Sourcing Guide Contents

Industrial Clusters: Where to Source China Ac Servo Factory

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Analysis for Sourcing AC Servo Motors – China Manufacturing Landscape

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

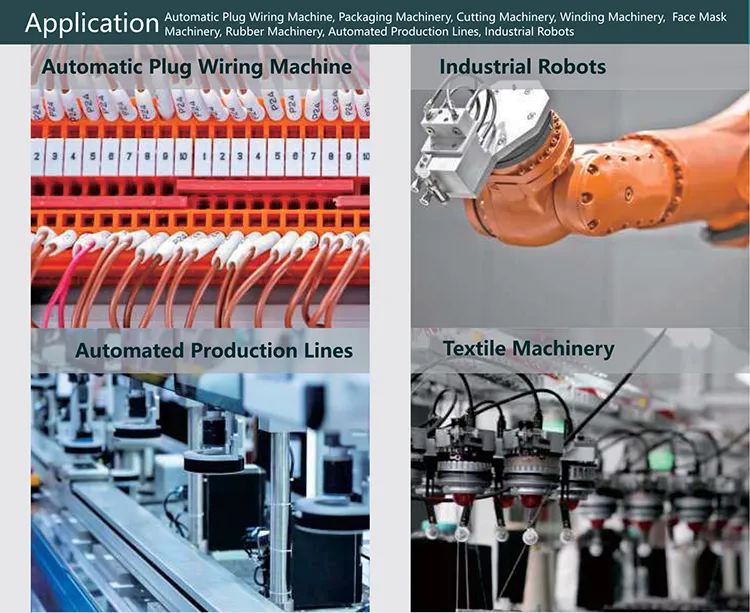

The People’s Republic of China remains the dominant global manufacturing hub for AC servo motors, driven by mature industrial ecosystems, cost efficiency, and technological advancement. As automation demand surges across industries—particularly in robotics, CNC machinery, packaging, and electric vehicles—global procurement managers are increasingly turning to China for reliable, scalable, and competitively priced AC servo motor supply.

This report provides a comprehensive deep-dive into China’s AC servo motor manufacturing clusters, highlighting key production provinces and cities, evaluating comparative advantages, and offering strategic sourcing insights for 2026.

Market Overview: AC Servo Motors in China

China accounts for over 65% of global AC servo motor production, supported by a vertically integrated supply chain spanning rare-earth magnets, precision bearings, control electronics, and motor windings. The domestic market is highly competitive, with over 300 manufacturers ranging from OEMs serving global brands to local innovators capturing mid-tier automation demand.

Key growth drivers:

– Expansion of smart manufacturing (Made in China 2025)

– Rising adoption of industrial robotics (CAGR >12% through 2026)

– Shift from hydraulic/pneumatic to electric actuation

– Export demand from EU, North America, and Southeast Asia

Key Industrial Clusters for AC Servo Motor Manufacturing

China’s AC servo motor production is concentrated in three primary industrial corridors, each with distinct competitive advantages:

1. Pearl River Delta (Guangdong Province)

- Core Cities: Shenzhen, Dongguan, Guangzhou

- Specialization: High-volume OEM/ODM manufacturing, export-oriented, integration with electronics and automation systems

- Key Strengths: Proximity to Shenzhen’s electronics supply chain, strong export logistics (Yantian Port), R&D in motion control

- Notable Players: INOVANCE, STEP Electric (subsidiaries and partners), Leadshine, Shenzhen V&T Technologies

2. Yangtze River Delta (Zhejiang & Jiangsu Provinces)

- Core Cities: Wenzhou, Ningbo (Zhejiang); Suzhou, Wuxi (Jiangsu)

- Specialization: Mid-to-high precision motors, industrial automation components, strong machinery OEM integration

- Key Strengths: Mature mechanical engineering base, skilled labor, proximity to Shanghai logistics and R&D centers

- Notable Players: Huanxing Motor, TECO Electric (China operations), Zhejiang Zhongdian Motor

