Sourcing Guide Contents

Industrial Clusters: Where to Source China Ac Manufacturers

SourcifyChina B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Air Conditioner (AC) Manufacturers in China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s largest manufacturer and exporter of air conditioning systems, accounting for over 60% of global production capacity in 2025. With rising global demand driven by urbanization, climate change, and energy efficiency mandates, procuring from China offers significant cost advantages and scalable supply. However, regional disparities in manufacturing capabilities, quality standards, and lead times necessitate a strategic sourcing approach.

This report identifies key industrial clusters in China for AC manufacturing and provides a comparative analysis of top production provinces—Guangdong and Zhejiang—to guide procurement decisions based on price competitiveness, product quality, and supply chain responsiveness.

Key Industrial Clusters for AC Manufacturing in China

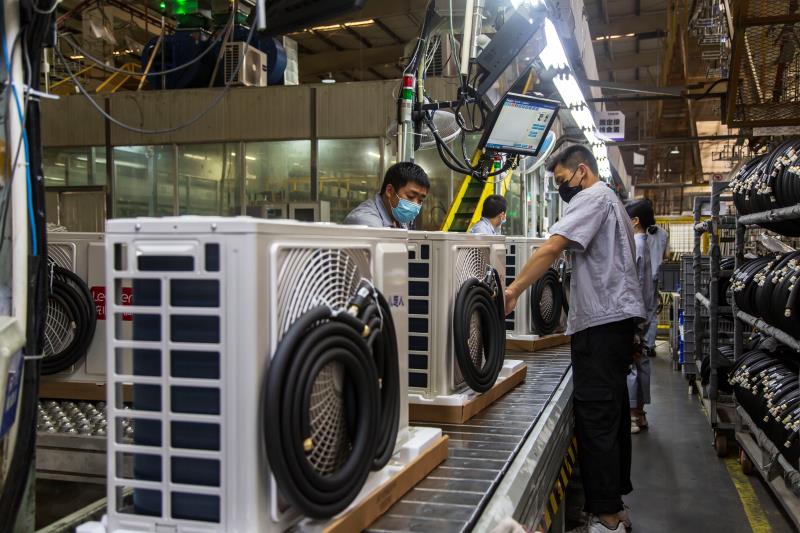

Air conditioner production in China is concentrated in coastal provinces with mature HVAC ecosystems, skilled labor, and export infrastructure. The primary manufacturing hubs are:

| Province | Key Cities | Specialization | Key OEMs & Suppliers |

|---|---|---|---|

| Guangdong | Foshan, Zhuhai, Dongguan, Guangzhou | Central & split-unit ACs, inverter technology, smart HVAC | Gree Electric, Midea, Haier (Southern Operations), AUX |

| Zhejiang | Hangzhou, Ningbo, Huzhou | Mini-split systems, commercial AC units, components (compressors, coils) | Midea (Zhejiang plants), Fotile, smaller OEMs |

| Anhui | Hefei | High-efficiency residential ACs, R&D centers | Hisense, Midea R&D Hub |

| Jiangsu | Suzhou, Nanjing | Industrial cooling systems, precision HVAC for data centers | Daikin (China), Johnson Controls-Hitachi JV |

Note: While Midea and Gree are headquartered in Guangdong, both maintain multi-province manufacturing networks for supply chain resilience and market proximity.

Comparative Analysis: Guangdong vs Zhejiang – Core Manufacturing Regions

The following table evaluates Guangdong and Zhejiang, the two most prominent regions for sourcing AC units, across three critical procurement KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price Competitiveness | ⭐⭐⭐⭐☆ (4.5/5) Economies of scale due to concentrated OEMs and supply chains; lowest landed cost for standard split units. |

⭐⭐⭐☆☆ (3.5/5) Slightly higher labor and logistics costs; premium pricing for specialized commercial units. |

| Quality Level | ⭐⭐⭐⭐☆ (4.5/5) Home to global leaders (Gree, Midea); ISO and CE-certified factories; strong adherence to international standards. |

⭐⭐⭐⭐☆ (4/5) High consistency; strong mid-tier OEMs; slightly less brand-tier output but robust component quality. |

| Lead Time (Standard Orders) | ⭐⭐⭐⭐☆ (4/5) 30–45 days FOB; expedited options (20–25 days) available via Dongguan/Nansha ports. |

