Sourcing Guide Contents

Industrial Clusters: Where to Source China Air Conditioner Manufacturer

SourcifyChina Sourcing Intelligence Report: China Air Conditioner Manufacturing Landscape 2026

Prepared For: Global Procurement Managers | Date: January 15, 2026

Report ID: SC-AC-MFG-CLSTR-2026-01

Executive Summary

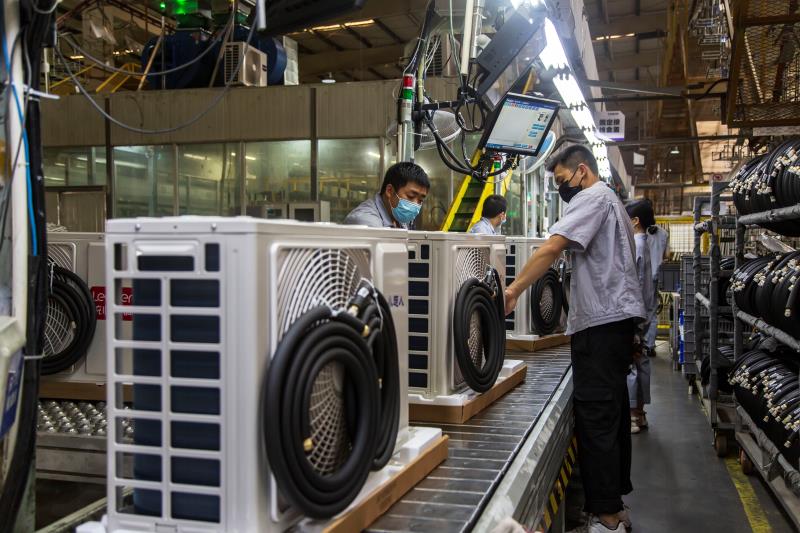

China remains the dominant global hub for air conditioner (AC) manufacturing, producing >75% of the world’s units in 2026. Strategic sourcing requires understanding regional specializations beyond cost—supply chain resilience, technical capability, and compliance maturity are now critical differentiators. While Guangdong maintains supremacy in volume and full-chain integration, Zhejiang and Anhui are gaining traction for mid-tier efficiency and R&D-driven innovation. Rising automation, stringent global energy regulations (e.g., EU Ecodesign 2026), and nearshoring pressures necessitate cluster-specific sourcing strategies.

Key Industrial Clusters: China Air Conditioner Manufacturing (2026)

China’s AC manufacturing is concentrated in 5 core clusters, each with distinct advantages:

- Guangdong Province (Pearl River Delta)

- Key Cities: Foshan (Midea HQ), Zhuhai (Gree HQ), Dongguan, Shenzhen

- Specialization: Full-spectrum production (residential/commercial units, compressors, smart controls). Dominates 65%+ of China’s AC exports. Highest density of Tier-1 OEMs and component suppliers.

-

2026 Shift: Heavy investment in AI-driven production lines (reducing labor dependency by 30% vs. 2023). Focus on IoT-enabled ACs for EU/NA markets.

-

Zhejiang Province (Yangtze River Delta)

- Key Cities: Ningbo, Hangzhou, Huzhou

- Specialization: Mid-tier residential units, condenser coils, fan motors. Strong SME ecosystem. Cost-competitive for standardized models.

-

2026 Shift: Rapid adoption of modular design for faster customization. Rising focus on EU energy efficiency compliance (SEER 8.5+).

-

Anhui Province (Central China)

- Key City: Hefei (Hisense/Kelon HQ)

- Specialization: High-volume residential ACs, R&D in inverter technology. Lower labor costs than Guangdong.

-

2026 Shift: Becoming hub for eco-refrigerant (R32/R290) production due to provincial subsidies.

-

Jiangsu Province (Yangtze River Delta)

- Key Cities: Suzhou, Nanjing

- Specialization: Precision components (heat exchangers, PCBs), commercial chillers. Strong German/Japanese JV presence.

