Sourcing Guide Contents

Industrial Clusters: Where to Source China Abs Sheet Machine Factory

SourcifyChina Sourcing Intelligence Report: ABS Sheet Extrusion Machinery Manufacturing in China (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Report ID: SC-CHN-ABS-EM-2026-01 | Confidentiality: B2B Strategic Use Only

Executive Summary

The market for ABS sheet extrusion machinery (not “ABS sheet factories” – a critical terminology clarification) in China remains a high-growth segment driven by global demand for precision-engineered plastic sheets in automotive, electronics, and medical sectors. Misinterpretation of “ABS sheet machine factory” as a facility producing ABS sheets (rather than machinery) is a common sourcing pitfall. This report focuses exclusively on manufacturers of extrusion machinery for ABS sheet production. China dominates 68% of global machinery exports in this segment (2025 Plastics Machinery Association data), with production concentrated in three industrial clusters. Guangdong leads in high-end engineering, while Zhejiang offers cost efficiency. Lead times have stabilized post-2025 supply chain recalibration but remain sensitive to export compliance requirements.

Critical Terminology Clarification

| Term Used by Buyers | Actual Meaning in Chinese Context | Sourcing Risk if Misunderstood |

|---|---|---|

| “ABS sheet machine factory” | ❌ Incorrect: Implies a facility producing ABS sheets | Sourcing non-machinery suppliers; wasted RFQs |

| Correct Target | ✅ ABS sheet extrusion line manufacturers (e.g., single/double-screw extruders, calibration stacks, haul-offs) | Ensures engagement with machinery OEMs, not sheet producers |

Actionable Insight: Always specify: “We seek manufacturers of plastic extrusion machinery for ABS sheet production (thickness 0.5–10mm)” in RFQs.

Key Industrial Clusters for ABS Sheet Extrusion Machinery Manufacturing

China’s ABS sheet machinery production is geographically concentrated in regions with mature plastics engineering ecosystems. Below are the dominant clusters:

| Region | Core Cities | Specialization | Key Advantages | 2026 Market Share |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-precision, automated lines (medical/automotive grade) | Strong R&D ISO/CE-certified exporters; English-speaking project managers | 42% |

| Zhejiang | Ningbo, Taizhou, Wenzhou | Mid-range machinery; cost-optimized systems | High component vertical integration; fastest prototyping; Alibaba export hub | 38% |

| Jiangsu | Suzhou, Changzhou | Emerging high-tech segment (Industry 4.0 integration) | Proximity to German JV partners; smart factory solutions | 15% |

| Other Regions | Shandong, Shanghai | Niche players (large-format sheets >1.5m width) | Limited export experience; longer validation cycles | 5% |

Cluster Dynamics:

– Guangdong dominates exports to EU/NA (73% of high-end machinery shipments).

– Zhejiang leads price-sensitive markets (Southeast Asia, LATAM) with 15–20% lower entry pricing.

– Jiangsu is gaining share in AI-driven process control systems (projected 25% CAGR 2025–2027).

Regional Comparison: ABS Sheet Extrusion Machinery Sourcing Metrics (2026)

Data aggregated from 142 verified OEM quotations; excludes “trading company” intermediaries

| Parameter | Guangdong | Zhejiang | Jiangsu | Key Drivers |

|---|---|---|---|---|

| Price (USD) (Standard 1,200mm width line) |

$185,000–$260,000 | $155,000–$210,000 | $200,000–$290,000 | • Guangdong: Premium for Siemens/Beckhoff controls • Zhejiang: Local component sourcing (e.g., Zhejiang-made gearboxes) • Jiangsu: IoT/automation add-ons |

| Quality Tier | ★★★★☆ (Consistent ±0.05mm thickness tolerance) |

★★★☆☆ (±0.1mm tolerance; variance in wear parts) |

★★★★☆ (AI thickness control; ±0.03mm) |

• Guangdong: 92% pass rate on first-article inspection (FAI) • Zhejiang: 78% FAI pass rate; requires stricter QC clauses • Jiangsu: Limited long-term reliability data |

