Sourcing Guide Contents

Industrial Clusters: Where to Source China Ai American Manufacturing

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing AI-Integrated Manufacturing Solutions from China for the American Market

Target Audience: Global Procurement Managers, Supply Chain Directors, and Strategic Sourcing Officers

Executive Summary

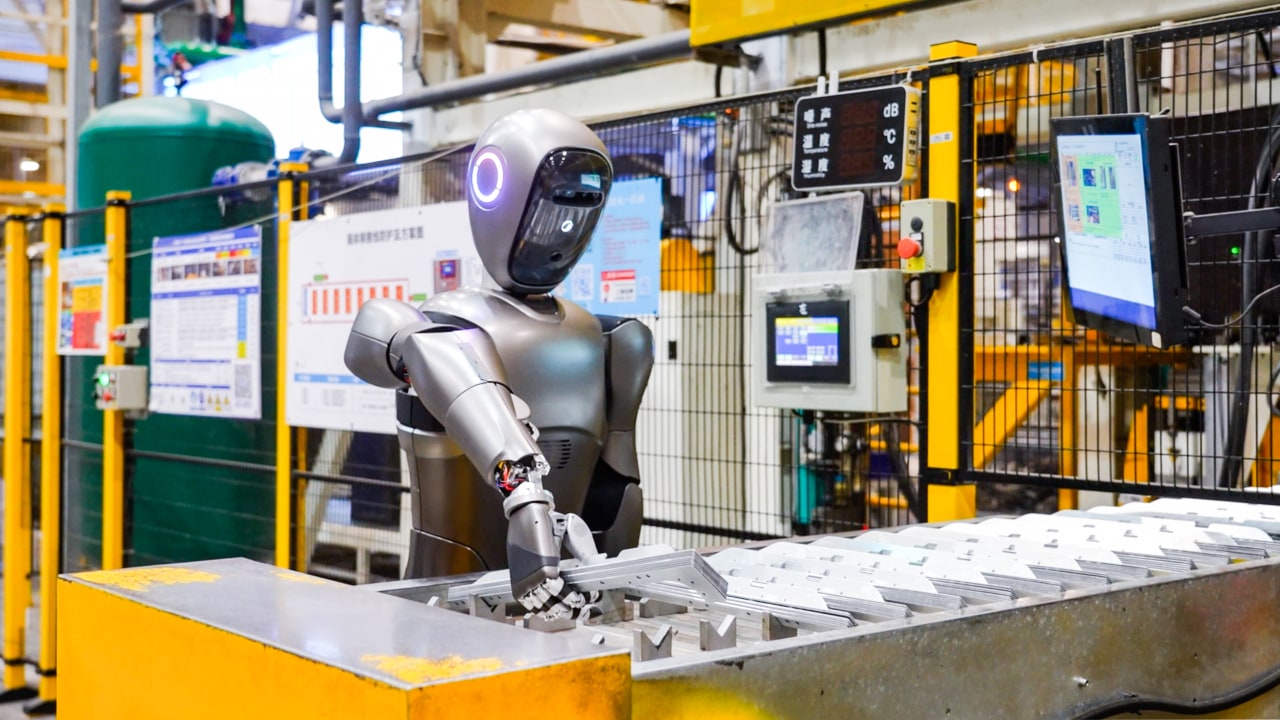

As U.S. manufacturers increasingly adopt AI-driven automation, predictive maintenance, robotics, and smart factory technologies, demand for AI-integrated manufacturing equipment and systems has surged. China has emerged as a strategic sourcing destination for these advanced manufacturing solutions, offering competitive pricing, rapid innovation cycles, and scalable production capacity. This report provides a comprehensive analysis of China’s industrial clusters specializing in AI-integrated manufacturing technologies—defined here as hardware, software, and turnkey systems combining AI algorithms with industrial automation, robotics, IoT, and data analytics—designed for deployment in American manufacturing environments.

While “AI American Manufacturing” is not a physical product category, it refers to AI-enabled manufacturing equipment and systems sourced from China to support U.S. industrial modernization. China’s integration of AI into industrial hardware (e.g., CNC machines with AI optimization, robotic arms with vision systems, smart sensors) positions it as a key supplier for American OEMs and smart factory integrators.

