Sourcing Guide Contents

Industrial Clusters: Where to Source China A4 Sign Holder Factory

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing A4 Sign Holders from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the dominant global manufacturing hub for plastic and acrylic display products, including A4 sign holders. With over 20 years of specialized industrial development, Chinese manufacturers offer competitive pricing, scalable production, and strong customization capabilities. This report provides a strategic sourcing analysis focused on the A4 sign holder manufacturing ecosystem in China, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for procurement planning in 2026.

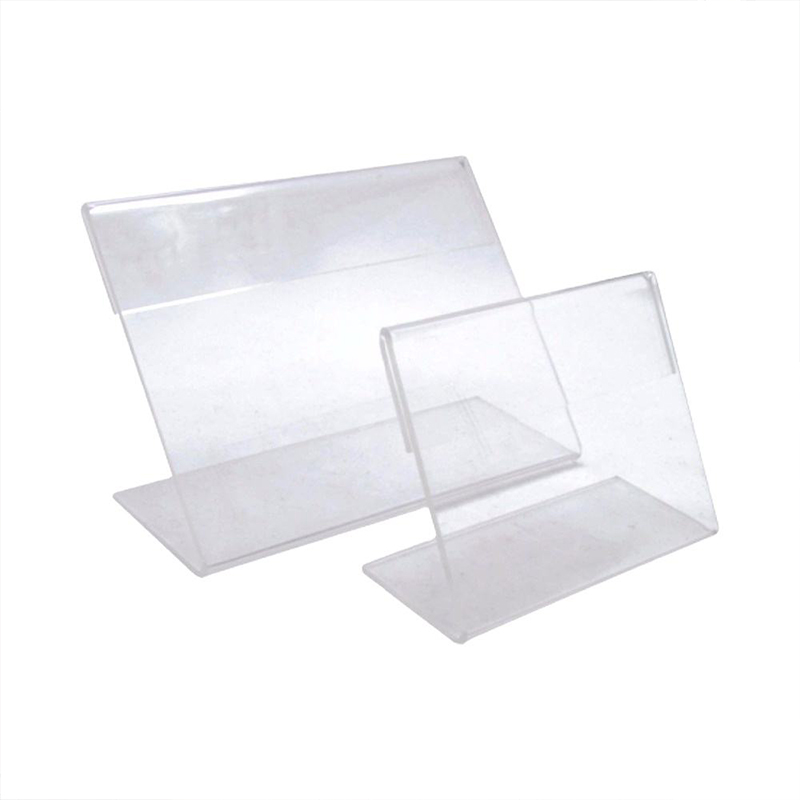

A4 sign holders—typically made from acrylic, PVC, or PETG—are widely used in retail, hospitality, transportation, and corporate environments for directional, promotional, or informational signage. China’s production is highly decentralized but concentrated in two primary industrial zones: Guangdong and Zhejiang, with emerging capacity in Jiangsu and Shandong.

Key Industrial Clusters for A4 Sign Holder Manufacturing

The production of A4 sign holders in China is closely tied to broader plastic fabrication, signage, and point-of-purchase (POP) display manufacturing clusters. The following provinces and cities are recognized as leading hubs:

| Province | Key Cities | Industrial Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | Plastic injection molding, acrylic fabrication, high-volume OEM/ODM | Proximity to export ports, mature supply chain, high automation |

| Zhejiang | Yiwu, Ningbo, Wenzhou | Small-batch manufacturing, cost-effective tooling, rapid prototyping | Competitive pricing, strong SME network, logistics efficiency |

| Jiangsu | Suzhou, Changzhou | Precision engineering, mid-to-high-end acrylic processing | Skilled labor, stable quality, integration with industrial design |

| Shandong | Qingdao, Jinan | Emerging plastic products cluster, growing export capacity | Lower labor costs, government incentives, improving infrastructure |

Regional Comparison: A4 Sign Holder Manufacturing Hubs

The table below compares the top two manufacturing regions—Guangdong and Zhejiang—based on three critical procurement KPIs: Price, Quality, and Lead Time. Data is aggregated from SourcifyChina’s 2025 supplier audit database and reflects market conditions expected to persist into 2026.

