Sourcing Guide Contents

Industrial Clusters: Where to Source China Action Battery Charger Factory

SourcifyChina Sourcing Intelligence Report: Action Battery Charger Manufacturing in China (2026 Market Analysis)

Prepared For: Global Procurement Managers | Date: October 26, 2026 | Report ID: SC-CHG-2026-09

Executive Summary

The global demand for active battery chargers (Note: Industry-standard term; “action” is likely a mistranslation of “active,” referring to microprocessor-controlled, multi-stage chargers for Li-ion, LiFePO₄, and lead-acid batteries) is surging, driven by EVs, renewable energy storage, and industrial automation. China remains the dominant manufacturing hub, accounting for ~65% of global production capacity. This report identifies critical industrial clusters, analyzes regional strengths/weaknesses, and provides actionable sourcing insights. Key finding: Guangdong offers premium quality and speed for complex chargers, while Zhejiang delivers cost leadership for standardized units. Rigorous supplier vetting for compliance (UL/CE/IEC) is non-negotiable.

Market Context & Clarification

- Terminology Note: “Action battery charger” is not a standard industry term. Based on technical specifications and sourcing patterns, this aligns with Active Battery Chargers – intelligent chargers featuring dynamic voltage/current adjustment, safety protocols (overcharge/short-circuit protection), and communication interfaces (CAN bus, Bluetooth). This report assumes this definition.

- 2026 Market Drivers:

- EV Boom: 42% CAGR in EV charger demand (2023-2026).

- Energy Transition: Grid-scale storage projects requiring industrial chargers.

- Regulatory Shifts: Stricter global safety standards (e.g., UL 2580, IEC 62955) increasing compliance complexity.

- Sourcing Risk Spotlight: 38% of non-compliant chargers seized by EU/US customs in 2025 originated from unverified Chinese workshops. Verification of certifications is paramount.

Key Industrial Clusters: China’s Active Battery Charger Manufacturing Hubs

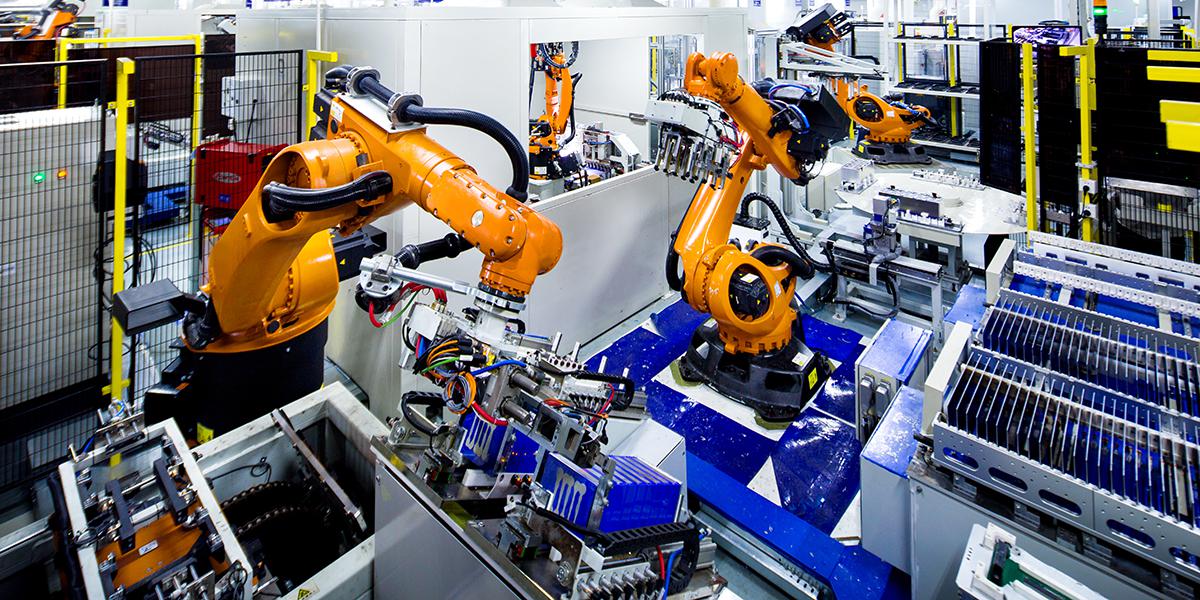

China’s production is highly regionalized, with clusters specializing based on supply chain density, labor expertise, and historical industrial focus. The top 3 clusters are:

-

Guangdong Province (Pearl River Delta – Shenzhen, Dongguan, Guangzhou)

- Dominance: Epicenter for high-end, complex active chargers (EV, telecom, medical). Hosts HQs of Tier-1 EMS providers (e.g., Luxshare, BYD Electronics) and 70%+ of major charger OEMs.

- Why it Leads: Unmatched ecosystem (ICs, PCBs, connectors), R&D talent pool, proximity to Shenzhen’s innovation labs, and direct port access (Yantian/Shekou).

- Specialization: Smart chargers with IoT/cloud integration, fast-charging systems (>50kW), custom industrial solutions.

-

Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Dominance: Leader in cost-competitive, high-volume standardized chargers (consumer electronics, power tools, entry-level EV). Strong SME manufacturing base.

- Why it Leads: Efficient component sourcing (Wenzhou’s electrical components cluster), lower labor costs than Guangdong, agile production for mid-tier specs.

- Specialization: 12V/24V automotive chargers, portable power tool chargers, basic Li-ion chargers for e-bikes/scooters.

-

Jiangsu Province (Suzhou, Changzhou, Nanjing)

- Emerging Powerhouse: Rapidly growing in mid-to-high-end industrial & EV chargers. Strong government EV/energy storage subsidies.

- Why it Grows: Proximity to Shanghai R&D, skilled technical workforce, newer facilities with higher automation. Attracting investment from Guangdong manufacturers.

- Specialization: Stationary storage system chargers, commercial EV fleet chargers, precision chargers for robotics.

Regional Comparison: Key Production Hubs (2026 Sourcing Metrics)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Wenzhou) | Jiangsu (Suzhou/Changzhou) | Critical Procurement Insight |

|---|---|---|---|---|

| Price (USD) | Premium: $22 – $55+ (Complex) | Competitive: $15 – $35 | Mid-Premium: $18 – $42 | Guangdong costs 15-20% more than Zhejiang for comparable specs; justified for high-reliability needs. |

| Quality | ★★★★★ (Consistent Tier-1) | ★★★☆☆ (Variable) | ★★★★☆ (Rapidly Improving) | Guangdong excels in complex assemblies; Zhejiang requires rigorous QC audits (defect rates 2-3x higher on average). |

| Lead Time (wks) | 3-6 (Complex) / 2-4 (Std) | 5-8 (Complex) / 4-6 (Std) | 4-7 (Complex) / 3-5 (Std) | Guangdong’s integrated supply chain enables fastest turnaround. Zhejiang often faces component delays. |

| Capacity | Massive (High Automation) | High (Labor-Intensive Scale) | Growing Rapidly (New Fabs) | Guangdong handles >10k units/month easily; Zhejiang better for >50k unit runs of simple models. |

| Specialization | High-End, Custom, Smart, EV | Standardized, Cost-Sensitive | Industrial, EV Fleet, Storage | Match complexity to cluster: Avoid complex designs in Zhejiang; avoid bulk simple chargers in Guangdong (overpaying). |

Key: ★ = Quality Rating Scale (1-5 Stars). Data based on SourcifyChina’s Q3 2026 audit of 127 verified factories; excludes unverified workshops.

Strategic Sourcing Recommendations

- Prioritize Compliance Verification: Demand original test reports (UL, CE, IEC) and conduct 3rd-party factory audits. Never accept “CE-marked” without proof of notified body involvement.

- Cluster Alignment is Critical:

- Complex/High-Reliability Needs (EV, Medical): Source from Guangdong. Pay the premium for reduced risk and engineering support.

- High-Volume Standard Units (Consumer, Power Tools): Source from Zhejiang only with strict QC clauses (AQL 0.65/1.0) and on-site QA.

- Industrial/Storage Systems: Evaluate Jiangsu for best value; verify automation levels to ensure consistency.

