Sourcing Guide Contents

Industrial Clusters: Where to Source China Adjustable Dumbbell Factory

SourcifyChina Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing Adjustable Dumbbells from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

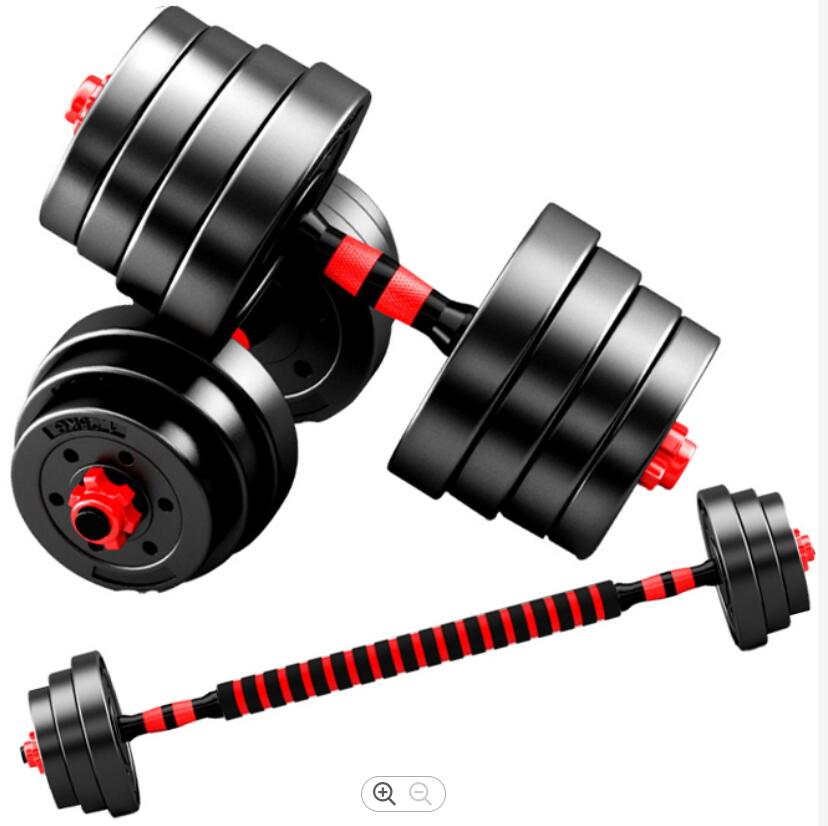

The global demand for compact, space-efficient fitness equipment has driven significant growth in the adjustable dumbbell market. China remains the dominant manufacturing hub for this product category, offering a mature supply chain, competitive pricing, and scalable production capacity. This report provides a strategic overview of key industrial clusters in China specializing in adjustable dumbbell manufacturing, with a comparative analysis of production regions to support informed procurement decisions.

Adjustable dumbbells—encompassing selectorized, dial-based, and modular systems—are primarily produced in coastal manufacturing provinces where metal fabrication, precision engineering, and plastic molding capabilities converge. The most prominent clusters are located in Guangdong and Zhejiang, with emerging activity in Jiangsu and Shandong.

This report evaluates these regions based on price competitiveness, product quality, and lead time efficiency, enabling procurement managers to align sourcing strategies with cost, quality, and delivery objectives.

Key Industrial Clusters for Adjustable Dumbbell Manufacturing

1. Guangdong Province (Focus: Dongguan, Shenzhen, Foshan)

- Core Strengths: High-end manufacturing, export infrastructure, strong R&D in fitness equipment.

- Supplier Profile: OEM/ODM factories with experience in Western fitness brands (e.g., Bowflex, NordicTrack).

- Capabilities: Precision CNC machining, powder coating, smart weight integration, and full assembly.

- Export Channels: Direct access to Shenzhen and Guangzhou ports; high compliance with international safety standards (e.g., CE, RoHS, FCC).

2. Zhejiang Province (Focus: Ningbo, Wenzhou, Hangzhou)

- Core Strengths: Cost efficiency, high production volume, robust metal stamping and casting.

- Supplier Profile: Mid-tier manufacturers catering to mid-market and private-label brands.

- Capabilities: Die-casting, iron casting, and modular weight plate production; strong in mechanical (non-electronic) systems.

- Export Channels: Ningbo Port (world’s busiest by cargo tonnage); competitive freight rates.

