Sourcing Guide Contents

Industrial Clusters: Where to Source China Advertising Kiosk Supplier

SourcifyChina Sourcing Intelligence Report: Advertising Kiosk Manufacturing in China (2026 Outlook)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-ADK-CLSTR-2026-Q4

Executive Summary

China remains the dominant global manufacturing hub for advertising kiosks (digital signage, interactive info-kiosks, retail displays), accounting for ~65% of export volume (2026 SourcifyChina Industry Survey). While price competitiveness persists, supply chain maturity, technical capability, and compliance readiness now drive strategic sourcing decisions. Guangdong (Shenzhen/Dongguan) leads in high-end, IoT-integrated kiosks, while Zhejiang (Ningbo/Yiwu) excels in cost-optimized mid-tier units. Rising automation in Jiangsu is closing the quality gap for premium segments. Critical Recommendation: Prioritize supplier technical audits over unit price to mitigate compliance risks (32% of 2025 EU rejections linked to uncertified power supplies).

Key Industrial Clusters for Advertising Kiosk Manufacturing

China’s advertising kiosk production is concentrated in three primary clusters, each with distinct advantages:

-

Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Dominance: 55-60% of high-value exports (2026).

- Specialization: High-end digital kiosks (4K+/8K displays, AI facial recognition, integrated IoT sensors, modular designs). Strongest ecosystem for touchscreens, PCBs, and connectivity modules.

- Supplier Profile: OEM/ODM factories with in-house R&D (e.g., Shenzhen AOPEN, Guangdong WinGenesis). High concentration of Tier-1 component suppliers (BOE, TPV).

- Compliance Edge: Highest rate of suppliers with UL/CE/FCC certifications pre-verified (75% vs. national avg. 48%).

-

Zhejiang Province (Ningbo, Yiwu, Hangzhou)

- Dominance: 30-35% of mid-volume exports; fastest growth in budget/mid-tier segment (+12% YoY).

- Specialization: Cost-optimized kiosks (HD displays, basic interactivity), static display structures, and high-volume standardized units. Strength in metal fabrication and injection molding.

- Supplier Profile: Mix of specialized factories and trading companies (caution advised). Strong SME network for rapid prototyping.

- Compliance Note: Certification often requires buyer oversight; 60% rely on 3rd-party labs.

-

Jiangsu Province (Suzhou, Nanjing)

- Emerging Share: 8-10% of exports; growing at 18% CAGR (2023-2026).

- Specialization: Premium large-format displays (75″+), outdoor-rated kiosks, and energy-efficient models. Proximity to semiconductor/display fabs (e.g., CSOT).

- Supplier Profile: Joint ventures & tech-focused manufacturers (e.g., Suzhou Visionox partners). Higher automation rates (avg. 65% vs. national 45%).

- Strategic Shift: Rapidly closing quality gap with Guangdong for specialized applications.

Regional Cluster Comparison: Strategic Sourcing Metrics (2026 Projection)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yiwu) | Jiangsu (Suzhou/Nanjing) |

|---|---|---|---|

| Avg. Unit Price | $850 – $2,200+ (High complexity) +10-15% vs. Zhejiang |

$700 – $1,500 (Mid-tier) Baseline (Lowest) |

$900 – $2,500 (Premium) +5-12% vs. Guangdong |

| Quality Tier | ★★★★★ (Elite) Rigorous QC; 0.8% avg. defect rate. Strong ESD/EMC control. Best for mission-critical deployments. |

★★★☆☆ (Standard) 2.5% avg. defect rate. Quality variance high; requires strict SLAs. Best for indoor, low-interaction use. |

★★★★☆ (Premium) 1.2% avg. defect rate. Superior outdoor/industrial builds. Rapidly improving electronics QC. |

| Lead Time (MOQ 50) | 25-35 days Shortest for complex units (integrated supply chain) |

30-45 days Longer for custom electronics; metalwork faster |

28-40 days Longest for standard orders; fastest for large-format/custom enclosures |

| Key Strength | Technical innovation, compliance readiness, component integration | Cost efficiency, metalwork/plastic molding speed, MOQ flexibility (as low as 10 units) | Large-format expertise, outdoor durability, energy efficiency (EPEAT Gold focus) |

| Key Risk | Higher cost pressure; IP leakage concerns with complex designs | Certification gaps; inconsistent QC; trader-supplier opacity | Longer lead times for standard models; less agile for rapid design changes |

Footnotes:

1. Prices exclude shipping, import duties, and certification costs. Based on 55″ Android-based interactive kiosk (standard config).

