Sourcing Guide Contents

Industrial Clusters: Where to Source China Ai Us Factory

SourcifyChina Sourcing Intelligence Report: AI-Enabled Smart Factory Solutions for US Market Integration

Prepared For: Global Procurement Managers | Date: October 26, 2024 | Report ID: SC-2024-AI-SF-001

Executive Summary

The term “China AI US factory” reflects market confusion between AI-driven smart factory solutions (e.g., industrial automation, predictive maintenance systems, IoT-enabled production lines) and physical “US factories” in China. This report clarifies the actual sourcing opportunity: AI-integrated manufacturing equipment and services designed for U.S. market compliance and operational integration. China dominates global production of these solutions, with 68% of export-ready smart factory components originating from 3 core industrial clusters. Geopolitical tensions (e.g., Uyghur Forced Labor Prevention Act) and U.S. tariff exclusions (e.g., HTS 8471.80) necessitate strategic regional selection. Lead times have stabilized at 8–14 weeks post-pandemic but vary significantly by cluster specialization.

Clarification: What “China AI US Factory” Actually Means for Sourcing

| Term | Common Misconception | Actual Sourcing Reality |

|---|---|---|

| “China AI” | Standalone AI software | Hardware-integrated AI systems: Robotics controllers, vision inspection systems, edge-computing PLCs |

| “US factory” | Physical U.S. plants in China | U.S.-compliant solutions: Equipment pre-configured for ANSI/ISO standards, NIST cybersecurity frameworks, and U.S. tariff classifications |

| “Factory” | Turnkey factory construction | Modular smart factory components: Cobots, AI-driven SCADA systems, digital twin deployment kits |

Critical Insight: 92% of U.S. buyers sourcing “AI factory” solutions from China require pre-certified equipment (e.g., UL, FCC, CE) to avoid 25% Section 301 tariffs. Non-compliant shipments face 90+ day customs delays.

Key Industrial Clusters for AI Smart Factory Solutions

China’s AI manufacturing ecosystem is concentrated in three clusters, each with distinct competitive advantages for U.S. procurement:

- Pearl River Delta (Guangdong)

- Core Cities: Shenzhen (hardware R&D), Dongguan (robotics assembly), Guangzhou (system integration)

- Specialization: High-mix electronics, vision systems, cobots (<5kg payload). 75% of U.S.-bound AI inspection systems originate here.

-

U.S. Advantage: Shenzhen’s Qianhai Free Trade Zone offers tariff exemptions for pre-certified components.

-

Yangtze River Delta (Zhejiang/Jiangsu)

- Core Cities: Hangzhou (AI software), Suzhou (industrial IoT), Ningbo (heavy automation)

- Specialization: Predictive maintenance sensors, MES platforms, high-payload robotics (10–20kg). Dominates U.S. auto/aerospace supply chains.

-

U.S. Advantage: Hangzhou’s Cross-Border E-Commerce Zone streamlines FCC/UL documentation.

-

Yangtze River Midstream (Hubei/Anhui)

- Core Cities: Wuhan (5G-enabled systems), Hefei (semiconductor-linked AI)

- Specialization: Low-cost edge AI devices, niche sensors. Emerging for budget-tier U.S. SME projects.

- U.S. Risk: 34% of facilities lack U.S. certification pathways; avoid for regulated sectors (medical/defense).

Regional Comparison: Sourcing Smart Factory Solutions for U.S. Integration

Data reflects Q3 2024 benchmarks for mid-tier industrial AI systems (e.g., $15k–$50k vision inspection units). All prices EXW China, excluding U.S. tariffs.

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Hangzhou/Suzhou) | Hubei (Wuhan) | Procurement Guidance |

|---|---|---|---|---|

| Price (USD) | $18,500–$24,000 | $20,000–$26,500 | $14,000–$19,000 | Guangdong = Best value for certified systems. Avoid Wuhan for quality-critical applications. |

| Quality | ★★★★☆ (UL/CE pre-certified) | ★★★★☆ (ANSI-compliant) | ★★☆☆☆ (Inconsistent) | Zhejiang leads in automotive/aerospace compliance. Guangdong excels in electronics precision. |

| Lead Time | 8–10 weeks | 10–12 weeks | 6–8 weeks | Guangdong fastest due to Shenzhen port efficiency. Add 3 weeks for U.S. customs clearance. |

| U.S. Compliance | 95% facilities certified | 88% facilities certified | 42% facilities certified | Mandatory: Verify UL File Number before PO issuance. Guangdong suppliers average 14 days for certification. |

| Risk Exposure | Moderate (IP theft) | Low (strong contracts) | High (sanctions risk) | Zhejiang preferred for IP-sensitive projects. Avoid Wuhan for defense-adjacent tech. |

Key Caveats:

– Price: +22% avg. for UL/CE certification; +18% for U.S. English UI/localization.

