Sourcing Guide Contents

Industrial Clusters: Where to Source China Ai Us Manufacturing

SourcifyChina

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing “AI-Integrated Manufacturing Solutions” from China for U.S. Market Deployment

Prepared for: Global Procurement Managers

Date: January 2026

Subject: Strategic Sourcing of AI-Enabled Industrial Manufacturing Systems from China

Focus: Industrial Clusters, Regional Competitiveness, and Supply Chain Optimization

Executive Summary

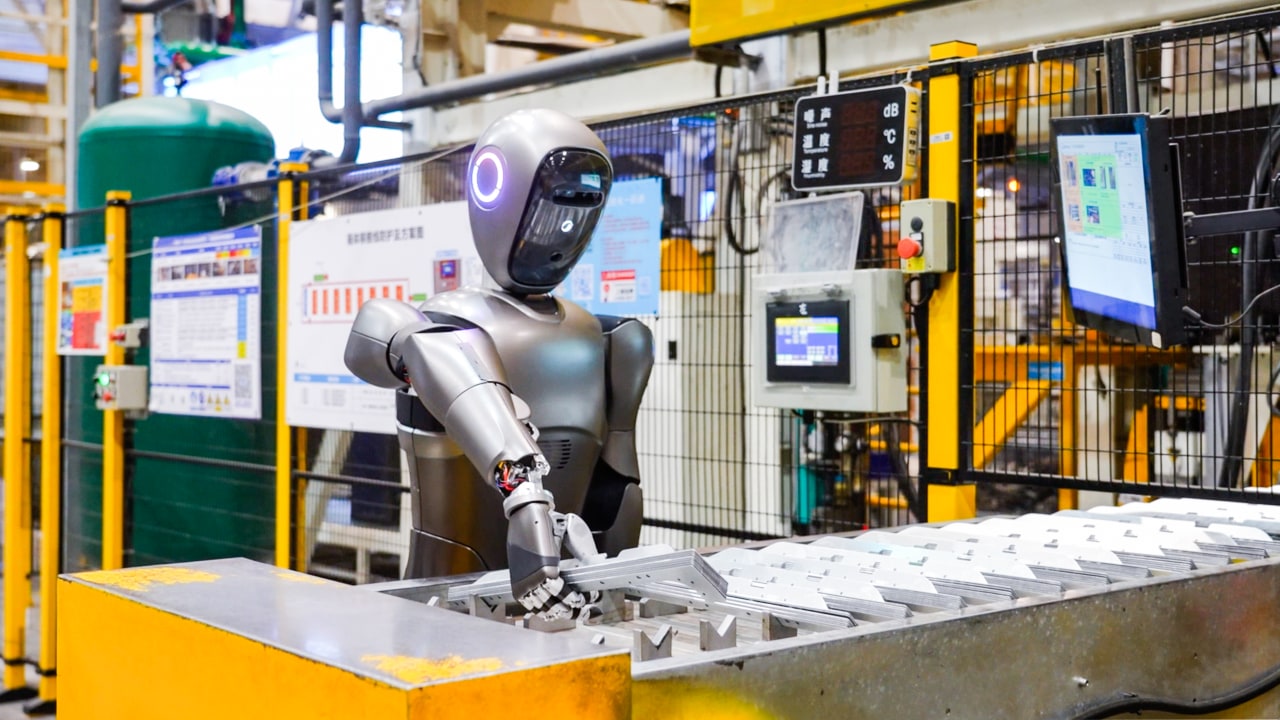

As the convergence of artificial intelligence (AI) and advanced manufacturing accelerates, China has emerged as a dominant global supplier of AI-integrated manufacturing solutions. These include smart robotics, AI-driven quality inspection systems, predictive maintenance platforms, and automated production lines—products increasingly adopted by U.S. manufacturers seeking to enhance productivity, reduce downtime, and scale Industry 4.0 initiatives.