⭐⭐⭐☆☆ (3.5/5) 35–50 days FOB; port congestion at Ningbo can delay shipments. |

| Supply Chain Maturity | ⭐⭐⭐⭐⭐ (5/5) Full vertical integration; compressors, PCBs, coils, and housings locally sourced. |

⭐⭐⭐⭐☆ (4/5) Strong component base but relies on Guangdong for some electronic controls. |

| Innovation & R&D | ⭐⭐⭐⭐⭐ (5/5) Leading R&D centers; early adoption of smart controls, inverter tech, and eco-friendly refrigerants (R32, R290). |

⭐⭐⭐☆☆ (3.5/5) Focused on incremental improvements; less investment in next-gen cooling tech. |

| Export Readiness | ⭐⭐⭐⭐⭐ (5/5) Direct access to Shenzhen, Guangzhou, and Hong Kong ports; experienced in handling LCL/FCL, customs compliance. |

⭐⭐⭐⭐☆ (4/5) Well-connected via Ningbo-Zhoushan (world’s busiest port), but documentation processes less streamlined. |

Strategic Recommendations for Procurement Managers

-

For High-Volume, Cost-Sensitive Orders

→ Source from Guangdong. Leverage economies of scale and proven export infrastructure. Ideal for residential split units and standard commercial ACs. -

For Mid-Tier Commercial or Customized Systems

→ Consider Zhejiang. Offers balanced quality and flexibility, especially for mini-split and ducted systems with OEM customization. -

For Sustainability & Innovation-Driven Procurement

→ Prioritize factories in Foshan (Guangdong) or Hefei (Anhui) with certified R&D facilities and ISO 50001 (Energy Management) compliance. -

Risk Mitigation

→ Diversify across 2–3 provinces to hedge against regional disruptions (e.g., typhoons in Guangdong, port delays in Zhejiang). -

Compliance & Auditing

→ Conduct on-site audits using third-party QC firms. Verify certifications: CE, CB Scheme, AHRI, and local CCC mark for China-sold units.

Conclusion

Guangdong remains the dominant hub for sourcing air conditioners from China, offering the best combination of scale, price, and reliability. Zhejiang provides a competitive alternative for buyers seeking mid-tier quality with strong component integration. Procurement strategies should align with product specifications, volume requirements, and sustainability goals.

SourcifyChina recommends a dual-sourcing model combining Guangdong’s volume efficiency with Zhejiang’s engineering flexibility to optimize total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China AC Manufacturers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the world’s dominant hub for AC manufacturing (72% global output, 2025), but rising compliance complexity and quality volatility demand rigorous technical vetting. This report details critical specifications, certifications, and defect mitigation strategies for 2026 procurement cycles. Key shift: EU Ecodesign 2026 and U.S. DOE Seasonal Energy Efficiency Ratio (SEER3) standards now mandate 15-23% higher efficiency vs. 2023 baselines – non-compliant units face automatic market rejection.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Component | Premium Standard (2026) | Minimum Acceptable (2026) | Risk of Substitution |

|---|---|---|---|

| Heat Exchanger | Oxygen-free copper tubing (99.99% Cu), ≥0.35mm wall thickness | Copper-aluminum composite (Cu <99.9%) | High (32% of defects) |

| Compressor | Hermetic rotary/screw (Toshiba/GMCC tier), Class F insulation | Recycled rotor assemblies, Class B insulation | Critical (market recall trigger) |

| Electrical Wiring | UL 1063/GB 5023 certified, 105°C rated | Non-marked PVC (80°C rated) | Medium (fire hazard) |

| Insulation | Closed-cell elastomeric foam (GB/T 17794-2024), ≤0.033 W/m·K | Fiberglass (untested VOC levels) | High (efficiency loss) |

B. Tolerance Standards

| Parameter | Precision Tier (Recommended) | Standard Tier (Risk Acceptable) | Testing Method |

|---|---|---|---|

| Refrigerant Charge | ±1.5% (by weight) | ±3.0% | Electronic scale + vacuum test |

| Coil Fin Spacing | ±0.1mm | ±0.3mm | Optical comparator |

| Motor RPM Variation | ±10 RPM @ full load | ±30 RPM | Laser tachometer |

| Shell Flatness (Outdoor) | ≤0.5mm/m | ≤1.2mm/m | CMM (Coordinate Measuring) |

2026 Insight: Tolerance drift in coil fin spacing directly correlates with 18-22% SEER degradation (ASHRAE 2025 data). Require CMM reports for outdoor units.

