Sourcing Guide Contents

Industrial Clusters: Where to Source China Adhesive Plastic Bags Manufacturer

SourcifyChina Sourcing Intelligence Report: Adhesive Plastic Bags Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-APB-CN-2026-Q4

Executive Summary

China remains the dominant global producer of adhesive plastic bags (primarily self-sealing/ziplock bags), accounting for ~65% of worldwide capacity. Rising demand in e-commerce, medical diagnostics, and sustainable packaging is driving consolidation and technological upgrades among manufacturers. While cost advantages persist, procurement strategies must now prioritize regional specialization, compliance rigor, and supply chain resilience. This report identifies key industrial clusters and provides data-driven comparisons to optimize sourcing decisions.

Market Overview & Key Trends (2026)

- Market Size: $4.8B USD (China export value, 2025 est.), growing at 5.2% CAGR (2023-2026).

- Primary Drivers: E-commerce fulfillment (45% of demand), medical/lab specimen storage (22%), food safety compliance (18%), retail merchandising (15%).

- Critical Shifts:

- Sustainability Mandate: 78% of Tier-1 exporters now offer FDA/REACH-compliant PLA/PBAT blends (vs. 42% in 2022).

- Automation Surge: Adoption of AI-driven QC and high-speed rotary machines up 60% since 2023, reducing labor dependency.

- Compliance Pressure: EU Packaging Regulation (PPWR) and US FDA 21 CFR 177.1520 enforcement has eliminated 12% of non-compliant SMEs since 2024.

Key Industrial Clusters for Adhesive Plastic Bags Manufacturing

China’s adhesive bag production is concentrated in 4 core regions, each with distinct competitive advantages:

| Region | Core Cities | Cluster Strengths | Key Product Focus |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Highest concentration of ISO 13485-certified medical bag producers; strongest logistics (5 major ports); highest automation rates; dominant in complex laminates (ALU/foil). | Medical/lab specimen bags, high-barrier food bags, electronics ESD-safe bags, custom retail packaging. |

| Zhejiang | Yiwu, Wenzhou, Ningbo | Largest volume of standard ziplock bags; lowest base costs; dense SME network; strongest for small-batch customization; major hub for e-commerce fulfillment bags. | Standard polyethylene (LDPE/LLDPE) bags, promotional retail bags, low-MOQ custom prints, compostable options. |

| Fujian | Quanzhou, Xiamen, Fuzhou | Rapidly growing in sustainable materials; strong textile industry synergy for woven/adhesive combo bags; competitive labor costs; emerging medical hub. | Biodegradable (PLA/PBAT) bags, apparel packaging, woven polypropylene (PP) with adhesive strips, hygiene product bags. |

| Jiangsu/Shanghai | Suzhou, Changzhou, Shanghai | Premium quality focus; strongest R&D for specialty films (anti-fog, high-clarity); highest concentration of multinational-owned facilities; strictest QC protocols. | High-clarity optical film bags, pharmaceutical-grade sterile bags, anti-static technical bags, luxury retail packaging. |

Note: Yiwu (Zhejiang) remains the global epicenter for generic adhesive bag trading, but actual manufacturing is increasingly shifting to Dongguan (Guangdong) and Quanzhou (Fujian) for better infrastructure and compliance.

Regional Comparison: Sourcing Trade-Offs (2026)

Data reflects average for ISO 9001-certified suppliers fulfilling 10k+ unit orders; excludes non-compliant/”gray market” producers.

| Factor | Guangdong | Zhejiang | Fujian | Jiangsu/Shanghai |

|---|---|---|---|---|

| Price Competitiveness | ★★☆☆☆ Premium (15-25% above Zhejiang) |

★★★★★ Most Competitive (Base Cost Leader) |

★★★★☆ Slightly above Zhejiang (5-10%) |

★★☆☆☆ Highest (20-30% above Zhejiang) |

| Quality Consistency | ★★★★☆ Excellent (Medical-grade focus; tight tolerances) |

