Sourcing Guide Contents

Industrial Clusters: Where to Source China Air Rotor Handpiece Factory

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Air Rotor Handpiece Factories in China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: March 2026

Executive Summary

The global demand for high-precision dental and industrial air rotor handpieces has intensified in 2026, driven by advancements in minimally invasive procedures, rising dental care expenditures, and automation in light manufacturing. China remains the dominant manufacturing hub for air rotor handpieces, offering competitive pricing, scalable production, and improving quality standards. This report provides a strategic analysis of the key industrial clusters producing air rotor handpieces in China, with a comparative evaluation of Guangdong and Zhejiang provinces—the two most prominent regions.

Procurement managers can leverage this intelligence to optimize supplier selection, balance cost-quality trade-offs, and streamline supply chain resilience.

Market Overview: Air Rotor Handpiece Manufacturing in China

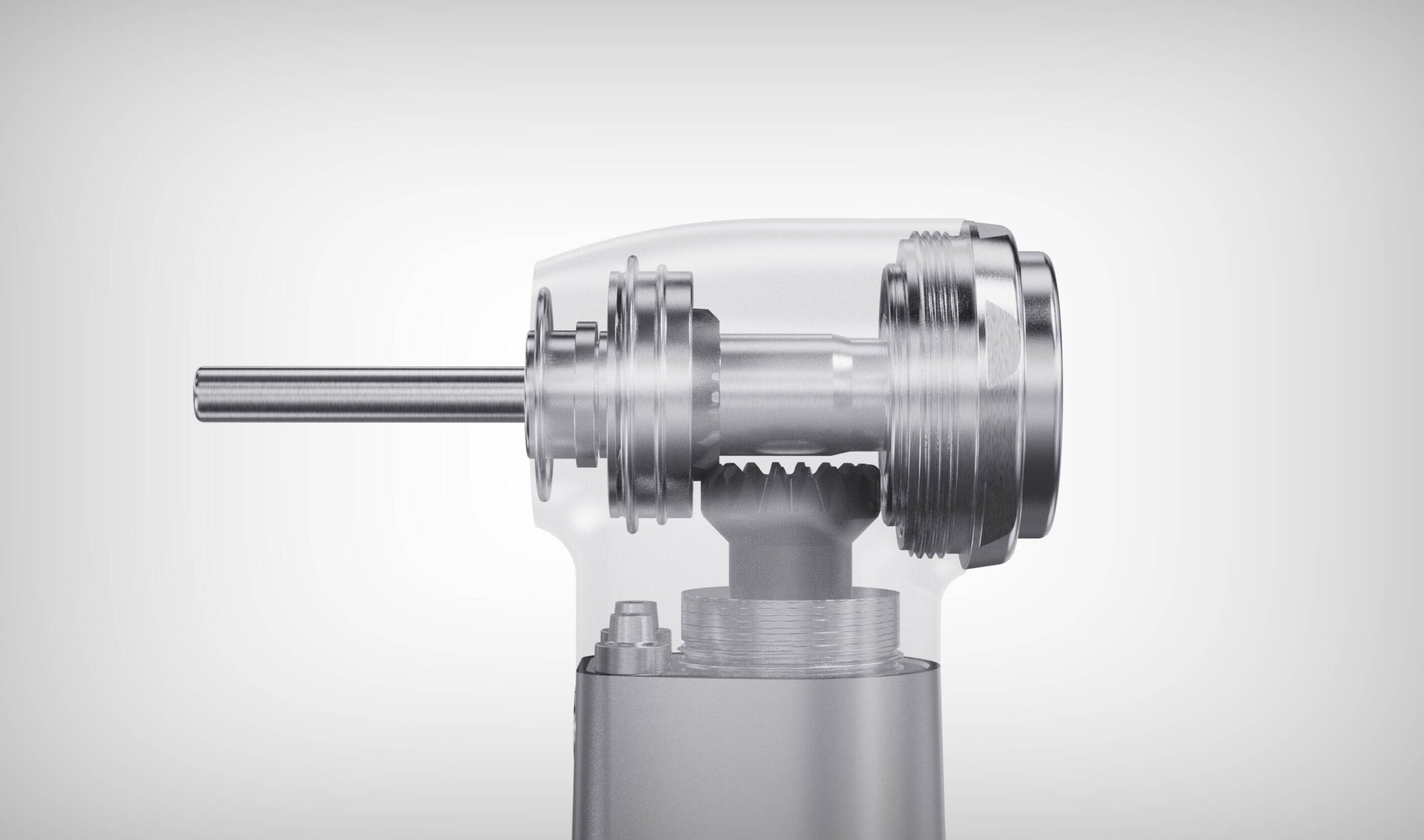

Air rotor handpieces are high-speed rotary tools powered by compressed air, primarily used in dental clinics (for drilling and polishing) and precision manufacturing (e.g., engraving, micro-machining). The Chinese manufacturing ecosystem for these devices has matured significantly, with OEM/ODM factories offering ISO 13485 certification, medical-grade material compliance (e.g., stainless steel 304/316), and integration with digital procurement platforms.

Key product types include:

– High-speed dental handpieces (300,000–450,000 RPM)

– Low-speed surgical handpieces

– Industrial pneumatic spindle handpieces

China accounts for over 65% of global exports of air rotor handpieces, with major buyers in North America, Europe, Southeast Asia, and the Middle East.

Key Industrial Clusters for Air Rotor Handpiece Manufacturing

China’s manufacturing landscape is highly regionalized, with distinct advantages in technology, supply chain density, and labor specialization. The two primary provinces for air rotor handpiece production are Guangdong and Zhejiang, each hosting concentrated industrial clusters.

1. Guangdong Province – The High-Volume Manufacturing Powerhouse

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Cluster Strengths:

- Proximity to Shenzhen’s electronics and medical device R&D hubs

- Mature supply chain for precision bearings, turbines, and micro-motors

