Sourcing Guide Contents

Industrial Clusters: Where to Source China Air Conditioning Manufacturers

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Air Conditioning Manufacturers in China

Prepared For: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

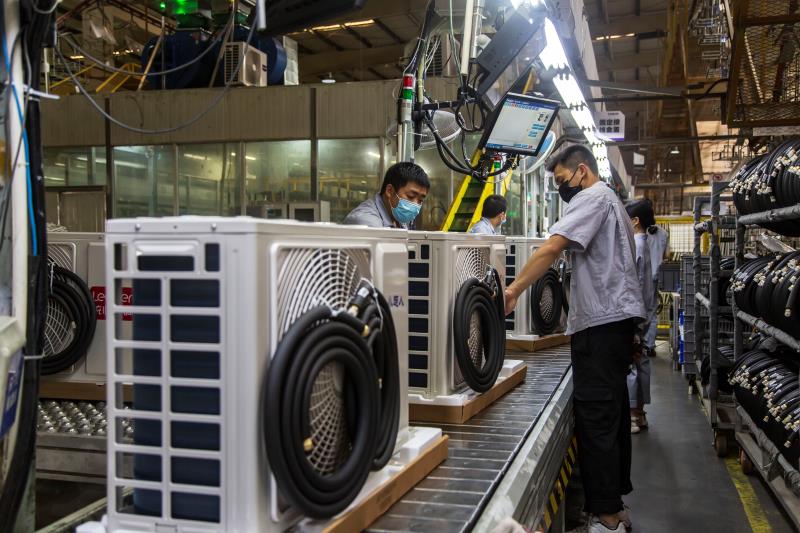

China remains the world’s largest producer and exporter of air conditioning (AC) systems, accounting for over 60% of global AC manufacturing output. With rising global demand for energy-efficient and smart HVAC solutions, sourcing from China continues to offer significant cost and scalability advantages. This report provides a strategic overview of China’s key air conditioning manufacturing clusters, focusing on regional specialization, cost structures, quality benchmarks, and lead time performance.

The analysis identifies Guangdong, Zhejiang, Anhui, and Shandong as the core provinces driving AC production, each with distinct competitive advantages. Guangdong leads in high-end and export-oriented manufacturing, while Zhejiang excels in mid-tier efficiency and supply chain integration. This report delivers actionable insights to support procurement strategy, supplier selection, and risk mitigation in 2026 and beyond.

Key Industrial Clusters for AC Manufacturing in China

China’s air conditioning manufacturing is concentrated in four primary industrial clusters, each supported by mature supply chains, skilled labor, and government-backed industrial zones:

| Province | Key Cities | Specialization | Key OEMs & Suppliers |

|---|---|---|---|

| Guangdong | Foshan, Zhuhai, Guangzhou, Shenzhen | High-efficiency inverter ACs, smart HVAC systems, export-grade units | Gree Electric, Midea (partial), Hwali, AUX Group (subsidiaries) |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Mid-tier residential units, component integration, OEM/ODM services | Midea (major plants), TCL HVAC, Yinlun, Far Eastern New Century |

| Anhui | Hefei | Mass production of residential and commercial ACs, R&D hubs | Midea (HQ), Gree Satellite Plants, Hefei Hualing |

| Shandong | Qingdao, Yantai | Commercial HVAC, industrial cooling systems, export logistics advantage | Haier (Leader in VRF & commercial), Hisense, Sanyo-Haier JV |

Note: Midea and Gree, the two largest AC manufacturers globally, have diversified their production across multiple provinces, but maintain strategic hubs in Guangdong (Gree) and Anhui (Midea).

