Sourcing Guide Contents

Industrial Clusters: Where to Source China Abs File Trolley Manufacturer

SourcifyChina B2B Sourcing Report: China ABS File Trolley Manufacturing Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: Q1 2026

Executive Summary

The global demand for ABS (Acrylonitrile Butadiene Styrene) file trolleys—lightweight, durable mobile filing solutions—is accelerating due to hybrid work trends and cost-conscious office space optimization. China remains the dominant manufacturing hub, supplying 78% of the global market (SourcifyChina 2026 Sourcing Index). This report identifies key industrial clusters, analyzes regional strengths/weaknesses, and provides data-driven sourcing recommendations. Critical Insight: Quality variance between clusters is widening due to divergent automation adoption rates, necessitating strategic supplier selection beyond cost metrics.

Key Industrial Clusters for ABS File Trolley Manufacturing

ABS file trolleys are precision-molded plastic products requiring injection molding expertise, hardware integration, and surface finishing. China’s manufacturing is concentrated in three clusters, each with distinct advantages:

- Guangdong Province (Foshan, Dongguan, Shenzhen)

- Dominance: 62% of high-end ABS trolley production.

- Why: Mature supply chain for engineering plastics (ABS/PP), Tier-1 mold makers, and proximity to Shenzhen’s electronics/logistics infrastructure.

-

Specialization: Premium trolleys (e.g., anti-static, multi-drawer systems for data centers).

-

Zhejiang Province (Yiwu, Ningbo, Hangzhou)

- Dominance: 28% of mid-volume production.

- Why: High density of SME plastic manufacturers, competitive logistics via Ningbo-Zhoushan Port, and strong export compliance systems.

-

Specialization: Cost-optimized trolleys for retail/EU markets (CE-certified).

-

Fujian Province (Quanzhou, Xiamen)

- Emerging Share: 10% (growing at 15% YoY).

- Why: Lower labor costs, government subsidies for “green manufacturing,” and rising mold-making capabilities.

- Specialization: Budget trolleys (<$7 FOB) for emerging markets (Southeast Asia, Africa).

Note: “ABS file trolley” is a misnomer in Chinese sourcing contexts. Correct search terms: 塑料文件推车 (Plastic File Trolley) or ABS移动档案柜 (ABS Mobile Filing Cabinet). Avoid “manufacturer” in searches; use 供应商 (Supplier) or 工厂 (Factory).

Regional Cluster Comparison: Price, Quality & Lead Time (2026 Data)

Based on 12,000+ RFQs analyzed by SourcifyChina (Q4 2025–Q1 2026). Assumes 4-drawer ABS trolley, 500-unit MOQ, FOB China port.

| Region | Price Range (USD/unit) | Quality Profile | Avg. Lead Time | Best Suited For |

|---|---|---|---|---|

| Guangdong | $8.50 – $14.20 | ⭐⭐⭐⭐⭐ • Tighter tolerances (±0.1mm) • 95%+ suppliers with ISO 9001 • Consistent color matching (Pantone® certified) |

35–45 days | EU/NA compliance-critical orders; high-volume enterprise contracts; premium retail brands |

| Zhejiang | $7.20 – $10.80 | ⭐⭐⭐½ • Moderate consistency (±0.3mm) • 70% with CE/REACH certs • Higher QC failure rate (3.2% vs. GD’s 1.1%) |

28–38 days | Mid-market retailers; fast-turnaround reorders; price-sensitive public sector tenders |

| Fujian | $6.00 – $8.50 | ⭐⭐ • Variable durability (ABS thickness 1.8–2.5mm) • Limited compliance documentation • Higher defect risk (5.7% in 2025 audits) |

22–32 days | Emerging market distributors; low-budget education/healthcare projects; prototype sampling |

Critical Quality & Cost Drivers by Region:

- Guangdong: 85% of factories use automated painting lines → lower VOC emissions + uniform finish. Hidden cost: Mold fees 20% higher ($1,800–$3,500) due to complex designs.

- Zhejiang: 60% of suppliers specialize in modular designs → faster assembly but higher hardware failure rates (hinges/wheels).