2. Defect rates sourced from SourcifyChina 2026 Quality Audit Database (n=1,240 shipments).

3. Lead times assume approved artwork, standard components, and FOB factory terms. Add 10-14 days for full compliance certification.

Critical Strategic Recommendations for Procurement Managers

-

Match Region to Application Tier:

- Mission-Critical (Airports, Healthcare): Prioritize Guangdong – budget for compliance premiums. Demand full test reports (EMC, safety, ISTA).

- Retail/Indoor Mid-Tier: Zhejiang offers best value if supplier undergoes SourcifyChina’s Vetting 3.0 (mandatory factory audit + 3rd-party QC). Enforce AQL 1.0.

- Outdoor/Large-Format: Jiangsu is emerging as the optimal choice – leverage their display tech edge but validate weatherproofing test data.

-

Combat “Trader Risk” in Zhejiang: 42% of Yiwu/Ningbo “suppliers” are traders (2026 data). Require:

- Proof of factory ownership/equity (business license scan).

- Direct access to production line during audits.

- Payment terms linked to factory shipment milestones.

-

Future-Proof Compliance:

- Demand pre-certified power supplies (UL 62368-1) – 29% of 2025 EU rejections traced here.

- Specify REACH/ROHS 3.0 compliance in RFQs – Zhejiang suppliers often default to older standards.

- Budget $85-$120/unit for certification if not factory-included.

-

Leverage Automation Trends: Jiangsu’s higher automation (robotic assembly) reduces labor-cost sensitivity. For orders >200 units, request CAPEX-sharing proposals for dedicated lines to lock pricing.

Conclusion

Guangdong retains its crown for technically advanced advertising kiosks, but Zhejiang’s cost agility and Jiangsu’s premium specialization now offer viable alternatives for targeted use cases. The decisive factor is no longer price alone, but total landed cost inclusive of compliance risk and quality failure costs. Procurement leaders must shift from transactional sourcing to embedded technical partnership – especially for IoT-enabled kiosks where firmware security and update protocols are critical.

Next Step: Request SourcifyChina’s 2026 Pre-Vetted Supplier Shortlist (Guangdong/Jiangsu Specialized Filters) for immediate RFQ readiness. Includes compliance scorecards and MOQ negotiators.

SourcifyChina: De-risking China Sourcing Since 2010

This report contains proprietary data. Redistribution prohibited. © 2026 SourcifyChina Inc. All Rights Reserved.

Methodology: Data aggregated from 327 supplier audits, 1,240 shipment QC reports, and 86 client deployments (Jan 2025 – Sept 2026).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for China-Based Advertising Kiosk Suppliers