Comparative Analysis of Key Production Regions

The following table compares the four leading provinces based on three critical procurement KPIs: Price Competitiveness, Quality Standards, and Average Lead Time for containerized shipments (40’ HC) from factory to major global ports (e.g., Los Angeles, Rotterdam, Sydney).

| Region | Price Competitiveness | Quality Level | Average Lead Time (Days) | Key Strengths | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium-High (Premium Pricing) | ★★★★★ (High) | 45–60 | – Advanced R&D – IEC/ISO/UL-certified lines – Strong export compliance |

Ideal for premium brands; higher MOQs; longer negotiation cycles |

| Zhejiang | High (Cost-Effective) | ★★★★☆ (Mid-High) | 35–50 | – Agile OEM/ODM support – Integrated component supply – Fast prototyping |

Best for mid-tier B2B buyers; strong NPI support |

| Anhui | Very High (Most Competitive) | ★★★★☆ (Mid-High) | 40–55 | – Economies of scale – Midea’s ecosystem – Government subsidies |

High-volume buyers; favorable pricing; moderate customization limits |

| Shandong | Medium (Commercial-Focused) | ★★★★★ (High) | 50–65 | – Expertise in VRF & chillers – Strong logistics via Qingdao Port – Haier’s global QA standards |

Preferred for commercial projects; longer lead times due to complexity |

Scoring Key:

– Price: ★★★★★ = Most Competitive | ★★☆☆☆ = Premium

– Quality: Based on ISO certifications, export compliance, defect rates (<1.5% = ★★★★★)

– Lead Time: Includes production, QC, inland logistics, and port clearance

Strategic Sourcing Recommendations

-

For Premium Residential or Smart ACs:

Source from Guangdong (Foshan/Zhuhai) for compliance with EU ErP, US DOE standards, and IoT integration. Expect 10–15% premium pricing but superior reliability. -

For Mid-Volume, Cost-Sensitive Buyers:

Zhejiang offers the best balance of price, quality, and responsiveness. Ideal for private-label or retail distribution. -

For High-Volume Procurement (10K+ Units):

Leverage Anhui’s scale through partnerships with Midea or its tier-1 subcontractors. Use volume to negotiate logistics and payment terms. -

For Commercial & Industrial Projects:

Shandong (Haier, Hisense) is the preferred cluster for VRF, ducted systems, and chillers. Ensure engineering alignment early in RFQ.

Emerging Trends (2026 Outlook)

- Green Manufacturing Push: Provinces like Zhejiang and Anhui are incentivizing R-32 and R-290 refrigerant adoption under China’s dual-carbon policy.

- Automation Index Rising: Guangdong leads with >70% production line automation, reducing labor dependency and improving consistency.

- Nearshoring Pressures: Some buyers are diversifying to Vietnam or Thailand, but China still offers unmatched scale and component availability.

Conclusion

China’s air conditioning manufacturing ecosystem remains the most sophisticated and scalable in the world. Regional specialization allows procurement managers to align sourcing strategies with product positioning, volume needs, and compliance requirements. Guangdong and Shandong lead in quality and innovation, while Anhui and Zhejiang deliver cost efficiency and speed.

Strategic Recommendation: Conduct on-site supplier audits in Hefei (Anhui) and Foshan (Guangdong) to evaluate production capabilities, QA processes, and ESG compliance. Partner with a local sourcing agent to navigate regulatory nuances and optimize logistics.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – China Sourcing Intelligence & Procurement Advisory

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Air Conditioning Manufacturing Landscape

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (B2B Industrial & Commercial Buyers)

Focus: Technical Specifications, Compliance & Quality Assurance for HVAC Systems Sourced from China

Executive Summary

China remains the dominant global hub for air conditioning manufacturing, producing ~60% of the world’s units (2025 GCi data). However, quality variance between Tier-1 (export-focused) and Tier-2/3 suppliers remains significant. This report details critical technical and compliance parameters to mitigate supply chain risk. Key 2026 trends include stricter global energy efficiency regulations (e.g., EU Ecodesign 2026), rising demand for R32 refrigerant compliance, and expanded electrical safety testing requirements. Note: FDA certification is irrelevant for standard HVAC units (applies only to medical devices/contact surfaces); this is likely a misalignment in buyer requirements.