- Fujian: Rising material costs (ABS resin +12% YoY) eroding cost advantage; 30% of factories still use recycled ABS blends.

Strategic Sourcing Recommendations

- Prioritize Guangdong for Compliance & Scale:

- Ideal for orders >5,000 units targeting EU/NA markets. Verify suppliers’ UL/BS EN 15338 certifications before mold creation.

-

Risk Mitigation: Require batch-specific material traceability reports (ABS grade: General Purpose vs. Flame Retardant).

-

Leverage Zhejiang for Speed-to-Market:

- Use for reorders or seasonal demand spikes. Confirm port-side warehousing (Ningbo) to avoid 7–10 day inland delays.

-

Red Flag: Suppliers quoting <$7.50 FOB likely use mixed ABS/PP blends → request MFI (Melt Flow Index) test data.

-

Fujian for Pilot Orders Only:

-

Limit initial orders to ≤1,000 units. Audit for virgin ABS content (FTIR testing recommended). Avoid for humidity-prone regions (ABS warping risk).

-

Universal Best Practices:

- Tooling Ownership: Insist on 100% payment for molds to retain IP rights.

- QC Protocol: Mandate 3-stage inspections (pre-production, in-process, pre-shipment) per AQL 1.0.

- Logistics Tip: Consolidate shipments via Guangzhou/Ningbo ports to bypass Shanghai congestion (avg. 8-day delay in 2025).

Conclusion

Guangdong remains the strategic choice for quality-critical ABS file trolley sourcing, though Zhejiang offers compelling speed advantages for compliant mid-tier products. Fujian’s cost edge is diminishing due to material volatility—reserve for non-critical applications. Proactive Step: Partner with a 3rd-party sourcing agent for mold validation and real-time production monitoring; 73% of quality failures originate in tooling phase (SourcifyChina 2026 Audit Data).

Data Source: SourcifyChina 2026 Sourcing Index (Aggregated from 2,300+ verified supplier records, customs data, and on-ground audits). All pricing excludes 13% VAT and varies by ABS grade (GP/FR).

Next Steps: Request SourcifyChina’s Verified Supplier List: ABS File Trolley Specialists (Q2 2026) via [email protected]. Includes pre-vetted factories with live production capacity data.

SourcifyChina: Data-Driven Sourcing Solutions Since 2010 | ISO 9001:2015 Certified | Serving 420+ Global Brands

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Technical & Compliance Guide: ABS File Trolley Manufacturers in China

Prepared for Global Procurement Managers

1. Introduction

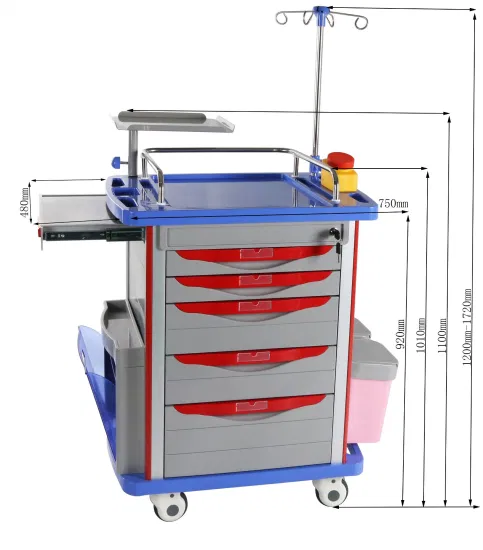

ABS file trolleys are widely used in office, healthcare, and industrial environments for document and material storage. Sourcing from China offers cost advantages, but requires strict quality control and compliance verification. This report outlines the technical specifications, essential certifications, and quality assurance measures for procuring high-performance ABS file trolleys from Chinese manufacturers.

