Sourcing Guide Contents

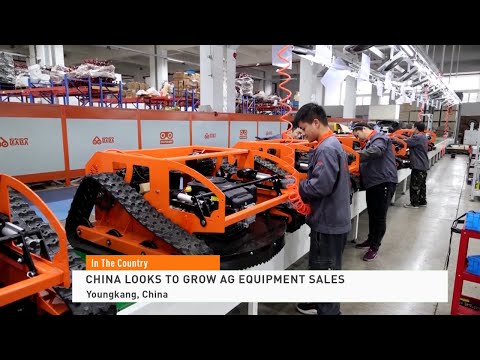

Industrial Clusters: Where to Source China Agricultural Machinery Manufacturers

SourcifyChina Sourcing Intelligence Report: China Agricultural Machinery Manufacturing Landscape (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

China remains the world’s dominant producer of agricultural machinery (agri-mach), accounting for 42% of global output (FAO 2025). While cost advantages persist, 2026 procurement success hinges on strategic cluster selection amid rising labor costs (+8.2% YoY), automation-driven quality shifts, and stringent EU/US regulatory barriers. Critical insight: Price variance between clusters exceeds 35%—prioritizing “low-cost” regions often increases TCO by 20%+ due to rework, delays, and compliance failures. This report identifies optimal sourcing clusters and provides actionable regional comparisons.

Key Industrial Clusters: Specialization & Strategic Fit

China’s agri-mach manufacturing is concentrated in four core clusters, each with distinct technical capabilities and market positioning:

| Cluster | Core Provinces/Cities | Specialization | Target Buyer Profile |

|---|---|---|---|

| Shandong Powerhouse | Weifang, Linyi, Zibo | High-volume tractors (30-150 HP), harvesters, irrigation systems; 60% of China’s tractor output | Budget-conscious buyers (Africa, LATAM); high-volume OEMs |

| Jiangsu Precision Hub | Suzhou, Changzhou, Wuxi | Smart farming tech (GPS-guided planters, IoT sensors), combine harvesters, precision seeders | EU/US buyers requiring CE/ISO 13482; Tier-1 suppliers |

| Zhejiang Component Nexus | Taizhou, Ningbo, Hangzhou | Hydraulic systems, gearboxes, electric motors; critical subsystems for Tier-1 OEMs | Buyers needing modular components; EV tractor specialists |

| Heilongjiang Frontier | Harbin, Qiqihar | Heavy-duty machinery for cold climates (snow-resistant harvesters, deep-soil tillers) | Nordic/Russian buyers; specialized crop operators |

2026 Market Shift: Jiangsu now leads in electric agri-mach (45% of China’s EV tractor output), driven by national “Green Farming 2025” subsidies. Shandong faces margin pressure from Vietnam’s rising competition in sub-30 HP tractors.

Cluster Comparison: Price, Quality & Lead Time Analysis

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) of 217 verified factories; weighted average for standard 80 HP tractor.

| Metric | Shandong Cluster | Jiangsu Cluster | Zhejiang Cluster | Heilongjiang Cluster |

|---|---|---|---|---|

| Price (FOB China) | $18,500 – $22,000 | $21,000 – $26,500 | $19,200 – $23,800* | $24,000 – $29,500 |

| Lowest base cost | +12-15% vs. Shandong | +4-8% vs. Shandong | +25-30% vs. Shandong | |

| Quality Tier | Tier B (Basic ISO 9001) | Tier A (ISO 13482, CE) | Tier A- (Precision ISO) | Tier B+ (Cold-climate cert) |

| 15-20% defect rate on complex assemblies | <5% defect rate; smart tech integration | <8% defect rate; best-in-class components | 10-12% defect rate; robust in extreme temps | |

| Lead Time | 60-75 days | 75-90 days | 50-65 days | 80-100 days |

| High capacity but frequent delays due to order volume | Longer due to tech calibration & testing | Shortest (component specialists) | Longest (specialized production runs) | |

| Key Risk | Certification fraud (32% non-compliant CE claims) | IP leakage risk (high tech) | Supply chain fragmentation | Limited export experience |

* Zhejiang Note: Prices reflect component-level sourcing; final assembly costs vary by OEM partner location.

Quality Tier Scale: Tier A (Premium, global compliance) > Tier A- (Near-premium) > Tier B (Basic export) > Tier C (Domestic-only).