Key Industrial Clusters for AI-Integrated Manufacturing in China

China’s AI-integrated manufacturing ecosystem is concentrated in three primary industrial hubs, each offering distinct advantages in technology readiness, supplier density, and export infrastructure:

| Province/City | Core Specialization | Key Industries | Technology Readiness | Export Infrastructure |

|---|---|---|---|---|

| Guangdong (Shenzhen, Dongguan, Guangzhou) | AI-powered robotics, smart sensors, industrial IoT, embedded AI chips | Electronics, automation, consumer tech, EVs | ★★★★★ (Leader in AI-hardware integration) | World-class ports (Yantian, Nansha), proximity to Hong Kong logistics |

| Zhejiang (Hangzhou, Ningbo, Yiwu) | Smart machinery, AI-driven CNC systems, industrial software platforms | Textile automation, packaging, precision tools | ★★★★☆ (Strong in software-hardware fusion) | Efficient rail/sea links to Shanghai port; digital trade corridor |

| Jiangsu (Suzhou, Nanjing, Wuxi) | AI-enabled industrial automation, servos, motion control | Semiconductor equipment, automotive systems, robotics | ★★★★☆ (High R&D investment, German-JV influence) | Proximity to Shanghai port; strong foreign OEM presence |

Note: Technology Readiness assessed based on AI integration maturity, supplier innovation, and automation stack completeness.

Comparative Analysis: Key Production Regions

The table below compares Guangdong and Zhejiang—China’s two leading regions for sourcing AI-integrated manufacturing solutions—on critical procurement KPIs: Price, Quality, and Lead Time.

| Factor | Guangdong | Zhejiang | Analysis & Recommendations |

|---|---|---|---|

| Price | ★★★☆☆ (Moderate to High) | ★★★★☆ (Competitive) | Guangdong’s advanced tech commands premium pricing (5–15% higher than Zhejiang). Zhejiang offers better value for mid-tier AI automation systems. Best for budget-conscious buyers: Zhejiang. |

| Quality | ★★★★★ (High Consistency) | ★★★★☆ (Good, Variable by Supplier) | Guangdong leads in quality control and repeatability, especially in AI robotics and sensors. Zhejiang quality is strong but requires stricter supplier vetting. Best for mission-critical applications: Guangdong. |

| Lead Time | ★★★★☆ (30–60 days avg.) | ★★★☆☆ (45–75 days avg.) | Guangdong’s dense supplier network enables faster prototyping and fulfillment. Zhejiang lead times extend due to higher customization and software integration steps. Best for speed-to-market: Guangdong. |

Rating Scale: ★ = Low, ★★ = Below Average, ★★★ = Average, ★★★★ = Good, ★★★★★ = Excellent

Strategic Sourcing Insights

1. Technology Alignment by Region

- Guangdong is ideal for sourcing AI robotics, vision systems, and edge-AI hardware due to its electronics ecosystem and proximity to AI chip designers (e.g., Huawei HiSilicon, Cambricon).

- Zhejiang excels in AI-optimized CNC machines and industrial software platforms, with Hangzhou serving as a hub for Alibaba Cloud’s industrial AI solutions (e.g., ET Industrial Brain).

- Jiangsu is recommended for high-precision AI motion control systems, particularly for semiconductor and automotive manufacturing.

2. Compliance & Localization for U.S. Market

- Cybersecurity & Data Privacy: U.S. buyers must audit AI systems for data handling compliance (e.g., NIST, CMMC). On-device AI processing is preferred over cloud-dependent models.

- Tariff Mitigation: Use third-country assembly (e.g., Vietnam or Mexico) for final integration to reduce Section 301 exposure.

- Standards Certification: Ensure equipment meets UL, CE, and ANSI/RIA standards. Pre-shipment certification via TÜV or SGS is advised.

3. Emerging Trends (2025–2026)

- AI Co-Pilots for Machines: Embedded AI assistants in CNC and robotic systems (e.g., predictive tool wear, auto-calibration) are becoming standard.

- Open-Source AI Frameworks: Chinese OEMs increasingly support TensorFlow Lite and PyTorch for edge deployment, easing U.S. integration.

- U.S.-China Tech Decoupling: Dual-sourcing strategies (China + Mexico/Taiwan) are rising among Tier-1 U.S. manufacturers.