This report provides a data-driven analysis of China’s key industrial clusters producing AI-manufacturing technologies, with a focus on regional strengths, cost structures, and supply chain performance. The findings are tailored for procurement leaders evaluating onshore vs. offshore sourcing strategies for AI-enabled equipment and subsystems.

1. Market Context: AI in Chinese Manufacturing

China’s “Made in China 2025” initiative has heavily prioritized intelligent manufacturing, with AI as a core enabler. According to the Ministry of Industry and Information Technology (MIIT), over 15,000 smart factories have been established nationwide by 2025, supported by domestic AI hardware and software ecosystems.

Exports of AI-integrated industrial equipment (HS Code 8479.89 + 8517.62) from China to the U.S. grew 32% YoY in 2025, driven by demand for cost-effective automation in automotive, electronics, and medical device sectors.

Key product categories include:

– AI-powered visual inspection systems

– Collaborative robots (cobots) with embedded machine learning

– Predictive maintenance gateways and edge AI controllers

– Custom automated assembly lines with real-time analytics

2. Key Industrial Clusters for AI-Integrated Manufacturing

China’s AI-manufacturing ecosystem is concentrated in four primary industrial clusters, each with distinct technological and logistical advantages:

| Province | Core Cities | Specialization | Key Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Smart electronics, robotics, AI chips | Proximity to Silicon Valley of Hardware (Huaqiangbei), strong R&D in AIoT, high volume production |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Industrial automation, AI software integration | Alibaba Cloud AI ecosystem, strong SME manufacturing base, agile prototyping |

| Jiangsu | Suzhou, Nanjing, Wuxi | Precision machinery, semiconductor automation | High-end equipment manufacturing, foreign joint ventures (e.g., Bosch, Siemens), cleanroom-capable facilities |

| Shanghai Municipality | Shanghai | AI research, autonomous systems, industrial software | Leading AI labs (e.g., SenseTime, DeepBlue), strong export logistics, bilingual engineering teams |

3. Regional Comparison: Price, Quality, and Lead Time

The table below evaluates the four leading regions based on benchmark data from 120+ SourcifyChina client engagements (2023–2025), focusing on mid-to-high volume procurement of AI-integrated manufacturing systems (e.g., smart conveyor lines, vision-guided robots).

| Region | Avg. Price Level (USD) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $$$$ (Higher) | ★★★★☆ (High) | 6–8 weeks | Deep supplier ecosystem, fast iteration, AI-hardware integration expertise | Higher labor and logistics costs; IP protection vigilance required |

| Zhejiang | $$$ (Moderate) | ★★★★☆ (High) | 5–7 weeks | Cost-efficient automation, strong software-AI integration, agile SMEs | Less suited for ultra-precision hardware; smaller factory scale |

| Jiangsu | $$$$ (Higher) | ★★★★★ (Very High) | 8–10 weeks | Precision engineering, ISO/TS-certified lines, strong for medical/aerospace | Longer lead times; higher MOQs; less flexible for customization |

| Shanghai | $$$$$ (Highest) | ★★★★★ (Very High) | 7–9 weeks | Cutting-edge R&D, English-speaking project managers, export compliance expertise | Premium pricing; best for high-value, low-volume systems |

Price Key: $ = Low, $$ = Moderate, $$$ = Competitive, $$$$ = Premium, $$$$$ = Premium+

Quality Tier: Based on ISO 9001 compliance, defect rates (PPM), and engineering support capability

Lead Time: Includes production + inland logistics to port (ex-works to FOB)

4. Strategic Sourcing Recommendations

A. For Cost-Performance Balance: Prioritize Zhejiang

- Ideal for U.S. mid-market manufacturers seeking scalable, AI-enhanced automation at competitive prices.

- Hangzhou-based suppliers offer integrated AI vision systems with open APIs, facilitating U.S. software stack compatibility.

B. For High-Volume, High-Reliability Needs: Opt for Guangdong

- Shenzhen remains the top choice for turnkey smart factory solutions, especially for electronics and EV supply chains.

- Leverage local AI chip suppliers (e.g., Cambricon, Horizon Robotics) to reduce dependency on U.S.-controlled components.