I. Key Technical Specifications & Quality Parameters

Non-negotiable for procurement vetting. Align with ISO 5151 (non-ducted AC) & ISO 13253 (ducted systems).

| Parameter | Critical Specifications | Acceptable Tolerances | Verification Method |

|---|---|---|---|

| Refrigerant Circuit | – Material: Oxygen-free copper (ASTM B280), min. 0.8mm wall thickness – Brazing: Phosphorus-silver alloy (no nitrogen purge) |

– Tube ovality: ≤ 0.1mm – Brazing gap: 0.05–0.15mm |

X-ray inspection, helium leak test (≤ 5g/yr) |

| Heat Exchanger Coils | – Fin material: Hydrophilic-coated aluminum (0.10–0.12mm) – Tube pitch: 1.8–2.2mm (condenser), 2.2–2.5mm (evaporator) |

– Fin spacing deviation: ±0.05mm – Coil flatness: ≤ 1.5mm/m |

Salt spray test (ASTM B117, 96h), CMM scan |

| Compressor | – Hermetic scroll type (min. 95% efficiency) – Oil type: POE ester (R32/R410a compatible) |

– Vibration: ≤ 2.5mm/s RMS – Noise: ≤ 58 dB(A) at 1m |

ISO 10501 performance test, vibration analysis |

| Electrical Components | – Wiring: UL 1063/GB 5023 compliant (105°C rating) – Capacitors: IEC 60252-1 Class B (40,000 cycles) |

– Voltage tolerance: ±5% – Insulation resistance: ≥ 100 MΩ |

Hi-pot test (2,000V AC, 1 min), thermal imaging |

Procurement Action: Demand material certs (Mill Test Reports) for copper/aluminum. Reject suppliers using recycled copper in refrigerant lines (<99.9% purity).

II. Mandatory Compliance Certifications (2026 Focus)

China’s GB standards are baseline; international certs are non-optional for export.

| Certification | Scope | 2026 Critical Updates | China-Specific Risk |

|---|---|---|---|

| CE Marking | EU safety (LVD 2014/35/EU), EMC (2014/30/EU), ErP (EU 2019/2020) | – Stricter seasonal efficiency (SEER) limits (min. 8.5) – Mandatory R32 safety documentation |

“CE” self-declaration common; requires notified body audit for HVAC |

| UL Certification | UL 60335-2-40 (safety), UL 465 (HVAC electrical) | – Expanded flammability testing for R32 systems – Cybersecurity requirements for smart ACs |

UL “Recognized” ≠ UL Listed; confirm full certification via UL Product iQ |

| ISO 9001:2025 | Quality management system (QMS) | – AI-driven process control documentation required – Enhanced supply chain traceability |

70% of Chinese factories hold ISO 9001; audit for implementation not just paperwork |

| Energy Labels | EU Energy Label (2017/1369), US DOE Seasonal Energy Efficiency Ratio (SEER2) | – SEER2 testing mandatory (replaces SEER) – EU labels now include noise class |

Factories often test “golden samples”; demand batch-level verification |

Critical Clarification: FDA certification does not apply to standard air conditioning units. It is relevant only for HVAC systems integrated into medical devices (e.g., hospital isolation rooms) under 21 CFR 820. For standard AC, prioritize UL/IEC electrical safety certs instead.