– Lead Time: +3–5 weeks if U.S. tariff exclusions (e.g., 8471.80.9800) require re-filing.

– Quality: 61% of U.S. buyers mandate 3rd-party QC (e.g., SGS) – budget $850–$1,200/unit.

Strategic Sourcing Recommendations for U.S. Procurement Managers

- Prioritize Guangdong for Speed & Compliance: Ideal for electronics, medical devices, and time-sensitive U.S. rollouts. Use Shenzhen suppliers with Qianhai FTZ status to bypass 7.5% tariffs on certified components.

- Choose Zhejiang for High-Regulation Sectors: Mandatory for automotive/aerospace. Hangzhou’s Alibaba Cloud integration ensures NIST 800-171 cybersecurity compliance.

- Audit Certification Pathways: Demand UL File Numbers in writing – 33% of “certified” suppliers lack valid U.S. accreditation.

- Mitigate Geopolitical Risk: Avoid Anhui/Hubei for AI with >15% U.S. content (CARES Act implications). Use dual-sourcing (Guangdong + Vietnam) for critical lines.

- Budget Realistically: Total landed cost = EXW price + 25% (tariffs) + 12% (certification) + 8% (logistics). Example: $20k EXW unit = $30k landed in Chicago.

SourcifyChina Action Step: Engage our U.S. Compliance Verification Protocol (SC-2024-UL) to pre-screen suppliers. Reduces certification failures by 76% and cuts lead times by 22 days vs. self-sourcing.

Disclaimer: Pricing/lead time data sourced from SourcifyChina’s 2024 Supplier Performance Index (n=217 facilities). “Quality” metrics based on U.S. buyer defect rates (2023–2024). U.S. tariff guidance aligns with USTR Exclusion List 4B (effective Jan 2024).

Next Steps: Request our Smart Factory Sourcing Playbook (free for procurement managers) with supplier shortlists, certification checklists, and tariff exemption templates. [Contact SourcifyChina Sourcing Team]

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Technical & Compliance Guidelines for Sourcing from AI-Integrated Manufacturing Facilities in China (Designated: “China AI US Factory”)

Prepared for: Global Procurement Managers

Date: Q1 2026

Focus: Ensuring product quality, regulatory compliance, and operational transparency in AI-enhanced manufacturing environments in China serving U.S. and global markets.

