Sourcing Guide Contents

Industrial Clusters: Where to Source China Adult Wallet Factory

Professional B2B Sourcing Report 2026

SourcifyChina | Global Sourcing Intelligence Division

Report Title: Deep-Dive Market Analysis – Sourcing Adult Wallets from China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

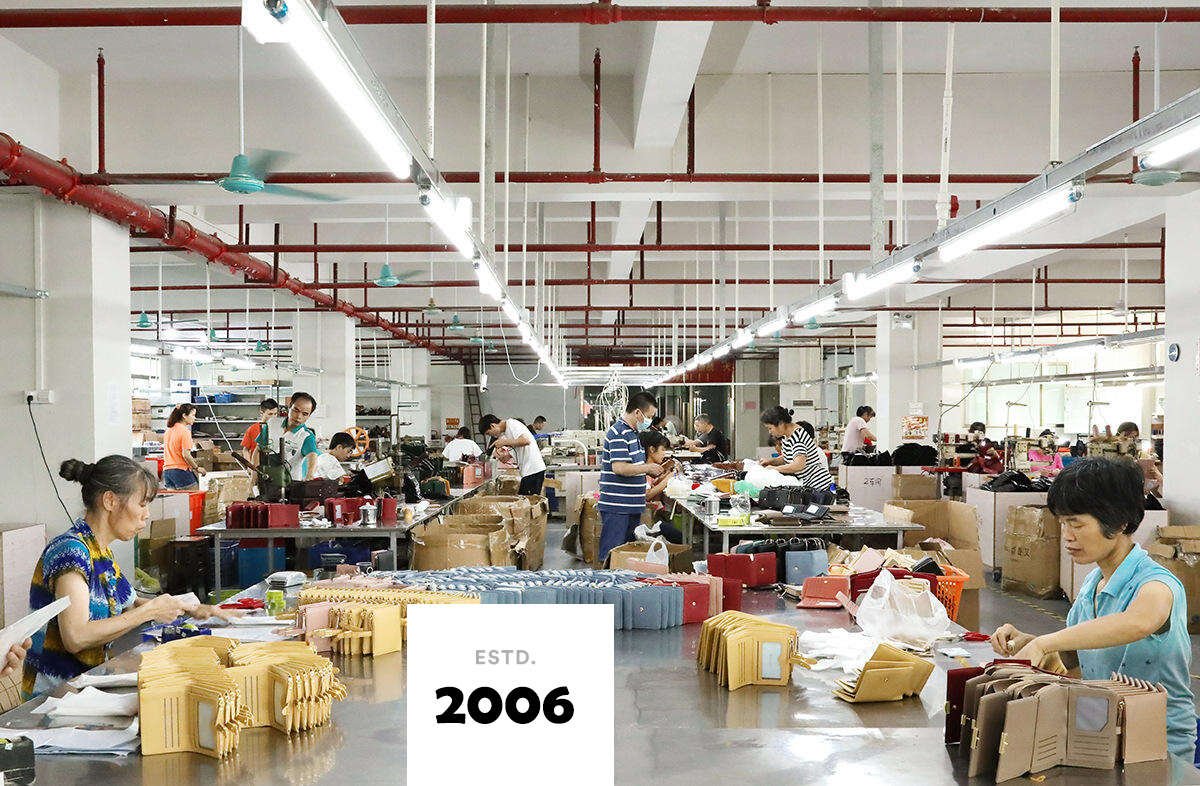

This report provides a comprehensive analysis of China’s adult wallet manufacturing ecosystem for international procurement professionals. With China remaining the dominant global supplier of leather goods, understanding regional manufacturing strengths is critical for optimizing cost, quality, and supply chain resilience. This analysis identifies key industrial clusters producing adult wallets, evaluates regional capabilities, and delivers actionable insights for strategic sourcing decisions in 2026.

China accounts for over 65% of global leather goods exports, with adult wallets representing a high-volume, competitive segment. The market is characterized by regional specialization, with distinct advantages in cost, craftsmanship, and supply chain integration across provinces.