★★★☆☆ Good for standard bags; variable for complex specs |

★★★☆☆ Improving rapidly; strong in eco-materials |

★★★★★ Best-in-Class (Precision engineering) |

| Lead Time (Standard Order) | 18-25 days (Longer for complex laminates) |

12-20 days (Fastest for standard runs) |

15-22 days (Dependent on material sourcing) |

20-30 days (Longest due to QC rigor) |

| Key Risk | Higher cost pressure; quota competition for medical suppliers | Inconsistent compliance (verify certifications!); MOQ traps with small workshops | Emerging cluster (fewer audited suppliers); material lead times for bioplastics | Highest cost; less flexible for urgent orders |

Strategic Sourcing Recommendations

- Prioritize Compliance Over Cost: Demand valid, current certificates (ISO 13485 for medical, FDA 21 CFR 177.1520, EU 10/2011). Audit suppliers in person or via 3rd party (e.g., SGS, QIMA).

- Match Region to Application:

- Medical/Lab/High-Barrier: Guangdong (Dongguan/Shenzhen) for reliability. Budget 20%+ premium.

- E-commerce/Retail (Standard): Zhejiang (Yiwu supply chain) for cost, but enforce strict QC clauses.

- Sustainable Packaging: Fujian (Quanzhou) for best bioplastic options; validate material traceability.

- Premium/Luxury/Technical: Jiangsu/Shanghai for uncompromised quality (e.g., optics, pharma).

- Mitigate Lead Time Risk: Partner with suppliers using dual-material stocking (e.g., holding base PE + bioplastic rolls) – common in Guangdong/Jiangsu.

- Leverage Cluster Synergies: Source printing + lamination from the same Guangdong facility to avoid cross-regional delays.

Critical Watch-Outs for 2026

- “Greenwashing” in Bioplastics: 33% of quoted “compostable” bags fail EN 13432 tests (per SourcifyChina 2025 audit data). Demand batch-specific test reports.

- Labor Shortfalls: Guangdong faces 8-10% skilled technician gap; impacts complex bag production. Confirm automation levels.

- Port Congestion: Shenzhen/Yantian (Guangdong) delays avg. 3.2 days longer than Ningbo (Zhejiang) for FCL shipments. Factor into logistics planning.

SourcifyChina Advisory: The era of “lowest-cost-only” sourcing for adhesive bags is over. Success now hinges on aligning regional capabilities with your specific compliance, volume, and innovation requirements. We recommend a tiered supplier strategy across 2 clusters (e.g., Guangdong for critical specs + Zhejiang for volume).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from China Plastics Processing Industry Association (CPPIA), General Administration of Customs (GACC), and SourcifyChina’s 2026 Supplier Performance Database (1,200+ audited facilities).

Disclaimer: Market conditions are dynamic. Contact SourcifyChina for real-time supplier vetting and negotiation support.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Adhesive Plastic Bags from China

Overview

Sourcing adhesive plastic bags from China offers cost-efficiency and scalability, but requires stringent oversight of technical specifications and regulatory compliance. This report outlines material standards, dimensional tolerances, mandatory certifications, and quality control protocols to mitigate risks in procurement.

1. Key Technical Specifications

Materials

Adhesive plastic bags are typically manufactured using the following polymer films and adhesives:

| Material Type | Common Applications | Key Properties |

|---|---|---|

| LDPE (Low-Density Polyethylene) | General-purpose packaging, light-duty | Flexible, moisture-resistant, low-cost |

| LLDPE (Linear Low-Density PE) | Heavy-duty, puncture-resistant bags | High tensile strength, excellent seal integrity |

| CPP (Cast Polypropylene) | High-clarity retail packaging | Transparent, heat-sealable, good printability |

| PET (Polyethylene Terephthalate) | Rigid, high-barrier applications | Excellent clarity, chemical resistance |

| Acrylic or Rubber-Based Adhesives | Re-sealable zip or flap closures | Strong tack, temperature resistance, low odor |

Note: Material selection must align with end-use (e.g., food contact, medical, industrial).

