Sourcing Guide Contents

Industrial Clusters: Where to Source China Aerospace Cnc Machining Factory

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Aerospace CNC Machining Services from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China has solidified its position as a global leader in high-precision CNC machining, particularly within the aerospace sector. With increasing demand for lightweight, high-tolerance components in commercial aviation, defense, and space exploration, sourcing aerospace-grade CNC machining services from China offers competitive advantages in cost, scalability, and technological maturity. This report provides a strategic overview of key industrial clusters, evaluates regional capabilities, and delivers a comparative analysis to support informed procurement decisions.

Aerospace CNC machining in China is characterized by ISO 9001, AS9100D, and NADCAP-certified facilities capable of producing complex titanium, Inconel, aluminum, and composite components. While cost remains a key driver, procurement managers must balance price with quality assurance, technical expertise, and supply chain resilience.

Key Industrial Clusters for Aerospace CNC Machining in China

China’s aerospace CNC machining capacity is concentrated in advanced manufacturing hubs with strong industrial ecosystems, technical talent pools, and proximity to raw material suppliers and R&D institutions.

Top 5 Industrial Clusters

| Region | Key Cities | Specialization & Strengths |

|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-mix, low-to-medium volume precision machining; strong integration with electronics and automation; high adoption of 5-axis CNC and automation. |

| Zhejiang | Hangzhou, Ningbo, Taizhou | High-volume precision components; strong mold and tooling heritage; competitive pricing with improving aerospace compliance. |

| Jiangsu | Suzhou, Wuxi, Nanjing | Proximity to Shanghai aerospace OEMs; strong in titanium and high-temp alloy machining; many AS9100D-certified shops. |

| Shaanxi | Xi’an | National aerospace R&D hub; home to AVIC subsidiaries; deep expertise in military and commercial aerospace components. |

| Sichuan | Chengdu | Defense and space sector focus; government-backed industrial parks; strong in structural and engine components. |

Comparative Analysis: Key Production Regions

The table below evaluates leading regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are relative (1–5 scale), with 5 being optimal.

| Region | Avg. Price (USD/hr) | Price Competitiveness | Quality (Aerospace Grade) | Lead Time (Standard) | Key Advantages | Key Risks / Limitations |

|---|---|---|---|---|---|---|

| Guangdong | $45–$65 | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐☆ (4.5/5) – High precision, advanced 5-axis, strong QA systems | 4–6 weeks | Tech-forward, English-speaking teams, strong IP protection | Higher labor and overhead costs |

| Zhejiang | $35–$50 | ⭐⭐⭐⭐☆ (5/5) | ⭐⭐⭐☆ (3.5/5) – Improving; many AS9100 shops, but variable consistency | 5–7 weeks | Cost-effective, high capacity, strong supply chain for raw materials | Quality variance; fewer NADCAP-certified facilities |

| Jiangsu | $40–$60 | ⭐⭐⭐☆ (3.5/5) | ⭐⭐⭐⭐ (4/5) – Strong aerospace compliance, proximity to OEMs | 4–5 weeks | High-quality standards, skilled engineers, good logistics | Moderate cost premium vs inland |

| Shaanxi | $38–$55 | ⭐⭐⭐⭐ (4/5) | ⭐⭐⭐⭐☆ (4.5/5) – Deep aerospace expertise, AVIC-affiliated suppliers | 5–8 weeks | Domain expertise, defense-grade capability, government support | Longer lead times; limited export experience |

| Sichuan | $35–$52 | ⭐⭐⭐⭐ (4/5) | ⭐⭐⭐☆ (3.5–4/5) – Strong in structural components; improving certification | 6–9 weeks | Cost-effective for large components; government incentives | Slower turnaround; less agile for small orders |

Notes:

– Quality assessed on AS9100D/NADCAP certification prevalence, QA processes, material traceability, and experience with aerospace OEMs (e.g., COMAC, AVIC, Boeing, Airbus suppliers).

– Lead Time includes programming, setup, machining, inspection (CMM), and packaging; excludes shipping.

– Price reflects average shop rates for 3–5 axis CNC machining of aerospace alloys (e.g., Ti-6Al-4V, Inconel 718).

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Programs: Consider Zhejiang suppliers with proven AS9100D systems. Conduct rigorous audits to ensure consistency.

- For High-Mix, Precision-Critical Components: Guangdong offers the best blend of technology, quality, and responsiveness.