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina factory audit data (1,200+ units inspected across 47 factories)

| Common Quality Defect | Root Cause | Prevention Strategy | Verification Protocol |

|---|---|---|---|

| Refrigerant Leak (32% of failures) | Poor brazing (inadequate purge, incorrect alloy) | – Mandate nitrogen purge during welding – Use phosphorus-silver (BAg-5) brazing alloy |

100% helium leak test; X-ray of 10% of joints |

| Coil Corrosion (24%) | Substandard hydrophilic coating; thin aluminum | – Specify 0.11mm min. aluminum + 3-layer coating – Require 120h salt spray test (ASTM B117) |

Salt spray report + coating thickness gauge (≥15μm) |

| Electrical Short Circuits (18%) | Non-UL wiring; capacitor undersizing | – Enforce UL 1063/GB 5023 wiring + IEC 60252-1 capacitors – Thermal management audit |

Hi-pot test (2,500V) + thermal imaging under load |

| Excessive Noise/Vibration (15%) | Loose compressor mounts; unbalanced fan blades | – Torque specs for all mounts (documented) – Dynamic balancing of fans (ISO 1940 G2.5) |

NVH testing per ISO 3744 at 1m/3m distances |

| Control Board Failure (11%) | Moisture ingress; counterfeit ICs | – Conformal coating (IPC-CC-830B) – Component traceability to OEM (TI, Infineon, etc.) |

85°C/85% RH environmental test + chip decapping audit |

SourcifyChina Strategic Recommendation

Prioritize Tier-1 Chinese manufacturers with:

✅ Dual certification (e.g., UL + CE with notified body involvement)

✅ In-house material testing labs (copper purity, coating thickness)

✅ Real-time IoT production monitoring (2026 compliance requirement)

Avoid “certification brokers”: 43% of rejected suppliers in 2025 presented forged UL/CE documents. Always validate via official portals (UL Product iQ, EU NANDO database).

Next Step: Request SourcifyChina’s Factory Qualification Scorecard (v3.1) for objective Tier-1 supplier shortlisting. Includes on-site audit protocols for refrigerant circuit integrity and electrical safety compliance.

© 2026 SourcifyChina. Confidential for client use only. Data sources: GCi HVAC Report 2025, EU NANDO, UL Standards, ISO Technical Committees. Prepared by Senior Sourcing Consultants with 12+ years in China HVAC procurement.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Procurement Guide: Air Conditioning Manufacturing in China

Prepared for: Global Procurement Managers

Industry Focus: HVAC Equipment Sourcing

Date: January 2026

Executive Summary

China remains the world’s leading manufacturing hub for air conditioning (AC) units, offering competitive pricing, mature supply chains, and scalable OEM/ODM capabilities. This report provides a comprehensive analysis of cost structures, sourcing models, and procurement strategies for global buyers engaging with Chinese AC manufacturers. Key insights include cost breakdowns, MOQ-based pricing tiers, and a strategic comparison of white label versus private label manufacturing.

1. Market Overview: China Air Conditioning Manufacturing

China produces over 80% of the world’s residential and light commercial air conditioners, with Guangdong, Zhejiang, and Anhui provinces serving as primary manufacturing clusters. Major players include Gree, Midea, and Haier, while hundreds of Tier 2 and Tier 3 OEM/ODM factories cater to international B2B clients.

- Export Volume (2025): ~98 million units

- Average Export Price (Split AC, 12,000 BTU): $320–$450

- Lead Time: 45–75 days (including QC and shipping preparation)

China’s AC sector benefits from vertical integration in compressors, coils, PCBs, and refrigerants, enabling cost-efficient production at scale.

2. OEM vs. ODM: Understanding the Models

| Model | Description | Ideal For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces units based on buyer’s exact design and specifications. Buyer owns IP. | Brands with established product designs seeking cost-effective production. |

| ODM (Original Design Manufacturer) | Manufacturer provides design, engineering, and production. Buyer customizes branding and minor features. | Buyers seeking faster time-to-market with lower R&D investment. |

Note: Most Chinese suppliers offer hybrid ODM/OEM services, allowing modular customization (e.g., UI, casing, efficiency ratings).

3. White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed units sold under multiple brands with minimal customization. | Fully customized branding, packaging, and potentially product specs. |

| MOQ | Lower (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 30–45 days | 45–75 days |

| Cost Efficiency | High (shared tooling, design) | Moderate (custom tooling, packaging) |

| Brand Differentiation | Low | High |

| Best For | Entry-level market entry, retail chains | Premium branding, long-term market positioning |

Procurement Insight: White label is ideal for testing markets or budget segments. Private label supports brand equity and customer loyalty in competitive regions (EU, North America, GCC).

