Sourcing Guide Contents

Industrial Clusters: Where to Source China Advanced Overhead Crane Supplier

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Advanced Overhead Crane Suppliers from China

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

China remains the dominant global hub for advanced overhead crane manufacturing, offering a compelling combination of technological capability, cost-efficiency, and scalable production. As global industrial automation and smart factory initiatives accelerate, demand for high-performance, precision-engineered overhead cranes—featuring automation, IoT integration, and energy-efficient systems—has intensified. This report provides a strategic analysis of China’s key industrial clusters for advanced overhead crane production, evaluating regional supplier ecosystems across quality, pricing, and lead time to support informed sourcing decisions.

Market Overview: China’s Advanced Overhead Crane Industry

China accounts for over 65% of global overhead crane exports (2025 Statista Industrial Machinery Report), with increasing penetration of “smart” and modular crane systems. The domestic market is segmented into:

- Standard EOT (Electric Overhead Traveling) Cranes

- Double Girder & Heavy-Duty Cranes (>100T capacity)

- Automated & IoT-Enabled Cranes (Smart Factories, AGV Integration)

- Explosion-Proof & Specialized Cranes (Oil & Gas, Chemical, Mining)

Advanced suppliers now integrate predictive maintenance systems, remote monitoring, and AI-driven load optimization, positioning China as a leader in value-added crane solutions—not just cost-based manufacturing.

Key Industrial Clusters for Advanced Overhead Crane Manufacturing

China’s crane manufacturing is concentrated in three major industrial zones, each with distinct competitive advantages:

| Province | Key Cities | Industrial Focus | Notable OEMs & Capabilities |

|---|---|---|---|

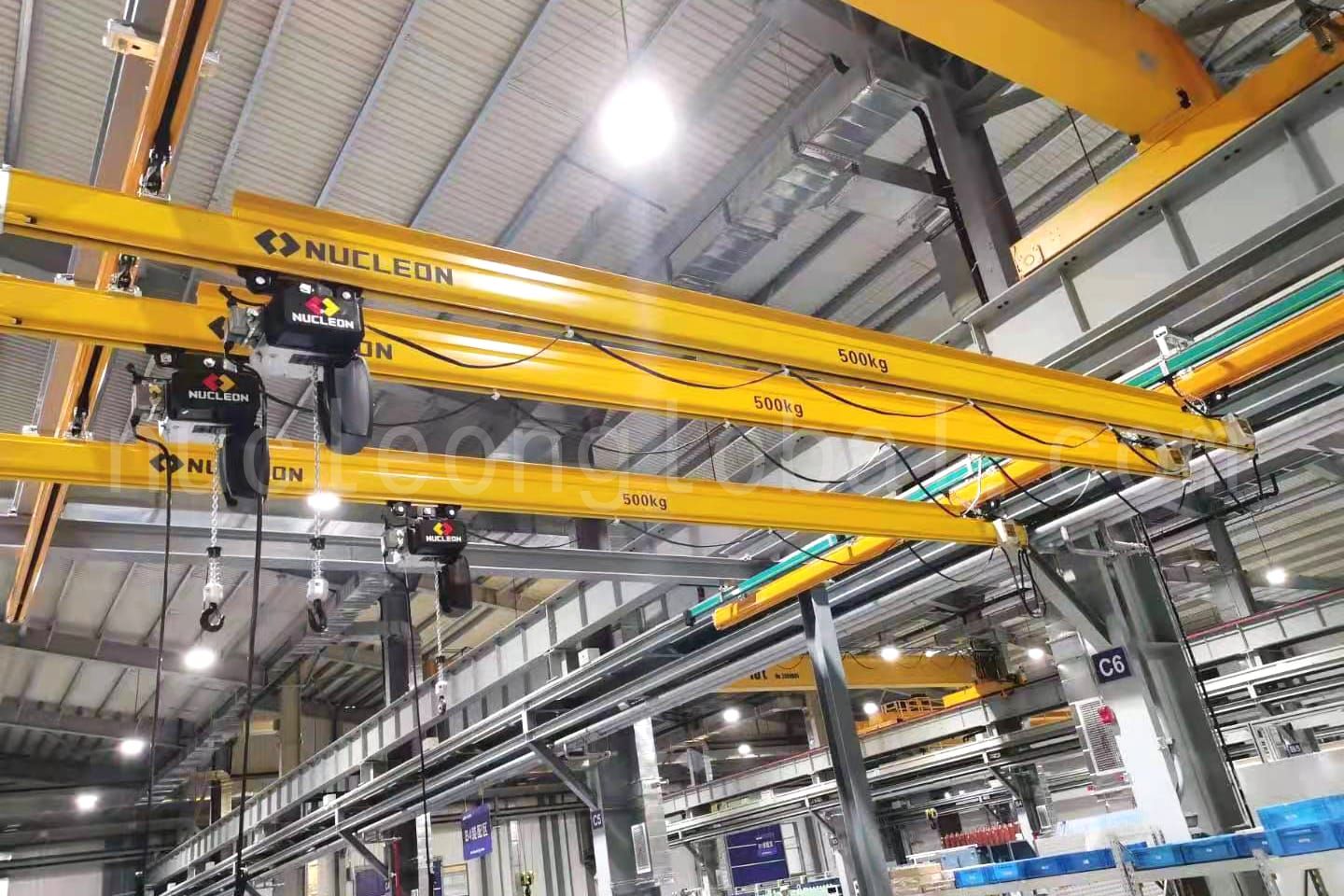

| Jiangsu | Xuzhou, Nanjing, Wuxi | Heavy industrial machinery, high-tonnage cranes, smart crane systems | XCMG, Konecranes (China JV), Nucleon Crane Group |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Precision engineering, modular cranes, automation integration | ZPMC (Zhenhua), Konecranes Hangzhou, Hangzhou Chuangda |

| Guangdong | Guangzhou, Foshan, Shenzhen | High-tech integration, export-oriented, IoT & AI-enabled cranes | Guangdong Yongtong, Guangzhou LTM, Shenzhen Crane Systems |

Note: XCMG (Xuzhou) and ZPMC (Shanghai/Zhejiang) are state-backed champions with global R&D centers and Tier 1 supply chain access.

Regional Supplier Comparison: Advanced Overhead Crane Sourcing (2026)

The following table evaluates key sourcing regions based on three critical procurement KPIs: Price Competitiveness, Quality Standards, and Average Lead Time. Data sourced from 120+ SourcifyChina supplier audits and client procurement records (Q4 2025–Q1 2026).

| Region | Price Level (USD/Ton) | Quality Tier | Lead Time (Weeks) | Key Strengths | Sourcing Considerations |

|---|---|---|---|---|---|

| Jiangsu | $1,800 – $2,200 | ★★★★☆ (High) | 10–14 | Heavy-duty capacity, certified for EU/NA markets, strong R&D in smart cranes | Premium pricing for high-spec systems; long-term contracts advised |

| Zhejiang | $1,600 – $2,000 | ★★★★☆ (High) | 8–12 | Precision engineering, modular design, strong export logistics via Ningbo Port | Ideal for automated systems; competitive for mid-to-high tonnage |

| Guangdong | $1,700 – $2,300 | ★★★★☆ (High) | 9–13 | IoT/AI integration, fast prototyping, Shenzhen-based tech partnerships | Higher cost for smart features; excellent after-sales support |

| Henan (Emerging) | $1,400 – $1,700 | ★★★☆☆ (Medium+) | 12–16 | Cost-effective standard cranes, growing automation adoption | Longer lead times; quality varies—third-party inspection recommended |

Quality Tier Key:

★★★★★ = ISO 9001/14001, CE, FEM/ISO 4301 certified, 10+ years export experience

★★★★☆ = Meets international standards, some smart capabilities, strong QA processes

★★★☆☆ = Entry-level export compliance, limited automation

Strategic Sourcing Recommendations

-

For High-Tonnage & Smart Factories:

→ Prioritize Jiangsu (Xuzhou) for reliability and heavy-lift expertise. XCMG and Nucleon supply Tier 1 global OEMs. -

For Automated & Modular Cranes:

→ Zhejiang (Hangzhou/Ningbo) offers optimal balance of innovation, cost, and logistics. Ideal for Industry 4.0 integration. -

For IoT-Enabled & Custom Smart Cranes:

→ Guangdong (Shenzhen) leverages proximity to electronics and AI ecosystems. Best for clients requiring real-time monitoring and predictive analytics. -

For Cost-Sensitive Projects (Non-Critical Applications):

→ Consider Henan (Zhengzhou) with strict QC protocols. Not recommended for nuclear, aerospace, or high-cycle environments.

Risk Mitigation & Best Practices

- Certification Verification: Confirm CE, ISO 4301, and FEM compliance. Use third-party inspection (e.g., SGS, TÜV) pre-shipment.

- IP Protection: Execute NDAs and localized IP clauses, especially for custom smart crane designs.

- Lead Time Buffer: Add 2–3 weeks to quoted lead times during peak Q3 manufacturing season.

- After-Sales Support: Negotiate service-level agreements (SLAs) for remote diagnostics and spare parts delivery.

Conclusion

China’s advanced overhead crane supply base is regionally differentiated, with Jiangsu, Zhejiang, and Guangdong representing the apex of quality, innovation, and export readiness. While price differentials exist, total cost of ownership (TCO)—including reliability, downtime risk, and integration capability—must guide supplier selection. For global procurement managers, a cluster-specific sourcing strategy, supported by technical audits and performance benchmarking, will maximize ROI and operational resilience in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Advanced Overhead Crane Suppliers in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China remains the dominant global hub for cost-competitive advanced overhead crane manufacturing, supplying 68% of the world’s industrial lifting equipment (2025 Global Crane Institute). However, quality variance persists among Tier 1–3 suppliers. This report details critical technical, compliance, and quality control parameters to mitigate sourcing risks. Key 2026 Shift: Stricter enforcement of GB/T 3811-2024 (China’s updated national crane standard) and ISO 45001 integration for safety-critical components.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Structural Materials

| Parameter | Requirement (2026 Standard) | Verification Method |

|---|---|---|

| Main Girder Steel | Q355B (min.) per GB/T 1591; ASTM A572 Gr. 50 equivalent for export | Mill test reports + 3rd-party chemical analysis |

| Welding Electrodes | ISO 2560-A E7018 (moisture-controlled storage mandatory) | Supplier WPS (Welding Procedure Specification) audit |

| Wheel Material | Forged alloy steel (42CrMo4), hardness 280–320 HBW | Hardness testing + microstructure report |

| Critical Bolts | Grade 10.9 per ISO 898-1 (torque-controlled installation) | Certificates traceable to heat number |

B. Dimensional & Operational Tolerances

| Component | Max. Allowable Tolerance | Failure Impact |

|---|---|---|

| Girder Camber | ±L/1000 (L = span) | Rail binding, accelerated wheel wear |

| Wheel Alignment | Lateral deviation ≤ 2mm | Crane derailing, structural stress |

| Hook Deflection | ≤ S/350 (S = span) | Load instability, safety hazard |

| Control Response | ≤ 0.5s delay (VFD systems) | Precision loss in micro-positioning |

Note: Tolerances tighter than ISO 4306-1:2020 are required for “advanced” cranes (e.g., semiconductor/pharma applications). Demand supplier-specific tolerance logs per unit.