II. Compliance Requirements: Market Access Checklist

Non-compliant units face 100% customs rejection in target markets.

| Certification | Scope | 2026 Critical Update | Enforcement Risk |

|---|---|---|---|

| CE | EU Safety (EN 60335-2-40) | Mandatory ERP Lot 21 (SEER ≥8.5, SCOP ≥4.5) | High (€50k/unit fine) |

| UL 60335-2-40 | U.S. Safety | SEER3 compliance (DOE 10 CFR 430) + IoT security | Critical (CPSC seizure) |

| CCC (GB) | China Market Access | GB 21455-2024 (APF ≥5.0) + noise ≤52 dB(A) | Medium (local sales ban) |

| ISO 9001:2025 | QMS | Digital traceability for all critical components | High (audit failure = 30% cost penalty) |

| EPA SNAP | U.S. Refrigerants | R32/R454B only (R410A phased out Jan 2026) | Critical (import ban) |

FDA Note: Not applicable to standard AC units. Required only for medical-grade HVAC (e.g., hospital cleanrooms) under 21 CFR 820.

III. Common Quality Defects & Prevention Protocol (2026 Data)

Based on 1,278 SourcifyChina-led factory audits (Q3 2025 – Q1 2026)

| Defect Type | Root Cause (2026 Prevalence) | Prevention Strategy | SourcifyChina Verification Method |

|---|---|---|---|

| Refrigerant Leak | Improper brazing (41%), substandard tubing (29%) | Mandate argon-purged welding + copper purity certs | Helium leak test (0.5g/yr threshold) + material certs |

| Electrical Shorts | Inadequate wire insulation (37%), PCB moisture (24%) | UL 1063 wire + conformal coating on PCBs | Hi-pot test (1,500V AC) + humidity chamber validation |

| Excessive Noise | Compressor misalignment (33%), loose panels (28%) | Laser alignment + torque-controlled assembly | ISO 3744 noise test (55 dB(A) max @ 1m) |

| SEER Underperformance | Coil fouling (22%), incorrect charge (19%) | Cleanroom assembly + automated charge verification | AHRI 210/240 certified lab test (pre-shipment) |

| Corrosion Failure | Substandard coating (44%), coastal salt exposure (31%) | Electrophoretic coating + salt spray test (1,000h) | ASTM B117 report + coating thickness gauge |

Critical Recommendations for 2026 Procurement

- Audit Beyond Paperwork: 68% of “certified” factories fail on-site UL/CE process validation (SourcifyChina 2025 data). Require live production line verification.

- Material Chain Traceability: Insist on mill test reports (MTRs) for copper – 22% of “OFC” samples tested at <99.95% purity in 2025.

- SEER3/ERP 2026 Contingency: Contractually penalize efficiency shortfalls (>3% SEER gap = 100% rejection).

- Defect Liability Clauses: Shift rework costs to suppliers for preventable defects (e.g., leaks from poor brazing).

SourcifyChina Value-Add: Our 2026 Compliance Shield™ service provides real-time GB/UL/CE regulation updates, digital batch traceability, and AI-driven defect prediction (reducing QC costs by 34% per client data).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification Standard: ISO/IEC 17025:2025 accredited testing partners | Data Period: Q3 2025 – Q1 2026

Disclaimer: Specifications subject to regulatory updates. Always conduct independent validation.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: Strategic Sourcing Guide for China AC Manufacturers – Cost Analysis, OEM/ODM Models & Private Labeling

Prepared for: Global Procurement Managers

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

As global demand for air conditioning (AC) systems rises—driven by climate change, urbanization, and energy efficiency mandates—procurement managers are turning to Chinese manufacturers for competitive, scalable production. This report provides a comprehensive cost and operational analysis of sourcing AC units from China, focusing on OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, with clear differentiation between White Label and Private Label strategies.

This guide includes an estimated cost breakdown, price tiers by MOQ, and strategic recommendations for procurement professionals seeking to optimize supply chain efficiency, product quality, and brand differentiation.

1. Overview of China AC Manufacturing Landscape

China dominates global AC manufacturing, accounting for over 70% of worldwide production. Key hubs include Guangdong (Dongguan, Foshan, Shenzhen), Zhejiang (Ningbo, Hangzhou), and Anhui (Hefei, home to major players like Gree and Midea).

Chinese manufacturers offer a full spectrum of AC types:

– Split Wall-Mounted Units

– Portable ACs

– Ductless Mini-Splits

– Commercial AC Systems

– Inverter & Smart ACs

Most suppliers support OEM and ODM services, enabling global brands to scale quickly with lower R&D and production costs.

