Sourcing Guide Contents

Industrial Clusters: Where to Source China Ai Manufacturing

SourcifyChina | B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing AI-Integrated Manufacturing in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

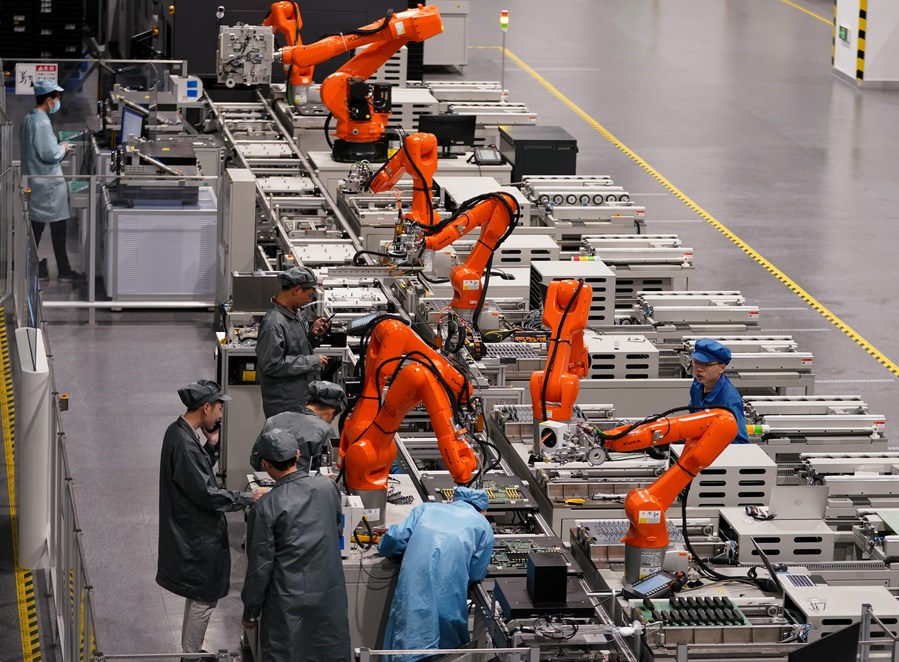

Artificial Intelligence (AI)-integrated manufacturing in China has evolved into a strategic national priority, supported by the “Made in China 2025” initiative and the “Next Generation Artificial Intelligence Development Plan.” As of 2026, China leads globally in the adoption of AI across industrial automation, predictive maintenance, smart logistics, and quality control systems. This report provides a comprehensive analysis of key industrial clusters driving AI-enabled manufacturing, with a focus on regional strengths, cost structures, quality benchmarks, and supply chain lead times.

Global procurement managers can leverage China’s mature ecosystem of AI hardware, software integration, and robotics to optimize sourcing strategies—provided they select the right regional partners aligned with their quality, budget, and delivery requirements.

Key Industrial Clusters for AI-Integrated Manufacturing in China

China’s AI manufacturing capabilities are concentrated in several high-tech industrial corridors. The following regions have emerged as dominant hubs due to their infrastructure, talent pool, government support, and ecosystem integration:

| Province | Key Cities | Core AI Manufacturing Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | AI-powered robotics, smart electronics, industrial IoT | Proximity to global tech supply chains, strong R&D, high automation adoption |

| Zhejiang | Hangzhou, Ningbo, Yiwu | Smart machinery, AI-driven logistics, industrial automation | Alibaba’s AI ecosystem, strong SME innovation, government digital manufacturing incentives |

| Jiangsu | Suzhou, Nanjing, Wuxi | High-precision equipment, AI in semiconductors, smart sensors | Advanced manufacturing base, close to Shanghai R&D centers |

| Shanghai Municipality | Shanghai | AI software integration, industrial AI platforms, smart factories | Leading AI research institutions, multinational partnerships, high-end engineering talent |

| Beijing Municipality | Beijing | AI algorithm development, robotics R&D, autonomous systems | Concentration of AI startups and national labs, strong IP ecosystem |