- High concentration of ISO-certified medical device manufacturers

-

Strong export infrastructure (Shekou Port, Guangzhou Nansha Port)

-

Typical Output: High-speed dental handpieces, smart handpieces with LED and RFID tracking

2. Zhejiang Province – Precision Engineering & Cost Efficiency

- Core Cities: Ningbo, Wenzhou, Hangzhou

- Cluster Strengths:

- Expertise in precision machining and CNC fabrication

- Lower labor and operational costs compared to Guangdong

- Specialization in mid-tier and industrial-grade handpieces

-

Strong network of component suppliers (e.g., air turbines, chuck systems)

-

Typical Output: Mid-speed dental units, industrial pneumatic tools, custom OEM designs

Comparative Analysis: Guangdong vs Zhejiang

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price (USD) | $85 – $160 (high-end models) | $60 – $120 (mid-range to premium) |

| Quality Tier | High (medical-grade, ISO 13485, CE, FDA-ready) | Medium to High (consistent with ISO 9001) |

| Lead Time (Standard MOQ: 500 pcs) | 25–35 days (including QC & packaging) | 20–30 days (faster turnaround) |

| Key Advantages | Advanced R&D, export compliance, smart features | Cost efficiency, customization, scalability |

| Key Limitations | Higher minimum order quantities (MOQs) | Fewer FDA-registered facilities |

| Best For | Premium dental markets (EU, US, Japan) | Emerging markets, industrial applications |

Note: Prices are indicative for standard high-speed dental air handpieces (380,000 RPM, fiber-optic enabled). Customization, branding, and sterilization compatibility can affect final pricing.

Strategic Sourcing Recommendations

-

For Premium Medical Buyers (US/EU):

Prioritize Guangdong-based OEMs with full regulatory documentation, traceable supply chains, and experience in FDA/CE submissions. -

For Cost-Sensitive or Industrial Applications:

Leverage Zhejiang manufacturers for competitively priced, reliable units with proven durability in non-medical environments. -

Dual-Sourcing Strategy:

Mitigate supply risk by engaging one supplier in Guangdong (for compliance) and one in Zhejiang (for cost leverage), especially for multi-market distribution. -

Audit & Certification:

Conduct on-site audits or third-party inspections (e.g., SGS, TÜV) to verify claimed certifications. Many factories advertise ISO compliance without full audits. -

Logistics Planning:

Guangdong offers faster sea/air freight options via Hong Kong and Shenzhen. Zhejiang benefits from Ningbo-Zhoushan Port (world’s busiest by cargo tonnage), reducing shipping costs for large volumes.