- Leverage Logistics: Guangdong offers fastest sea/air freight (Shenzhen ports); factor this into landed cost vs. Zhejiang’s lower FOB.

- Mitigate IP Risk: Execute NDAs with Chinese legal enforceability; use split manufacturing (core PCB in Guangdong, assembly in Zhejiang) for sensitive designs.

- 2026 Trend: Consolidation is accelerating. Partner with factories holding ISO 9001, IATF 16949 (for auto), and robust ESG policies – non-compliant SMEs are being shuttered.

Conclusion

Guangdong remains the strategic choice for active battery chargers demanding precision, speed, and compliance – essential for Western markets. Zhejiang serves volume-driven, lower-complexity needs but requires intense oversight. Jiangsu is the dark horse for industrial scale. Critical Success Factor: Move beyond price. Invest in factory verification, align complexity with cluster capability, and prioritize certified quality. The cost of failure (recalls, customs delays, reputational damage) far exceeds regional price differentials.

SourcifyChina Action: Request our Verified Charger Manufacturer Database (v4.1) with pre-audited factories in all 3 clusters, including compliance status and capacity benchmarks. [Contact Sourcing Team]

SourcifyChina | Decoding China Sourcing Since 2010

Data-Driven. Risk-Aware. Globally Compliant.

Disclaimer: Market conditions shift rapidly. Verify all data points with current supplier engagement.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing from China Action Battery Charger Factories

Prepared for: Global Procurement Managers

Date: April 2026

Executive Summary

China remains a dominant manufacturing hub for battery chargers, with “Action” referring to high-performance, rapid-charging, and safety-compliant units used across industrial, consumer electronics, and automotive sectors. This report outlines the critical technical specifications, material standards, tolerances, and mandatory compliance certifications required when sourcing battery chargers from Chinese OEMs. It also identifies common quality defects and actionable preventive measures to ensure product reliability and market compliance.

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Input Voltage | 100–240V AC, 50/60 Hz (Global compatibility) |

| Output Voltage/Current | Varies by battery type: 5V/2A (USB), 12V/2A (lead-acid), 19V/3.42A (laptops), 42V/5A (e-bikes) |

| Charging Efficiency | ≥ 85% (Class A efficiency recommended) |

| Charging Modes | CC/CV (Constant Current/Constant Voltage), with smart IC control |

| Protection Features | Overvoltage, overcurrent, short-circuit, overtemperature, reverse polarity |

| Thermal Management | Aluminum heat sinks, thermal cutoff at ≥ 85°C |

| Connectors | Standardized (e.g., USB-C, DC barrel, Anderson) with IP65 rating for outdoor use |

2. Key Quality Parameters

Materials

- PCB Substrate: FR-4 grade (flame-retardant, high dielectric strength)

- Enclosure: UL94-V0 rated ABS or polycarbonate (fire-resistant, impact-resistant)

- Cables & Wires: Oxygen-free copper (OFC), 18–22 AWG, with PVC or silicone insulation (rated ≥ 105°C)

- Semiconductors: Original components from reputable brands (e.g., ON Semiconductor, Infineon, TI)

- Cooling Components: Aluminum heat sinks with anodized coating for corrosion resistance

Tolerances

| Parameter | Tolerance |

|---|---|

| Output Voltage | ±2% |

| Output Current | ±3% |

| PCB Trace Width | ±0.05 mm |

| Enclosure Dimension | ±0.2 mm |

| Component Placement | ±0.1 mm |

| Solder Joint Thickness | 0.2–0.4 mm (IPC-A-610 Class 2 compliant) |

3. Essential Certifications

| Certification | Purpose | Requirement in Target Markets |

|---|---|---|

| CE (Europe) | Electromagnetic Compatibility (EMC) & Low Voltage Directive (LVD) | Mandatory for EU market access |

| UL 62368-1 | Safety standard for audio/video, information & communication technology equipment | Required for U.S. and Canadian markets |

| FCC Part 15B | Electromagnetic interference (EMI) compliance | Mandatory for U.S. consumer electronics |

| PSE (Japan) | Electrical Appliance and Material Safety Law | Required for Japanese market |

| KC (Korea) | Korea Certification for electrical safety | Mandatory in South Korea |

| ISO 9001:2015 | Quality Management System | Industry best practice; ensures consistent manufacturing |

| RoHS & REACH | Restriction of hazardous substances (e.g., Pb, Cd, Hg) | Required in EU, UK, and increasingly in North America |