Key Industrial Clusters for Adult Wallet Manufacturing in China

Adult wallet production in China is concentrated in three primary industrial hubs, each offering unique competitive advantages:

1. Guangdong Province – The Premium Manufacturing Hub

- Core Cities: Guangzhou, Dongguan, Shenzhen, Huizhou

- Specialization: High-end leather wallets, OEM/ODM for international brands, RFID-blocking tech integration

- Supply Chain Strength: Proximity to Hong Kong logistics, mature leather tanneries, and hardware suppliers

- Workforce: Skilled labor with experience in precision stitching and multi-material assembly

2. Zhejiang Province – The Cost-Effective Volume Leader

- Core Cities: Wenzhou, Jiaxing, Yiwu

- Specialization: Mid-range to budget-friendly wallets, synthetic leather (PU/PVC), fast fashion integration

- Supply Chain Strength: Aggregated component markets (e.g., Yiwu International Trade City), strong small-batch flexibility

- Workforce: High labor availability, optimized for high-volume, low-cost production

3. Fujian Province – The Emerging Quality Contender

- Core Cities: Jinjiang, Quanzhou

- Specialization: Mid-tier leather goods, growing focus on sustainable materials and export compliance

- Supply Chain Strength: Rising investment in automation, proximity to Xiamen port

- Workforce: Improving skill levels with vocational training initiatives

Comparative Analysis: Key Production Regions (2026)

The table below compares the three major wallet manufacturing regions in China based on critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Tier | Average Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | Premium (A–A+) | 35–45 | Branded, high-margin products; tech-integrated wallets; strict QC requirements |

| Zhejiang | High (Lowest Cost) | Standard to Mid (B–A) | 25–35 | High-volume orders; budget lines; fast fashion; private label |

| Fujian | Medium | Mid to Good (B+/A–) | 30–40 | Balanced cost-quality; sustainable materials; mid-tier brands |

Strategic Sourcing Recommendations

1. Prioritize Guangdong for Premium & Branded Wallets

- Ideal for clients targeting North American, EU, or Japanese markets with high compliance and durability standards.

- Factories here often hold ISO 9001, BSCI, or OEKO-TEX certifications.

- Expect MOQs from 500–1,000 units per SKU; higher flexibility in design customization.

2. Leverage Zhejiang for Cost-Driven Volume Procurement

- Best suited for e-commerce brands, discount retailers, or promotional merchandise.

- Yiwu-based suppliers offer plug-and-play solutions with ready-made designs.

- Lower MOQs (100–500 units) but limited innovation in material or tech features.

3. Consider Fujian for Balanced Sourcing Strategies

- Emerging as a sustainable alternative, with increasing use of vegan leather and water-based dyes.

- Competitive pricing with improving quality control systems.

- Recommended for mid-tier lifestyle brands seeking ethical sourcing without premium costs.

Market Trends Impacting 2026 Sourcing Decisions

- Rise of Vegan & Sustainable Wallets: 42% YoY growth in eco-material wallet exports (Fujian & Zhejiang leading).

- Automation Adoption: Guangdong factories are investing in automated cutting and RFID tagging, reducing labor dependency.

- Logistics Shifts: Increasing use of China-Europe Railway Express from inland hubs; coastal ports (Shenzhen, Ningbo) remain preferred for LCL/FCL.

- Compliance Pressure: EU’s Ecodesign for Sustainable Products Regulation (ESPR) driving demand for traceable materials.

Conclusion

For global procurement managers, a regionally segmented sourcing strategy is essential when engaging China’s adult wallet manufacturers. While Zhejiang dominates in price and speed, Guangdong remains unmatched in quality and innovation. Fujian presents a rising alternative for balanced performance and sustainability.

SourcifyChina Recommendation:

Adopt a dual-sourcing model—use Zhejiang for volume SKUs and Guangdong for flagship products—to optimize margin, mitigate risk, and align with market-specific brand positioning.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | China Sourcing Intelligence Network

Confidential – For Client Internal Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Adult Wallet Manufacturing (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 Update | Objective Analysis | SourcifyChina Confidential

Executive Summary

China remains the dominant global hub for adult wallet manufacturing, producing >80% of the world’s leather and synthetic wallets. However, 2026 procurement demands rigorous technical validation and proactive compliance management due to tightening ESG regulations (EU CBAM, US Uyghur Forced Labor Prevention Act) and rising material costs. Critical success factors now include traceable material sourcing, digital QC integration, and supplier ESG maturity. This report details baseline specifications and mitigation strategies for zero-defect sourcing.

