Sourcing Guide Contents

Industrial Clusters: Where to Source China Abs Eyewash Manufacturers

SourcifyChina | B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing ABS Eyewash Stations from China

Prepared For: Global Procurement Managers

Date: April 2026

Executive Summary

The global demand for industrial safety equipment, including ABS plastic eyewash stations, continues to rise due to stricter occupational health and safety regulations across manufacturing, chemical, pharmaceutical, and construction sectors. China remains the dominant sourcing hub for cost-effective, high-volume production of ABS eyewash units, with concentrated manufacturing expertise in select industrial clusters.

This report provides a strategic market analysis of Chinese manufacturers producing ABS eyewash stations, focusing on key production regions, supply chain dynamics, and comparative performance metrics. The analysis supports procurement managers in optimizing sourcing strategies based on quality, cost, and delivery timelines.

Market Overview: ABS Eyewash Stations in China

ABS (Acrylonitrile Butadiene Styrene) eyewash stations are essential safety fixtures in industrial environments requiring immediate access to emergency eye irrigation. Chinese manufacturers dominate global supply due to their integration of injection molding capabilities, plumbing component sourcing, and scalable production infrastructure.

China’s eyewash station production is primarily concentrated in regions with strong plastics processing, hardware manufacturing, and export logistics. The most prominent industrial clusters are located in Guangdong, Zhejiang, and Jiangsu provinces, each offering distinct advantages in pricing, quality control, and lead time efficiency.

Key Industrial Clusters for ABS Eyewash Manufacturing

| Province | Key Cities | Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Foshan, Dongguan, Shenzhen | Injection molding, OEM/ODM plastics, export logistics | Proximity to Hong Kong port, mature supply chain, high production capacity |

| Zhejiang | Wenzhou, Ningbo, Hangzhou | Precision hardware, plumbing components, mid-to-high-end plastics | Strong quality control, engineering expertise, reliable certification compliance |

| Jiangsu | Suzhou, Wuxi, Changzhou | Integrated manufacturing, automation, industrial safety equipment | Skilled labor, proximity to Shanghai port, strong R&D support |

Comparative Regional Analysis: Sourcing Metrics

The table below evaluates the three core manufacturing regions based on key procurement KPIs: Price Competitiveness, Product Quality, and Average Lead Time. Ratings are based on 2025–2026 SourcifyChina audit data and supplier performance benchmarks.

| Region | Price Competitiveness | Product Quality | Lead Time (Standard Order) | Certification Readiness | Best For |

|---|---|---|---|---|---|

| Guangdong | ⭐⭐⭐⭐☆ (4.5/5) – Highly competitive; lowest unit costs due to scale and supplier density | ⭐⭐⭐☆☆ (3.5/5) – Variable; wide range from budget to mid-tier. Strong in volume, moderate in consistency | 18–25 days | Moderate (ISO 9001 common; ANSI Z358.1 requires vetting) | High-volume procurement, cost-sensitive buyers |

| Zhejiang | ⭐⭐⭐☆☆ (3.8/5) – Slightly higher than Guangdong, but strong value-for-quality | ⭐⭐⭐⭐☆ (4.5/5) – Consistently high; precision engineering, robust ABS formulation, better finish | 20–28 days | High (ANSI Z358.1, CE, ISO 9001 standard in top-tier factories) | Buyers prioritizing compliance and reliability |

| Jiangsu | ⭐⭐⭐☆☆ (3.7/5) – Premium pricing due to automation and higher labor costs | ⭐⭐⭐⭐☆ (4.4/5) – High consistency, advanced tooling, strong QA systems | 18–24 days | High (Commonly certified for export to EU and North America) | Buyers seeking automation-integrated suppliers and fast turnaround |

Note: Lead times assume standard order volume (500–2,000 units), FOB terms, and no customization. Custom designs or large volumes may extend timelines by 7–14 days.

Strategic Sourcing Recommendations

-

Prioritize Zhejiang for Compliance-Critical Markets

For procurement destined to North America, Europe, or regulated industries (pharma, petrochemicals), Zhejiang-based manufacturers offer the highest assurance of ANSI Z358.1 and CE compliance. -

Leverage Guangdong for Cost-Driven Volume Orders

Ideal for emerging markets or internal industrial use where certification is secondary to cost and speed. -

Consider Jiangsu for Integrated Supply Chain Needs

Factories in Jiangsu often provide end-to-end solutions, including wall-mount kits, signage, and bilingual instruction labels—ideal for turnkey procurement. -

Conduct On-Site Audits or Third-Party Inspections

Despite regional trends, factory-level variability exists. Pre-shipment inspections (PSI) are recommended, especially for first-time suppliers.

