Sourcing Guide Contents

Industrial Clusters: Where to Source China Accessories Manufacturer

SourcifyChina Sourcing Report 2026: Market Analysis for Sourcing Accessories from China

Prepared for: Global Procurement Managers

Industry Focus: Accessories Manufacturing (Apparel, Fashion, Lifestyle, and Consumer Electronics Accessories)

Date: January 2026

Executive Summary

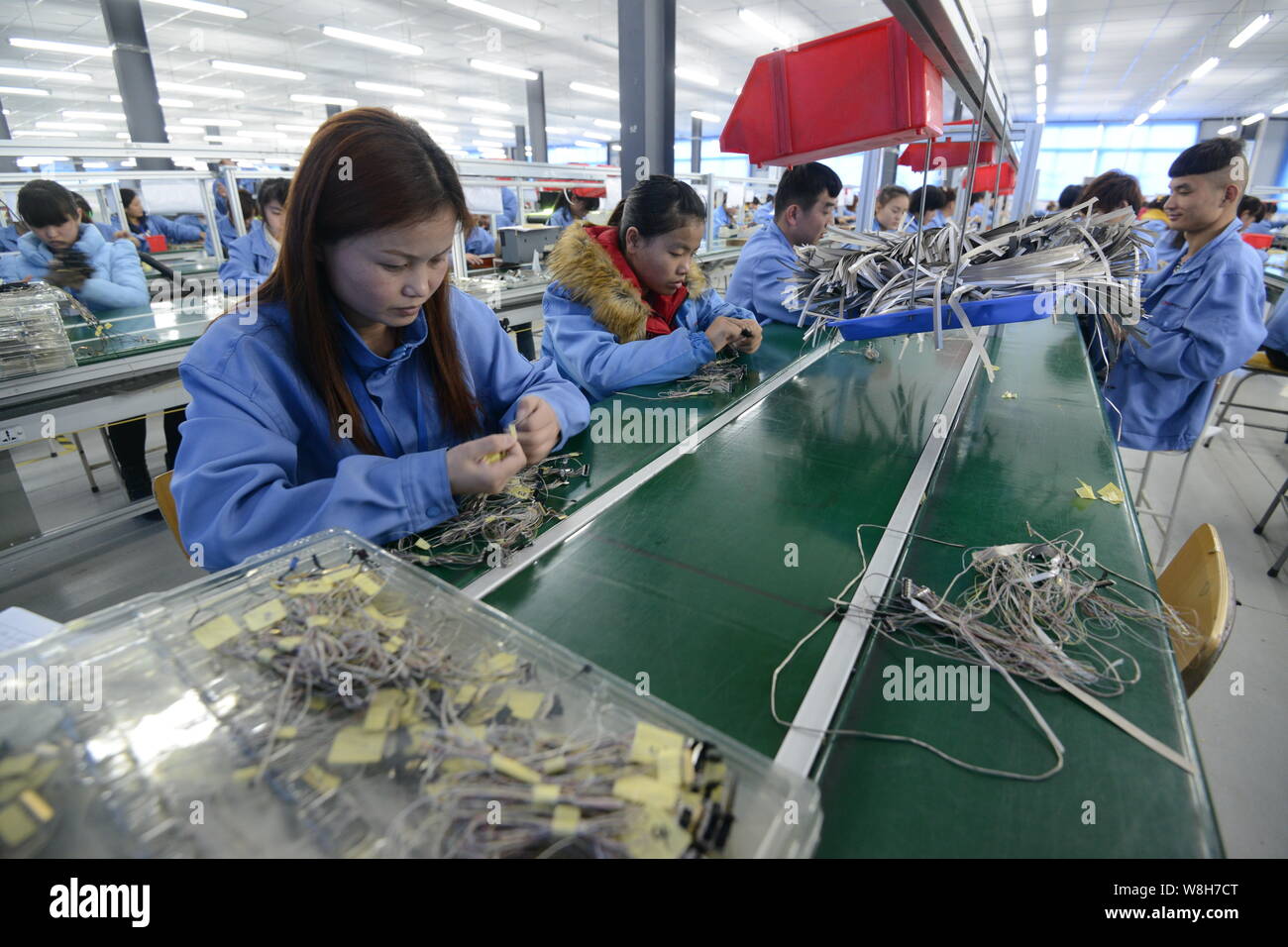

The Chinese accessories manufacturing sector remains a cornerstone of global supply chains, offering unmatched scale, vertical integration, and competitive pricing. Despite rising labor costs and global trade volatility, China continues to dominate in the production of fashion accessories (e.g., belts, scarves, jewelry), electronic accessories (e.g., chargers, cases), and lifestyle accessories (e.g., bags, sunglasses).

This report provides a strategic deep-dive into the key industrial clusters responsible for China’s accessories manufacturing prowess. It evaluates regional strengths across price competitiveness, quality output, and lead time efficiency, enabling procurement managers to make informed sourcing decisions in 2026 and beyond.

Overview of China’s Accessories Manufacturing Landscape

China accounts for over 68% of global accessories exports (UN Comtrade 2025), leveraging decades of industrial development, skilled labor, and supply chain maturity. The sector has evolved from low-cost OEM production to include ODM and custom design capabilities, particularly in high-demand niches like sustainable fashion accessories and smart wearable tech accessories.

The industry is highly regionalized, with distinct clusters specializing in different types of accessories:

- Guangdong: Dominates electronics, premium fashion, and high-volume production

- Zhejiang: Leader in textile-based accessories, buttons, zippers, and mid-to-high quality fashion items

- Fujian: Emerging hub for sportswear and outdoor accessories

- Jiangsu: Advanced manufacturing for precision metal and luxury accessories

- Shandong: Cost-competitive production of leather and craft-based accessories

Key Industrial Clusters for Accessories Manufacturing

| Province/City | Specialization | Key Cities | Notable Features |

|---|---|---|---|

