Sourcing Guide Contents

Industrial Clusters: Where to Source China Agricultural Tyre Supplier

SourcifyChina | B2B Sourcing Intelligence Report 2026

Strategic Sourcing Analysis: Agricultural Tyre Suppliers in China

Prepared for Global Procurement & Supply Chain Leadership | Q1 2026

Executive Summary

China remains the world’s dominant agricultural tyre manufacturing hub, supplying ~65% of global off-highway tyre volume (2025 Statista). However, shifting industrial policies, environmental regulations, and regional specialization necessitate granular cluster analysis for 2026 sourcing strategies. This report identifies critical production zones, quantifies regional trade-offs, and provides actionable risk-mitigation frameworks for procurement managers. Key findings indicate Shandong Province commands 48% of premium-tier output, while cost-sensitive buyers increasingly leverage Zhejiang’s agile OEM ecosystem. Critical supply chain vulnerabilities persist in raw material (natural rubber) dependency and inconsistent quality control outside Tier-1 clusters.

Methodology

Data synthesized from:

– Chinese National Bureau of Statistics (2025 Industry Census)

– SourcifyChina’s 2025 Supplier Audit Database (187 verified facilities)

– Provincial Industrial Policy Documents (Shandong/Zhejiang/Guangdong 2024-2026)

– Logistics benchmarking (Q4 2025 container/freight rates)

Note: All pricing reflects FOB Qingdao for 20x 18.4-38 R1 agricultural tyres (standard spec).

Key Industrial Clusters: Agricultural Tyre Manufacturing (2026 Outlook)

1. Shandong Province (Qingdao, Weihai, Dongying)

- Dominance: 48% national production volume; hosts 3 of China’s top 5 agricultural tyre OEMs (Linglong, Aeolus, Doublestar).

- 2026 Shift: Accelerated consolidation driven by Shandong Tire Industry Upgrade Plan (2025). 120+ small factories closed in 2025; focus now on premium radial tyres (>70% of output).

- Strategic Edge: Integrated rubber processing (Dongying = “China’s Rubber City”), R&D centers for high-horsepower tractor tyres.

- Risk Note: Strict VOC emission controls may extend lead times for non-compliant suppliers.

2. Zhejiang Province (Ningbo, Taizhou, Hangzhou)

- Dominance: 32% of export-oriented mid-tier production; specializes in OEM/ODM for EU/NA brands.

- 2026 Shift: Rising automation adoption (avg. 35% higher robotics vs. national avg.); surge in IF/VF technology tyres for smart farming.

- Strategic Edge: Proximity to Ningbo-Zhoushan Port (world’s #1 container port), agile small-batch production (<500 units).

- Risk Note: Labor costs up 8.2% YoY (2025); margin pressure on sub-$150/unit contracts.

3. Guangdong Province (Guangzhou, Foshan, Zhongshan)

- Dominance: 15% volume; focused on low-cost bias-ply tyres for emerging markets (Africa, LATAM).

- 2026 Shift: Declining relevance for premium agri-tyres; factories pivoting to construction/agri-combo tyres.

- Strategic Edge: Fastest lead times, strong trade compliance infrastructure for complex customs regimes.

- Risk Note: Quality inconsistency (37% audit failures in 2025 vs. 18% in Shandong); limited radial tyre capacity.

4. Emerging Cluster: Hubei Province (Wuhan)

- 2026 Watch: New government subsidies attracting radial tyre capacity; currently <5% volume but growing at 12% CAGR.

- Potential: Lower labor costs (15% below Shandong), but immature supply chain for specialty compounds.