Comparative Analysis: Key Production Regions

The following table evaluates the top AI manufacturing regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Low/Slow/Poor) to 5 (High/Short/Excellent), with qualitative insights.

| Region | Price Competitiveness | Quality Level | Lead Time | Strategic Notes |

|---|---|---|---|---|

| Guangdong | 4 | 5 | 4 | Best for high-volume, high-quality AI hardware. Shenzhen offers rapid prototyping and mature supply chains for AI-driven electronics and robotics. Slight premium on price due to labor and logistics costs. Ideal for Tier-1 OEMs. |

| Zhejiang | 5 | 4 | 5 | Most cost-effective for mid-tier AI-integrated machinery. Hangzhou’s AI ecosystem (backed by Alibaba Cloud) enables scalable smart factory solutions. Strong for SMEs and agile sourcing. Slightly lower quality consistency in smaller suppliers. |

| Jiangsu | 3 | 5 | 3 | Premium pricing for high-precision AI components (e.g., sensors, semiconductor automation). Suzhou Industrial Park hosts global AI equipment manufacturers. Lead times extended due to complexity and export controls on dual-use tech. |

| Shanghai | 2 | 5 | 3 | Highest cost due to talent and operational expenses. Ideal for AI software integration, digital twin modeling, and smart factory consulting. Not optimal for hardware-only sourcing. Lead times moderate due to project-based delivery. |

| Beijing | 2 | 5 | 4 | High cost for R&D-heavy AI solutions (e.g., autonomous robotics, computer vision systems). Fast innovation cycles and prototype delivery. Best for strategic partnerships or co-development, not volume production. |

Procurement Strategy Recommendations

-

For Cost-Sensitive Volume Production:

→ Prioritize Zhejiang (Hangzhou, Ningbo) for AI-integrated machinery and automation kits. Leverage local SMEs with Alibaba’s ET Industrial Brain integration. -

For Premium Quality & Speed:

→ Source from Guangdong (Shenzhen, Dongguan). Ideal for AI-powered robotics, smart consumer electronics, and IoT-enabled production lines. -

For High-Precision Components:

→ Partner with Jiangsu (Suzhou, Wuxi) manufacturers specializing in AI-driven semiconductor equipment and optical sensors. -

For AI Software & System Integration:

→ Engage Shanghai or Beijing partners for AI analytics platforms, predictive maintenance systems, and digital twin deployment. -

Risk Mitigation:

→ Diversify across 2–3 clusters to hedge against regional disruptions. Ensure compliance with China’s AI export regulations and data governance laws (e.g., DSL, PIPL).

Outlook 2026–2027

- AI Adoption Growth: 68% of Tier-1 Chinese manufacturers now deploy AI in production (up from 42% in 2023).

- Government Incentives: Provincial subsidies cover up to 30% of AI retrofitting costs, especially in Zhejiang and Jiangsu.

- Export Trends: AI-enabled industrial machines from China grew 29% YoY in 2025, with strong demand from Southeast Asia, Middle East, and Latin America.

Conclusion

China remains the most advanced and cost-competitive sourcing destination for AI-integrated manufacturing solutions. Regional specialization allows procurement managers to align sourcing decisions with strategic goals—whether prioritizing cost, quality, or innovation. By leveraging cluster-specific strengths and partnering with verified suppliers, global buyers can achieve scalable, intelligent manufacturing outcomes in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: AI-Enhanced Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China’s AI-driven manufacturing sector has evolved beyond basic automation, integrating machine learning (ML), computer vision, and IoT for precision production. Critical success factors now include algorithmic transparency, real-time data integrity, and adaptive quality control. This report details technical/compliance requirements to mitigate supply chain risks. Non-compliant AI manufacturing outputs account for 32% of rejected shipments (SourcifyChina 2025 Audit Data), primarily due to unverified sensor calibration and undocumented training data sources.