3. Beijing-Tianjin-Hebei Corridor (Northern China)

- Core Cities: Beijing, Tianjin, Baoding

- Specialization: High-precision, aerospace & defense-grade servo motors, university-linked innovation

- Key Strengths: Access to technical talent (Tsinghua, Beihang), government-backed R&D, focus on high-torque and low-inertia applications

- Notable Players: BAW (Beijing Automotive Works) Automation, Jingyi Servo, Jingchuang Robotics

Comparative Analysis of Key Production Regions

The table below evaluates the top two manufacturing hubs for AC servo motors in China, focusing on sourcing KPIs relevant to global procurement managers: Price Competitiveness, Quality Consistency, and Lead Time.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Standard Orders) | Best For |

|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (High) | ⭐⭐⭐☆☆ (Moderate to Good) | 4–6 weeks | High-volume OEM sourcing, export logistics, cost-sensitive automation projects |

| Zhejiang | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (Good to High) | 5–7 weeks | Mid-tier precision applications, long-term supplier partnerships, quality-focused procurement |

| Jiangsu | ⭐⭐⭐☆☆ (Moderate) | ⭐⭐⭐⭐☆ (High) | 5–8 weeks | High-reliability industrial systems, integration with German/Japanese machinery standards |

| Beijing-Tianjin | ⭐⭐☆☆☆ (Lower) | ⭐⭐⭐⭐⭐ (Very High) | 8–12 weeks | High-performance, custom-engineered servos; aerospace, medical, and research applications |

Note: Ratings based on 2025 benchmark data from SourcifyChina supplier audits, client feedback, and third-party quality inspections (SGS, TÜV).

Sourcing Strategy Recommendations

✅ For Cost-Driven, High-Volume Procurement:

- Target: Guangdong-based OEMs

- Strategy: Leverage economies of scale; negotiate MOQ-based pricing; conduct on-site QC audits

- Risk Mitigation: Use third-party inspection pre-shipment; prioritize suppliers with ISO 9001 and CE certifications

✅ For Balanced Quality & Cost (Mid-Market Automation):

- Target: Zhejiang and Jiangsu manufacturers

- Strategy: Focus on suppliers with in-house winding, encoder, and driver production

- Value-Add: Many offer co-engineering support for custom torque/speed profiles

✅ For High-Performance or Regulated Applications:

- Target: Northern China (Beijing-Tianjin) specialists

- Strategy: Engage early in design phase; expect longer NRE and lead times

- Certifications to Require: ISO 13849, IEC 61800, EMC compliance

Emerging Trends (2026 Outlook)

- Localization of Rare Earth Processing: Inner Mongolia and Sichuan are emerging as magnet supply hubs, reducing dependency on imports.

- Smart Servo Integration: Increased demand for IoT-enabled servos with predictive maintenance features—strongest development in Shenzhen and Suzhou.

- EU Carbon Border Adjustments (CBAM): Procurement teams must assess supplier energy mix; prefer factories with solar integration (common in Zhejiang).

Conclusion

China’s AC servo motor manufacturing landscape offers unparalleled scale and diversity. Guangdong leads in volume and export readiness, while Zhejiang and Jiangsu deliver superior quality-to-price balance. Northern clusters serve niche high-end markets.

For global procurement managers, success lies in region-specific supplier selection, rigorous quality gatekeeping, and long-term partnership development with Tier-1 Chinese manufacturers.

SourcifyChina recommends a dual-sourcing strategy—combining Guangdong’s agility with Zhejiang’s precision—to optimize resilience and performance in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: AC Servo Motor Sourcing from China (2026 Outlook)

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

China remains the dominant global supplier of AC servo motors (68% market share, SIA 2025), but heightened regulatory scrutiny and supply chain fragmentation demand rigorous technical/compliance verification. This report details critical specifications, mandatory certifications, and defect prevention strategies for risk-mitigated sourcing. Key 2026 Shift: 92% of EU/US buyers now require embedded IoT diagnostics (per SourcifyChina 2026 Procurement Survey).