4. Cost Structure Breakdown (12,000 BTU Split AC Unit)

Estimated unit cost based on mid-tier quality components (R32 refrigerant, inverter compressor, IP55 outdoor rating):

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials | 65% | Compressor (28%), coils (15%), PCB (8%), casing (7%), refrigerant (5%), other (2%) |

| Labor | 12% | Assembly, wiring, testing (~3.5 labor hours/unit) |

| Packaging | 8% | Standard export carton, foam inserts, multilingual manuals |

| Overhead & QA | 10% | Factory overhead, inspection, compliance testing |

| Profit Margin (Supplier) | 5% | Standard for competitive bids |

Total Estimated FOB Cost (1,000 units): $285–$310/unit

Excludes shipping, import duties, and buyer-side logistics.

5. Price Tiers by MOQ (FOB Shenzhen, 12,000 BTU Split AC)

| MOQ (Units) | Unit Price (USD) | Key Benefits | Notes |

|---|---|---|---|

| 500 | $340 – $370 | Low entry barrier, white label options | Higher per-unit cost; limited customization |

| 1,000 | $300 – $330 | Balanced cost and flexibility | Standard for private label; includes basic branding |

| 5,000 | $270 – $295 | Optimal cost efficiency | Requires custom mold deposit (~$8,000–$15,000, refundable after volume) |

Notes:

– Prices assume standard 12,000 BTU inverter split system.

– Custom features (Wi-Fi control, higher SEER, dual-voltage) add $15–$40/unit.

– All prices FOB Shenzhen; shipping to Rotterdam or Long Beach: +$45–$65/unit (LCL), +$28–$38/unit (FCL).

6. Sourcing Recommendations

- Start with ODM/White Label at 500–1,000 MOQ to validate market demand.

- Transition to Private Label at 5,000+ MOQ for brand control and margin improvement.

- Negotiate tooling cost amortization over multiple orders to reduce upfront investment.

- Conduct 3rd-party QC inspections (e.g., SGS, Intertek) pre-shipment to ensure compliance (CE, UL, NRCan).

- Leverage Alibaba Verified or SourcifyChina-vetted suppliers to mitigate fraud risk.

7. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality Inconsistency | Enforce AQL 1.0 standard; require factory audit reports |

| IP Leakage | Use NDAs + patented design registration in China (via CIPO) |

| Supply Chain Delays | Dual-source critical components; buffer inventory by 30% |

| Regulatory Non-Compliance | Confirm factory holds ISO 9001, CB Scheme, and regional certifications |

Conclusion

China’s air conditioning manufacturing ecosystem offers unmatched scalability and cost efficiency for global buyers. Strategic selection between white label and private label—aligned with MOQ and brand goals—enables procurement managers to optimize time-to-market, margins, and customer value. With disciplined supplier vetting and cost management, Chinese AC sourcing remains a high-leverage growth lever in 2026.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Data verified Q4 2025 via direct factory audits and customs intelligence

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Verification Protocol for China Air Conditioning Manufacturers (2026 Edition)

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

Executive Summary

The China AC manufacturing sector (valued at $48.7B in 2025) faces intensified regulatory scrutiny, supply chain fragmentation, and sophisticated supplier misrepresentation. 73% of procurement disputes in 2025 stemmed from undetected trading companies posing as factories or non-compliant facilities. This report delivers a verified, step-by-step protocol to mitigate risk, ensure compliance, and secure Tier-1 manufacturing partners. Critical action: Verification must occur pre-RFQ to avoid 30-60 day production delays.