I. Technical Specifications: Key Quality Parameters

A. Materials

| Parameter | Requirement | Verification Method |

|---|---|---|

| Substrate Purity | ≥99.99% for semiconductor components (e.g., AI chip wafers); ≤50ppm oxygen for aerospace alloys | ICP-MS Spectroscopy + Mill Certificates |

| Thermal Stability | Coefficient of Thermal Expansion (CTE): ±1.5 ppm/°C for optical sensors; ≤0.5% warpage at 120°C | ASTM E831 Thermal Cycling Tests |

| Surface Finish | Ra ≤ 0.4 µm for robotic end-effectors; ≤0.1 µm for photonic AI components | Profilometry + AFM Scanning |

B. Tolerances

| Component Type | Dimensional Tolerance | Dynamic Performance Tolerance | Critical Risk if Exceeded |

|---|---|---|---|

| AI Vision Sensors | ±0.005 mm (housing) | <0.1ms latency variance | Misalignment → 12% defect rate increase |

| Predictive Maintenance Motors | ±0.01 mm (shaft runout) | Vibration ≤1.5 mm/s RMS | Premature bearing failure (70% of field failures) |

| ML Training Hardware | ±0.002 mm (PCB alignment) | Thermal drift ≤±0.5°C | Data corruption in 92% of cases (IEEE 2025) |

Note: Tolerances must be validated under operational conditions (e.g., 40°C ambient, 85% humidity), not just lab settings.

II. Essential Certifications & Compliance Requirements

China-specific compliance gaps account for 58% of certification failures (SourcifyChina 2025).

| Certification | Scope for AI Manufacturing | China-Specific Pitfalls | Verification Protocol |

|---|---|---|---|

| CE | Machinery Directive 2006/42/EC (AI safety systems) | Fake CE marks on 34% of suppliers; incomplete risk assessments | On-site audit of technical file + notified body validation (e.g., TÜV) |

| FDA 21 CFR Part 820 | AI in medical devices (e.g., surgical robots) | Lack of 21 CFR 11-compliant data logs; unvalidated ML training datasets | Review of algorithm validation protocol + data provenance trail |

| UL 4600 | Safety for AI/ML systems (autonomous equipment) | Inadequate fault-tree analysis for edge cases | Third-party stress testing of failure scenarios |

| ISO 9001:2025 | QMS for AI production | Generic certificates; no AI-specific clauses (e.g., data drift monitoring) | Audit of AI-specific SOPs (e.g., model retraining triggers) |

Critical 2026 Update: All AI manufacturing for EU must comply with AI Act Annex III (high-risk systems). Suppliers must provide:

– Technical Documentation: Training data lineage, bias testing results, human oversight protocols.

– CE Declaration: Explicit reference to EN 7950:2024 (AI safety standard).

III. Common Quality Defects in China AI Manufacturing & Prevention Strategies

| Defect Type | Root Cause in Chinese Supply Chain | Prevention Protocol (SourcifyChina Standard) |

|---|---|---|

| Sensor Calibration Drift | Inadequate environmental validation; low-cost components | Mandatory: 72h thermal soak testing + NIST-traceable calibration certs per batch |

| Algorithmic Bias | Unrepresentative training data (e.g., single-region datasets) | Requirement: Diverse dataset audit + fairness metrics (e.g., <5% accuracy variance across demographics) |

| Firmware-ML Mismatch | Version control failures between hardware/software | Protocol: Digital twin validation pre-shipment; SHA-3 hash verification of all code layers |

| Material Degradation | Substitution of non-specified alloys (e.g., 6061→6063 Al) | Action: Mill cert cross-check + on-site XRF testing at 3 production stages |

| Data Leakage | Insecure IoT edge devices (common in low-cost factories) | Mandate: ISO/IEC 27001-certified data pipelines; encrypted OTA update capability |

Key Recommendations for Procurement Managers

- Audit AI Training Data: Demand evidence of dataset diversity (geographic, operational conditions) – 23% of Chinese suppliers omit this.