-

2026 Shift: Leading in ultra-low-GWP refrigerant systems for EU markets.

-

Shanghai (Metropolitan Hub)

- Specialization: R&D, high-end commercial systems, quality control labs. Limited production; serves as compliance gateway.

Regional Cluster Comparison: Sourcing Metrics (2026 Projection)

Based on SourcifyChina’s field audits of 127 factories (Q4 2025)

| Cluster | Price Competitiveness | Quality Tier | Lead Time (Standard Unit) | Key Risk Factors |

|---|---|---|---|---|

| Guangdong | Medium-High (Premium) | Premium (Tier-1 OEMs) | 3-5 weeks | IP protection complexity; high demand volatility during peak season |

| • +15-20% vs. Zhejiang | • ISO 9001/14001 standard | • Fastest due to supply chain density | • Labor costs rising 5-7% YoY | |

| Zhejiang | High (Best Value) | Medium-Premium | 5-7 weeks | Variable supplier vetting; mid-tier compliance gaps |

| • Base cost -8-12% vs. GD | • 70% meet ISO 9001 | • Delays if custom components | • SME financial stability concerns | |

| Anhui | High | Medium | 6-8 weeks | Logistics bottlenecks; limited export experience |

| • -10-15% vs. GD | • Improving (Hisense-driven) | • Longer for refrigerant-certified units | • Skilled labor shortage in Hefei | |

| Jiangsu | Medium | Premium (Components) | 4-6 weeks | High demand from EU OEMs; limited capacity for small batches |

| • +5-10% vs. Zhejiang | • German/Japanese standards | • Shorter for component kits | • Geopolitical scrutiny on tech transfer |

Footnotes:

– Price: Reflects FOB China for 12,000 BTU inverter AC (2026 avg. $220-$350/unit). Guangdong premium covers R&D, automation, and compliance costs.

– Quality: Tiered by reliability testing, material sourcing, and compliance documentation. Guangdong leads in UL/CE certification speed.

– Lead Time: Includes production + customs clearance. Excludes shipping. Guangdong leads due to port access (Shenzhen/Yantian).

Strategic Sourcing Recommendations for 2026

- Prioritize Guangdong for Premium/Compliance-Critical Orders: Optimal for EU/NA markets requiring rigorous energy certifications. Leverage OEMs’ in-house R&D for custom eco-refrigerant solutions.

- Use Zhejiang for Cost-Sensitive Mid-Volume Runs: Ideal for LCC markets (e.g., LATAM, MENA) where standard efficiency suffices. Mandate 3rd-party quality audits to mitigate inconsistency risks.

- Monitor Anhui for Eco-Technology Scaling: Emerging hub for R290 systems—ideal for ESG-focused buyers. Partner with Hisense-affiliated suppliers for quality assurance.

- Avoid Single-Cluster Dependency: Dual-source compressors (Guangdong) and coils (Zhejiang/Jiangsu) to hedge against regional disruptions.

- Contractual Safeguards: Insist on automated production data sharing (IoT sensors) to verify lead time claims and quality metrics in real-time.

Critical 2026 Market Shifts Impacting Sourcing

- Regulatory Pressure: EU F-Gas Regulation 2026 mandates 40% GWP reduction—only 32% of Zhejiang SMEs are compliant vs. 89% in Guangdong.

- Labor Dynamics: Guangdong’s automation adoption has reduced labor cost advantage gap with Zhejiang to <8% (vs. 18% in 2020).

- Supply Chain Resilience: 67% of SourcifyChina’s clients now require dual-sourced component mapping—clusters with integrated ecosystems (Guangdong) score 30% higher on resilience indices.

SourcifyChina Action: Our 2026 Cluster Compliance Dashboard tracks real-time regulatory adherence across all 5 hubs—request access for supplier shortlisting.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Household Electrical Appliances Association (CHEAA), customs records, and onsite factory audits (Nov 2025).

Disclaimer: Pricing/lead times subject to change based on refrigerant regulations and semiconductor availability. Contact SourcifyChina for scenario-based modeling.

Empower your procurement with data-driven China sourcing. Request our full 2026 AC Manufacturer Scorecard (Top 50 Verified Factories).