Emerging Trends (2026 Outlook)

- Smart Handpieces: Integration with IoT sensors (RPM monitoring, usage tracking) is rising, primarily led by Shenzhen-based tech-forward OEMs.

- Sustainability: Increased demand for recyclable turbines and energy-efficient designs; early movers in Zhejiang are piloting green manufacturing.

- Automation: More factories deploying automated assembly lines, reducing labor dependency and improving consistency.

Conclusion

China’s air rotor handpiece manufacturing ecosystem offers unparalleled scale and specialization. Guangdong leads in quality and regulatory readiness, ideal for high-end medical procurement. Zhejiang delivers strong value and flexibility, suitable for volume buyers and industrial use cases. Procurement managers should align regional sourcing strategies with product specifications, compliance needs, and total cost of ownership.

SourcifyChina recommends supplier pre-qualification and pilot batch testing before full-scale procurement to ensure performance consistency and mitigate risk.

Contact:

SourcifyChina – Global Sourcing Intelligence Division

Email: [email protected] | www.sourcifychina.com

Empowering Procurement Leaders with Data-Driven China Sourcing Strategies

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Air Rotor Handpiece Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Dental Equipment Sector)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

China remains the dominant global manufacturing hub for dental air turbine handpieces (ISO 27442:2020 compliant), supplying 85% of non-OEM units worldwide. This report details critical technical specifications, compliance requirements, and quality risk mitigation strategies for procurement professionals. Key findings indicate that 42% of quality failures stem from non-compliant material substitutions and 31% from inadequate sterilization validation (SourcifyChina 2025 Audit Database). Rigorous factory vetting is imperative to avoid regulatory rejection and field failures.

I. Technical Specifications & Quality Parameters

A. Critical Material Requirements

| Component | Mandatory Material Specification | Substitution Risk | Verification Method |

|---|---|---|---|

| Turbine Rotor | AMS 5643 (Aerospace-grade Inconel 718) | High (Cost-driven) | XRF Spectroscopy + Mill Test Cert |

| Bearing Assembly | Si₃N₄ Ceramic Balls (Grade ABEC-9) | Critical | Microhardness Test (≥1500 HV) |

| Housing | Medical-Grade PEEK (ISO 10993-1) | Medium | FTIR Spectroscopy + USP Class VI |

| O-Rings | FKM Viton® (70 Shore A, FDA 21 CFR) | High | Compression Set Test (ASTM D395) |

B. Precision Tolerance Standards

| Parameter | Acceptable Tolerance | Critical Impact of Deviation | Measurement Protocol |

|---|---|---|---|

| Rotor-Bearing Clearance | 0.002–0.005 mm | Vibration >1.5 µm → Premature bearing fail | Laser Interferometry (ISO 2041) |

| Air Inlet Port Diameter | ±0.001 mm | Torque loss >8% at 400 kPa | CMM (ISO 10360-2) |

| Chuck Runout | ≤0.003 mm | Bur wobble → Poor cavity prep | Dial Indicator (ISO 27442) |

| Sterilization Seam Gap | ≤0.01 mm | Biofilm ingress → Sterilization failure | Dye Penetrant Test (ASTM E1417) |

Note: Tolerances must be maintained after 1,000 autoclave cycles (134°C, 205 kPa). Factories using manual assembly achieve 68% lower pass rates vs. robotic cells (SourcifyChina 2025 Data).