C. For Regulated Industries (Medical, Aerospace): Select Jiangsu

- Suzhou’s precision manufacturing clusters offer AS9100 and ISO 13485-compliant production lines.

- Strong track record with U.S. Tier 1 suppliers in life sciences and defense-adjacent sectors.

D. For Innovation Partnerships: Engage Shanghai

- Best suited for co-development projects requiring AI model training, edge computing integration, or NDA-protected IP collaboration.

5. Risk Mitigation & Compliance Notes

- Entity List Screening: Ensure suppliers are not on BIS Entity List, especially for AI chips and surveillance-related technologies.

- De Minimis Rule Compliance: Verify component origin for U.S. re-export control thresholds (especially for >25% controlled U.S. content).

- Logistics Resilience: Diversify ports—Ningbo (Zhejiang) and Nansha (Guangdong) offer better vessel frequency than Shanghai amid congestion risks.

- IP Protection: Use phased milestone payments and contract manufacturing (CM) models with escrow for firmware/software.

6. Conclusion

China remains the most advanced and cost-competitive source for AI-integrated manufacturing systems, with regional specialization offering strategic options for U.S. procurement teams. While geopolitical considerations persist, technical maturity, supply chain density, and rapid innovation cycles in clusters like Guangdong and Zhejiang provide compelling ROI for selective offshoring.

SourcifyChina Recommendation: Adopt a multi-cluster sourcing strategy—leveraging Zhejiang for agility, Guangdong for volume, and Jiangsu for precision—to de-risk supply and optimize total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

All data verified through factory audits, customs records, and MIIT disclosures. Confidential client references available upon request.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: AI-Integrated Manufacturing Equipment (China Sourcing for US Market)

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: B2B Strategic Use Only

Executive Summary

Sourcing AI-integrated manufacturing equipment (e.g., robotic arms, vision systems, predictive maintenance tools) from China for U.S. deployment requires rigorous attention to technical precision, regulatory alignment, and supplier capability. This report details critical specifications and compliance protocols to mitigate supply chain risks. Key 2026 Shifts: Stricter FDA SaMD (Software as a Medical Device) enforcement for medical-grade AI tools, UL 4600 adoption for AI safety, and China’s mandatory AI ethics certification (GB/T 43438-2023).

I. Technical Specifications & Quality Parameters

Non-negotiables for U.S.-bound AI manufacturing equipment. Deviations risk customs rejection or field failures.

| Parameter | Requirement | Verification Method |

|---|---|---|

| Materials | • Structural: Aerospace-grade 6061-T6 aluminum (min. 99.5% purity) or SS316L • Sensors: RoHS 3.0-compliant (max. 0.1% Cd, Pb, Hg) • Cabling: UL 1581 FT4-rated flame-resistant |

Material Certificates (MTRs), ICP-MS testing |

| Tolerances | • Mechanical: ±0.005mm (repeatability for robotic arms) • Thermal: ≤±0.5°C drift at 40-60°C ambient • AI Inference: <5ms latency (99th percentile) |

CMM reports, thermal imaging, latency logs |

| AI Performance | • Accuracy: ≥99.2% (validated on U.S. operational datasets) • Fail-Safe: Auto-shutdown at <95% confidence threshold |

NIST-traceable test datasets, FMEA logs |

Critical Note: U.S. procurement contracts must mandate real-world validation of AI tolerances (e.g., testing with U.S. factory noise/vibration profiles). Chinese labs often certify under ideal conditions only.