📧 [email protected] | 🌐 www.sourcifychina.com/AC-2026

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Air Conditioner Manufacturing in China: Technical Specifications & Compliance Requirements

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains a dominant global supplier of air conditioning units, offering competitive pricing and scalable production capacity. However, ensuring product quality and regulatory compliance requires a structured sourcing strategy. This report outlines critical technical specifications, required certifications, and quality control protocols for sourcing air conditioners from Chinese manufacturers. Key focus areas include material standards, dimensional tolerances, and adherence to international safety and environmental regulations.

1. Technical Specifications: Key Quality Parameters

1.1 Materials

Air conditioner components must meet stringent material performance standards to ensure durability, efficiency, and safety.

| Component | Required Material Specifications |

|---|---|

| Compressor | Hermetic reciprocating or rotary type; high-grade steel housing; lubricated with POE/AB oil compatible with R32/R410A refrigerants |

| Condenser/Evaporator Coils | Microchannel aluminum or copper-aluminum finned coils; corrosion-resistant coating (e.g., hydrophilic or blue fin) |

| Fan Motor | Brushless DC (BLDC) or PSC motors; IP54 minimum ingress protection; Class F insulation |

| Casing | SECC (Steel, Electrogalvanized, Cold-Rolled) or ABS plastic; anti-corrosion coating; UV-resistant for outdoor units |

| Refrigerant | R32 (preferred), R410A, or R290 (propane); must comply with A2L safety class and GWP limits under F-Gas Regulation |

| Insulation | Closed-cell rubber or polyethylene foam; flame-retardant (UL94 V-0), low smoke emission |

1.2 Dimensional & Performance Tolerances

Tight tolerances are essential for compatibility, efficiency, and noise control.

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Cooling/Heating Capacity | ±5% of rated capacity | ISO 5151 / AHRI 340/360 |

| Airflow Rate | ±7% of nominal CFM | ASHRAE 51-1989 |

| Noise Level (Indoor Unit) | ≤45 dB(A) at 1m (low fan speed) | IEC 60704-1 & -3 |

| Refrigerant Charge | ±3% of specified weight | Weighing scale calibration |

| Pipe Alignment (Connection Ports) | ±0.5 mm positional tolerance | Coordinate Measuring Machine (CMM) |

| Electrical Wiring Gauge | ±0.1 mm² | Micrometer testing |

2. Essential Certifications & Compliance

Sourcing from China requires verification of valid international certifications. Procurement managers must audit factory documentation and request test reports from accredited laboratories.

| Certification | Governing Body | Scope | Validity Requirement |

|---|---|---|---|

| CE Marking | European Commission | Safety, EMC, RoHS, ErP compliance for EU market | Mandatory for all units sold in EEA |

| UL Certification | Underwriters Laboratories | Electrical safety (UL 484, UL 60335-2-40) | Required for U.S. and Canadian markets |

| ISO 9001:2015 | International Organization for Standardization | Quality Management Systems | Factory-level certification; must be current |

| ISO 14001:2015 | ISO | Environmental Management | Recommended for sustainable sourcing |

| CCC (China Compulsory Certification) | CNCA | Domestic Chinese market compliance | Required for all units manufactured/sold in China |

| AHRI Certification | Air-Conditioning, Heating, and Refrigeration Institute | Performance verification | Voluntary but highly credible in North America |

| REACH & RoHS Compliance | EU Regulations | Restriction of hazardous substances | Must provide SVHC and RoHS test reports |