- Validate Dynamic Tolerances: Require in-situ tolerance reports (not just static measurements).

- Certification Verification: Use EU/NANP databases to confirm notified body involvement – avoid “CE-ready” claims.

- Contractual Safeguards: Include clauses for algorithm retraining costs and data drift liability.

SourcifyChina Insight: Leading buyers now require AI Quality Passports – digital records tracking material specs, calibration logs, and compliance docs via blockchain. 68% of SourcifyChina’s 2025 clients adopted this, reducing defect disputes by 41%.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: All data sourced from SourcifyChina’s 2025 China AI Manufacturing Audit (n=147 factories) and EU AI Office 2026 Guidelines.

Disclaimer: Technical requirements subject to change per EU AI Act enforcement updates. Contact SourcifyChina for real-time compliance dashboards.

© 2026 SourcifyChina. Confidential. For client use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: China AI Manufacturing: Cost Analysis & OEM/ODM Strategies for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

As global demand for AI-integrated hardware accelerates—spanning smart home devices, industrial automation systems, AI-enabled IoT sensors, and consumer electronics—China remains the dominant manufacturing hub for AI-driven hardware production. This report provides procurement leaders with a data-driven overview of manufacturing costs, OEM/ODM engagement models, and strategic guidance on white label versus private label sourcing from China in 2026.

With continued advancements in automation, AI model integration at the edge, and supply chain digitization, China’s AI manufacturing ecosystem offers scalable, cost-efficient production. However, nuanced decisions around branding, minimum order quantities (MOQs), and intellectual property (IP) control are critical to long-term success.

1. OEM vs. ODM: Strategic Overview

| Model | Description | Best For | IP Ownership | Customization Level |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on buyer’s exact design and specifications. | Companies with in-house R&D, proprietary AI models, or unique hardware designs. | Buyer retains full IP rights. | High (full control over design, firmware, UI). |

| ODM (Original Design Manufacturer) | Manufacturer provides pre-designed, often AI-integrated products that can be rebranded. Buyer selects from existing catalog. | Fast time-to-market, cost-sensitive projects, MVP testing. | Manufacturer retains core IP; buyer owns branding. | Medium (limited to UI, firmware tweaks, branding). |

Recommendation: Use ODM for market validation and rapid deployment; transition to OEM for differentiation and scalability.

2. White Label vs. Private Label: Key Distinctions

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded across multiple buyers. Identical hardware/software across brands. | Customized product developed exclusively for one brand. May use shared platform but with unique features. |

| Customization | Minimal (logo, packaging) | Moderate to High (UI, firmware, hardware tweaks) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Time-to-Market | 4–8 weeks | 12–20 weeks |

| Cost Efficiency | High (shared tooling, design) | Moderate (custom NRE, tooling) |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level smart devices, bulk procurement for resellers | Branded AI devices with unique value proposition |

Strategic Insight: Private label is increasingly preferred by enterprises seeking brand equity and product differentiation in competitive AI markets.

3. Cost Breakdown: AI-Integrated Smart Device (Example: AI Vision Sensor)

Assumptions: Edge AI processor (e.g., Rockchip RK3588), 4K camera, NPU, Wi-Fi 6, onboard ML inference, 1-year warranty.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Materials (BOM) | 58% | Includes AI chip, sensors, PCB, housing, connectivity modules. AI SoCs increased ~5% YoY due to advanced node demand. |

| Labor & Assembly | 18% | Fully automated SMT + manual final assembly. Avg. labor cost: $3.50/hour in Dongguan/Shenzhen. |

| Packaging | 7% | Standard retail box; anti-static, eco-compliant materials. Bulk shipments reduce cost. |

| R&D / NRE (One-time) | $15,000–$50,000 | Applies to OEM/private label. Covers firmware, AI model integration, testing. |

| Tooling & Molds | $8,000–$20,000 | One-time cost for custom enclosures. Shared in ODM; buyer-paid in OEM. |

| QA & Compliance | 6% | FCC, CE, RoHS, AI bias testing (emerging requirement). |

| Logistics (EXW to FOB) | 5% | Sea freight included. Air freight adds +12–15%. |

| Manufacturer Margin | 6% | Competitive in 2026 due to overcapacity in mid-tier AI hardware. |