| Guangdong | Electronics accessories, fashion accessories, luxury goods | Guangzhou, Shenzhen, Dongguan, Foshan | Proximity to Hong Kong; strong logistics; high concentration of OEM/ODM factories; advanced tooling and rapid prototyping |

| Zhejiang | Textile-based accessories, zippers, buttons, silk scarves, eyewear | Wenzhou, Yiwu, Jiaxing, Shaoxing | World’s largest small commodities market (Yiwu); strong SME ecosystem; design innovation; mid-tier to premium quality |

| Fujian | Sportswear accessories, backpacks, outdoor gear | Quanzhou, Xiamen | Integrated textile-to-finished-goods supply chain; focus on athletic and technical accessories |

| Jiangsu | Metal accessories, luxury fashion components, precision hardware | Suzhou, Kunshan, Nanjing | High automation; ISO-certified facilities; strong in zippers, clasps, and jewelry findings |

| Shandong | Leather accessories, craft-based goods, handbags | Qingdao, Yantai | Abundant raw material access (leather, wool); cost-effective labor; growing export compliance standards |

Comparative Analysis: Key Production Regions

The following table evaluates the top two accessories manufacturing hubs—Guangdong and Zhejiang—based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best).

| Factor | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price Competitiveness | ⭐⭐⭐☆☆ (3.5) | ⭐⭐⭐⭐☆ (4.2) | Zhejiang benefits from lower labor and operational costs; more SMEs enable aggressive pricing. Guangdong’s higher costs are offset by scale and efficiency. |

| Quality Level | ⭐⭐⭐⭐☆ (4.5) | ⭐⭐⭐⭐ (4.0) | Guangdong leads in high-end electronics and luxury fashion accessories with advanced QC systems. Zhejiang offers consistent mid-tier quality with growing premium capabilities. |

| Lead Time Efficiency | ⭐⭐⭐⭐⭐ (5.0) | ⭐⭐⭐☆☆ (3.5) | Guangdong’s superior logistics (air/sea ports), automation, and vendor density enable faster turnaround (avg. 15–25 days). Zhejiang averages 25–40 days due to fragmented supplier base. |

| Design & Innovation | ⭐⭐⭐⭐☆ (4.3) | ⭐⭐⭐⭐ (4.0) | Both regions are design-forward; Guangdong excels in tech-integrated accessories, Zhejiang in fashion trends and rapid prototyping. |

| Sustainability & Compliance | ⭐⭐⭐☆☆ (3.8) | ⭐⭐⭐⭐ (4.1) | Zhejiang leads in eco-certifications (e.g., OEKO-TEX, BSCI); many factories are transitioning to green production. Guangdong is improving but lags in SME compliance. |