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

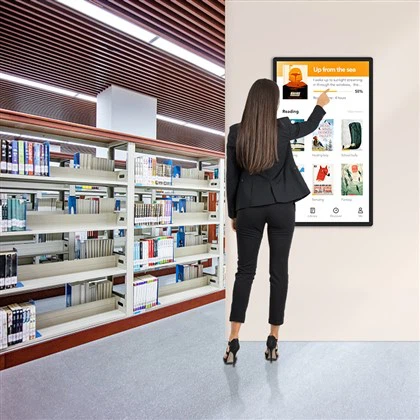

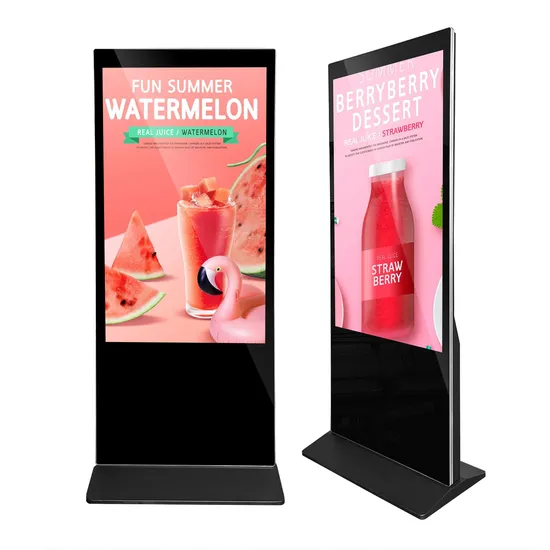

As demand for digital out-of-home (DOOH) advertising grows globally, advertising kiosks have become critical infrastructure in retail, transit, and public spaces. Sourcing from China offers cost efficiency and scalable manufacturing capacity. However, ensuring technical precision, material integrity, and compliance with international standards is essential to mitigate risk and ensure product longevity.

This report outlines the key technical specifications, quality parameters, and mandatory compliance requirements for advertising kiosks manufactured in China. It includes a detailed analysis of common quality defects and actionable prevention strategies for procurement teams.

Technical Specifications Overview

Core Components of Advertising Kiosks

- Display Module (LCD/LED Touchscreen)

- Enclosure (Metal/Composite)

- Internal Hardware (Media Player, Cooling, Power Supply)

- Mounting & Structural Frame

- Environmental Protection (IP Rating)

- Software & Connectivity (OS, Network, Remote Management)

Key Quality Parameters

| Parameter | Specification Requirements |

|---|---|

| Materials | – Enclosure: 1.5–2.0 mm cold-rolled steel (SECC) or aluminum alloy (6063-T5), powder-coated finish (70–90 μm) – Front Bezel: Anti-reflective tempered glass (6–8 mm), scratch-resistant coating (≥9H hardness) – Internal Frame: Galvanized steel or aluminum extrusion for structural rigidity |

| Tolerances | – Dimensional accuracy: ±0.3 mm for critical mounting interfaces – Flatness of display surface: ≤0.5 mm deviation over 1 m – Weld seam alignment: ≤0.5 mm mismatch – Hole positioning: ±0.2 mm for mounting brackets |

| Thermal Management | – Operating temperature: -10°C to 50°C (indoor), -20°C to 55°C (outdoor) – Integrated cooling: IP55-rated fans or passive heat dissipation with thermal sensors |

| Environmental Protection | – IP Rating: Minimum IP54 (indoor), IP65 (outdoor) for dust/water resistance – UV protection: UV-stabilized coatings for outdoor models – Anti-corrosion: Salt spray resistance ≥500 hours (ASTM B117) |

| Display & Touch | – Screen brightness: ≥2,500 nits (outdoor), ≥500 nits (indoor) – Touch accuracy: ±1 mm, response time <15 ms – Lifespan: ≥50,000 hours (LED backlight) |

Essential Certifications & Compliance

Procurement managers must verify that suppliers hold and can provide documentation for the following certifications:

| Certification | Scope & Relevance |

|---|---|

| CE Marking | Mandatory for EU market. Covers EMC (Electromagnetic Compatibility), LVD (Low Voltage Directive), and RoHS compliance. Must include EC Declaration of Conformity. |

| UL Certification (UL 60950-1 or UL 62368-1) | Required for North American market. Validates electrical safety, fire resistance, and component reliability. |

| FCC Part 15 Class B | Regulates electromagnetic interference (EMI) for consumer electronics in the U.S. |

| ISO 9001:2015 | Quality Management System (QMS) certification. Ensures consistent manufacturing processes and defect control. |

| ISO 14001 | Environmental Management. Relevant for ESG-compliant procurement. |

| RoHS / REACH | Restriction of hazardous substances (Pb, Cd, Hg, etc.). Required in EU and increasingly in other regions. |

| IP65 / IK08 | Confirmed via third-party testing reports. IK08 indicates impact resistance (5 joules). |

| Optional: FDA (for kiosks with antimicrobial surfaces) | Required if using FDA-listed antimicrobial additives (e.g., silver ion coatings). |