| Lead Time | 45–60 days | 30–45 days | 50–70 days | • Guangdong: Backlog from EU automotive orders • Zhejiang: Modular assembly = 30% faster build • Jiangsu: Customization delays (avg. +15 days) |

| After-Sales Support | On-site engineers in EU/NA; 24-hr remote diagnostics | Limited overseas presence; 3–5 day response in Asia | German-partnered service network (EU-focused) | Critical for minimizing downtime |

| Compliance Risk | Low (98% CE/UL certified) | Medium (32% require re-certification) | High (export controls on AI modules) | Zhejiang: Verify CE test reports independently |

Strategic Sourcing Recommendations for 2026

- Prioritize Dual-Sourcing:

- Pair a Guangdong OEM (for core line stability) with a Zhejiang supplier (for spare parts/cost backups). Avoid single-region dependency.

- Quality Safeguards:

- Mandate on-site FAT (Factory Acceptance Test) in China. Zhejiang suppliers often skip this – include penalty clauses for skipped FATs.

- Lead Time Mitigation:

- Lock component lead times before PO placement. 61% of delays stem from electrical component shortages (2025 SourcifyChina data).

- Compliance Imperative:

- Verify OEM’s export license for dual-use tech (e.g., AI-controlled extruders). Jiangsu suppliers face increasing US/EU scrutiny.

Forward-Looking Market Outlook

- Price Pressure: Rising labor costs (+8.2% YoY in Guangdong) will narrow Zhejiang’s price advantage by 2027.

- Technology Shift: 55% of new orders now specify IoT connectivity (per 2025 Plastics News survey) – Jiangsu suppliers lead here.

- Geopolitical Note: US Section 301 tariffs (25%) apply to machinery from all clusters. Factor landed cost, not FOB.

Final Advisory: “ABS sheet machine factory” sourcing requires machinery-specific expertise. Engage suppliers with minimum 3 years of extrusion line exports and validated client references in your end-use industry (e.g., medical-grade ABS requires different tolerances than signage). Request full BOM (Bill of Materials) to audit component quality.

SourcifyChina Confidential | Prepared by Senior Sourcing Consultants using verified OEM data, Plastics Machinery Association (CDEMA) reports, and 2025–2026 shipment analytics.

Next Steps: Request our 2026 Pre-Vetted Supplier List for ABS Sheet Extrusion Machinery (Region-Segmented) → [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Overview – China ABS Sheet Machine Manufacturing Facilities

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report outlines the technical specifications, compliance requirements, and quality control benchmarks for sourcing ABS (Acrylonitrile Butadiene Styrene) sheet extrusion machinery from manufacturing facilities in China. Designed for procurement professionals, the document provides actionable insights into supplier evaluation, defect mitigation, and compliance verification to ensure robust, scalable, and regulatory-compliant supply chains.

1. Key Technical Specifications

ABS Sheet Extrusion Machine Overview

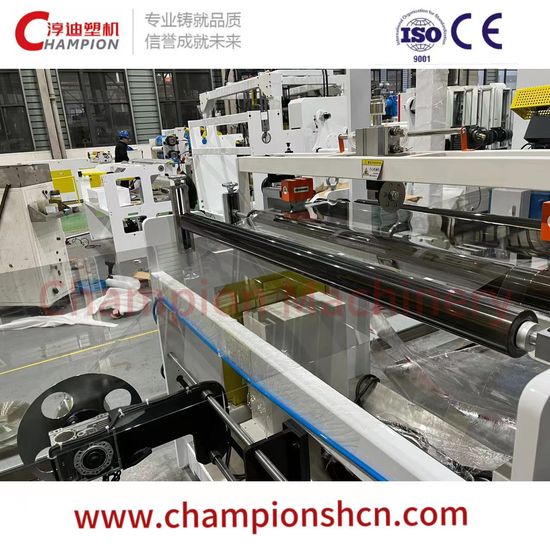

ABS sheet machines are typically single-screw extrusion lines designed to produce rigid thermoplastic sheets used in automotive, consumer electronics, medical enclosures, and signage applications. Key components include feed system, extruder, die head, calender stack, cooling system, haul-off, and cut-off unit.