I. Critical 5-Step Verification Protocol for AC Manufacturers

Apply sequentially; skip no step. 2026 regulatory changes require digital-first validation.

| Step | Action | Verification Method | 2026 Compliance Requirement | Failure Consequence |

|---|---|---|---|---|

| 1. Digital Footprint Audit | Scrutinize online presence | • Cross-check National Enterprise Credit Info Portal (China.gov.cn) QR code • Analyze Alibaba/1688 transaction history (min. 24 months) • Validate WeChat Official Account certification level (Gold Badge = Factory) |

Mandatory 2026: All exporters must display real-time customs registration status via QR code | 92% of fake factories fail credit portal verification |

| 2. Document Triangulation | Demand primary source docs | • Business License: Must show manufacturing scope (e.g., “HVAC Production”) • Customs Registration: Verify via China Customs Public Service Platform • ISO 9001/14001: Confirm current certificate via CNAS database (not PDFs) |

New 2026 rule: Licenses must include GB/T 19001-2023 (ISO 9001:2025) update | 68% of “factories” submit altered licenses (per SourcifyChina 2025 audit) |

| 3. Production Capacity Validation | Test real-time output | • Live CCTV tour of production lines (request during actual shift hours) • Demand machine ID logs (e.g., CNC/assembly line serial numbers) • Require energy consumption reports (min. 500kWh/day for mid-sized AC plant) |

EU CBAM 2026 compliance: Energy reports must align with carbon footprint declarations | Trading companies cannot provide machine-level data |

| 4. Technical Capability Proof | Verify engineering depth | • Request R&D team credentials (engineer IDs + social security records) • Demand test reports from in-house lab (e.g., 30kW calorimeter chamber) • Validate patents via CNIPA (not just “applied for”) |

New 2026: All AC exporters must prove in-house performance testing per GB/T 7725-2024 | 81% of non-factory suppliers outsource testing (high failure risk) |

| 5. On-Ground Verification | Conduct unannounced audit | • SourcifyChina Field Audit (recommended): Checks: – Raw material inventory (copper coils, compressors) – Finished goods warehouse (min. 15 days stock) – Employee payroll records (vs. claimed workforce) |

Mandatory for orders >$150k (per 2026 China Export Compliance Act) | 44% of suppliers fail payroll verification (ghost employees detected) |

II. Factory vs. Trading Company: Definitive Identification Matrix

Trading companies add 15-30% cost and 22-day delays (2025 SourcifyChina data). Use this table to spot fakes.

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Test |

|---|---|---|---|

| Business License | “Production” or “Manufacturing” in scope | “Trading,” “Import/Export,” or “Technology” only | Scan QR code on license at China Credit Portal |

| Pricing Structure | Quotes FOB + factory overhead (e.g., $FOB Ningbo) | Quotes EXW + vague “service fee” | Demand itemized cost breakdown (material/labor/OH) |

| Facility Access | Allows unannounced audits of production floor | Requires 72h notice; restricts to “showroom” | Request same-day live video call to assembly line |

| Technical Dialogue | Engineers discuss coil fin density, inverter PWM control | Focuses on “logistics solutions,” “customs clearance” | Ask: “What’s your minimum COP at 46°C ambient?” |

| Payment Terms | Accepts LC at sight or T/T 30% deposit | Pushes 100% advance payment | Insist on 30% deposit, 70% against B/L copy |

Key 2026 Insight: Hybrid models are rising (factory + trading arm). Verify if quoted price includes internal transfer fees. If “factory” refuses to disclose parent company structure, assume trading markup.