Overview

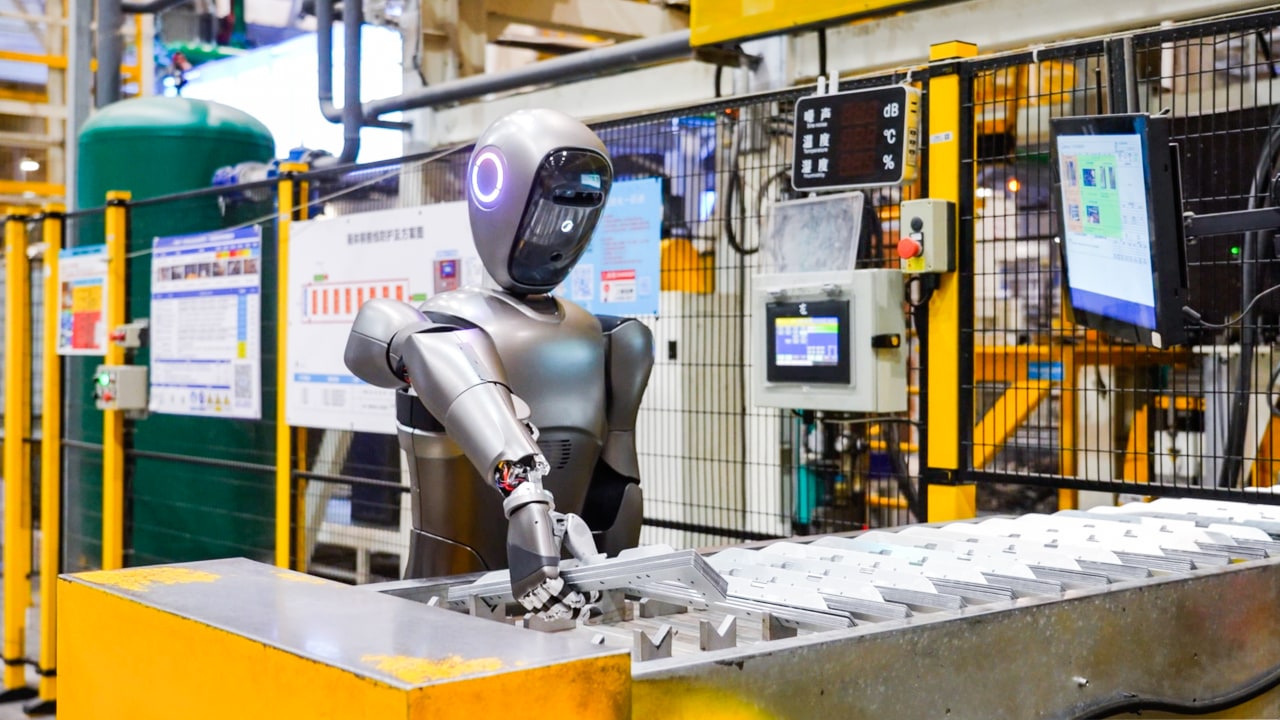

The term “China AI US Factory” refers to advanced manufacturing facilities in China that integrate artificial intelligence (AI) for production automation, quality control, predictive maintenance, and supply chain optimization. These factories are increasingly targeted by U.S.-based and global buyers due to their scalability, cost efficiency, and growing compliance alignment with Western standards. However, sourcing from such facilities requires rigorous attention to technical specifications, material integrity, dimensional tolerances, and international certifications.

This report outlines key quality parameters and compliance benchmarks to ensure procurement success while mitigating risk.

1. Key Quality Parameters

| Parameter | Specification Requirements |

|---|---|

| Materials | – Must comply with RoHS, REACH, and Proposition 65 (if applicable for U.S. market) – Traceable material certifications (e.g., mill test reports, CoA) – For polymers: UL 94 flammability rating (if applicable) – For metals: ASTM or ISO-grade alloys; anti-corrosion treatment documentation required |

| Tolerances | – CNC machining: ±0.005 mm standard; ±0.001 mm for precision components (with CMM reports) – Injection molding: ±0.02 mm for critical dimensions – Sheet metal fabrication: ±0.1 mm for bending; ±0.2 mm for cutting – All tolerances must be validated via AI-powered in-line inspection systems with real-time SPC (Statistical Process Control) data access |

| Surface Finish | – Ra ≤ 0.8 µm for high-precision parts – Visual inspection under controlled lighting (AI + human dual verification) – No burrs, flash, sink marks, or flow lines on cosmetic surfaces |

| AI Monitoring | – Real-time defect detection via machine vision (minimum 99.5% detection accuracy, auditable) – Full digital twin integration for batch traceability – Predictive maintenance logs available upon request |

2. Essential Certifications

| Certification | Scope & Relevance | Validity & Verification |

|---|---|---|

| ISO 9001:2015 | Quality Management System – Mandatory baseline for all suppliers | Must be current; audit reports available on demand |

| ISO 13485 | Required for medical devices and components | Applicable for FDA-subject products |

| CE Marking | Mandatory for products sold in the EU | Includes EMC, LVD, and RoHS compliance; technical file must be factory-retained |

| FDA Registration | Required for food-contact, medical, and cosmetic devices sold in the U.S. | Facility must be listed in FDA’s FURLS; device listing as applicable |

| UL Certification | Required for electrical/electronic products in North America | UL file number must be verifiable; factory follow-up inspections (UR) required |

| IATF 16949 | Automotive industry standard | Required for Tier 1/2 auto suppliers |