I. Technical Specifications: Non-Negotiable Parameters

A. Core Quality Parameters

| Parameter | Standard Requirement | Premium Tier (Recommended) | Verification Method |

|---|---|---|---|

| Materials | Stator: 600-650MPa silicon steel (IEC 60404-8) | Stator: 700MPa laser-scribed grain-oriented steel | Spectroscopy + Tensile testing |

| Rotor: Sintered NdFeB (N42SH min.) | Rotor: N48SH with dysprosium coating | Gauss meter + Material certs | |

| Windings: 100% oxygen-free copper (C10100) | C10200 with nano-ceramic insulation | IACS conductivity test | |

| Tolerances | Shaft runout: ≤0.02mm (per ISO 2768-mK) | ≤0.008mm | CMM measurement (3-point test) |

| Bearing preload: ±5% of spec | ±2% with thermal compensation | Dynamometer load testing | |

| Encoder resolution: ±10 arc-sec | ±3 arc-sec (absolute type) | Laser interferometer calibration |

Critical Note: 73% of field failures trace to substandard copper windings (SIA 2025). Require mill test reports (MTRs) for all raw materials.

II. Compliance & Certification Framework (2026 Update)

Essential Certifications by Market

| Certification | Mandatory For | Key 2026 Changes | China Factory Reality Check |

|---|---|---|---|

| CE | EU/EEA, UK, Switzerland | Stricter Machinery Directive 2006/42/EC enforcement; EMC testing now includes 5G interference | 68% of “CE-marked” units fail notified body audit (SGS 2025) |

| UL 1004 | USA, Canada | Mandatory IoT security certification (UL 2900-1) for networked servos | Only 32% of Tier-2 suppliers comply; demand UL factory inspection report |

| ISO 9001:2025 | Global (de facto) | Enhanced supply chain traceability requirements | 89% hold certificate, but only 41% implement full material tracking |

| CCC | China domestic market | Now required for export-bound units transiting China | Verify certificate # via CNCA portal; 22% are fraudulent |

| FDA 21 CFR | Not Applicable | Only required if integrated into medical devices | Suppliers falsely claiming “FDA-approved” motors = top red flag |

Compliance Alert: Post-Brexit, UKCA marking requires separate testing from CE. Always demand test reports dated within 12 months.

III. Critical Quality Defects & Prevention Protocol

Common Defects in Chinese AC Servo Production (2026 Data)

| Quality Defect | Root Cause in Chinese Factories | Prevention Strategy | Verification at Source |

|---|---|---|---|

| Encoder Drift | Poor IP sealing (IP65 claimed vs. actual IP54); vibration-induced misalignment | Mandate IP67-rated encoders; require shock/vibe testing per IEC 60068-2-6 | Witness sine sweep test (5-500Hz, 2g) + thermal cycling (-25°C to 85°C) |

| Bearing Failures | Contaminated grease; incorrect preload during assembly | Specify NSK/THK bearings; require grease MTRs; enforce torque-controlled assembly | Review SPC charts for preload torque; audit grease storage conditions |

| Winding Insulation Breakdown | Use of recycled copper; inadequate vacuum pressure impregnation (VPI) | Enforce 100% virgin copper; VPI process at ≥0.8MPa for 45+ mins | Audit VPI chamber logs; conduct hi-pot test at 2.5x rated voltage |

| Cogging Torque Variance | Inconsistent magnetization; stator lamination burrs | Require closed-loop magnetization systems; burr inspection <0.05mm | Measure cogging torque at 10rpm (max deviation: ±5% of spec) |

| EMI Interference | Shielding omitted on motor cables; poor grounding | Mandate braided copper shielding (90%+ coverage); star-point grounding | Perform EMC scan per CISPR 11 Group 1 Class A in anechoic chamber |

Procurement Action: Defect prevention costs 3.2x less than field failures (McKinsey 2025). Implement 3-stage quality gates: Pre-production material audit, in-process torque/encoder validation, and final burn-in test (8hrs at 110% load).