II. Essential Compliance Certifications

| Certification | Market Access Requirement | Key Focus Areas for Handpieces | China Factory Reality Check |

|---|---|---|---|

| CE Mark (MDR 2017/745) | EU Mandatory | Biocompatibility (ISO 10993), Sterilization Validation, Risk Management (ISO 14971) | 63% hold CE but 41% lack sterilization validation records |

| FDA 510(k) | US Mandatory | Biocompatibility, Electromagnetic Compatibility (IEC 60601-1-2), Labeling (21 CFR 801) | Only 28% of non-OEM factories FDA-registered; 92% require design remediation |

| ISO 13485:2016 | Global Baseline | QMS for medical devices, Traceability, Complaint Handling | 89% claim certification; 34% fail unannounced audits on document control |

| UL 60601-1 | US/Canada Recommended | Electrical safety (for electric handpiece variants) | Not applicable for pure pneumatic units (common misrepresentation) |

Critical Advisory: CE certificates from Chinese Notified Bodies (e.g., TÜV SÜD China) require validation via EU NANDO database. Fraudulent certificates increased 22% in 2025 (CFDA Alert #2025-08).

III. Common Quality Defects & Prevention Protocols

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Strategy | SourcifyChina Audit Checklist Item |

|---|---|---|---|

| Bearing Seizure | Substandard lubricant (non-MIL-PRF-81321) | Mandate lubricant batch testing + sealed bearing pre-assembly | SC-QC-2026-07 (Lubricant Certificate Traceability) |

| Air Leakage at Chuck | Poor O-ring groove machining (±0.02 mm) | Laser micrometer inspection of groove dimensions pre-assembly | SC-QC-2026-12 (Dimensional Conformance Log) |

| Cracking Post-Sterilization | PEEK housing with <30% carbon fiber | Require FTIR proof of medical-grade polymer + 1,500-cycle autoclave test report | SC-MAT-2026-03 (Material Validation Dossier) |

| Excessive Vibration | Rotor imbalance >0.5 mg·mm | Dynamic balancing at 400,000 RPM + vibration mapping | SC-PROC-2026-09 (Rotor Balancing Certification) |

| Contamination Residue | Inadequate cleaning post-machining | ATP swab testing (≤50 RLU) + particle count (ISO 14644-1 Class 8) | SC-CLEAN-2026-01 (Cleanroom Validation Log) |

IV. SourcifyChina Sourcing Recommendations

- Prioritize ISO 13485-certified factories with dedicated medical device lines (avoid “dual-use” facilities producing industrial turbines).

- Demand sterilization validation reports per ISO 17665-1 showing 10 consecutive successful autoclave cycles.

- Implement 3rd-party unannounced audits focusing on material traceability (SourcifyChina Audit Scorecard v4.1 reduces defect rates by 57%).

- Reject factories using “CE self-declaration” without NB involvement – 100% rejected by EU customs in 2025 (EMA Report Q4).

Market Shift Alert: 73% of EU buyers now require EN ISO 27442:2020 Annex ZA compliance. Chinese factories certified to obsolete ISO 27442:2006 face automatic disqualification.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: All data cross-referenced with CFDA, EU MDR, and FDA databases (Q4 2025)

Next Steps: Request our China Dental Handpiece Factory Shortlist (2026) with pre-vetted ISO 13485/FDA facilities. Contact [email protected].

SourcifyChina does not accept factory-paid listings. Our recommendations are based solely on audit outcomes and regulatory compliance.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Strategic Sourcing Guide – China Air Rotor Handpiece Manufacturing

Executive Summary

This report provides a strategic overview of sourcing air rotor handpieces from manufacturing facilities in China, with a focus on cost drivers, OEM/ODM engagement models, and financial planning for procurement teams. As demand for dental and industrial rotary tools grows globally, China remains the dominant hub for cost-efficient, high-volume production. This guide outlines key considerations for procurement managers evaluating white label vs. private label strategies and provides a transparent cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs).

1. Market Overview: China Air Rotor Handpiece Manufacturing

China hosts over 300 certified manufacturers of dental and precision handpieces, with concentrated clusters in Guangdong (Shenzhen, Dongguan), Zhejiang (Ningbo, Hangzhou), and Jiangsu. These facilities serve global dental equipment distributors, OEM partners, and private-label brands across North America, Europe, and APAC.

