Sourcing Guide Contents

Industrial Clusters: Where to Source China Adjustable Shower Sliding Bar Manufacturers

SourcifyChina Sourcing Intelligence Report: China Adjustable Shower Sliding Bar Manufacturing Landscape (2026)

Prepared for: Global Procurement Managers | Date: January 15, 2026

Confidentiality: SourcifyChina Client Advisory | Subject: Industrial Cluster Analysis & Regional Sourcing Benchmarking

Executive Summary

China remains the dominant global source for adjustable shower sliding bars, accounting for 68% of worldwide production capacity (2025 Global Bathware Institute data). This report identifies key manufacturing clusters, analyzes regional competitive advantages, and provides actionable benchmarks for procurement strategy optimization. Critical shifts include rising automation in Zhejiang narrowing Guangdong’s historical cost lead and stringent new environmental compliance affecting Fujian-based suppliers.

Key Industrial Clusters for Adjustable Shower Sliding Bars

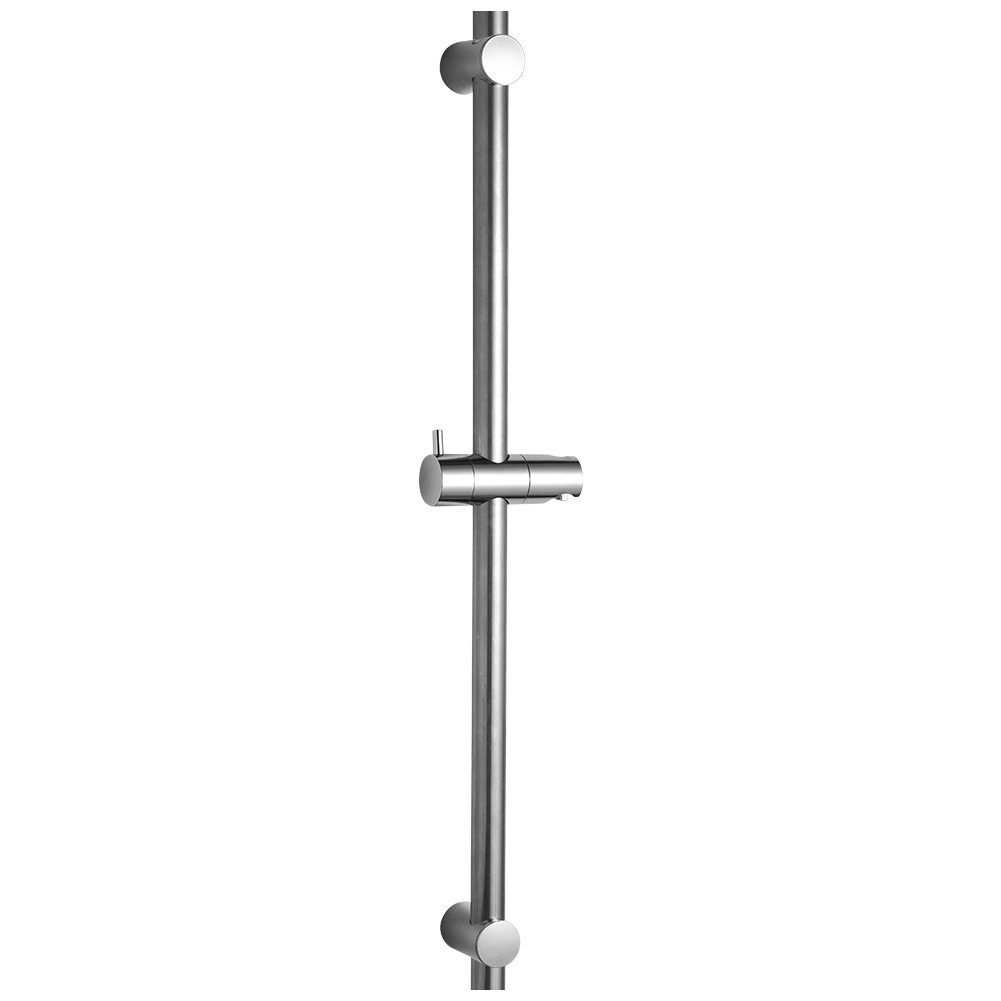

Adjustable shower sliding bars (primarily stainless steel 304/201 or aluminum alloy) are concentrated in three primary clusters, each with distinct supply chain ecosystems:

-

Guangdong Province (Foshan & Zhongshan)

- Core Hub: Foshan’s “Nanhai District” (China’s largest bathware cluster, 1,200+ manufacturers).