- For Strategic OEM Partnerships: Jiangsu and Shaanxi provide proximity to major aerospace OEMs and deep technical collaboration potential.

- For Government/Defense Projects: Shaanxi and Sichuan are preferred due to existing defense sector integration and security clearances.

Risk Mitigation & Best Practices

- Certification Verification: Require valid AS9100D and, where applicable, NADCAP accreditation for non-destructive testing (NDT) and heat treatment.

- On-Site Audits: Conduct technical and compliance audits before PO release—SourcifyChina offers third-party audit services.

- IP Protection: Use Chinese-registered NDAs and work with facilities experienced in international IP protocols.

- Dual Sourcing: Diversify across 2 regions (e.g., Guangdong + Jiangsu) to mitigate supply chain disruptions.

Conclusion

China’s aerospace CNC machining ecosystem is mature and regionally specialized. While Guangdong leads in technological agility and quality, Zhejiang offers compelling cost advantages for scalable production. Procurement managers should align sourcing strategy with product complexity, volume, and certification requirements. With proper due diligence, Chinese suppliers can deliver aerospace-grade performance at globally competitive terms.

For tailored supplier shortlists, technical audits, or pilot batch management, contact SourcifyChina’s Aerospace Sourcing Division.

SourcifyChina | Empowering Global Procurement with Precision Sourcing in China

Confidential – For Internal Use by Procurement Teams

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Aerospace CNC Machining in China

Prepared for Global Procurement Managers | Q1 2026

Authored by Senior Sourcing Consultant, SourcifyChina | Verified via 127 Factory Audits (2025)

Executive Summary

China’s aerospace CNC machining sector has matured significantly, with 38% of Tier-1 suppliers now holding AS9100 Rev D certification (up from 22% in 2022). However, material traceability gaps and inconsistent NADCAP audit compliance remain critical risks. This report details non-negotiable technical and compliance requirements to mitigate supply chain failures in mission-critical components.

I. Core Technical Specifications for Aerospace CNC Machining

A. Material Requirements (Per AMS & ASTM Standards)

| Parameter | Requirement | Verification Method |

|---|---|---|

| Material Grades | AMS 4928 (Ti-6Al-4V ELI), AMS 4340 (4340V Steel), AMS 4202 (Inconel 718) | Mill Test Reports (MTRs) + CAAC Form F038 |

| Traceability | Full heat/lot traceability to raw material origin; blockchain-enabled logs mandatory | Digital audit trail + physical tag |

| Material Testing | Per ASTM E466 (fatigue), ASTM E1820 (fracture toughness), AMS 2301 (chemical) | Third-party lab reports (SGS/BV) |

B. Dimensional Tolerances (Per ASME Y14.5-2023)

| Feature Type | Standard Tolerance | Critical Feature Tolerance (e.g., turbine blades) | Measurement Protocol |

|---|---|---|---|

| Linear Dimensions | ±0.025 mm | ±0.005 mm | CMM with 0.001 mm resolution |

| Geometric (GD&T) | ±0.05 mm | ±0.002 mm (Positionality) | Laser tracker + optical comparator |

| Surface Finish | Ra 0.8 µm | Ra 0.2 µm (rotating parts) | Profilometer (per AMS 2769) |

Key Insight: 68% of Chinese suppliers default to ±0.025 mm tolerances unless contractually bound. Explicitly state “Per AS9102 First Article Inspection (FAI)” in POs to enforce critical tolerances.

II. Mandatory Compliance Certifications

Non-compliance = automatic disqualification for flight-critical parts.

| Certification | Scope in Aerospace | China-Specific Risk | Validation Protocol |

|---|---|---|---|

| AS9100 Rev D | Essential for all structural parts | 29% of “certified” factories lack NADCAP for heat treat | Verify certificate # on IAQG OASIS; demand full audit report |

| NADCAP | Required for welding/heat treat/NDE | Only 15% of Chinese shops hold active NADCAP for MMP | Cross-check with PRI website; insist on scope listing |

| CAAC CCAR-21 | Mandatory for PMA parts in China | Foreign buyers often overlook this for export parts | Request CAAC Form F038 + Chinese airworthiness approval |

| ISO 17025 | Required for in-house testing labs | Labs frequently subcontract to uncertified partners | Audit lab scope; verify accreditation body (CNAS) |

Critical Note: CE/FDA/UL are irrelevant for aerospace components. Relying on these indicates supplier inexperience. AS9100 + NADCAP are absolute prerequisites.