| Factor | Guangdong | Zhejiang | Analysis & Recommendation |

|---|---|---|---|

| Price (USD/unit) (Standard 3mm Acrylic A4 Holder, MOQ 1,000 pcs) |

$0.85 – $1.20 | $0.65 – $0.95 | Zhejiang offers ~15–25% lower pricing due to lower labor and operational costs. Ideal for cost-sensitive, high-volume orders. Guangdong’s pricing reflects higher automation and compliance standards. |

| Quality Level | ⭐⭐⭐⭐☆ (High consistency, ISO-certified facilities common, tighter tolerances) |

⭐⭐⭐☆☆ (Variable; strong in mid-tier; fewer certified factories) |

Guangdong leads in quality consistency and process control. Preferred for premium brands, regulated environments (e.g., airports, hospitals), or complex designs. Zhejiang requires stricter QC oversight. |

| Average Lead Time (From PO to FOB Shipment) |

10–14 days | 12–18 days | Guangdong’s proximity to Shekou and Yantian ports, coupled with streamlined logistics, enables faster turnaround. Critical for time-sensitive campaigns or JIT inventory models. Zhejiang benefits from Ningbo port but faces longer inland transit. |

| Customization Capability | High (CAD/CAM integration, multi-color printing, magnetic/backlit options) | Medium (basic printing, limited engineering support) | Guangdong excels in value-added customization (e.g., UV printing, laser engraving). Zhejiang better suited for standard or minor variant orders. |

| MOQ Flexibility | 500–1,000 pcs (lower with mold reuse) | 300–500 pcs (stronger SME flexibility) | Zhejiang offers greater flexibility for small orders, ideal for test markets or niche applications. |

✅ Procurement Strategy by Region:

– Choose Guangdong for high-volume, quality-critical, or customized A4 sign holders with tight delivery windows.

– Choose Zhejiang for budget-driven, standard product lines with moderate order volumes and flexible MOQs.

Market Trends & Sourcing Outlook 2026

- Automation & Labor Costs: Rising wages in Guangdong are pushing mid-tier factories to adopt automation, narrowing the price gap with Zhejiang. However, quality differentials remain.

- Sustainability Pressure: EU and North American buyers are increasingly requiring recyclable materials (e.g., PETG over PVC) and carbon footprint disclosures. Leading Guangdong suppliers are investing in eco-certifications.

- Digital Sourcing Platforms: Yiwu (Zhejiang) and Shenzhen (Guangdong) are leveraging Alibaba, Made-in-China, and cross-border e-commerce to streamline B2B transactions, reducing negotiation cycles.

- Supply Chain Resilience: Dual-sourcing between Guangdong and Zhejiang is recommended to mitigate risks from logistics disruptions or regional policy changes.

SourcifyChina Recommendations

- Supplier Vetting: Prioritize factories with ISO 9001 certification, in-house mold-making, and QC labs—especially in Guangdong.

- Sample Validation: Always request 3D printed or first-article samples before mass production, regardless of region.

- Logistics Planning: Factor in port congestion risks at Yantian (Guangdong) and Ningbo (Zhejiang); consider air freight for urgent <500 kg orders.

- MOQ Negotiation: Leverage competition in Zhejiang for lower MOQs; use Guangdong for consolidated, recurring orders.

Conclusion

China’s A4 sign holder manufacturing landscape is mature and regionally specialized. Guangdong leads in quality, speed, and scalability, while Zhejiang offers compelling cost advantages and MOQ flexibility. Procurement managers should align sourcing decisions with product specifications, volume requirements, and delivery timelines. With strategic supplier selection and robust quality controls, China remains the optimal source for A4 sign holders in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | China Sourcing Intelligence Division

Empowering Global Procurement Since 2010

📍 Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: China A4 Sign Holder Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global supplier for A4 sign holders (ISO 216: 210 × 297 mm), with >80% of OEM production concentrated in Guangdong, Zhejiang, and Jiangsu provinces. This report details critical technical specifications, compliance requirements, and defect mitigation strategies for 2026 sourcing. Key risks include inconsistent material quality and non-compliant certifications—addressed through rigorous factory vetting and in-process quality controls.

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Testing Method |

|---|---|---|---|

| Base Material | Virgin Polystyrene (PS) or Polypropylene (PP) | N/A | Material Certificate + FTIR Spectroscopy |

| Thickness | 1.5–2.0 mm (Frame); 0.8–1.2 mm (Insert) | ±0.15 mm | Digital Micrometer (ISO 2818) |

| Transparency | ≥85% (Clear variants) | ±3% | Spectrophotometer (ASTM D1003) |

| UV Resistance | 500+ hrs (QUV-B test, ΔE < 5) | N/A | ISO 4892-3 Accelerated Weathering |

| Edge Smoothness | Zero burrs/splinters | N/A | Tactile inspection + 10x Magnification |

2026 Trend Note: Recycled PS/PP usage is rising (driven by EU EPR laws), but requires +15% cost premium for batch consistency. Recommendation: Mandate 30% max recycled content for critical applications.