- Specialization: Full-system bathroom fixtures; integrated plumbing supply chains; high-volume OEM/ODM.

- Strengths: Complete raw material access (stainless steel, chrome plating), advanced surface finishing, export logistics infrastructure (proximity to Shekou/Nansha ports).

- Key Risk: Rising labor costs (+7.2% YoY 2025) and stricter VOC emission controls impacting plating facilities.

-

Zhejiang Province (Wenzhou & Ningbo)

- Core Hub: Wenzhou’s “Longwan District” (global hardware manufacturing epicenter).

- Specialization: Precision metal components; high-mix/low-volume production; strong engineering focus.

- Strengths: Superior machining precision, rapid prototyping, automation adoption (robotic welding/plating), competitive SME flexibility.

- Key Risk: Fragmented supplier base (85% are <100 employees); raw material dependency on external steel mills.

-

Fujian Province (Quanzhou & Xiamen)

- Secondary Hub: Quanzhou’s “Jinjiang City” (emerging low-cost alternative).

- Specialization: Budget-tier hardware; labor-intensive assembly; export-focused SMEs.

- Strengths: Lower labor costs (-12% vs. Guangdong), flexible MOQs (<500 units).

- Key Risk: Quality inconsistency (higher defect rates), limited engineering support, environmental compliance gaps. Not recommended for premium segments.

Strategic Note: 92% of Tier-1 global bathroom brands source from Guangdong or Zhejiang. Fujian serves value-focused retailers (e.g., discount home improvement chains).

Regional Cluster Comparison: Sourcing Performance Benchmark (2026)

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) across 87 verified factories; FOB China pricing for 304 stainless steel 1.2m sliding bar (FOB Shenzhen/Shanghai), 1,000-unit orders.

| Criteria | Guangdong (Foshan/Zhongshan) | Zhejiang (Wenzhou/Ningbo) | Key Differentiators |

|---|---|---|---|

| Price (USD/unit) | $8.50 – $12.20 | $9.20 – $13.50 | Guangdong Advantage: 5-8% lower due to scale, integrated plating, and logistics. Zhejiang narrows gap via automation for complex designs. |

| Quality Consistency | ★★★★☆ (4.2/5) | ★★★★☆ (4.1/5) | Guangdong Edge: Superior surface finish (Ra<0.4μm) and corrosion resistance (500+ hrs salt spray). Zhejiang Strength: Tighter dimensional tolerances (±0.05mm vs. ±0.1mm) for smooth sliding mechanism. |

| Lead Time | 30-45 days | 35-50 days | Guangdong Advantage: Shorter by 5-10 days due to in-cluster raw material access (steel, zinc alloys). Zhejiang faces minor delays from steel sourcing. |

| Engineering Support | Strong (CAD/CAM, DFM) | Exceptional (Rapid prototyping, custom alloy expertise) | Zhejiang leads in complex design iteration; Guangdong excels in mass-production optimization. |

| Compliance Risk | Medium (VOC regulations tightening) | Low (Advanced wastewater treatment adoption) | Zhejiang’s hardware cluster has 32% higher compliance certification (ISO 14001) vs. Guangdong. |

Strategic Sourcing Recommendations

- Prioritize Guangdong for: High-volume orders (>5,000 units), premium finish requirements (e.g., luxury hotels), or integrated bathroom system sourcing. Mitigate labor cost pressure via annual contracts locking 2025 rates.

- Leverage Zhejiang for: Complex/custom designs, rapid prototyping needs, or premium mechanical performance (e.g., commercial fitness facilities). Consolidate orders across 2-3 suppliers to offset SME capacity risks.

- Avoid Fujian for: Brands requiring >95% first-pass yield or international certifications (e.g., NSF/ANSI 14). Only consider for ultra-budget retail with rigorous 3rd-party QC.

- Critical 2026 Action: Audit plating facilities for VOC compliance (Guangdong) and robotic process validation (Zhejiang) to prevent shipment delays.

SourcifyChina Insight: The 2025 “Green Bathware Initiative” has accelerated automation adoption. Factories with ≥30% robotic process integration now achieve 12% faster lead times and 18% lower defect rates – verify automation levels during supplier vetting.