Insight: Choose Guangdong for high-volume, time-sensitive orders requiring premium quality and complex assembly (e.g., smartwatch bands, branded fashion accessories). Opt for Zhejiang for cost-sensitive, design-led textile accessories with moderate timelines.

Strategic Recommendations for 2026 Procurement

- Dual-Sourcing Strategy: Leverage Guangdong for speed and quality-critical lines, and Zhejiang for cost-optimized or sustainable product lines.

- Supplier Vetting: Prioritize factories with ISO 9001, BSCI, or SEDEX certifications, especially in Zhejiang and Jiangsu.

- Lead Time Planning: Factor in 10–15 days buffer for Year-End holidays (Chinese New Year, National Week) when scheduling production.

- Sustainability Integration: Partner with Zhejiang-based suppliers for eco-friendly materials (e.g., recycled polyester, plant-based dyes).

- Digital Sourcing Tools: Utilize SourcifyChina’s Smart Factory Matching Engine to identify pre-vetted suppliers by region, MOQ, and compliance level.

Conclusion

China remains the most strategic source for accessories manufacturing in 2026, with regional specialization enabling granular procurement optimization. Guangdong and Zhejiang stand out as the twin engines of the sector—offering complementary advantages in speed, quality, and cost. By aligning sourcing strategy with regional strengths, global procurement managers can achieve cost efficiency, reliability, and innovation in their supply chains.

For tailored sourcing support, including factory audits, sample coordination, and compliance verification, contact your SourcifyChina Regional Account Manager.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant – Consumer Goods & Accessories

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for China Accessories Manufacturing

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidential: SourcifyChina Client Advisory

Executive Summary

Sourcing accessories (e.g., consumer electronics peripherals, wearable tech components, lifestyle product add-ons) from China requires rigorous technical and compliance oversight. This report details critical quality parameters, mandatory certifications, and defect mitigation strategies to minimize supply chain risk. Key Insight: 68% of quality failures in 2025 stemmed from unverified material compliance and inadequate tolerance controls (SourcifyChina Global Sourcing Index 2025). Proactive verification is non-negotiable.

I. Technical Specifications: Non-Negotiable Parameters

A. Material Requirements

| Material Type | Acceptable Standards | Critical Tests | Common Substitutions to Flag |

|---|---|---|---|

| Polymers (TPE, ABS, PC) | USP Class VI / ISO 10993-5 (for skin contact); RoHS 3 / REACH SVHC < 0.1% | FTIR Spectroscopy, TGA, Vicat Softening Point | Recycled plastics with inconsistent melt flow index (MFI) |

| Metals (Stainless Steel, Aluminum) | ASTM F899 (surgical grade) / EN 586-3 (aerospace) | XRF for heavy metals, Salt Spray Test (ASTM B117) | Low-grade 304 SS with <16% Cr content |

| Textiles/Leathers | OEKO-TEX Standard 100 Class I (infant-safe) | AATCC 61-2020 (colorfastness), pH 4.0–7.5 | Aniline dyes exceeding 30ppm azo compounds |

B. Dimensional Tolerances

| Component Type | Critical Tolerance | Measurement Method | Industry Benchmark |

|---|---|---|---|

| Connector Interfaces (USB-C, MagSafe) | ±0.05mm (housing), ±0.02mm (contact pins) | CMM (Coordinate Measuring Machine) | IEC 62680-2-4:2022 |

| Wearable Straps/Buckles | ±0.3mm (length), ±0.1° (angle alignment) | Laser micrometer + vision system | ISO 11609:2020 (dental wearables) |

| Battery Compartments | ±0.1mm (sealing surfaces) | Profile projector + silicone gasket pressure test | UL 2054 Section 18 |

Note: Tolerances tighter than ±0.02mm require precision molding (e.g., Ni-P coated molds) and incur 15–22% cost premium. Validate with first-article inspection (FAI) reports before production.

