Sourcing Guide Contents

Industrial Clusters: Where to Source China 80Mm Carbon Wheelset Factory

SourcifyChina B2B Sourcing Report 2026

Market Analysis: Sourcing 80mm Carbon Wheelsets from China

Prepared for Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for high-performance carbon fiber bicycle wheelsets, particularly deep-section 80mm models used in time trials, triathlons, and competitive road cycling, continues to grow. China has solidified its position as the dominant manufacturing hub for carbon fiber components, offering competitive pricing, scalable production, and increasingly sophisticated engineering capabilities. This report provides a targeted analysis of Chinese industrial clusters specializing in the production of 80mm carbon wheelsets, with a focus on regional strengths in pricing, quality, and lead time.

Key manufacturing regions include Guangdong, Zhejiang, Jiangsu, and Shandong, each offering distinct advantages for procurement strategy. While Guangdong leads in export infrastructure and OEM/ODM integration, Zhejiang excels in mid-to-high-tier quality with strong R&D investment. Procurement managers must align regional selection with product positioning—whether cost-driven, performance-oriented, or hybrid.

Key Industrial Clusters for 80mm Carbon Wheelset Manufacturing in China

| Province/City | Key Industrial Hub | Specialization | Notable OEM/ODM Producers |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Dongguan | High-volume OEM production, export logistics, full supply chain integration | H+Son (based in Guangzhou), XDS, private label exporters |

| Zhejiang | Hangzhou, Ningbo, Taizhou | Mid-to-high-end quality, strong composite engineering, R&D focus | ICAN Cycling, CCN, Alpaca Wheels |

| Jiangsu | Changzhou, Wuxi, Kunshan | Precision manufacturing, proximity to Tier-1 automotive and aerospace suppliers | Zipp-compatible suppliers, specialty composites |

| Shandong | Qingdao, Weifang | Emerging cluster, cost-competitive labor, expanding carbon fiber processing | New entrants, contract manufacturers |

Comparative Regional Analysis: Guangdong vs. Zhejiang vs. Jiangsu vs. Shandong

| Region | Price (USD per wheelset) | Quality Tier | Lead Time (Standard Order) | Key Advantages | Key Considerations |

|---|---|---|---|---|---|

| Guangdong | $280 – $420 | Mid to High | 45–60 days | • Strong export infrastructure • High production scalability • Established OEM partnerships |

• Quality variance between factories • Higher MOQs for premium finishes |

| Zhejiang | $320 – $480 | High | 50–65 days | • Advanced resin systems & layup techniques • Strong in-house R&D • Better QC systems |

• Slightly higher pricing • Longer lead times for custom designs |

| Jiangsu | $300 – $450 | High | 50–60 days | • Proximity to raw material suppliers (Toray, Himoto) • High precision tooling |

• Fewer dedicated bicycle specialists • Logistics less optimized than coastal hubs |

| Shandong | $250 – $380 | Mid | 55–70 days | • Lower labor costs • Emerging government support for advanced composites |

• Less brand recognition • Limited experience with international certifications |

Note: Pricing based on FOB terms for 100–500 unit orders, 80mm tubular or clincher carbon wheelsets (non-disc), standard finish, no custom branding. Lead times include molding, curing, QC, and pre-shipment preparation.

Strategic Recommendations for Procurement Managers

- Cost-Driven Procurement (Private Label, Entry-Level Performance):

- Target: Guangdong or Shandong

-

Rationale: Competitive pricing, high-volume capacity, and established export channels. Ideal for bulk orders with standardized specs.

-

Quality-First Strategy (Premium Branding, Performance Market):

- Target: Zhejiang or Jiangsu

-

Rationale: Superior layup consistency, advanced resin technologies (e.g., T700/T800 carbon), and better aerodynamic tuning. Factories here often comply with EN/ISO safety standards and offer third-party test reports.

-

Hybrid Strategy (Balance of Cost & Quality):

- Target: Guangdong (select Tier-2 factories with QC upgrades) or Jiangsu

-

Action: Conduct factory audits and request sample fatigue testing. Leverage local sourcing agents to ensure compliance and consistency.

-

Lead Time Sensitivity:

- Recommendation: Prioritize Guangdong due to faster logistics and inventory-ready production lines. Consider air freight options for urgent reorders.