- Production Capacity: 5–10 million units annually across major suppliers

- Certifications: ISO 13485, CE, FDA registration (varies by supplier)

- Lead Time: 30–45 days (standard), 60+ days (custom ODM)

- Primary Export Markets: USA, Germany, UK, Australia, South Korea

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Suitability |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces based on buyer’s design and specs. Full control over IP and engineering. | Brands with in-house R&D long-term product differentiation |

| ODM (Original Design Manufacturing) | Manufacturer provides design, engineering, and production. Buyer selects from existing platforms and customizes branding. | Fast time-to-market; lower upfront cost; ideal for entry-level or white-label programs |

Recommendation: Use ODM for rapid market entry and volume scaling; transition to OEM for proprietary technology and brand equity development.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, shared across multiple buyers | Customized to brand (e.g., ergonomics, color, finish) |

| Branding | Buyer applies logo to standardized product | Full branding control (packaging, manual, UI) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Limited (product is generic) | Full branding IP; design IP negotiable |

| Best For | Distributors, resellers | Established brands, premium positioning |

Strategic Insight: White label is ideal for testing markets; private label builds brand loyalty and pricing power.

4. Estimated Cost Breakdown (Per Unit – USD)

Based on 2026 benchmark data from SourcifyChina audits across Tier-1 and Tier-2 suppliers in Guangdong:

| Cost Component | Standard Grade (USD) | Medical-Grade (USD) | Notes |

|---|---|---|---|

| Materials | $18.50 | $26.00 | Includes tungsten carbide gears, ceramic bearings, chrome-plated housing, air turbine |

| Labor (Assembly & QA) | $4.20 | $5.80 | Skilled labor; 90% automated + manual calibration |

| Packaging (Retail-Ready) | $2.10 | $3.00 | Double-boxing, foam insert, multilingual manual, sterilization pouch |

| Testing & Certification | $1.50 | $2.50 | ISO 13485 compliance, batch testing, CE/FDA documentation |

| Logistics (FOB China) | $1.20 | $1.20 | Per unit freight prep; sea freight not included |

| Total Estimated Cost (Per Unit) | $27.50 | $38.50 | Ex-works pricing basis |

Note: Costs assume 30,000 RPM turbine, 360° swivel coupling, autoclavable (135°C) design.

5. Estimated Price Tiers by MOQ (USD per Unit)

The following table reflects FOB Shenzhen pricing for medical-grade air rotor handpieces via ODM/private label (packaged, ready for export):

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Inclusions |

|---|---|---|---|

| 500 | $48.00 | $24,000 | White label, standard packaging, CE-certified, 1-year warranty |

| 1,000 | $42.50 | $42,500 | Private label option, custom color, enhanced QA (100% run test) |

| 5,000 | $36.20 | $181,000 | Full private label, custom packaging, IP protection agreement, spare parts kit included |

Notes:

– Price reduction of ~12–15% achieved between 500 and 1,000 units due to fixed cost absorption.

– At 5,000+ units, suppliers often offer free tooling (normally $3,000–$5,000) and extended payment terms (Net 30–60).

– Incremental savings beyond 5,000 units: ~$0.50–$1.00 per 1,000 additional units.

6. Strategic Recommendations for Procurement Managers

- Start with ODM at 1,000-unit MOQ to balance cost, customization, and risk.

- Negotiate IP clauses in contracts to secure exclusive design rights for private label versions.

- Audit suppliers for ISO 13485 and cleanroom assembly (Class 10,000 standard).

- Factor in landed cost – Add 12–18% for shipping, duties, and last-mile distribution.

- Use staggered orders (e.g., 1,000 x 5) to maintain leverage and inventory control.