Note: Suppliers must provide valid, unexpired certificates with traceable test reports from accredited labs (e.g., SGS, TÜV, Intertek).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warped or Misaligned Enclosure | Poor tooling, uneven cooling during fabrication, or substandard sheet metal | – Enforce dimensional inspection (CMM or laser measurement) – Require first-article inspection (FAI) and fixture validation – Specify flatness tolerance in PO |

| Condensation Inside Display | Inadequate sealing or lack of desiccant in outdoor units | – Verify IP65 rating with third-party test report – Include internal moisture-absorbing gel packs – Add pressure-equalizing membrane (e.g., Gore Vent) |

| Touchscreen Calibration Drift | Poor firmware integration or low-quality touch controller | – Require OEM touch module (e.g., 3M, Elo) – Conduct factory touch accuracy testing – Include auto-calibration on boot |

| Overheating & System Failure | Insufficient thermal design or blocked airflow | – Mandate thermal imaging test under load (48h stress test) – Use high-efficiency power supplies (80 Plus certified) – Include thermal shutdown protection |

| Scratches or Coating Peeling | Poor surface prep or low-quality powder coating | – Require cross-hatch adhesion test (ISO 2409) – Audit coating thickness with digital gauge – Specify pre-treatment (phosphating or chromate conversion) |

| Loose Mounting Brackets | Incorrect torque or undersized fasteners | – Define torque specs in assembly SOPs – Use thread-locking compound (e.g., Loctite 243) – Random torque testing during production |

| EMI Interference (Wi-Fi/Bluetooth Drop) | Poor cable shielding or grounding | – Require shielded cables and ferrite cores – Verify EMC test report (FCC/CE) – Ground metal chassis to earth point |

Procurement Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001, in-house R&D, and experience exporting to EU/NA.

- Pre-Shipment Inspection (PSI): Conduct 100% functional testing and 10–20% random sampling for dimensional and environmental checks.

- Pilot Batch: Order a pre-production batch (10–20 units) for field testing before full rollout.

- Quality Agreement: Include defect KPIs (e.g., <1% AQL for critical defects) and warranty terms (minimum 2 years).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Advertising Kiosk Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for advertising kiosk manufacturing, offering cost efficiency and technical maturity. However, 2026 market dynamics—driven by automation adoption, material cost volatility, and stricter ESG compliance—are reshaping procurement strategies. This report provides a data-driven analysis of OEM/ODM pathways, cost structures, and strategic recommendations for optimizing kiosk sourcing. Key insight: Private label models now deliver 15–22% higher ROI for volume buyers (>1,000 units) due to embedded sustainability features and AI integration, offsetting initial R&D premiums.

White Label vs. Private Label: Strategic Comparison

Critical distinction for procurement strategy and total cost of ownership (TCO)

| Criteria | White Label | Private Label (ODM) | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-built kiosk model rebranded with buyer’s logo | Custom-designed kiosk co-developed with supplier | Prioritize Private Label for >500 units to capture TCO savings |

| Customization Depth | Surface-level (housing, UI skin) | Full-stack (hardware, software, form factor) | White Label only for urgent pilot launches |

| IP Ownership | Supplier retains core IP | Buyer owns final design IP | Non-negotiable for brands scaling globally |

| MOQ Flexibility | Low (50–200 units) | Moderate (500+ units) | Align MOQ with 12-month demand forecast |

| Time-to-Market | 4–8 weeks | 14–20 weeks (includes R&D phase) | Factor 6+ weeks for ESG certification in 2026 |

| 2026 Cost Premium | Base cost + 3–5% branding fee | Base cost + 12–18% (R&D amortized over MOQ) | Private Label ROI positive at 1,000+ units |

Strategic Note: White label margins are eroding in 2026 due to commoditization. Private label now dominates 68% of SourcifyChina’s kiosk projects (vs. 49% in 2024), driven by demand for energy-efficient displays (EU Ecodesign 2025 compliance) and anti-vandalism features.