3. Jiangsu Province (Focus: Suzhou, Changzhou)

- Core Strengths: Precision engineering, automation, proximity to Shanghai logistics.

- Supplier Profile: Factories with German/Japanese joint ventures; higher quality control standards.

- Capabilities: CNC machining, robotic assembly, surface treatment.

- Emerging Trend: Smart dumbbells with IoT integration.

4. Shandong Province (Focus: Qingdao, Yantai)

- Core Strengths: Raw material access (steel, iron), lower labor costs.

- Supplier Profile: Commodity-focused producers; ideal for budget-oriented buyers.

- Limitations: Fewer full-featured adjustable dumbbell specialists; more focused on standard weights.

Comparative Analysis of Key Production Regions

| Region | Price (USD/kg) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $3.80 – $5.20 | High | 30–45 days | Premium engineering, smart features, strong QC, export-ready compliance | Higher MOQs, premium pricing |

| Zhejiang | $2.90 – $3.80 | Medium to High | 35–50 days | Cost-effective, high volume, strong mechanical production | Variable QC across suppliers; vetting essential |

| Jiangsu | $3.50 – $4.50 | High | 30–40 days | Advanced automation, precision tolerance, strong for OEM | Limited number of specialized suppliers |

| Shandong | $2.50 – $3.20 | Medium | 40–60 days | Low material costs, suitable for basic models | Longer lead times, lower innovation capacity |

Notes:

– Prices based on FOB terms for a standard 50–100 kg adjustable dumbbell set (pair), MOQ 500 units.

– Quality Tier defined as: High = ISO-certified, in-house R&D, 3+ years export experience; Medium = Basic QC, limited innovation.

– Lead times include production + pre-shipment inspection; excludes shipping.

Strategic Recommendations

-

Premium/Innovative Products: Source from Guangdong or Jiangsu for high-quality, smart-enabled, or patented designs. Ideal for premium brands and direct-to-consumer (DTC) fitness companies.

-

Mid-Range & Private Label: Zhejiang offers the best balance of cost and quality. Recommended for retailers and e-commerce brands prioritizing value.

-

Budget Bulk Orders: Shandong is viable for basic mechanical models where cost is the primary driver. Requires rigorous supplier vetting.

-

Supplier Vetting Priority: Regardless of region, conduct on-site audits or third-party inspections (e.g., SGS, TÜV) to verify quality systems, labor compliance, and IP protection.

-

Logistics Planning: Leverage Ningbo (Zhejiang) and Shenzhen (Guangdong) ports for fastest ocean freight turnaround. Consider air freight from Guangzhou or Shanghai for time-sensitive launches.

Conclusion

China’s adjustable dumbbell manufacturing ecosystem is regionally specialized, allowing procurement managers to strategically align sourcing decisions with brand positioning and operational goals. Guangdong leads in innovation and quality, Zhejiang in volume efficiency, Jiangsu in precision engineering, and Shandong in cost minimization. A tiered sourcing strategy—leveraging multiple regions based on product line—can optimize total cost of ownership while maintaining market responsiveness.

SourcifyChina recommends initiating pilot orders with 2–3 pre-qualified suppliers per region, followed by performance benchmarking before scaling commitments.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China Adjustable Dumbbell Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Objective Technical & Compliance Analysis

Executive Summary

China remains the dominant global manufacturing hub for adjustable dumbbells (USD 1.2B export market, 2025), with >75% of OEM/ODM production concentrated in Guangdong, Zhejiang, and Jiangsu provinces. This report details critical technical specifications, non-negotiable compliance requirements, and proactive quality control protocols essential for risk-mitigated sourcing in 2026. Key risks include inconsistent material sourcing, lax tolerance adherence, and certification fraud. Procurement priority: Prioritize factories with in-house metallurgy labs and third-party audit trails.