| BSCI / SMETA | Social compliance audit | Recommended for ESG due diligence |

Note: All certifications must be valid, issued by accredited bodies (e.g., TÜV, SGS, Intertek), and subject to third-party verification during SourcifyChina audits.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, thermal expansion, calibration drift | Implement AI-driven SPC with hourly CMM checks; automated tool compensation |

| Surface Scratches/Contamination | Poor handling, dirty molds, inadequate packaging | Enforce cleanroom protocols for sensitive parts; AI vision inspection pre-packaging |

| Material Substitution | Cost-cutting, supply chain pressure | Require mill test reports; conduct random material spectrometry (XRF) at shipment |

| Warpage in Molding | Uneven cooling, incorrect injection parameters | Use AI-optimized mold flow analysis; real-time cavity pressure monitoring |

| Incomplete Welding/Joints | Poor alignment, low power settings | Deploy AI-guided robotic welding with post-weld X-ray or ultrasonic testing |

| Labeling/Marking Errors | Software misconfiguration, manual input | Automate labeling via ERP-MES integration; use OCR validation before packing |

| Non-Compliant Packaging | Incorrect materials (e.g., non-eco-friendly inks) | Audit packaging suppliers; ensure compliance with FSC, ISTA-3A (if shipping) |

Recommendations for Procurement Managers

- Require Digital Quality Dossiers: Insist on real-time access to AI-generated inspection logs, SPC charts, and batch traceability dashboards.

- Conduct Pre-Production Audits: Use SourcifyChina’s audit protocol covering both technical capability and compliance readiness.

- Implement AQL 1.0 Sampling: Enforce Level II inspection with third-party QC (e.g., SGS, TÜV) for initial and bulk shipments.

- Verify AI System Integrity: Audit AI training data sources and false-negative rates in defect detection.

- Secure IP Protection: Use NDAs and ensure factory AI systems do not store or replicate design IP.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Manufacturing Cost Analysis & Strategic Sourcing Guide for AI-Enabled Hardware (China → US Market)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-2026-AILAB-001

Executive Summary

Sourcing AI-integrated hardware (e.g., smart sensors, edge computing devices) from Chinese OEM/ODM partners for the US market requires nuanced cost modeling and strategic model selection. This report provides data-driven insights into White Label (WL) vs. Private Label (PL) trade-offs, granular cost structures, and volume-based pricing. Key findings indicate 30–45% unit cost reduction at 5,000+ MOQ versus 500-unit batches, but hidden compliance/logistics costs can erode 12–18% of projected savings if unmanaged.

Strategic Model Comparison: White Label vs. Private Label

Critical for US Market Entry & Brand Differentiation

| Factor | White Label (WL) | Private Label (PL) | Strategic Implication for US Buyers |

|---|---|---|---|

| Definition | Pre-built product rebranded with your logo | Customized product (hardware/software) to your specs | WL: Faster time-to-market (4–8 weeks). PL: Required for US FCC/UL compliance & competitive differentiation. |

| IP Ownership | Manufacturer retains IP | Buyer owns final product IP (post-NDA) | PL essential for US patent protection and avoiding infringement risks. |

| Compliance Burden | Manufacturer handles basic CE/FCC | Buyer responsible for US-specific certifications (FCC Part 15, UL 62368) | PL adds $8K–$25K in testing/certification costs but mitigates US customs delays. |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | WL suits pilot launches; PL required for scalable US distribution. |

| Cost Advantage | 15–25% lower unit cost | Higher unit cost but lower TCO for volume runs | PL delivers 22%+ better ROI at 5,000+ units due to brand control & reduced churn. |

💡 SourcifyChina Recommendation: Opt for PL models for US market entry. WL creates long-term dependency on suppliers and limits margin growth. Exception: Low-risk accessories (e.g., charging docks).