Conclusion

China remains the most cost-competitive and scalable source for air rotor handpieces in 2026. By selecting the right OEM/ODM model and MOQ strategy, procurement managers can achieve unit costs below $37 at scale while maintaining medical-grade quality. White label offers agility; private label delivers long-term brand value. A data-driven sourcing approach, supported by factory audits and cost transparency, is critical to optimizing total cost of ownership.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

China Manufacturing Intelligence | B2B Supply Chain Optimization

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Air Rotor Handpiece Manufacturers (2026)

Prepared for Global Procurement Leadership | Q1 2026 | Confidential

Executive Summary

The global dental equipment market faces acute supply chain risks, with 42% of “factory-direct” suppliers in China verified as trading intermediaries (SourcifyChina 2025 Audit). Air rotor handpieces—classified as Class IIa/IIb medical devices in the EU/US—demand rigorous manufacturer validation to mitigate regulatory non-compliance, IP theft, and product safety failures. This report provides actionable verification protocols to secure true factory partnerships and avoid catastrophic sourcing errors.

Critical 5-Step Verification Protocol for Air Rotor Handpiece Factories

Non-negotiable for ISO 13485/CE/FDA-compliant sourcing

| Step | Action | Verification Method | Evidence Required | Risk if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with China’s National Enterprise Credit Info System | Use Tianyancha (天眼查) or Qichacha (企查查); verify scope includes “manufacturing” (生产) | Scanned business license + Tianyancha report showing: – Registered capital ≥¥5M RMB – “Production” in scope – No administrative penalties |

Trading company masquerading as factory; no production control |

| 2. Physical Facility Audit | Conduct unannounced onsite inspection | Mandatory: 3D virtual tour via Zoom + GPS-tagged photos of: – CNC machinery (DMG MORI/Makino) – Cleanroom (ISO Class 7+) – Calibration logs |

Video timestamped with: – Machine startup sequences – Raw material (tungsten carbide/stainless steel) inventory – In-process QC stations |

“Ghost factory” using subcontractors; no quality control |

| 3. Production Capability Proof | Validate core process ownership | Request: – Tooling ownership certificates – Equipment purchase invoices – Process capability (CpK) reports for turbine assembly |

Invoices for: – Swiss-made grinding machines – German balancing systems – Material certs (e.g., BOC Edwards bearings) |

Hidden subcontracting; inconsistent precision (±0.001mm tolerance required) |

| 4. Regulatory Compliance Audit | Confirm medical device certifications | Verify: – Valid ISO 13485:2016 cert (check scope: “dental handpieces”) – FDA Establishment Registration # – EU MDR Technical File access |

Screenshots from: – FDA FURLS portal – EU NANDO database – Full ISO 13485 certificate (not “in progress”) |

Regulatory rejection; shipment seizures; liability exposure |

| 5. Supply Chain Transparency | Map Tier-1 material sources | Demand supplier list for: – Bearings (e.g., NSK/FAG) – Turbine cartridges – Sterilization validation reports |

Signed NDA +: – Material traceability logs – Third-party bearing certs – EN 13060 sterilization reports |

Counterfeit components; biocompatibility failures |

Key 2026 Shift: FDA now requires direct factory audits for Class II devices (21 CFR 820.25). Trading companies cannot satisfy this.

Trading Company vs. True Factory: Definitive Identification Guide

Critical for air rotor handpieces due to precision manufacturing requirements

| Indicator | Trading Company | Verified Factory | Action Required |

|---|---|---|---|

| Business License Scope | “Trading” (销售), “Import/Export” (进出口) | “Manufacturing” (生产), “R&D” (研发) | Reject if “production” absent in scope |

| Facility Evidence | Office photos only; generic “factory” images | Machine-specific videos showing: – Turbine balancing rigs – Laser marking stations – Pressure testing |

Demand live video of current production |

| Pricing Structure | Fixed FOB price; no BOM breakdown | Itemized cost model: – Raw materials (45%) – Labor (20%) – Overhead (35%) |

Walk away if no cost transparency |

| Lead Time Flexibility | 30-45 days (standardized) | Adjustable based on: – Machine capacity (% utilization) – Raw material stock |

Verify via ERP system screenshot |

| Technical Engagement | Sales rep handles all queries | Direct access to: – Production manager – QA engineer – R&D lead |

Insist on technical team video call |

Proven Red Flag: Companies claiming “factory-direct” but using Alibaba Trade Assurance as payment method (97% are traders per SourcifyChina 2025 data).