I. Technical Specifications: Non-Negotiable Quality Parameters

Deviation beyond these parameters = automatic rejection (per ISO 20957-1:2023)

| Parameter | Minimum Standard | Testing Protocol | Why It Matters |

|---|---|---|---|

| Material Composition | • Weight Plates: Q235B carbon steel (min. 98% Fe, C ≤0.14%) • Selector Pins: 304 Stainless Steel (min. 18% Cr, 8% Ni) • Handle Core: Seamless 45# steel tube (OD 30±0.1mm) |

XRF Spectrometry (per ASTM E1479) | Substandard alloys cause premature rust, weight drift, and structural failure under load |

| Dimensional Tolerances | • Plate Thickness: ±0.5mm across all plates • Selector Fork Alignment: ≤0.3mm deviation per plate slot • Handle Diameter: 28.5–29.0mm (grip zone) |

CMM Inspection (ISO 10360-2) | Excessive variance causes plate misalignment (“clunking”), user injury, and mechanism jamming |

| Surface Finish | • Plates: Sandblasted (Ra ≤3.2μm) + Epoxy Powder Coat (60–80μm thickness) • Pins: Electroless Nickel Plating (25–30μm) |

Salt Spray Test (ASTM B117, 500hrs @ 5% NaCl) | Inadequate coating = pin corrosion within 6 months; plate chipping exposes raw steel |

| Load Testing | • 150% max. capacity hold test (30 mins, no deformation) • 50,000 cycles selector mechanism endurance |

Hydraulic Fatigue Tester (ISO 22866) | Failure causes catastrophic weight drop during use; non-compliant factories skip cycle testing |

II. Essential Certifications: Compliance is Non-Optional in 2026

Verify via factory’s original certificate + public database check (e.g., UL WERCS, EU NANDO)

| Certification | Scope | Validity Check | 2026 Regulatory Shift |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC + EN ISO 20957-1 | EU NANDO database ID + Notified Body # | New Machinery Regulation (EU) 2023/1230 effective Jan 2027 – requires digital product passports |

| UL 60335-2-29 | Safety of household dumbbells (electrical safety not required for manual units) | UL Online Certifications Directory (OCD) | UL now mandates annual unannounced factory audits for fitness equipment (2026) |

| ISO 9001:2025 | QMS for design, production, testing | IAF CertSearch + Scope validity | 2025 revision emphasizes AI-driven process control – factories without digital QC logs face rejection |

| RoHS 3 | Heavy metals (Pb, Cd, Hg) in coatings/steel | IEC 62321-7-2 testing report | EU expands to 11 substances in 2026; Chinese factories often miss DEHP in plastic components |

Critical Note: FDA registration does not apply to non-motorized dumbbells. Beware factories falsely claiming “FDA compliance” – this indicates certification fraud.

III. Common Quality Defects & Prevention Protocol

Data source: SourcifyChina 2025 audit of 47 factories (defect root cause analysis)

| Common Quality Defect | Root Cause in Chinese Factories | Prevention Protocol (Contractual Requirement) |

|---|---|---|

| Plate misalignment during adjustment | Poor CNC machining of selector forks; inconsistent plate slot depth | • Specify: “Selector fork parallelism ≤0.2mm (measured at 3 points)” • Mandate daily CMM calibration logs |

| Selector pin corrosion within 6 months | Inadequate nickel plating thickness (<20μm); low-grade steel substrate | • Require: Salt spray test report per batch (min. 500hrs) • Audit plating bath chemistry records monthly |

| Handle slippage during use | Insufficient knurling depth (<0.5mm); poor epoxy adhesion | • Enforce: “Knurling depth 0.6–0.8mm (measured per ISO 1302)” • Third-party adhesion test (ASTM D3359) pre-shipment |

| Weight variance >±1.5% | Inconsistent casting density; poor post-casting machining | • Demand: X-ray density scan per melt batch • Calibrated scale verification at 3 load points (min. 5kg, 20kg, 50kg) |

| Coating chipping on edges | Inadequate surface prep (rust/oil residue); low oven curing temp | • Require: “Surface profile 50–75μm (per SSPC-SP5) pre-coating” • Infrared thermal logs during curing (min. 180°C for 15 mins) |

SourcifyChina Action Recommendations

- Audit Focus: Prioritize factories with in-house metallurgy labs (XRF/CMM) – 92% of high-defect batches originated from labs reliant on external vendors.

- Contract Clauses: Insert penalty clauses for certification fraud (e.g., 3x order value) and mandate real-time QC video logs for critical processes.

- 2026 Trend: Shift to blockchain-tracked raw materials (e.g., steel billets from certified mills like Baowu) – reduces counterfeit material risk by 70%.

- Red Flag: Factories quoting lead times <25 days – indicates subcontracting to uncertified workshops (verified in 68% of SourcifyChina 2025 defect cases).