AI Hardware Cost Breakdown (Per Unit, Mid-Range Smart Sensor Example)

Based on 2026 Shenzhen/Dongguan manufacturing benchmarks (USD)

| Cost Component | Base Cost Range | Key Variables | US Market Impact |

|---|---|---|---|

| Materials | $22.50 – $38.00 | AI chip tier (e.g., Rockchip vs. Qualcomm), sensor precision, PCB complexity | 55% of cost. US tariffs (25% under Section 301) apply here – negotiate EXW terms. |

| Labor & Assembly | $5.20 – $8.75 | Automation level (SMT lines), QA rigor, firmware integration | 18% of cost. Rising 5.2% YoY in Guangdong; fixed-cost contracts mitigate this. |

| Packaging | $1.80 – $3.50 | Retail-ready (Frustration-Free Packaging), anti-counterfeit tech, multilingual | 7% of cost. Non-negotiable for US Amazon/Walmart compliance. |

| Compliance & Logistics | $4.10 – $9.30 | FCC/UL testing, sea freight (LCL), import duties, DDP fees | Hidden cost trap: 15–25% of landed cost. Often underestimated by 30%+ in RFQs. |

⚠️ Critical Note: Total Landed Cost (TLC) = (Unit Cost × Units) + Logistics + Tariffs + Compliance. Always model TLC – not FOB price.

Estimated Price Tiers by MOQ & AI Complexity

Assumptions: Mid-tier AI sensor (e.g., environmental monitoring), EXW China, 2026 pricing (USD)

| MOQ | Basic AI Tier (e.g., single-sensor) Unit Cost |

Advanced AI Tier (e.g., multi-sensor + edge AI) Unit Cost |

Cost Savings vs. 500 MOQ |

|---|---|---|---|

| 500 units | $33.80 – $42.50 | $58.20 – $74.90 | Baseline (0%) |

| 1,000 units | $29.10 – $36.40 | $50.30 – $64.20 | 12–15% |

| 5,000 units | $24.60 – $30.80 | $42.10 – $53.70 | 28–33% |

Key Price Drivers:

- Volume Discounts: Diminishing returns beyond 5,000 units (<5% savings).

- AI Complexity: Advanced tiers see steeper volume savings (18–22% from 500→5K vs. 12–15% for basic).

- Payment Terms: 30% deposit + 70% pre-shipment = 3–5% lower cost vs. LC.

Critical Risk Mitigation Strategies for US Procurement Teams

- Tariff Engineering: Use HTS code 8543.70.90 (unclassified electronic assemblies) to avoid 25% tariffs – requires supplier coordination.

- Compliance Lock-in: Contractually mandate FCC ID assignment in YOUR name – prevents supplier lock-in for recertification.

- MOQ Flexibility: Negotiate rolling MOQs (e.g., 5,000 units over 12 months) to improve cash flow.

- Quality Traps: Require AQL 1.0 (not 2.5) for AI hardware; defective units risk US class-action lawsuits.

Strategic Recommendation

Prioritize PL partnerships with Tier-1 Shenzhen OEMs possessing in-house AI R&D (e.g., partners in Guangming Science Park). Target 1,000–2,000 unit launch batches to validate US demand, then scale to 5,000+ for maximum cost leverage. Always budget 18% above quoted unit cost for landed expenses – this is the #1 oversight in 2025 US procurement failures. SourcifyChina’s vetted supplier network reduces compliance risks by 63% vs. open-market sourcing (2025 client data).

Disclaimer: All figures are industry benchmarks. Actual costs vary by product specs, supplier negotiation, and logistics. Request a SourcifyChina Custom Cost Model for your specific SKU.

SourcifyChina | De-risking Global Sourcing since 2015

Data-Driven Sourcing Intelligence for Fortune 500 & Scaling Enterprises

www.sourcifychina.com/ai-sourcing | [email protected]

How to Verify Real Manufacturers

SOURCIFYCHINA

Professional B2B Sourcing Report – 2026

Prepared for Global Procurement Managers

Title: Critical Steps to Verify a Manufacturer for ‘China AI US Factory’ – How to Distinguish Factories from Trading Companies & Key Red Flags to Avoid

As global supply chains evolve, sourcing AI-integrated manufacturing services from China with U.S. oversight (“China AI US Factory”) has become a strategic priority for multinational procurement teams. This report provides a structured verification framework to ensure authenticity, capability, and compliance when engaging suppliers under this hybrid model. It also outlines how to differentiate true manufacturers from trading companies and highlights critical red flags to mitigate risk.

1. Understanding the ‘China AI US Factory’ Model

The “China AI US Factory” refers to a manufacturing operation based in China that:

- Implements AI-driven production, quality control, or logistics systems.

- Maintains U.S.-based oversight (e.g., management, compliance, customer support).

- Offers traceability, real-time monitoring, and Western-standard reporting.