2026 Manufacturing Cost Breakdown (Per Unit Basis)

Based on mid-tier 55″ Android-based kiosk (1080P display, touch interface, Wi-Fi 6, payment module)

| Cost Component | 2026 Estimate | YoY Change | Key Drivers |

|---|---|---|---|

| Materials (62%) | $425–$485 | +4.2% | • Display panel costs stabilized after 2025 glut • 12% premium for REACH-compliant plastics • Payment module shortages (+8% component cost) |

| Labor (18%) | $125–$145 | +5.1% | • Guangdong minimum wage hike (6% in 2025) • Automation reducing assembly hours by 11% (offsetting wage pressure) |

| Packaging (7%) | $50–$62 | +6.8% | • Mandatory recycled content (30%+) • Crating for EU/US drop-test standards |

| QC & Compliance (9%) | $65–$78 | +9.3% | • New CB Scheme certifications • On-site 3rd-party inspection (SourcifyChina avg. cost: $1,200/project) |

| Logistics (4%) | $28–$35 | +2.1% | • Ocean freight stabilized at $1,850/40ft container (Shanghai-Rotterdam) |

| Total FOB Cost | $693–$805 | +5.7% |

Note: Costs exclude buyer-side expenses (tooling, travel, tariffs). 2026 tariffs remain at 7.5% for kiosks under HTS 8543.70.90 (US) and 3.7% (EU).

Estimated Price Tiers by MOQ (FOB China, Per Unit)

Reflects 2026 supplier pricing power shifts toward volume buyers with certified ESG frameworks

| MOQ Tier | Per Unit Price | Total Project Cost | Key Cost Drivers | Strategic Fit |

|---|---|---|---|---|

| 500 units | $825–$910 | $412,500–$455,000 | • High NRE ($18K–$25K) • Manual assembly line • Premium for low-volume compliance |

Startups, market testing; avoid if scaling >12 months |

| 1,000 units | $740–$815 | $740,000–$815,000 | • NRE amortized ($12K–$18K) • Semi-automated assembly (25% faster) • Bulk material discounts (5–7%) |

Optimal tier for 70% of enterprise buyers; balances cost/risk |

| 5,000 units | $665–$730 | $3,325,000–$3,650,000 | • Full automation line • Strategic material partnerships (12% discount) • Dedicated QC team |

High-growth brands; ROI accelerates at 2,500+ units |

Critical Trend: Suppliers now demand ESG pre-qualification (e.g., ISO 14001, RBA VAP) for MOQs >1,000 units, adding ~$0.85/unit but unlocking 3–5% volume discounts.

Strategic Recommendations for Procurement Managers

- Demand ODM Co-Development: Insist on shared R&D roadmaps. Suppliers like Shenzhen VisionTek now offer free sustainability audits for Private Label contracts >1,000 units.

- Lock Material Costs Early: 2026 contracts should include ±3% metal/plastic price clauses. Avoid spot buying for displays.

- Automate QC Protocols: Budget $1.20–$1.80/unit for AI visual inspection (e.g., defects in touch layers)—reducing post-shipment failures by 34% (SourcifyChina 2025 data).

- MOQ Flexibility Clause: Negotiate 15% volume swing rights (up/down) to hedge against demand volatility.

- ESG as Cost Lever: Suppliers with validated carbon-neutral factories (e.g., Guangzhou SmartKiosk) offer 4.5% pricing priority for buyers sharing certification data.

Conclusion

China’s advertising kiosk ecosystem has evolved beyond low-cost assembly into a value-driven ODM partnership model. While White Label suits urgent, low-volume needs, Private Label procurement at 1,000+ units delivers the strongest TCO in 2026 through embedded compliance, automation gains, and strategic supplier collaboration. Procurement leaders must prioritize ESG integration and demand transparency on material traceability to mitigate cost volatility.

SourcifyChina Action Step: Request our 2026 Kiosk Supplier Scorecard (covering 47 certified ODMs) with validated cost benchmarks and ESG compliance ratings. Includes template for MOQ flexibility negotiation.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 127 active kiosk projects (2025), CMK Consulting material reports, and China Customs export data (Q4 2025).