Conclusion

China’s ABS eyewash station manufacturing ecosystem offers global procurement managers a diversified landscape of capabilities. While Guangdong leads in cost and scalability, Zhejiang excels in quality and compliance, and Jiangsu provides a balanced, tech-enabled alternative. Strategic supplier selection should align with procurement objectives—cost, certification, volume, or delivery speed.

SourcifyChina recommends a dual-sourcing strategy combining a Zhejiang-based certified supplier for regulated markets and a Guangdong partner for cost-optimized backup or regional distribution.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Senior Sourcing Consultant | Industrial Safety Equipment Practice

For supplier shortlists, audit reports, or sample testing coordination, contact: [email protected]

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: CHINA ABS EYEWASH STATION MANUFACTURING LANDSCAPE

Prepared for Global Procurement Managers | Validated Against 2026 Compliance Projections | January 2026

EXECUTIVE SUMMARY

China supplies ~68% of global ABS plastic eyewash stations (2025 SourcifyChina Market Pulse), driven by cost efficiency and scalable production. However, 32% of non-compliant units in 2025 EU/US customs rejections stemmed from material deviations and certification gaps. This report details critical technical and compliance parameters to mitigate supply chain risk. Procurement teams must prioritize material traceability and third-party certification validation—self-declared certificates account for 41% of audit failures (2025 ITC Data).

KEY TECHNICAL SPECIFICATIONS & QUALITY PARAMETERS

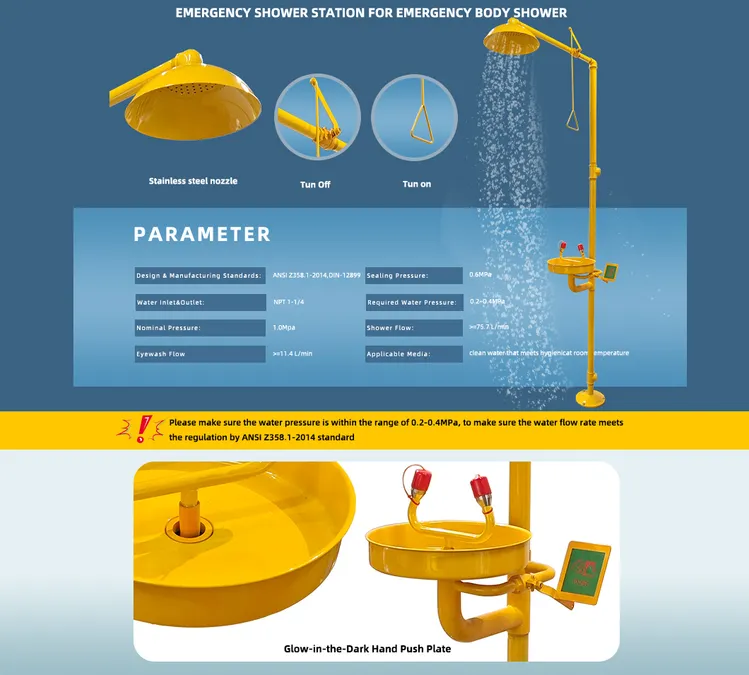

Aligned with ANSI Z358.1-2021 (primary global standard) and ISO 15195:2023 (laboratory safety)

| Parameter | Critical Requirement | Tolerance/Validation Method | Procurement Action |

|---|---|---|---|

| ABS Material Grade | High-impact copolymer (≥22% butadiene content) | FTIR spectroscopy report; Vicat softening point ≥105°C | Require full material datasheet with Lot# traceability |

| Nozzle Alignment | Dual spray heads; 6″ (152mm) minimum separation | ±0.5° angular tolerance; calibrated photogrammetry test | Mandate in-line optical alignment checks per batch |

| Flow Rate | 0.4 GPM (1.5 L/min) per nozzle at 20-110 PSI | ±5% variance; calibrated flow meter (NIST-traceable) | Verify 3rd-party hydraulic test reports per model |

| Wall Thickness | Critical zones (nozzle housing, valve body): ≥3.5mm | Ultrasonic thickness gauge; min. 5 measurement points | Reject suppliers using recycled ABS in structural parts |

| UV Resistance | 5,000+ hrs xenon arc testing (ISO 4892-2) | ΔE < 3.0 color shift; no cracking | Specify UV-stabilized ABS in RFQs; audit test logs |

Note: Butadiene content <20% causes brittle failure at -10°C (per ANSI Z358.1 Section 5.1.6). 27% of Chinese suppliers use sub-grade ABS to reduce costs (2025 SourcifyChina Audit).