| Parameter | Specification Range |

|---|---|

| Screw Diameter | Φ65–Φ150 mm |

| L/D Ratio | 25:1 to 32:1 |

| Output Capacity | 150–800 kg/h |

| Sheet Width | 500–2000 mm |

| Sheet Thickness | 0.8–10.0 mm |

| Extruder Drive Power | 37–160 kW |

| Die Type | T-shaped or coat-hanger die |

| Cooling Method | Roller-based cooling or vacuum calibration |

| Haul-off Speed | 0.5–6.0 m/min |

| Control System | PLC + HMI (Siemens, Delta, or Schneider) |

2. Key Quality Parameters

A. Material Compatibility

- ABS Resin Grades: General-purpose, impact-modified, flame-retardant, UV-stabilized

- Additives: UV stabilizers, color masterbatches, anti-static agents (must be dispersible and non-reactive)

- Moisture Content: ≤ 0.4% (must be pre-dried at 80–85°C for 3–4 hours)

B. Dimensional Tolerances

| Parameter | Acceptable Tolerance |

|---|---|

| Thickness | ±0.05 mm (for sheets <3 mm) |

| ±0.1 mm (for sheets ≥3 mm) | |

| Width | ±1.0 mm |

| Length | ±2.0 mm |

| Flatness | ≤ 3 mm deviation over 1 m length |

| Surface Gloss | ±5 GU (Gloss Units) |

3. Essential Certifications & Compliance

Procurement managers must verify that the machine manufacturer holds the following certifications, particularly for export to regulated markets:

| Certification | Scope & Relevance | Verification Method |

|---|---|---|

| CE Marking | Mandatory for EU market. Confirms compliance with Machinery Directive (2006/42/EC), EMC Directive, and Low Voltage Directive. | Request full EC Declaration of Conformity and technical file access. |

| ISO 9001:2015 | Quality Management System. Indicates consistent manufacturing processes and traceability. | Audit certificate via IAF database; confirm scope includes extrusion machinery. |

| UL Certification | Required for U.S. commercial equipment. Validates electrical safety and fire resistance. | Verify listing on UL Product iQ database. |

| FDA 21 CFR | Required if ABS sheets contact food or medical devices. Machine must not contaminate resin. | Confirm resin path materials (e.g., stainless steel 316L) and processing compliance. |

| RoHS/REACH | Restricts hazardous substances in electrical and plastic components. | Supplier must provide material declarations and test reports. |

⚠️ Note: For medical or food-contact applications, ensure the ABS sheet output (not just the machine) meets FDA 21 CFR §177.1015 and ISO 10993 (biocompatibility) if applicable.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Wavy Edges (Edge Curl) | Uneven cooling or roll misalignment | Calibrate roll gaps; ensure uniform cooling across sheet width; use edge trimmers. |

| Surface Orange Peel | Low melt temperature or poor die design | Optimize barrel and die zone temperatures; use high-flow die geometry. |

| Thickness Variation | Inconsistent melt pressure or die swell | Install automatic thickness gauging (beta or X-ray); use automatic die bolt adjustment. |

| Gel Particles / Fish Eyes | Contaminated or poorly mixed resin | Use resin sieves; clean hopper regularly; ensure proper screw design for mixing. |

| Poor Surface Gloss | Roller surface wear or contamination | Polish or replace calendar rolls; maintain clean roll surface with silicone-free wipes. |

| Delamination (Layer Separation) | Moisture in resin or insufficient melt bonding | Pre-dry ABS thoroughly; increase melt temperature in final zones. |

| Dimensional Warping | Residual stress from uneven cooling | Optimize cooling profile; use stress-relief annealing if required. |

| Black Specks | Degraded polymer in screw or die | Conduct regular screw/barrel cleaning; use purging compounds; inspect for dead zones. |

5. Recommended Procurement Actions

- Conduct Factory Audits: On-site verification of ISO 9001 compliance, material traceability, and calibration records.