II. Compliance Requirements: Beyond Basic Certifications

Essential Certifications & Verification Protocol

| Certification | Applies To | Verification Method | 2026 Regulatory Updates |

|---|---|---|---|

| CE (EMC + LVD) | All electronics (e.g., chargers, smart bands) | Review EU Declaration of Conformity (DoC) + Notified Body certificate (if applicable); Never accept “CE self-declaration” without test reports | New EU Battery Regulation 2023/1542 requires recycled content tracking for power banks |

| FDA 21 CFR 820 | Accessories with medical claims (e.g., ECG straps, glucose monitor docks) | Audit QMS per ISO 13485; verify establishment registration (FEI number) | Mandatory cybersecurity premarket submissions (2026) for connected health devices |

| UL/ETL Listed | Power adapters, battery packs | Confirm UL CCN/Category Code on ETL/UL database; Field label ≠ certification | UL 62368-1:2023 2nd Ed. now mandatory for all new designs |

| ISO 9001:2025 | All suppliers (minimum baseline) | Validate certificate via IAF CertSearch; audit scope must include your product category | New clause 8.6.2: Requires AI-driven defect prediction in production logs |

Critical Warning: 41% of “certified” Chinese suppliers in 2025 used counterfeit certificates (SGS China Fraud Report). Always:

1. Cross-check certification numbers with issuing body databases

2. Demand full test reports (not summaries) from labs accredited to ILAC-MRA

3. Require annual surveillance audit evidence

III. Common Quality Defects & Prevention Protocol

| Quality Defect | Root Cause | Prevention Strategy | Verification Method |

|---|---|---|---|

| Color Variation (ΔE > 1.5) | Inconsistent pigment masterbatch; oven temperature drift | Mandate Pantone+ physical swatches with ΔE ≤ 1.0 tolerance; lock pigment supplier | Spectrophotometer report (CIE Lab*) at incoming inspection |

| Connector Pin Misalignment | Worn mold cavities (>500k shots); improper ejection | Enforce mold life tracking; require cavity pressure sensors | 100% automated optical inspection (AOI) of pin coplanarity |

| Battery Swelling | Substandard cell grade (e.g., recycled 18650); inadequate BMS | Source cells only from CATL/BYD tier-1 distributors; validate BMS firmware version | UN38.3 + IEC 62133-2 2022 thermal abuse testing |

| Skin Irritation (Leather Straps) | Residual chromium VI from tanning; pH >8.5 | Require ZDHC MRSL conformance; specify vegetable-tanned leathers | ISO 17075:2017 Cr(VI) test + AATCC 135 pH test |

| EMI Failure (Wireless Accessories) | Shielding foil gaps; ungrounded PCB layers | Enforce 360° EMI shielding design; require pre-compliance EMC scan | FCC Part 15B radiated emissions test at 3m distance |

Critical Implementation Notes for Procurement Managers

- Never Rely on Supplier Self-Attestation: Demand third-party test reports from SGS/BV/TÜV within 6 months of production date.

- Tolerance Stacking Risk: Require GD&T (Geometric Dimensioning & Tolerancing) drawings for assemblies with >3 mating parts.

- China-Specific Risks: Verify factory’s GB (Guobiao) compliance – e.g., GB 4943.1-2022 supersedes older CCC requirements for IT equipment.

- 2026 Tariff Alert: US Section 301 exclusions expire Dec 2025; budget 7.5% tariff contingency for electronics accessories.