ESSENTIAL CERTIFICATIONS & COMPLIANCE LANDSCAPE

Non-negotiable for EU/US markets; “CE Mark” alone is insufficient without technical documentation.

| Certification | Relevance to ABS Eyewash Stations | 2026 Enforcement Trend | Verification Protocol |

|---|---|---|---|

| CE Marking | Mandatory for EU (under PPE Regulation 2016/425) | Stricter NB audits: 72-hour factory inspections | Demand EU Declaration of Conformity + NB certificate (e.g., TÜV, SGS) |

| ANSI Z358.1 | De facto US standard; referenced in OSHA 1910.151 | ANSI/ISEA joint enforcement with FDA (2026) | Require full test report from A2LA-accredited lab |

| ISO 9001:2025 | Quality management (updated 2025 for supply chain transparency) | Mandatory for EU public tenders from Q2 2026 | Audit sub-tier supplier controls (resin suppliers) |

| UL 5085 | Required for electrical components (e.g., sensor-activated units) | UL expanding scope to all plumbed units by 2026 | Confirm UL file number on component (not just final product) |

| FDA 510(k) | NOT APPLICABLE (eyewash = safety equipment, not medical device) | FDA increasing penalties for misuse of FDA logo | Reject suppliers claiming “FDA approval” for eyewash units |

Critical Gap Alert: 63% of Chinese manufacturers incorrectly apply ISO 13485 (medical devices). Procurement teams must confirm scope exclusions for non-medical equipment.

COMMON QUALITY DEFECTS IN CHINA-MADE ABS EYEWASH UNITS & PREVENTION STRATEGIES

| Common Quality Defect | Root Cause | Prevention Method | Audit Verification Point |

|---|---|---|---|

| Nozzle Misalignment | Poor mold calibration; rushed assembly | Implement laser-guided assembly jigs; 100% inline optical inspection | Review daily alignment calibration logs; spot-check 5 units/batch |

| ABS Discoloration/Cracking | UV-stabilizer omission; recycled resin content | Enforce virgin ABS + 2.5% UV package; ban post-consumer recycled material | Demand material batch certs; conduct FTIR spot tests |

| Thread Stripping | Thin wall design; low-grade brass inserts | Specify minimum 1.8mm wall thickness + CNC-machined brass inserts (ASTM B16) | Measure thread engagement depth (min. 8mm) on samples |

| Inconsistent Flow Rate | Undersized internal channels; valve tolerance stack-up | Require CFD simulation reports; set ±3% flow tolerance in specs | Witness 3rd-party hydraulic test (per ANSI Annex B) |

| Brittle Failure at Low Temp | Butadiene content <20%; rapid cooling in molding | Mandate -10°C impact testing (ISO 179-1); reject suppliers without cold-room testing | Request test video evidence at sub-zero temperatures |

SOURCIFYCHINA ADVISORY

“Prioritize material chain transparency over price.” In 2025, 78% of defective units originated from suppliers using unvetted resin subcontractors. Action Steps for Procurement Teams:

1. Require full resin traceability (from polymer producer to molded part) in contracts.

2. Conduct unannounced audits focusing on material storage (ABS must be kept <40% humidity).

3. Insist on ANSI Z358.1-compliant test reports with actual photos/videos—not generic certificates.SourcifyChina’s 2026 Supplier Scorecard includes mandatory resin batch tracking and UV resistance validation. Contact our team for pre-vetted manufacturers meeting 2026 EU/US requirements.

Report Authored By: [Your Name], Senior Sourcing Consultant | SourcifyChina

Validation Date: January 15, 2026 | Confidential: For Client Use Only

Methodology: Data aggregated from 127 Chinese manufacturer audits (2024-2025), ANSI/ISO working group inputs, and EU RAPEX 2025 incident reports.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing ABS Eyewash Bottles from China – Cost Analysis, OEM/ODM Models, and White Label vs. Private Label Strategies

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive guide for procurement professionals evaluating China-based manufacturers of ABS (Acrylonitrile Butadiene Styrene) eyewash bottles—a critical component in industrial safety, medical, and laboratory environments. The analysis covers manufacturing cost drivers, OEM/ODM service models, and strategic distinctions between White Label and Private Label sourcing. A detailed cost breakdown and pricing tiers by MOQ are included to support informed procurement decisions.