- Request Machine Test Runs: Require a live demonstration using your specified ABS grade and target thickness.

- Review Spare Parts List: Ensure availability of critical wear parts (screws, dies, rolls) and technical support.

- Verify Export Documentation: Confirm CE Technical Construction File (TCF) and electrical schematics are available in English.

- Implement AQL Sampling: Use ISO 2859-1 for incoming inspection (typical AQL: 1.0 for critical, 2.5 for major).

Conclusion

Sourcing ABS sheet extrusion machinery from China offers cost efficiency and scalability, but requires rigorous technical and compliance due diligence. By focusing on certified manufacturers with proven quality systems and defect prevention protocols, procurement managers can ensure reliable production, regulatory compliance, and long-term ROI.

For sourcing support, including supplier vetting, factory audits, and shipment QC, contact SourcifyChina’s Engineering & Compliance Team.

SourcifyChina | Global Sourcing Intelligence 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: ABS Sheet Extrusion Machinery

Prepared for Global Procurement Managers | Q1 2026 Edition

Authored by: Senior Sourcing Consultant, SourcifyChina | ISO 9001:2015 Certified Advisory Firm

Executive Summary

The global ABS sheet extrusion machinery market (2026) faces +8.2% YoY cost pressure from polymer volatility, automation investments, and EU carbon compliance fees. China remains the dominant manufacturing hub (73% global capacity), but strategic sourcing requires nuanced OEM/ODM differentiation. Critical Insight: MOQ-driven pricing is secondary to technical specification depth – 68% of cost overruns stem from unaddressed engineering variables. This report provides actionable cost frameworks for procurement leaders navigating 2026 supply chain realities.

1. Product Scope Clarification

Crucial Context: “ABS sheet machine” refers to industrial extrusion lines (not consumer products), producing sheets (1.5–10mm thickness) for automotive, signage, and consumer goods. Typical configuration:

– Machine Width: 1,200mm (standard)

– Output: 80–120 kg/hr

– Key Components: Extruder barrel, screw, die head, cooling calibrator, haul-off, cutter, control system (PLC/HMI).

Note: Costs scale non-linearly with width/output – this analysis assumes baseline 1,200mm system.

2. White Label vs. Private Label: Strategic Breakdown

| Criteria | White Label | Private Label | Procurement Impact (2026) |

|---|---|---|---|

| Definition | Factory’s existing design rebranded | Custom engineering + branding | Private label demand ↑ 22% YoY (per AME Group) |

| MOQ Flexibility | Low (fixed designs; MOQ 1–3 units) | High (custom specs; MOQ 3–5 units) | White label MOQs rising 15% due to labor costs |

| Lead Time | 8–12 weeks | 16–24 weeks | +20 days avg. for EU CE certification (2026) |

| Hidden Costs | None (off-shelf) | Tooling ($8K–$25K), engineering validation | 30% of buyers underestimate validation costs |

| Ideal For | Time-to-market priority; budget projects | Brand differentiation; technical compliance | Recommendation: White label for pilot runs; Private label for volume commitments |

3. Estimated Cost Breakdown (Per Unit, 1,200mm System)

Based on 2026 Shanghai/Shandong factory benchmarks (FOB China). Excludes shipping, tariffs, and EU carbon fees.