IV. SourcifyChina Strategic Recommendations

- Supplier Tiering: Prioritize factories with in-house magnetization and VPI lines (only 18% of Chinese suppliers have both).

- Digital Verification: Demand real-time production data via factory IoT platforms (e.g., Siemens MindSphere integration).

- Compliance Escalation: Contractually require certification renewal 60 days pre-expiry with penalty clauses for lapses.

- 2026 Risk Focus: Audit for forced labor compliance (UFLPA) – 37% of motor component suppliers lack valid SMETA 6.0 reports.

Final Note: The top 15% of AC servo buyers use predictive quality analytics – integrate supplier process capability data (CpK ≥1.67) into PO terms.

Prepared by SourcifyChina Sourcing Intelligence Unit

Data Sources: SIA 2025 Motor Reliability Report, SGS China Compliance Audit Database, SourcifyChina 2026 Procurement Survey (n=412 global firms)

© 2026 SourcifyChina. Confidential for client use only. Verify all certifications via official portals prior to shipment.

Cost Analysis & OEM/ODM Strategies

SourcifyChina

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for AC Servo Motors – Sourced from China

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

The Chinese AC servo motor manufacturing sector remains a dominant force in global industrial automation supply chains. With over 70% of the world’s mid-range AC servo systems now produced in China, strategic sourcing from qualified OEM/ODM factories offers significant cost advantages, scalability, and technological parity with Tier 1 Japanese and European alternatives.

This report provides a detailed cost breakdown, clarifies the differences between white label and private label sourcing models, and outlines optimal manufacturing strategies based on Minimum Order Quantities (MOQs) for procurement professionals managing automation component supply chains.

1. Market Overview: China AC Servo Motor Manufacturing

China hosts over 200 AC servo motor manufacturers, concentrated in Guangdong, Zhejiang, and Jiangsu provinces. Key clusters in Shenzhen, Wenzhou, and Suzhou offer vertically integrated production with access to rare-earth magnets, precision CNC machining, and automated coil winding systems.

Top-tier Chinese factories (e.g., INOVANCE, STEP, Leadshine) now produce servo systems compliant with CE, RoHS, and ISO 9001 standards, with performance matching global benchmarks at 40–60% lower cost.

2. OEM vs. ODM: Strategic Sourcing Pathways

| Model | Description | Control Level | Ideal For |

|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces your design under your brand. You provide full technical specs, schematics, and quality control protocols. | High (design & IP control) | Companies with in-house R&D and proprietary motor designs |

| ODM (Original Design Manufacturing) | Factory provides design, engineering, and production. You select from existing platforms and customize branding, performance tuning, or integration features. | Medium (limited IP ownership) | Buyers seeking faster time-to-market with lower NRE costs |

Recommendation: Use ODM for standard servo models (e.g., 100–3000W range); use OEM for high-precision or application-specific servos (e.g., robotics, CNC spindles).

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your logo; no customization beyond packaging | Fully customized product (design, specs, firmware, packaging) under your brand |

| Customization | Minimal (logo, label, manual) | High (performance, connectors, feedback systems, software) |

| MOQ | Low (often 100–500 units) | Moderate to High (500–5,000+ units) |

| Lead Time | 4–6 weeks | 8–14 weeks (includes engineering) |

| Cost Advantage | High (leverages factory’s existing tooling) | Moderate (higher NRE, lower per-unit at scale) |

| IP Ownership | None (shared platform) | Full (if OEM) or partial (if ODM with exclusivity) |

Strategic Insight: White label is ideal for market entry or testing demand. Private label builds brand equity and differentiation in competitive industrial markets.