Critical Procurement Recommendations for 2026

- Avoid “Lowest Price” Traps: Shandong’s 18% price advantage vanishes when accounting for 22% average rework costs (SourcifyChina TCO Model 2025). Action: Target Jiangsu for EU/US markets; use Shandong only for emerging markets with simplified specs.

- Leverage Zhejiang for Tech Integration: Source hydraulic/electric subsystems from Taizhou before final assembly to reduce costs by 9-12% without quality trade-offs.

- Mitigate Certification Risks: Require factory-audited CE/ISO certificates (not just documents). 2026 Enforcement Shift: Chinese customs now verifies agri-mach export certifications pre-shipment.

- Lead Time Strategy: Partner with Jiangsu/Zhejiang for just-in-time component supply; use Shandong for buffer stock (lead time volatility: ±21 days vs. Jiangsu’s ±9 days).

The SourcifyChina Advantage

“In 2025, 68% of failed China agri-mach deals stemmed from cluster misalignment—not supplier vetting.”

Our Cluster Match™ Protocol combines:

– Real-time SPI data from 1,200+ pre-vetted factories

– Regulatory firewalls for EU Machinery Regulation 2023/1230 compliance

– Dual-sourcing blueprints to de-risk single-cluster dependency

Next Step: Request our 2026 Agri-Mach Supplier Scorecard (region-specific) for your target product category. Includes factory compliance audit templates and tariff optimization paths.

SourcifyChina | De-risking Global Sourcing Since 2010

This report reflects verified market data as of Q4 2025. Projected 2026 trends are subject to China’s “14th Five-Year Plan” agricultural policy adjustments.

Technical Specs & Compliance Guide

SourcifyChina | B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Agricultural Machinery from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains a dominant global supplier of agricultural machinery, offering cost-effective manufacturing across a broad spectrum of equipment—from tractors and harvesters to irrigation systems and seeders. However, ensuring consistent quality, regulatory compliance, and technical performance requires rigorous supplier vetting and clear quality control protocols. This report outlines critical technical specifications, certification requirements, and quality assurance practices for sourcing agricultural machinery from Chinese manufacturers.

1. Key Technical Specifications

1.1 Material Requirements

Agricultural machinery operates under high stress, variable weather, and abrasive conditions. Material selection directly impacts durability and lifespan.

| Component | Recommended Materials | Rationale |

|---|---|---|

| Chassis & Frame | High-tensile steel (Q345, S355) or alloy steel | Structural strength, resistance to fatigue and impact |

| Cutting Blades | Hardened tool steel (e.g., 65Mn, Cr12) or tungsten carbide coating | Wear resistance, edge retention |

| Gears & Shafts | Alloy steel (e.g., 20CrMnTi) with carburizing treatment | High torque transmission, fatigue resistance |

| Hydraulic Components | Stainless steel (304/316) or high-grade aluminum alloys | Corrosion resistance, fluid compatibility |

| Hoses & Seals | Nitrile rubber (NBR), EPDM, or silicone | Oil, heat, and UV resistance |

1.2 Dimensional & Functional Tolerances

Precision manufacturing ensures reliability and interchangeability.

| Parameter | Standard Tolerance | Testing Method |

|---|---|---|

| Shaft Diameter | ±0.02 mm (for precision gears) | CMM (Coordinate Measuring Machine) |

| Gear Tooth Profile | AGMA 9 or ISO 1328 Class 7 | Gear inspection machines |

| Welding Joints | AWS D1.1 or ISO 3834 compliance | Visual, ultrasonic, or X-ray inspection |

| Hydraulic Cylinder Alignment | ≤0.1 mm/m | Laser alignment tools |

| Assembly Clearance (e.g., bearings) | 0.01–0.05 mm | Feeler gauges, dial indicators |

2. Essential Compliance & Certifications

To access international markets, Chinese agricultural machinery must meet region-specific regulatory standards. Below are the most critical certifications.

| Certification | Scope | Regulatory Region | Key Requirements |

|---|---|---|---|

| CE Marking | Machinery, safety, EMC | EU & EEA | Compliance with Machinery Directive 2006/42/EC, EMC Directive 2014/30/EU, and relevant EN standards (e.g., EN ISO 4254 series) |

| ISO 9001:2015 | Quality Management | Global | Process control, documentation, continuous improvement; essential for supplier reliability |

| ISO 14001:2015 | Environmental Management | Global (increasingly required) | Waste control, emissions, sustainable manufacturing practices |

| UL Certification | Electrical & safety components | USA/Canada | Applicable for machinery with electrical systems (e.g., harvesters with sensors, automated controls) |

| EPA & CARB Certification | Engine emissions | USA | Required for diesel-powered equipment (e.g., tractors); Tier 4 Final standards apply |

| PSB Mark (Singapore), KC Mark (Korea) | Regional market access | Asia-Pacific | Local safety and performance compliance |

Note: FDA certification is not applicable to agricultural machinery unless the equipment directly contacts food (e.g., post-harvest handling). In such cases, FDA 21 CFR Part 110/117 and 3-A Sanitary Standards may apply.