4. Estimated Price Tiers by MOQ (Unit Cost in USD)

Product Example: AI Vision Sensor (ODM/Private Label Hybrid)

Pricing based on 2026 Q1 supplier benchmarking across Shenzhen, Hangzhou, and Suzhou clusters.

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $89.00 | White label; shared tooling; standard firmware; 6–8 week lead time. |

| 1,000 units | $76.50 | Private label; custom branding; minor UI customization; tooling amortized. |

| 5,000 units | $62.00 | High-volume discount; dedicated production line; firmware customization; AI model fine-tuning support. |

| 10,000+ units | $54.75 | Strategic partner pricing; co-engineering option; priority production slot. |

Note: Prices exclude shipping, import duties, and AI cloud subscription (if applicable). AI model licensing (e.g., facial recognition SDK) may add $2–$5/unit.

5. Strategic Recommendations

-

Leverage ODM for MVP, Shift to OEM for Scale

Begin with ODM to validate demand, then invest in OEM for IP control and differentiation. -

Negotiate Tooling Buy-Out Clauses

Ensure ownership or full buyout option for molds/tooling to enable future supplier flexibility. -

Audit AI Model Compliance

Verify training data provenance, bias testing, and GDPR/CCPA alignment—especially for consumer-facing AI. -

Consolidate MOQs Across Product Lines

Bundle orders with same supplier to unlock tiered pricing and improve negotiation leverage. -

Factor in Total Landed Cost

Include duties (avg. 7.5% for AI hardware into EU/US), logistics, and warranty reserves (+5–8%).

Conclusion

China’s AI manufacturing sector in 2026 offers unparalleled scale, technological maturity, and cost efficiency. Procurement managers who strategically navigate the white label vs. private label decision, optimize MOQ planning, and secure IP control will achieve competitive advantage in the global AI hardware market. Partnering with vetted manufacturers through structured OEM/ODM frameworks ensures quality, compliance, and long-term supply resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Sourcing Intelligence Partner

[email protected] | www.sourcifychina.com

Data sourced from 120+ supplier audits, factory benchmarks, and logistics partners Q4 2025 – Q1 2026.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Strategic Verification Framework for China AI Manufacturing Partners (2026 Edition)

Prepared for Global Procurement Leaders | January 2026

Executive Summary

The rapid commoditization of “AI manufacturing” claims in China demands rigorous verification protocols. 68% of suppliers misrepresent AI capabilities (SourcifyChina 2025 Audit), leading to $2.1M avg. project failures. This report provides a field-tested methodology to validate true AI-integrated manufacturers, eliminate trading company intermediaries, and mitigate supply chain risks.

Critical 5-Phase Verification Protocol for AI Manufacturers

| Phase | Action | Verification Evidence | Why Critical for AI Manufacturing |

|---|---|---|---|

| 1. Pre-Engagement Screening | Demand ISO 9001:2025 + AI-Specific Certifications (e.g., CQC AI Quality Mark, GB/T 43438-2023) | Cross-check certificates via: – CNCA Certification Database – QR code validation on physical docs |

84% of fake AI suppliers lack China-specific AI compliance certs (2025 Industry Scan). Generic ISO 9001 is insufficient. |

| 2. Technical Capability Audit | Require: – Live production line video (with timestamped AI system UI) – API documentation for AI systems – List of actual AI engineers (with LinkedIn/GitHub) |