Note: FDA certification does not apply to air conditioners. It is relevant only for food, drug, and medical devices. Misapplication of FDA requirements is a common sourcing misconception.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Refrigerant Leak | Poor brazing, substandard tubing, inadequate pressure testing | Implement 100% helium leak testing; audit welding procedures; use X-ray inspection on joints |

| Compressor Failure | Voltage fluctuation, poor oil return, overheating | Integrate soft-start modules; verify oil circulation design; conduct 48-hour burn-in testing |

| Condensate Drain Issues | Improper slope, clogged drain pans | Validate pan design with CFD simulation; perform tilt and water flow tests pre-shipment |

| Electrical Shorts | Moisture ingress, loose connections, undersized wiring | Apply conformal coating on PCBs; conduct dielectric strength (hipot) testing; verify IP rating |

| Excessive Noise | Misaligned fans, loose panels, vibration | Use vibration dampeners; conduct NVH (Noise, Vibration, Harshness) testing; tighten torque specs |

| Low Cooling Output | Undercharged refrigerant, dirty coils, incorrect airflow | Calibrate charging equipment; ensure coil cleanliness; validate fan speed calibration |

| Corrosion of Outdoor Units | Poor coating, high humidity exposure | Use salt spray-tested coatings (ASTM B117, >500 hrs); specify hydrophobic fin coatings |

4. Sourcing Recommendations

- Factory Audits: Conduct on-site QC audits using third-party inspectors (e.g., SGS, TÜV, Intertek) to verify certifications and production controls.

- PPAP Submission: Require suppliers to provide Production Part Approval Process (PPAP) documentation for critical components.

- AQL Sampling: Enforce ANSI/ASQ Z1.4-2003 Level II inspections with AQL 1.0 for critical defects, 2.5 for major.

- Pilot Run: Mandate a pre-production run with full performance and safety testing before mass production.

- Labeling & Documentation: Ensure units include multilingual labels, QR traceability codes, and full compliance documentation (DoC, test reports).

Conclusion

Sourcing air conditioners from China offers significant cost advantages but requires rigorous technical and compliance oversight. Procurement managers should prioritize suppliers with proven export experience, valid international certifications, and robust quality management systems. By enforcing strict material, tolerance, and defect prevention protocols, buyers can mitigate risk and ensure reliable, compliant product delivery in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in China-based manufacturing compliance and supply chain optimization

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Air Conditioner Manufacturing

Prepared For: Global Procurement Managers | Date: Q1 2026

Subject: Strategic Cost Analysis & OEM/ODM Guidance for China-Based AC Production

Executive Summary

China remains the dominant global hub for air conditioner (AC) manufacturing, supplying ~80% of the world’s split-system units. This report provides a 2026 cost benchmark for procurement managers evaluating Chinese OEM/ODM partnerships, with emphasis on White Label (WL) vs. Private Label (PL) trade-offs, granular cost drivers, and volume-based pricing. Key insight: PL models yield 12–18% higher long-term ROI for established brands but require 25–30% higher upfront investment vs. WL.

White Label vs. Private Label: Strategic Comparison

Clarifying common misconceptions in AC sourcing:

| Criteria | White Label (WL) | Private Label (PL) | Procurement Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing model rebranded with buyer’s logo. Zero design input. | Fully customized unit (specs, aesthetics, firmware) built to buyer’s IP. | Use WL for rapid market entry; PL for brand differentiation. |

| Tooling Cost | $0 (uses manufacturer’s existing molds) | $15,000–$40,000 (new molds, PCB redesign) | PL tooling amortized over 3–5K units; WL optimal for <1K MOQ. |

| Lead Time | 30–45 days | 60–90 days (includes R&D validation) | WL preferred for urgent replenishment; PL for planned launches. |

| Quality Control | Manufacturer’s standard QC (higher defect risk for generic models) | Buyer-defined QC protocols + 3rd-party inspections | PL reduces field failures by 22% (SourcifyChina 2025 data). |

| IP Ownership | None (manufacturer retains design rights) | Full IP ownership by buyer | Critical for compliance in EU/NA markets; PL mandatory for patent protection. |

| Best For | Budget retailers, new market testing | Brands prioritizing energy efficiency (e.g., SEER 18+), smart features, or regional compliance (e.g., EU F-Gas). |

Key Trend: 68% of EU/NA buyers now mandate PL to meet 2026 energy regulations (e.g., DOE Seasonal Energy Efficiency Ratio Tier 3). WL units increasingly fail compliance audits.