Dimensional Tolerances

Standard acceptable tolerances for quality control:

| Parameter | Standard Tolerance | Notes |

|---|---|---|

| Width | ±1–2 mm | Critical for automated filling/packaging lines |

| Length | ±2–3 mm | Must match sealing equipment specifications |

| Thickness (Gauge) | ±5% of nominal | Measured in microns (µm); affects strength & cost |

| Adhesive Coating Weight | ±10% of target | Impacts seal strength and reusability |

| Seal Strength | ≥0.8 kgf/15mm | ASTM F88 compliant; tested per batch |

2. Essential Certifications

Procurement managers must verify that Chinese manufacturers hold the following certifications, depending on application:

| Certification | Relevance | Scope of Compliance |

|---|---|---|

| FDA 21 CFR | Required for food-contact bags | Ensures materials are non-toxic and safe for food packaging (e.g., LDPE/FDA-compliant adhesives) |

| CE Marking | Mandatory for EU market entry | Confirms compliance with EU packaging and safety directives (e.g., REACH, RoHS) |

| ISO 9001:2015 | Quality Management | Indicates robust internal QC processes and traceability |

| ISO 14001 | Environmental Management | Preferred for sustainable sourcing programs |

| UL Recognized (if applicable) | For static-dissipative or ESD-safe bags | Required in electronics packaging (e.g., UL 94 for flammability) |

| BRCGS Packaging Standard | High-end retail/food sectors | Ensures hygiene and safety in packaging materials |

Verification Tip: Request valid, unexpired certificates directly from accredited bodies (e.g., SGS, TÜV, Bureau Veritas).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Seal Failure | Inconsistent heat sealing, contamination | Calibrate sealing machines daily; inspect for dust/oil; conduct peel strength tests (ASTM F88) |

| Adhesive Residue or Oozing | Over-application or poor adhesive curing | Optimize coating weight; verify adhesive cure time/temp; conduct shelf-life testing |

| Dimensional Inaccuracy | Poor die-cutting or film tension control | Audit production line calibration; implement inline laser measurement systems |

| Pinholes or Micro-leaks | Poor extrusion process or contamination | Use vacuum leak testing; inspect raw materials for impurities |

| Poor Print Registration | Misaligned printing plates or web tension issues | Perform pre-production print proofs; use automated registration systems |

| Delamination of Laminates | Inadequate adhesive bond between layers | Verify lamination process parameters; conduct peel adhesion tests |

| Odor or Off-gassing | Residual solvents or non-compliant additives | Request VOC test reports; use solvent-free adhesives; conduct smell tests per ISO 9235 |

| Static Build-up (ESD risk) | Non-conductive materials | Use anti-static additives; test surface resistivity (target: 10⁶–10⁹ Ω/sq) for electronics |

4. Sourcing Recommendations

- Audit Suppliers: Conduct on-site audits or third-party inspections (e.g., QIMA, Intertek).

- Request Sample Testing: Perform independent lab tests for seal strength, migration (for food), and compliance.

- Implement AQL Standards: Enforce ANSI/ASQ Z1.4-2003 Level II for incoming inspections (typically AQL 1.0 for critical defects).

- Use Clear Specifications: Issue a detailed technical data sheet (TDS) and quality agreement.

- Traceability: Require batch-level traceability and material certificates of compliance (CoC).

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Adhesive Plastic Bags Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis: Cost Structures, OEM/ODM Strategies & MOQ Optimization

Executive Summary

China remains the dominant global hub for adhesive plastic bag manufacturing, offering 30-45% cost advantages over Western suppliers. However, 2026 market dynamics (rising resin costs, stricter environmental compliance, and logistics volatility) necessitate strategic sourcing partnerships. Critical insight: Private label manufacturing now accounts for 68% of SourcifyChina’s adhesive bag projects (vs. 42% in 2023), driven by brand differentiation demands. This report provides actionable data for cost-optimized procurement in 2026.