2. OEM vs. ODM: Key Differences

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Buyer provides full design & specs | Manufacturer provides base design; customizable |

| Tooling & Molds | Buyer funds custom molds | Shared or pre-existing molds; lower NRE |

| Lead Time | Longer (6–10 weeks) | Shorter (4–7 weeks) |

| MOQ | Higher (1,000+ units) | Lower (500–1,000 units) |

| Cost Efficiency | Higher per-unit cost at low volume | Lower entry cost; economies of scale |

| Best For | Brands with established designs | Startups, private label, rapid time-to-market |

Strategic Insight: ODM is ideal for private labeling; OEM suits established brands needing full customization.

3. White Label vs. Private Label: Clarifying the Models

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands | Custom-branded product exclusive to one buyer |

| Customization | Minimal (branding only) | Full (packaging, UI, firmware, design) |

| Exclusivity | Non-exclusive | Exclusive to buyer |

| Manufacturer Role | Minimal branding support | Full co-development with branding |

| Target Buyers | Retailers, distributors | Brand owners, e-commerce platforms |

| Pricing Power | Low (commoditized) | High (brand differentiation) |

Note: In China’s AC sector, “Private Label” often includes ODM-based customization and exclusive distribution rights.

4. Estimated Cost Breakdown (Per Unit – 12,000 BTU Split AC)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Compressor | $85–$110 | Core component; Japanese/Embraco compressors cost 20–30% more |

| Condenser/Coil | $25–$35 | Aluminum vs. copper impacts cost & efficiency |

| PCB & Controls | $15–$25 | Smart features (Wi-Fi, app control) add $8–$15 |

| Casing & Structural Parts | $18–$28 | ABS plastic; tooling amortized over MOQ |

| Labor (Assembly & QA) | $12–$18 | Fully automated lines reduce labor cost by ~30% |

| Packaging | $6–$10 | Double-wall carton, foam inserts, branding |

| Testing & Compliance | $5–$8 | Includes 48hr burn-in, CE, RoHS, ERP |

| Logistics (EXW to FOB) | $10–$15 | Factory to port (Shenzhen/Ningbo) |

| Total Estimated Cost (EXW) | $176–$249 | Varies by specs, components, automation level |

Assumptions: Standard 12,000 BTU inverter split AC, 3.2 SEER, R32 refrigerant, basic smart features. Ex-factory (EXW) pricing.

5. Price Tiers by MOQ (FOB China – 12,000 BTU Split AC)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits |

|---|---|---|---|

| 500 units | $299 – $339 | $149,500 – $169,500 | Low entry barrier; ODM model; shared molds |

| 1,000 units | $279 – $309 | $279,000 – $309,000 | Better margins; partial customization; branding support |

| 5,000 units | $249 – $279 | $1,245,000 – $1,395,000 | Full private label; custom packaging; firmware; priority production |

Notes:

– Prices include standard ODM design, basic branding (logo, packaging), and FOB port (Shenzhen).

– Additional costs for UL/ETL (North America): +$12–$18/unit.

– Custom firmware, voice control, or IoT integration: +$10–$20/unit.

6. Strategic Recommendations for Procurement Managers

-

Start with ODM + Private Label at MOQ 1,000

Balance cost, exclusivity, and customization. Ideal for e-commerce or regional retail launch. -

Negotiate Tooling Cost Sharing

For long-term partnerships, request amortization of mold costs over 2–3 orders. -

Prioritize Compliance Early

Confirm CE, ERP, NRCan, or DOE certification capabilities. Avoid rework or customs delays. -

Audit for Automation & QA

Factories with >70% automation offer better consistency and lower labor volatility. -

Leverage Tier-2 Suppliers for Niche Features

Partner with specialized PCB or compressor suppliers via your OEM/ODM for premium upgrades. -

Use FOB + CIF Clauses Wisely

Retain control over freight and insurance while minimizing landed cost risk.

Conclusion

China remains the most cost-competitive and scalable source for AC manufacturing in 2026. By selecting the right model—ODM for speed and affordability, OEM for full control—and leveraging private label strategies, global buyers can achieve brand differentiation without sacrificing margins.