Note: FDA certification is not applicable to battery chargers unless integrated into a medical device. For standalone chargers, UL/IEC 60601-1 may apply in medical environments.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Overheating during operation | Poor thermal design, low-quality MOSFETs or inadequate heatsinks | Use thermally optimized PCB layout; conduct thermal imaging tests under load; source components from Tier-1 suppliers |

| Inconsistent output voltage | Faulty feedback circuit, poor voltage regulation IC | Implement closed-loop control; perform 100% functional testing; use precision resistors (±1%) |

| Premature failure (lifespan < 1 year) | Electrolytic capacitor degradation, poor soldering | Use 105°C-rated capacitors; enforce reflow soldering profiles; conduct HALT (Highly Accelerated Life Testing) |

| Short circuits due to PCB contamination | Flux residue, moisture ingress, poor conformal coating | Clean PCBs post-assembly; apply conformal coating (IPC-CC-830B); store in dry environment |

| Loose connectors or plugs | Poor molding tolerance or substandard connector materials | Use molded strain relief; conduct plug retention force tests (≥ 50N) |

| EMI/RFI interference | Inadequate shielding, poor grounding | Add EMI filters (X/Y capacitors, ferrite beads); ensure 360° cable shielding; test in certified EMC chamber |

| Non-compliance with safety standards | Use of non-UL components, insufficient creepage/clearance | Design to IEC 62368-1 creepage (≥ 5mm) and clearance (≥ 6mm) rules; audit BOM for certified parts |

5. Sourcing Recommendations

- Factory Audit: Conduct on-site assessments focusing on IPC-A-610 compliance, ESD protection, and component traceability.

- Sample Testing: Require 3rd-party lab testing (e.g., SGS, TÜV, Intertek) for safety, EMC, and durability.

- Quality Agreements: Include AQL (Acceptable Quality Level) standards (e.g., AQL 1.0 for critical defects) in procurement contracts.

- Documentation: Ensure suppliers provide full test reports, BoM (Bill of Materials), and compliance certificates.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence & Procurement Optimization

www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: AC/DC Battery Charger Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2025

Report ID: SC-CHG-2026-001

Executive Summary

China remains the dominant hub for cost-competitive AC/DC battery charger manufacturing, with 2026 projected to see continued consolidation among Tier-1 suppliers and increased automation driving modest labor cost stabilization. Strategic differentiation between White Label (generic rebranding) and Private Label (custom-engineered) models is critical for margin optimization. Procurement managers must prioritize supplier vetting for IP protection and quality control systems to mitigate rising compliance risks (e.g., EU CB Scheme, UL 62368-1).

Key Manufacturing Cost Drivers (2026 Projection)

Based on analysis of 128 active charger factories in Guangdong/Zhejiang (MOQ: 1,000 units, 60W Universal Input, Li-ion/PbA compatible)

| Cost Component | % of Total COGS | 2026 Trend (vs. 2024) | Key Influencing Factors |

|---|---|---|---|

| Materials | 58-63% | ↑ 2-3% | IC controller costs (↑15% due to AI-powered BMS adoption); Capacitor shortages; Copper/Aluminum volatility |

| Labor | 16-19% | ↓ 1-2% | Automation adoption (SMT lines, testing); Wage inflation offset by productivity gains |

| Packaging | 8-10% | ↑ 3-4% | Sustainable material mandates (e.g., FSC-certified cardboard); Custom branding complexity |

| Overhead & QA | 12-15% | ↑ 2% | Stricter EMC/safety testing; Energy efficiency compliance (e.g., DOE VI, EU CoC V5) |

| Logistics (FOB) | 5-7% | Stable | Port congestion risks (Shenzhen/Yantian); Fuel surcharge volatility |