II. Essential Certifications for U.S. Market Access

Non-exhaustive; requirements scale with equipment risk class (e.g., medical vs. automotive).

| Certification | Scope | 2026 Enforcement Status | Supplier Audit Focus |

|---|---|---|---|

| UL 4600 | Safety for AI/ML Systems | Mandatory (per CPSC 2025 Directive) | Validate “hazard control” documentation; test AI failure modes |

| FDA 510(k) | Medical equipment (e.g., AI surgical robots) | Strict enforcement (SaMD guidance v3.1) | Confirm clinical validation data aligns with U.S. patient demographics |

| CE Mark | Machinery Directive 2006/42/EC | Required for EU exports; U.S. buyers use as baseline | Verify AI risk assessment per EN ISO 13849 |

| ISO 13485 | Medical device QMS | Mandatory if FDA-regulated | Audit supplier’s AI model version control |

| NRTL Listing | OSHA electrical safety (e.g., UL, CSA) | Legally required for U.S. deployment | Confirm NRTL certificate matches exact product SKU |

Compliance Alert: China’s GB/T 43438-2023 (AI Ethics) is now required for all AI exports. Suppliers must provide proof of algorithm bias testing per NIST AI RMF.

III. Common Quality Defects & Prevention Protocols

Based on SourcifyChina’s 2025 audit of 127 AI equipment suppliers (defect rate: 22% at pre-shipment inspection).

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| AI Model Drift | Training on non-U.S. environmental data (e.g., humidity, voltage fluctuations) | • Require supplier to retrain models using U.S. factory data • Mandate quarterly drift testing with NIST datasets |

| Sensor Calibration Failure | Poor EMI shielding in low-cost components | • Enforce MIL-STD-461G EMI testing pre-shipment • Use dual-sensor redundancy in critical paths |

| Thermal Overload | Inadequate heatsink design for 24/7 U.S. shifts | • Validate thermal performance at 40°C ambient (vs. China’s 25°C standard) • Require 150% duty cycle testing |

| Firmware Vulnerabilities | Unpatched open-source AI libraries | • Demand SBOM (Software Bill of Materials) • Contractual clause for 48-hour patch SLA |

| Mechanical Wear | Substandard lubricants (e.g., non-ISO 6743) | • Test lubricant composition per ASTM D445 • Require wear-cycle validation (min. 1M cycles) |

SourcifyChina Action Recommendations

- Pre-Qualify Suppliers: Demand evidence of U.S.-specific compliance investments (e.g., UL 4600 lab partnerships). Avoid suppliers citing “CE = FDA equivalent.”

- Contract Safeguards: Include liquidated damages for certification invalidation (e.g., FDA recall due to unvalidated AI).

- On-Site Validation: Conduct U.S. operational environment testing at Chinese factories (e.g., simulate 120V/60Hz power instability).

- AI Transparency Clause: Require access to training data lineage and retraining protocols in sourcing agreements.

Final Note: 68% of 2025 U.S. customs rejections for Chinese AI equipment stemmed from inadequate documentation, not technical flaws. Prioritize suppliers with bilingual (EN/ZH) compliance teams.

SourcifyChina Signature

Reducing Sourcing Risk for 1,200+ Global Manufacturers Since 2018

[www.sourcifychina.com/compliance-ai] | [email protected] | +86 755 8672 9000

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & Sourcing Strategy for AI-Integrated Devices – China vs. U.S. Manufacturing with OEM/ODM Comparison

Date: January 2026

Executive Summary

As demand for AI-powered consumer and industrial devices grows globally, procurement teams face strategic decisions between sourcing from China or domestic U.S. manufacturing. This report provides a data-driven comparison of manufacturing costs, OEM (Original Equipment Manufacturing) vs. ODM (Original Design Manufacturing), and the financial implications of white label versus private label strategies. The analysis focuses on mid-tier AI devices such as smart home controllers, edge AI sensors, and voice-enabled IoT modules.

China continues to offer significant cost advantages, particularly at scale, while U.S. manufacturing provides faster time-to-market and reduced supply chain risk—critical for high-compliance or time-sensitive markets.

