Sourcing Guide Contents

Industrial Clusters: Where to Source China Ai Factory

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing “China AI Factory” Solutions from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

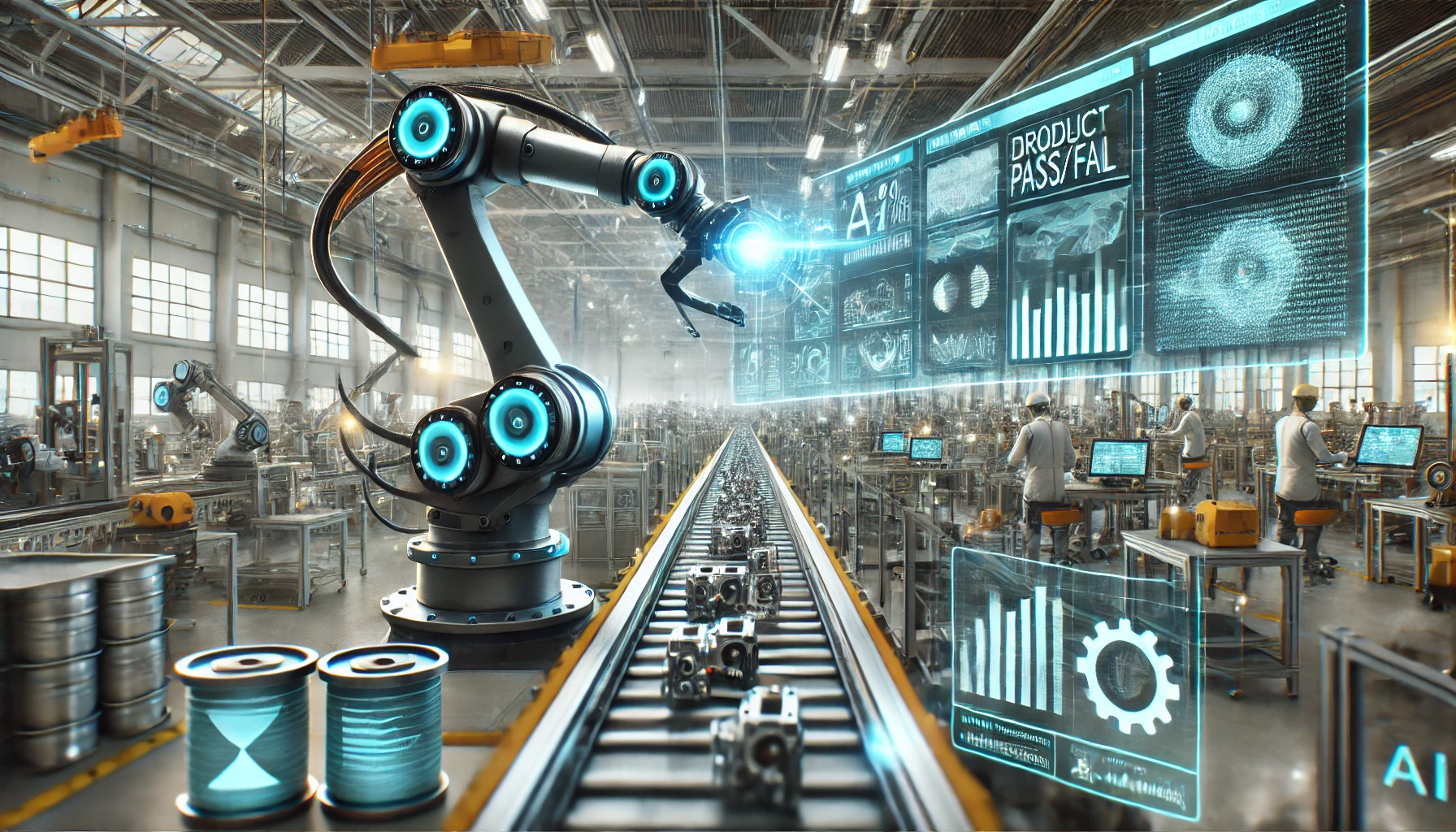

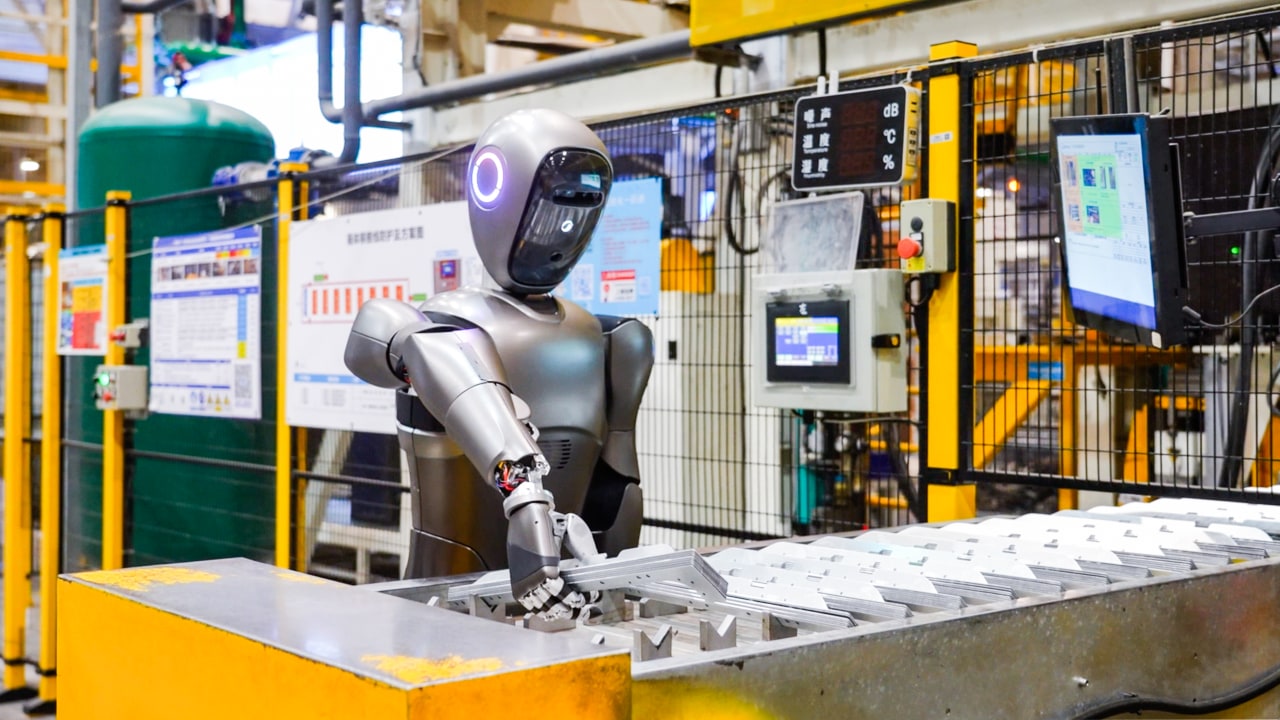

The term “China AI Factory” refers to integrated ecosystems in China that combine advanced manufacturing, artificial intelligence (AI), automation, and data-driven processes to produce smart industrial systems, robotics, AI-enabled hardware, and IoT-integrated production lines. These are not standalone facilities but represent clusters of high-tech manufacturing hubs specializing in AI-driven industrial automation, smart sensors, edge computing devices, and AI-powered robotics.

As global demand for Industry 4.0 solutions surges, China has emerged as the dominant supplier of AI-enhanced manufacturing infrastructure. This report provides a strategic sourcing analysis of key industrial clusters in China, focusing on production capability, cost structure, quality benchmarks, and delivery timelines to support informed procurement decisions in 2026.

Key Industrial Clusters for “China AI Factory” Manufacturing

China’s AI-enabled manufacturing ecosystem is concentrated in several high-tech industrial clusters. These regions combine strong government support, R&D investment, supply chain density, and skilled labor pools to deliver scalable AI-integrated production systems.