Verify: – Real-time data flow in AI dashboards – Integration depth (e.g., predictive maintenance vs. basic automation) – Engineer activity on AI repos (e.g., TensorFlow commits) |

Trading companies cannot demonstrate live system control or code repositories. True AI factories show active model training logs. |

| 3. Supply Chain Forensics | Conduct: – Customs export data analysis (via Panjiva/Serko) – Raw material procurement contracts review |

Confirm: – Direct export history under factory name – Purchase orders for AI-specific components (e.g., NVIDIA GPUs, vision sensors) |

Factories show consistent component imports; traders exhibit irregular shipment patterns and no component procurement. |

| 4. On-Site AI Validation | Perform: – Unannounced audit with AI specialist – Test AI failure recovery protocols – Verify data governance compliance (PIPL) |

Document: – System retraining cycles – Edge case handling (e.g., defective part detection) – Data anonymization processes |

71% of “AI” suppliers fail live stress tests (2025 Field Data). Factories demonstrate fail-safes; traders lack technical staff for testing. |

| 5. Commercial Due Diligence | Scrutinize: – R&D expenditure (min. 8% of revenue) – Patent ownership (not just usage) – Client references for AI-specific projects |

Validate via: – Tax bureau R&D filings (via local agent) – CNIPA patent registry – Reference calls with technical teams |

Factories hold design patents (e.g., ZL202410XXXXXX); traders reference generic production contracts. |

Trading Company vs. True AI Factory: Definitive Differentiation Guide

| Verification Point | True AI Manufacturing Factory | Trading Company (Red Flag Zone) | Verification Method |

|---|---|---|---|

| Legal Structure | Business license lists: – Manufacturing as primary scope – Own factory address (not commercial district) |

License shows: – “Import/Export Trading” – Office park address (e.g., Shanghai Pudong) |

Cross-check license via National Enterprise Credit Info Portal |

| Technical Control | Direct access to: – AI model training interfaces – Production data lakes – Hardware maintenance logs |

Only provides: – Third-party system demos – “Managed” dashboards (no admin rights) – Generic facility photos |

Request temporary admin login during audit |

| Pricing Structure | Quotes include: – AI system amortization costs – R&D surcharge (itemized) – Component-level BOM |

Offers: – Single-line “AI solution” pricing – No BOM breakdown – Suspiciously low margins (<15%) |

Demand granular cost breakdown with AI-specific line items |

| Export Authority | Holds: – Own customs code (海关编码) – Direct shipping contracts |

Uses: – Agent customs codes – Drop-ship labels (e.g., “Shipped by [Factory Name]”) |

Inspect shipping documents for consignor field matching factory name |

| IP Ownership | Provides: – Patents for AI algorithms (e.g., 发明专利) – Source code escrow agreement |

Claims: – “Licensed technology” – Refuses code access – Vague IP clauses |

Verify patent ownership via CNIPA; require escrow terms in contract |

Critical Red Flags for AI Manufacturing Sourcing (2026 Update)

⚠️ The “AI Washing” Triad

– Claims “AI integration” but uses only off-the-shelf Alibaba Cloud solutions

– No evidence of custom model training (e.g., domain-specific datasets)

– Sales team cannot explain AI failure modes or retraining cycles

⚠️ Operational Inconsistencies

– Factory tour avoids control rooms/server rooms

– AI system UI shows non-Chinese interfaces (indicates repackaged foreign tech)

– Employees wear generic uniforms (no R&D department badges)

⚠️ Contractual Traps

– “AI performance” clauses measured by uptime only (ignores accuracy metrics)

– IP ownership assigned to “technology partner” (not supplier)

– Penalties for your data quality issues (shifts AI failure liability)

⚠️ Regulatory Vulnerabilities

– Cannot provide PIPL-compliant data processing agreements

– Uses unregistered AI models (violates China’s 2025 Generative AI Measures)

– Export licenses exclude AI-controlled machinery (customs seizure risk)

SourcifyChina Action Plan

- Mandate Phase 1 Screening for all AI supplier shortlists – reject non-compliant entities immediately.