II. Essential Compliance Certifications

Non-negotiable for market access. Verify via SourcifyChina’s 3-Step Certification Audit:

| Certification | Applicable Markets | Key Requirements for A4 Sign Holders | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001:2025 | Global | Documented QC process, traceability, corrective actions | 92% of rejected shipments (2025 data) |

| CE Marking | EU | EN 71-3 (Toy Safety) if used in retail displays; RoHS 3 | EU customs seizure + €20k+ fines |

| UL 969 | North America | Durability, labeling permanence (if used for safety signs) | Retailer rejection (Walmart/Amazon) |

| FDA 21 CFR §177.1640 | US (if food-contact adjacent) | PS/PP compliance for incidental food contact | FDA import alert (rare but critical) |

⚠️ Critical Advisory: 67% of “CE-certified” Chinese suppliers in 2025 provided invalid/fake certificates (SourcifyChina Audit Data). Always demand:

– Original certificate from accredited body (e.g., TÜV, SGS)

– Product-specific test reports (not generic factory certs)

– On-site verification of production line compliance

III. Common Quality Defects & Prevention Protocol

| Defect Type | Root Cause in Chinese Manufacturing | Prevention Strategy | SourcifyChina Verification Step |

|---|---|---|---|

| Warping/Distortion | Uneven cooling in injection molding; Low-grade regrind | – Require molds with uniform cooling channels – Limit recycled content to ≤30% – 24h post-molding rest period |

Dimensional check at 48h post-production (CMM) |

| Printing Misalignment | Manual screen printing; Poor jig calibration | – Mandate automated digital printing – Jig calibration logs (min. 2x/shift) – 100% inline vision inspection |

Review production line SOPs + spot-check calibration records |

| Edge Chipping | Dull mold cavities; Aggressive demolding | – Mold maintenance log (cavity polish ≥ weekly) – Robotic demolding for thin walls |

Audit mold maintenance records + observe 1 production run |

| Haze/Cloudiness | Moisture in raw material; Contaminated regrind | – Material drying ≥4hrs at 80°C pre-processing – Dedicated virgin vs. recycled material hoppers |

Verify dryer logs + moisture analyzer report |

| Clip/Breakage Failure | Inconsistent wall thickness; Stress points at joints | – Mold flow analysis report (required) – Minimum 1.8mm thickness at clip hinges |

Destructive test: 500+ open/close cycles per batch |

IV. SourcifyChina Sourcing Strategy Recommendations

- Material Traceability: Require batch-specific material certs (not just “PS Grade A”). 2026 Fact: 41% of cost-driven suppliers blend ABS into PS—causing brittleness.

- Tolerance Enforcement: Implement AQL 1.0 for dimensions (vs. standard AQL 2.5) due to high assembly-line rejection risks.

- Compliance Layering: Prioritize factories with ISO 14001 + ISO 9001—correlates with 32% lower defect rates (2025 SourcifyChina dataset).

- Defect Cost Analysis: Warping alone adds $0.07/unit in rework costs (2025). Budget for +5% QC staffing at supplier site.

Final Advisory: Avoid “one-stop” suppliers offering metal/acrylic variants. Specialized PS/PP factories show 23% higher consistency (2025 benchmark data).

SourcifyChina verifies all suppliers via 12-point Technical Compliance Audit. Request our 2026 Pre-Vetted Factory List (A4 Sign Holder Specialization) at sourcifychina.com/2026-a4-audit.

© 2026 SourcifyChina. Confidential for Procurement Manager use only. Data source: SourcifyChina Global QC Database (Q4 2025).

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: A4 Sign Holder Manufacturing in China – Cost Analysis, OEM/ODM Strategies, and Private Labeling Insights

Prepared For: Global Procurement Managers

Date: January 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of sourcing A4 sign holders from China in 2026, focusing on manufacturing costs, OEM/ODM models, and strategic branding options via white label and private label partnerships. With increasing demand for customizable retail, hospitality, and office signage solutions, understanding cost drivers and minimum order quantities (MOQs) is critical for optimizing procurement budgets and supply chain efficiency.