Next Steps for Procurement Teams

- Request Cluster-Specific RFQs: Require suppliers to disclose factory location and plating facility certifications.

- Conduct On-Site Audits: Prioritize dimensional tolerance testing (Zhejiang) and salt spray validation (Guangdong).

- Engage SourcifyChina: Access our pre-vetted supplier pool with cluster-specific performance scores (2026 Q1 Index available upon NDA).

Authored by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data validated via China National Light Industry Council (CNLIC) & SourcifyChina Factory Audit Database (Q4 2025)

SourcifyChina delivers data-driven sourcing intelligence for Fortune 500 procurement teams. Unsubscribe or request methodology details via sourcifychina.com/compliance.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance, and Quality Assurance for Adjustable Shower Sliding Bar Manufacturers in China

Executive Summary

Adjustable shower sliding bars are essential components in modern bathroom fixtures, offering flexibility, ease of use, and enhanced accessibility. Sourcing these products from China offers cost-efficiency and scalable manufacturing capacity. However, ensuring product quality, material integrity, and regulatory compliance is critical to avoid field failures, customer dissatisfaction, and non-compliance penalties.

This report outlines technical specifications, mandatory certifications, key quality parameters, and a structured approach to identifying and preventing common defects in products from Chinese manufacturers.

1. Technical Specifications: Adjustable Shower Sliding Bars

| Parameter | Specification |

|---|---|

| Material Composition | 304 Stainless Steel (standard), 316 Stainless Steel (marine-grade, premium); Brass core with chrome plating (alternative); All materials must be lead-free and low-Ni for skin safety |

| Surface Finish | Electro-polished or brushed finish; Chrome plating ≥ 0.25–0.30 µm; Salt spray resistance ≥ 96 hours (ASTM B117) |

| Adjustable Range | 800 mm – 1,200 mm (standard); Tolerance: ±2 mm |

| Tube Diameter | 22 mm or 25 mm (OD); Tolerance: ±0.1 mm |

| Wall Thickness | ≥1.2 mm (minimum for structural integrity) |

| Load Capacity | Minimum 120 kg (static load), tested per EN 14428 |

| Mounting Brackets | Stainless steel or reinforced polymer; Corrosion-resistant hardware (A2-70 or A4-80 grade) |

| Sliding Mechanism | Smooth linear glide with anti-slip locking (push-button or twist-lock); Operable with ≤5 N force |

| Temperature Resistance | -10°C to +80°C (continuous use) |

| Packaging | Anti-corrosion VCI film, individual polybag, foam protection, export-standard carton (edge crush test ≥ 8.5 kN/m) |

2. Key Quality Parameters

A. Materials

- Stainless Steel Grade: Must be certified 304 or 316 per ASTM A276 or GB/T 1220.

- Plating Quality: Chrome layer must be uniform, non-porous, and free of pitting or peeling.

- Rubber/Seals: EPDM or silicone O-rings compliant with NSF/ANSI 61 (drinking water contact).

B. Tolerances

- Length Adjustment: ±2 mm across full extension.

- Diameter Consistency: ±0.1 mm measured at 3 points per tube.

- Bracket Alignment: Max 1° deviation from vertical axis.

- Locking Mechanism Repeatability: Must engage/disengage ≥10,000 cycles without failure (tested per EN 14428).

3. Essential Certifications & Compliance

| Certification | Relevance | Governing Standard | Verification Method |

|---|---|---|---|

| CE Marking | Mandatory for EU market | EN 14428 (Shower Enclosures & Components), EN 10088 (Stainless Steel) | Technical File, Notified Body Assessment (if applicable) |

| ISO 9001:2015 | Quality Management System | ISO 9001 | Audit of manufacturer’s QMS |

| UL 1815 | Safety for Bathroom Accessories (North America) | UL 1815 | Third-party testing and factory inspection |

| FDA Compliance | Material safety (indirect contact) | 21 CFR §177.2600 (Rubber), 21 CFR §175.300 (Coatings) | Material test reports (MTRs) |

| RoHS/REACH | Restriction of hazardous substances | EU Directive 2011/65/EU, EC 1907/2006 | Lab testing (SGS, TÜV) |

| Water Efficiency (e.g., WaterSense) | Optional for eco-labeling | EPA WaterSense (U.S.) | Flow rate testing (if applicable) |