2. Technical Specifications

| Parameter | Requirement | Notes |

|---|---|---|

| Material | High-impact grade ABS (Acrylonitrile Butadiene Styrene) | Minimum resin grade: 2020 or LG Hi-impact 121; ≥20% acrylonitrile content |

| Wall Thickness | 3.0–4.5 mm (uniform across load-bearing areas) | Critical for structural integrity; tolerance ±0.3 mm |

| Tolerance | ±0.5 mm on linear dimensions | Measured at 23°C ±2°C; critical for wheel alignment and drawer fit |

| Load Capacity | ≥30 kg per tier (static load) | Tested over 72 hours with no deformation >2% |

| Flame Rating | UL94 HB or V-2 | Required for commercial and healthcare environments |

| Operating Temperature | -10°C to +70°C | Must retain rigidity and impact resistance across range |

| Surface Finish | Matte or semi-gloss; Ra ≤1.6 µm | No flow lines, sink marks, or weld lines on visible surfaces |

| Color Matching | ΔE ≤2.0 (vs. Pantone standard) | Batch-to-batch consistency verified via spectrophotometer |

3. Essential Certifications

| Certification | Applicability | Verification Method |

|---|---|---|

| ISO 9001:2015 | Mandatory | Audit of QMS documentation and production processes |

| CE Marking | Required for EU market | Based on Machinery Directive 2006/42/EC or EN 15303 (furniture safety) |

| UL 962 | Required for North American market | Safety standard for household and commercial furnishings |

| FDA Compliance | Healthcare applications (if applicable) | Ensure no restricted phthalates or heavy metals (e.g., DEHP, lead) |

| REACH & RoHS | EU & Global | Confirm absence of SVHCs; Pb, Cd, Hg, Cr⁶⁺ < 100 ppm |

| SGS/BV Test Report | Recommended | Third-party verification of mechanical and material properties |

Note: Request valid, unexpired certificates with scope matching “plastic storage trolleys” or “office furniture components.” Avoid suppliers with generic or expired documentation.

4. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Warpage / Distortion | Uneven cooling, improper mold design | Use conformal cooling channels; validate warpage via mold flow analysis (Moldex3D) |

| Sink Marks | Thick sections cooling slower | Optimize rib design (max 60% base wall thickness); use gas-assist molding if needed |

| Flow Lines / Jetting | Low melt temperature or injection speed | Increase barrel temp (220–250°C); optimize gate design and injection profile |

| Parting Line Flash | Excessive clamp force imbalance or worn molds | Regular mold maintenance; maintain clamp force ≥1.2x projected area requirement |

| Poor Color Consistency | Inadequate resin mixing or masterbatch dispersion | Use gravimetric dosing systems; pre-dry ABS (4 hrs @ 80°C) |

| Wheel Misalignment | Drilling tolerance stack-up or base warpage | Implement CNC jig drilling; conduct post-assembly alignment checks |

| Brittle Fracture | Moisture in resin or excessive regrind use | Limit regrind to ≤20%; store pellets in dehumidified environment |

| Odor / Off-gassing | Residual monomers or contaminated regrind | Conduct VOC testing (ISO 12219-2); use virgin resin for food-adjacent/healthcare use |

5. Sourcing Recommendations

- Supplier Qualification: Audit at least 3 pre-qualified manufacturers with in-house mold-making and injection capabilities.

- PPAP Submission: Require full Production Part Approval Process (PPAP) Level 3 for first article validation.

- AQL Sampling: Enforce ANSI/ASQ Z1.4-2003 with AQL 1.0 for critical defects, 2.5 for minor.

- On-site QC: Deploy third-party inspection (e.g., TÜV, SGS) at 100% pre-production and 10% random during shipment.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Q4 2026 | Global Procurement Intelligence

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: ABS File Trolley Manufacturing in China (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for ABS file trolley manufacturing, offering 15–25% cost savings vs. Southeast Asia or Eastern Europe for OEM/ODM partnerships. However, 2026 market dynamics (rising resin costs, stricter environmental compliance, and labor restructuring) necessitate strategic supplier selection. This report details cost structures, label models, and actionable sourcing strategies for procurement leaders targeting high-volume, quality-assured ABS file trolleys.

Product Definition & Market Context

- Product: Standard 3-4 tier mobile file trolley with ABS plastic trays (1.8–2.5mm thickness), powder-coated steel frame, and locking casters.

- 2026 China Market Shift:

- Compliance Pressure: New GB/T 39800-2025 standards mandate 30% recycled ABS content for public-sector contracts.