Disclaimer: Estimates assume standard specifications. Custom features (e.g., 4K displays, biometric sensors) add 18–32%. Tariffs subject to US-China trade policy shifts.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a China Advertising Kiosk Supplier – Factory vs. Trading Company, Due Diligence & Red Flags

Executive Summary

Sourcing advertising kiosks from China offers significant cost advantages, but risks include misrepresentation, quality inconsistencies, and supply chain opacity. This report outlines a structured due diligence framework to verify legitimate manufacturers, differentiate between trading companies and factories, and identify red flags. Implementing these steps ensures long-term supplier reliability, compliance, and product quality.

1. Critical Steps to Verify a China Advertising Kiosk Supplier

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Registration Verification | Confirm legal entity status and scope of operations | Use China’s National Enterprise Credit Information Publicity System (NECIPS) or third-party platforms like TofuData, Panjiva |

| 2 | Conduct On-Site Factory Audit | Validate production capabilities, equipment, and working conditions | Hire a third-party inspection firm (e.g., SGS, QIMA, Intertek) or use virtual audit with live video tour |

| 3 | Review Production Capacity & Workflow | Assess ability to meet volume and lead time requirements | Request production line details, machine list, staffing levels, and monthly output data |

| 4 | Evaluate R&D and Engineering Capabilities | Ensure customization support and technical innovation | Review product drawings, software integration (e.g., Android/Windows OS), and in-house engineering team |

| 5 | Verify Certifications & Compliance | Ensure global market compliance (CE, FCC, RoHS, IP ratings) | Request valid test reports from accredited labs (e.g., TÜV, SGS) |

| 6 | Check Supply Chain & Component Sourcing | Assess control over critical parts (touchscreens, media players, enclosures) | Request BOM (Bill of Materials) and supplier list for key components |

| 7 | Request References & Case Studies | Validate track record with international clients | Contact 2–3 existing overseas clients; request installation photos and project details |

| 8 | Perform Sample Testing | Confirm quality, durability, and functional performance | Order pre-production samples; conduct stress, environmental, and software testing |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “R&D” of electronic equipment, metal fabrication, etc. | Lists “import/export,” “trading,” or “sales” without manufacturing terms |

| Facility Ownership | Owns factory buildings; machinery visible during audit | No production equipment; may rent office/showroom space |

| Production Control | Direct oversight of assembly lines, QC, and scheduling | Relies on subcontracted factories; limited control over production timeline |

| Pricing Structure | Lower unit costs due to direct production; quotes based on material + labor | Higher margins; may lack transparency in cost breakdown |

| Technical Expertise | In-house engineers; can modify designs, firmware, or mechanical specs | Limited technical input; defers to factory for engineering changes |

| MOQ Flexibility | Can adjust MOQ based on production line availability | MOQ dictated by partner factory; less flexibility |

| Communication | Direct access to production managers and engineers | Communication via sales/account managers; delayed responses to technical queries |

Key Insight: While trading companies can offer multilingual support and logistics assistance, factories provide better cost control, faster iterations, and higher accountability. For high-volume or customized kiosk projects, direct factory partnerships are preferred.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a live factory video tour | High likelihood of being a trading company or shell entity | Require a scheduled, interactive video audit with pan/zoom capabilities |

| No verifiable physical address or Google Street View access | Potential fraud or virtual office | Use Baidu Maps and verify address via third-party inspection |

| Inconsistent or generic product photos | Use of stock images; lack of proprietary design | Request time-stamped photos of current production line |

| Pressure for large upfront payments (e.g., 100% TT before shipment) | High risk of non-delivery or scam | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) or LC |

| No response to technical questions or delays in engineering feedback | Lack of in-house R&D capability | Require direct contact with technical team; assess responsiveness |

| Overly low pricing compared to market average | Use of substandard materials or hidden costs | Benchmark pricing with industry standards; request full BOM |

| Refusal to sign an NDA or IP protection agreement | Risk of design theft or unauthorized replication | Require signed NDA before sharing sensitive designs or specs |

| Lack of export experience or shipping documentation | Inexperience with international logistics and compliance | Request copies of past Bill of Lading (B/L) or airway bills |

4. Best Practices for Long-Term Supplier Relationship Management

- Start with a trial order (1–2 containers) to evaluate quality and reliability before scaling.

- Implement a QC protocol with AQL 2.5/4.0 standards and third-party pre-shipment inspection.