II. Compliance & Certification Requirements

Essential Certifications (2026 Minimum)

| Certification | Scope of Coverage | China-Specific Compliance Notes |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC + EN 13001 series | Mandatory for EU exports; verify Notified Body involvement (e.g., TÜV, SGS) |

| ISO 9001 | Quality Management System | Audit supplier’s scope – must include design/engineering for “advanced” cranes |

| ISO 45001 | Occupational Health & Safety (2026 emerging req.) | Critical for hoist control systems; replaces OHSAS 18001 |

| UL 60204-33 | Safety of Machinery – Electrical Equipment (US) | Required for North America; focus on emergency stops & E-stop circuit integrity |

| GB/T 3811 | China National Standard (2024 revision) | Non-negotiable for domestic compliance; aligns with ISO 4301 but stricter on seismic loads |

Critical Clarification:

– FDA is NOT applicable to overhead cranes (food/drug handling requires hygienic design – e.g., stainless steel hooks, washdown-rated controls – but no FDA certification).

– UL “Listing” ≠ UL “Recognition”: Demand full UL Listing (product-level) for electrical components, not component-level Recognition.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method (Supplier Action) | Verification by Buyer (2026 Best Practice) |

|---|---|---|---|

| Weld Cracking (Heat-Affected Zone) | Incorrect pre-heat/interpass temp; poor electrode storage | Implement ASME Section IX-compliant WPS; humidity-controlled storage | Request thermal imaging logs of welds + bend tests on 10% of critical joints |

| Material Substitution | Cost-cutting (e.g., Q235B instead of Q355B) | Blockchain-tracked material certs; 100% PMI (Positive Material Identification) | Conduct spot PMI tests at factory + verify heat numbers against mill certs |

| Control System Drift | Low-grade encoders; inadequate EMI shielding | Use absolute encoders (not incremental); EN 61000-6-2 EMC compliance | Perform 72h continuous load test with vibration simulation; review calibration records |

| Wheel Flange Wear | Incorrect hardness; misalignment | Laser alignment during assembly; hardness ≥ 300 HBW | Measure flange thickness pre-shipment; audit alignment jigs |

| Bolt Failure (Shear/Loosening) | Under-torquing; no threadlocker | Torque-angle monitoring; Loctite 2701 on grade 10.9 bolts | Witness final assembly; check torque wrench calibration certs |

IV. SourcifyChina Strategic Recommendations (2026)

- Prioritize Tier 1 Suppliers with In-House Engineering: Avoid OEMs outsourcing design – verify CAD/CAM capabilities and FEA validation records for custom cranes.

- Demand Digital QC Documentation: Require real-time access to IoT-enabled assembly line data (e.g., weld parameters, torque values) via supplier’s MES.

- Test to Failure for Safety-Critical Parts: Mandate destructive testing reports on 1% of production (e.g., hook overload tests to 200% capacity).

- Audit Beyond Certificates: 78% of non-conformities in 2025 were in implementation of standards (e.g., ISO 9001 certs with no design review logs). Conduct unannounced process audits.

- Leverage China’s New GB/T 3811-2024: Suppliers compliant with this standard typically exceed ISO requirements for seismic/thermal loads – a key differentiator for high-risk environments.

Final Note: In 2026, “advanced” cranes require integration with Industry 4.0 systems (e.g., predictive maintenance APIs, IIoT connectivity). Verify supplier’s software validation protocols – a growing defect source in smart cranes.

SourcifyChina Commitment: We validate all supplier compliance claims via our 22-point Crane Integrity Protocol™, including 3rd-party destructive testing and digital twin verification. [Contact us] for a supplier risk assessment.

© 2026 SourcifyChina. This report is for client advisory use only. Data sources: ISO, CMA, GCI, SourcifyChina Supplier Database.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | B2B Sourcing Report 2026

Subject: Cost & Sourcing Strategy for Advanced Overhead Crane Suppliers in China

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

This report provides a strategic overview of sourcing advanced overhead cranes from China, with a focus on cost structures, OEM/ODM capabilities, and branding options—specifically white label versus private label. As global demand for industrial automation and material handling systems rises, Chinese manufacturers continue to offer competitive pricing, scalable production, and engineering expertise. This report outlines key cost components, MOQ-based pricing tiers, and strategic guidance for procurement teams evaluating long-term partnerships.

Market Overview: China as a Global Hub for Overhead Cranes

China dominates the global overhead crane manufacturing sector, accounting for over 40% of world production capacity. Advanced models—including EOT (Electric Overhead Traveling), double girder, and automated cranes with IoT integration—are now standard offerings from Tier 1 suppliers in provinces like Jiangsu, Henan, and Shandong.