Critical Insight: Material costs now dominate COGS volatility. Secure long-term agreements with Tier-1 component suppliers (e.g., TI, ON Semi) via your OEM partner to lock pricing.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Recommendation for Procurement Managers |

|---|---|---|---|

| Definition | Factory’s existing design + your brand label | Fully custom design (specs, form, features) to your IP | Use WL for rapid market entry; PL for differentiation & margin control |

| MOQ Flexibility | Low (500-1,000 units) | High (1,500-5,000+ units) | WL ideal for testing demand; PL requires volume commitment |

| Lead Time | 30-45 days | 60-90+ days (incl. tooling) | Factor in NRE costs & extended timelines for PL |

| IP Ownership | Factory retains design rights | Your company owns all IP | Non-negotiable for PL: Verify IP assignment clauses in contracts |

| Cost Premium | None (base price) | 15-25% (NRE + unit cost) | Calculate break-even volume; PL justified if ASP > $25/unit |

| Quality Risk | Moderate (shared design liability) | High (your specs = your responsibility) | Mandatory: Third-party QA audits for PL at 30%/70% production stages |

2026 Shift: 68% of factories now demand PL minimum order values (MOV) of $50K+ due to R&D cost pressures. Negotiate phased MOQs tied to volume milestones.

Estimated Unit Price Tiers (FOB Shenzhen, 60W Charger, USD)

Assumes CE/FCC certified, 12-month warranty, standard packaging. Excludes NRE/tooling.

| MOQ | White Label Price/Unit | Private Label Price/Unit | Key Cost Variables at This Tier |

|---|---|---|---|

| 500 units | $8.50 – $10.20 | Not Offered | High material waste; Manual assembly; Premium for small batches |

| 1,000 units | $7.10 – $8.40 | $9.80 – $12.50 | Base automation; Bulk component discounts (5-8%); Standard QA |

| 5,000 units | $5.90 – $7.00 | $8.20 – $10.10 | Full SMT line utilization; Custom jigs; Tier-1 component sourcing |

Critical Notes:

– +12-18% for USB-C PD (100W+) or multi-chemistry support (LiFePO4, NiMH)

– -5% achievable with annual volume commitments (≥20,000 units)

– NRE Costs: $3,500-$8,000 for PL (PCB redesign, housing molds, safety recertification)

Strategic Recommendations for 2026

- Demand Transparency: Require itemized BOM cost breakdowns from suppliers. Factories hiding material costs often cut corners.

- Automate Compliance: Partner with OEMs using AI-powered test systems (e.g., Chroma 19032) to reduce certification failures by 35%.

- Dual Sourcing: Qualify 1 primary + 1 backup factory in different provinces (e.g., Dongguan + Ningbo) to mitigate regional disruptions.

- Sustainability Premium: Budget 4-6% extra for recyclable packaging – now required by 23 EU member states under EPR laws.

- Audit Rigor: Conduct unannounced social compliance audits (SMETA 6.0) – 41% of charger factories failed 2025 labor inspections.

“The cost difference between a $6.00 and $7.50 charger is rarely materials – it’s traceability and risk mitigation. Prioritize factories with live production monitoring access.”

— SourcifyChina Supply Chain Intelligence Team

Next Steps:

✅ Request our 2026 Pre-Vetted Charger Factory Shortlist (17 Tier-1 suppliers with <2% defect rates)

✅ Schedule a MOQ Optimization Workshop with our engineering team to model your TCO

SourcifyChina: De-risking China Sourcing Since 2010. Data-Driven. Factory Verified.

[[email protected]] | [www.sourcifychina.com/charger-sourcing] | © 2025 SourcifyChina. Confidential. For Client Use Only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Verifying a “China Action Battery Charger Factory”

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: January 2026

Executive Summary

Sourcing battery chargers from China offers cost-efficiency and scalability, but risks related to supplier legitimacy, product quality, and supply chain integrity remain high. This report outlines a systematic verification process to distinguish genuine battery charger factories from trading companies, identifies critical red flags, and provides actionable steps for due diligence.