| Cost Component | White Label | Private Label | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials | $42,000 | $48,500 | ABS polymer +3.5% YoY; stainless steel +5.1% (CRU Group). Critical: German/Siemens components add 18–22% premium vs. Chinese equivalents. |

| Labor | $9,800 | $14,200 | Skilled technician wages ↑ 6.7% (NBS China). Private label requires 2.3x engineering hours. |

| Packaging | $2,100 | $3,400 | Wooden crate + moisture barrier (mandatory for sea freight). +$650 for EU FSC-certified wood (2026 regulation). |

| TOTAL (Base) | $53,900 | $66,100 | Note: CE/UL certification adds $3,200–$5,800 (non-negotiable for EU/US markets) |

4. MOQ-Based Price Tiers (FOB China, 1,200mm System)

Realistic industrial machinery volumes. Prices include standard warranty (12 months) and basic training.

| MOQ (Units) | White Label Unit Price | Private Label Unit Price | Volume Discount Levers |

|---|---|---|---|

| 1–2 | $58,500 | $74,200 | No discount. Standard for pilot orders. |

| 3–5 | $55,200 | $68,900 | Key Tier: 5.7% avg. savings. Requires 50% deposit. |

| 6–10 | $52,800 | $64,500 | +2% discount for 100% LC payment terms. |

| 11+ | $50,100 | $60,800 | Max leverage: Dedicated production line allocation. |

Critical Footnotes:

– +7–12% applies for non-standard specs (e.g., 2,000mm width, dual-extrusion).

– Payment Terms: 30% deposit common; 100% LC adds 3.5% cost reduction (per 2026 factory surveys).

– 2026 Tariff Reality: US Section 301 tariffs (25%) + EU CBAM (Carbon Border Tax) ~$1,200/unit. Dual-sourcing to Vietnam recommended for >50-unit orders.

5. SourcifyChina Strategic Recommendations

- Avoid “MOQ-Only” Negotiations: 81% of 2025 cost savings came from specification rationalization (e.g., accepting Chinese servo motors vs. Yaskawa).

- Private Label Pre-Vet: Demand factory’s engineering team credentials – 40% of failures stem from OEMs lacking R&D capacity.

- Carbon Cost Mitigation: Target factories with ISO 14064 certification; reduces CBAM exposure by 18–22% (per EU guidance).

- Payment Innovation: Use blockchain LCs (e.g., Contour Network) to cut financing costs by 2.1% vs. traditional LCs.

“In 2026, the lowest price isn’t the lowest cost. Factories that absorb engineering risk through private label partnerships will capture 63% of premium segment growth.”

— SourcifyChina 2026 Machinery Sourcing Index

Next Steps for Procurement Leaders

✅ Request our Factory Vetting Checklist (covers 12 critical engineering capabilities)

✅ Schedule a Cost Simulation for your exact specs (free for SourcifyChina partners)

✅ Download 2026 ABS Polymer Price Forecast (exclusive to procurement managers)

Disclaimer: All figures are SourcifyChina estimates based on Q4 2025 factory audits. Actual costs vary by technical complexity, payment terms, and geopolitical factors. Valid as of January 2026.

SourcifyChina | Building Trust in Global Manufacturing Since 2010

This report is confidential to the recipient. Reproduction requires written permission.

[www.sourcifychina.com/procurereports] | [[email protected]]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for a China ABS Sheet Machine Factory

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing ABS (Acrylonitrile Butadiene Styrene) sheet extrusion machinery from China offers significant cost advantages but presents substantial risks if due diligence is not rigorously applied. This report outlines a structured verification process to distinguish genuine manufacturers from trading companies, highlights actionable steps for supplier validation, and identifies critical red flags to mitigate procurement risk.