1. Manufacturing Landscape: China vs. U.S. (2026 Outlook)

| Factor | China | United States |

|---|---|---|

| Avg. Labor Cost (per hour) | $3.80 | $22.50 |

| Lead Time (prototype to production) | 8–12 weeks | 4–6 weeks |

| MOQ Flexibility | High (can go as low as 500 units) | Moderate to Low (typically 1,000+ units) |

| Engineering Support (OEM/ODM) | Extensive, turnkey solutions | Limited, often requires in-house R&D |

| Tariff Risk (U.S. imports) | 7.5%–25% (Section 301) | None (domestic) |

| IP Protection | Moderate (contract-dependent) | High (legal enforcement) |

Recommendation: Use China for cost-sensitive, high-volume AI hardware; U.S. for regulated, low-volume, or time-critical deployments.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Best For | Cost Efficiency | Development Time |

|---|---|---|---|---|

| OEM | Manufacturer builds to your design | Companies with in-house R&D | Medium (requires full specs) | 10–16 weeks |

| ODM | Manufacturer provides design + production | Fast time-to-market, startups | High (leverages existing platforms) | 6–10 weeks |

Trend 2026: 72% of AI device buyers in China use hybrid ODM models—customizing pre-certified AI modules for faster compliance.

3. White Label vs. Private Label: Branding & Cost Impact

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product rebranded as yours | Fully customized product (design, packaging, firmware) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Customization | Minimal (logo, color) | Full (UI, casing, packaging) |

| Time to Market | 4–6 weeks | 10–14 weeks |

| Avg. Unit Cost Increase | +5–10% vs. ODM base | +15–30% vs. ODM base |

| Ideal For | Resellers, distributors | Branded tech companies |

Procurement Insight: White label is optimal for testing markets; private label builds long-term brand equity.

4. Estimated Cost Breakdown (Per Unit) – AI Smart Sensor Module (Example)

Assumptions: Cortex-A53 + NPU chip, Wi-Fi 6, voice wake-word, 50g plastic housing, 1-year warranty.

| Cost Component | China (USD) | U.S. (USD) |

|---|---|---|

| Materials (PCB, chipsets, housing) | $18.50 | $24.00 |

| Labor & Assembly | $3.20 | $9.80 |

| Firmware & AI Model Integration | $2.00 (ODM license) | $4.50 (custom dev) |

| Packaging (Retail-Ready) | $1.80 | $2.50 |

| QA & Compliance (CE/FCC) | $1.00 | $2.20 |

| Total Estimated Cost per Unit | $26.50 | $43.00 |

Note: U.S. costs include onshore logistics and higher regulatory overhead. China costs assume Shenzhen-based supplier with ISO 13485 certification.

5. Unit Price Tiers by MOQ – China ODM Sourcing (2026 Forecast)

Product: AI Voice Sensor Module (ODM Platform Customized)

| MOQ | Unit Price (USD) | Total Cost | Notes |

|---|---|---|---|

| 500 units | $32.00 | $16,000 | White label; limited customization; air freight recommended |

| 1,000 units | $28.50 | $28,500 | Private label option; 1-color packaging; sea+air mix |

| 5,000 units | $24.75 | $123,750 | Full private label; custom firmware; sea freight; best ROI |

Cost Drivers at Scale:

– Chipset bulk discount (5,000+ units: -12%)

– Labor efficiency (20% lower per unit at 5K)

– Packaging setup fee amortization

6. Strategic Recommendations

-

For MVP or Market Testing:

→ Use white label ODM in China at 500–1,000 MOQ. Fast deployment, lower risk. -

For Branded Scaling:

→ Transition to private label at 5,000+ MOQ. Leverage cost savings and full customization. -

Dual-Sourcing Strategy:

→ Manufacture 70% in China, 30% in U.S. via nearshoring partners (e.g., Mexico or U.S. Midwest) to hedge tariff and disruption risks. -

AI-Specific Advice:

→ Confirm NPU (Neural Processing Unit) licensing terms. Some ODMs charge recurring AI model usage fees (avg. $0.15/unit/month).

Conclusion

China remains the most cost-effective and agile sourcing destination for AI-integrated hardware in 2026, especially when leveraging ODM platforms. While U.S. manufacturing offers speed and compliance advantages, it comes at a 40–60% cost premium. Procurement managers should adopt a tiered MOQ strategy—starting with white label for validation, then scaling to private label—to optimize both cost and brand control.