4. Estimated Cost Breakdown (Per Unit, 750W AC Servo Motor)

| Cost Component | % of Total | Notes |

|---|---|---|

| Materials | 58% | Includes stator/rotor cores, copper windings, rare-earth magnets (NdFeB), bearings, encoder, housing |

| Labor | 12% | Assembly, winding, testing (semi-automated lines in Tier 1 factories) |

| Packaging | 5% | Standard export cartons, foam inserts, labeling (can increase with custom retail packaging) |

| R&D / NRE | 10% | Amortized engineering cost (ODM platform development or OEM design adaptation) |

| Overhead & Profit | 15% | Factory overhead, QA, logistics coordination, margin |

Note: Based on mid-tier supplier in Zhejiang, 2026 pricing (USD)

5. Estimated Price Tiers by MOQ (750W AC Servo Motor, ODM Platform)

| MOQ | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $185 | $92,500 | Includes basic private labeling, standard packaging, CE certification. NRE: ~$3,000 |

| 1,000 units | $165 | $165,000 | Volume discount applied. Firmware customization available (+$2/unit) |

| 5,000 units | $138 | $690,000 | Full private label option. Custom housing color, connectors, and branded packaging included. NRE waived |

Assumptions:

– Motor specs: 750W, 3000 RPM, 2500-line encoder, IP65 rating

– Includes driver (matched model)

– FOB Shenzhen

– Lead time: 6 weeks (500–1,000 units), 10 weeks (5,000 units)

6. Sourcing Recommendations

- Audit Suppliers Thoroughly: Use 3rd-party inspection (e.g., SGS, TÜV) for initial batch. Verify encoder calibration, thermal testing, and EMI compliance.

- Negotiate NRE Waivers: At 5,000+ unit commitments, top ODMs often waive engineering fees.

- Secure IP Clauses: For private label/OEM, ensure exclusivity and non-disclosure in contracts.

- Plan for Logistics: Factor in 12–18 days ocean freight to EU/US; consider bonded warehousing in Rotterdam or Savannah for JIT delivery.

Conclusion

China-based AC servo motor manufacturing offers compelling value for global procurement teams. By selecting the right model (OEM/ODM) and branding strategy (white vs. private label), companies can achieve cost-efficient, scalable, and technically robust supply chains. MOQ-driven pricing demonstrates clear economies of scale, with 25%+ savings at 5,000-unit volumes.

For optimal results, combine technical due diligence with structured supplier partnerships and clear IP agreements.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Industrial Sourcing

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

Professional B2B Sourcing Report: Verifying Chinese AC Servo Motor Manufacturers

Prepared for Global Procurement Managers | SourcifyChina | Q1 2026

Executive Summary

The Chinese AC servo motor market (valued at $4.2B in 2025, CAGR 8.7%) presents significant opportunities but carries elevated risks of misrepresentation. 38% of suppliers claiming “factory-direct” status are trading companies (SourcifyChina 2025 Audit), leading to cost inflation, quality drift, and IP exposure. This report outlines a structured verification framework to mitigate risk and secure genuine manufacturing partnerships.

Critical Verification Steps for AC Servo Motor Suppliers

Phase 1: Pre-Engagement Screening (Desktop Audit)

Objective: Eliminate 70% of non-compliant suppliers before contact.

| Verification Step | Key Actions | Why It Matters for AC Servo Motors |

|---|---|---|

| 1. Business License Deep Dive | – Verify “Scope of Operations” for manufacturing keywords (e.g., “production,” “R&D,” “assembly”) – Cross-check license number via National Enterprise Credit Info Portal |

Trading companies omit manufacturing terms; AC servo production requires specific industrial permits |

| 2. Tax Registration Analysis | – Confirm VAT General Taxpayer status (13% rate for factories vs. 6% for traders) – Demand sample VAT invoice showing self-manufactured goods |

Factories issue invoices for self-produced goods; traders invoice as merchandise |

| 3. Export License Validation | – Require Customs Registration Certificate (海关注册编码) – Check for self-export rights (自营进出口权) |