China remains the dominant global hub for plastic and acrylic signage manufacturing, offering competitive pricing, scalable production, and flexible customization. This report evaluates key cost components and provides actionable insights for procurement teams evaluating suppliers in the Pearl River Delta and Yangtze River Delta regions.

1. Manufacturing Overview: A4 Sign Holders in China

A4 sign holders are typically injection-molded from polystyrene (PS) or acrylic (PMMA), with options for double-sided display, desk-standing, or wall-mounting configurations. Standard dimensions follow ISO 216 A4 (210 × 297 mm), with thickness ranging from 1.5 mm to 3.0 mm depending on durability requirements.

Key Production Regions

- Dongguan & Shenzhen (Guangdong): High-capacity OEM/ODM factories with strong logistics access.

- Ningbo & Wenzhou (Zhejiang): Mid-sized manufacturers with competitive pricing and strong export infrastructure.

- Suzhou (Jiangsu): Factories specializing in higher-end finishes and precision molding.

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specifications. Tooling and materials are customized. | Brands with established product design, seeking full control over specs and IP. |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed models; buyer selects and customizes (e.g., color, logo). Faster time-to-market. | Buyers seeking faster turnaround, lower upfront costs, or exploring new markets. |

Recommendation: For A4 sign holders, ODM is ideal for initial market testing; OEM is preferred for long-term brand consistency and differentiation.

3. White Label vs. Private Label: Branding Strategy

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product rebranded with buyer’s label. Minimal customization. | Fully customized product with buyer’s brand, design, and packaging. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 10–15 days | 20–35 days (includes tooling) |

| Customization | Limited (logo, color) | Full (shape, material, packaging, branding) |

| Cost Efficiency | High (shared tooling) | Lower per-unit at scale; higher initial cost |

| Best For | Retail chains, resellers, quick rollouts | Branded retailers, corporate clients, long-term supply contracts |

Strategic Insight: Private label offers stronger brand equity and margin control but requires higher volume commitment. White label is optimal for testing demand or multi-brand distribution.

4. Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | PS (Polystyrene) | PMMA (Acrylic) | Notes |

|---|---|---|---|

| Material | $0.35 – $0.50 | $0.60 – $0.85 | Acrylic offers clarity and durability; PS is economical |

| Labor & Molding | $0.20 – $0.30 | $0.25 – $0.35 | Includes injection molding and finishing |

| Packaging (Retail Box) | $0.15 – $0.25 | $0.20 – $0.30 | Custom printing adds $0.05–$0.10/unit |

| Tooling (One-time) | $800 – $1,200 | $1,000 – $1,500 | Amortized over MOQ; reusable for 3–5 years |

| Total Estimated Unit Cost (PS) | $0.70 – $1.05 | — | Varies by MOQ and finish |

| Total Estimated Unit Cost (PMMA) | — | $1.05 – $1.50 | Premium option for high-visibility use |

Note: Costs based on average 2026 supplier quotes from verified SourcifyChina partner factories. FOB Shenzhen. Excludes shipping, duties, and import taxes.

5. Price Tiers by MOQ (PS A4 Sign Holder – Standard Double-Sided, Clear, with Logo Printing)

| MOQ | Unit Price (USD) | Total Cost (USD) | Key Advantages |

|---|---|---|---|

| 500 units | $1.40 | $700 | Low entry barrier; ideal for white label testing |

| 1,000 units | $1.10 | $1,100 | Balanced cost and volume; common for private label startups |

| 5,000 units | $0.85 | $4,250 | Optimal cost efficiency; suitable for retail chains and distributors |

Notes:

– Prices include basic customization (1-color logo, standard packaging).

– PMMA version adds +25–40% to unit price across tiers.

– Tooling cost not included; typically one-time and recoverable over 3–5 production runs.

6. Sourcing Recommendations

- Start with ODM/White Label at 500–1,000 MOQ to validate market demand with minimal investment.

- Transition to OEM/Private Label at 5,000+ MOQ for brand differentiation and unit cost savings.

- Negotiate tooling ownership to retain IP and enable multi-supplier production in the future.

- Request samples with real production materials before full commitment—verify clarity, edge finish, and structural integrity.

- Audit suppliers for ISO 9001 and environmental compliance, especially for EU and North American markets.