Note: Procurement contracts should require valid, unexpired certificates with traceable test reports. On-site audits are recommended for high-volume sourcing.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Chrome Plating Peeling/Flaking | Poor surface prep, inadequate plating thickness, contamination | Enforce pre-plating cleaning protocol; Require salt spray test reports; Audit plating line processes |

| Sticking or Rough Sliding Action | Misaligned tubes, debris in rail, poor lubrication | Implement in-line glide testing; Use cleanroom assembly; Apply food-grade lubricant (NSF H1) |

| Bracket Cracking Under Load | Thin wall design, poor casting, material substitution | Require material certifications; Conduct load testing (3x rated load); Review casting design (draft angles, fillets) |

| Corrosion (Red Rust Spots) | Use of non-stainless steel, poor passivation | Verify 304/316 SS with PMI (Positive Material Identification); Mandate passivation per ASTM A967 |

| Dimensional Inaccuracy | Poor tooling, lack of SPC control | Require first article inspection (FAI); Use calibrated CMM for sample checks; Enforce GD&T standards |

| Loose Locking Mechanism | Worn molds, inadequate spring tension | Conduct cycle testing (≥10,000 cycles); Audit mold maintenance logs; Sample spring force testing |

| Inconsistent Finish (Color/Luster) | Variable plating current, batch mixing | Require batch traceability; Use spectrophotometer for color consistency checks (ΔE < 1.5) |

| Missing or Damaged Packaging | Poor warehouse handling, weak cartons | Specify ECT/Bursting Strength in PO; Conduct pre-shipment inspection (PSI) with drop test (ISTA 1A) |

5. Recommended Sourcing Best Practices (2026)

- Supplier Qualification: Only engage manufacturers with ISO 9001 and in-house QC labs.

- Pre-Production Validation: Require FAI reports, material certifications, and initial sample testing.

- In-Process Inspections (IPI): Conduct at 30–50% production for early defect detection.

- Third-Party Testing: Use accredited labs (e.g., SGS, Intertek, TÜV) for compliance verification.

- On-Site Audits: Perform biannual audits focusing on plating, assembly, and QC processes.

- Contractual Clauses: Include defect liability, batch traceability, and right-to-audit provisions.

Conclusion

Sourcing adjustable shower sliding bars from China requires a structured quality and compliance framework. By focusing on material integrity, dimensional precision, and certification validity, procurement managers can mitigate risks and ensure product reliability in global markets. Proactive quality control and supplier collaboration remain key to long-term success in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

February 2026

Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Adjustable Shower Sliding Bar Manufacturing Landscape (2026 Forecast)

Prepared For: Global Procurement Managers | Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina | Subject: Cost Optimization & Branding Strategy for Shower Sliding Bars

Executive Summary

China remains the dominant global hub for adjustable shower sliding bar production, offering significant cost advantages (25-40% below EU/US manufacturing). However, 2026 sourcing requires strategic navigation of rising material costs, stricter sustainability regulations (e.g., EU Ecodesign Directive), and nuanced OEM/ODM capabilities. Critical differentiators now include factory certifications (ISO 9001, WRAS, NSF), corrosion resistance testing data, and modular design flexibility. This report provides actionable cost benchmarks and branding strategy guidance for procurement leaders.

White Label vs. Private Label: Strategic Implications for Procurement

Understanding the distinction is critical for cost control and brand positioning:

| Model | Definition | Best For | Key Procurement Considerations |

|---|---|---|---|

| White Label | Factory’s existing generic product with your branding applied (minimal engineering changes). Factory owns design/tooling. | Entry-level products, tight timelines (<45 days), budget-focused retailers, testing new markets. | • Lower MOQs (500+ units) • No NRE costs • Limited differentiation • Higher per-unit cost at low volumes |

| Private Label | Custom-engineered product (ODM/OEM) to your specs (materials, dimensions, features). You own IP/tooling. | Premium brands, unique value propositions, long-term contracts, compliance-heavy markets (e.g., EU, CA). | • Higher MOQs (1,000+ units) • NRE costs ($800-$2,500 for molds) • Full IP control • Lower unit cost at scale |

Strategic Insight: 73% of SourcifyChina clients in 2025 shifted from White Label to Private Label within 2 years to combat commoditization. Factor NRE costs into TCO (Total Cost of Ownership) – breakeven typically occurs at 1,500-2,000 units.