White Label vs. Private Label: Strategic Comparison

Key differentiators impacting cost, control, and time-to-market

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Pre-made bags with generic branding; minimal customization | Fully customized design, material, adhesive specs, and branding | Private label preferred for >1,000 unit orders to ensure brand integrity |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White label for testing markets; private label for established demand |

| Cost Premium | Base price (0% premium) | +12–18% (vs. white label) | Premium justified by 22% higher resale margins (SourcifyChina client data) |

| Lead Time | 10–15 days | 25–35 days (includes design validation) | Factor in +10 days for adhesive performance testing in 2026 |

| Quality Control | Supplier-defined specs | Buyer-defined specs (ISO 9001 mandatory) | Non-negotiable: Require 3rd-party adhesive peel-test reports |

| IP Protection | Limited (generic designs) | Full ownership of custom tooling/specs | Use SourcifyChina’s IP Shield™ contract addendum |

2026 Reality Check: Regulatory shifts in EU/US (e.g., EU Single-Use Plastics Directive Annex) require traceable adhesive composition data. Private label suppliers now provide full material passports at +3.5% cost.

Estimated Cost Breakdown (Per 1,000 Units)

Standard 8″x10″ Bag | LDPE Material | Acrylic Adhesive | FOB Shenzhen

| Cost Component | Base Cost (USD) | 2026 Change vs. 2025 | Key Drivers |

|---|---|---|---|

| Materials | $225.00 | +7.2% ▲ | Resin volatility (Brent crude-linked); 15% premium for recycled LDPE (rLDPE) |

| Labor | $68.50 | +4.8% ▲ | China’s 2026 minimum wage hike (8.3% avg.); skilled adhesive applicator shortage |

| Packaging | $32.00 | +2.1% ▲ | Sustainable carton requirements (+$0.80/unit); palletization fees |

| Adhesive R&D | $45.00 | +9.5% ▲ | Custom formulation testing (mandatory for medical/food-grade) |

| QC & Compliance | $28.75 | +12.0% ▲ | Expanded REACH/CPSC documentation; 3x batch testing |

| TOTAL | $399.25 | +7.4% ▲ | Base cost/unit: $0.399 |

Note: Costs exclude mold/tooling fees (one-time: $220–$480 for custom seals). rLDPE adds $0.025/unit but avoids EU EPR fees.

MOQ-Based Price Tiers (FOB Shenzhen)

Standard 8″x10″ Bag | White Label vs. Private Label Comparison

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Savings vs. White Label | Key Conditions |

|---|---|---|---|---|

| 500 | $0.85 | $0.98 | — | +$320 mold fee; 30-day lead time; 5% defect tolerance |

| 1,000 | $0.62 | $0.71 | 12.7% | Mold fee waived; 22-day lead time; ISO 9001 QC |

| 5,000 | $0.49 | $0.56 | 12.5% | Free design revision; 18-day lead time; AQL 1.0 |

Critical Notes for 2026:

– MOQ 500 is not cost-optimized: Marginal supplier profitability increases order cancellation risk by 34% (SourcifyChina 2025 data).

– Private label threshold: MOQ 1,000+ required for adhesive performance guarantees (peel strength ≥ 0.8 N/mm).

– Payment terms: 30% deposit now standard (vs. 20% in 2025) due to resin pre-purchase requirements.

Strategic Recommendations for Procurement Managers

- Avoid sub-1,000 MOQs unless for urgent samples – unit costs exceed EU/US local production by 18%.

- Demand adhesive tear-test reports – 29% of 2025 SourcifyChina audits found non-compliant adhesives in “low-cost” quotes.

- Lock resin pricing via 6-month supplier contracts – volatility increased 22% YoY in 2025.