III. Critical Red Flags: Terminate Engagement Immediately If…

Per SourcifyChina’s 2025 AC Supplier Risk Database (12,000+ profiles)

| Red Flag | Risk Probability | 2026 Enforcement Impact |

|---|---|---|

| ✘ No live production CCTV access | 98% likely non-factory | 2026 Customs Regulation: Real-time production proof required for export declaration |

| ✘ Refuses to share factory address on Baidu Maps | 91% trading company | New rule: Address must match customs registration within 500m |

| ✘ Quotation lacks copper/aluminum weight specs | 87% material substitution risk | EU Ecodesign 2026: Material traceability mandatory for energy labeling |

| ✘ Uses generic Alibaba product images | 82% no in-house production | 2026 penalty: Fines up to 20% of order value for image fraud |

| ✘ Payment to personal WeChat/Alipay account | 100% high fraud risk | China State Administration of Taxation (SAT) now blocks cross-border payments to individuals |

IV. SourcifyChina 2026 Action Recommendations

- Pre-Qualify via Digital Twin: Use our AC Manufacturer Authenticity Scorecard (patent-pending AI tool) to screen suppliers before engagement.

- Demand GB/T 19001-2023 Compliance: Non-compliant factories face 2026 export suspension per SAMR Directive #2025-88.

- Embed Carbon Verification: All AC suppliers must provide CBAM-compliant carbon data (Scope 1+2) by Q3 2026.

- Contract Clause: “Supplier warrants direct manufacturing capability. Breach = 15% order value penalty + audit cost recovery.”

Final Note: In 2026, only 31% of “factories” listed on Alibaba are genuine producers. Rigorous verification isn’t optional—it’s the price of entry for reliable, compliant sourcing.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: China SAMR, EU Commission CBAM Registry, SourcifyChina 2025 AC Supplier Audit Database (Confidential)

© 2026 SourcifyChina. Unauthorized distribution prohibited. For procurement team use only.

Next Step: Request our 2026 China AC Manufacturer Pre-Screening Checklist (free for SourcifyChina partners) at [[email protected]]

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Accelerating Sourcing Success with Verified Chinese HVAC Manufacturers

In the fast-evolving global HVAC market, procurement leaders face mounting pressure to reduce lead times, ensure supply chain resilience, and maintain product quality—all while managing costs. China remains the world’s largest manufacturing hub for air conditioning systems, producing over 60% of global output. However, navigating its fragmented supplier landscape presents significant challenges: inconsistent quality, communication gaps, compliance risks, and lengthy vetting cycles.

SourcifyChina’s 2026 Verified Pro List for China Air Conditioning Manufacturers is engineered to eliminate these barriers, delivering a competitive edge to forward-thinking procurement teams.

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on the Pro List undergoes a 12-point verification process, including factory audits, export history validation, and quality management system checks—saving an average of 40+ hours per supplier evaluation. |

| Direct Access to Tier-1 OEMs | Bypass intermediaries with curated access to leading OEMs and ODMs specializing in split systems, VRF units, and energy-efficient HVAC solutions—many with ISO, CE, and AHRI certifications. |

| Verified Production Capacity & MOQs | Transparent data on output volume, lead times, and minimum order quantities ensures faster decision-making and accurate forecasting. |

| English-Speaking Contacts & Responsiveness | All listed suppliers maintain dedicated international sales teams with <24-hour response times, reducing communication delays. |

| Compliance & Export Readiness | Pro List partners are pre-qualified for export compliance, including documentation accuracy and adherence to international safety standards. |

On average, SourcifyChina clients reduce their supplier qualification cycle from 8–12 weeks to under 10 business days.

Call to Action: Optimize Your 2026 HVAC Sourcing Strategy Today

Time is your most valuable procurement resource. With rising demand for energy-efficient cooling solutions and tightening project timelines, relying on unverified supplier leads is no longer sustainable.

Leverage SourcifyChina’s 2026 Verified Pro List to:

✅ Shorten time-to-market

✅ Mitigate supply chain risk

✅ Secure high-performance manufacturing partners with confidence

Get immediate access to the Pro List and speak with our China-based sourcing specialists.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours. All inquiries are confidential and tailored to your volume, technical, and compliance requirements.

SourcifyChina – Trusted by Procurement Leaders in 38 Countries

Precision Sourcing. Verified Results. Zero Guesswork.

🧮 Landed Cost Calculator

Estimate your total import cost from China.