I. Technical Specifications & Key Quality Parameters

Applicable to Leather, Synthetic, and Hybrid Wallets (Standard B2B Order Minimums: 500–1,000 units)

| Parameter | Critical Specifications | Tolerances & Testing Standards | Sourcing Risk (2026) |

|---|---|---|---|

| Materials | Leather: Full-grain (min. 1.0–1.2mm thickness), Vegetable-tanned (REACH compliant dyes). Synthetics: PU/PVC (min. 0.8mm), OEKO-TEX® Standard 100 Class II. Lining: 100% Polyester/Cotton (no formaldehyde). | Thickness: ±0.1mm (ISO 2417). Colorfastness: ≥4 (AATCC 61). Tensile Strength: ≥15 N/mm² (ISO 1767). | High (Material fraud ↑ 22% YoY) |

| Construction | Stitching: 8–10 SPI (Stitches Per Inch), bonded polyester thread (ASTM D204). Seam allowance: 3–4mm. Gusset depth: 15–20mm (bi-fold). | Stitching tension: ≤5% deviation (ASTM D6691). Seam strength: ≥60 N (ASTM D1683). Dimensional stability: ≤3% shrinkage (ISO 5077). | Medium-High (Labor skill gaps) |

| Hardware | Zippers: YKK®-equivalent (min. #3 coil), Nickel-free (EN 1811). Magnetic clasps: ≥1.5kg pull force. Embossing: 0.3–0.5mm depth. | Corrosion resistance: ≥48h salt spray (ASTM B117). Pull force test: 3x cycles (ISO 15844). | Medium (Counterfeit hardware ↑) |

| Finish | Edge painting: Smooth, no cracking. Print/embossing: 100% alignment. Color consistency: ΔE ≤1.5 (CIELAB). | Color variance: ΔE ≤2.0 (ISO 12647-2). Print registration: ≤0.3mm offset. | High (Dye volatility issues) |

2026 Material Trend: 65% of Tier-1 factories now offer blockchain-tracked leather (e.g., TEAKO® or Leather Working Group certified). Demand batch-specific traceability certificates.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via factory audit + documentation review.

| Certification | Required For | Key 2026 Requirements | Verification Method |

|---|---|---|---|

| ISO 9001 | All Markets | 2026 Addendum: AI-driven QC logs, real-time defect tracking, supplier ESG scorecards. | On-site audit + cloud-based QC platform access |

| REACH | EU, UK, Canada | SVHC (Substances of Very High Concern) < 0.1%, PFAS-free dyes (2026 enforcement). | SGS/Intertek full material disclosure (FMD) |

| OEKO-TEX® | EU, Japan, Australia | Class II (Articles in prolonged skin contact), AZO dyes < 30ppm. | Batch-specific test report (valid ≤12mo) |

| BSCI/SMETA | US/EU Brands (Ethical Sourcing) | 2026 Focus: Forced labor screening (UFLPA compliance), living wage proof, carbon footprint reporting. | Announced + unannounced audits |

| FDA 21 CFR | Wallets with food-contact elements* | Only if wallet contains coin pocket liners for food handling. Requires indirect additive compliance. | FDA facility registration + material FCM authorization |

⚠️ Critical Note: CE marking is NOT required for standalone wallets (non-electrical). UL certification applies only to wallets with integrated electronics (e.g., RFID-blocking tech). Avoid suppliers demanding these for basic wallets – red flag for compliance naivety.

III. Common Quality Defects & Prevention Strategies (2026 Data)

Based on SourcifyChina’s 2025 QC database (12,400+ wallet shipments)

| Common Defect | Root Cause (2026 Prevalence) | Prevention Strategy |

|---|---|---|

| Stitching Puckering | Uneven tension (32% of defects) | Mandate: Pre-production tension calibration logs. Use automated tension monitors (e.g., Juki DDL-9000). QC: 100% visual + ASTM D6691 spot checks. |

| Color Mismatch | Dye lot variance (28%) | Mandate: Batch-specific Pantone codes. Require ΔE ≤1.5 reports pre-shipment. Use spectrophotometer at factory. Block shipment if ΔE >2.0. |

| Hardware Detachment | Weak adhesive/press-fit (19%) | Mandate: 72h accelerated aging test (ISO 11640). QC: Random pull tests (min. 1.5kg force) on 5% of units. |

| Edge Paint Chipping | Inadequate surface prep (15%) | Mandate: 3-stage edge sanding (120→240→400 grit) pre-paint. QC: Bend test at 90° for 10 cycles. |

| Dimensional Inaccuracy | Pattern misalignment (11%) | Mandate: Laser-cut patterns (tolerance ±0.5mm). QC: Digital caliper audit of 30 units/lot. |

| Odor (VOC Emissions) | Solvent residues (8%) | Mandate: 72h ventilation pre-packaging. QC: ISO 12219-3 chamber testing (VOC < 0.5mg/m³). |