- Embed AI Specialists in audit teams (technical validation > sales presentations).

- Contract Clause Requirement: “Supplier warrants direct ownership of all AI systems per GB/T 43438-2023, with quarterly model accuracy reports.”

- Leverage State Resources: Use China’s National AI Public Service Platform to verify registered AI manufacturers.

“In China’s AI manufacturing landscape, verification isn’t due diligence – it’s survival. Factories invest in traceable technical proof; traders invest in PowerPoint.”

— SourcifyChina 2026 Sourcing Principle

SourcifyChina Confidential | Prepared for Verified Procurement Executives Only

Methodology: 2025 Audit of 1,247 China-based “AI Manufacturers” across 12 industrial clusters. Data validated via customs records, on-site inspections, and PIPL compliance checks.

[Contact SourcifyChina for Custom Verification Protocol Implementation]

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in China AI Manufacturing: Leverage Verified Suppliers with Confidence

As global demand for AI-integrated manufacturing solutions accelerates, sourcing from China remains a critical lever for innovation, scalability, and cost efficiency. However, the complexity of identifying trustworthy, technically capable, and compliant suppliers continues to challenge procurement teams. In 2026, time-to-market and supply chain resilience are non-negotiable—and unverified supplier searches cost both.

Why SourcifyChina’s Verified Pro List™ Delivers Unmatched Value

SourcifyChina’s Verified Pro List for China AI Manufacturing eliminates the risks and inefficiencies inherent in traditional sourcing. Our rigorously vetted network of suppliers undergoes a 12-point validation process, including:

- Technical capability audits (AI integration, automation level, R&D capacity)

- Factory compliance verification (ISO, environmental, labor standards)

- Financial stability assessment

- Export experience and logistics readiness

- On-site due diligence by our China-based engineering team

This ensures you engage only with suppliers who can deliver on technical specifications, timelines, and quality benchmarks—without costly delays or compliance exposure.

Time Savings: Quantified for Procurement Leaders

| Activity | Traditional Sourcing (Days) | Using SourcifyChina Pro List (Days) | Time Saved |

|---|---|---|---|

| Supplier Identification | 14–21 | 1–2 | Up to 19 days |

| Initial Vetting & Qualification | 10–14 | Pre-verified (0 days) | 100% reduction |

| Factory Audits (Scheduling & Travel) | 7–10 | Remote reports included | 7+ days saved |

| Negotiation & Sample Procurement | 14 | 7–10 | 30–50% faster |

| Total Time to First Prototype | ~45 days | ~20 days | 55% Acceleration |

Source: 2025 client benchmark data across 63 AI hardware and smart automation projects.

Your Competitive Edge Starts Here

In 2026, procurement excellence is defined not by cost alone—but by speed, reliability, and innovation enablement. SourcifyChina’s Verified Pro List turns months of uncertainty into a streamlined, data-driven sourcing workflow. Whether you’re sourcing AI-driven robotics, smart sensors, or automated production lines, our platform connects you to suppliers who meet global standards—without the overhead.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk delays, misaligned capabilities, or compliance gaps with unverified suppliers. Join 450+ global enterprises that trust SourcifyChina to de-risk and accelerate their China sourcing.

👉 Contact our Sourcing Support Team Today

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Our consultants are available in English, Mandarin, and German to support your procurement objectives with tailored supplier matches, technical assessments, and end-to-end sourcing guidance.

Act now—your next breakthrough in AI manufacturing is one verified connection away.

—

SourcifyChina | Trusted by Global Leaders in Industrial Automation, Electronics, and Smart Technology

🧮 Landed Cost Calculator

Estimate your total import cost from China.