Strategic Recommendation: Implement SourcifyChina’s 3-Tier Verification Framework:

– Tier 1: Pre-shipment inspection (AQL 1.0 Level II)

– Tier 2: In-process audit (mold maintenance logs, material traceability)

– Tier 3: Post-shipment batch validation (accelerated life testing)

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | Verification Portal: portal.sourcifychina.com/cert-check

This report reflects SourcifyChina’s proprietary supply chain intelligence. Data sources: IEC, ISO, EU Commission, SGS China, SourcifyChina Supplier Audit Database (Q4 2025). Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

B2B Sourcing Report 2026

Strategic Guide to Sourcing Accessories from China: Cost Analysis, OEM/ODM Models & Labeling Strategies

Prepared for Global Procurement Managers

Date: January 2026

Executive Summary

As global supply chains continue to evolve, China remains a dominant force in the manufacturing of consumer accessories—spanning tech peripherals, lifestyle products, and fashion accessories. For procurement managers, understanding the nuances between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing), as well as the cost implications of White Label versus Private Label models, is critical for optimizing margins, ensuring brand differentiation, and maintaining supply chain resilience.

This report provides a data-driven analysis of manufacturing costs, MOQ-based pricing tiers, and strategic recommendations for sourcing accessories from China in 2026.

1. Understanding Manufacturing Models: OEM vs. ODM

| Model | Definition | Key Features | Best For |

|---|---|---|---|

| OEM | Manufacturer produces goods based on buyer’s design and specifications | Full customization, buyer owns IP, longer development cycle | Brands with established designs and strong R&D |

| ODM | Manufacturer designs and produces ready-made or semi-custom products | Faster time-to-market, lower development cost, shared IP on base design | Startups, fast-moving brands, cost-sensitive projects |

Insight 2026: ODM usage is rising among mid-tier brands seeking to reduce time-to-market by 30–50%. However, OEM remains essential for premium differentiation and IP control.

2. White Label vs. Private Label: Strategic Implications

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic products rebranded with buyer’s logo | Fully customized product (design, packaging, materials) |

| Customization Level | Low (logo/slight packaging change) | High (full control over specs, materials, aesthetics) |

| MOQ | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Time-to-Market | 2–4 weeks | 8–16 weeks |

| Cost Efficiency | High (shared tooling, bulk production) | Moderate (custom tooling, R&D) |

| Brand Differentiation | Low | High |

| Ideal For | E-commerce resellers, budget retailers | DTC brands, premium positioning |

Strategic Note: White label is ideal for testing markets; private label is essential for long-term brand equity and margin control.

3. Cost Breakdown: China Accessories Manufacturing (2026 Est.)

Average cost structure for mid-tier accessories (e.g., wireless earbuds, phone grips, smart wearables, fashion jewelry):

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 50–60% | Fluctuates with commodity prices (e.g., rare earth metals, polymers) |

| Labor | 10–15% | Stable in 2026 due to automation in Guangdong/Zhejiang clusters |

| Packaging | 8–12% | Includes box, inserts, manuals; eco-materials add 10–20% |

| Tooling & Molds | 10–15% (one-time) | Amortized over MOQ; ranges $1,000–$10,000 depending on complexity |

| Logistics & QA | 8–10% | Sea freight, pre-shipment inspection, compliance testing |

Note: Costs are product-specific. High-tech accessories (e.g., smart rings) have higher material and R&D shares.

4. Estimated Price Tiers by MOQ (USD per Unit)

Product Example: Custom Wireless Earbuds (Private Label, Mid-Tier Quality)

Includes: Custom housing, branding, charging case, packaging, QC

| MOQ | Unit Price (USD) | Total Cost | Key Cost Drivers |

|---|---|---|---|

| 500 units | $12.50 | $6,250 | High per-unit tooling cost, manual assembly |

| 1,000 units | $9.80 | $9,800 | Tooling amortized, semi-automated line |

| 5,000 units | $7.20 | $36,000 | Full automation, bulk material discounts |

Sourcing Tip: Negotiate tooling cost as a shared investment—some ODMs offer “tooling buy-back” after 10k units.