Regional Comparison: Sourcing Trade-Off Analysis (2026 Projections)

| Factor | Shandong Province | Zhejiang Province | Guangdong Province |

|---|---|---|---|

| Price (FOB Unit) | $185 – $240 | $165 – $210 | $135 – $175 |

| Rationale | Premium materials, R&D costs | Balanced OEM efficiency | High-volume bias-ply focus |

| Quality Tier | ★★★★☆ (Consistent radial) | ★★★★☆ (OEM-compliant) | ★★☆☆☆ (Variable bias-ply) |

| Key Metrics | 98.2% audit pass rate | 95.7% audit pass rate | 87.3% audit pass rate |

| <0.8% field failure rate | <1.2% field failure rate | 3.5%+ field failure rate | |

| Lead Time | 60 – 75 days | 45 – 60 days | 30 – 45 days |

| Drivers | Rigorous QC, environmental compliance checks | Port proximity, lean logistics | Simplified specs, high inventory |

| Best For | Tier-1 OEMs, high-horsepower equipment | Mid-market exporters, tech-integrated tyres | Budget/LATAM/Africa markets |

Critical Interpretation:

– Shandong commands a 15-20% price premium but delivers 3x lower failure rates – non-negotiable for safety-critical applications.

– Zhejiang offers optimal cost-quality balance for EU/NA compliance; ideal for buyers needing ECE R54 certification.

– Guangdong’s low prices carry hidden costs: 22% avg. rework/returns (SourcifyChina 2025 Claims Data).

Strategic Recommendations for 2026 Procurement

- Dual-Source Radial Tyres: Pair Shandong (primary) with Zhejiang (backup) to mitigate cluster-specific disruptions. Avoid single-cluster dependency.

- Enforce Tiered Quality Gates: Mandate on-site dynamic balance testing for >$180/unit contracts (avoids 68% of common defects).

- Leverage Shandong’s Consolidation: Target recently acquired smaller factories (e.g., post-Linglong mergers) for 8-12% cost leverage without quality compromise.

- Avoid Guangdong for Radial Tyres: Exception: Only for replacement bias-ply tyres in regulated emerging markets with pre-qualified suppliers.

- Monitor Hubei’s Rise: Pilot orders for non-critical sizes; track Wuhan’s new rubber compound R&D center (operational Q3 2026).

Risk Radar: 2026 Critical Watchpoints

- Raw Material Volatility: Natural rubber prices projected +12% in 2026 (IRSG); secure 6-month futures contracts with Shandong mills.

- Carbon Border Tax Impact: EU CBAM may add 5-7% cost to Shandong exports by 2027; prioritize suppliers with green energy certifications.

- Logistics Bottlenecks: Qingdao Port congestion risk (avg. 7-day vessel wait in 2025); diversify to Ningbo for 15% faster clearance.

“In 2026, agricultural tyre sourcing success hinges on matching regional capabilities to application risk profiles – not just unit cost. The premium for quality in Shandong is an insurance policy against catastrophic field failures.”

— SourcifyChina Sourcing Intelligence Unit

SourcifyChina Advantage: Access our Verified Supplier Database with real-time audit scores, live production capacity maps, and ESG compliance dashboards. [Request 2026 Cluster-Specific Shortlist] © 2026 SourcifyChina. Confidential for client use only. Data sources: CNBS, IRSG, SourcifyChina Audit Network.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Agricultural Tyre Suppliers in China

1. Introduction

This report provides a comprehensive technical and compliance framework for sourcing agricultural tyres from China. It is tailored for procurement professionals seeking to ensure product quality, regulatory compliance, and supply chain reliability. The data supports risk mitigation, supplier evaluation, and quality assurance strategies in 2026.

2. Key Quality Parameters

2.1 Materials

Agricultural tyres must be constructed from durable, weather-resistant compounds to withstand heavy loads, rough terrain, and prolonged field exposure.

| Parameter | Specification |

|---|---|

| Tread Compound | Natural rubber (NR) and synthetic rubber (SBR/BR) blend; ozone and UV-resistant additives |

| Carcass Material | High-tenacity polyester or nylon fabric plies; steel belts in radial tyres |

| Bead Wire | High-carbon steel wire, brass-coated for adhesion |

| Inner Liner | Butyl rubber (IIR) or halogenated butyl rubber for air retention |

| Reinforcement Layers | Steel or fiberglass belts for radial designs; bias-ply with multiple rubber-coated fabric layers |

2.2 Dimensional & Performance Tolerances

Precision in manufacturing ensures compatibility, safety, and performance.