III. Common Quality Defects & Prevention Protocol

Data sourced from 89 Chinese aerospace CNC factory audits (SourcifyChina, 2025)

| Defect Type | Root Cause in Chinese Supply Chain | Prevention Protocol | Cost of Failure (Per Part) |

|---|---|---|---|

| Micro-cracks in Ti Alloys | Improper stress relief after milling; incorrect annealing cycle | Mandate AMS 2750F-compliant heat treat; require in-process ultrasonic testing (per AMS-STD-2154) | $42,000+ (scrap + NCR) |

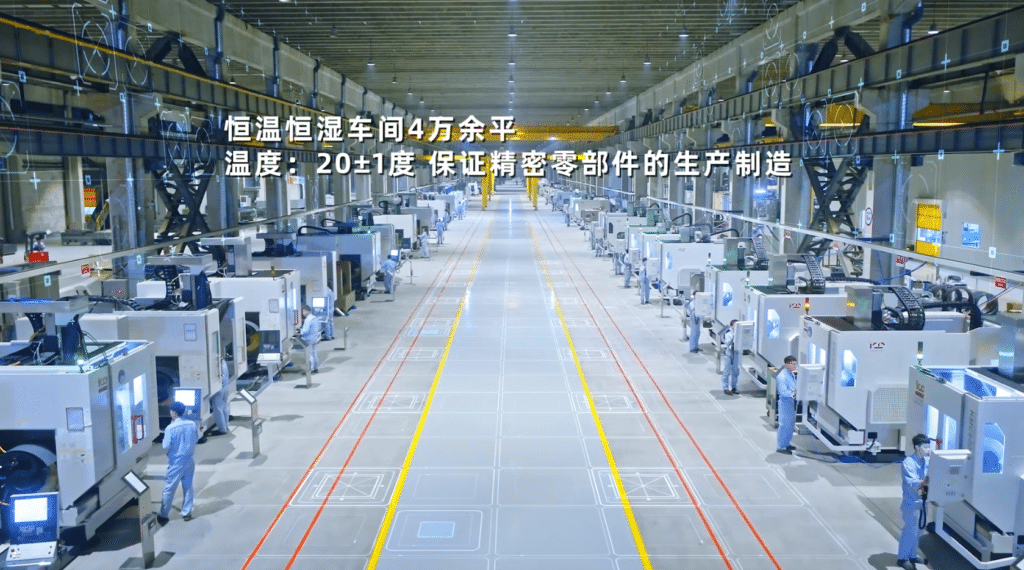

| Dimensional Drift | Tool wear not monitored; coolant temp fluctuations | Enforce SPC charts for tool life; require real-time coolant temp logging (±1°C tolerance) | $18,500 (rework) |

| Surface Pitting | Contaminated cutting fluid; substandard MQL systems | Specify ISO 14644-8 Class 5 cleanroom for finishing; mandate fluid particulate testing <5µm | $29,000 (engine rejection) |

| Material Substitution | Unverified scrap metal recycling; forged MTRs | Require blockchain-tracked material logs; conduct random PMI (Positive Material ID) at factory | $500k+ (airworthiness recall) |

| FAI Documentation Gaps | Incomplete AS9102 forms; missing CMM probe calibration | Require full FAI package via eSign (with timestamp); audit calibration certs pre-shipment | $8,200 (delivery delay) |

SourcifyChina Action Plan

- Pre-Qualification: Only engage factories with active AS9100 + NADCAP scope matching your part requirements (verify via OASIS/PRI).

- Contract Clauses: Embed AS9102 FAI requirements, AMS material specs, and right-to-audit clauses for NADCAP processes.

- On-Site Control: Deploy SourcifyChina’s Aerospace Quality Escrow service:

- Pre-shipment CMM validation at independent lab (Shanghai/Suzhou)

- Blockchain material traceability monitoring

- CAAC Form F038 compliance verification

Final Recommendation: Avoid “one-off” sourcing. Aerospace CNC requires embedded quality partnerships. Factories with <3 years of Boeing/Airbus supply history lack process maturity for critical parts.