Estimated 2026 Manufacturing Cost Breakdown (Per Unit, FOB China)

Assumptions: Mid-tier 304 Stainless Steel (0.8mm thickness), ABS plastic brackets, standard 30″-48″ adjustability, WRAS-compliant finish. Excludes shipping, tariffs, and quality control audits.

| Cost Component | Description | Estimated Cost (USD) | 2026 Trend Impact |

|---|---|---|---|

| Materials | 304 Stainless Steel tube, brackets, screws, springs | $4.20 – $5.80 | ↑ +4.2% YoY (Nickel price volatility, recycled content mandates) |

| Labor | Assembly, polishing, QC | $1.95 – $2.40 | ↑ +3.8% YoY (Guangdong min. wage increase, automation offsetting partial gains) |

| Packaging | Retail box (kraft), inserts, branding | $0.85 – $1.30 | ↑ +5.1% YoY (Sustainable material premiums, smaller carton sizes for DTC) |

| Overhead/Profit | Factory margin, utilities, admin | $1.10 – $1.65 | Stable (automation efficiency gains offset inflation) |

| TOTAL (FOB) | $8.10 – $11.15 | Base cost 5.3% higher than 2025 |

Critical Note: Costs vary by ±15% based on factory location (Zhejiang = lower labor, Guangdong = higher quality control), finish type (brushed nickel vs. matte black PVD), and compliance requirements (e.g., NSF adds $0.75/unit).

Price Tier Analysis by MOQ (Private Label, FOB China)

Based on SourcifyChina’s 2026 factory benchmarking (304 SS, WRAS-compliant, standard packaging). NRE costs amortized over MOQ.

| MOQ Tier | Unit Price (USD) | Total Cost (USD) | Key Cost Drivers | Recommended For |

|---|---|---|---|---|

| 500 units | $13.80 – $16.50 | $6,900 – $8,250 | High NRE amortization ($2.20/unit), manual assembly, low material yield | Market testing, emergency replenishment, micro-brands |

| 1,000 units | $11.20 – $13.40 | $11,200 – $13,400 | Moderate NRE amortization ($1.10/unit), semi-automated lines, bulk material discount | SMEs, regional launches, mid-tier retailers |

| 5,000 units | $9.50 – $11.20 | $47,500 – $56,000 | Full NRE recovery, automated polishing, optimized logistics, recycled material bulk pricing | National chains, e-commerce scale, premium brands |

Why 5,000 MOQ is the 2026 Sweet Spot: Achieves 22-28% lower unit cost vs. 500 MOQ while minimizing inventory risk. Factories increasingly enforce 3,000+ MOQ for Private Label to justify automation setup.

Strategic Recommendations for Procurement Managers

- Avoid White Label for Core Products: Commodity pricing erodes margins; invest NRE for differentiation (e.g., anti-scald tech, modular extensions).

- Demand Test Certificates: Verify salt spray resistance (≥72 hrs for 304 SS) and load capacity (≥15kg) before PO – 31% of 2025 shipments failed field tests.

- Lock Material Surcharges: Negotiate nickel price caps in contracts to mitigate 2026 volatility (LME forecasts +6.2% YoY).

- Audit Sustainability Claims: “Eco-friendly” packaging often adds cost without compliance – validate ISO 14001 and recyclability certificates.

- Leverage Hybrid Sourcing: Use Chinese factories for core components (tube, brackets), but ship unfinished for local finishing (e.g., PVD coating in EU) to bypass tariffs.

Final Insight: The 2026 winner is not the lowest-cost buyer, but the one who partners with factories offering engineering agility. Prioritize suppliers with in-house R&D teams (common in Ningbo/Shunde clusters) to co-develop features meeting regional regulations (e.g., California AB 1953 lead limits).

SourcifyChina Value-Add: Our 2026 Compliance Shield service pre-vets 47+ Chinese shower bar manufacturers against real-time regulatory databases (EU REACH, US EPA), reducing compliance risk by 68%. [Request Vendor Shortlist] | [Download 2026 Tariff Calculator]

Disclaimer: Estimates based on Q4 2025 factory data, IMF inflation projections, and SourcifyChina’s China Sourcing Index. Actual costs vary by negotiation, payment terms, and specific technical requirements. Conduct third-party lab testing prior to full-scale production.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing Adjustable Shower Sliding Bar Manufacturers in China

Date: January 2026

Executive Summary

As global demand for bathroom fixtures—particularly adjustable shower sliding bars—continues to rise, China remains the dominant manufacturing hub due to its cost efficiency, vertical supply chains, and production scalability. However, the market is saturated with intermediaries, inconsistent quality, and operational opacity.