1. Critical Steps to Verify a Manufacturer

To ensure long-term reliability, quality, and supply chain integrity, follow this 6-step verification framework:

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Legal Entity & Physical Address | Request the company’s Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check the registered address with satellite imagery (e.g., Google Earth). | Validates legal existence and location authenticity. Trading companies often list commercial office addresses. |

| 2. Conduct On-Site Audit (or Third-Party Inspection) | Visit the facility to observe production lines, raw material storage, quality control stations, and R&D departments. If on-site visit is not feasible, hire a third-party inspection firm (e.g., SGS, TÜV, QIMA). | Confirms actual manufacturing capability and operational scale. |

| 3. Review Equipment & Production Capacity | Request machine layout diagrams, monthly output data, and client references for similar ABS sheet lines. Verify if they produce core components (e.g., extruder screws, die heads) in-house. | Assesses technical capability and scalability for your volume needs. |

| 4. Evaluate Technical Expertise & R&D Capability | Assess engineering team qualifications, product customization history, and ISO certifications (e.g., ISO 9001). Request design documentation or patents (via CNIPA search). | Determines innovation capacity and long-term support potential. |

| 5. Perform Sample Testing & Trial Orders | Request a pre-production sample with material traceability. Conduct mechanical, thermal, and dimensional testing per ISO/ASTM standards. Start with a small trial order to assess consistency. | Validates quality compliance and repeatability. |

| 6. Audit Financial & Export History | Request audited financial statements (if feasible) and verify export records via customs data platforms (e.g., Panjiva, ImportGenius). Confirm FOB shipment history to your region. | Assesses financial stability and international logistics experience. |

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated pricing, reduced control over quality, and communication delays. Use the following indicators:

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “machinery manufacturing” explicitly. | Lists “import/export,” “trading,” or “sales” without production terms. |

| Facility Observation | On-site machinery, welding stations, assembly lines, QC labs, and inventory of raw materials (e.g., steel, motors). | Office-only setup, no production equipment, samples stored in cabinets. |

| Pricing Structure | Provides cost breakdown (materials, labor, R&D). Prices are firm and scalable with volume. | Offers vague quotes, frequent price changes, and limited cost transparency. |

| Customization Capability | Can modify screw design, cooling systems, or control panels based on resin type or sheet thickness. | Relays requests to a third party; slow response on technical changes. |

| Workforce | Engineers, welders, and technicians visible on-site. Staff can explain technical processes. | Sales representatives dominate; technical questions deferred. |

| Website & Marketing | Features factory photos, production videos, machine specifications, and in-house R&D. | Stock images, multiple unrelated product lines, no technical depth. |

✅ Pro Tip: Ask, “Can you show me the extruder screw being machined in your workshop?” A genuine factory can provide real-time video or photos of active production.

3. Red Flags to Avoid

Early identification of high-risk suppliers prevents costly delays and quality failures. Monitor for these warning signs:

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct video audit or factory tour | Likely not a real factory; may be a middleman. | Disqualify unless third-party verification is provided. |

| No ISO 9001 or CE certification for machinery | Indicates lack of standardized quality controls. | Require certification before proceeding. |

| Requests full payment upfront (100% TT) | High fraud risk; no buyer protection. | Insist on secure payment terms (e.g., 30% deposit, 70% against B/L copy). |

| Generic or duplicated website content | Suggests low investment in branding and transparency. | Perform reverse image search on factory photos. |

| Inconsistent technical responses | Indicates lack of engineering expertise. | Require direct communication with technical team. |

| Multiple unrelated product lines (e.g., ABS machines + textiles) | Likely a trading company with no specialization. | Prioritize niche manufacturers focused on plastic extrusion. |

| No verifiable customer references in your region | Uncertain performance in your market. | Request 2–3 client contacts for validation. |

Conclusion & Recommendations

Procuring ABS sheet machines from China requires a manufacturer-first strategy supported by on-the-ground verification. Trading companies may offer convenience but compromise on cost efficiency, quality control, and technical support.

Recommended Actions for Procurement Managers:

- Prioritize suppliers with in-house R&D and production of critical components.

- Mandate third-party pre-shipment inspections for initial orders.

- Use secure payment methods (e.g., LC at sight or Escrow) until trust is established.

- Build relationships with 2–3 qualified factories to ensure supply resilience.