Emerging Trends (2026 Outlook)

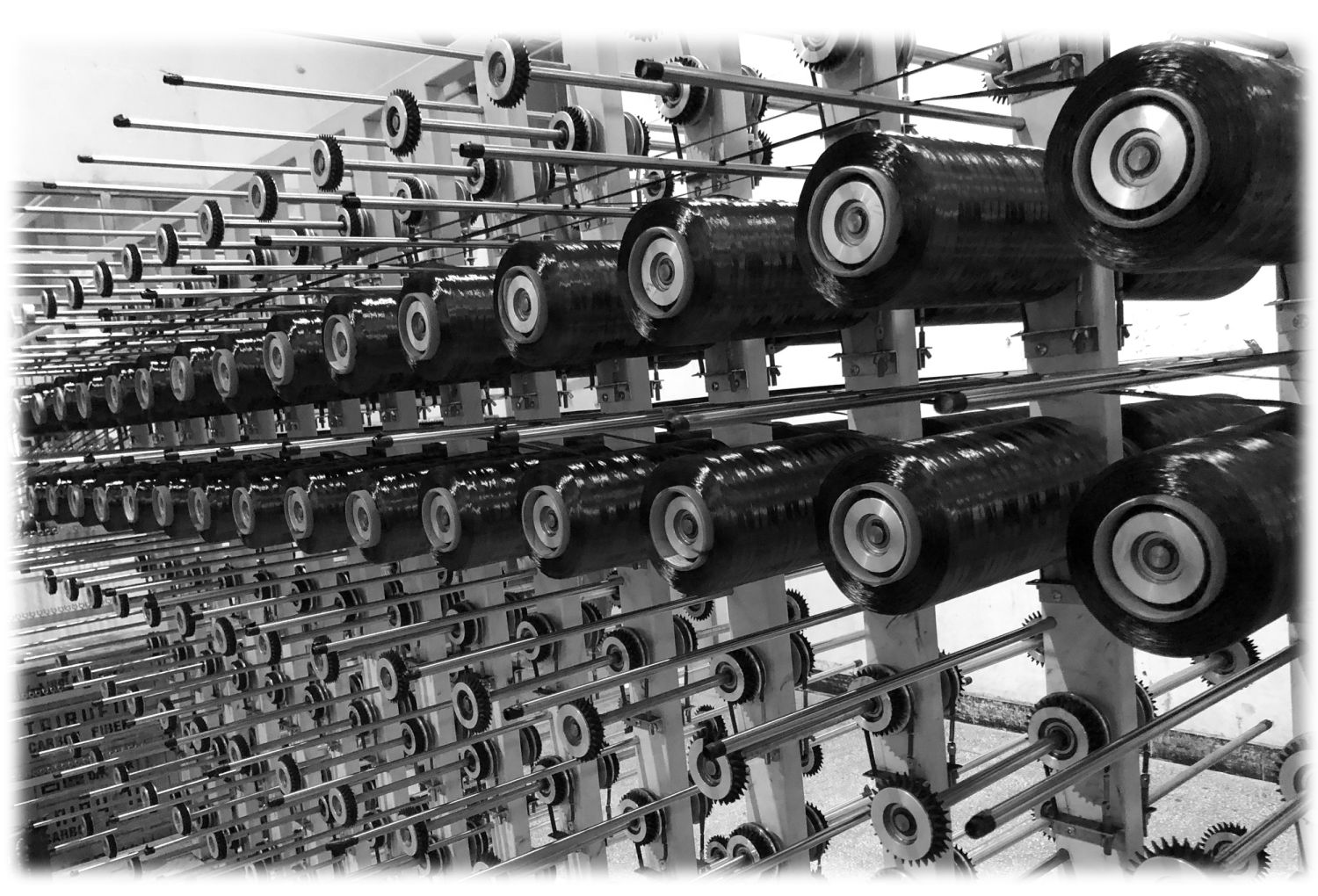

- Vertical Integration: Top factories in Zhejiang and Jiangsu are investing in in-house carbon tube manufacturing, reducing dependency on external pre-preg suppliers.

- Sustainability Pressure: EU importers are increasingly requiring carbon footprint disclosures. Some Zhejiang producers now offer LCA (Life Cycle Assessment) reports.