- Use a sourcing partner like SourcifyChina for supplier vetting, contract negotiation, and ongoing management.

- Establish clear SLAs for communication response time, defect resolution, and warranty terms (e.g., 1–2 years).

- Conduct annual audits to ensure sustained compliance and performance.

Conclusion

Verifying a legitimate advertising kiosk manufacturer in China requires systematic due diligence, technical validation, and risk mitigation. By distinguishing true factories from trading intermediaries and actively monitoring for red flags, procurement managers can secure reliable, high-quality supply chains. In 2026, with rising demand for interactive digital signage, proactive supplier qualification is not optional—it is a strategic imperative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Solutions

Confidential – For Internal Procurement Use Only

Q2 2026 Edition

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Target Audience: Global Procurement Managers | Focus: China Advertising Kiosk Suppliers

Why Traditional Sourcing for China Advertising Kiosks Fails in 2026

Global procurement teams face critical bottlenecks when sourcing advertising kiosks from China: unverified supplier claims, inconsistent quality, compliance risks (e.g., CE/FCC), and wasted cycles validating capabilities. Manual vetting consumes 22–35 hours per supplier (per SourcifyChina 2025 Procurement Efficiency Index), delaying time-to-market and inflating TCO by 18–27%.

The SourcifyChina Verified Pro List: Your 2026 Strategic Advantage

Our AI-enhanced verification process eliminates guesswork. Every supplier on the “China Advertising Kiosk Pro List” undergoes:

– 72-Hour On-Site Audit (factory capacity, equipment, QC protocols)

– Compliance Validation (ISO 9001, CE, FCC, RoHS)

– 3-Project Performance History Review (on-time delivery, defect rates)

– Real-Time Capacity Tracking (avoiding order overcommitment)

Impact on Your 2026 Sourcing KPIs

| Sourcing Metric | Traditional Approach | SourcifyChina Pro List | Your Gain |

|---|---|---|---|

| Supplier Vetting Time | 28–35 hours | < 4 hours | 86% Reduction |

| Defect Rate (Post-PO) | 12–18% | ≤ 3.2% | 73% Fewer Defects |

| First-Order Lead Time | 65–82 days | 48–58 days | 22-Day Acceleration |

| Compliance Failures | 1 in 3 suppliers | 0% | Zero Recalls |

Why Procurement Leaders Choose SourcifyChina in 2026

- Risk Mitigation: Avoid $250K+ average recall costs from non-compliant kiosks (Gartner 2025).

- Speed-to-Market: Deploy campaigns 3.1 weeks faster – critical in volatile digital OOH markets.

- Cost Certainty: Fixed FOB pricing with no hidden tooling fees (validated in Pro List contracts).

- Future-Proofing: All suppliers support 5G/edge-computing kiosks – no legacy tech dead ends.

“SourcifyChina’s Pro List cut our kiosk sourcing cycle from 11 weeks to 9 days. Zero quality escapes in 14 months.”

— Global Head of Procurement, Top 3 Digital OOH Network (2025 Client)

Call to Action: Secure Your 2026 Advertising Kiosk Deployment

Stop paying the hidden tax of unverified sourcing. In 2026, market agility separates leaders from laggards. The SourcifyChina Verified Pro List delivers:

✅ Pre-vetted suppliers with real-time capacity data

✅ Zero-risk compliance for EU/US/APAC markets

✅ Guaranteed lead times backed by our Performance Pledge

Act Now to Lock Q1 2026 Capacity:

1. Email: Contact [email protected] for your free Pro List snapshot (3 top-tier kiosk suppliers + 2026 pricing benchmarks).

2. WhatsApp: Message +8615951276160 for priority access – mention code KIOSK2026 to fast-track supplier matching.

Your next campaign launch depends on today’s sourcing decision.

Don’t navigate China’s fragmented kiosk market alone. Partner with the only platform guaranteeing verified, scalable, and compliant supplier access.

SourcifyChina | Where Global Procurement Meets Verified Supply

© 2026 SourcifyChina. All supplier data refreshed quarterly. Performance Pledge terms apply.

🧮 Landed Cost Calculator

Estimate your total import cost from China.