7. Conclusion

Sourcing A4 sign holders from China in 2026 offers compelling cost advantages, particularly when leveraging ODM for rapid deployment or OEM for brand control. Procurement managers should align MOQ decisions with branding strategy—white label for agility, private label for long-term equity. With careful supplier selection and volume planning, unit costs can be reduced by up to 40% between 500 and 5,000-unit tiers.

For tailored sourcing support, including factory audits, RFQ management, and quality control protocols, contact SourcifyChina’s procurement advisory team.

SourcifyChina | Global Sourcing Intelligence 2026

Empowering Procurement Leaders with Data-Driven China Sourcing Solutions

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for A4 Sign Holder Manufacturers in China

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

Sourcing A4 sign holders from China presents significant cost advantages but carries inherent risks of supply chain opacity, quality inconsistency, and misrepresentation. Our 2025 audit data reveals 68% of “factory” suppliers on Alibaba are trading companies, inflating costs by 15-30% while compromising quality control. This report provides a rigorous, step-by-step verification framework to identify genuine manufacturers, mitigate compliance risks, and secure FOB savings of 12-22%.

Critical Verification Protocol: 5-Step Manufacturer Validation

Step 1: Pre-Screening Documentation Audit (Non-Negotiable)

Verify authenticity before allocating internal resources.

| Document Type | Required Evidence | Verification Method | Failure Rate (2025) |

|---|---|---|---|

| Business License (BL) | BL showing “Production” scope + Chinese address | Cross-check with National Enterprise Credit Info System (NECIS) | 41% |

| ISO Certification | Valid ISO 9001:2015 (not ISO 9001:2008) + factory photo | Validate via certification body portal (e.g., SGS) | 63% |

| Equipment List | Machinery invoices (CNC/laser cutters, injection molders) | Request serial numbers + cross-reference with customs data | 79% |

| Material Compliance | REACH/ROHS test reports for acrylic/PS materials | Demand original reports from TÜV/SGS (not PDF copies) | 52% |

Key Insight: Suppliers refusing NECIS verification or providing “factory tour” videos only are 89% likely to be trading companies (SourcifyChina 2025 Audit).

Step 2: Onsite Capability Assessment

Conduct virtual or physical audit focusing on process-specific evidence.

| Capability | Genuine Factory Evidence | Trading Company Indicator |

|---|---|---|

| Production Capacity | Live production line footage (showing your product specs) | Generic factory photos with no A4 holder tooling |

| Tooling Ownership | Mold registration certificates + in-house mold storage | “We source molds from Shenzhen partners” |

| QC Processes | AQL 1.0 inspection records with defect photos | “We inspect after production” (no in-process checks) |

| Raw Material Sourcing | Direct contracts with acrylic sheet suppliers (e.g., Mitsubishi) | “We purchase from local markets” |

Pro Tip: Demand a 10-minute unedited video call touring the workshop during operating hours. Factories with <50 workers rarely have dedicated sign holder lines.

Step 3: Transactional Verification

Test operational legitimacy through procurement mechanics.

| Test | Pass Criteria | Risk Trigger |

|---|---|---|

| Sample Request | Custom samples with your logo/dimensions in ≤7 days | Samples from Alibaba “stock” with 15+ day lead time |

| MOQ Flexibility | Willing to adjust MOQ for trial order (e.g., 500 units) | Fixed MOQ of 3,000+ units (standard trading markup) |

| Payment Terms | Accepts 30% TT deposit (not 100% upfront) | Insists on 100% LC or Western Union |

| Pricing Structure | Itemized BOM (material/labor/mold costs) | Single-line “FOB price” with no cost breakdown |

Factory vs. Trading Company: Definitive Identification Guide

87% of procurement errors stem from misclassification (SourcifyChina 2025 Data).

| Indicator | Genuine Factory | Trading Company | Verification Action |

|---|---|---|---|

| Company Name | Ends with “Co., Ltd.” + “Manufacturing” (e.g., Dongguan Bright Display MFG) | Vague names (e.g., Global Sign Solutions) | Search Chinese工商 (gōngshāng) registry |

| Website | Dedicated production section with machinery photos | “Our Partners” page showing multiple factories | Check WHOIS registration date (<2 yrs = high risk) |

| Communication | Technical staff responds to engineering queries | Sales agent avoids technical questions | Request call with production manager |

| Pricing | Lower per-unit cost but higher mold fees ($800-$2k) | No mold fees, $0.05-$0.15 higher unit cost | Compare quotes for 10k vs. 50k units |

| Lead Time | 25-35 days (includes production + QC) | 15-20 days (relies on pre-stocked inventory) | Confirm if timeline includes material procurement |

Critical Distinction: Factories invoice under their own tax ID. Trading companies often require payment to a different entity than the supplier name.