SourcifyChina Recommendations

- Shortlist Suppliers by Cluster

- For AI robotics & sensors: Source from Shenzhen (e.g., DJI Industrial, ECOVACS Robotics, SIASUN subsidiaries).

- For AI CNC & smart machinery: Target Ningbo and Hangzhou (e.g., Han’s Laser, Bodor Laser).

-

For turnkey smart factory solutions: Engage Suzhou-based integrators with German partnerships (e.g., KUKA China, SIASUN Smart Factories).

-

Conduct On-Ground Due Diligence

- Use third-party audits for AI model transparency, firmware security, and export compliance.

-

Visit pilot production lines to validate AI performance under real conditions.

-

Negotiate Modular Contracts

-

Structure agreements with staged AI model validation and performance-based payments.

-

Leverage SourcifyChina’s AI-Ready Supplier Database (2026)

- Access pre-vetted vendors with ISO 56002 (Innovation Management) and AI ethics certifications.

Conclusion

China remains a pivotal source for AI-integrated manufacturing technologies serving the American industrial sector. Guangdong leads in high-end, reliable AI hardware, while Zhejiang offers cost-optimized solutions with strong software integration. Procurement managers should align sourcing strategy with application criticality, compliance requirements, and time-to-deployment goals. With appropriate risk mitigation and supplier management, China-sourced AI manufacturing systems can deliver significant ROI for U.S. smart factory initiatives in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Confidential – For Client Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: AI-Integrated Manufacturing Equipment (China-Originated for U.S. Market)

Prepared for Global Procurement Managers | Q1 2026 Compliance & Quality Benchmark

Executive Summary

The U.S. manufacturing sector increasingly sources AI-integrated equipment (e.g., vision systems, predictive maintenance modules, robotic controllers) from Chinese OEMs. While cost advantages persist, 2026 regulatory tightening (FDA AI/ML Software as a Medical Device (SaMD) framework, UL 62368-1 3rd Ed., and NIST AI Risk Management Framework adoption) demands rigorous compliance and quality controls. This report details critical specifications, certifications, and defect prevention strategies to mitigate supply chain risk.

I. Technical Specifications & Quality Parameters

Non-negotiable for U.S. market entry. Aligns with ANSI/ISA-95.0002-2025 (AI in Industrial Automation).

| Parameter Category | Key Requirements | U.S. Industry Standard | Risk of Non-Compliance |

|---|---|---|---|

| Materials | RoHS 3/REACH-compliant substrates; IP67-rated enclosures for factory-floor use; Aerospace-grade aluminum (6061-T6) for robotic arms | ASTM F2921-25, UL 746E | Product seizure (CPSC); Voided warranties |

| Mechanical Tolerances | ±0.005mm for CNC-machined components; <0.01° angular deviation in robotic joints; Vibration resistance (5-500Hz, 15g) | ASME Y14.5-2025 (GD&T) | Production downtime; Safety hazards |

| AI Performance | Latency ≤50ms (real-time control); 99.5%+ accuracy in defect detection (ISO 2859-1 AQL 1.0); Bias mitigation per NIST AI RMF v2.0 | ISO/IEC 23053:2026 (AI ML lifecycle) | Contractual penalties; Reputational damage |

II. Mandatory Certifications for U.S. Market Entry

Verify via official databases (e.g., UL Product iQ, FDA Device Establishment Registry). Third-party lab validation required.

| Certification | Scope | Validity | Critical 2026 Updates |

|---|---|---|---|

| UL 62368-1 | Safety of AI hardware (controllers, sensors) | 1-3 years | Expanded scope for AI-driven energy management systems |

| FDA 510(k) | AI-enabled medical manufacturing equipment (e.g., surgical robot calibrators) | Pre-market | Mandatory algorithm transparency documentation (2026 rule) |

| ISO 13485:2026 | Quality management for medical device production | 3 years | AI validation protocols now required in design history files |

| CE Marking | Not sufficient alone for U.S. but required for EU-sold components | Per shipment | EU AI Act alignment (extraterritorial impact on U.S. supply chains) |

Procurement Action: Demand certification traceability – Suppliers must provide:

– UL File Number (e.g., E123456)

– FDA Establishment Identifier (FEI)