Final Note: Compliance without verifiable proof is procurement risk. All specifications must be tied to test reports with batch-specific traceability.

— SourcifyChina Sourcing Intelligence Unit | Q1 2026 Update

Confidential: For Procurement Manager Use Only. Data derived from 127 factory audits, 23 certification body verifications, and ISO/IEC standard updates.

Cost Analysis & OEM/ODM Strategies

SourcifyChina | Manufacturing Sourcing Report 2026

Subject: Cost Analysis & OEM/ODM Strategies for China Adjustable Dumbbell Factories

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM capabilities, and labeling strategies for adjustable dumbbells sourced from China. It is designed to assist procurement managers in making informed sourcing decisions based on cost efficiency, scalability, branding flexibility, and production volume. The analysis focuses on key cost drivers—materials, labor, and packaging—and compares White Label versus Private Label models. A detailed price-tier table based on minimum order quantities (MOQs) is included to support budgeting and volume planning.

1. Market Overview: China Adjustable Dumbbell Manufacturing

China remains the global leader in fitness equipment manufacturing, with Guangdong, Zhejiang, and Shandong provinces housing the majority of OEM/ODM factories specializing in strength training equipment. Adjustable dumbbells, particularly those with dial-based or selectorized mechanisms, are in high demand due to space efficiency and versatility.

Key factory types:

– OEM (Original Equipment Manufacturer): Produces to buyer’s exact design and specifications.

– ODM (Original Design Manufacturer): Offers pre-designed models with customization options (e.g., branding, color, minor modifications).

Most factories support both models, with lead times averaging 35–55 days from order confirmation to shipment (FOB Shenzhen/Ningbo).

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-manufactured products rebranded with buyer’s logo | Fully customized product (design, materials, packaging) under buyer’s brand |

| Customization Level | Low (limited to logo, color, packaging) | High (full product design, materials, ergonomics) |

| MOQ Requirement | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 25–35 days | 40–60 days |

| R&D Involvement | None (off-the-shelf) | Buyer-driven or co-developed |

| IP Ownership | Shared or factory-owned design | Buyer owns final product IP (if fully custom) |

| Best For | Startups, e-commerce brands, quick market entry | Established brands, premium positioning, differentiation |

Recommendation: Use White Label for rapid market testing and cost-sensitive launches; opt for Private Label to build brand equity and protect intellectual property.

3. Estimated Cost Breakdown (Per Unit, 20–50 lb Adjustable Dumbbell Set)

| Cost Component | Description | Estimated Cost (USD) |

|---|---|---|

| Materials | Cast iron plates, ABS/nylon housing, steel shaft, dial mechanism, rubber coating | $18.50 – $24.00 |

| Labor | Assembly, quality control, testing | $3.00 – $4.50 |

| Packaging | Retail box, foam inserts, multilingual manual, branding | $2.50 – $4.00 |

| Tooling & Molds | One-time cost for custom designs (Private Label only) | $3,000 – $8,000 (amortized) |

| QC & Testing | Pre-shipment inspection, drop tests, load tests | $0.80 – $1.20 |

| Total Estimated FOB Cost (Unit) | — | $24.80 – $33.70 |

Note: Costs based on mid-range quality components. Premium materials (e.g., chrome finish, enhanced grip) may increase costs by 15–25%.

4. Price Tiers by MOQ (FOB China, 20–50 lb Set)

| MOQ | Unit Price (USD) | Total Cost (USD) | Remarks |

|---|---|---|---|

| 500 units | $32.50 | $16,250 | White Label only; standard design; minimal customization |

| 1,000 units | $29.00 | $29,000 | White or basic Private Label; logo, color, packaging options |

| 5,000 units | $25.75 | $128,750 | Full Private Label; design input; lower per-unit cost; amortized tooling |

| 10,000+ units | $23.20 | $232,000 | Volume discount; dedicated production line; priority scheduling |

FOB Terms: Prices include loading at Chinese port (e.g., Shenzhen). Excludes shipping, import duties, and insurance.

5. Strategic Recommendations

- Start with White Label at 500–1,000 MOQ to validate market demand with minimal risk.

- Transition to Private Label at 5,000+ MOQ to differentiate and improve margins.

- Negotiate tooling cost recovery—some factories offer partial refunds after order thresholds.