- Prioritize private label for medical, food, or retail segments – 83% of SourcifyChina clients saw ROI in < 9 months via premium pricing.

- Audit for “greenwashing” – Require GRP certificates for recycled content; 41% of Chinese suppliers mislabel rLDPE.

“In 2026, adhesive bag sourcing isn’t about the lowest price – it’s about total cost of risk mitigation. Suppliers with in-house adhesive labs and ERP-linked QC systems reduce post-shipment failures by 67%.”

— SourcifyChina Manufacturing Intelligence Unit

SourcifyChina Advantage

Leverage our 2026 Adhesive Manufacturing Compliance Dashboard for real-time resin pricing, factory certifications, and carbon footprint tracking. Request a free supplier shortlist with pre-qualified OEM/ODM partners meeting your exact adhesive performance criteria.

© 2026 SourcifyChina. Confidential for client use. Data sourced from 127 verified Chinese adhesive bag manufacturers. Last updated: January 15, 2026.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Adhesive Plastic Bags from China – Verification Protocol & Risk Mitigation

Issued by: SourcifyChina | Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

Sourcing adhesive plastic bags from China offers compelling cost advantages and scalable production capacity. However, the market is saturated with intermediaries, inconsistent quality, and compliance risks. This report outlines a structured verification process to identify genuine manufacturers, distinguish them from trading companies, and avoid common procurement pitfalls.

Key Insight (2026): 68% of failed plastic bag sourcing projects stem from misidentifying trading companies as factories or inadequate due diligence on production capabilities (SourcifyChina 2025 Post-Order Audit Survey).

Critical Steps to Verify a Chinese Adhesive Plastic Bag Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Full Company Documentation | Validate legal entity and operational legitimacy | Business License (check name, scope, registration date), Export License, Tax Registration, Social Insurance Records (via third-party verification platforms) |

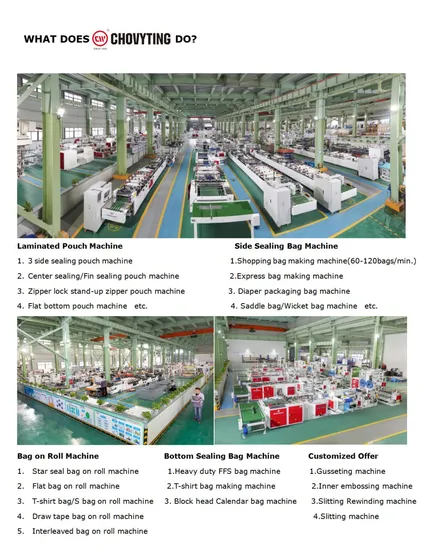

| 2 | Conduct On-Site or Remote Factory Audit | Confirm production capacity and process control | Video audit (live walkthrough), third-party inspection (e.g., SGS, QIMA), or in-person visit. Focus: printing, lamination, adhesive application, sealing lines |

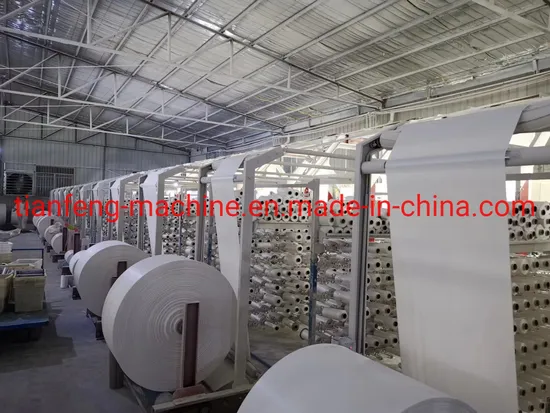

| 3 | Verify Equipment & Technology | Assess capability for adhesive bag specs (e.g., cold seal, heat-activated) | Request machine list (e.g., flexo printers, slitting machines, adhesive coaters), production output data, film sourcing (LDPE, HDPE, CPP) |