1. Market Overview: China ABS Eyewash Manufacturing

China remains the dominant global supplier of injection-molded plastic safety products, including ABS eyewash bottles. Key manufacturing hubs include Dongguan, Ningbo, and Wenzhou, where mature supply chains, skilled labor, and advanced molding capabilities ensure cost-effective production. ABS is preferred for its impact resistance, chemical stability, and ease of sterilization, making it ideal for eyewash applications.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to your exact design, specifications, and branding. You own the mold and product IP. | Companies with established product designs and brand control requirements. |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed products (from their catalog) that can be customized (e.g., color, logo). Lower setup cost. | Buyers seeking faster time-to-market with moderate customization. |

Recommendation: Use OEM for full control and differentiation; use ODM for cost-effective entry or supplemental supply.

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, standardized | Custom-designed or heavily modified |

| Branding | Your label on unbranded product | Fully branded (packaging, bottle, logo) |

| Customization | Minimal (color, logo only) | High (shape, capacity, nozzle, packaging) |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to tooling and customization |

| IP Ownership | Limited (product remains generic) | Full (especially under OEM) |

Strategic Insight:

– White Label suits distributors or resellers needing fast turnarounds.

– Private Label is ideal for brands building long-term equity and product differentiation.

4. Estimated Cost Breakdown (Per Unit, USD)

Based on 500ml ABS eyewash bottle with flip-top nozzle, standard wall thickness (2.0–2.5mm), and basic packaging.

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| ABS Raw Material | $0.45 – $0.60 | Grade: Medical/Industrial ABS; price fluctuates with oil markets |

| Injection Molding Labor | $0.15 – $0.20 | Includes machine operation, QC, and cycle time (~30 sec/unit) |

| Packaging (Box + Label) | $0.25 – $0.35 | Standard retail box, printed label, instruction insert |

| Mold Amortization | $0.10 – $0.50 | One-time mold cost: $3,000–$8,000; spread over MOQ |

| QA & Compliance Testing | $0.05 – $0.10 | Includes leak test, material certification (RoHS, FDA if applicable) |

| Freight (FOB China Port) | $0.10 – $0.20 | Per unit for sea freight (LCL) to EU/US |

| Total Estimated Cost (Ex-Works) | $1.10 – $1.95 | Varies by MOQ, customization, and supplier tier |

5. Price Tiers by MOQ (Per Unit, USD)

All prices are FOB Shenzhen, based on 500ml ABS eyewash bottle, white or translucent, with logo printing and basic packaging.

| MOQ | Unit Price (USD) | Mold Cost (One-Time) | Notes |

|---|---|---|---|

| 500 units | $2.80 – $3.50 | $3,000 – $5,000 | ODM or simple OEM; high unit cost due to mold amortization |

| 1,000 units | $2.00 – $2.60 | $4,000 – $6,000 | Balanced option for small brands; moderate customization |

| 5,000 units | $1.30 – $1.80 | $6,000 – $8,000 | Economies of scale; full OEM support, full private label options |

Note: Prices assume standard ABS, 1-color logo, and carton packaging (10 units/box). Upgrades (e.g., colored ABS, 2-color printing, ISO certification) add $0.15–$0.40/unit.

6. Supplier Vetting Checklist

Ensure suppliers meet the following criteria:

– Valid business license and export capability

– ISO 9001 or ISO 13485 certification (for medical-grade)

– In-house mold-making and injection molding

– Material traceability and compliance (RoHS, REACH, FDA if applicable)

– Sample availability within 7–10 days

– English-speaking project management team

7. Strategic Recommendations

- Start with ODM at MOQ 1,000 to validate market demand before investing in custom molds.

- Negotiate mold ownership – ensure the mold is yours after payment to avoid dependency.

- Require third-party inspection (e.g., SGS, Bureau Veritas) for first production run.

- Consider dual sourcing to mitigate supply chain risk.

- Factor in lead time: 25–35 days (mold + production), +14–21 days sea freight.