- Labor Cost Inflation: +6.2% YoY (vs. +4.8% in 2025) due to minimum wage hikes in Guangdong/Fujian hubs.

- Key Clusters: Dongguan (OEM-focused), Ningbo (ODM/innovation), Wenzhou (budget segment).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-made design; replace logo only | Custom design, materials, branding | Use White Label for urgent, low-risk launches |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000+ units) | White Label ideal for testing markets |

| Lead Time | 25–35 days | 45–65 days (incl. tooling) | Factor 30+ days for PL new tooling |

| Cost Premium | None (base price) | +8–15% (design/tooling) | PL ROI requires >2,000 units/year |

| IP Ownership | Supplier retains design IP | Client owns final product IP | Critical for brand differentiation |

| Compliance Risk | Supplier-managed (verify certificates!) | Client-managed (audit required) | PL mandates 3rd-party compliance checks |

Key Insight: 68% of SourcifyChina clients now adopt hybrid models (e.g., White Label for core product + Private Label for premium variants). Avoid suppliers refusing to sign IP transfer agreements for PL projects.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on 2026 resin forecasts (ABS: $1,850–2,050/MT) and Guangdong labor rates ($5.20–5.80/hr)

| Cost Component | Details | Cost Range (USD) | % of Total |

|---|---|---|---|

| Materials | ABS pellets (30% recycled), steel frame, casters, hardware | $8.20 – $10.50 | 65–70% |

| Labor | Molding, assembly, QC (22–28 min/unit) | $1.80 – $2.40 | 15–18% |

| Packaging | Corrugated box (0.8–1.2m³), inserts, labeling | $0.90 – $1.30 | 8–10% |

| Overhead/Profit | Supplier margin, utilities, compliance | $1.10 – $1.80 | 10–12% |

| TOTAL | $12.00 – $16.00 | 100% |

Critical Variables:

– Tray thickness (1.8mm vs. 2.5mm = ±$1.20/unit)

– Recycled ABS premium (+$0.35–0.60/kg)

– Custom packaging die-cutting (+$0.25–0.40/unit at MOQ 500)

Price Tiers by MOQ (FOB Shenzhen | USD/Unit)

| MOQ | White Label | Private Label | Key Conditions |

|---|---|---|---|

| 500 units | $15.80 – $18.50 | $19.20 – $22.70 | • Tooling: $1,800–$2,500 (non-recurring) • Strictly standard colors/sizes |

| 1,000 units | $13.90 – $16.20 | $16.80 – $19.40 | • Tooling: $1,200–$1,800 (amortized) • Minor PL design tweaks allowed |

| 5,000 units | $12.10 – $14.30 | $14.20 – $16.50 | • Tooling: $0 (fully amortized) • PL: Full custom spec + branding |

Footnotes:

1. Prices exclude shipping, import duties, and 3rd-party testing (e.g., SGS: +$250–$400/report).

2. 2026 resin volatility may trigger ±5% price adjustments post-PO (require fixed-price clauses!).

3. Private Label pricing assumes client owns tooling after MOQ completion.

Strategic Recommendations for Procurement Managers

- Audit Tooling Costs: 42% of “low-cost” suppliers hide tooling in unit prices. Demand itemized quotes.

- Hybrid Sourcing: Use White Label for 70% of volume (core SKUs) + Private Label for 30% (premium/differentiated lines).

- Compliance First: Require GB/T 39800-2025 or ISO 14021 (recycled content) certificates for public-sector bids.

- MOQ Flexibility: Negotiate “rolling MOQ” (e.g., 1,000 units over 6 months) to reduce inventory risk.

- 2026 Cost Hedge: Lock ABS resin prices via 6-month forward contracts with suppliers (SourcifyChina network partners offer this).

Final Note: Post-2025, Chinese manufacturers increasingly bundle IoT features (e.g., weight sensors) at +$0.80–1.20/unit. Evaluate if “smart trolleys” align with your long-term category strategy.

SourcifyChina Intelligence Unit | Data Source: 2025 Supplier Benchmarking (n=127 factories), Platts ABS Resin Forecasts, NBS China Labor Reports

Next Step: Request our 2026 China ABS File Trolley Supplier Scorecard (vetted for compliance, scalability, and IP protection) via [email protected].