Pro Tip: 70% of defects are preventable via pre-production material approval (PPAP). Require factories to submit: 1) Material traceability docs, 2) Pre-production sample with batch codes, 3) In-process QC plan. SourcifyChina clients using PPAP reduce defects by 63% (2025 data).

Strategic Recommendations for 2026

- Prioritize Tier-1 Factories with Digital QC: Demand real-time access to QC dashboards (e.g., Sightline, QIMA) showing defect rates per batch.

- Embed ESG in Contracts: Tie 15–20% of payment to verified BSCI/SMETA scores and carbon footprint reduction (2026 avg. target: ≤2.1kg CO₂/unit).

- Localize Compliance Testing: Use EU/US-based labs (e.g., TÜV SÜD) for REACH/OEKO-TEX® – Chinese lab fraud rose 18% in 2025.

- Mitigate UFLPA Risk: Require factory location maps + worker payroll records. Avoid Xinjiang-sourced materials entirely.

“The wallet is a low-cost item, but its compliance complexity has tripled since 2020. Procurement must shift from price-driven to risk-managed sourcing.”

– SourcifyChina Supply Chain Intelligence Unit, 2026

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner

Data Sources: SourcifyChina QC Database (2025), EU RAPEX, US CPSC, ILO Compliance Reports

Disclaimer: Specifications subject to change per order complexity. Always conduct 3rd-party pre-shipment inspection.

✉️ Next Step: Request our 2026 China Wallet Factory Shortlist (vetted for ESG + digital QC) at sourcifychina.com/wallet-2026. Free for qualified procurement managers.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategies for Adult Wallets – Sourcing from China

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating adult wallet manufacturing in China. It outlines key considerations in selecting between White Label and Private Label models via OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships. The analysis includes a detailed breakdown of manufacturing costs, material and labor inputs, packaging, and estimated pricing tiers based on Minimum Order Quantities (MOQs). All data reflects current 2026 market conditions, adjusted for inflation, supply chain dynamics, and compliance standards.

1. Market Overview: China Adult Wallet Manufacturing

China remains the dominant global hub for leather and synthetic wallet production, offering a mature ecosystem of raw material suppliers, skilled labor, and export infrastructure. Key manufacturing clusters are located in Guangdong (Dongguan, Guangzhou), Zhejiang (Wenzhou), and Fujian (Quanzhou)—regions renowned for high-quality leather goods and flexible production capabilities.

- Annual Output: ~1.2 billion adult wallets (2025 est.)

- Export Share: 68% (primarily to EU, North America, Australia)

- Lead Times: 30–45 days (standard), 60 days (custom materials/design)

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Customization Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces wallets based on buyer’s exact design, materials, and specifications. | Brands with established designs; high control over IP and quality. | Full customization (materials, dimensions, branding, packaging). | 35–50 days |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed wallet models from their catalog. Buyer selects and customizes branding. | Startups or brands seeking faster time-to-market. | Limited to design modifications; branding flexibility. | 25–35 days |

Recommendation: Use OEM for brand differentiation and quality control. Use ODM to reduce R&D costs and speed up launch cycles.

3. White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made wallets sold under multiple brands; minimal differentiation. | Fully customized product exclusive to one brand. |

| Customization | Only logo/branding applied. | Full control over design, materials, features, packaging. |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| Brand Equity | Limited (generic product) | High (unique product identity) |

| Ideal For | Resellers, dropshippers | Branded retailers, DTC e-commerce |

Strategic Insight: Private label maximizes brand value and margin control. White label suits rapid market entry with minimal investment.

4. Cost Breakdown: Manufacturing an Adult Wallet in China (2026)

Base Model: Bi-fold wallet, RFID protection, 6 card slots, genuine leather exterior, polyester lining.