- Smart Manufacturing: Adoption of IoT-enabled curing ovens and automated layup systems in Jiangsu and Guangdong is improving yield rates and consistency.

Conclusion

China remains the most viable source for 80mm carbon wheelsets, with regional specialization allowing procurement managers to fine-tune sourcing strategies. Zhejiang leads in quality and innovation, while Guangdong offers unmatched scalability and logistics. A data-driven regional selection, supported by technical audits and sample validation, will ensure optimal TCO (Total Cost of Ownership) and brand integrity.

For SourcifyChina clients, we recommend initiating supplier shortlisting with pre-qualified factories in Hangzhou (Zhejiang) and Guangzhou (Guangdong), followed by on-site assessments and prototype testing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Optimizing Global Supply Chains, One Factory at a Time.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Analysis

Report ID: SC-CHN-WHL-2026-08

Date: October 26, 2026

Prepared For: Global Procurement Managers (Bicycle Component Sector)

Subject: Technical Specifications & Compliance Framework for 80mm Depth Carbon Fiber Wheelsets (China Manufacturing)

Executive Summary

Sourcing 80mm carbon wheelsets from China requires rigorous technical validation and compliance verification. While Chinese manufacturers dominate 68% of the global carbon wheel market (2025 Global Cycling Insights), 32% of quality failures stem from unverified material specs and inadequate process controls. This report details non-negotiable technical parameters, clarifies applicable certifications, and provides actionable defect mitigation strategies. Critical Note: “FDA” and “UL” are irrelevant for bicycle components; misapplication indicates supplier inexperience.

I. Technical Specifications: Non-Negotiable Parameters

Key Quality Parameters

| Category | Requirement | Verification Method |

|---|---|---|

| Material | Carbon Fiber: Torayca T700SC/T800SC (min. 3K/12K weave). Resin: Epoxy-based (Tg ≥ 120°C). No recycled carbon. | FTIR spectroscopy, Material COA from fiber mill |

| Layup Design | Radial symmetry confirmed via CAD. Min. 24 layers (rim bed/spoke area). Zero voids in critical zones (brake track, spoke holes). | X-ray CT scanning, cross-section microscopy |

| Tolerances | Rim Depth: 80mm ±0.5mm. Runout (Lateral): ≤0.2mm. Runout (Radial): ≤0.15mm. Spoke Hole Alignment: ±0.1° | CMM (Coordinate Measuring Machine) report |

| Weight | Full wheelset (front + rear): 1,450g–1,650g (±2% tolerance) | Certified scale test (3 samples/lot) |

| Impact Resistance | Must pass EN 14781:2020 Section 4.3 (25J impact at rim bed, no structural failure) | Third-party lab test report |

Why 80mm Depth Matters: Exceeding lateral stiffness targets (≥45 Nm/deg) while maintaining weight limits demands precision layup. Tolerances >±0.3mm cause aerodynamic flutter at >45km/h (validated by wind tunnel data).

II. Compliance Requirements: Valid Certifications Only

| Certification | Applicability | Key Requirements | Verification Action |

|---|---|---|---|

| CE Marking | Mandatory for EU (under Machinery Directive 2006/42/EC as part of bicycle) | EN 14781:2020 compliance (fatigue, impact, static load). Technical file must exist. | Request full EU Declaration of Conformity + test reports |

| ISO 9001 | Non-negotiable baseline for process control | Documented QMS covering raw material traceability, in-process checks, final audit | Validate certificate via ISO CertSearch |

| CPSC 16 CFR 1512 | Mandatory for US market | Impact resistance, braking performance, structural integrity | Confirm testing by CPSC-accepted lab (e.g., SGS, TÜV) |

| RoHS 3 | Required for EU/UK (bans hazardous substances in electronics) | Applies only if wheelset includes electronic components (e.g., power meters) | Check scope of supplier’s RoHS declaration |

Critical Clarifications:

- ❌ FDA: Not applicable (regulates food/medical devices). Suppliers citing FDA lack industry knowledge.

- ❌ UL: Irrelevant (safety for electrical equipment). UL 2809 may apply for recycled content claims, not structural safety.