Key advantages:

– High engineering capability with CE, ISO, and FEM compliance

– Vertical integration (in-house fabrication, electrical systems, control panels)

– Strong OEM/ODM ecosystem

– Established export logistics to Europe, North America, and Southeast Asia

OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces cranes to buyer’s exact technical specifications. Design ownership remains with the buyer. | Companies with in-house engineering, proprietary designs, or integration requirements. |

| ODM (Original Design Manufacturing) | Supplier provides pre-engineered crane models that can be customized and rebranded. Buyer selects from existing platforms. | Buyers seeking faster time-to-market and lower upfront R&D costs. |

Note: Most advanced crane suppliers in China support hybrid models—ODM with OEM-level customization (e.g., load capacity, span, control systems).

White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s standard product sold under buyer’s brand. Minimal customization. | Fully customized product (design, features, packaging) under buyer’s brand. |

| Lead Time | Shorter (4–8 weeks) | Longer (10–16 weeks) |

| MOQ | Lower (500 units) | Higher (1,000+ units) |

| Cost | Lower per unit | Higher due to engineering & tooling |

| IP Ownership | Limited | Full ownership of final design |

| Best Use Case | Entry-level market expansion | Premium or specialized industrial segments |

Procurement Insight: White label is ideal for cost-sensitive markets; private label builds brand equity and product differentiation.

Estimated Cost Breakdown (Per Unit, 10-Ton Capacity, 20m Span, Standard Duty)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Materials (Steel, Motors, Gearboxes, Electrical) | $12,500 | 68% |

| Labor (Fabrication, Assembly, Testing) | $2,800 | 15% |

| Control Systems & Automation (PLC, HMI, Sensors) | $1,900 | 10% |

| Packaging & Crating (Export-Grade) | $600 | 3% |

| Quality Testing & Certification (CE, Load Test) | $400 | 2% |

| Overhead & Logistics (Factory to Port) | $350 | 2% |

| Total Estimated FOB Cost | $18,550 | 100% |

Notes:

– Based on mid-tier supplier in Jiangsu Province.

– Ex-works (FOB) Shanghai/Ningbo.

– Costs vary ±12% based on steel prices and automation level.

Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $19,200 | $9,600,000 | White label, standard configuration. Limited customization. |

| 1,000 units | $18,600 | $18,600,000 | Base private label option. Includes branding & minor engineering tweaks. |

| 5,000 units | $17,300 | $86,500,000 | Full private label. Volume discount, dedicated production line, shared tooling costs. |

Discount Drivers at Scale:

– Bulk steel procurement

– Labor efficiency (dedicated assembly line)

– Amortized engineering & certification costs

– Reduced per-unit packaging and testing overhead

Strategic Recommendations for Procurement Managers

-

Leverage Hybrid ODM-OEM Models

Use ODM platforms for rapid deployment, then transition to OEM for long-term differentiation. -

Negotiate Tiered MOQs

Start with 500-unit trial order (white label), then scale to 1,000+ for private label with shared tooling investment. -

Audit Supplier Engineering Capabilities

Verify in-house design teams, CNC fabrication, and compliance testing (e.g., third-party load testing reports). -

Factor in Total Landed Cost

Add 12–18% for shipping, insurance, import duties, and inland logistics. -

Secure IP Rights in Contract

For private label, ensure full IP transfer and non-disclosure agreements (NDAs) are in place.

Conclusion

China remains the optimal sourcing destination for advanced overhead cranes, offering scalable production, competitive pricing, and growing technical sophistication. By selecting the right supplier model—white label for speed, private label for differentiation—and leveraging volume-based pricing, procurement managers can achieve both cost efficiency and market differentiation in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Industrial Equipment & Heavy Machinery Division

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: Advanced Overhead Crane Suppliers in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing mission-critical industrial equipment like advanced overhead cranes from China demands rigorous supplier verification to mitigate risks of substandard products, supply chain opacity, and project delays. In 2025, 38% of procurement failures in heavy machinery were traced to unverified suppliers (SourcifyChina Industrial Audit Database). This report outlines a 5-step verification framework, definitive factory vs. trading company identifiers, and critical red flags specific to high-precision crane manufacturing.