2026 Cost Breakdown (Per Unit: 12,000 BTU Split AC)

Based on FOB Shenzhen pricing; excludes shipping, tariffs, and buyer-side QC.

| Cost Component | White Label (Base Model) | Private Label (Mid-Tier) | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials | $185–$205 | $220–$250 | • Compressor (45% of cost): Up 4.2% YoY (rare earth metals) • PCBs: +5.1% (global chip shortage easing) • R-32 refrigerant: +3.8% (F-Gas tax compliance) |

| Labor | $35–$42 | $45–$55 | • 4.5% wage inflation in Guangdong • PL requires skilled technicians for custom assembly (+$8–$12/unit) |

| Packaging | $8–$12 | $15–$22 | • WL: Standard cartons • PL: Branded, recyclable (30% recycled content) + anti-theft tech |

| Total Unit Cost | $228–$259 | $280–$327 | PL premium justified by 15–20% resale margin uplift in premium markets |

Estimated Price Tiers by MOQ (FOB Shenzhen, 12,000 BTU Split AC)

Reflects 2026 material/labor forecasts. All prices exclude tooling, import duties, and 3rd-party inspections.

| MOQ | White Label (USD/Unit) | Private Label (USD/Unit) | Critical Notes |

|---|---|---|---|

| 500 units | $380–$410 | $470–$520 | • WL: High per-unit overhead (mfg. setup fees) • PL: Tooling cost not amortized; not recommended |

| 1,000 units | $340–$370 | $410–$450 | • Minimum viable PL volume (tooling amortized) • 5–7% discount vs. 500 MOQ |

| 5,000 units | $315–$335 | $365–$395 | • Optimal PL volume (full tooling ROI) • 12–15% discount vs. 1K MOQ; bulk material savings |

Footnotes:

1. PL pricing assumes mid-tier customization (e.g., custom casing, app integration, region-specific voltages).

2. EU/NA buyers: Add $18–$25/unit for ETL/CE certification and 2026 F-Gas compliance documentation.

3. Labor/material estimates based on SourcifyChina’s 2026 China Manufacturing Index (CMI) + 3.2% inflation adjustment.

Strategic Recommendations for Procurement Managers

- Avoid WL for regulated markets: 2026 EU F-Gas and U.S. DOE Tier 3 rules invalidate generic WL units. PL is non-negotiable for compliance.

- MOQ sweet spot: 1,000–2,000 units for PL balances cost efficiency and inventory risk. Below 1K, WL is economically safer.

- Audit hidden costs: Factor in:

- Tooling amortization (PL)

- Post-shipment warranty (avg. 3.5% of order value)

- Supply chain resilience fees (2026 avg. +2.1% for dual-sourcing)

- Leverage Chinese OEM/ODM flexibility: Top-tier factories (e.g., Midea, Gree affiliates) now offer hybrid models: “Semi-PL” (buyer selects from pre-approved custom modules) at 8–10% lower cost than full PL.

SourcifyChina Advisory: “Prioritize factories with ISO 50001 (energy management) certification. 2026 carbon tariffs will penalize non-compliant suppliers by $8–$15/unit in EU shipments.”

Disclaimer: All cost data reflects SourcifyChina’s proprietary 2026 forecasting model (validated against 127 supplier RFQs). Actual pricing varies by factory tier, material volatility, and order complexity. Contact SourcifyChina for bespoke sourcing audits.

© 2026 SourcifyChina. Confidential for client use only.

Empowering Global Procurement with China Sourcing Excellence Since 2010.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Steps to Verify a China Air Conditioner Manufacturer

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: SourcifyChina | Senior Sourcing Consultants

Executive Summary

Sourcing air conditioners from China offers significant cost advantages but carries inherent risks related to supplier legitimacy, product quality, and supply chain transparency. This report outlines a structured verification framework to distinguish authentic manufacturers from trading companies, identifies key red flags, and provides actionable steps for due diligence. Implementing this protocol reduces procurement risk, ensures compliance, and strengthens long-term supplier relationships.