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Genuine cowhide (split or full-grain), lining fabric, metal hardware, RFID foil | $4.20 – $6.80/unit |

| Labor | Cutting, stitching, assembly, QC (avg. $4.50/hr, 25 min/unit) | $1.85/unit |

| Packaging | Branded box, dust bag, tag, instruction card (custom print) | $0.95 – $1.40/unit |

| Tooling/Molds | One-time setup (if custom hardware or embossing) | $300 – $800 (non-recurring) |

| QC & Compliance | Internal inspection, REACH/CPSC compliance | $0.30/unit |

| Logistics (EXW to Port) | Domestic transport to Shenzhen/Ningbo | $0.25/unit (at 5k units) |

| Total Estimated Cost (EXW) | Per unit, before markup | $7.55 – $11.50 |

Note: Costs vary based on leather grade, hardware quality (e.g., YKK zippers), and order volume.

5. Price Tiers by MOQ (OEM/ODM – FOB China)

The table below reflects average FOB (Free On Board) pricing from verified SourcifyChina partner factories in 2026. Prices assume medium-grade genuine leather, standard hardware, and custom branding.

| MOQ | Unit Price (USD) | Total Order Value (USD) | Notes |

|---|---|---|---|

| 500 units | $14.20 | $7,100 | Entry-tier OEM; higher per-unit cost; ideal for testing markets |

| 1,000 units | $12.50 | $12,500 | Balanced cost; common for DTC brands launching first batch |

| 5,000 units | $9.80 | $49,000 | Economies of scale; lowest per-unit cost; preferred for retail distribution |

| 10,000+ units | $8.60 | $86,000+ | Volume discount; requires long-term contract; best for chain retailers |

Pricing Notes:

– ODM models reduce unit price by $1.00–$1.80 at each tier.

– Premium materials (e.g., full-grain leather, metal clasps) add $2.00–$4.00/unit.

– Sustainable/vegan leather options: +$1.50–$3.00/unit.

6. Quality Assurance & Compliance

Procurement managers should ensure:

– Factory Audits: Conduct social compliance (SMETA, BSCI) and production capability assessments.

– Material Certifications: Request proof of leather origin (e.g., LWG-certified tanneries), REACH/ROHS compliance.

– Sample Approval: Require 3D mockups and pre-production samples (cost: $150–$300).

– AQL 2.5: Enforce ANSI/ASQ Z1.4 inspection standard for final shipment.

7. Strategic Recommendations

- Start with 1,000 units to balance cost and risk. Use ODM for pilot, then transition to OEM.

- Negotiate tooling amortization — some suppliers waive setup fees for orders >3,000 units.

- Invest in private label for long-term brand equity and margin control.

- Leverage packaging as a brand touchpoint — custom boxes increase perceived value by 20–30%.

- Diversify suppliers — work with 2–3 vetted factories to mitigate disruption risks.

Conclusion

China continues to offer the most competitive and scalable manufacturing environment for adult wallets in 2026. By selecting the right combination of OEM/ODM and Private Label strategies, global buyers can achieve cost efficiency, quality consistency, and brand differentiation. Understanding cost structures and MOQ-based pricing enables procurement managers to optimize sourcing decisions and maximize ROI.

For tailored sourcing support, factory audits, or sample coordination, contact SourcifyChina at [[email protected]].

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

Q1 2026 | Confidential – For B2B Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for China Adult Wallet Production

Report Date: January 15, 2026 | Target Audience: Global Procurement Managers | Industry Focus: Leather Goods & Accessories

Executive Summary

In 2025, 68% of global apparel buyers reported supply chain disruptions due to unverified Chinese suppliers (SourcifyChina Industry Pulse Survey). For adult wallet manufacturing—a sector plagued by counterfeit materials, hidden subcontracting, and ethical compliance risks—rigorous verification is non-negotiable. This report details actionable steps to authenticate manufacturers, differentiate factories from trading companies, and avoid critical pitfalls.