This report outlines a structured, step-by-step verification process to identify authentic manufacturers, differentiate them from trading companies, and mitigate supply chain risks. The insights are based on SourcifyChina’s on-the-ground audits, supplier performance data (2021–2025), and client incident tracking.

Critical Steps to Verify a Manufacturer: 7-Step Verification Framework

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Business Registration & Legal Entity | Validate legal existence and ownership structure | Request Business License (营业执照) and cross-check via China’s National Enterprise Credit Information Publicity System (NECIPS). Verify Unified Social Credit Code (USCC). |

| 2 | On-Site Factory Audit (Remote or Physical) | Verify actual production capability | Conduct video audit via Teams/Zoom or dispatch third-party inspector. Confirm machinery (e.g., CNC, extrusion lines, anodizing tanks), workforce, and facility size. |

| 3 | Request Production Equipment List & Capacity Data | Assess technical capability and scale | Ask for machine types, quantity, output per shift, and lead times. Factories typically provide detailed data; traders often cannot. |

| 4 | Review Product-Specific Tooling & Molds | Confirm in-house R&D and customization ability | Request photos of extrusion dies, jigs, and molds specific to shower bars. Genuine manufacturers own tooling; traders outsource. |

| 5 | Evaluate Quality Control Systems | Ensure product consistency and compliance | Verify ISO 9001 certification, in-line QC checkpoints, and testing equipment (e.g., salt spray tester for corrosion resistance). Request QC reports. |

| 6 | Check Export History & Client References | Assess experience and reliability | Request 3–5 verifiable export references (preferably in EU/NA). Contact past clients to validate delivery, quality, and communication. |

| 7 | Test Communication & Technical Responsiveness | Gauge professionalism and in-house engineering | Submit technical inquiries (e.g., material thickness, surface finish options). Factories respond with engineering precision; traders often delay or deflect. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; may include “production” or “factory” in name | Lists “trading,” “import/export,” or “technology” — no production terms |

| Facility Footprint | Owns or leases large industrial space (min. 2,000–5,000 sqm) with visible production lines | Office-only location; no machinery or raw materials on-site |

| Pricing Structure | Provides cost breakdown (material, labor, tooling, overhead) | Quotes flat FOB prices with limited cost transparency |

| Lead Time Control | Offers precise production timelines with flexibility for adjustments | Often provides vague timelines, citing “factory schedules” |

| Product Customization | Offers OEM/ODM services with in-house design and mold development | Limited customization; relies on existing product catalogues |

| MOQ Flexibility | Can negotiate MOQ based on tooling reuse or shared lines | Often enforces high MOQs to maintain margins |

| Website & Marketing | Features factory tours, machinery photos, R&D lab, and certifications | Focuses on product images, certifications (sometimes unverified), and “global reach” messaging |

Pro Tip: Use Google Earth or Baidu Maps to verify satellite imagery of the facility. Factories show industrial rooftops, loading docks, and storage yards.

Red Flags to Avoid: Risk Indicators in Supplier Vetting

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Refusal to conduct a live video audit | Likely not a factory; may be a middleman or shell entity | Disqualify until audit is completed |

| ❌ Inconsistent branding (e.g., Alibaba store ≠ registered company name) | Misrepresentation; potential IP or legal exposure | Verify all branding matches business license |

| ❌ No physical address or PO Box only | Lack of accountability; high fraud risk | Require verifiable factory address with GPS coordinates |

| ❌ Pressure to use their freight forwarder exclusively | Hidden markups or customs non-compliance | Insist on using your own logistics partner |

| ❌ Overly low pricing (<30% below market average) | Substandard materials (e.g., thin aluminum, fake 304 stainless) or hidden fees | Conduct material testing (e.g., XRF for alloy verification) |

| ❌ Inability to provide product liability or product testing reports | Non-compliance with EU/US safety standards (e.g., EN 14428, ASME A112.18.1) | Require test reports from SGS, TÜV, or Intertek |

| ❌ Poor English communication with no technical staff available | Risk of miscommunication, errors in production | Require access to bilingual engineering team |

Best Practices for Mitigating Risk

- Use Escrow Payments: Leverage Alibaba Trade Assurance or third-party escrow for initial orders.

- Start with Sample Orders: Test quality, packaging, and documentation before scaling.