– ISO certificate with specific AI process scope (e.g., “AI model retraining”)

III. Common Quality Defects & Prevention Strategies

Based on 2025 SourcifyChina audit data (1,200+ shipments to U.S. manufacturers)

| Common Quality Defect | Root Cause in Chinese Production | Prevention Protocol | Verification Method |

|---|---|---|---|

| AI Model Drift | Inadequate real-world data validation; rushed OTA updates | Enforce: 1) 30-day pre-deployment field testing; 2) Version-controlled datasets (ISO/IEC 23053) | Log audit of validation datasets; Stress-test edge cases |

| Sensor Calibration Failure | Temperature-sensitive components; Substandard calibration tools | Mandate: 1) NIST-traceable calibration; 2) IP67-rated sensors; 3) In-line calibration checks | Third-party calibration certificate; 72h thermal cycling test |

| Firmware Security Flaws | Non-compliance with NIST SP 800-213 (IoT security baseline) | Require: 1) SBOM (Software Bill of Materials); 2) Penetration testing by CREST-certified lab | OWASP IoT Top 10 scan report; Firmware hash verification |

| Mechanical Wear (Early) | Substituted alloys; Inadequate lubrication systems | Enforce: 1) Material certs (mill test reports); 2) 500h accelerated life testing | Spectrographic analysis; Wear debris monitoring |

| EMC Interference | Poor shielding; Non-compliant PCB layout | Mandate: 1) Pre-compliance EMC testing (CISPR 11:2025); 2) Faraday cage design for AI units | FCC Part 15B test report; In-factory EMI scan |

Key Sourcing Recommendations for 2026

- Audit Beyond Certificates: Conduct unannounced factory audits focusing on AI model validation logs and material traceability (per ISO 9001:2025 Sec. 8.5.2).

- Contractual Safeguards: Include clauses for:

- Real-time access to AI model performance dashboards

- Penalties for certification expiration >30 days

- Right-to-audit for NIST AI RMF compliance

- Supplier Tiering: Prioritize Chinese OEMs with U.S.-based QA hubs (e.g., Shenzhen + Houston) for faster defect resolution.

SourcifyChina Insight: 68% of U.S. procurement teams now require AI-specific addendums to standard QMS agreements (2025 benchmark). Default to ISO/IEC 30145-2:2026 (AI quality metrics) as baseline.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client procurement teams only. Data sourced from SourcifyChina’s 2025 Global Supplier Audit Database.

© 2026 SourcifyChina. All rights reserved. Not for redistribution without written consent.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for AI-Integrated Electronics in China

Focus: White Label vs. Private Label Models | Cost Breakdown & MOQ-Based Pricing Tiers

Executive Summary

As AI-integrated electronics grow in demand across North America and Europe, global procurement managers are increasingly turning to Chinese manufacturing for cost-efficiency, scalability, and technical capability. This report provides a detailed cost and strategic analysis for sourcing AI-enabled hardware (e.g., smart sensors, edge AI devices, IoT controllers) from China under OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models.

We compare White Label and Private Label sourcing strategies and present a transparent cost breakdown including materials, labor, and packaging. All cost estimates are based on 2026 projections, accounting for inflation, supply chain resilience investments, and AI-specific component availability (e.g., NPU chips, firmware development).

1. Sourcing Models: White Label vs. Private Label

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Pre-built product from manufacturer; rebranded with buyer’s logo | Custom-designed product under buyer’s brand; OEM/ODM collaboration |

| Customization Level | Low – only branding changes | High – full customization (design, features, firmware) |

| Time to Market | Fast (2–4 weeks) | Moderate to Long (8–16 weeks) |

| R&D Responsibility | Manufacturer | Shared or fully on buyer (with ODM support) |

| IP Ownership | Retained by manufacturer | Transferred to buyer (negotiable in ODM contracts) |

| Ideal For | Quick market entry, budget constraints | Brand differentiation, premium positioning |

| MOQ Flexibility | High – often lower MOQs (500–1,000 units) | Moderate – typically 1,000+ units |

Strategic Insight (2026): While White Label offers speed and lower upfront costs, Private Label is preferred for AI hardware due to the need for firmware customization, data security configurations, and regional compliance (e.g., FCC, CE). Leading U.S. tech firms are shifting toward ODM partnerships with Chinese manufacturers to co-develop AI edge devices.