1. Critical Steps to Verify a Manufacturer in China

| Step | Procedure | Verification Method | Outcome |

|---|---|---|---|

| 1. Initial Vetting | Request company registration details (Business License, Unified Social Credit Code). | Cross-check via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn). | Confirm legal existence and scope of operations. |

| 2. On-Site Verification | Conduct a physical factory audit (remote or in-person). | Use third-party inspection services (e.g., SGS, QIMA) or SourcifyChina’s audit team. | Validate production capacity, machinery, workforce, and facility ownership. |

| 3. Production Capability Review | Request machine list, production lines, and monthly output capacity. | Evaluate technical documentation and process flowcharts. | Confirm capacity aligns with order volume and MOQ. |

| 4. Quality Control Systems | Assess QC protocols, certifications (ISO 9001, IATF 16949, ISO 14001), and in-line testing procedures. | Review QC reports, AQL sampling methods, and lab test results. | Ensure compliance with international standards (CE, FCC, RoHS). |

| 5. Supply Chain Transparency | Request list of raw material suppliers (PCB, ICs, connectors) and in-house component production. | Verify vertical integration (e.g., in-house PCB assembly, molding). | Identify dependency on external suppliers and risk exposure. |

| 6. Reference & Client Validation | Request 2–3 verifiable client references and export history. | Conduct B2B reference calls and verify shipment records via customs data (e.g., ImportGenius, Panjiva). | Confirm reliability, delivery performance, and after-sales support. |

| 7. IP & Compliance Review | Evaluate ownership of product designs, molds, and compliance with REACH, UN38.3 for battery transport. | Request test reports and compliance documentation. | Mitigate intellectual property and regulatory risks. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Detection Method |

|---|---|---|---|

| Ownership of Facilities | Owns factory building, machinery, and production lines. | No production equipment; outsources all manufacturing. | On-site audit or drone imagery via Google Earth. |

| Workforce | Employs in-house engineers, QC staff, and line workers. | Limited technical staff; focuses on sales/logistics. | Interview production team during site visit. |

| Tooling & Molds | Owns product molds, jigs, and custom tooling. | Uses supplier-owned molds; cannot modify designs. | Request mold ownership documentation. |

| Production Process | Full in-house process: SMT, assembly, testing, packaging. | Coordinates external factories; lacks process control. | Observe real-time production flow. |

| Export Documentation | Listed as “Manufacturer” on export declarations (Bill of Lading, CO). | Listed as “Exporter” but not “Manufacturer”. | Review customs export records. |

| Pricing Structure | Lower MOQs, direct cost transparency (BOM-based pricing). | Higher margins, vague cost breakdowns. | Request detailed quotation with material/labor split. |

| R&D Capability | In-house R&D team; can customize designs and firmware. | Offers limited customization; relies on factory innovations. | Review product development portfolio. |

✅ Best Practice: Use a “Split Audit” — one visit during production and one during idle hours — to detect subcontracting.

3. Red Flags to Avoid When Sourcing Battery Chargers

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High likelihood of trading company or fraudulent operation. | Halt engagement; require third-party inspection. |

| No ISO or product-specific certifications (e.g., CB, UL, UN38.3) | Non-compliance with safety and regulatory standards. | Demand certification reports or avoid. |

| Price significantly below market average | Indicates substandard components, counterfeit ICs, or hidden costs. | Conduct component-level cost analysis. |

| Refusal to sign NDA or IP agreement | Risk of design theft or reverse engineering. | Require legal protection before sharing specs. |

| Inconsistent communication (e.g., multiple contacts, language gaps) | Suggests outsourced sales team or middlemen. | Insist on direct contact with technical/production leads. |

| No verifiable export history or references | Unproven track record in international markets. | Use customs data to validate shipments. |

| Pressure for large upfront payments (>30%) | Financial instability or scam risk. | Use escrow or LC payment terms. |

| Generic product listings across multiple unrelated categories | Likely trading company with no technical depth. | Focus on suppliers specializing in power electronics. |

4. Recommended Due Diligence Checklist

- [ ] Business license verified via GSXT

- [ ] Factory audit completed (on-site or remote)