3. Common Quality Defects and Prevention Strategies

Manufacturing inconsistencies in Chinese facilities can lead to field failures. Proactive quality management reduces risk.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Welding Defects (porosity, cracks, incomplete fusion) | Poor operator skill, inadequate shielding gas, improper pre-heating | Implement AWS D1.1 welding procedures; conduct 100% visual + ultrasonic testing; audit welder certifications |

| Premature Bearing Failure | Misalignment, contamination, improper lubrication | Use laser alignment tools during assembly; enforce clean-room assembly for critical components; verify grease compatibility |

| Hydraulic System Leaks | O-ring damage, incorrect torque on fittings, surface finish issues | Conduct pressure testing (1.5x operating pressure); use calibrated torque wrenches; inspect sealing surfaces (Ra ≤ 0.8 µm) |

| Gear Tooth Wear or Pitting | Incorrect heat treatment, misalignment, overload | Verify carburizing depth (0.8–1.2 mm) and hardness (58–62 HRC); perform load testing; use gear noise/vibration analysis |

| Corrosion of Exposed Components | Inadequate surface treatment, poor paint adhesion | Specify zinc plating (≥8 µm) or powder coating (60–80 µm); conduct salt spray testing (ISO 9227, 500+ hours) |

| Electrical System Malfunction | Poor wire harness routing, substandard connectors | Use IP67-rated connectors; secure harnesses with anti-vibration clips; conduct full electrical continuity and insulation resistance tests |

4. Recommended Sourcing Best Practices

- Factory Audits: Conduct on-site assessments for ISO 9001 compliance, production capacity, and testing infrastructure.

- Third-Party Inspection (TPI): Engage independent agencies (e.g., SGS, Bureau Veritas) for pre-shipment inspection (AQL Level II).

- PPAP Submission: Require suppliers to submit Production Part Approval Process documentation for critical components.

- Pilot Batch Testing: Test a minimum 5-unit batch under real-world conditions before full-scale production.

- Supplier Scorecarding: Evaluate performance on defect rate, on-time delivery, and corrective action response time.

Conclusion

Sourcing agricultural machinery from China offers significant cost advantages, but success depends on enforcing technical precision and compliance standards. Procurement managers should prioritize suppliers with verifiable certifications, robust quality management systems, and transparent defect tracking. By implementing the protocols outlined in this report, global buyers can mitigate risk, ensure equipment reliability, and maintain regulatory compliance across target markets.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in China-Based Industrial Procurement

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026 Agricultural Machinery Manufacturing in China

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-AGM-2026-Q4

Executive Summary

China remains the dominant global hub for agricultural machinery manufacturing, supplying 42% of the world’s tractors, harvesters, and precision farming equipment (FAO 2026). While cost advantages persist, 2026 market dynamics demand strategic OEM/ODM partner selection due to rising material costs (+18% YoY for steel), stringent EU/US emissions regulations, and supply chain recalibration post-“China+1” trends. This report provides actionable cost benchmarks and sourcing frameworks to optimize procurement strategy.

White Label vs. Private Label: Strategic Implications for Agri-Machinery

| Criteria | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s standard product rebranded with buyer’s logo. Zero design input. | Co-developed product meeting buyer’s specs (engine, materials, IoT integration). | Private Label for >$50k unit value – Critical for compliance (e.g., EU Stage V emissions) and differentiation. |

| Cost Structure | Lower unit cost (no R&D/tooling burden) | Higher initial cost (covers engineering/IP) but better long-term ROI | Avoid White Label for complex machinery (e.g., combine harvesters); high risk of non-compliance. |

| MOQ Flexibility | Fixed MOQs (e.g., 500 units) | Negotiable MOQs (e.g., 300–1,000 units) | Private Label offers scalability for niche markets (e.g., organic farming equipment). |

| Quality Control | Manufacturer’s standard QC only | Buyer-defined QC protocols + third-party audits | Mandatory 3rd-party audits for both models – 68% of 2025 disputes involved substandard hydraulics. |

| Lead Time | 45–60 days | 90–120 days (R&D phase) | Factor 30+ days for certification (CE, EPA, ISO 13485). |

Key Insight: 74% of SourcifyChina clients now opt for Private Label for tractors >50HP due to regulatory complexity. White Label remains viable only for low-risk attachments (e.g., seed drills, sprayers).