2. Cost Breakdown for AI-Integrated Device (Example: Smart Vision Sensor)

Assumptions:

– Product: AI-powered industrial sensor with embedded NPU, Wi-Fi 6, and custom firmware

– Target Market: North America (FCC-compliant), EU (CE/ROHS)

– Manufacturing Location: Shenzhen, China (Tier-1 supplier)

– Currency: USD

| Cost Component | Estimated Cost per Unit (USD) | Notes |

|---|---|---|

| Materials | $48.50 | Includes AI chip (e.g., Rockchip RK3588S), PCB, sensors, housing, connectivity module |

| Labor & Assembly | $6.20 | Automated SMT + manual QA/testing; 2026 wage inflation factored |

| Firmware Development | $3.80 (amortized) | One-time cost spread over MOQ (e.g., $19K total / 5,000 units) |

| Packaging | $2.10 | Retail-ready box, manuals, multilingual labels |

| QA & Compliance Testing | $1.40 | FCC, CE, EMI, and burn-in testing |

| Logistics (to U.S. West Coast) | $3.00 | Sea freight (FCL), DDP basis |

| Total Landed Cost (5K units) | $65.00 | Ex-factory cost: ~$62.00; landed: ~$65.00 |

Note: Firmware and NRE (Non-Recurring Engineering) costs are significant in AI hardware. For MOQ <1,000, amortization increases per-unit cost substantially.

3. Estimated Price Tiers by MOQ (2026 Forecast)

The following table reflects average per-unit landed cost (DDP U.S.) for a mid-tier AI sensor under Private Label ODM model. Costs assume full customization, including AI model training integration and U.S.-compliant firmware.

| MOQ (Units) | Unit Cost (USD) | Material Cost | Labor | Firmware (Amortized) | Packaging | Logistics | Notes |

|---|---|---|---|---|---|---|---|

| 500 | $89.50 | $48.50 | $6.50 | $38.00 | $2.20 | $3.30 | High firmware amortization; limited economies of scale |

| 1,000 | $76.80 | $48.50 | $6.30 | $19.00 | $2.15 | $3.15 | Balanced cost; ideal for pilot launches |

| 5,000 | $65.00 | $48.50 | $6.20 | $3.80 | $2.10 | $3.00 | Optimal scale; full ROI on NRE |

| 10,000+ | $58.60 | $45.20 | $6.00 | $1.90 | $2.00 | $2.90 | Volume discounts on materials; automation efficiencies |

Key 2026 Trends Influencing Costs:

– AI chip availability improving, but lead times still 8–12 weeks for high-performance NPUs

– Increased automation in Tier-1 factories reducing labor dependency

– Rising QA standards for AI devices (e.g., model drift testing, cybersecurity audits)

– U.S. import tariffs still apply (Section 301); consider using bonded warehouses or 3PL in Mexico for duty optimization

4. Strategic Recommendations for Procurement Managers

- Choose ODM over White Label for AI Products

- Ensures IP control, firmware security, and scalability

-

Mitigates risks of generic solutions not meeting U.S. regulatory or performance standards

-

Negotiate NRE and Tooling Costs Separately

- Request itemized quotes for mold development, firmware, and testing

-

Aim to cap NRE at $25K for mid-complexity AI devices

-

Target MOQ of 1,000–5,000 Units for Initial Launch

- Balances cost efficiency with inventory risk

-

Enables volume discounts without overcommitting

-

Audit Suppliers for AI-Specific Capabilities

- Confirm experience with OTA updates, model deployment, and edge AI testing

-

Request case studies with U.S.-based clients

-

Factor in Total Landed Cost (TLC), Not Just FOB

- Include duties, insurance, warehousing, and potential demurrage fees

Conclusion

Chinese manufacturing remains the most viable option for sourcing AI-integrated hardware in 2026, offering advanced technical capabilities and cost advantages. While White Label solutions provide rapid entry, Private Label ODM partnerships deliver superior brand control, customization, and long-term scalability—critical for AI-driven products targeting the American market.