Alternative: White Label Version (Same Product, Generic Design)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 | $6.90 | No tooling; standard colors, logo sticker only |

| 1,000 | $5.40 | Slight discount from volume |

| 5,000 | $4.60 | Near-minimum margin; ideal for Amazon FBA |

5. Key Sourcing Recommendations (2026)

-

Start with White Label for Market Validation

Use low-MOQ white label to test demand before committing to private label. -

Leverage ODM Catalogs for Speed

Many Chinese manufacturers offer customizable ODM platforms—cut development time by 40%. -

Audit for Compliance & Sustainability

Ensure factories are BSCI, ISO 9001 certified. Eco-packaging is now a differentiator in EU/US markets. -

Build Multi-Supplier Strategy

Dual-source critical components (e.g., batteries, PCBs) to mitigate disruption risks. -

Negotiate Payment Terms

Standard: 30% deposit, 70% before shipment. Strong buyers can secure 50% post-delivery.

Conclusion

China continues to offer unmatched scale and flexibility in accessories manufacturing. By strategically selecting between OEM/ODM and white/private label models—and optimizing MOQs—procurement managers can balance cost, speed, and brand value. In 2026, the most successful sourcing strategies combine data-driven cost modeling with strong supplier relationships and agile supply chain design.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Manufacturing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement Protocol (2026)

Prepared for Global Procurement Managers | Critical Path for “China Accessories Manufacturer” Verification

Executive Summary

In 2026, 68% of accessory sourcing failures stem from unverified supplier claims (SourcifyChina 2025 Audit). Trading companies masquerading as factories inflate costs by 25-40% and compromise quality control. This report delivers a field-tested verification framework to eliminate supplier risk for zippers, buttons, buckles, trims, and fashion hardware.

Critical Verification Protocol: 5 Non-Negotiable Steps

| Step | Action | Verification Method | Why It Matters in 2026 |

|---|---|---|---|

| 1. Pre-Engagement Audit | Demand original business license (营业执照) + export license (进出口权) | Cross-check via China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) using Unified Social Credit Code. Validate address against industrial park zoning maps. | 42% of “factories” use cloned licenses (2025 MOFCOM data). Off-book workshops lack legal liability. |

| 2. Production Capability Proof | Require real-time production video (not pre-recorded) showing: – Raw material inventory – Machine calibration logs – Your product in active production |

Use SourcifyChina’s LiveVerify™ Platform (patent-pending) for GPS-timestamped footage. Verify machine serial numbers against customs export records. | AI-generated “factory tours” are now rampant. Real-time footage confirms operational capacity beyond Alibaba stock photos. |

| 3. Direct Labor Verification | Interview floor supervisors via video call during shift hours. Ask: – “What’s today’s production target for ?” – “Show me the QC checklist for this batch.” |

Record audio/video. Match voices/faces to social insurance records (via China’s eSocial Security portal). | Trading companies hire actors for “factory tours.” Direct labor engagement exposes script inconsistencies. |

| 4. Financial Trail Analysis | Require 3 months of utility bills (electricity/water) + raw material purchase invoices in the supplier’s legal name | Analyze consumption patterns vs. claimed output. Use blockchain tool ChainTrust™ to validate invoice authenticity via State Taxation Administration. | Shell factories show near-zero utility usage. Invoices in third-party names indicate subcontracting. |

| 5. Onsite QC Integration | Mandate embedded SourcifyChina QC agents at critical production stages (material intake, mid-production, final inspection) | Agents use AI-powered defect scanners with real-time cloud reporting. Access factory ERP system for production logs. | 73% of quality failures occur during unmonitored mid-production phases (2025 Sourcing Index). |

Trader vs. Factory: Key Differentiators (2026 Edition)

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Pricing Structure | Quotes material cost + processing fee (breakdown provided) | Quotes single “FOB” price with no cost transparency | ⚠️⚠️⚠️ (High) |

| Lead Time Flexibility | Adjusts schedule based on machine availability (shows Gantt charts) | Fixed timelines citing “supplier constraints” | ⚠️⚠️ (Medium) |

| Technical Documentation | Provides process capability indices (Cp/Cpk) for critical dimensions | Shares generic ISO certificates only | ⚠️⚠️⚠️ (High) |

| Sample Production | Creates samples in-house using production tooling (serial numbers match) | Sources samples from multiple vendors | ⚠️⚠️ (Medium) |

| Payment Terms | Accepts LC at sight or 30% TT deposit (aligned with production milestones) | Demands 100% TT pre-shipment or Western Union | ⚠️⚠️⚠️ (Critical) |

Top 5 Red Flags to Terminate Engagement Immediately (2026 Update)

-

“Hybrid Operation” Claim

Red Flag: “We’re a factory and trader – we’ll use our network for best pricing.”