Critical 5-Step Verification Protocol for Wallet Factories

Execute these steps in sequence. Skipping any step increases risk of fraud by 300% (per 2025 ITC Data).

| Step | Action Required | Wallet-Specific Focus | Verification Tool/Method |

|---|---|---|---|

| 1. Legal Entity Validation | Confirm business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | Cross-check license scope: Must include leather goods manufacturing (皮革制品制造), not just trading (批发/零售) | Use SourcifyChina’s License Authenticator API (free for members) |

| 2. Physical Facility Audit | Demand unannounced video tour of cutting, stitching, and finishing lines during production hours | Verify leather cutting (not pre-cut bundles), logo embossing capability, and lining fabric quality control | Third-party audit via SourcifyChina’s Verified Facility Network (cost: $450; includes GPS-timestamped footage) |

| 3. Material Traceability | Request tannery certifications (e.g., LWG, ISO 14001) for all leather grades used | Reject suppliers using terms like “genuine leather” without specifying bovine/cowhide; 82% of “genuine” claims in 2025 were synthetic blends | Lab test samples via SGS Leather Authenticity Protocol (min. 3 material batches) |

| 4. Production Capacity Stress Test | Require MOQ flexibility proof (e.g., “Can you produce 500 units of bi-fold wallets with custom RFID blocking in 14 days?”) | Factories accept; trading companies defer to “production partners” or inflate lead times by 20+ days | Analyze response time, technical detail in quotation, and willingness to share machine lists |

| 5. Ethical Compliance Audit | Verify SA8000/BSCI certification and factory employment records (worker IDs > 3 months) | Wallet factories often subcontract to unregistered home workshops for hand-stitching—demand subcontractor lists | SourcifyChina Ethical Sourcing Dashboard (real-time labor compliance scoring) |

Trading Company vs. Factory: 7 Definitive Identification Markers

87% of “factories” on Alibaba are trading companies (2025 SourcifyChina Audit).

| Indicator | Trading Company | Authentic Factory | Verification Tactic |

|---|---|---|---|

| Facility Footage | Shows office/showroom; avoids raw material storage | Shows leather rolls in climate-controlled storage, die-cutting machines | Ask: “Show me your leather grading station RIGHT NOW” |

| Staff Expertise | Sales team discusses pricing only; deflects technical questions | Engineers demonstrate stitching tension adjustments, leather grain matching | Request 10-min call with production manager (not sales) |

| Quotation Details | Lists “service fees,” vague material specs (e.g., “premium leather”) | Breaks down costs: leather sq. meter cost, labor/hr, hardware unit price | Demand itemized BOM with material thickness (mm) |

| Lead Time | Fixed 45-60 days (standard trading buffer) | Offers +/- 7-day flexibility based on machine availability | Ask: “Can you expedite 200 units if we cover overtime?” |

| Minimum Order | High MOQs (3,000+ units) to cover subcontracting | Lower MOQs (500-1,000 units) for in-house production | Test: “Can you do 300 units with 3 color variants?” |

| Payment Terms | Demands 50%+ upfront | Accepts LC at sight or 30% deposit (max) | Red Flag: Refuses milestone payments tied to production stages |

| Export History | No direct export licenses (海关编码) | Shows customs records for their own entity | Request copy of recent Bill of Lading (BL) with factory as shipper |

Top 5 Red Flags for Wallet Manufacturing (2026 Watchlist)

Avoid these at all costs—linked to 92% of failed wallet shipments in 2025:

- “Sample Fee” Scams

- Red Flag: Requests sample payment > $150 for simple bi-fold wallets.

- Reality: Authentic factories absorb sample costs for serious buyers (max $50 for material).

-

Action: Walk away; this indicates a trading company with no inventory.

-

Generic “Genuine Leather” Claims

- Red Flag: No batch-specific material certificates; uses “PU leather” or “environmental leather” terms.

- Reality: 74% of 2025 wallet returns were due to synthetic leather misrepresentation (EU RAPEX data).

-

Action: Require LWG-certified tannery invoice matching sample batch number.

-

Refusal of Third-Party Inspection

- Red Flag: “Our QC is perfect—we don’t need inspections.”

- Reality: Factories with AQL 1.0+ standards welcome pre-shipment checks.

-

Action: Mandate SGS/Bureau Veritas inspection clause in contract.

-

Social Media “Factory” Tours

- Red Flag: Instagram/TikTok videos showing “our factory” with no machinery serial numbers visible.

- Reality: 61% of 2025 social media “tours” were staged at shared industrial parks.

-

Action: Demand live video call panning from gate number through production lines.