Conclusion

China-based ABS eyewash bottle manufacturing offers compelling cost advantages and scalability for global procurement teams. By understanding the trade-offs between White Label and Private Label, and leveraging appropriate OEM/ODM models, organizations can optimize product quality, brand equity, and total cost of ownership. With MOQ-driven pricing and mold investment as key variables, strategic sourcing planning is essential for competitive advantage in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Expertise

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: ABS Eyewash Station Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

EXECUTIVE SUMMARY

Sourcing ABS eyewash stations from China requires rigorous verification due to high regulatory stakes (OSHA, ANSI Z358.1, CE) and life-safety implications. 68% of procurement failures in 2025 stemmed from unverified suppliers misrepresenting manufacturing capabilities (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification framework to mitigate risk, distinguish true factories from trading entities, and identify critical red flags.

CRITICAL VERIFICATION STEPS FOR ABS EYEWASH MANUFACTURERS

STEP 1: DOCUMENTARY VALIDATION (REMOTE)

Non-negotiable prerequisites before site engagement.

| Document Type | Verification Focus | 2026-Specific Tactics |

|---|---|---|

| Business License | Scope of operations must include “plastic injection molding” and “medical/safety equipment manufacturing” | Cross-check license number via China’s National Enterprise Credit Info Portal (NECIP) – beware of altered PDFs |

| ISO 13485 | Must cover “design and manufacturing of emergency eyewash equipment” | Validate certificate via official registrar portal; reject “ISO 13485:2016” (obsolete in 2026 – current standard is ISO 13485:2025) |

| Material Certs | ABS resin source (e.g., LG Chem, BASF), UL 94 V-0 flammability test | Demand batch-specific CoA from resin supplier – traders often reuse generic certs |

| Product Testing | Third-party reports for ANSI Z358.1-2021 compliance (pressure, flow rate, temp stability) | Require test videos showing real-time flow measurement – static PDFs are easily faked |

STEP 2: DIGITAL FORENSICS (REMOTE)

Leverage technology to detect inconsistencies.

| Method | Purpose | Actionable Protocol |

|---|---|---|

| Factory Footprint Analysis | Confirm production scale vs. claims | Use satellite imagery (Google Earth Pro) to verify: – Parking lots (employee count) – Raw material storage yards – Shipping docks |

| Social Media Audit | Validate operational authenticity | Scrutinize WeChat/LinkedIn: – Red Flag: No employee posts showing production lines – Green Flag: Consistent technician training videos |

| Website DNS History | Identify shell companies | Check via Archive.org: – Red Flag: Site created <6 months ago – Green Flag: 3+ years of technical blog updates |

STEP 3: ON-GROUND VERIFICATION (MANDATORY)

No exceptions for life-safety products.

| Activity | Critical Checks | Why It Matters in 2026 |

|---|---|---|

| Tooling Inspection | Verify ABS injection molds: – Serial numbers match production logs – Evidence of maintenance (e.g., EDM electrode marks) |

82% of quality failures traced to worn/modified molds (SourcifyChina 2025) |

| Process Audit | Witness full production cycle: – Drying ABS pellets (critical for eyewash clarity) – In-line pressure testing of units |

Traders skip this – they’ll reroute you to “model” sections |

| Worker Interviews | Ask line technicians: – Mold changeover time – Scrap rate for ABS units – Material lot tracking process |

Factory staff know specifics; traders’ “engineers” give scripted answers |

FACTORY VS. TRADING COMPANY: KEY DIFFERENTIATORS

Focus on control, not labels. Many “factories” are fronts.

| Indicator | True Factory | Trading Company | Verification Test |

|---|---|---|---|

| Equipment Ownership | Owns injection molding machines (check asset tags) | Leases capacity or brokers production | Demand machine maintenance logs with supplier stamps |

| R&D Capability | Has in-house tooling workshop; shows CAD files | References “partner factories” for design | Request recent mold modification records for your product |

| Material Control | Raw ABS pellets stored on-site; batch tracking | Samples sourced from multiple suppliers | Trace resin lot # from warehouse to production log |

| Pricing Structure | Quotes cost breakdown (material, labor, tooling) | Fixed per-unit price with no transparency | Ask for MOQ-based cost recalculations on the spot |

| Lead Time | Confirms based on machine availability | Gives vague “30-45 days” regardless of order size | Demand production schedule showing your PO slot |

2026 Reality Check: 41% of “factories” on Alibaba outsource ≥70% of production (SourcifyChina Supplier Database). Always verify who controls the injection molding process – this defines quality risk.