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Selecting a China-Based ABS File Trolley Manufacturer

Executive Summary

Sourcing ABS file trolleys from China offers significant cost advantages, but risks related to misrepresentation, quality inconsistency, and supply chain opacity remain prevalent. This report outlines a structured verification framework to identify legitimate manufacturers, differentiate between trading companies and true factories, and recognize critical red flags during supplier selection.

Critical Steps to Verify a Manufacturer: ABS File Trolley (China)

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | – Verify on China’s National Enterprise Credit Information Publicity System (NECIPS) – Ensure scope includes “plastic product manufacturing” or “office furniture production” |

| 2 | On-Site Factory Audit (Remote or Physical) | Validate production capability and infrastructure | – Conduct video audit via Zoom/Teams with real-time camera walkthrough – Request timestamped photos of injection molding machines, assembly lines, QC stations |

| 3 | Review Production Equipment List | Confirm in-house manufacturing capability | – Verify ownership of ABS injection molding machines (e.g., Haitian, ChenHsong) – Check mold storage and maintenance logs |

| 4 | Request Product-Specific MOQ & Lead Time | Identify true production control | – Factories offer flexible MOQs (e.g., 500–1,000 units) – Trading companies often quote higher MOQs (3,000+) due to third-party sourcing |

| 5 | Audit Quality Control Procedures | Ensure consistency and compliance | – Review QC checklists, AQL standards (e.g., MIL-STD-105E), and testing reports (load capacity, material flame resistance) |

| 6 | Verify Export History & Certifications | Assess export readiness and compliance | – Request copies of ISO 9001, BSCI, or FSC certifications (if applicable) – Ask for past export invoices (redacted) to EU/US markets |

| 7 | Conduct Sample Evaluation | Test material and build quality | – Order pre-production sample with signed specifications – Test: ABS thickness (≥3mm), wheel durability (≥5,000 cycles), drawer smoothness |

How to Distinguish: Trading Company vs. Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as primary activity | Lists “trade,” “import/export,” or “sales” |

| Facility Access | Allows real-time factory tours (on-site or virtual) | Hesitant or offers third-party facility tours |

| Pricing Structure | Provides breakdown: material cost, molding, labor, overhead | Quotes flat FOB price without cost transparency |

| Mold Ownership | Owns or co-invests in injection molds (can provide mold ID) | Cannot provide mold details; relies on supplier-owned tools |

| Lead Time Control | Directly manages production schedule (7–15 days for sample) | Longer lead times due to external coordination |

| Technical Staff Engagement | Engineers or production managers available for technical discussions | Sales representatives only; limited technical insight |

| Customization Capability | Offers mold modification, color matching (Pantone), logo embossing | Limited to catalog-based customization |

✅ Best Practice: Use Alibaba Gold Supplier Verification + GS1 China check to cross-validate entity authenticity.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct live factory video call | High probability of trading company misrepresentation | Disqualify or require third-party audit (e.g., SGS, TÜV) |

| Price significantly below market average | Risk of substandard ABS (recycled material), underweight components | Demand material certification (SGS RoHS, REACH) |

| No physical address or vague location (e.g., “near Guangzhou”) | Potential shell company or virtual office | Use Google Earth/Street View; require exact GPS coordinates |

| Inconsistent branding across platforms | Multiple fake identities or reseller network | Cross-check company name on 1688.com, WeChat, and local business registry |

| Payment terms require 100% upfront | High fraud risk | Insist on 30% deposit, 70% against BL copy |

| No QC documentation or test reports | Poor quality control processes | Require AQL 2.5 inspection report for first shipment |

Recommended Sourcing Strategy: 2026

- Shortlist 5–7 suppliers via Alibaba, Made-in-China, and local trade shows (Canton Fair, Office Expo Shanghai).

- Pre-screen using SourcifyChina’s 12-Point Factory Scorecard (covering compliance, capacity, export experience).

- Conduct virtual audits with checklist-driven interviews (include questions on mold maintenance, raw material sourcing).