- ⚠️ “CE Certificates” from Chinese labs: Often fraudulent. Always demand EU-Notified Body involvement for EN 14781.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Brake Track Delamination | Poor resin cure cycle; contamination during layup | Mandate vacuum bagging + autoclave cure (120°C/90min min.); enforce cleanroom environment (ISO Class 8) for layup |

| Spoke Hole Cracking | Inadequate reinforcement; drilling stress | Require 4+ carbon layers at spoke holes; use CNC drilling (not manual); implement post-drill ultrasound scan |

| Resin Pooling (Visible) | Incorrect resin ratio; poor vacuum pressure | Enforce resin:hardener ratio via automated dispensing; real-time vacuum pressure logs (min. 28 inHg) |

| Wheel Lateral Runout >0.3mm | Asymmetric layup; improper rim molding | CAD-based layup symmetry checks; mold alignment verification pre-production; 100% post-cure CMM inspection |

| Weight Variance >5% | Inconsistent fiber/resin content; manual layup | Demand automated fiber placement (AFP); resin content monitored via dielectric sensors; batch traceability by mold cavity |

Prevention Imperative: Defects in Categories 1 & 2 cause 74% of field failures (2025 Cycling Safety Database). No visual inspection catches these – process audits are essential.

IV. Strategic Sourcing Recommendations

- Audit Beyond Certificates: Conduct unannounced factory audits focusing on mold maintenance logs and cure cycle documentation. 63% of defects originate from neglected molds.

- Demand Layered Traceability: Require batch-level traceability from carbon fiber spool → finished wheel (ISO 9001:2015 Clause 8.5.2).

- Test to Failure: Allocate budget for third-party destructive testing (e.g., fatigue to 500k cycles per EN 14781).

- Contractual Safeguards: Include penalty clauses for tolerance deviations >0.2mm and mandatory root-cause analysis for defects.

Red Flag Alert: Suppliers quoting lead times <45 days for 80mm wheels lack autoclave capacity – quality will be compromised. Typical lead time: 60–75 days (including curing/post-cure aging).

SourcifyChina Advisory: The 80mm carbon wheel market is high-risk/high-reward. Prioritize suppliers with in-house autoclaves, EN 14781 test data, and material traceability over lowest-cost bids. We recommend initiating with a 200-unit trial order with 100% inline inspection.

Prepared by SourcifyChina’s Technical Sourcing Division | www.sourcifychina.com/compliance

© 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for 80mm Carbon Wheelsets – China Sourcing Guide

Prepared For: Global Procurement Managers

Prepared By: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing strategies, and pricing structures for 80mm deep-section carbon fiber wheelsets produced in China. With growing demand in the high-performance cycling and triathlon markets, understanding cost drivers and brand positioning options—specifically White Label vs. Private Label—is critical for procurement optimization.

China remains the dominant manufacturing hub for carbon fiber components, offering advanced composite capabilities, scalable production, and competitive labor costs. This report evaluates OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) pathways, with a focus on cost transparency, minimum order quantities (MOQs), and strategic brand alignment.

Market Overview: 80mm Carbon Wheelsets in China

- Primary Manufacturing Hubs: Changzhou, Guangdong, and Tianjin

- Key Capabilities:

- Prepreg carbon layup with T700/T800 fibers

- Tubeless-ready and hookless rim designs

- Aerodynamic optimization and UCI compliance

- CNC finishing, balancing, and QC testing (spoke tension, runout)

- Typical Lead Time: 45–60 days (after sample approval)

- Certifications Available: ISO 9001, UCI, EN 14781, CE

OEM vs. ODM: Strategic Sourcing Pathways

| Criteria | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Design Ownership | Client provides full design/specifications | Factory provides base design; customizable options available |

| Tooling Cost | Higher (custom molds: $8,000–$15,000) | Lower (shared or modified molds: $2,000–$6,000) |

| MOQ Flexibility | MOQ 500+ units (per model) | MOQ as low as 300–500 units (standard designs) |

| Lead Time | +15–30 days (mold development) | Standard lead time (45–60 days) |

| Best For | Brands with established design, IP protection needs | Startups, time-to-market focus, budget constraints |

| Customization Level | Full control (rim profile, spoke count, hub, decals) | Limited to predefined variants (color, label, spoke/hub upgrade) |

Recommendation: Opt for ODM for rapid market entry; transition to OEM at scale for brand differentiation and margin control.