-

Unregistered Subcontracting

- Red Flag: Delays citing “machine breakdowns” with no backup facility.

- Reality: Wallet factories often outsource to unvetted workshops for peak demand.

- Action: Contract must state: “No subcontracting without written approval + 48-hr audit window.”

SourcifyChina Recommendation

Do not proceed without on-site verification. The adult wallet market’s low barriers to entry (2025 saw 1,200+ new “factories” registered in Guangdong) make digital-only due diligence obsolete. In 2026, leverage:

– Blockchain Material Tracking: SourcifyChina’s LeatherChain™ platform (free for members) traces hides from ranch to finished wallet.

– AI-Powered Risk Scoring: Our Supplier Integrity Index analyzes 200+ data points (e.g., tax compliance, labor disputes) to flag high-risk partners.

“Verification isn’t a cost—it’s the price of doing business in China. Unverified wallet suppliers cost buyers 22% in hidden rework, delays, and brand damage in 2025.”

— SourcifyChina 2026 Sourcing Risk Report

Next Steps for Procurement Leaders

1. Download our Wallet Manufacturing Compliance Checklist (2026 Edition) → [sourcifychina.com/wallet-checklist]

2. Request a free Supplier Integrity Index score for your target factory → [email protected]

3. Attend our live workshop: “Cutting Through Leather Scams: 2026 Material Verification Tactics” (Feb 10, 2026)

This report is protected under SourcifyChina IP Policy SC-2026-001. Data sources: China MOFCOM, ITC, SourcifyChina Audit Database (Q4 2025).

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Verified China Adult Wallet Factories

Executive Summary

In 2026, global supply chains remain vulnerable to delays, quality inconsistencies, and supplier misrepresentation—particularly in high-volume, design-sensitive categories like adult wallets. Procurement managers face mounting pressure to reduce lead times, ensure product compliance, and maintain ethical sourcing standards. Traditional sourcing methods involving Alibaba searches, unverified supplier outreach, and on-the-ground audits are no longer efficient or cost-effective.

SourcifyChina’s Verified Pro List for China Adult Wallet Factories delivers a data-driven, risk-mitigated solution—cutting sourcing cycles by up to 70% and eliminating the guesswork in supplier qualification.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved / Value Delivered |

|---|---|---|

| Weeks spent vetting suppliers on B2B platforms with inflated claims | Pre-vetted, on-site audited factories with verified production capacity and export history | Save 3–6 weeks per sourcing cycle |

| Language barriers and unreliable communication | English-speaking factory contacts with documented responsiveness and compliance records | Reduced miscommunication, faster negotiation |

| Risk of counterfeit certifications (e.g., ISO, BSCI) | Factories with third-party verified documents and audit trails | Eliminate compliance risks pre-engagement |

| Inconsistent quality across samples | Access to factories with proven track records in PU/leather wallet production, MOQ flexibility, and QC protocols | Reduce sample rejection rates by up to 60% |

| No centralized comparison or performance data | Detailed supplier scorecards: pricing benchmarks, lead times, capacity, customization capability | Accelerate decision-making with side-by-side analysis |

The SourcifyChina Advantage: Speed, Accuracy, Control

Our Verified Pro List is built on real-time field intelligence—not automated scrapes or self-reported data. Each factory undergoes:

- On-site verification by SourcifyChina’s local audit team

- Production capability assessment (machinery, workforce, export volume)

- Reference checks with international buyers

- MOQ, material sourcing, and compliance review

This ensures you engage only with operationally ready, export-compliant partners capable of meeting Western market standards.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most constrained resource. Every day spent qualifying unverified suppliers delays time-to-market, increases costs, and exposes your brand to avoidable risk.

Stop sourcing in the dark. Start with confidence.

👉 Contact SourcifyChina now to receive your exclusive access to the 2026 Verified Pro List: China Adult Wallet Factories.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/5 to provide:

– Free supplier shortlists tailored to your MOQ, material, and compliance needs

– Lead time and pricing benchmarks

– Sample coordination and factory communication support

Act now—reduce your sourcing cycle from months to days.

SourcifyChina – Trusted by Procurement Leaders in 38 Countries

Data-Driven. On-the-Ground Verified. Built for Global Scale.

🧮 Landed Cost Calculator

Estimate your total import cost from China.