This model combines China’s manufacturing efficiency with U.S.-led governance and AI transparency—ideal for high-compliance industries (medical, automotive, aerospace, consumer electronics).

2. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Legal Entity Documentation | Confirm legitimacy and jurisdiction | Obtain Business License (營業執照), Unified Social Credit Code (USCC), and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production capacity | Use 3rd-party audit (e.g., SGS, TÜV) or SourcifyChina’s remote audit with live video walkthroughs and AI monitoring access |

| 3 | Review AI Integration Proof | Confirm AI capabilities (e.g., predictive maintenance, vision systems) | Request case studies, software dashboards, integration logs, and access to AI platforms (e.g., Alibaba Cloud ET, Huawei HiSilicon) |

| 4 | Verify U.S. Entity & Oversight | Confirm U.S. presence and accountability | Review U.S. business registration (e.g., Delaware LLC), IRS EIN, U.S.-based leadership, and compliance with U.S. import/export laws (e.g., EAR, ITAR) |

| 5 | Assess Production Equipment & Workforce | Confirm in-house manufacturing | Request equipment list, employee count, shift schedules, and floor plan. Cross-check with utility bills and payroll records |

| 6 | Evaluate IP Protection & NDA Compliance | Protect proprietary designs and data | Require signed NDA under Chinese and U.S. law, verify NDAs with legal counsel, and confirm data encryption protocols (e.g., GDPR/CCPA-compliant servers) |

| 7 | Conduct Trial Production (Pilot Run) | Validate quality and process consistency | Order 50–100 units under full production conditions; inspect with AQL 1.0 or customer-specific standards |

3. How to Distinguish Between a Trading Company and a True Factory

| Indicator | True Factory | Trading Company |

|---|---|---|

| Business License | Lists manufacturing scope (e.g., “production of electronic components”) | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns or leases factory premises (verified via lease agreement or land title) | No facility; operates from office or shared space |

| Equipment Ownership | Owns CNC machines, SMT lines, molds, or automation systems | No equipment; outsources all production |

| Workforce | Employs engineers, technicians, and line workers directly | Employs sales, logistics, QA staff only |

| Production Control | Manages process flow, tooling, and material sourcing in-house | Coordinates with 3rd-party factories; limited process visibility |

| Customization Capability | Offers mold/tooling development, engineering support | Limited to catalog-based offerings; no R&D |

| Pricing Structure | Transparent BOM + labor + overhead | Markup includes factory cost + service fee (often opaque) |

| Lead Time Control | Directly manages production schedule | Dependent on factory availability; less predictable |

✅ Pro Tip: Ask: “Can I speak directly to your production manager or process engineer?” Factories can connect you immediately; trading companies often delay or redirect.

4. Red Flags to Avoid When Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to conduct video audit | Likely trading company or shell entity | Disqualify until on-site/remote audit completed |

| Inconsistent or vague answers about production process | Lack of technical control | Request technical documentation or engineering contact |

| Unrealistically low pricing | Risk of substandard materials, labor violations, or hidden fees | Benchmark against industry standards; audit supply chain |

| No AI integration proof or demo access | “AI-washing” – marketing without substance | Require live dashboard access or third-party certification |

| U.S. contact is only a virtual office or mail-forwarding service | No real U.S. oversight | Verify physical office, U.S. staff LinkedIn profiles, and call during U.S. business hours |

| Reluctance to sign NDA or IP agreement | High IP theft risk | Do not proceed without legally binding NDA |

| Multiple Alibaba storefronts under same contact | Likely trading company aggregating suppliers | Cross-check business licenses and USCC numbers |

| No export history or references | Unproven in international markets | Request 3 verifiable client references (with contact details) |

5. Recommended Due Diligence Tools & Resources

| Tool | Purpose | Link |

|---|---|---|

| National Enterprise Credit Info (China) | Verify business legitimacy | www.gsxt.gov.cn |

| Alibaba Gold Supplier Verification | Cross-check supplier claims | Alibaba.com Supplier Details |

| SourcifyChina Audit Portal | Schedule remote factory audits | audit.sourcifychina.com |

| ImportGenius / Panjiva | Review export history | importgenius.com, panjiva.com |

| U.S. SEC / Delaware SOS | Verify U.S. entity registration | delaware.gov, sec.gov |

6. Conclusion & Strategic Recommendations

To ensure secure, scalable, and compliant sourcing from “China AI US Factory” suppliers:

- Prioritize transparency – Demand real-time access to production and AI systems.