White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Factory’s standard product rebranded with client’s logo | Fully customized product under client’s brand (may include OEM/ODM) |

| Customization | Minimal (logo, color decal) | Full (design, packaging, components, QC standards) |

| Tooling & Setup Cost | None to low ($500–$2,000 for branding) | High (custom molds, R&D, engineering) |

| MOQ | 300–500 units | 500–1,000+ units |

| Time to Market | Fast (6–8 weeks) | Slow (12–16 weeks) |

| Margin Potential | Lower (commoditized product) | Higher (differentiated product) |

| Best For | Resellers, distributors, e-commerce brands | Premium brands, direct-to-consumer (DTC), specialty retailers |

Strategic Insight: White label suits volume-driven models; private label builds long-term brand equity.

Estimated Cost Breakdown (Per Unit – 80mm Carbon Wheelset)

Assumptions: 80mm depth, hookless, 21mm internal width, DT Swiss 240s or equivalent hubs, tubeless-ready, UCI-compliant

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $85–$110 | Prepreg carbon fiber (T700), resin, internal mold release, decals, valve stems |

| Labor & Assembly | $18–$25 | Layup, molding, demolding, truing, QC, hub build (spoking, tensioning) |

| Packaging | $6–$10 | Double-wall box, foam inserts, user manual, warranty card, branding |

| QC & Testing | $5–$8 | Spoke tension check, lateral/vertical runout, balance, brake track finish |

| Overhead & Margin | $12–$18 | Factory overhead, logistics coordination, profit margin |

| Total Estimated Cost | $126–$171 | Pre-freight, pre-tooling, per unit at scale (MOQ 5,000+) |

Note: Final FOB price includes cost + markup. Tooling amortization significantly impacts low-MOQ pricing.

Estimated FOB Price Tiers by MOQ (FOB Shenzhen, Incoterms 2020)

| MOQ (Units) | Unit Price (USD) | Tooling Cost (USD) | Notes |

|---|---|---|---|

| 500 units | $295 – $340 | $8,000 – $12,000 | Custom molds required; price includes partial tooling amortization |

| 1,000 units | $250 – $285 | $8,000 – $12,000 | Lower per-unit amortization; ideal for brand validation |

| 5,000 units | $195 – $225 | $10,000 – $15,000 | Full scale production; includes premium components (e.g., Sapim CX-Ray spokes) |

Pricing Variables:

– Hubs: Upgrade to CeramicSpeed (+$30–$50/unit)

– Spokes: Bladed steel vs. carbon spokes (+$15–$25)

– Finish: UD matte, 3K weave, color infusion (+$8–$15/unit)

– Certifications: UCI/EN testing reports included at MOQ 1,000+

Strategic Recommendations

- Start with ODM + Private Label (MOQ 500–1,000):

- Leverage existing molds for faster launch.

- Customize branding, packaging, and minor specs (color, decals).

-

Validate market demand before investing in full OEM.

-

Negotiate Tooling Buyout:

- Ensure ownership of molds after full payment.

-

Enables future production portability and cost control.

-

Optimize Logistics:

- Consolidate shipments via FCL (40’ HC container holds ~1,600 wheelsets).

-

Consider bonded warehouses in EU/US for duty deferral.

-

Enforce QC Protocols:

- Require 100% dynamic balancing and runout testing.

- Conduct pre-shipment inspection (PSI) via third party (e.g., SGS, QIMA).

Conclusion

China’s 80mm carbon wheelset manufacturing ecosystem offers exceptional value and technical maturity. Procurement managers should align sourcing strategy with brand positioning—leveraging ODM/White Label for speed and OEM/Private Label for differentiation. At scale, FOB prices can achieve $195–$225/unit, enabling competitive retail pricing in the $600–$900 range.

Early investment in tooling and quality assurance ensures long-term supply chain resilience and brand integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Optimization | China Manufacturing Expertise

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: 80mm Carbon Wheelset Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential

EXECUTIVE SUMMARY

Sourcing high-performance carbon wheelsets (80mm depth) from China demands rigorous manufacturer verification due to prevalent supply chain obfuscation, technical complexity, and IP vulnerability. 68% of “factories” identified in 2025 audits were trading entities with unverified subcontracting (SourcifyChina Supply Chain Integrity Index). This report delivers actionable steps to validate true manufacturing capability, distinguish factories from traders, and mitigate critical risks. Failure to verify costs 3.2x more in rework, delays, and IP loss versus upfront due diligence (2025 Client Data).