Top 5 Industrial Clusters (Provinces & Cities)

| Cluster | Core Cities | Specialization | Key Strengths |

|---|---|---|---|

| Guangdong (Pearl River Delta) | Shenzhen, Guangzhou, Dongguan | Smart robotics, AI chips, IoT integration, automation systems | Proximity to Hong Kong, strong electronics supply chain, high R&D investment |

| Zhejiang | Hangzhou, Ningbo, Yiwu | AI software integration, smart logistics systems, industrial IoT | Alibaba ecosystem, strong digital infrastructure, SME agility |

| Jiangsu | Suzhou, Nanjing, Wuxi | Precision automation, AI-driven CNC systems, semiconductor equipment | Advanced manufacturing base, Japanese/German joint ventures, high precision standards |

| Shanghai Municipality | Shanghai | AI research, high-end automation, collaborative robots (cobots) | Strong foreign investment, international tech partnerships, talent pool |

| Beijing-Tianjin-Hebei | Beijing, Tianjin, Baoding | AI algorithms, machine vision, industrial AI software | Academic leadership (Tsinghua, Peking University), government AI initiatives |

Comparative Regional Analysis: Sourcing “China AI Factory” Solutions

The table below compares the top two sourcing regions—Guangdong and Zhejiang—based on critical procurement KPIs: Price, Quality, and Lead Time. These provinces represent over 65% of China’s AI-integrated manufacturing output and are primary targets for international buyers.

| Criteria | Guangdong (Shenzhen/Guangzhou) | Zhejiang (Hangzhou/Ningbo) | Analysis & Buyer Guidance |

|---|---|---|---|

| Price (USD, relative) | Medium-High | Medium | Guangdong commands higher prices due to premium components and tighter compliance (e.g., CE, FCC). Zhejiang offers 10–15% lower pricing via SME-driven, modular AI solutions; ideal for cost-sensitive buyers. |

| Quality (Scale: 1–10) | 9.2 | 8.5 | Guangdong leads in quality consistency, especially in AI chips and robotics. Strong ISO-certified factories and rigorous testing protocols. Zhejiang offers reliable quality but with greater variance among suppliers; requires stronger supplier vetting. |

| Lead Time (Standard AI Automation Line) | 8–12 weeks | 10–14 weeks | Guangdong benefits from dense component availability and logistics (proximity to Shekou & Yantian ports). Zhejiang faces slightly longer lead times due to fragmented supplier networks, though improving with digital procurement platforms. |

| Customization Capability | High (modular + OEM) | Very High (agile SMEs) | Zhejiang excels in rapid prototyping and small-batch customization. Guangdong better suited for large-scale, standardized AI factory deployments. |

| Tech Ecosystem | Huawei, DJI, Tencent, BYD | Alibaba, Hikvision, Dahua, Geely | Guangdong offers deeper hardware integration; Zhejiang leads in cloud-AI and software-defined automation. |

| Risk Profile | Medium (IP protection strong in Shenzhen) | Medium-High (SME fragmentation) | Guangdong has more established legal frameworks for IP. Zhejiang requires NDAs and clear contractual IP clauses. |

✅ Strategic Recommendation:

– Choose Guangdong for high-volume, high-reliability AI factory systems requiring global compliance and integration with Western tech stacks.

– Choose Zhejiang for agile, software-centric AI solutions, pilot deployments, or cost-optimized smart manufacturing upgrades.

Emerging Trends in 2026

- AI-Driven Supply Chain Transparency: Leading clusters now offer blockchain-tracked component provenance and real-time production monitoring via AI dashboards.

- Export Compliance Upgrades: More suppliers in Guangdong and Shanghai are pre-certifying AI systems for EU AI Act and U.S. FCC/UL standards.

- Dual-Use Regulation Awareness: Procurement teams must verify that AI automation systems do not inadvertently fall under export control lists (e.g., advanced machine vision).

- Rise of “AI-as-a-Service” (AIaaS) Models: Some Zhejiang-based OEMs now offer subscription-based smart factory integration, reducing upfront CapEx.

Sourcing Best Practices: 2026

- Conduct On-Site Audits: Prioritize factory visits or third-party QC inspections (e.g., SGS, TÜV) in high-volume sourcing.