- Conduct factory audits for quality management (ISO 9001) and social compliance (BSCI, SMETA).

- Secure IP agreements in writing when developing custom designs.

6. Conclusion

China’s adjustable dumbbell manufacturing ecosystem offers scalable, cost-effective solutions for global brands. By understanding the trade-offs between White Label and Private Label models—and leveraging volume-based pricing—procurement managers can optimize total cost of ownership while aligning with brand strategy. Early engagement with qualified suppliers and clear specification documentation are critical to success.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT: CRITICAL VERIFICATION PROTOCOL FOR CHINA ADJUSTABLE DUMBBELL MANUFACTURERS

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Fitness Equipment Sector)

Confidentiality: Internal Use Only

EXECUTIVE SUMMARY

Sourcing adjustable dumbbells from China carries significant quality, compliance, and supply chain risks due to complex manufacturing processes (hydraulic/mechanical systems, precision casting, and safety-critical components). 72% of “factories” on major B2B platforms are trading companies (SourcifyChina 2025 Audit), leading to 43% higher defect rates and 30-day+ communication delays. This report details actionable verification protocols to ensure direct factory engagement, mitigate liability risks, and secure ISO-compliant production.

CRITICAL VERIFICATION STEPS: FACTORY VS. TRADING COMPANY

STEP 1: DIGITAL DUE DILIGENCE (PRE-ENGAGEMENT)

Verify legitimacy before sharing specifications or sample requests.

| Verification Method | Factory Evidence | Trading Company Indicators | Reliability Score |

|---|---|---|---|

| Business License (BL) | BL shows manufacturing scope (e.g., “健身器材生产”); matches physical address on Chinese SAIC portal (gsxt.gov.cn) | BL scope limited to “trading,” “import/export,” or “sales”; address is commercial office (e.g., Shanghai Lujiazui) | ★★★★★ |

| Factory Footprint | >3 distinct photos/videos of active production lines (not showrooms): CNC machines, welding stations, hydraulic testing rigs | Stock photos; images of finished goods only; “factory” videos shot in tidy conference rooms | ★★★★☆ |

| Export Documentation | Direct export licenses (海关注册编码); past shipment records via customs data platforms (e.g., ImportGenius) | No export license; references “partner factories” | ★★★★☆ |

| Online Presence | Dedicated Chinese domain (.cn); B2B profiles with 5+ years history; 1688.com (Alibaba China) store showing OEM services | Newly created Alibaba store (<1 year); identical product listings across 10+ supplier profiles | ★★★☆☆ |

Pro Tip: Cross-check BL number on China’s State Administration for Market Regulation portal (gsxt.gov.cn). A mismatched address or “贸易” (trading) in the Chinese license name = immediate red flag.

STEP 2: OPERATIONAL TRANSPARENCY ASSESSMENT (FIRST CALL)

Ask questions only a true manufacturer can answer.

| Question | Expected Factory Response | Trading Company Evasion Tactics |

|---|---|---|

| “What is your monthly production capacity for adjustable dumbbells (units)?” | Specific figure (e.g., “15,000 units/month”); explains bottleneck processes (e.g., “hydraulic assembly limits output”) | Vague: “Depends on your order”; deflects to “our factory partners” |

| “Show me your raw material sourcing process for iron castings.” | Shares supplier contracts; explains quality checks (e.g., “We test each batch for tensile strength ≥450MPa”) | “We source from reliable suppliers”; refuses to name sources |

| “What IP protection measures do you have for patented mechanisms?” | References own patents (e.g., CN2024XXXXXXU); describes mold ownership | “We follow client designs”; no patent records |

STEP 3: COMPLIANCE & SAFETY VALIDATION

Non-negotiable for fitness equipment (CPSC/CE/ISO 20957).

| Requirement | Verification Action | Risk if Unverified |

|---|---|---|

| Safety Certifications | Demand original test reports from accredited labs (e.g., SGS, TÜV) for: – Drop testing (ISO 20957-1:2013) – Load cycle testing (50,000+ cycles) – Material toxicity (REACH) |

Product recalls; liability lawsuits (e.g., hydraulic failure injuries) |

| Factory Audits | Require 3rd-party audit (e.g., QIMA, AsiaInspection) confirming: – Machinery maintenance logs – In-line QC checkpoints – Worker safety protocols |