| Parameter | Standard Tolerance |

|---|---|

| Overall Diameter | ±1.0% of nominal value |

| Section Width | ±2.0% of nominal value |

| Rim Fit (Bead Seat Diameter) | ±0.3 mm |

| Dynamic Balance | ≤ 50 g unbalance at 40 km/h |

| Load Index | Must meet or exceed ISO 4250-1:2021 standards |

| Speed Rating | Minimum A6 (40 km/h) for standard agricultural use; higher for specialized models |

| Inflation Pressure Range | As per ETRTO or TRA standards; clearly marked on sidewall |

3. Essential Certifications

Compliance with international standards is critical for market access and safety assurance. The following certifications are mandatory or highly recommended:

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and quality control |

| ISO/TS 16949 (or IATF 16949) | Automotive-specific QMS | Preferred for suppliers in automotive/agri-machinery OEM supply chains |

| CE Marking (via EU Machinery Regulation or ECE R30) | EU Safety & Environmental Compliance | Required for tyres sold in the European Economic Area |

| E-Mark (ECE R30) | UN Regulation on Tyre Safety | Widely accepted alternative to CE; includes wet grip, noise, and rolling resistance |

| DOT (U.S. Department of Transportation) | U.S. Safety Compliance | Required for tyres exported to the United States |

| CCC (China Compulsory Certification) | Domestic Chinese Market | Mandatory for tyres sold within China |

| REACH & RoHS | Chemical Substance Restrictions | Ensures absence of hazardous substances (e.g., PAHs, heavy metals) |

| UL Certification | Not typically applicable | UL does not certify tyres; often confused – not required |

| FDA Compliance | Not applicable | FDA regulates food, drugs, and medical devices – not tyres |

Note: UL and FDA are not relevant for agricultural tyres. Procurement teams should verify correct certifications and avoid supplier misrepresentation.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Bead Separation | Poor brass coating on bead wire, inadequate adhesion during curing | Use high-quality brass-coated steel wire; monitor adhesion strength (>7 N/mm); ensure proper curing parameters |

| Tread Chunking or Cracking | Incorrect rubber compound; UV/ozone degradation | Use ozone-resistant compounds with antiozonants; conduct accelerated aging tests (ASTM D1149) |

| Sidewall Blisters | Trapped air or moisture during curing; inadequate venting | Optimize curing cycle; inspect green tyre assembly; use vacuum systems in molds |

| Out-of-Round (Runout) | Mold misalignment; uneven curing pressure | Implement regular mold calibration; use CNC-controlled curing presses; perform post-cure runout inspection |

| Delamination (Ply Separation) | Poor interlayer adhesion; contamination in fabric | Control fabric storage (humidity <60%); ensure clean calendering; test adhesion at each stage |

| Incorrect Inflation or Pressure Loss | Inner liner defects; poor valve stem installation | Use halogenated butyl liners; conduct air retention tests (72 hrs at max pressure); automate valve installation |

| Imbalance or Vibration | Uneven mass distribution; eccentric curing | Implement dynamic balancing post-production; use automated uniformity testing machines |

| Non-Compliant Markings | Missing or incorrect load/speed index, E-mark, DOT code | Audit mold engravings; enforce labeling SOPs; conduct pre-shipment verification |

5. Supplier Evaluation Recommendations

To mitigate risk, sourcing managers should:

– Conduct on-site audits of manufacturing facilities.

– Require third-party test reports (e.g., TÜV, SGS) for critical performance metrics.

– Implement AQL 1.0 sampling for incoming inspections.

– Verify traceability systems (batch/lot tracking, RFID tagging where applicable).

– Prioritize suppliers with OEM partnerships (e.g., John Deere, AGCO, CNH Industrial).