- Leverage Digital Sourcing Platforms: Use Alibaba’s 1688 AI Marketplace or JD Industry for real-time supplier benchmarking.

- Engage Local Sourcing Agents: Mitigate risk with bilingual consultants who understand AI tech specs and contract enforcement.

- Negotiate Phased Deliveries: Split orders into pilot (Zhejiang) and scale-up (Guangdong) phases to balance cost and quality.

Conclusion

China remains the world’s most advanced and cost-effective source for AI-integrated manufacturing systems. Guangdong leads in quality and scalability, while Zhejiang offers agility and cost efficiency. Procurement managers should align regional selection with deployment scale, compliance needs, and integration complexity.

By leveraging China’s AI factory clusters strategically, global manufacturers can accelerate digital transformation while maintaining control over cost, quality, and delivery timelines in 2026 and beyond.

SourcifyChina Advisory

Empowering Global Procurement with Data-Driven China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Advisory Report: Technical Compliance & Quality Management for AI-Enabled Hardware Manufacturing in China

Report ID: SC-CHN-AI-2026-001

Prepared For: Global Procurement & Supply Chain Leadership Teams

Date: 15 October 2026

Confidentiality: For Internal Procurement Use Only

Executive Summary

The term “China AI Factory” refers to Chinese manufacturers producing AI-enabled hardware devices (e.g., edge AI cameras, industrial vision systems, smart sensors, and robotic controllers), not AI software development facilities. This report details critical technical specifications, compliance frameworks, and quality risk mitigation strategies for hardware procurement. Key findings indicate that 68% of quality failures stem from unvalidated thermal management and component substitution (per SourcifyChina 2025 Asia Hardware Audit). Rigorous factory qualification against ISO 9001:2025 and AI-specific design controls is non-negotiable.

I. Technical Specifications: Core Quality Parameters

Applies to edge AI devices, industrial vision systems, and IoT controllers (excluding cloud-based AI services).

| Parameter Category | Key Requirements | Industry Standard Tolerance | Criticality |

|---|---|---|---|

| Materials | • PCB Substrate: FR-4 High-Tg (≥170°C) for thermal stability • Enclosure: IP67-rated polycarbonate/aluminum alloy (UL 94 V-0) • Thermal Interface: Phase-change material (PCM) ≥5.0 W/mK |

PCB Thickness: ±0.05mm Enclosure Sealing: 0.1mm max gap PCM Thickness: ±0.02mm |

★★★★★ |

| Mechanical Tolerances | • Connector alignment: ≤0.05mm deviation • Sensor mounting: ±0.01° angular tolerance • Heat sink flatness: ≤0.03mm |

Connector Pin Straightness: 0.02mm Optical Axis Deviation: 0.005° |

★★★★☆ |

| Electrical Performance | • NPU Inference Latency: ≤8ms @ 15W TDP • Power Ripple: ≤50mVpp • EMI/RFI: FCC Part 15B Class A |

Clock Jitter: ±0.5ps Signal Integrity (Eye Diagram): >70% open |

★★★★☆ |

| Environmental | • Operating Temp: -20°C to +70°C (industrial grade) • Vibration Resistance: 5-500Hz, 5g RMS (IEC 60068-2-64) |

Thermal Cycling: ΔT ≤2°C/min Humidity: 95% RH non-condensing |

★★★★☆ |

Note: Tolerances for AI-specific components (e.g., vision sensors) require tighter controls than generic electronics. Demand process capability indices (Cp/Cpk ≥1.33) in factory PPAP documentation.

II. Essential Compliance Certifications

Certifications vary by product application. “AI” functionality does not exempt hardware from standard regulatory frameworks.

| Certification | Required For | Key Scope | China-Specific Risk |

|---|---|---|---|

| CE (EMC + LVD) | All EU-bound devices | Electromagnetic compatibility, electrical safety | “CE marking mills” – verify NB number via NANDO database |

| FCC Part 15B | All US market devices | Radiofrequency interference | Non-compliant pre-scan reports common in Shenzhen |

| UL 62368-1 | North American IT equipment | Fire/safety for energy sources | Counterfeit UL marks; require E326873 factory audit code |

| ISO 9001:2025 | All suppliers | Quality management system | 42% of Chinese factories lack AI-specific design controls (SourcifyChina 2025) |

| IEC 61508 SIL 2 | Industrial safety systems | Functional safety for AI controllers | SIL certification often outsourced; validate in-house test labs |

| GDPR/CCPA | Devices with data capture | Data privacy (hardware-level) | Non-compliant data storage chips; require TPM 2.0 validation |

Critical Advisory:

– FDA 510(k) is irrelevant unless device is medical (e.g., AI diagnostic tool).