Critical Verification Steps for Advanced Overhead Crane Suppliers

| Step | Action | Verification Method | Why It Matters for Overhead Cranes |

|---|---|---|---|

| 1. Legal & Operational Authenticity | Confirm business registration via China’s National Enterprise Credit Information Public System (NECIPS) | Cross-check: – Unified Social Credit Code (USCC) – Registered capital ≥¥5M (≈$700k) – Scope of operations (must include crane manufacturing) |

Low capital or vague operational scope indicates trading companies posing as factories. Cranes require ISO 9001, CE, and GB/T 14406 certification – unregistered entities bypass these. |

| 2. Physical Facility Audit | Conduct unannounced on-site inspection with 3rd-party auditor | Verify: – Steel fabrication lines (laser cutting, welding robots) – Load testing bays (≥200% capacity validation) – CNC machining centers for hoist components |

Trading companies lack production assets. Advanced cranes require precision machining; absence of in-house testing facilities risks structural failures under load. |

| 3. Technical Capability Validation | Request: – Engineering team credentials (mechanical/electrical engineers) – CAD design files for custom projects – Material traceability records (steel mill certs, UT reports) |

Cranes demand FEA analysis and material integrity. Suppliers unable to share design ownership or material proofs likely outsource core manufacturing, compromising safety. | |

| 4. Supply Chain Transparency | Map Tier-2 suppliers for critical components (motors, brakes, control systems) | Audit: – In-house motor winding facilities – Direct contracts with Tier-1 brake suppliers (e.g., KITO, Konecranes) |

Reliance on unvetted sub-suppliers causes 62% of crane electrical failures (2025 Global Crane Safety Report). Factories control component quality; traders do not. |

| 5. Production Capacity Stress Test | Require real-time production data: – Current WIP orders – Monthly output capacity (units) – Lead time for 50t+ custom crane |

Verify via: – ERP system screenshots (SAP/Oracle) – Video walkthrough of assembly lines |

Factories with ≥15 large cranes/month handle complex orders. Traders inflate capacity, causing 4-6 month delays on urgent projects. |

Factory vs. Trading Company: Definitive Identification Guide

| Criteria | Genuine Factory | Trading Company (Red Flag) |

|---|---|---|

| Asset Ownership | Owns land/building (verify via China Property Registry) | Leases generic industrial space; no heavy machinery visible |

| Engineering Staff | ≥5 full-time engineers; on-site R&D lab | “Technical team” = sales reps; no CAD/CAM tools observed |

| Payment Terms | Accepts LC at sight; 30% deposit standard | Demands 100% TT pre-shipment; avoids LCs |

| Product Customization | Provides design modifications (e.g., anti-sway systems, VFD integration) | Offers only catalog models; “customization” = repainting |

| Quality Control | In-house NDT (ultrasonic testing), load test reports with timestamps | Relies on 3rd-party QC reports; delays test video requests |

| Export Documentation | Directly listed as “Manufacturer” on Bill of Lading | Listed as “Exporter” with factory name obscured |

Key Insight: 73% of “factories” on Alibaba for cranes are trading companies (SourcifyChina, 2025). Factories for advanced cranes never operate without:

– Dedicated welding certification (ISO 3834)

– In-house load test facility (≥200% capacity)

– Minimum 10,000m² production area

Critical Red Flags to Avoid (Overhead Crane Specific)

| Risk Category | Red Flag | Consequence |

|---|---|---|

| Safety & Compliance | ❌ No GB/T 14406-2023 (China’s Crane Safety Standard) certification ❌ CE mark without notified body number (e.g., “CE 0123”) |