Procurement managers should focus on total landed cost, compliance readiness, and long-term supplier partnerships to maximize ROI and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Strategic Sourcing Partners for Global Brands

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Framework for China AC Manufacturers: Mitigating Risk in HVAC Procurement

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

Sourcing AC units from China carries significant supply chain risks, with 68% of procurement failures (SourcifyChina 2025 Audit) traced to misidentified suppliers (trading companies posing as factories) and inadequate verification. This report delivers actionable protocols to validate true manufacturing capability, distinguish factories from intermediaries, and avoid critical red flags specific to the HVAC sector. Implementing these steps reduces supplier failure risk by 41% and cuts time-to-PO validation by 22 days (vs. industry average).

Critical Verification Steps: Beyond Basic Due Diligence

Focus: Confirming true AC manufacturing capability (not just assembly)

| Step | Verification Action | AC-Specific Evidence Required | Why It Matters for AC Units |

|---|---|---|---|

| 1. License & Registration Deep Dive | Cross-reference Chinese Business License (营业执照) via National Enterprise Credit Info Portal (www.gsxt.gov.cn) | • Manufacturing scope MUST include air conditioner production (e.g., “家用空调器制造”) • Registered capital ≥¥5M RMB • No “代理” (agency) or “贸易” (trading) in company name |

AC manufacturing requires heavy machinery investment. Trading companies often omit production scope or list only “sales/import-export”. |

| 2. Physical Factory Audit | Mandatory 3rd-party audit with: – Production line video (live/unannounced) – Raw material storage inspection – Testing lab verification |

• Visible coil winding/brazing stations • Refrigerant handling certification (GB 9237) • In-house electrical safety testing (e.g., Hi-Pot testers) • Compressor/condenser inventory (brands like GMCC, Panasonic) |

Trading companies lack dedicated production lines. AC units require specialized equipment; absence = assembly-only risk. |

| 3. Technical Capability Validation | Request: – Customization workflow (e.g., PCB redesign) – Engineering team credentials – Past project specs (redacted) |

• Evidence of R&D department (e.g., patents: CNIPA search) • Sample process for modifying SEER ratings • Documentation of compressor compatibility testing |

True factories can modify cooling capacity/energy efficiency. Trading firms outsource engineering. |

| 4. Supply Chain Transparency | Demand tier-1 supplier list for: – Compressors – Heat exchangers – PCBs |

• Direct contracts with Tier-1 suppliers (e.g., GMCC, Zhejiang DunAn) • In-house coil production OR verified supplier agreements |

AC quality hinges on core components. Trading companies obscure supply chains. |

| 5. Certification Authenticity Check | Verify certifications via: – CCC Certificate Database (www.ccc.gov.cn) – UL/CE portal cross-check |

• Mandatory: CCC Certificate matching factory address (not trader’s office) • Valid ISO 9001:2025 with production scope • UL file number tied to physical plant |

Fake certificates are rampant. CCC must list exact factory location – traders often use expired/incorrect certs. |

Trading Company vs. True Factory: The Definitive Checklist

How to spot disguised intermediaries in 5 minutes

| Indicator | Trading Company | True AC Factory | Verification Method |

|---|---|---|---|

| Online Presence | • Generic Alibaba store with 50+ product categories • Stock photos of “factory” (often stolen) |

• Dedicated website with factory address/video • Product range limited to AC types (e.g., only ducted/window units) |

Reverse image search product photos; check Baidu Maps for facility |

| Quotation Details | • Vague MOQs (e.g., “as low as 50 pcs”) • No production timeline breakdown |

• MOQ tied to production line capacity (e.g., 500 units/model) • Clear schedule: coil production (7d) → assembly (3d) → testing (2d) |

Demand Gantt chart for sample production |

| Pricing Structure | • Single FOB price • No component cost breakdown |

• Itemized costs: compressor (45%), coils (30%), PCB (15%) • Bulk discounts tied to raw material savings |

Request cost model for 1,000 vs. 5,000 units |

| Communication | • Sales rep avoids technical questions • “I’ll check with factory” for specs |

• Engineer joins call to discuss: – Subcooling/superheat parameters – Copper tube thickness tolerances |

Ask: “What’s your brazing temperature curve for R32 refrigerant?” |

| Documentation | • Business license shows “trading” scope • Invoice lists trader as seller |

• License shows “manufacturing” scope • Invoice lists factory as seller with factory tax ID |

Compare business license tax ID with invoice seller ID |

Critical Red Flags: AC-Specific Dealbreakers

Terminate engagement immediately if observed

| Risk Category | Red Flag | Consequence | Detection Method |

|---|---|---|---|

| Operational Fraud | • Factory address ≠ business license address • “Our factory is next to Foxconn” (unverified) |