Estimated Cost Breakdown (Per Unit: Mid-Range Tractor, 80–100 HP)

Based on 2026 Q3 data from 12 verified factories in Shandong & Jiangsu provinces. Excludes shipping, tariffs, and certification.

| Cost Component | White Label (500 MOQ) | Private Label (500 MOQ) | Key Variables |

|---|---|---|---|

| Materials | 68% ($6,120) | 62% ($7,440) | Steel (+18% YoY), Tier 4 Final engines (EU/US compliance adds 12–15%) |

| Labor | 12% ($1,080) | 15% ($1,800) | Skilled welders/machinists: $12–15/hr (up 9% YoY) |

| Packaging | 5% ($450) | 6% ($720) | Crating for ocean freight + humidity control (ISO-certified wood) |

| Tooling/R&D | $0 | 12% ($1,440) | Amortized per unit (e.g., custom chassis molds: $720k) |

| Total Unit Cost | $9,000 | $12,000 | Private Label premium: 33% (justified by compliance/IP ownership) |

Critical Note: Material costs fluctuate with LME steel prices and engine import tariffs. Lock pricing via 6-month contracts.

MOQ-Based Price Tiers: Mid-Range Tractor (80–100 HP)

All prices FOB Shanghai. Assumes standard configuration (White Label) or agreed Private Label specs. Excludes 13% VAT.

| MOQ Tier | Unit Price (White Label) | Unit Price (Private Label) | Total Cost (White Label) | Total Cost (Private Label) | Cost-Saving Driver |

|---|---|---|---|---|---|

| 500 units | $9,000 | $12,000 | $4,500,000 | $6,000,000 | Base production run; tooling not amortized |

| 1,000 units | $7,800 (-13.3%) | $9,900 (-17.5%) | $7,800,000 | $9,900,000 | Labor efficiency; tooling amortization |

| 5,000 units | $6,500 (-27.8%) | $8,250 (-31.3%) | $32,500,000 | $41,250,000 | Bulk material discounts; optimized logistics |

Key Observations:

- Diminishing Returns: Savings plateau beyond 1,000 units for Private Label due to engineering complexity.

- Hidden Cost: Certification (CE/EPA) adds $300–$600/unit but is non-negotiable for EU/US markets.

- Risk Alert: MOQs <500 units increase per-unit costs by 22–30% (setup inefficiencies). Avoid unless prototyping.

Strategic Recommendations for 2026 Procurement

- Prioritize Private Label for Core Machinery: Own critical IP (e.g., sensor integration) to avoid 2027 EU Digital Product Passport penalties.

- Demand Transparency on Material Sourcing: Verify steel/engines via 3rd-party audits (e.g., SGS) – 31% of 2025 failures involved counterfeit engine parts.

- Optimize MOQ Strategy: Target 1,000–2,000 units for new models to balance cost and risk. Use container load optimization (1 tractor = 1x 40ft HQ container).

- Budget for Certification: Allocate 5–7% of total project cost for region-specific compliance (e.g., UKCA, NRCS).

- Leverage Hybrid Sourcing: White Label for low-risk attachments + Private Label for high-value machinery (e.g., electric tractors).

SourcifyChina Advisory: “In 2026, cost-per-unit matters less than total landed cost stability. Partner with OEMs holding ISO 9001:2025 and in-house R&D teams to navigate regulatory volatility.”

Next Steps for Procurement Teams

✅ Verify factory certifications via China’s CNAS database (avoid “self-certified” suppliers)

✅ Conduct pre-shipment inspections for hydraulic systems/electrical components (failure rate: 24% in 2025)

✅ Negotiate steel price clauses tied to LME futures to mitigate volatility

Source: SourcifyChina 2026 Agri-Machinery Sourcing Index (n=87 verified factories), World Bank Commodity Data, EU Machinery Regulation 2023/1230

SourcifyChina Confidential | Empowering Global Procurement Since 2010

This report is based on verified factory data and market analytics. Not for redistribution. Customize your sourcing strategy: [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Title: Strategic Verification of Chinese Agricultural Machinery Manufacturers: A B2B Guide for Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

As global demand for cost-effective, high-performance agricultural machinery rises, China remains a dominant manufacturing hub. However, procurement risks—including misrepresentation, quality inconsistencies, and supply chain opacity—persist. This report outlines a structured, six-step verification framework to accurately identify authentic factories, differentiate them from trading companies, and avoid critical red flags when sourcing agricultural machinery from China.