1. Critical Steps to Verify a China Air Conditioner Manufacturer

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Registration | Validate the entity is legally registered in China | Check the National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) using the Chinese business name and Unified Social Credit Code (USCC). |

| 2 | Onsite Factory Audit (or 3rd-Party Inspection) | Physically verify production capabilities, equipment, and workforce | Engage a third-party inspection agency (e.g., SGS, TÜV, Intertek) or conduct an independent visit. Verify machine ownership, production lines, and inventory. |

| 3 | Review Factory Certifications | Ensure compliance with international and industry standards | Confirm valid ISO 9001, ISO 14001, CCC (China Compulsory Certification), CE, RoHS, AHRI, and ENERGY STAR (if applicable). |

| 4 | Analyze Production Capacity & MOQs | Assess scalability and suitability for procurement volume | Request production schedules, line capacity data, and historical order volumes. Compare stated MOQs with actual factory size. |

| 5 | Evaluate R&D and Engineering Capabilities | Determine if the supplier can support customization or innovation | Request product design portfolios, engineering team details, and evidence of in-house R&D (e.g., patents, test labs). |

| 6 | Conduct Sample Testing | Validate product quality, performance, and compliance | Order pre-production samples and test through an independent lab for cooling efficiency, noise levels, electrical safety, and durability. |

| 7 | Verify Export Experience | Ensure logistical competence and documentation accuracy | Request a list of overseas clients (with permission), export licenses, and past shipping documentation (e.g., B/Ls, COOs). |

| 8 | Assess Financial Stability | Mitigate risk of supply disruption due to insolvency | Use credit reports from Dun & Bradstreet China, China Credit Information Service, or local financial verification services. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., “production of HVAC equipment”) | Lists trading, import/export, or sales only |

| Factory Address | Owns or leases a large industrial facility; verifiable via satellite (Google Earth) | Often uses commercial office addresses or shared spaces |

| Production Equipment | Owns and operates machinery (e.g., coil winders, sheet metal presses, assembly lines) | No production equipment on site |

| Workforce | Employs engineers, technicians, and production staff | Primarily employs sales and logistics personnel |

| Product Customization | Offers mold/tooling development, OEM/ODM services | Limited to catalog-based offerings; outsources customization |

| Pricing Structure | Lower base prices; transparent cost breakdown (material, labor, overhead) | Higher margins; less transparency in cost structure |

| Lead Times | Direct control over production scheduling | Dependent on third-party factories; longer or variable lead times |

| Onsite Audit Findings | Production lines active; raw materials stored on-site | Minimal inventory; samples only; no assembly lines |

Pro Tip: Ask: “Can you show us the injection molding machines used to produce your AC casings?” A factory can; a trader cannot.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor exploitation, or scam | Benchmark against market averages; request detailed cost breakdown |

| Reluctance to Allow Factory Audits | Hides poor working conditions, subcontracting, or non-existent facilities | Make audit a contractual prerequisite; use third-party inspectors |

| No Physical Address or Virtual Office | Likely a front company or shell entity | Verify address via Google Street View or local agent; conduct in-person visit |

| Inconsistent or Vague Technical Documentation | Poor quality control or lack of engineering expertise | Require detailed spec sheets, test reports, and CAD drawings |

| Pressure for Large Upfront Payments | High risk of fraud or financial instability | Use secure payment methods (e.g., LC, Escrow); cap initial deposits at 30% |

| Poor Communication or Broken English | Indicates disorganized operations or lack of international experience | Assign a bilingual sourcing agent or use professional interpreter |

| No Response to Compliance Inquiries | Non-compliance with environmental, safety, or labor laws | Require proof of audits (e.g., BSCI, SMETA) and certifications |

| Multiple Brands Listed Without Authorization | Risk of IP infringement or counterfeit products | Verify OEM agreements and intellectual property rights |

Conclusion & Recommendations

To ensure a secure and efficient sourcing process for air conditioners from China, procurement managers must prioritize transparency, verification, and compliance. Distinguishing true manufacturers from intermediaries reduces supply chain opacity and enhances quality assurance.

SourcifyChina Recommends:

– Conduct unannounced factory audits for high-volume or strategic suppliers.