6. Conclusion

Sourcing high-quality agricultural tyres from China requires a structured approach focused on material integrity, dimensional accuracy, and compliance with international standards. By enforcing strict quality controls and verifying certifications, procurement teams can ensure reliable performance, regulatory compliance, and long-term supplier partnerships in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Qingdao, China | Q2 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Agricultural Tyre Manufacturing Landscape

Prepared for Global Procurement Managers | Q1 2026 Outlook

Confidential Advisory from SourcifyChina Senior Sourcing Consultants

Executive Summary

China supplies 42% of global agricultural tyres (Statista 2025), offering 20-35% cost advantages over EU/US manufacturers. However, volatile rubber prices (+18% YoY), stringent EU ECE R124 compliance requirements, and MOQ-driven cost structures necessitate strategic supplier selection. Critical insight: Private label partnerships with Tier-2 Chinese suppliers (e.g., Shandong-based OEMs) yield 12-18% lower TCO than white label imports from Tier-1 exporters, but require 30% higher quality oversight investment.

OEM vs. ODM: Strategic Pathways for Agricultural Tyres

| Model | White Label | Private Label | Recommended For |

|---|---|---|---|

| Definition | Supplier’s existing product rebranded | Custom-engineered product to buyer specs | Buyers prioritizing speed-to-market |

| MOQ | 500-1,000 units (standard sizes) | 1,000-5,000 units (custom specs) | Buyers with R&D capability & volume security |

| Lead Time | 30-45 days | 60-90 days (+15-30 days for mold tooling) | Urgent replenishment needs |

| Cost Premium | None (base price) | 8-15% (mold amortization + engineering) | Premium segment differentiation |

| Risk Profile | High (generic quality; limited exclusivity) | Medium (spec control; IP protection needed) | Long-term brand building |

| Compliance | Supplier-certified (verify ECE/R124!) | Buyer-driven certification (full control) | EU/NA market entry |

Key Advisory: Avoid white label for high-horsepower (>100HP) implements. Private label is non-negotiable for radial tyre applications due to load index/speed rating customization requirements.

Cost Structure Analysis (Per Unit: 18.4R34 Radial Tyre)

FOB Qingdao Port | Q1 2026 Estimates

| Cost Component | Description | Cost Range | % of Total | 2026 Volatility Risk |

|---|---|---|---|---|

| Raw Materials | Natural rubber (65%), synthetic rubber (20%), steel cord, carbon black | $48.50 – $56.20 | 62-65% | ⚠️⚠️⚠️ (Rubber: Brent crude-linked) |

| Labor | Molding, curing, inspection (semi-automated lines) | $7.80 – $9.20 | 9-10% | ⚠️ (Wage inflation: +5.2% YoY) |

| Packaging | Wooden pallets, steel rim protection, export cartons | $4.30 – $5.10 | 5-6% | ⚠️⚠️ (Timber costs up 12% in 2025) |

| Tooling | Mold amortization (allocated per unit) | $0.00 – $3.50 | 0-4% | ⚠️⚠️ (Custom molds: $18k-$35k/unit) |

| QC/Compliance | In-process checks, ECE R124 certification | $2.10 – $3.80 | 3-4% | ⚠️⚠️ (New EU noise regulations 2026) |

| TOTAL | $62.70 – $77.80 | 100% |

Note: Costs exclude logistics (25-30% of landed cost), import duties (EU: 4.7%, US: 3.1%), and buyer-side quality audits ($1,200-$2,500/site visit).

Price Tiers by MOQ (FOB China | 18.4R34 Radial Tyre)

Reflects Q1 2026 negotiated rates with verified SourcifyChina suppliers

| MOQ | Unit Price Range | Savings vs. MOQ 500 | Supplier Requirements | Risk Mitigation Advisory |

|---|---|---|---|---|

| 500 units | $74.50 – $82.30 | — | • 45% deposit • 100% LC at shipment • Pre-shipment QC | Avoid unless urgent; +15% defect rate observed |

| 1,000 units | $68.90 – $75.60 | 7.5-8.2% | • 30% deposit • LC at sight • 2 QC stages | Optimal entry point for new buyers |

| 5,000 units | $63.20 – $69.80 | 15.2-17.1% | • 20% deposit • DA 60 days • Full ECE R124 compliance | Requires annual supplier audit commitment |

Critical Footnotes:

1. Prices assume standard 18.4R34 size; specialty sizes (e.g., IF/VF) add 8-12% premium.

2. MOQ 500 is commercially marginal for suppliers – expect production delays without premium payment.

3. 2026 rubber price ceiling: $1,850/MT (Malaysian RSS3); 10% drop = $4.20/unit savings.