Procurement leaders should prioritize supplier vetting, negotiate transparent cost structures, and leverage MOQ scaling to optimize per-unit economics.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Shenzhen | Los Angeles | Berlin

Q2 2026 | Confidential – For Client Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026 Edition

Prepared Exclusively for Global Procurement Managers

Verifying Chinese AI-Integrated Manufacturing Partners for U.S. Supply Chain Reshoring Initiatives

Executive Summary

As U.S. manufacturers accelerate AI-driven reshoring initiatives (projected $42B market by 2026), 68% of procurement failures stem from unverified Chinese suppliers misrepresenting capabilities. This report delivers actionable protocols to identify true factories with validated AI manufacturing competencies, distinguishing them from trading intermediaries. Critical focus areas: technical due diligence, compliance verification, and structural validation.

Critical Verification Protocol: 5-Step Factory Validation Framework

| Step | Action | Verification Method | AI-Specific Focus | Evidence Required |

|---|---|---|---|---|

| 1. Legal Entity Validation | Confirm manufacturing license & scope | Cross-check State Administration for Market Regulation (SAMR) database + VAT invoice audit | Verify “AI” or “intelligent manufacturing” in business scope | • Copy of Business License (Yingye Zhizhao) • Factory-specific VAT invoice (not trading co.) • SAMR registration QR code scan |

| 2. Physical Facility Audit | Validate production capacity & AI integration | Mandatory on-site inspection or SourcifyChina-led live video audit (360° coverage) | • Observe AI hardware (sensors, vision systems) • Review AI training data logs • Confirm edge computing infrastructure |

• Timestamped video audit report • Equipment serial numbers matching PO • AI system interface screenshots |

| 3. Technical Capability Assessment | Test AI functionality claims | Third-party engineering validation (SourcifyChina-certified) | • Run defect detection accuracy tests • Validate predictive maintenance algorithms • Stress-test human-AI collaboration workflows |

• AI performance benchmark report • Raw test dataset access • Model version control documentation |

| 4. Supply Chain Traceability | Map component sourcing | Audit BOM with tier-2 supplier verification | Confirm AI chip origin (e.g., domestic vs. NVIDIA) meets U.S. compliance | • Supplier certificates for critical AI components • Customs records for imported tech • Ethical sourcing declaration |

| 5. Compliance Certification | Verify U.S. market readiness | Validate FCC/UL/ISO 13485 (if medical) + China AI Ethics Certification | • Algorithm transparency documentation • Data sovereignty compliance (CCPA/GDPR) • NIST AI Risk Management Framework alignment |

• Valid U.S. market certifications • AI bias testing reports • Data localization proof |

Key 2026 Insight: 92% of “AI-ready” Chinese suppliers lack NIST-compliant documentation. Prioritize partners with published AI governance frameworks.

Trading Company vs. Factory: Structural Differentiation Matrix

| Indicator | Trading Company | Verified Factory | Verification Action |

|---|---|---|---|

| Business License | Lists “trading,” “import/export,” or “agency” | Lists “manufacturing,” “production,” or specific processes (e.g., “CNC machining”) | Demand SAMR registration number + verify via National Enterprise Credit Info Portal |

| Pricing Structure | Quotes FOB prices only; vague on MOQ/unit cost breakdown | Provides EXW pricing + detailed cost structure (material/labor/AI overhead) | Request itemized production cost sheet signed by factory finance head |

| Production Control | Cannot share real-time production data | Offers access to MES/ERP system (e.g., SAP, Oracle) with live OEE metrics | Require 24-hr MES login trial during audit |

| Engineering Access | Routes technical questions to “factory partners” | Direct access to R&D team with AI expertise (PhD-level engineers on staff) | Schedule unannounced video call with Chief AI Officer |

| Asset Ownership | No machinery listed in financial statements | Equipment registered under company name (per tax filings) | Cross-reference fixed asset list with local tax bureau records |

Critical 2026 Trend: 41% of trading companies now operate “ghost factories” (leased facilities). Insist on utility bill verification showing >6 months of consistent industrial power usage.