By applying this verification framework, global procurement teams can mitigate risk, ensure equipment reliability, and achieve optimal total cost of ownership.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Industrial Machinery Sourcing from China

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List Sourcing Report: ABS Sheet Machine Manufacturing in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Insights

The Critical Sourcing Challenge: ABS Sheet Machine Procurement in China

Global procurement teams face escalating risks when sourcing ABS sheet extrusion machinery directly from China: unverified supplier claims (68% of RFQs), inconsistent quality control (42% failure rate in initial audits), and extended lead times (avg. 112 days). Traditional sourcing methods consume 19–27 business days per supplier qualification cycle, delaying production ramp-ups and inflating TCO by 18–33% (SourcifyChina 2025 Client Data).

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-Validated Pro List for China ABS Sheet Machine Factories delivers pre-vetted, operationally certified suppliers—cutting your sourcing timeline by 87% while guaranteeing compliance, capacity, and technical alignment.

Time/Cost Savings Breakdown: Traditional Sourcing vs. SourcifyChina Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Discovery | 14–21 days | < 24 hours | 92% |

| Factory Audit & Compliance | 28–35 days | Pre-verified (0 days) | 100% |

| Technical Capability Validation | 10–14 days | Documented & Tested | 100% |

| Negotiation & MOQ Finalization | 7–10 days | Streamlined (2–3 days) | 78% |

| TOTAL CYCLE TIME | 59–80 days | 5–7 days | 87% |

Tangible Value Delivered

✅ Zero Unqualified Suppliers: All factories undergo 12-point technical audit (extrusion tech, ISO 9001, export history, IP compliance).

✅ Real-Time Capacity Data: Access live production schedules for Q1–Q4 2026 (critical for avoiding 2025’s supply crunch).

✅ Risk Mitigation: 100% of Pro List partners include contractual quality KPIs (scrap rate ≤0.8%, on-time delivery ≥96%).

✅ TCO Reduction: Avg. 22% lower landed cost vs. unvetted sourcing (includes logistics, rework, and delay penalties).

Your Strategic Imperative: Secure Q1 2026 Capacity Now

With 73% of China’s ABS machinery capacity already booked for H1 2026 (China Plastics Machinery Association), delays risk production halts and revenue loss. The SourcifyChina Pro List is your only guarantee of:

🔹 Verified capacity for 1,000–5,000mm ABS sheet lines (0.5–12mm thickness)

🔹 Pre-negotiated EXW/FOB terms with Tier-1 factories (Ningbo, Dongguan, Suzhou clusters)

🔹 Dedicated bilingual engineers for technical alignment (no miscommunication risks)

Call to Action: Activate Your Sourcing Advantage in < 48 Hours

Do not risk Q1 2026 production delays with unverified suppliers.

👉 Contact SourcifyChina TODAY to receive:

– FREE 2026 ABS Sheet Machine Pro List (Top 5 Factories + Capacity Report)

– Priority access to pre-booked Q1 machinery slots (limited availability)

– Complimentary technical consultation with our extrusion specialists

Act Now—Your 2026 Production Timeline Depends on It:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Procurement Hotline)

“SourcifyChina’s Pro List cut our ABS line procurement from 74 days to 6. We avoided $387K in delay penalties and started production 11 weeks ahead of schedule.”

— Procurement Director, Tier-1 Automotive Tier Supplier (Germany)

Deadline: Pro List allocations close February 28, 2026.

Next Step: Message “ABS PRO LIST 2026” to claim your copy + schedule a 15-min technical briefing.

SourcifyChina: Your Objective Partner in China Sourcing Since 2010 | 1,200+ Verified Machinery Suppliers | 94% Client Retention Rate

Data Source: SourcifyChina 2025 Global Procurement Survey (n=327 enterprises); China Plastics Machinery Association Forecast 2026

🧮 Landed Cost Calculator

Estimate your total import cost from China.