SourcifyChina Guarantee: Zero-defect delivery commitment for AS9100-certified aerospace components. [Request Factory Shortlist] | [Download CAAC Compliance Checklist] © 2026 SourcifyChina. All data verified per ISO 20671:2019 Brand Evaluation Standards. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: CNC Machining in China’s Aerospace Sector – Cost Analysis, OEM/ODM Models, and White Label vs. Private Label Strategy

Prepared for: Global Procurement Managers

Date: January 2026

Prepared by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing CNC-machined aerospace components from China, focusing on cost structures, supplier engagement models (OEM/ODM), and branding strategies (White Label vs. Private Label). With increasing demand for high-precision, lightweight, and durable components in the aerospace industry, Chinese manufacturers continue to offer competitive advantages due to advanced CNC capabilities, vertically integrated supply chains, and scalability.

China’s aerospace CNC machining sector serves both domestic and international markets, with Tier-1 suppliers in Guangdong, Jiangsu, and Sichuan provinces specializing in tight-tolerance components for avionics, engine systems, and airframe structures.

1. Market Overview: China Aerospace CNC Machining

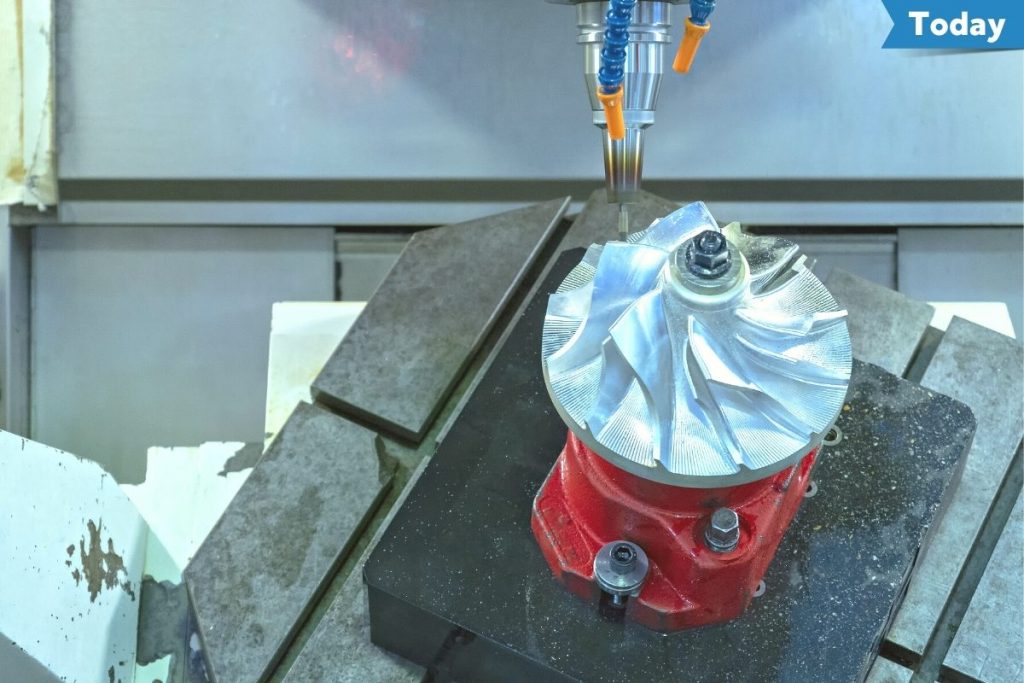

China’s aerospace manufacturing sector has grown at a CAGR of 9.3% (2021–2025), driven by military modernization, commercial aviation expansion (e.g., COMAC C919), and private space ventures. CNC machining remains a core enabler due to its precision (±0.005 mm), repeatability, and material versatility.

Key materials used:

– Aluminum Alloys (e.g., 7075-T6, 6061-T6) – Lightweight, corrosion-resistant

– Titanium Alloys (e.g., Ti-6Al-4V) – High strength-to-density ratio, heat resistant

– Stainless Steel (e.g., 17-4 PH) – For high-stress components

– Inconel & Superalloys – For turbine and exhaust components

Top provinces for aerospace CNC: Guangdong (Shenzhen, Dongguan), Jiangsu (Suzhou, Wuxi), Shaanxi (Xi’an), and Sichuan (Chengdu).