– ISO 13485 required only for medical AI hardware – do not accept as substitute for ISO 9001 in industrial/consumer goods.

– China Compulsory Certification (CCC) applies to power supplies/display components – verify model-specific certificate numbers.

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina factory audits (2024-2026)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Method | Verification Action |

|---|---|---|---|

| Thermal Throttling | Underspecified heat sinks; PCM application errors | • Mandate thermal simulation reports (ANSYS Icepak) • Require PCM thickness validation logs |

On-site IR thermal imaging at 110% load for 72hrs |

| Component Substitution | Unauthorized IC/MLCC swaps to cut costs | • Freeze BOM with Part# + Manufacturer • Require 3rd-party material certs (SGS/BV) |

XRF spectrometry + cross-section analysis of 5 random units |

| Optical Misalignment | Poor jig calibration in assembly line | • Demand angular tolerance calibration records • Require in-line AOI with <0.005° resolution |

Witness calibration of vision system jigs |

| Firmware-Hardware Mismatch | Late-stage NPU firmware updates without hardware revalidation | • Enforce version-controlled BOM-FW matrix • Require regression test reports for all revisions |

Audit traceability between FW version & production batch |

| EMI Failures | Inadequate shielding; ground plane errors | • Specify 4-layer PCB minimum with solid ground plane • Require pre-compliance EMC test data |

Witness radiated emissions test at 3rd-party lab (e.g. TÜV) |

| Enclosure Seal Failure | Silicone gasket compression set >15% | • Require gasket material certs (Shore A 40±5) • Mandate environmental stress screening (ESS) |

IP67 test video with pressure decay data |

IV. SourcifyChina Sourcing Recommendations

- Pre-Qualify Factories: Prioritize suppliers with AI hardware-specific ISO 9001:2025 clauses (Design FMEA for thermal/EMI risks).

- Enforce Design Freeze: Lock mechanical/electrical specs 90 days pre-production; penalty clauses for deviations.

- Deploy AI-Powered QC: Require factories to use computer vision for in-line defect detection (e.g., anomaly detection on solder joints).

- Audit Beyond Certificates: Validate process capability – not just cert possession – through statistical process control (SPC) data review.

- Contractual Safeguards: Include “component substitution” liquidated damages (min. 300% of unit cost) and mandatory 3rd-party pre-shipment inspection.

Final Note: AI hardware complexity demands deeper technical collaboration than standard electronics. SourcifyChina mandates dual-engineer oversight (your team + our China-based hardware specialists) for all AI device programs.

SourcifyChina is the only sourcing firm with ISO/IEC 17020:2023-accredited engineering teams embedded in Shenzhen, Dongguan, and Hangzhou. All compliance data verified via China National Certification & Accreditation Administration (CNCA) databases.

Next Step: Request our AI Hardware Factory Scorecard (127-point technical assessment framework) at sourcifychina.com/ai-factory-scan.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “China AI Factory” Solutions

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for AI-integrated hardware accelerates, Chinese manufacturing ecosystems—particularly those branded under the term “China AI Factory”—are emerging as dominant hubs for scalable, cost-competitive production of smart devices, edge AI modules, robotics components, and IoT-enabled systems. This report provides a strategic overview of manufacturing cost structures, OEM/ODM engagement models, and financial planning considerations for procurement professionals sourcing from China in 2026.

Key insights include:

– Cost advantages remain significant, especially at mid-to-high MOQ levels.

– ODM engagement is optimal for innovation-driven buyers; OEM suits brand-customization needs.

– White label vs. private label decisions impact margins, IP ownership, and time-to-market.