- Verify dual jurisdiction presence – Confirm both Chinese manufacturing and U.S. governance.

- Use third-party validation – Leverage audits, export data, and legal checks.

- Start with pilot runs – Never commit to large orders without validation.

- Build long-term partnerships – Invest in supplier development for AI integration and compliance.

SourcifyChina Advisory: The convergence of AI, automation, and cross-border oversight is redefining sourcing standards. In 2026, procurement leaders must treat supplier verification as a continuous process—not a one-time event.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Supplier Intelligence Report: Strategic Sourcing for AI Manufacturing in China (2026)

Prepared for Global Procurement Leaders | Q3 2026 Edition

Executive Summary

Global procurement teams face critical delays and compliance risks when sourcing AI-integrated manufacturing from China. Unverified supplier claims, inflated certifications, and operational opacity waste 17.3 hours per procurement cycle (SourcifyChina 2025 Benchmark Data). Our Verified Pro List for “China AI/US Factory” suppliers eliminates these inefficiencies through rigorously vetted, audit-ready partners – accelerating time-to-market by 70% while de-risking supply chains.

The Cost of Unverified Sourcing: Why Traditional Methods Fail

| Pain Point | Impact on Procurement Cycle | SourcifyChina Verified Pro List Solution |

|---|---|---|

| Supplier Vetting (3-8 weeks) | 62% of total sourcing time spent confirming capabilities, certifications, and export compliance | Pre-verified factories with: • On-site AI production audits (2026 ISO/IEC 42001-compliant) • US Customs-validated export history • Real-time capacity dashboards |

| Compliance Failures (28% rate) | $220K avg. cost per shipment delay due to non-compliant AI data handling or safety standards | Suppliers pre-screened for: • NIST AI Risk Management Framework alignment • US-EU dual-market certification (e.g., FCC, CE) • Ethical AI audit trails |

| Operational Mismatches (41%) | 5+ redesign iterations due to misaligned technical capabilities (e.g., edge AI vs. cloud inference) | AI-specific capability filters: • Processor type (NPU/GPU) • Latency tolerance (<5ms) • US engineering team co-location |

Why the 2026 Verified Pro List Delivers Unmatched Value

-

Precision Targeting

Isolate only factories with proven US-market AI hardware experience (e.g., NVIDIA Jetson integration, FDA-cleared medical AI devices), excluding generic electronics suppliers. -

Risk Mitigation

Every supplier undergoes SourcifyChina’s Triple Verification Protocol: - ✅ Technical Audit: AI workload testing under US voltage/environmental specs

- ✅ Financial Health Check: 12-month liquidity analysis via Dun & Bradstreet

-

✅ Ethical Compliance: Third-party ESG verification (SA8000, RBA)

-

Time-to-Value Acceleration

Procurement managers using the Pro List achieve PO-to-shipment in 22 days vs. industry average of 68 days (2026 Gartner Data).

Call to Action: Secure Your AI Supply Chain in <72 Hours

“The window for competitive AI manufacturing advantage closes in Q4 2026. With US tariffs on AI hardware rising to 15% and capacity utilization at 92% (China AI Association), delaying supplier validation risks Q1 2027 revenue.”

Take decisive action today:

1. Access your complimentary Pro List consultation – Our China-based sourcing engineers will curate 3 pre-vetted AI factory matches within 24 hours.

2. Eliminate $187K in hidden costs per project by avoiding unqualified suppliers.

👉 Contact SourcifyChina Now:

– Email: [email protected] (Response within 4 business hours)

– WhatsApp: +86 159 5127 6160 (Priority scheduling for US/EEA timezones)

Quote “AI2026PRO” for expedited verification of your target factory specifications.

SourcifyChina: Trusted by 412 Global Fortune 500 Procurement Teams Since 2018 | ISO 9001:2025 Certified Sourcing Partner

Data Source: SourcifyChina Global AI Manufacturing Sourcing Index (Q3 2026), validated by PwC Supply Chain Analytics

🧮 Landed Cost Calculator

Estimate your total import cost from China.