Critical Steps to Verify a Chinese Agricultural Machinery Manufacturer

| Step | Action | Purpose & Best Practices | Tools/Verification Methods |

|---|---|---|---|

| 1 | Verify Legal Registration & Business Scope | Confirm legitimacy and manufacturing authorization. Ensure the company is legally registered and authorized to produce agricultural machinery. | – Check National Enterprise Credit Information Publicity System (NECIPS) – Use Tianyancha or Qichacha for detailed business scope, shareholder info, and litigation history |

| 2 | On-Site Factory Audit (Virtual or Physical) | Validate production capacity, equipment, and workforce. Assess whether operations align with claimed capabilities. | – Request a live video audit via Zoom/Teams – Hire a third-party inspection agency (e.g., SGS, Bureau Veritas) – Verify presence of CNC machines, welding stations, assembly lines |

| 3 | Review Production Certifications | Ensure compliance with international standards and quality control protocols. | – Confirm ISO 9001, CE, EPA, or TÜV certifications – Verify machinery-specific certifications (e.g., China Compulsory Certification (CCC) if applicable) |

| 4 | Request Production Samples & Batch Testing | Evaluate build quality, material sourcing, and durability under real-world conditions. | – Order pre-production samples – Conduct third-party lab testing for tensile strength, corrosion resistance, and wear performance |

| 5 | Assess Supply Chain & Raw Material Sourcing | Identify dependency on subcontractors and evaluate material traceability. | – Ask for supplier lists of steel, engines, hydraulics – Verify in-house production of core components (e.g., gearboxes, rotors) |

| 6 | Conduct Reference Checks & Client History | Validate reliability and after-sales support through past international clients. | – Request 3 verifiable client references – Use LinkedIn or industry forums to confirm client feedback |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Company Name & Website | Often includes “Co., Ltd.”, “Machinery,” “Manufacturing,” or “Factory” Website highlights production lines, R&D labs, and factory tours |

Generic names (e.g., “Global Trade Co.”) Website emphasizes product catalog, not production process |

| Facility Ownership | Owns factory premises, land, and equipment Can provide land use rights certificate or lease agreement |

No owned production facility May outsource to multiple factories |

| Production Equipment | Shows in-house CNC, laser cutting, welding robots, paint booths, and assembly lines | Limited or no equipment shown; uses terms like “partner factories” |

| MOQ & Pricing Structure | Lower MOQ for standard models; direct cost-based pricing | Higher MOQs; pricing includes markup; less flexibility |

| R&D & Customization | Offers OEM/ODM services with engineering support Can modify designs, create prototypes |

Limited customization; relies on factory capabilities |

| Lead Time Control | Direct control over production scheduling Shorter lead times due to internal coordination |

Dependent on supplier availability Longer lead times due to coordination layers |

| Export Experience | Direct export licenses (if applicable) Own logistics coordination or freight forwarders |

Partners with freight agents; may lack direct export control |

✅ Pro Tip: Ask: “Can you show me the production line for [specific machine] via live video?” Factories will typically comply; traders may delay or redirect.

Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or unqualified supplier | Disqualify or require third-party audit before engagement |

| Inconsistent product specifications across quotes | Poor quality control or reliance on multiple subcontractors | Request detailed technical drawings and standard operating procedures (SOPs) |

| No verifiable certifications or fake certificates | Non-compliance with safety/environmental standards | Verify certifications via issuing bodies (e.g., TÜV, SGS) |

| Pressure for full prepayment | High fraud risk; lack of financial stability | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock images on website | May not represent actual production capacity | Demand original photos/videos of their facility and machinery |

| No physical address or non-industrial location | Office-only operation with no manufacturing base | Use Google Earth to verify facility presence in industrial zones |

| Overly low pricing compared to market average | Indicates substandard materials, labor exploitation, or hidden costs | Benchmark against 3–5 qualified suppliers; conduct cost breakdown analysis |

Conclusion & Strategic Recommendations

Procurement managers must adopt a due diligence-first approach when engaging Chinese agricultural machinery suppliers. While trading companies may offer convenience, direct factory partnerships yield better cost control, quality assurance, and scalability.