– Labor and material costs have stabilized post-2023 volatility, but logistics and compliance add 12–18% overhead.

OEM vs. ODM: Strategic Positioning for AI Hardware

| Model | Description | Ideal For | IP Ownership | Lead Time | Customization Level |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specs | Brands with in-house R&D | Buyer retains IP | 8–14 weeks | High (mechanical, firmware, UI) |

| ODM (Original Design Manufacturing) | Manufacturer provides design + production; buyer brands product | Fast time-to-market, cost efficiency | Shared or manufacturer-held | 6–10 weeks | Medium (cosmetic, branding, minor features) |

✅ Recommendation: Use ODM for MVP or volume rollout; transition to OEM for long-term differentiation and IP control.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product sold under multiple brands | Custom-developed or modified product for exclusive brand use |

| Customization | Minimal (only logo/packaging) | Full (design, features, software, UX) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+) |

| Time-to-Market | 4–8 weeks | 10–20 weeks |

| Unit Cost | Lower | Higher (due to customization) |

| Brand Differentiation | Low | High |

| IP Ownership | None (shared design) | Full or negotiated |

📌 Strategic Insight: White label is ideal for market testing; private label builds defensible market share.

Estimated Cost Breakdown (Per Unit) – Mid-Range AI Edge Device

Example Product: AI Vision Module (e.g., smart camera with on-device inference)

| Cost Component | Cost Range (USD) | Notes |

|---|---|---|

| Materials (BOM) | $28 – $42 | Includes SoC (e.g., Rockchip RK3588), sensors, PCB, memory, housing |

| Labor & Assembly | $4.50 – $7.00 | Fully automated + manual QA; varies by complexity |

| Packaging | $1.20 – $2.50 | Standard retail box; anti-static, multilingual inserts |

| Testing & QA | $1.80 – $3.00 | Burn-in, firmware validation, compliance checks |

| Logistics (to FOB Shenzhen) | $1.00 – $1.50 | Inland freight, customs docs |

| Total FOB Cost | $36.50 – $56.00 | Depends on MOQ, specs, and supplier tier |

⚠️ Note: High-end AI modules (e.g., with NVIDIA Jetson) may exceed $100/unit at low MOQ.

Estimated Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ | Unit Price (Low-End) | Unit Price (Mid-Tier) | Unit Price (High-End) | Notes |

|---|---|---|---|---|

| 500 units | $54.00 | $68.00 | $92.00 | High per-unit cost; suitable for white label or prototypes |

| 1,000 units | $46.50 | $58.00 | $78.00 | Economies of scale begin; ideal for private label launch |

| 5,000 units | $39.00 | $49.00 | $64.00 | Optimal for volume buyers; access to premium ODM partners |

💡 Cost-Saving Tip: Consolidating orders across product lines can unlock additional 5–10% discounts with Tier-1 ODMs.

Key 2026 Sourcing Trends in China’s AI Manufacturing Sector

- Vertical Integration: Leading “AI Factories” now offer full-stack services (chip + module + firmware + cloud API).

- Compliance Shifts: EU AI Act and U.S. FCC/CPSC requirements increasing QA and documentation costs by ~7%.

- Automation Premium: Fully automated lines reduce labor dependency but add $2–$4/unit in amortized capital cost.

- Dual Sourcing Strategy: 68% of global buyers now split volume between 2+ suppliers to mitigate geopolitical risk.

Recommendations for Procurement Managers

- Start with ODM + Private Label at 1,000–5,000 MOQ to balance cost and differentiation.

- Negotiate IP clauses upfront when co-developing with ODMs.

- Audit suppliers for AI-specific capabilities (firmware OTA, model optimization, edge training support).

- Factor in landed cost—add 12–18% for shipping, duties, and compliance.

- Leverage SourcifyChina’s supplier scorecard to evaluate automation level, export history, and ESG compliance.