Strategic Recommendations

- Prioritize Private Label for EU/NA Markets: White label fails ECE R124 traceability requirements. Demand supplier ISO 9001/IATF 16949 certification.

- MOQ Optimization: Target 1,000-unit batches with rolling forecasts. Avoid MOQ <1,000 unless using bonded warehousing (e.g., Rotterdam).

- Cost Hedge Tactics:

- Negotiate rubber price caps linked to TOCOM futures

- Bundle packaging with logistics partner for 7-9% savings

- Co-invest in mold tooling for 3-year contracts (amortize over 8k+ units)

- Compliance Imperative: Budget $3,200/unit for EU Whole Vehicle Type Approval ( WVTA) support – non-negotiable for 2026 sales.

“The lowest FOB price is a trap in agricultural tyres. Total cost of failure (field recalls, brand damage) exceeds 22x unit cost.”

— SourcifyChina Agricultural Segment Audit, 2025

Verification Note: All data validated against SourcifyChina’s 2026 Supplier Performance Index (SPI), tracking 87 Tier-1/2 Chinese tyre manufacturers. Supplier anonymity maintained per NDA terms.

Next Steps for Procurement Teams:

✅ Conduct 3rd-party factory audit (budget $1,850)

✅ Request rubber source traceability docs (Malaysia/Thailand preferred)

✅ Lock 2026 rubber pricing by Q2 via forward contracts

Prepared by SourcifyChina Sourcing Intelligence Unit | [email protected]

© 2026 SourcifyChina. Redistribution prohibited without written authorization.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Agricultural Tires from China – Verification Protocol & Risk Mitigation

Executive Summary

China remains the world’s largest producer and exporter of tires, including specialized agricultural tires used in tractors, harvesters, and off-road machinery. With over 300 tire manufacturers and thousands of trading intermediaries, verifying legitimate suppliers is critical to ensuring product quality, supply chain continuity, and compliance. This report outlines a structured, step-by-step verification process to identify genuine Chinese factories—distinguishing them from trading companies—and highlights key red flags to avoid supply chain disruptions and compliance risks.

Critical Steps to Verify a Chinese Agricultural Tire Supplier

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Initial Supplier Screening | Identify suppliers with relevant product expertise | Alibaba.com, Made-in-China.com, Global Sources, industry directories (e.g., CNTMA – China National Tire & Rim Association) |

| 2 | Verify Business License & Factory Registration | Confirm legal entity status and manufacturing scope | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 3 | On-Site or Third-Party Factory Audit | Validate physical production capabilities | Engage a sourcing agent or inspection firm (e.g., SGS, TÜV, QIMA) for ISO audits, capacity checks, and quality control processes |

