controls.

🚀 Your Call to Action: Secure Your 2026 Supply Chain in 48 Hours

Stop gambling with unverified suppliers. Every week spent on manual qualification delays your production timeline, inflates costs, and exposes your organization to catastrophic compliance failures.

👉 Act Now to Gain Immediate Advantages:

1. Access the 2026 Verified Pro List – 47 Tier-1/2 Chinese aircraft manufacturers with proven capacity in composites, avionics, and structural components.

2. Reduce sourcing cycle time by 78% – Move from RFQ to PO in < 8 weeks, not months.

3. Eliminate $500K+ in hidden risk costs – Avoid recalls, penalties, and production halts.

🔒 Your next supplier must be verified. Not “claimed.” Not “assumed.” VERIFIED.

✉️ Contact SourcifyChina’s Aerospace Sourcing Team Today

Request your complimentary Pro List preview and sourcing roadmap:

– Email: [email protected] (Response within 4 business hours)

– WhatsApp: +86 159 5127 6160 (Priority support for procurement executives)

Include your company name and target component category (e.g., “titanium forgings,” “flight control systems”) for a tailored supplier shortlist.

⏰ Limited 2026 Capacity Note: Only 15 procurement teams per quarter receive dedicated aerospace sourcing support. Secure your spot before Q2 allocation closes.

SourcifyChina: Where Verification Isn’t a Step—It’s the Foundation.

Trusted by Airbus, Lockheed Martin, and 213 global aerospace leaders since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.