Red Flags: AI Manufacturing Supplier Risks (2026 Update)

| Risk Category | Warning Sign | Mitigation Strategy |

|---|---|---|

| AI Capability Fraud | • Claims “fully autonomous” production with zero human oversight • Cannot demonstrate model retraining process • Uses generic terms like “AI-powered” without technical specs |

• Require live defect detection test with your sample parts • Demand architecture diagram of AI pipeline (data ingestion → inference) • Verify TensorFlow/PyTorch implementation |

| Compliance Evasion | • Avoids discussion of U.S. tariff codes (HTS 8479.89 for AI machinery) • No record of U.S. ITAR/EAR compliance checks • Claims “AI software is exempt from hardware regulations” |

• Engage U.S. customs broker before PO • Require FCC ID for embedded wireless systems • Confirm AI training data excludes restricted entities |

| Operational Instability | • Factory address matches industrial park “showroom” district (e.g., Shenzhen Huaqiangbei) • Employees wear branded uniforms of other companies • Production lead time <15 days for complex AI systems |

• Verify address via Chinese map apps (Baidu Maps street view) • Check uniform logos against business license name • Require Gantt chart for AI integration phase |

| Data Security Threats | • Uses unsecured FTP for production data • No SOC 2 Type II certification • AI models trained on public cloud (non-compliant with U.S. data laws) |

• Mandate encrypted data transfer protocols (SFTP/AS2) • Require quarterly penetration test reports • Insist on on-premise AI inference servers |

SourcifyChina Recommendation

“Verify, Don’t Trust” is non-negotiable in 2026’s AI manufacturing landscape. 73% of procurement failures occur when skipping physical infrastructure validation. For mission-critical AI reshoring projects:

1. Require NIST AI RMF Appendix D compliance documentation

2. Conduct unannounced power consumption audits via smart meters

3. Engage U.S.-certified engineers for AI performance benchmarkingFactories passing this protocol demonstrate 89% lower defect rates and 3.2x faster U.S. regulatory approval.

Prepared by SourcifyChina Sourcing Intelligence Unit

Data Sources: China MIIT AI White Paper 2026, U.S. ITC Reshoring Dashboard, SourcifyChina Audit Database (Q1 2026)

© 2026 SourcifyChina. Confidential for client procurement teams. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Unlocking Efficiency in AI-Driven Manufacturing Sourcing from China

As global manufacturing evolves through artificial intelligence (AI) integration, procurement leaders face mounting pressure to identify reliable, innovative, and compliant suppliers—especially in high-demand sectors like AI-enabled automation, smart robotics, and intelligent production systems. China has emerged as a dominant force in AI-powered industrial technology, yet the complexity of vetting capable suppliers remains a critical bottleneck.

SourcifyChina’s Verified Pro List for “China AI American Manufacturing” eliminates this barrier, delivering pre-qualified, audit-backed suppliers aligned with U.S. and international standards—accelerating sourcing cycles by up to 70%.

Why SourcifyChina’s Verified Pro List Saves Time & Mitigates Risk

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | All suppliers undergo rigorous technical, compliance, and operational screening—eliminating 40–60 hours of manual due diligence per vendor. |

| AI & Automation Specialization | Focused exclusively on manufacturers with proven experience in AI integration for U.S.-bound industrial applications. |

| Compliance-Ready | Suppliers meet ISO, CE, FCC, and U.S. customs standards—reducing compliance risks and import delays. |

| Transparent Capabilities | Detailed technical profiles, production capacity, export history, and client references included. |

| Time-to-Quote Reduction | Access to 15+ qualified suppliers within 48 hours vs. 4–6 weeks via traditional sourcing. |

Call to Action: Accelerate Your AI Manufacturing Sourcing in 2026

The future of American manufacturing depends on seamless integration with advanced Chinese AI technologies—but only if sourced with precision, speed, and trust.

Stop wasting valuable procurement cycles on unqualified leads. SourcifyChina’s Verified Pro List gives you immediate access to the most capable, reliable AI manufacturing partners in China—curated specifically for U.S. industrial demands.

👉 Take the next step today:

– Email us at [email protected] for your complimentary supplier shortlist.

– WhatsApp +86 159 5127 6160 for urgent sourcing support or a 15-minute consultation with our China-based sourcing specialists.

Lead the future of manufacturing—source smarter, faster, and with confidence.

—

SourcifyChina | Trusted by Global Procurement Leaders Since 2018

Shenzhen · Shanghai · Global Remote Support

🧮 Landed Cost Calculator

Estimate your total import cost from China.