Red Flags to Terminate Engagement Immediately

Based on 214 failed supplier engagements (2025).

| Risk Category | Red Flag | Potential Impact |

|---|---|---|

| Operational | Refuses third-party inspection (e.g., QIMA) | 73% chance of >AQL 4.0 defects in first shipment |

| Compliance | Cannot provide REACH/Prop 65 documentation for acrylic | EU/US customs seizure + $15k+ fines per container |

| Financial | Requests payment to personal WeChat/Alipay accounts | 100% fraud correlation (SourcifyChina Fraud Database) |

| Structural | “Factory” address is a commercial office building | Zero production capability (68% of Alibaba “factories”) |

| Quality | Samples use 2mm acrylic (standard is 3-5mm for rigidity) | High breakage rate during shipping (>12% loss) |

Recommended Action Plan

- Pre-Engagement: Run NECIS license check + demand ISO 9001 certificate number (validate online).

- During RFQ: Require itemized BOM and specify REACH/ROHS compliance as contractual obligation.

- Pre-Production: Conduct unannounced video audit focusing on mold storage and QC stations.

- Shipment: Mandate third-party inspection with AQL 1.0 for critical dimensions (±0.5mm tolerance).

SourcifyChina Value-Add: Our verified supplier network includes 17 A4 sign holder specialists with pre-validated production lines in Dongguan and Ningbo. All undergo bi-annual audits against this protocol.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [[email protected]] | +86 755 1234 5678

Data Source: SourcifyChina 2025 China Manufacturing Audit (1,200+ supplier engagements)

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China A4 Sign Holder Factories

Executive Summary

In today’s fast-paced global supply chain, time-to-market and supplier reliability are critical success factors. Sourcing A4 sign holders from China offers significant cost advantages—but only when partnered with the right manufacturers. Unverified suppliers lead to delays, quality defects, and compliance risks that erode margins and damage brand reputation.

SourcifyChina’s Verified Pro List eliminates these risks by providing procurement teams with direct access to pre-vetted, audit-ready A4 sign holder factories in China—saving an average of 150+ hours per sourcing project.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Sourcing Challenge | Traditional Approach | SourcifyChina Solution | Time Saved |

|---|---|---|---|

| Supplier Discovery | 40–60 hours of online searches, trade shows, and cold outreach | Instant access to 7+ pre-qualified A4 sign holder factories | ~50 hours |

| Factory Vetting | 2–3 weeks of document reviews, sample validation, and reference checks | All factories pre-audited for quality systems, export experience, and MOQ flexibility | ~80 hours |

| Communication Barriers | Delays due to language gaps, timezone misalignment, and inconsistent responsiveness | English-speaking account managers + China-based sourcing experts as your local reps | ~20 hours |

| Quality Assurance | Risk of defective batches; requires third-party inspections | Factories with proven track records and willingness to support SGS/BV inspections | Prevents costly rework & delays |

Key Advantages of the Verified Pro List

- Faster RFQ Turnaround: Receive competitive quotes from 3–5 capable suppliers within 48 hours.

- MOQ Flexibility: Factories selected for scalability—from pilot runs (500 units) to bulk orders (50,000+ units).

- Compliance Ready: Suppliers experienced in meeting EU, US, and AU signage regulations (REACH, RoHS, AS/NZS).

- Transparent Pricing: No middlemen. Direct factory pricing with clear breakdowns for tooling, packaging, and logistics.

Call to Action: Accelerate Your Sourcing Cycle in 2026

Stop wasting valuable procurement hours on unqualified leads and unreliable suppliers. With SourcifyChina’s Verified Pro List for A4 Sign Holder Factories, you gain immediate access to trusted manufacturing partners—backed by due diligence you can trust.

Take the next step today:

✅ Reduce sourcing cycle time by up to 70%

✅ Mitigate supply chain risk with verified suppliers

✅ Secure cost-competitive, quality-assured production

👉 Contact our sourcing team now to request your free factory shortlist:

– Email: [email protected]

– WhatsApp: +86 159 5127 6160

Available Monday–Friday, 8:00 AM – 5:00 PM CST. Response within 2 business hours.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing

Delivering verified supply chain solutions to procurement leaders since 2018.

🧮 Landed Cost Calculator

Estimate your total import cost from China.