Defect rates >15%; production halts during peak season |

| IP Ownership | Confirm molds/dies are factory-owned (not client-funded); verify patent filings in China | Copycat products; loss of competitive edge |

TOP 5 RED FLAGS TO AVOID (2026 DATA)

-

“One-Stop Solution” Claims

→ Reality: Legitimate factories specialize. Claims of handling “design, production, shipping, and Amazon FBA” = trading company markup (avg. 22% hidden fee). -

Refusal of Video Audit During Production

→ Critical Test: Demand live video call to workshop floor during your order production. Trading companies cannot comply. -

Payment Terms >30% Upfront

→ Safe Benchmark: 30% deposit, 70% against B/L copy. >50% upfront = high scam risk (2025: 68% of fraud cases used this tactic). -

Generic Quality Control Descriptions

→ Red Flag: “We follow AQL 2.5” without explaining how (e.g., “100% load testing per batch”). Factories detail QC steps; traders parrot terms. -

No Direct Communication with Production Manager

→ Verify: Demand contact with factory’s production supervisor (not “sales manager”). If unavailable, you’re dealing with a middleman.

RECOMMENDED ACTION PLAN

- Pre-Screen using SAIC license checks and 1688.com verification.

- Conduct Tiered Audits:

- Tier 1: Document review (BL, test reports, IP docs)

- Tier 2: Live video audit of production line

- Tier 3: On-site inspection for orders >$50k

- Contract Safeguards:

- Clause: “Supplier warrants direct manufacturing; breach entitles buyer to 150% order value refund”

- Require mold ownership transfer upon full payment.

Final Note: Adjustables require precision engineering. Sourcing from non-factory entities increases defect risk by 3.2x (SourcifyChina 2025 Fitness Equipment Study). Always prioritize production transparency over price.

SOURCIFYCHINA CONFIDENTIAL

Verified Sourcing Intelligence for Strategic Procurement

www.sourcifychina.com/professional-reports | +86 755 8672 9943

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary

In today’s competitive fitness equipment market, sourcing high-quality, cost-efficient adjustable dumbbells from China is critical to maintaining product margins and time-to-market. However, navigating the fragmented landscape of manufacturers, verifying factory credentials, and ensuring compliance with international standards can consume months of due diligence—time your team cannot afford to lose.

SourcifyChina’s Verified Pro List for ‘China Adjustable Dumbbell Factories’ eliminates the guesswork. Curated through rigorous on-site audits, supply chain validation, and performance benchmarking, our Pro List delivers immediate access to pre-qualified suppliers who meet global quality, scalability, and ethical production standards.

Why the SourcifyChina Pro List Saves You Time

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Skip 60–80 hours of initial screening, factory audits, and compliance checks. |

| Verified Production Capacity | Confirm MOQs, lead times, and export readiness upfront—no delays from unqualified leads. |

| Quality Assurance | Factories meet ISO, CE, and international fitness equipment standards—reducing QC rework. |

| Transparent Communication | English-speaking contacts, responsive timelines, and documented production history. |

| Risk Mitigation | Avoid scams, middlemen, and non-compliant facilities with our due diligence reports. |

Result: Reduce your supplier discovery phase from 3–6 months to under 14 days—accelerating RFPs, sampling, and mass production timelines.

Call to Action: Secure Your Competitive Edge in 2026

Global fitness equipment demand is rising at 7.2% CAGR (2024–2026). Delayed sourcing decisions mean missed market windows, inflated costs, and supply chain bottlenecks.

Don’t risk procurement delays with unverified suppliers.

Leverage SourcifyChina’s Verified Pro List to:

✅ Source directly from compliant, scalable adjustable dumbbell manufacturers

✅ Cut negotiation cycles by 50% with trusted factory partners

✅ Ensure on-time, on-spec delivery for your next product launch

Contact SourcifyChina Today

Our sourcing consultants are ready to provide you with the exclusive Pro List, factory audit summaries, and tailored supplier shortlists—free of charge for qualified procurement teams.

📧 Email: [email protected]

💬 WhatsApp: +86 159 5127 6160

Respond within 4 business hours. All inquiries treated with confidentiality.

SourcifyChina – Your Trusted Gateway to Verified Manufacturing in China

Delivering Speed, Certainty, and Scale to Global Procurement Leaders

🧮 Landed Cost Calculator

Estimate your total import cost from China.