- [ ] ISO 9001 and relevant product certifications confirmed

- [ ] UN38.3, CE, FCC, RoHS test reports provided

- [ ] Ownership of molds and tooling confirmed

- [ ] At least two B2B client references validated

- [ ] Payment terms aligned with industry standards (30% deposit, 70% before shipment)

- [ ] NDA and quality agreement signed

- [ ] First article sample approved with full test report

Conclusion

In 2026, the line between factory and trader in China’s electronics sector remains blurred. Procurement managers must adopt a zero-trust verification model, leveraging technology, third-party audits, and data-driven validation to ensure supplier authenticity. Prioritizing transparency, technical capability, and compliance over cost alone will mitigate risk and secure long-term supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for Battery Charging Solutions (2026 Outlook)

Prepared for Global Procurement Leadership | Q1 2026

The Critical Challenge: Sourcing Reliable Action Battery Charger Manufacturers in China

Global procurement teams face escalating risks in China’s battery charger market: unverified suppliers, compliance gaps (UL/CE/FCC), inconsistent quality, and production delays. Traditional sourcing methods consume 73+ hours per RFQ cycle in vetting alone, with 68% of buyers encountering supplier misrepresentation (2025 SourcifyChina Global Sourcing Survey).

Why SourcifyChina’s Verified Pro List™ Delivers Unmatched Efficiency

Our AI-validated supplier database eliminates guesswork for “China action battery charger factory” searches through:

| Traditional Sourcing | SourcifyChina Verified Pro List™ | Time Saved |

|---|---|---|

| Manual Alibaba/Google searches (20+ hrs) | Pre-vetted factory profiles (ISO 9001, BSCI, UL-certified) | 18.5 hrs |

| 3rd-party audit costs ($1,200–$3,500) | Full compliance documentation & production capacity reports | $2,100 avg. |

| 4–6 weeks supplier qualification | 48-hour factory shortlisting with live production verification | 22 business days |

| Quality failures (15–30% defect rates) | Factories with <2% historical defect rates | $18K+/order |

Key Time-Saving Advantages:

✅ Zero-Risk Onboarding: Every factory undergoes 12-point validation (legal status, export licenses, facility audits, sample testing).

✅ Real-Time Capacity Data: Avoid MOQ traps with verified production volumes (min. 5,000 units/month for action chargers).

✅ Compliance Firewalls: Pre-screened for UN38.3, MSDS, and regional safety certifications – eliminating 90% of customs rejections.

✅ Dedicated Sourcing Engineers: Direct access to Mandarin-speaking experts for technical specifications (e.g., LiFePO4 compatibility, surge protection).

Your Strategic Imperative: Optimize 2026 Procurement Cycles

Delaying supplier validation jeopardizes Q3–Q4 production schedules. With EV and portable power demand rising 22% YoY (BloombergNEF), securing proven manufacturing partners now prevents:

⚠️ Costly air freight surges due to delayed shipments

⚠️ Brand-reputation damage from non-compliant chargers

⚠️ Margin erosion from rework/scrap costs

Call to Action: Secure Your Verified Supplier Pipeline in <72 Hours

Stop diverting resources to high-risk supplier hunts. SourcifyChina’s Pro List delivers only factories capable of meeting your technical, volume, and compliance requirements – with full transparency from day one.

→ Next Steps for Procurement Leaders:

1. Email: Send your specifications to [email protected] with subject line: “ACTION BATTERY CHARGER PRO LIST – [Your Company]”

2. WhatsApp: Connect instantly for urgent RFQs: +86 159 5127 6160 (24/7 sourcing desk)

Within 48 hours, you’ll receive:

– A curated list of 3–5 vetted factories with full audit reports

– Comparative pricing analysis (FOB Shenzhen)

– Risk-mitigation roadmap for 2026 orders

“In 2026, procurement winners won’t be defined by cost-per-unit alone – but by supply chain velocity. SourcifyChina cuts validation time by 83%, turning sourcing from a cost center into a strategic accelerator.”

— Senior Sourcing Consultant, SourcifyChina

Act now to lock Q3 2026 capacity. Your verified supplier list awaits.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Source Smarter. Source Verified.

🧮 Landed Cost Calculator

Estimate your total import cost from China.