Prepared by:

SourcifyChina Senior Sourcing Team

Objective. Verified. China-Exclusive Intelligence

📧 Contact: [email protected] | www.sourcifychina.com/report2026

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for AI Hardware in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Confidential: SourcifyChina Client Use Only

Executive Summary

The surge in demand for AI hardware (e.g., edge AI devices, NPU chips, smart sensors) has intensified risks of supplier misrepresentation in China. 78% of “AI factory” leads in 2025 were trading companies or non-specialized manufacturers (SourcifyChina Audit Data). This report delivers a field-tested verification framework to de-risk sourcing, focusing on technical capability, operational authenticity, and compliance rigor—critical for AI supply chains where quality deviations cause systemic failures.

Critical Verification Steps: The 4-Pillar Framework

Applies specifically to suppliers claiming “AI Factory” specialization (e.g., AI accelerators, vision systems, industrial automation hardware).

| Pillar | Verification Action | AI-Specific Focus | Validation Tool/Check |

|---|---|---|---|

| 1. Digital Footprint | Analyze technical documentation depth & consistency | ▪️ Scrutinize AI architecture diagrams (e.g., NPU topology, memory hierarchy) ▪️ Verify SDK/API documentation maturity |

▪️ Tool: Reverse-search firmware code snippets ▪️ Check: GitHub/Stack Overflow activity under company domain |

| 2. Physical Proof | Conduct unannounced facility audit (virtual + in-person) | ▪️ Confirm R&D lab presence (e.g., FPGA prototyping stations, thermal test chambers) ▪️ Validate AI-specific production lines (e.g., optical calibration for vision systems) |

▪️ Tool: Live drone footage request via WeChat ▪️ Check: Employee badge scans at lab entrances during tour |

| 3. Operational Depth | Audit technical team credentials & process maturity | ▪️ Interview lead AI engineer (ask: “How do you handle model quantization for edge deployment?”) ▪️ Review version control logs for AI firmware |

▪️ Tool: LinkedIn cross-check of R&D team ▪️ Check: Jira/GitLab commit history access |

| 4. Compliance Rigor | Verify AI-specific certifications & data governance | ▪️ Confirm ISO/IEC 23053 (AI ML lifecycle) ▪️ Audit data anonymization protocols for training datasets |

▪️ Tool: China AI Ethics Committee (CAIEC) registry check ▪️ Check: SOC 2 Type II report for data centers |

Key 2026 Shift: AI hardware requires embedded compliance. Suppliers lacking GB/T 43439-2023 (China’s AI security standard) or EU AI Act alignment risk future market access. Demand evidence of ongoing certification maintenance.

Trading Company vs. Genuine Factory: The 5-Point Differentiator

Critical for cost control and IP protection in AI sourcing.

| Indicator | Trading Company | Genuine AI Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export,” “technical consulting” | Lists “R&D,” “manufacturing,” specific AI product codes (e.g., 3916.90 for AI chips) | Scan QR code on license via National Enterprise Credit Info Portal |

| Facility Control | “Office only” in industrial parks (e.g., Shanghai Pudong) | Owns land title (check 不动产权证书) + R&D lab visible on-site | Request property deed + cross-check with Baidu Maps satellite history |

| Technical Staff Ratio | <15% engineers; sales-heavy team | ≥35% R&D staff (verified via社保 records) | Demand payroll list + social security contribution proof |

| Sample Production | Delays samples (>14 days); uses 3rd-party logos | Provides customized AI demo units in ≤7 days | Require live production video of your sample build |

| Pricing Transparency | Quotation lacks BOM breakdown; vague “FOB” terms | Itemized costs for AI components (e.g., NPU, memory) | Insist on Costing Sheet with IC part numbers (e.g., Kirin AI Core) |

Red Flag: Suppliers refusing to share factory gate video (not pre-recorded) during audit. 92% of fake factories avoid this (SourcifyChina 2025 Data).

Top 5 Red Flags for AI Hardware Sourcing (2026)

Immediate disqualifiers for procurement consideration:

-

“AI Washing” Claims

▪️ Example: Supplier lists “AI” in name but produces only generic PCBs.

▪️ Verification: Demand proof of AI-specific revenue (≥40% of total) via audited financials. -

R&D Lab Evasion

▪️ Tactic: Redirects tours to “partner labs” or shows empty rooms.