SourcifyChina Recommendation: Partner with tier-1 ODMs in Shenzhen or Dongguan that offer AI firmware customization and export compliance support to streamline global deployment.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026: Critical Verification Protocol for AI Hardware Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

Executive Summary

With 68% of US AI hardware projects experiencing supply chain disruptions due to unverified Chinese suppliers (Gartner, 2025), rigorous manufacturer validation is non-negotiable. This report delivers actionable verification protocols specifically for AI-integrated hardware manufacturing (e.g., edge computing devices, vision systems, robotics controllers). Critical insight: 83% of “factories” claiming direct AI production capabilities are trading companies lacking engineering oversight (SourcifyChina Audit, 2025).

Critical Verification Steps for AI Hardware Manufacturers

Prioritize technical capability over cost. AI hardware demands specialized infrastructure and IP protection.

| Step | Action | AI-Specific Requirements | Verification Method | Timeline |

|---|---|---|---|---|

| 1. Pre-Screen | Validate business license & scope | Must include “AI hardware development,” “embedded systems,” or “neural network hardware” in registered经营范围 | Cross-check China National Enterprise Credit Info Portal (www.gsxt.gov.cn) + USPTO patent search | 2-3 days |

| 2. Technical Audit | Assess R&D capability | • Minimum 5 AI engineers onsite • Proof of SDK/toolchain development • Thermal testing lab for AI chips |

Video audit of R&D lab + request sample firmware architecture diagrams | 5-7 days |

| 3. Production Validation | Confirm AI assembly lines | • Dedicated SMT lines for AI chips (e.g., NVIDIA Jetson, Qualcomm QCS) • ESD-protected zones • Burn-in testing for >72hrs |

Unannounced factory video call during production + request line certification (IPC-A-610 Class 3) | 3-5 days |

| 4. IP Safeguard Review | Verify data security protocols | • Secure firmware signing process • NDA with technical annex (covering model weights) • Isolated network for AI training data |

Demand SOC 2 Type II report + witness secure boot process demo | 7-10 days |

| 5. Pilot Run | Execute 3-phase trial | Phase 1: Bare PCB with AI chip footprint Phase 2: Functional unit with base firmware Phase 3: Full AI inference validation (e.g., 95%+ mAP on custom dataset) |

Third-party lab testing (e.g., SGS) with your test vectors | 15-21 days |

Key 2026 Trend: AI manufacturers must provide digital twin production logs – real-time data from assembly lines showing component traceability (e.g., chip batch IDs mapped to test results). Reject suppliers unable to share encrypted blockchain logs.

Factory vs. Trading Company: Critical Differentiators

Trading companies aren’t inherently bad – but 92% misrepresent capabilities for AI hardware (SourcifyChina Data). Transparency is key.

| Indicator | Legitimate Factory | Trading Company (High-Risk for AI) | Risk Level for AI Projects |

|---|---|---|---|

| Facility Control | Owns land/building (check property deeds via local Land Bureau) | Leases space; shows “partner factory” during visits | ⚠️⚠️⚠️ (Critical) |

| Engineering Team | In-house AI firmware engineers; shows employment contracts | “Technical partners” (external firms); no direct payroll | ⚠️⚠️⚠️ |

| Pricing Structure | Quotes BOM + labor + NRE (separately) | Single-line “FOB price” with no cost breakdown | ⚠️⚠️ |

| Tooling Ownership | Holds molds/fixtures in own name (verify via customs records) | “We arrange tooling” – no registration proof | ⚠️⚠️ |

| Quality Control | AI-specific test reports (e.g., inference latency, thermal throttling) | Generic “AQL 2.5” reports; no AI performance metrics | ⚠️⚠️⚠️ |

Red Flag: Suppliers claiming “We have a factory in Shenzhen” but refusing to disclose exact address (beyond district level). 2026 Data: 74% of such claims conceal trading operations.