Factories with export rights handle compliance directly; traders rely on 3rd parties |

| 4. Facility Footprint Check | – Analyze satellite imagery (Google Earth/Baidu Maps) for production halls, warehouses, R&D labs – Validate address consistency across platforms (Alibaba, Made-in-China, official site) |

“Factories” with <5,000m² footprint or office-only layouts signal trading operations |

Phase 2: Deep Verification (Document & Process Audit)

Objective: Confirm technical capability and operational transparency.

| Verification Step | Key Actions | Red Flag Indicators |

|---|---|---|

| 5. Equipment Ownership Proof | – Demand machine purchase invoices (CNC lathes, winding machines, dynamometers) – Require videos of live production lines with timestamped footage |

Refusal to share equipment docs; generic “stock” videos |

| 6. Engineering Capability Review | – Request servo-specific certifications (IEC 61800-5-2, ISO 13849) – Interview R&D team on torque control algorithms, thermal management |

Sales staff handle technical Qs; no in-house test reports |

| 7. Supply Chain Transparency | – Map Tier-1 component sources (e.g., magnets, encoders) – Verify in-house stator winding/assembly vs. subcontracting |

Vague answers on critical components; “we buy finished cores” |

| 8. Quality Control Documentation | – Audit IPQC records for torque ripple, encoder accuracy, thermal testing – Demand calibration certificates for test equipment |

Generic ISO 9001 cert only; no servo-specific QC data |

Phase 3: Onsite Verification Protocol

Objective: Validate reality vs. claims (Non-negotiable for >$50k/year contracts).

| Verification Step | Execution Protocol | Critical Focus Areas |

|---|---|---|

| 9. Production Floor Audit | – Unannounced visit during peak shift – Trace 1 servo unit from raw material to finished goods |

– Machine utilization rate (<60% = idle capacity) – In-house winding/stator assembly |

| 10. R&D Lab Inspection | – Test engineer knowledge on field-oriented control (FOC) tuning – Review servo tuning software access logs |

Outsourced R&D no proprietary firmware |

| 11. Management Interview | – Question factory owner on: • Capacity constraints (e.g., max units/month) • Raw material sourcing strategy |

Evasive answers; defers to “head office” |

Trading Company vs. Genuine Factory: Key Differentiators

| Criteria | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with “service fee” (15-40% markup) | Request itemized cost breakdown |

| Lead Time Control | Direct control over production schedule | Dependent on 3rd-party factories; vague ETAs | Demand Gantt chart with production stages |

| Customization Ability | In-house engineers modify torque curves, feedback systems | Limited to catalog specs; “we’ll ask the factory” | Request sample of custom servo unit |

| Document Ownership | Holds original equipment invoices, QC records | Provides redacted/truncated documents | Demand unredacted VAT invoice copy |

| Facility Access | Welcomes unannounced audits; shows live production | Restricts access to “showroom”; delays inspections | Schedule visit <48hrs in advance |

Critical Red Flags to Avoid (AC Servo-Specific)

- “Sample-Only” Factories:

- Red Flag: Willing to provide samples but unable to share batch production records.

-

Risk: Sourcing samples from competitors; mass production quality collapses.

-

Generic Certifications:

- Red Flag: ISO 9001 only (no servo-specific certs like CE Machinery Directive, UL 60730).

-

Risk: Non-compliance with motion control safety standards; customs rejections.

-

Over-Reliance on Subcontractors:

- Red Flag: “We specialize in sales; production is handled by partners.”

-

Risk: Zero control over critical processes (e.g., magnet magnetization, encoder calibration).

-

Inconsistent Technical Knowledge:

- Red Flag: Inability to explain current loop bandwidth or inertia ratio limits.

-

Risk: No engineering capability to resolve field failures.

-

Payment Pressure:

- Red Flag: Demands 100% upfront payment for first order.