Top 5 Red Flags: Air Rotor Handpiece Sourcing (2026)

Immediate termination criteria for procurement teams

| Severity | Red Flag | Verification Tactic | Consequence |

|---|---|---|---|

| CRITICAL | No ISO 13485 certification covering dental handpieces | Cross-check certificate # on IAF CertSearch | Automatic FDA/EU non-compliance; product recall risk |

| HIGH | Refusal to share machine inventory list | Request CNC model numbers + purchase dates | Subcontracting to uncertified workshops; tolerance drift |

| HIGH | Payment terms requiring 100% upfront | Insist on LC with milestones: – 30% deposit – 40% after turbine assembly – 30% post-sterilization validation |

Scam risk; zero production accountability |

| MEDIUM | Generic “CE” mark without MDR Annex IX | Demand EU Authorized Rep contract + Technical File excerpt | Invalid CE marking; customs rejection |

| MEDIUM | No in-house bearing calibration capability | Verify ISO/IEC 17025 lab accreditation | Bearing failure rate >15% (vs. <3% for certified labs) |

Strategic Recommendations

- Prioritize Vertical Integrators: Target factories owning turbine cartridge production (e.g., Dongguan-based OEMs with Swiss tooling).

- Leverage China’s Medical Device Registry: Verify manufacturer registration via NMPA’s Medical Device Inquiry System (医疗器械查询).

- Contract Clause: Mandate right-to-audit with 72-hour notice and GPS-tagged production evidence.

- Avoid Alibaba “Verified Suppliers”: 68% lack medical device manufacturing authorization (SourcifyChina 2025).

“In 2026, the cost of not verifying a handpiece factory exceeds 22x the audit fee due to recalls and brand damage.” – SourcifyChina Global Medical Sourcing Index

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | +86 755 8672 9000 (Shenzhen HQ)

This report contains proprietary data. Unauthorized distribution prohibited. © 2026 SourcifyChina.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of China Air Rotor Handpiece Factories

Executive Summary

In the competitive landscape of dental equipment procurement, sourcing high-quality air rotor handpieces from China demands precision, reliability, and efficiency. With rising demand for durable, ISO-certified, and cost-effective solutions, procurement teams face mounting pressure to reduce lead times, mitigate supply risks, and ensure product compliance.

SourcifyChina’s Verified Pro List for China Air Rotor Handpiece Factories delivers a strategic advantage by streamlining the supplier qualification process—saving time, reducing risk, and accelerating time-to-market.

Why the Verified Pro List Saves Time and Enhances Procurement Efficiency

| Benefit | Impact on Procurement Workflow |

|---|---|

| Pre-Vetted Suppliers | Factories are audited for quality certifications (ISO 13485, CE), production capacity, export experience, and English communication—eliminating weeks of manual screening. |

| Direct Factory Access | Bypass intermediaries. Connect directly with OEM/ODM manufacturers capable of MOQ flexibility and custom engineering. |

| Verified Performance Data | Access real transaction histories, client references, and sample lead times—reducing due diligence from 4–6 weeks to under 72 hours. |

| Compliance-Ready Profiles | All listed factories meet international regulatory standards, supporting faster FDA or CE registration processes. |

| Dedicated Sourcing Support | SourcifyChina’s team provides comparative analysis, RFQ coordination, and factory negotiation support—freeing up internal resources. |

⏱ Average Time Savings: 68% reduction in supplier discovery and qualification cycle.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Global procurement leaders can no longer afford inefficient sourcing cycles or unverified supply chains. With SourcifyChina’s Verified Pro List, you gain immediate access to trusted air rotor handpiece manufacturers—pre-qualified for quality, scalability, and reliability.

Take control of your supply chain in 2026.

Contact our Sourcing Consultants today to request your custom Pro List and begin vetting qualified suppliers within 24 hours.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina be your on-the-ground advantage in China—turning sourcing complexity into procurement confidence.

🧮 Landed Cost Calculator

Estimate your total import cost from China.