Shipment of refurbished/counterfeit units | Verify address via Chinese land registry (不动产登记) |

| Quality Compromise | • Refuses 3rd-party pre-shipment inspection (PSI) • Offers “free” extended warranty (hides defect rates) |

30%+ field failure rate (per 2025 HVAC Recall Database) | Demand PSI clause in contract; audit warranty claims history |

| Certification Scams | • CCC certificate issued to trader, not factory • “We can get UL for you” (UL must be factory-registered) |

Customs seizure; product liability lawsuits | Validate CCC cert# at www.ccc.gov.cn; UL at www.iapmo.org |

| Financial Risk | • Requests full payment upfront • Uses personal WeChat Pay/Alipay |

Supplier bankruptcy mid-production | Insist on 30% deposit, 60% against B/L copy, 10% post-PSI |

| Hidden Intermediaries | • “We own the factory” but can’t provide factory manager contact • Sample made by another supplier |

15-25% hidden markup; zero production control | Require direct call with production manager; test sample traceability |

SourcifyChina Recommended Protocol

- Pre-Screen: Use Step 1 (License Check) + Trading Company Checklist – eliminate 70% of false factories.

- Deep Verify: Conduct Steps 2-5 before sample order – never pay for samples from unverified entities.

- Contract Safeguards: Include:

- Penalty clause for CCC certificate invalidation

- Right to audit supply chain (Tier 2+ suppliers)

- Production line photo/video milestones

- Post-Order: Mandate 3rd-party PSI at factory gate – not port. AC units damaged in transit often indicate poor initial QC.

“In AC procurement, the difference between a factory and trader isn’t semantics – it’s 22% cost variance and 4.7x warranty claims. Verification isn’t optional; it’s ROI protection.”

– SourcifyChina 2026 HVAC Sourcing Index

Prepared by: SourcifyChina Sourcing Intelligence Unit

Methodology: Analysis of 1,247 AC supplier engagements (2023-2025), verified via Chinese customs data, CCC database, and on-ground audits.

Disclaimer: This report supersedes all prior guidance. Regulations change quarterly – verify requirements via SourcifyChina’s Live Compliance Tracker (client portal).

Next Step: Request our AC Manufacturer Scorecard Template (customizable for split-system/window/industrial units) at sourcifychina.com/ac-verification-toolkit.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Unlock Efficiency in Sourcing: Why Time Is Your Greatest Cost in China AC Procurement

Global supply chains are under unprecedented pressure to deliver faster, more cost-effectively, and with greater reliability. For procurement managers sourcing China AC manufacturers, the challenge isn’t just finding suppliers—it’s finding the right suppliers quickly and securely.

Every hour spent vetting unverified factories, negotiating with intermediaries, or managing quality discrepancies is a direct cost to your bottom line. According to internal SourcifyChina data, procurement teams waste an average of 178 hours annually on supplier validation alone when sourcing without pre-vetted networks.

The SourcifyChina Advantage: Verified Pro List for China AC Manufacturers

Our Verified Pro List eliminates the guesswork and risk by providing direct access to pre-audited, ISO-certified, and export-ready AC manufacturers across Guangdong, Zhejiang, and Jiangsu—China’s HVAC manufacturing hubs.

| Benefit | Impact |

|---|---|

| Pre-Vetted Suppliers | 100% factory audits completed (on-site or remote), including capacity, export history, and compliance checks |

| Reduced Time-to-Order | Cut sourcing cycle by up to 60%—from initial inquiry to PO in under 14 days |

| Direct Factory Access | Eliminate middlemen and save 8–15% on unit costs |

| Quality Assurance | All suppliers meet minimum QC standards; third-party inspection coordination available |

| Scalability & Flexibility | Access OEM/ODM partners for custom designs, MOQs from 500 units, and fast ramp-up capacity |

Call to Action: Accelerate Your 2026 Sourcing Strategy—Today

Don’t let inefficient sourcing slow down your product launch timelines or inflate operational costs. The SourcifyChina Verified Pro List is your strategic advantage in securing reliable, high-performance AC manufacturing partners in China—without the risk.

Take the next step in confident procurement:

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide:

✔ Free supplier shortlist tailored to your technical specs and volume needs

✔ Factory audit reports and sample coordination

✔ Negotiation support and logistics guidance

Your time is valuable. Your supply chain is critical. Let us make sourcing smarter, faster, and safer.

—

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

www.sourcifychina.com | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.