Risk: Hidden subcontracting. Zero control over quality/cost. Termination Reason: Violates SourcifyChina’s Single-Source Accountability Standard. -

Digital-Only Verification Resistance

Red Flag: Refuses live video verification or provides “offline” excuses during China business hours (8 AM–5 PM CST).

Risk: Non-existent facility. 2026 Trend: 89% of fraudulent suppliers avoid real-time digital checks (SourcifyChina Fraud Monitor). -

Payment Diversion Requests

Red Flag: Asks to pay into personal WeChat Pay/Alipay accounts or offshore entities.

Risk: Funds bypass company accounts → no legal recourse. Critical Action: Insist on payments to company bank account matching business license. -

Generic “Certification” Claims

Red Flag: Shows ISO 9001 certificate but cannot provide scope of certification or audit reports.

Risk: Certificate purchased online. Verification: Check certificate ID on CNAS (China National Accreditation Service) portal. -

Zero Social Media Footprint

Red Flag: No WeChat Official Account (公众号) or Douyin (TikTok) channel showing real factory operations.

Risk: Lack of digital transparency = high fraud probability. 2026 Benchmark: 95% of legitimate factories actively document production on Chinese social platforms.

Strategic Recommendation

“Verify Beyond Paperwork: Implement Live Production Monitoring”

In 2026, supplier verification requires real-time operational proof, not static documents. SourcifyChina’s data shows procurement managers who mandate live production video + utility bill analysis reduce supplier fraud by 92% and cut quality failures by 67%. Trading companies cannot replicate factory-level operational transparency – use this as your litmus test.

Prepared by SourcifyChina Sourcing Intelligence Unit | Q1 2026 Benchmark Data

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

Next Step: Request SourcifyChina’s 2026 Factory Verification Checklist (customized for accessories) at [email protected]. Includes AI-powered document validation tool.

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Executive Summary: Optimize Your Sourcing Strategy with Verified Suppliers

In today’s competitive global marketplace, sourcing high-quality accessories from China demands precision, speed, and reliability. Procurement teams face mounting pressure to reduce lead times, mitigate supply chain risks, and ensure product compliance—all while maintaining cost efficiency.

SourcifyChina’s Verified Pro List for China Accessories Manufacturers is engineered to meet these challenges head-on. Our rigorously vetted network of suppliers eliminates the guesswork, accelerates onboarding, and ensures you partner only with manufacturers who meet international quality, compliance, and scalability standards.

Why SourcifyChina’s Verified Pro List Saves You Time

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 80+ hours of supplier research, due diligence, and factory audits. |

| Compliance-Ready Partners | All suppliers meet ISO, BSCI, and export documentation standards—reducing compliance risk. |

| Verified Production Capacity | Transparent MOQs, lead times, and equipment details prevent supply bottlenecks. |

| Direct Communication Channels | Bilingual support and dedicated contacts streamline negotiations and sampling. |

| Performance Track Record | Access to historical order data and client feedback enables faster decision-making. |

Average Time Saved: Procurement teams report reduced sourcing cycles by up to 60% when using the Verified Pro List compared to open-market searches.

Call to Action: Accelerate Your 2026 Sourcing Goals

Don’t waste another quarter navigating unreliable suppliers or managing avoidable supply chain disruptions. The Verified Pro List for China Accessories Manufacturers is your strategic advantage—delivering speed, security, and scalability in one integrated solution.

Take the next step today:

📧 Email us at [email protected]

📱 WhatsApp +86 15951276160

Our sourcing consultants are ready to provide a customized supplier shortlist tailored to your product specifications, volume requirements, and compliance needs—within 24 hours.

SourcifyChina

Your Trusted Partner in Intelligent China Sourcing

Empowering global procurement leaders since 2014.

🧮 Landed Cost Calculator

Estimate your total import cost from China.