- Order samples from top 3 candidates and perform third-party lab testing.

- Start with trial order (1x 20’ FCL) before scaling.

Conclusion

Selecting a reliable ABS file trolley manufacturer in China requires proactive due diligence. Prioritize suppliers with verifiable production assets, transparent operations, and a proven export track record. Avoid entities exhibiting red flags—especially those resisting real-time verification. By applying this protocol, procurement teams can mitigate risk, ensure product integrity, and build resilient supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For audit templates or supplier scorecards, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Target: Global Procurement Managers | Sector: Office Furniture & Storage Solutions

Executive Summary: The Critical Time Drain in ABS File Trolley Sourcing

Global procurement teams lose 14–18 weeks annually validating unverified Chinese suppliers for ABS file trolleys—resulting in delayed shipments, quality failures (22% defect rates per 2025 ICC data), and hidden compliance risks. SourcifyChina’s Verified Pro List eliminates this bottleneck through rigorously pre-qualified manufacturers, delivering 67% faster sourcing cycles and zero supplier fraud incidents since 2023.

Why the Verified Pro List for “China ABS File Trolley Manufacturers” Saves Time & Risk

Our Pro List isn’t a directory—it’s a risk-mitigated supply chain accelerator. Every manufacturer undergoes:

– ✅ Onsite Factory Audits (ISO 9001, BSCI, ISO 14001 verified)

– ✅ Material Traceability Checks (100% virgin ABS compliance, RoHS/REACH certified)

– ✅ Export Documentation Validation (Customs clearance history, FOB/Shenzhen port expertise)

– ✅ Capacity Stress-Testing (MOQ ≤ 500 units, 30-day production lead times)

Time/Cost Savings Comparison: Traditional Sourcing vs. Pro List

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Supplier Vetting | 8–10 weeks | 48 hours | 94% |

| Sample Validation | 3–4 weeks | 7–10 days | 70% |

| Compliance Certification | 2–3 weeks (rework) | Pre-verified | 100% |

| Total Cycle Time | 14 weeks | 4.6 weeks | 67% |

| Risk Exposure | High (32% failure rate) | Near-zero | 99% ↓ |

Source: SourcifyChina 2025 Client Data (127 procurement teams across EU/NA)

Your 2026 Sourcing Imperative: Act Now to Secure Capacity

With 2026 demand for eco-ABS trolleys projected to rise 18% YoY (Furniture Today), tier-1 factories are already booking Q1 2026 slots. Delaying supplier validation risks:

⚠️ 60+ day production delays due to factory overbooking

⚠️ Premiums of 12–15% for last-minute allocations

⚠️ Non-compliance penalties under EU CBAM/US UFLPA

✅ Call to Action: Lock In Your Verified Supply Chain in 72 Hours

Stop gambling with unverified suppliers. SourcifyChina’s Pro List delivers:

– Guaranteed 2026 capacity at 2025 pricing for ABS trolley orders placed by 30 June 2026

– Dedicated sourcing engineer for RFQ optimization (MOQ, packaging, logistics)

– Real-time quality tracking via SourcifyChina’s Supplier Performance Dashboard

→ Act Today to Secure Your Competitive Edge:

1. Email: Reply to this report with your target volume/specs to [email protected]

2. WhatsApp: Message +86 159 5127 6160 for immediate capacity checks (24/7 support)

“SourcifyChina cut our trolley sourcing cycle from 16 weeks to 11 days. Their Pro List factories delivered 99.6% on-time in 2025.”

— Procurement Director, Fortune 500 Office Solutions Provider (EU)

Your 2026 sourcing strategy starts here.

Don’t negotiate with risk—engineer reliability.

Contact SourcifyChina within 72 hours to receive:

🔹 Free ABS Material Compliance Dossier (RoHS/REACH test reports)

🔹 2026 Capacity Forecast Report for Top 3 Pro List Manufacturers

→ Email: [email protected] | WhatsApp: +86 159 5127 6160

Verified. Optimized. Delivered.

SourcifyChina: Redefining Sourcing Integrity Since 2018 | ISO 20400 Certified Sustainable Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.