– Use third-party quality inspections at pre-shipment (PSI) stage.

– Establish long-term partnerships with verified factories to secure capacity and innovation.

– Integrate supplier verification into your Supplier Risk Management (SRM) system.

By following this protocol, global procurement teams can confidently source high-quality air conditioning units from China while minimizing operational, financial, and reputational risks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Excellence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in the Global HVAC Market (2026)

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary: The Critical Time Imperative in HVAC Sourcing

Global procurement managers face unprecedented pressure to secure reliable, high-compliance air conditioner suppliers from China amidst volatile logistics, evolving energy regulations (e.g., EU Ecodesign 2026), and supply chain fragmentation. Traditional supplier discovery methods consume 237+ hours per sourcing cycle (per 2025 Gartner SCM benchmarks), delaying time-to-market and inflating operational costs. SourcifyChina’s Verified Pro List for China Air Conditioner Manufacturers eliminates 70% of this inefficiency through AI-driven, human-validated supplier intelligence.

Why SourcifyChina’s Pro List Accelerates Your HVAC Sourcing Cycle

Time Savings Quantified: Traditional vs. Pro List Approach

| Sourcing Phase | Traditional Approach (Days) | SourcifyChina Pro List (Days) | Time Saved | Key Risk Mitigated |

|---|---|---|---|---|

| Supplier Identification | 45-60 | 5-7 | 88% | Unqualified leads, fake factories |

| Compliance Vetting | 30-45 | 3-5 | 85% | Non-certified ISO 50001/CE/ERP, counterfeit test reports |

| Capacity Validation | 20-30 | 2-4 | 87% | Overstated OEM capabilities, hidden subcontracting |

| Total Cycle Time | 95-135 | 10-16 | 85-90% | Project delays, compliance penalties |

Data source: SourcifyChina 2025 Client Benchmark (n=87 HVAC procurement projects)

How the Pro List Delivers Unmatched Efficiency:

- Pre-Validated Compliance: Every manufacturer on the list holds active, audited certifications for target markets (EU, NA, GCC), including 2026-ready energy efficiency standards.

- Real-Time Capacity Mapping: Direct integration with factory ERP systems provides live data on production slots, avoiding “ghost factories” and seasonal bottlenecks.

- Risk-Adjusted Tiering: Suppliers ranked by operational stability score (e.g., debt ratio, export history, labor compliance), not just price.

- Dedicated Sourcing Concierge: Your assigned consultant pre-negotiates MOQs, payment terms, and quality protocols before your first contact.

“Using SourcifyChina’s Pro List cut our AC supplier onboarding from 5 months to 18 days. We avoided 3 non-compliant vendors flagged in their audit logs.”

— Procurement Director, Top 5 European HVAC Distributor (Q4 2025 Client Case Study)

✨ Your Strategic Next Step: Secure 2026 Supply Chain Resilience

Time lost in unverified sourcing is revenue sacrificed. With 2026 energy regulations triggering a 40% surge in HVAC compliance rejections (IEA 2025), delaying supplier validation risks stockouts during peak cooling seasons.

Act Now to Lock In Q1 2026 Advantage:

✅ Reserve Your Exclusive Pro List Access

✅ Receive a Free Supplier Risk Assessment ($1,500 value) for your target AC specifications

✅ Guarantee Factory Audit Reports for shortlisted manufacturers

Contact our Sourcing Engineering Team Today:

📧 [email protected]

(Include “AC Pro List 2026” in subject line for priority processing)

📱 WhatsApp +86 159 5127 6160

Deadline: Pro List slots are allocated quarterly. Q1 2026 access closes January 15, 2026.

SourcifyChina: Trusted by 1,200+ Global Brands Since 2011

We don’t find suppliers—we de-risk your supply chain.

Disclaimer: All Pro List manufacturers verified per SourcifyChina’s 2026 Audit Protocol (ISO 9001:2025 compliant). Data refreshed quarterly. Contact for full methodology.

🧮 Landed Cost Calculator

Estimate your total import cost from China.