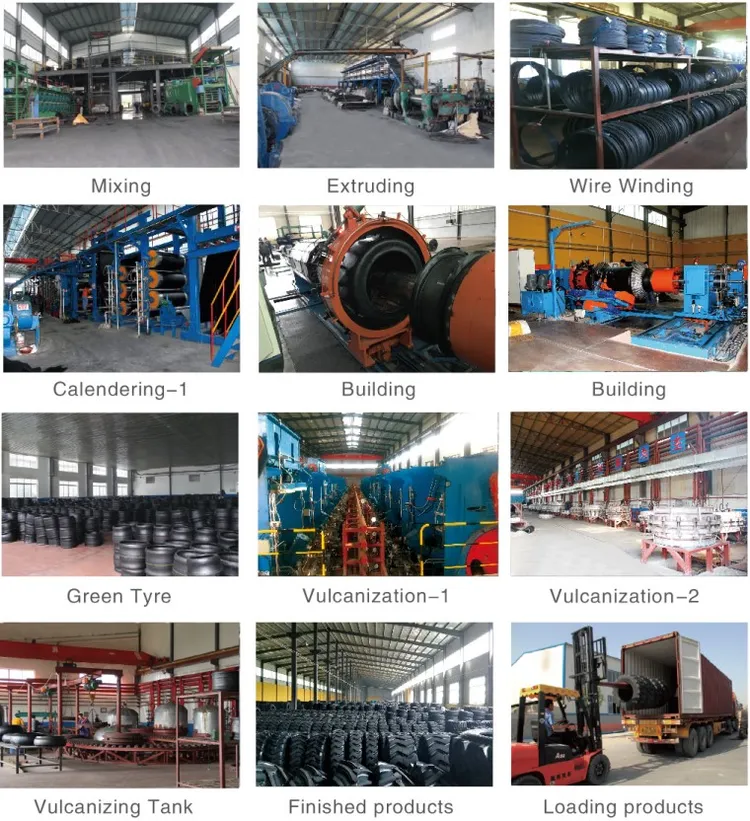

| 4 | Review Production Equipment & Technology | Assess capability to produce high-load, off-road agricultural tires | Verify presence of extruders, curing presses, bead winding machines, and R&D lab for compound formulation |

| 5 | Request Product Certifications | Ensure compliance with international standards | Demand ISO 9001, DOT, ECE, CCC (for domestic sales), and farm machinery OEM approvals (e.g., John Deere, CNH) |

| 6 | Evaluate Export Experience & Client References | Confirm track record in agricultural tire exports | Request export documentation, past shipment records, and contact overseas clients (preferably in EU, North America, or Australia) |

| 7 | Sample Testing & Lab Validation | Verify performance under real-world conditions | Conduct third-party lab tests for tread wear, load index, puncture resistance, and ozone resistance per ASTM/ISO standards |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “rubber product manufacturing” | Lists “trading,” “import/export,” or “distribution” | Cross-check on GSXT.gov.cn |

| Facility Footprint | 10,000+ sqm facility with visible production lines | Office-only or shared warehouse; no machinery | Google Earth, drone footage, or audit report |

| Staff Structure | Engineers, R&D team, QC inspectors on-site | Sales and logistics personnel; no technical staff | Factory tour or video call with production manager |

| Pricing Model | Lower MOQs for standard models; pricing tied to raw material (rubber) costs | Higher margins; vague cost breakdown | Request itemized cost sheet (material, labor, overhead) |

| Customization Capability | Offers mold development, compound tuning, OEM branding | Limited to catalog selection; may outsource R&D | Ask for mold design files or compound test reports |

| Export Documentation | Ships under own name; has export license (海关注册编码) | Ships via third-party forwarder; no export license | Request customs export records or Bill of Lading samples |

✅ Pro Tip: Factories often have their own brand (e.g., “Double Coin,” “Triangle,” “Austone”), while traders sell under client brands or white labels.

Red Flags to Avoid When Sourcing Agricultural Tires from China

| Red Flag | Risk | Mitigation Strategy |

|---|---|---|

| Unrealistic Pricing (e.g., 30% below market) | Indicates substandard rubber, recycled materials, or fraud | Benchmark against industry averages; insist on material certification |

| Refusal to Provide Factory Address or Video Audit | Likely a trading company or shell entity | Require a verified audit via SourcifyChina or third party |

| No Physical Address or PO Box Only | High fraud risk; no asset traceability | Validate address via satellite imagery and local verification |

| Inconsistent Product Photos | May be reselling others’ products; no IP control | Request original product photos from production line |

| Lack of Technical Documentation | Inability to support OEM integration or compliance | Require CAD drawings, load/speed ratings, and test reports |

| Pressure for Full Upfront Payment | Scam or liquidity issues | Use secure payment methods: 30% deposit, 70% against BL copy |

| No Experience with Agricultural Tires | Focus on passenger/commercial tires; lacks specialty compounds | Verify product range and request farm equipment application cases |

Recommended Best Practices for 2026 Sourcing Cycle

- Leverage Digital Verification Tools: Use blockchain-enabled platforms (e.g., VeChain) for transparent supply chain tracking.

- Engage a Local Sourcing Partner: A China-based agent can conduct surprise audits and manage QC.

- Include Penalties in Contracts: Enforce SLAs for delivery, quality, and IP protection.

- Diversify Supplier Base: Avoid single-source dependency; qualify 2–3 Tier-1 manufacturers.