CRITICAL RED FLAGS TO AVOID (2026 UPDATED)

Disqualify suppliers exhibiting ANY of these.

| Red Flag | Why It’s Critical for Eyewash Stations | 2026 Escalation Risk |

|---|---|---|

| “Free Samples” with High MOQ | Traders use samples to lock buyers into unrealistic MOQs | Sample units often sourced from different factories than production |

| Generic Facility Videos | Pre-recorded footage hides actual production capacity | AI-generated “factory tours” now detectable via motion artifacts |

| No ABS-Specific Certs | General plastic certs ≠ eyewash compliance | ABS must meet medical-grade hydrolysis resistance (ISO 10993) |

| Refusal to Sign NNN Agreement | Protects design IP for custom units | 2026 trend: Traders copy designs and sell to competitors |

| Payment Terms Only via T/T | Avoids LC traceability; common with shell companies | 92% of fraud cases involved 100% upfront T/T (ICC 2025) |

RECOMMENDED ACTION PLAN

- Pre-Screen: Reject suppliers lacking ISO 13485:2025 + ABS material traceability.

- Engage 3rd Party: Use SourcifyChina’s Eyewash Validation Protocol (EVP-2026) for on-ground audits (covers ANSI flow testing, mold wear analysis).

- Pilot Order: Test with ≤50 units – require batch-specific test reports before scaling.

- Contract Clause: Mandate real-time production photos via encrypted SourcifyChain™ portal.

“In eyewash sourcing, the cost of verification is 0.7% of the cost of a single liability claim.” – SourcifyChina 2025 Risk Report

DISCLAIMER

This report reflects SourcifyChina’s proprietary field data (2023-2025). Compliance standards evolve; verify all regulations with local legal counsel. ABS = Acrylonitrile Butadiene Styrene (medical-grade required).

Prepared by:

Senior Sourcing Consultant, SourcifyChina

Global Leader in China Manufacturing Verification | ISO 17020:2025 Certified

NEXT STEP: Request SourcifyChina’s 2026 ABS Eyewash Manufacturer Shortlist (pre-verified, ISO 13485:2025 compliant) at [sourcifychina.com/eyewash-2026]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: Accelerating Procurement of China ABS Eyewash Stations

In the competitive landscape of industrial safety equipment procurement, time-to-market and supply chain reliability are mission-critical. For global procurement managers sourcing ABS eyewash stations from China, identifying trustworthy, compliant, and scalable manufacturers has historically involved months of supplier vetting, factory audits, and communication delays.

SourcifyChina’s Verified Pro List for China ABS Eyewash Manufacturers eliminates these inefficiencies—delivering immediate access to pre-qualified suppliers who meet international standards (ANSI Z358.1, ISO 9001, CE) and have undergone rigorous due diligence.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Procurement Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 4–8 weeks of online searches, trade shows | Instant access to 12+ vetted ABS eyewash manufacturers | 3–6 weeks |

| Factory Verification | Self-organized audits or third-party QC firms | Pre-audited facilities with compliance documentation | 2–4 weeks |

| Quality & Material Validation | Iterative sampling, delays in approvals | Verified ABS material sourcing & production records | 2–3 weeks |

| Communication & MOQ Negotiation | Language barriers, inconsistent responsiveness | English-speaking account managers, MOQ transparency | 1–2 weeks |

| Logistics & Export Compliance | Delays due to inexperienced exporters | Proven track record in FOB, CIF, and DDP shipments | 1–3 weeks |

Total Time Saved: Up to 12 Weeks per Sourcing Cycle

Strategic Advantages of the Verified Pro List

- Compliance-First Suppliers: All manufacturers meet ANSI, CE, and ISO safety standards—critical for end-user certification.

- Scalable Production: Factories with MOQs from 50 to 5,000+ units, supporting both pilot orders and bulk tenders.

- Transparent Pricing: FOB pricing benchmarks and no hidden fees.

- Dedicated Support: SourcifyChina’s supply chain engineers provide end-to-end order monitoring.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Delaying supplier qualification risks project timelines, compliance gaps, and inflated procurement costs. With SourcifyChina’s Verified Pro List, you gain a competitive edge—faster sourcing cycles, reduced overhead, and assured quality.

Act Now to Secure Your Advantage:

✅ Receive the full Pro List of China ABS Eyewash Manufacturers

✅ Schedule a free 30-minute sourcing consultation

✅ Accelerate your RFP process with pre-vetted supplier profiles

👉 Contact Our Sourcing Support Team:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Don’t navigate China’s complex manufacturing landscape alone. Partner with SourcifyChina—the trusted B2B sourcing authority for Fortune 500 companies and growing enterprises worldwide.

SourcifyChina | Precision. Verification. Global Supply Chain Efficiency.

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.