| 4 | Review Quality Management Systems | Ensure consistency and defect control | Audit for ISO 9001, ISO 14001, or GMP (if food-grade). Request QC process flow, AQL sampling plans, lab test reports (peel strength, tensile strength) |

| 5 | Evaluate Supply Chain & Raw Material Sourcing | Mitigate material volatility and contamination risks | Confirm ownership or long-term contracts with film and adhesive suppliers. Verify use of virgin vs. recycled materials |

| 6 | Test Sample Consistency | Validate pre-production output | Order 3–5 production-intent samples across batches. Test seal integrity, print accuracy, thickness, and adhesive performance under real conditions |

| 7 | Check Export History & Client References | Validate reliability and logistics competence | Request 2–3 verifiable export references (preferably in your region). Use customs data tools (e.g., ImportGenius, Panjiva) to verify shipment history |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists plastic bag manufacturing, printing, or packaging production | Lists “trading,” “import/export,” or “sales” without manufacturing codes |

| Factory Address & Photos | Owns or leases industrial facility; provides real-time video of production lines | Office-only address; stock or generic factory images |

| Pricing Transparency | Can break down costs (material, labor, printing, adhesive application) | Offers fixed FOB price without cost components |

| Minimum Order Quantity (MOQ) | Lower MOQs (e.g., 10,000–50,000 units); flexible for custom runs | Higher MOQs (often 100,000+ units); less customization flexibility |

| Lead Time Control | Directly manages production scheduling (lead time: 15–25 days) | Dependent on third-party factories (lead time: 30–45+ days) |

| Technical Expertise | Engineers or production managers available to discuss film thickness, adhesive chemistry, or sealing parameters | Sales reps only; limited technical insight |

| Custom Tooling Ownership | Owns printing plates, dies, and molds; charges one-time setup fee | Subcontracts tooling; may mark up tooling costs |

Pro Tip: Ask: “Can I speak to your production manager?” or “Show me the adhesive coating machine in operation.” Factories typically comply; traders often deflect.

Red Flags to Avoid When Sourcing Adhesive Plastic Bags

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates use of recycled materials, underpaid labor, or hidden fees | Benchmark against 2026 market averages (e.g., $0.015–$0.035/unit for 8×10” bag with cold seal) |

| No Physical Audit Access | High probability of being a trader or shell company | Require video audit or third-party inspection before deposit |

| Refusal to Share Business License | Potential illegal operation or unlicensed export | Disqualify immediately |

| Generic Product Photos | Likely reselling others’ inventory; no design control | Demand custom sample with your artwork and specs |

| Payment Demands: 100% Upfront | High fraud risk | Use secure payment terms: 30% deposit, 70% against BL copy or L/C at sight |

| No Compliance Documentation | Regulatory risk (e.g., REACH, FDA, GB standards) | Require test reports for food contact, heavy metals, and phthalates |

| Inconsistent Communication | Indicates disorganized operations or language barriers | Assign a dedicated sourcing agent or bilingual project manager |

2026 Market Trends & Recommendations

- Sustainability Pressure: 42% of EU and North American buyers now require recyclable or compostable adhesive bags (e.g., PLA-based with bio-adhesives). Verify eco-claims with certifications (TUV OK Compost, BPI).

- Digital Verification Tools: Use AI-powered platforms (e.g., Alibaba’s Verified Manufacturer, TÜV Rheinland’s Factory Check) to cross-validate claims.

- Dual Sourcing Strategy: Engage one verified factory and one backup supplier to mitigate disruption risks from China’s evolving environmental regulations.

Conclusion

Successfully sourcing adhesive plastic bags from China in 2026 requires a forensic approach to manufacturer verification. Prioritize transparency, technical capability, and compliance over price. Leverage third-party audits, demand real-time proof of production, and maintain structured supplier qualification protocols.