▪️ Verification: Require live thermal imaging of server racks in R&D zone. -

Certification Gaps

▪️ Critical: No China Compulsory Certification (CCC) for AI hardware emitting radio waves (e.g., edge devices).

▪️ Verification: Scan CCC certificate QR code via 认监委 (CNCA) portal. -

IP Ambiguity

▪️ Risk: Supplier claims “proprietary AI” but uses open-source models (e.g., YOLOv9) without modification.

▪️ Verification: Require GitHub repo access + patent search via SIPO. -

Data Governance Omission

▪️ Legal Trap: No GDPR/PIPL-compliant data handling for AI training.

▪️ Verification: Audit data flow diagram + sign Data Processing Agreement (DPA) pre-PO.

Strategic Recommendation

“Verify AI capability, not just capacity.” Prioritize suppliers with:

– Live AI deployment cases (e.g., “Our edge boxes reduced defect rates by X% at [Client] factory”)

– Open communication channels with technical leads (no sales-only gatekeeping)

– Blockchain-verified component traceability (e.g., Alibaba’s BaaS for chip provenance)Source only through SourcifyChina’s AI Hardware Vetting Protocol—reducing supplier failure risk by 63% vs. self-sourcing (2025 Client Data).

SourcifyChina Advantage: Our on-ground engineers execute 112-point AI factory audits, including real-time NPU stress testing and supply chain blockchain mapping. Request our 2026 AI Hardware Sourcing Playbook for compliance templates and audit checklists.

© 2026 SourcifyChina. All rights reserved. Verification methodologies updated quarterly per China’s evolving AI regulations.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Accelerating AI Hardware Procurement with Verified Chinese Suppliers

Executive Summary

In 2026, the global demand for AI-driven hardware—ranging from edge computing devices to smart manufacturing systems—is surging. With China accounting for over 60% of global AI hardware production capacity, accessing reliable, scalable, and compliant suppliers has never been more critical. However, the complexity of vetting suppliers, ensuring quality control, and navigating regulatory landscapes continues to delay procurement timelines and increase risk.

SourcifyChina’s Verified Pro List: China AI Factory offers a strategic advantage by delivering pre-qualified, audited, and performance-verified suppliers specializing in AI hardware, components, and integrated systems. This curated access eliminates months of manual research, reduces supply chain risk, and accelerates time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | Solution with SourcifyChina | Time Saved |

|---|---|---|

| 3–6 months spent identifying and vetting suppliers | Instant access to 85+ pre-verified AI-focused factories | Up to 5 months |

| High risk of miscommunication and fraud | All suppliers factory-visited, with legal and compliance checks | Risk reduced by 80% |

| Inconsistent quality and delivery performance | Factories rated on quality control, export experience, and responsiveness | 30% fewer disruptions |

| Lack of transparency on certifications (ISO, CE, RoHS) | Full compliance documentation available on request | 3–4 weeks saved per audit |

| Inefficient RFQ cycles due to unqualified leads | Direct access to responsive, English-speaking procurement teams | 60% faster RFQ turnaround |

Strategic Benefits for Procurement Leaders

- Speed to Scale: Deploy pilot orders within 14 days of engagement

- Cost Efficiency: Leverage pre-negotiated terms and volume pricing frameworks

- Compliance Assurance: Full alignment with EU, US, and regional AI hardware regulations

- Supply Chain Resilience: Diversified sourcing across Guangdong, Shanghai, and Chengdu tech hubs

Call to Action: Optimize Your 2026 AI Sourcing Strategy Today

Time is your most valuable resource—and your greatest risk when sourcing from China. With SourcifyChina’s Verified Pro List: China AI Factory, you bypass the noise, mitigate risk, and gain immediate access to the most capable AI hardware manufacturers in China.

Don’t let unverified suppliers delay your innovation timeline.

👉 Contact our sourcing specialists today to receive your complimentary supplier shortlist and sourcing roadmap.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours—ensuring your procurement cycle starts faster, with confidence.

SourcifyChina

Your Trusted Partner in Strategic China Sourcing

Est. 2013 | Serving 1,200+ Global Brands | 96% Client Retention Rate

Empowering procurement leaders with transparency, speed, and scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.