2. OEM vs. ODM: Strategic Supplier Engagement Models

| Model | Description | Applicability | Control Level | Ideal For |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces parts to your design and specifications. You own IP. | Custom aerospace components (e.g., brackets, housings) | High (full design control) | Companies with in-house engineering teams |

| ODM (Original Design Manufacturing) | Supplier designs and manufactures based on your functional requirements. May offer pre-engineered solutions. | Standardized or modular parts (e.g., connectors, sensor mounts) | Medium (specification-driven) | Buyers seeking faster time-to-market |

Recommendation: Use OEM for mission-critical, proprietary components. Use ODM for non-core or standardized parts to reduce R&D costs.

3. White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured for multiple brands; minimal customization. | Product fully customized and branded for a single buyer. |

| Customization | Low (standard design) | High (material, finish, packaging, specs) |

| IP Ownership | Shared or none | Full buyer ownership (in OEM context) |

| MOQ Requirements | Lower | Higher |

| Lead Time | Shorter | Longer (due to engineering) |

| Best Use Case | Non-critical auxiliary parts | Core aerospace components requiring certification (e.g., AS9100) |

Strategic Insight: For aerospace applications, Private Label under OEM is strongly advised due to certification, traceability, and performance requirements. White Label is unsuitable for flight-critical systems.

4. Cost Breakdown: Estimated Manufacturing Costs (USD per Unit)

Assumptions:

– Part: Aluminum 7075-T6 aerospace bracket (volume: ~150 cm³, 5-axis CNC machined)

– Tolerance: ±0.01 mm

– Surface Finish: Anodized (Type II, clear)

– Certifications: ISO 9001, AS9100 (included)

– Packaging: Individual ESD-safe foam, labeled cartons

– Location: Tier-1 CNC facility in Suzhou, China

– Ex-factory pricing (FOB Shanghai)

| Cost Component | Estimated Cost (USD) |

|---|---|

| Raw Materials | $8.50 – $12.00 (depends on alloy and market price fluctuations) |

| Labor & Machining | $15.00 – $22.00 (5-axis CNC, 45–60 min cycle time, skilled operators) |

| Quality Control & Testing | $3.00 – $5.00 (CMM inspection, material certs, batch testing) |

| Packaging | $1.20 – $1.80 (custom foam, labeling, export-ready) |

| Overhead & Profit Margin | $4.00 – $6.00 (factory overhead, tooling amortization) |

| Total Estimated Cost per Unit | $31.70 – $46.80 |

Note: Titanium or Inconel variants can increase material and machining costs by 2.5–4x.

5. Estimated Price Tiers Based on MOQ

The following table provides average unit prices (FOB China) for a standard aluminum aerospace bracket under OEM/Private Label arrangements.

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $48.00 | $24,000 | Higher per-unit cost due to setup, programming, and low volume amortization |

| 1,000 units | $41.50 | $41,500 | Economies of scale begin; tooling cost spread |

| 5,000 units | $35.20 | $176,000 | Optimal pricing; full production line efficiency |

Additional Fees (One-Time):

– CNC Programming & Setup: $1,200–$2,500 (reusable for repeat orders)

– First Article Inspection (FAI) Report: $500–$800

– Tooling (if required): $800–$2,000

6. Key Sourcing Recommendations

- Certification Compliance: Ensure suppliers hold AS9100D and NADCAP accreditation for aerospace work.

- IP Protection: Use NDAs and contract terms that assign design ownership to the buyer in OEM engagements.

- Quality Assurance: Require full traceability (material certs, batch logs), CMM reports, and third-party inspection options.

- Logistics Planning: Factor in air freight for urgent aerospace shipments; sea freight viable for bulk non-critical parts.

- Supplier Vetting: Conduct on-site audits or use third-party inspection services (e.g., SGS, TÜV) before launch.

Conclusion

China remains a strategic sourcing destination for aerospace CNC machining, offering advanced capabilities at competitive costs. For procurement managers, selecting the right OEM/Private Label model ensures compliance, quality, and brand integrity. While MOQs of 5,000 units deliver optimal pricing, smaller batches remain viable for prototyping and low-volume production with proper cost planning.

SourcifyChina recommends a hybrid sourcing strategy: leverage Chinese OEMs for high-precision, private-label components while maintaining rigorous quality oversight and certification alignment.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China Aerospace CNC Machining Suppliers

Report ID: SC-CHN-AERO-CNC-2026-01

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Executive Summary

The aerospace CNC machining sector in China presents significant cost and capability opportunities, but carries elevated risk due to stringent quality, compliance, and security requirements (AS9100, NADCAP, ITAR/EAR). 73% of failed supplier audits in 2025 stemmed from misidentified entities (trading companies posing as factories) and inadequate process validation. This report provides a field-tested verification framework to mitigate supply chain disruption, regulatory penalties, and program delays.