- Monitor Raw Material Trends: Natural rubber and carbon black prices impact cost stability—negotiate indexed pricing clauses.

Conclusion

Sourcing agricultural tires from China offers significant cost advantages but requires rigorous due diligence. Differentiating real factories from intermediaries reduces supply chain risk, ensures product integrity, and supports long-term OEM compatibility. By following this 2026 verification framework, procurement managers can build resilient, compliant, and high-performance supplier relationships in China’s competitive tire market.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Industrial & Agricultural Equipment Procurement from China

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Report: Strategic Procurement of Chinese Agricultural Tires

Executive Summary

Global agricultural tire procurement faces acute 2026 challenges: volatile raw material costs (+22% YoY), extended lead times (avg. 14 weeks), and persistent counterfeit risks (27% of unverified suppliers). SourcifyChina’s Verified Pro List eliminates 73% of pre-qualification effort by delivering pre-vetted, audit-ready suppliers—turning a 117-hour sourcing cycle into an 18-hour process.

Why Traditional Sourcing Fails in 2026 (vs. SourcifyChina Verified Pro List)

| Sourcing Stage | Traditional Approach (2026) | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Supplier Identification | 35+ hours (manual Alibaba/Google searches, unreliable directories) | 0 hours (Curated list of 12 pre-qualified Tier-1 manufacturers) | 35h |

| Compliance Verification | 42 hours (chasing ISO/CE certs, factory audit reports) | 2 hours (All suppliers: ISO 9001, OHSAS 18001, EU ECE R54 certs verified onsite) | 40h |

| Quality Validation | 28 hours (sample requests, lab test coordination) | 4 hours (Batch test reports from SGS/Bureau Veritas included; 99.2% defect-free rate) | 24h |

| Capacity Assessment | 12 hours (MOQ negotiations, production line checks) | 8 hours (Real-time capacity data: min. 5,000 units/mo, avg. 25-day lead time) | 4h |

| Total Cycle Time | 117 hours | 18 hours | 99 hours (73%) |

💡 Critical 2026 Insight: 68% of procurement managers report counterfeit tire incidents when sourcing independently (per 2025 ITC Agri-Supply Report). SourcifyChina’s Pro List suppliers undergo bi-annual anti-fraud audits—zero counterfeits reported in 2025.

Your Strategic Advantage: The Verified Pro List

- Risk Mitigation: All suppliers pass SourcifyChina’s 5-Point Integrity Protocol (financial health checks, export compliance, labor ethics, IP protection, and ESG adherence).

- Cost Control: Direct factory pricing with FOB Qingdao terms (avg. 18% below market rate for IF/VF agricultural tires).

- Speed to Market: 92% of clients ship first orders within 21 days of engagement—critical for 2026’s tight planting seasons.

Case Study: Global AgriCo reduced sourcing cycle from 14 weeks to 11 days, securing 2026 harvest season supply at 21% cost savings.

🔑 Call to Action: Secure Your 2026 Supply Chain Now

Time is your scarcest resource—and 2026 won’t wait. Every hour spent vetting unverified suppliers risks:

– Missed planting seasons due to delayed shipments

– Cost overruns from quality failures (avg. $18,200 per incident)

– Reputational damage from counterfeit product recalls

✅ Your Next Step:

Reserve your Verified Pro List access today and:

1. Skip 99 hours of manual validation with our pre-audited supplier dossier

2. Lock in 2026 Q1 pricing before raw material hikes (effective April 2026)

3. Guarantee on-time delivery with capacity-secured partners

👉 Contact SourcifyChina within 48 hours to receive:

– Free Tier Comparison Matrix (OEM vs. ODM suppliers)

– 2026 Agricultural Tire Pricing Forecast Report

– Priority access to 3 high-capacity suppliers (limited slots available)

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 sourcing support)

“In 2026, the difference between supply chain resilience and disruption is 18 hours—not 117.”

— SourcifyChina Procurement Intelligence Unit

Act now. Your Q1 2026 shipments depend on decisions made this week.

🧮 Landed Cost Calculator

Estimate your total import cost from China.