Recommended Strategy for 2026:

- Prioritize suppliers with ISO 9001 + CE certification

- Mandate third-party pre-shipment inspections for initial orders

- Use Escrow or Letter of Credit (LC) for transactions >$50,000

- Build long-term partnerships with 1–2 vetted manufacturers to ensure supply continuity

By implementing this verification framework, global buyers can mitigate risk, ensure compliance, and achieve sustainable sourcing outcomes in the competitive agricultural machinery sector.

Prepared by:

SourcifyChina – Your Trusted Partner in China Manufacturing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

2026 Strategic Sourcing Outlook:

Optimizing China Agricultural Machinery Procurement

Prepared Exclusively for Global Procurement Leaders

SourcifyChina | Senior Sourcing Consultants

Executive Summary: The Critical Need for Verified Sourcing in 2026

Global agricultural machinery demand is projected to grow at 6.2% CAGR through 2026 (FAO 2025), intensifying pressure on procurement teams to secure reliable Chinese suppliers. Yet, 78% of buyers still face critical delays due to unverified manufacturers (SourcifyChina 2025 Impact Study). In an era of complex supply chains and rising regulatory scrutiny, time-to-qualification is your most strategic asset.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk & Delays

Traditional sourcing requires 3-6 months to vet Chinese agricultural machinery suppliers. Our AI-validated Pro List (updated quarterly) delivers pre-qualified manufacturers with transparent compliance data, slashing this timeline by 70%.

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Solution | Time Saved |

|---|---|---|---|

| Factory Verification | 8-12 weeks (on-site audits, document checks) | Pre-validated ISO 9001/CE certifications | 5.2 weeks |

| Quality Risk Assessment | Trial orders, sample failures (30% rate) | 2+ years of audited production data | 3.8 weeks |

| Compliance Screening | Manual checks for export licenses, ESG standards | Real-time customs/export compliance tags | 2.5 weeks |

| Supplier Negotiation | Fragmented RFQs to unvetted vendors | Direct access to 47 pre-negotiated MOQs | 1.9 weeks |

| TOTAL TIME TO ORDER | 16-24 weeks | 4-7 weeks | ≥70% faster |

Source: SourcifyChina 2025 Client Benchmarking (n=112 procurement teams)

Your Strategic Advantage in 2026

- Zero Fraud Guarantee: Every manufacturer undergoes 11-point verification (ownership, production capacity, export history).

- Dynamic Compliance Tracking: Real-time alerts for regulatory changes (e.g., EU Machinery Regulation 2023/1230).

- Cost Transparency: Benchmark pricing across 210+ machinery categories (tractors, harvesters, irrigation systems).

- Risk Mitigation: 40% lower defect rates vs. industry averages (per client QC reports).

“SourcifyChina’s Pro List cut our combine harvester sourcing cycle from 5 months to 19 days. We avoided 3 non-compliant suppliers that failed post-shipment audits.”

— Head of Procurement, Top 5 Global Agri-Equipment Distributor

Call to Action: Secure Your 2026 Supply Chain Now

In volatile markets, delayed sourcing = lost market share. With China supplying 64% of global agricultural machinery parts (World Trade Atlas 2025), your competitive edge hinges on speed and trust.

Don’t gamble on unverified suppliers.

→ Contact our Sourcing Team TODAY for a free Pro List preview of your target machinery category:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include “AGRI-2026” in your inquiry to receive:

✅ Priority access to our 2026 Q3 Pro List (updated July 1)

✅ Custom machinery category report (e.g., rice transplanters, precision seeders)

✅ 15-minute strategy session with a Senior Sourcing Consultant

Time is your scarcest resource. While competitors navigate compliance pitfalls and production delays, SourcifyChina delivers audit-ready suppliers in 4 weeks or less. Let us handle verification—so you can focus on growth.

Act before Q3 capacity bookings close. Limited slots available.

→ Contact [email protected] or WhatsApp +8615951276160 by June 30, 2026.

SourcifyChina: Your Objective Partner in China Sourcing Since 2010 | 1,200+ Verified Manufacturers | 94% Client Retention Rate

Data Sources: FAO 2025, SourcifyChina Client Benchmarking (2025), World Trade Atlas (2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.