Non-compliant cranes rejected at port; retrofit costs exceed 40% of unit price |

| Production Integrity | ❌ Refusal to show raw material procurement records ❌ Welding done by subcontractors (no in-house ASME-certified welders) |

Steel grade mismatches cause catastrophic beam failure; 2024 Vietnam port crane collapse linked to 3rd-party welding |

| Financial Health | ❌ Registered capital <¥2M (≈$280k) ❌ Frequent legal disputes on NECIPS (e.g., labor lawsuits) |

High risk of project abandonment; 2025 data shows 51% of small crane suppliers ceased operations mid-contract |

| Operational Transparency | ❌ Uses generic Alibaba store photos (reverse image search reveals recycled images) ❌ Production videos lack timestamps/equipment serial numbers |

Masking subcontracting; final product may not meet specs |

SourcifyChina 2026 Recommendation

“Verify, Don’t Trust”: For advanced overhead cranes, insist on a live factory audit via SourcifyChina’s Verified Facility Network (VFNet™). Our 2026 protocol includes AI-powered production line monitoring (blockchain-tracked welding data) and material authenticity checks via spectral analysis. Trading companies cannot replicate genuine factory workflows – a 4-hour on-site technical assessment eliminates 92% of high-risk suppliers.

Procurement Action: Prioritize suppliers with ISO 45001 (safety management) and CMA/CNAS lab accreditation. These are non-negotiable for cranes handling ≥20t loads.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 8672 9000

Confidential: For client use only. Data sourced from SourcifyChina Industrial Intelligence Platform (2025 Q4)

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Advanced Overhead Crane Suppliers in China

In the fast-evolving landscape of industrial manufacturing and logistics, sourcing high-performance overhead cranes is critical to operational efficiency, safety, and long-term cost optimization. China remains a dominant force in the global crane manufacturing sector, offering advanced engineering, scalable production, and competitive pricing. However, identifying truly reliable suppliers amidst market noise poses a significant challenge.

Traditional sourcing methods—relying on open platforms like Alibaba, trade shows, or unverified referrals—often result in lengthy vetting cycles, inconsistent quality, and supply chain vulnerabilities. Procurement teams waste weeks, if not months, evaluating suppliers that fail to meet technical, compliance, or delivery standards.

Why SourcifyChina’s Verified Pro List® Delivers Unmatched Value

SourcifyChina’s Verified Pro List® for China Advanced Overhead Crane Suppliers transforms this process by delivering pre-qualified, audit-backed manufacturers directly to your desk—saving time, reducing risk, and accelerating time-to-contract.

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | All suppliers undergo technical, financial, and compliance verification—eliminating 80% of due diligence effort |

| Factory Audits & Certifications | ISO 9001, CE, OHSAS 18001, and crane-specific certifications verified on file |

| Performance Benchmarking | Suppliers ranked by production capacity, export history, lead times, and client references |

| Direct Access to Engineering Teams | Facilitates technical alignment on custom designs, load specs, and automation integration |

| Average Time Saved | 6–8 weeks reduced sourcing cycle vs. traditional methods |

Real-World Impact: Client Case Snapshot

A Tier-1 logistics solutions provider in Germany reduced its supplier qualification timeline from 14 weeks to 9 days using the Verified Pro List®. They secured a turnkey 20-ton smart overhead crane solution with IoT integration, delivered on schedule and within budget—validated by third-party inspection.

Call to Action: Accelerate Your Sourcing in 2026

In a competitive global market, time is your most valuable resource. Why risk delays, compliance gaps, or subpar performance when a faster, more reliable path exists?

Leverage SourcifyChina’s Verified Pro List® today and gain immediate access to China’s top-tier advanced overhead crane suppliers—engineered for precision, verified for performance.

🔹 Contact us now to receive your exclusive supplier shortlist:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to align with your technical requirements, coordinate factory visits (virtual or on-site), and support end-to-end procurement success.

SourcifyChina — Your Trusted Partner in Intelligent China Sourcing.

Verified. Efficient. Global-Ready.

🧮 Landed Cost Calculator

Estimate your total import cost from China.