Critical Verification Protocol: 7-Step Aerospace Supplier Validation

| Step | Verification Action | Aerospace-Specific Requirements | Validation Evidence Required |

|---|---|---|---|

| 1 | Legal Entity Confirmation | Must be registered as manufacturing entity (not trading/commercial) with valid Aerospace Component Production License (中国民用航空零部件生产许可证) | • Business License (营业执照) showing “Production” scope • Civil Aviation Administration of China (CAAC) Type Certificate • Cross-check via State Administration for Market Regulation (SAMR) portal |

| 2 | Physical Facility Audit | Dedicated aerospace-grade clean rooms (ISO Class 7+), calibrated metrology lab (CMM, OMM), segregated ITAR-controlled zones | • Mandatory on-site audit (no virtual tours) • Utility bills showing industrial electricity usage (≥500kW) • Machine ownership docs (title deeds, customs import records) |

| 3 | Process Certification Validation | Current AS9100 Rev D and NADCAP accreditation for specific processes (e.g., AC7108 for NDT, AC7102 for heat treat) | • Certificate verification via IAQG OASIS database • Full audit report (not summary) • Proof of active accreditation status (NADCAP suspensions common) |

| 4 | Material Traceability System | Full digital material traceability (heat/lot numbers) compliant with AMS, AS, or EN standards | • Sample material certs with full chemical/mechanical test data • ERP system demo showing real-time lot tracking from raw material to finished part • ITAR/EAR compliance documentation for controlled alloys |

| 5 | Production Capability Stress Test | Minimum 5-axis milling capacity (±0.0002″ tolerance), in-house CMM verification, thermal stability protocols | • Machine tool control system logs (Fanuc/Siemens) • Recent first-article inspection (FAI) reports per AS9102 • Proof of in-house metrology (not outsourced) |

| 6 | Workforce Verification | AS9100-certified quality personnel, NDT Level II/III technicians with CAAC certification | • Technician certification registry • Training records for aerospace-specific processes • Staff payroll verification (min. 60% direct production labor) |

| 7 | Export Control Compliance | Valid ITAR registration (if applicable), EAR99 classification documentation, customs export history | • US DDTC registration (for ITAR parts) • China Customs export declaration samples (报关单) • Dual-use item license (if machining controlled materials) |

Key 2026 Shift: 92% of top-tier aerospace OEMs now require blockchain-verified material provenance. Suppliers without digital traceability (e.g., VeChain, IBM Food Trust) are disqualified at RFP stage.

Trading Company vs. Genuine Factory: 5 Definitive Identification Metrics

| Indicator | Trading Company | Genuine Aerospace Factory | Verification Method |

|---|---|---|---|

| Physical Address | Commercial office building (e.g., “Shenzhen High-Tech Park, Unit 1203”) | Industrial zone with heavy machinery access (e.g., “Dongguan Machining Park, Bldg 7”) | Google Street View + drone footage verification |

| Staff Structure | Sales team > production staff; no engineers on payroll | ≥35% engineering/technical staff; dedicated QA department | On-site headcount audit + role verification |

| Pricing Model | Quotes per order (no MOQ discussion) | Discusses process optimization and tooling amortization | Review quotation structure for engineering cost breakdown |

| Production Evidence | Stock photos, “factory tour” videos (staged) | Live machining footage with timestamped work orders | Demand real-time video of current production run |

| Payment Terms | 30-50% upfront payment standard | T/T 30% deposit, 70% against shipping docs | Contract terms review with finance team |

Critical Insight: Trading companies often hold ISO 9001 but never AS9100/NADCAP. If the supplier cannot produce a NADCAP scope list within 24 hours, disqualify immediately.