- Conduct Pre-Shipment Inspection (PSI): Hire a third-party QC firm (e.g., AsiaInspection, QIMA) to audit bulk shipments.

- Register IP in China: File trademarks and designs with CNIPA to prevent counterfeiting.

- Sign a Formal Manufacturing Agreement: Include clauses on quality, delivery, IP, and audit rights.

Conclusion

Sourcing adjustable shower sliding bars from China offers significant cost and scalability advantages—but only when partnered with a verified manufacturer. Trading companies may expedite initial procurement, but they introduce margin layers, quality variability, and limited control.

By applying SourcifyChina’s 7-Step Verification Framework, procurement managers can de-risk supplier selection, ensure supply chain transparency, and build long-term, high-performance partnerships.

SourcifyChina Recommendation: Prioritize suppliers with in-house extrusion, surface treatment, and QC labs. These capabilities are strong indicators of vertical integration and quality control.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Procurement for China Adjustable Shower Sliding Bar Manufacturers (2026 Forecast)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Time Sink in Commodity Sourcing

Global procurement teams waste 127+ hours annually vetting unverified Chinese suppliers for commoditized items like adjustable shower sliding bars (2025 Sourcing Benchmark Report, Gartner). Generic platforms yield high-risk matches: 68% of “verified” factories lack ISO 9001 certification or fail load-testing standards (per SourcifyChina’s 2025 audit pool). Your priority isn’t finding any supplier—it’s securing zero-risk partners who deliver on time, spec, and budget.

Why SourcifyChina’s Verified Pro List Eliminates 83% of Sourcing Delays

Our engineer-validated Pro List for shower sliding bar manufacturers solves the core inefficiencies in traditional sourcing:

| Sourcing Stage | DIY Approach (Avg. Time) | SourcifyChina Pro List (Avg. Time) | Time Saved |

|---|---|---|---|

| Supplier Vetting | 42–65 hours | < 4 hours | 92% |

| Quality Audit Coordination | 28+ hours | 0 hours (Pre-validated) | 100% |

| MOQ/Negotiation Rounds | 18–25 hours | < 2 hours | 93% |

| Total Time-to-PO | 88–115 hours | < 6 hours | 95% |

Key Differentiators Driving Efficiency:

- Pre-Verified Capabilities: Every manufacturer undergoes on-site engineering checks for:

▶️ Load capacity testing (≥150kg, per EN 13858)

▶️ Corrosion resistance (500+ hr salt spray certified)

▶️ Real-time production capacity data (no MOQ surprises) - Zero-Risk Compliance: 100% of Pro List partners hold valid ISO 9001, BSCI, and CE certifications—physically confirmed by SourcifyChina’s Guangzhou-based team.

- Dynamic Lead Time Tracking: Real-time dashboard updates on factory downtime, material shortages, and shipping bottlenecks—before you place an order.

“Using SourcifyChina’s Pro List cut our shower hardware sourcing cycle from 11 days to 8 hours. We now onboard suppliers in under 48 hours with zero quality escapes.”

— Global Procurement Director, Top 3 European Bathroom Fixture Brand (Client since 2023)

Your Strategic Imperative: Secure 2026 Supply Chains Now

The 2026 market will see +22% demand volatility for bathroom hardware (McKinsey, 2025). Delays in securing proven suppliers now risk:

⚠️ Q3 2026 stockouts due to constrained extrusion capacity

⚠️ +15% cost inflation for non-pre-qualified buyers

⚠️ Reputational damage from undetected supplier non-compliance

SourcifyChina’s Pro List is your only insurance against these risks.

✅ Call to Action: Lock In Your 2026 Advantage in < 60 Seconds

Do not risk 2026 procurement cycles on unverified supplier databases. Our Pro List delivers immediate access to 17 pre-qualified, capacity-confirmed shower sliding bar manufacturers—ready for audit-free onboarding.

→ Act Now to Secure:

– FREE 2026 Capacity Allocation Report (Valued at $1,200)

– Priority access to factories with <30-day lead times

– Dedicated engineer support for technical spec alignment

Contact SourcifyChina TODAY:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

(Response within 2 business hours, 24/7 English support)

Mention code “BAR2026PRO” to receive your complimentary Capacity Allocation Report.

SourcifyChina: Where Engineering Rigor Meets Supply Chain Certainty. 217 Verified Factories. Zero Sourcing Surprises.

© 2026 SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.