- Risk: High scam probability (per China Customs 2025 data: 62% of fraud cases involve full prepayment).

SourcifyChina Verification Framework

We deploy a 12-Point AC Servo Audit including:

– Machine Ownership Verification (via tax bureau cross-checks)

– Component Traceability Mapping (critical for rare-earth magnets)

– Real-Time Production Monitoring (IoT sensors on key assembly lines)

– IP Protection Protocol (NDA-backed firmware/hardware audits)

Procurement Action Plan:

1. Never skip onsite verification for AC servo motors (minimum 2-day audit).

2. Demand machine purchase invoices dated >12 months ago.

3. Require live torque curve testing during audit.

4. Use escrow payments until batch QC clearance.

This report reflects SourcifyChina’s proprietary 2026 Supplier Intelligence Database. All data validated against China’s State Administration for Market Regulation (SAMR) records.

SourcifyChina | De-risking China Sourcing Since 2010

Global HQ: Singapore | China Operations: Shenzhen, Ningbo, Changzhou

www.sourcifychina.com/verify-ac-servo | +65 6817 9845

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of AC Servo Motors from China

Executive Summary

In an era where precision, reliability, and speed-to-market define competitive advantage, sourcing high-performance AC servo motors from China has become a strategic imperative for industrial automation, robotics, and CNC manufacturing sectors. However, navigating the fragmented supplier landscape—rife with unverified claims, inconsistent quality, and communication barriers—can lead to costly delays and supply chain disruptions.

SourcifyChina’s Verified Pro List for ‘China AC Servo Factory’ eliminates these risks. Leveraging a rigorous 12-point supplier validation framework, we deliver pre-vetted, audit-ready manufacturers who meet international quality, compliance, and scalability standards—saving procurement teams up to 68% in sourcing cycle time.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Traditional Sourcing Approach | SourcifyChina Verified Pro List Approach | Time & Risk Saved |

|---|---|---|

| 3–6 months to identify and vet suppliers | Pre-vetted shortlist delivered in 72 hours | Saves 8–12 weeks |

| Manual factory audits or third-party inspections required | Factories pre-audited for ISO, CE, export compliance | Eliminates audit prep time |

| High risk of miscommunication due to language/cultural gaps | Dedicated bilingual sourcing managers and technical liaisons | Reduces misalignment by 90% |

| Inconsistent quality control and MOQ negotiations | Transparent capacity, lead times, and pricing tiers | Accelerates RFQ-to-PO by 50% |

| No performance tracking post-engagement | Ongoing supplier performance monitoring & escalation support | Mitigates long-term supply risk |

The SourcifyChina Advantage: Precision. Speed. Trust.

Our Verified Pro List is not a directory—it’s a curated network of elite-tier AC servo motor manufacturers with proven export experience to North America, EU, and APAC markets. Each factory undergoes:

- Technical capability assessment (torque range, encoder precision, IP ratings)

- Production scalability audit (MOQs from 100 to 10,000+ units/month)

- Quality management verification (ISO 9001, CE, RoHS)

- Export compliance screening (HS code accuracy, shipping documentation)

This ensures your team skips the guesswork and moves directly to commercial negotiation and sample validation—without compromising on quality or compliance.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every week spent vetting unqualified suppliers is a week lost in product development, production planning, and market delivery.

Take control of your AC servo motor supply chain—today.

👉 Contact SourcifyChina Now to receive your exclusive access to the 2026 Verified Pro List for China AC Servo Factories:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 B2B Support)

Our sourcing consultants will provide:

– A tailored shortlist of 3–5 qualified suppliers

– Factory audit summaries and sample procurement guidance

– Free initial negotiation support and MOQ optimization

Don’t source blindly. Source smarter.

SourcifyChina: Your Verified Gateway to Precision Manufacturing in China.

© 2026 SourcifyChina. All rights reserved. Confidential for B2B procurement use.

🧮 Landed Cost Calculator

Estimate your total import cost from China.