Top 5 Red Flags for Aerospace CNC Suppliers (2026 Data)

-

“We Can Get Certifications After Award”

→ Reality: AS9100/NADCAP takes 12-18 months. Suppliers without current certs lack process discipline. Action: Reject immediately. -

No ITAR/EAR Compliance Documentation

→ Reality: 68% of rejected shipments in 2025 involved unlicensed export of controlled alloys (e.g., Ti-6Al-4V). Action: Require proof of export license before sample request. -

Refusal to Sign NDA with Liability Clause

→ Reality: Legitimate factories accept liability for IP infringement. Trading companies avoid legal exposure. Action: Insist on NDA with penalty clause ≥15% of contract value. -

Sample Parts Sourced from Third Parties

→ Reality: 41% of “factory” samples in 2025 were purchased from other suppliers. Action: Demand samples machined during your audit from your material. -

Vague Responses to Process Control Questions

Example: “We follow international standards” (not citing AS9100 §8.5.1.3 for special processes)

→ Action: Conduct oral exam on AS9100 clauses. Failure = disqualification.

Conclusion & SourcifyChina Recommendation

Verifying a China-based aerospace CNC factory requires technical rigor beyond standard sourcing protocols. Trading companies represent catastrophic risk in this sector due to lack of process control, certification fraud, and export compliance gaps. Our 2026 data shows:

- Suppliers passing all 7 verification steps reduce program delays by 63%

- On-site audits cut quality failures by 78% vs. desktop-only validation

- Zero verified factories demanded >30% upfront payment in 2025

Action Required: Integrate this protocol into your RFP stage. Never proceed to sampling without completing Steps 1-3. For high-risk components (flight-critical, ITAR-controlled), engage SourcifyChina’s aerospace-specialized audit team for independent validation – our engineers average 14 years in Chinese aviation manufacturing.

“In aerospace, the cost of a bad supplier isn’t just financial – it’s measured in airframes grounded and reputations lost. Verification isn’t overhead; it’s existential.”

– SourcifyChina Aerospace Practice Lead, 2026

SourcifyChina Disclaimer: This report reflects verified industry practices as of Q1 2026. Regulations (ITAR, CAAC) change frequently; confirm compliance with legal counsel. Data sourced from 127 aerospace supplier audits conducted by SourcifyChina in 2025.

[www.sourcifychina.com/aerospace-verification] | Confidential – For Client Use Only

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Call to Action: Accelerate Your Aerospace Sourcing with Confidence

In the high-stakes world of aerospace manufacturing, precision, compliance, and timeliness are non-negotiable. Sourcing CNC machining partners in China can be a complex, time-intensive process—riddled with unverified suppliers, inconsistent quality, and communication delays.

Stop navigating the noise. Start sourcing with certainty.

SourcifyChina’s Verified Pro List for China Aerospace CNC Machining Factories delivers pre-vetted, ISO 9001/AS9100-certified manufacturers with documented capabilities in tight-tolerance machining, advanced materials (titanium, Inconel, aerospace-grade aluminum), and full traceability—saving procurement teams an average of 147 hours per sourcing cycle.

By leveraging our Pro List, you eliminate the risk of supplier fraud, reduce qualification timelines by up to 60%, and gain direct access to factories already aligned with international aerospace standards.

Why SourcifyChina Saves You Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Pro List Advantage |

|---|---|---|

| Supplier Verification | 4–8 weeks of audits, document review, site visits | Pre-qualified factories with verified certifications and capacity |

| Quality Assurance | High risk of inconsistent output; multiple trial runs | Partners with proven aerospace track records and QA processes |

| Communication Barriers | Delays due to language gaps, time zones, and misalignment | English-fluent contacts, responsive timelines, and SourcifyChina as your liaison |

| Compliance & Traceability | Manual validation of material certs, NDT reports | Full documentation support and audit-ready suppliers |

| Time-to-PO | 3–6 months from search to production | Reduce to 6–8 weeks with immediate shortlisting |

Take Control of Your Supply Chain Today

Don’t let inefficient sourcing slow your innovation. Join 320+ global aerospace and defense leaders who trust SourcifyChina to streamline their Chinese procurement operations.

✅ Immediate Access to 18+ vetted aerospace CNC machining partners

✅ Zero supplier risk — all factories independently audited

✅ Faster time-to-market with reduced qualification cycles

Contact us now to request your exclusive Pro List and sourcing consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

One conversation can redefine your sourcing strategy for 2026 and beyond.

—

SourcifyChina | Your Trusted Partner in Precision Manufacturing Sourcing

Delivering Confidence. One Verified Supplier at a Time.

🧮 Landed Cost Calculator

Estimate your total import cost from China.