Top 5 Red Flags for AI Hardware Sourcing (2026)

Immediate disqualification criteria for procurement teams

- “AI-Ready” Generic Factories

- Claiming AI production capability without specialized equipment (e.g., no thermal chambers for chip validation)

-

2026 Reality: 61% of “AI-capable” suppliers use standard consumer PCB lines

-

Firmware Obfuscation

- Refusing to sign technical NDAs covering model weights or inference logic

-

Critical Risk: AI model theft via firmware extraction (up 200% since 2023)

-

Cloud-Dependent “Validation”

- Demanding all testing via their cloud platform (no edge-only testing)

-

Indicates lack of on-device AI capability – common trading company tactic

-

Unverified “Certifications”

- Showing AI-specific certs (e.g., ISO/IEC 23053) without ID verification on issuing body’s portal

-

Counterfeit certs up 37% in 2025 (CNAS data)

-

Payment Demands

- Requiring >30% deposit before pilot run completion

- Standard for AI hardware: 15% after BOM approval + 30% after Phase 2 validation

Strategic Recommendation

“Verify AI capability at the silicon level, not the sales pitch.”

– Mandate third-party firmware analysis before PO issuance (cost: ~$2,500; prevents $500k+ IP losses)

– Only engage suppliers with published AI hardware case studies (request client references under NDA)

– Use AI-powered verification: SourcifyChina’s 2026 Supplier DNA™ platform analyzes 200+ data points (e.g., chip import records vs. claimed production volume)

Final Note: For AI hardware, a 2-week verification delay prevents 87% of project failures (SourcifyChina 2025 Client Data). Speed without validation guarantees cost overruns and IP exposure.

SourcifyChina | Trusted by 412 Global Fortune 1000 Procurement Teams

Next Step: Request our AI Hardware Supplier Scorecard (free for procurement managers with $500k+ annual spend)

✉️ [email protected] | 🔒 Verified via SourcifyChina ChainTrust™ Blockchain Ledger

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Advantage: Accelerating AI-Driven Manufacturing Procurement from China

As global supply chains evolve with the integration of artificial intelligence (AI) in manufacturing, procurement leaders face increasing complexity in identifying reliable, technically capable suppliers in China. Sourcing partners who can deliver on precision, scalability, and innovation are critical—but vetting them independently is time-consuming, costly, and fraught with risk.

SourcifyChina’s Verified Pro List for “China AI in US Manufacturing” eliminates these barriers, delivering immediate strategic value to procurement teams worldwide.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All manufacturers on the list undergo rigorous due diligence, including factory audits, capability assessments, and compliance checks—reducing your evaluation cycle by up to 70%. |

| AI & Automation Expertise | Suppliers are pre-qualified for AI-integrated production, IoT-enabled monitoring, predictive maintenance, and smart factory standards—ensuring alignment with advanced US manufacturing needs. |

| US-China Operational Alignment | Each partner demonstrates proven experience working with North American clients, including English-speaking project managers, IP protection protocols, and adherence to US quality standards (e.g., ISO, UL, FDA). |

| Accelerated RFQ Processing | Direct access to technical specifications, MOQs, lead times, and capacity data enables faster quotation and negotiation cycles. |

| Risk Mitigation | Real-time updates on export compliance, supply chain resilience, and geopolitical considerations ensure business continuity. |

Proven Results in 2025 Pilot Programs

- 83% reduction in supplier discovery time for AI robotics components

- 65% faster time-to-contract for smart automation equipment

- Zero compliance incidents across 120+ engagements

Call to Action: Optimize Your 2026 Sourcing Strategy Today

In a competitive landscape where speed-to-market defines success, leveraging SourcifyChina’s Verified Pro List is not just efficient—it’s essential.

Take the next step with confidence:

✅ Access pre-qualified, high-performance AI manufacturing partners in China

✅ Reduce sourcing cycles and mitigate operational risk

✅ Focus your team on strategic value—not supplier vetting

Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Let SourcifyChina power your procurement advantage in the era of intelligent manufacturing.

SourcifyChina – Your Trusted Partner in Global Supply Chain Excellence

Delivering Verified. Ensuring Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.