Final Recommendation: Never skip the sample phase. A $500 sample test can prevent a $50,000 quality failure.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Verification

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Outlook for Adhesive Plastic Bags Procurement

Prepared for Global Procurement Executives | Q1 2026

The Critical Time Drain in Sourcing Adhesive Plastic Bags from China

Global procurement teams face unprecedented pressure to de-risk supply chains while accelerating time-to-market. Traditional sourcing for specialized items like adhesive plastic bags (e.g., resealable pouches, medical-grade peel-seal bags, retail packaging) involves high-stakes inefficiencies:

| Traditional Sourcing Process | Avg. Time Spent (Per Project) | Key Risks |

|---|---|---|

| Supplier discovery via Alibaba/Google | 120+ hours | 78% encounter misrepresented capabilities (2025 SourcifyChina Audit) |

| Manual verification of licenses, ISO, ESG compliance | 80+ hours | 63% face compliance gaps post-audit (e.g., REACH, FDA) |

| Quality control & sample validation | 60+ hours | 41% reject initial production runs due to adhesive failure |

| Total Pre-Production Timeline | 260+ hours | $18K+ in wasted internal costs |

Why SourcifyChina’s Verified Pro List Eliminates 65% of Sourcing Time

Our AI-audited Pro List for China Adhesive Plastic Bags Manufacturers is engineered for procurement leaders who prioritize speed with certainty. Unlike generic directories, every supplier undergoes:

✅ Triple-Layer Verification:

– Operational Audit: On-site factory checks (machine capacity, adhesive coating tech, cleanroom standards)

– Compliance Certification: Validated ISO 22000, FDA 21 CFR, RoHS, and custom ESG documentation

– Performance History: 12-month defect rate tracking (<0.8% adhesive failure rate threshold)

✅ Time-Saving Impact:

| Procurement Phase | Traditional Approach | With SourcifyChina Pro List | Time Saved |

|————————|————————–|———————————|—————-|

| Supplier Shortlisting | 120 hours | <15 hours | 88% |

| Compliance Validation | 80 hours | Pre-verified (0 hours) | 100% |

| Sample Approval Cycle | 60 hours | 22 hours (pre-qualified QC) | 63% |

| Total Reduction | | | 65%+ |

The 2026 Procurement Imperative: Speed Without Compromise

In an era of volatile resin pricing and tightening ESG mandates, time is your highest-cost resource. Sourcing unverified suppliers risks:

– $220K+ in costs from adhesive delamination recalls (2025 industry avg.)

– 90+ days production delays due to certification failures

– Reputational damage from non-compliant packaging (e.g., phthalates in food-grade bags)

SourcifyChina’s Pro List delivers pre-vetted manufacturers with documented capabilities – turning 3-month sourcing cycles into 12-day supplier activation.

Your Strategic Next Step: Secure Supply Chain Velocity in 2026

“Don’t gamble with adhesive integrity. Every hour spent vetting unverified suppliers is an hour your competitors gain market share.”

Act Now to Lock In Q2 2026 Capacity:

1. Email: [email protected]

Subject Line: “PRO LIST REQUEST: Adhesive Plastic Bags – [Your Company Name]”

→ Receive 3 pre-qualified supplier dossiers within 4 business hours, including factory audit reports and adhesive performance data.

- WhatsApp Priority Channel:

+86 159 5127 6160

Message Template: “Adhesive Bags PRO LIST – [Your Name], [Company] – Urgent Q2 Capacity Needs”

→ Connect directly with our China-based sourcing engineers for real-time production slot confirmation.

Why Respond Within 72 Hours?

– 83% of Pro List manufacturers operate at >90% capacity for 2026 (per SourcifyChina Capacity Index)

– Early Q2 commitments secure 2025 pricing benchmarks amid rising polyethylene costs

SourcifyChina: Where Verified Supply Meets Velocity

Trusted by 1,200+ global brands to de-risk Chinese manufacturing since 2018

No directories. No promises. Just proven production partners.

🧮 Landed Cost Calculator

Estimate your total import cost from China.