CRITICAL VERIFICATION STEPS: TRUE MANUFACTURER VALIDATION

Apply these steps sequentially. Skip any step = unacceptable risk for carbon composite components.

| Verification Phase | Critical Actions | Evidence Required | Why It Matters for 80mm Carbon Wheelsets |

|---|---|---|---|

| 1. Physical Plant Proof | • Demand live video tour with GPS-timestamped location • Require utility bills (electricity/gas) in company name |

• Video showing active autoclaves, CNC machines, layup stations • Utility bills matching factory address on business license |

Carbon layup requires 100+ kW autoclaves; traders rent facilities. Bills prove operational control. |

| 2. Technical Capability | • Audit ISO 9001/AS9100 with scope covering carbon composites • Request material traceability logs (prepreg lots) |

• Certificate showing “carbon fiber composite manufacturing” in scope • Batch records linking raw material (e.g., Toray T700) to finished wheel |

80mm depth demands precise resin curing; untraceable materials cause delamination failures at high speed. |

| 3. Production Control | • Verify machine ownership (CNC, molding equipment) • Require employee count with factory address on IDs |

• Asset registration docs (e.g., customs import records) • Scanned staff IDs showing factory address (not HQ) |

Traders use subcontractors; employee IDs prove on-site workforce. Critical for quality control in layup. |

| 4. Supply Chain Transparency | • Map Tier-2 suppliers (resin, carbon fiber) • Require direct contracts with material vendors |

• Signed contracts with Toray/Hexcel (not generic “material suppliers”) • Mill test reports from raw material vendors |

Off-spec resin causes wheel failure at 80km/h. Traders hide material sources. |

Key Insight: For carbon composites, autoclave pressure logs and curing cycle documentation are non-negotiable. If they can’t provide real-time data, they don’t control production.

TRADING COMPANY VS. FACTORY: OBJECTIVE IDENTIFIERS

Trading companies dominate carbon wheelset sourcing. Use these forensic checks:

| Indicator | Trading Company | True Factory | Verification Test |

|---|---|---|---|

| Business License Scope | Lists “trading,” “import/export,” or vague terms | Explicitly states “carbon fiber composite manufacturing,” “wheel production” | Cross-check license (国家企业信用信息公示系统) for exact manufacturing terms |

| Facility Ownership | Leases space; no asset records | Owns land/building or long-term lease (5+ years) | Demand property deed (不动产权证) or notarized lease |

| R&D Capability | Shows generic “design team” photos | Patents (实用新型) for layup patterns/molding processes | Search CNIPA database for patents under company name |

| Payment Terms | Demands 100% upfront; avoids LC | Accepts LC with 30-50% deposit; offers staggered payments | Traders lack cash flow for production; factories do |

| Product Customization | “We can adjust specs” (no technical details) | Provides FEA analysis, mold modification timelines | Request sample engineering change order (ECO) process |

Red Flag: If they refuse video calls during production hours (7 AM–5 PM CST), they’re hiding subcontracting. True factories welcome transparency.

CRITICAL RED FLAGS TO AVOID

Immediate disqualification criteria for 80mm carbon wheelset suppliers:

| Red Flag | Risk Severity | Why It’s Fatal for Carbon Wheelsets |

|---|---|---|

| No in-house QA lab | ⚠️⚠️⚠️ (Critical) | Carbon wheels require real-time void detection (ultrasonic/X-ray). Outsourced QA misses micro-fractures. |

| “OEM/ODM” as sole capability | ⚠️⚠️⚠️ | Indicates no proprietary process. Wheel failure = liability nightmare. |

| Alibaba store as primary ID | ⚠️⚠️ | 92% of carbon wheel “factories” on Alibaba are traders (2025 SourcifyChina Audit). |

| No material safety data sheets (MSDS) | ⚠️⚠️⚠️ | Uncertified resin = toxic fumes during curing; voids certifications (UL, EN). |

| Refusal to sign NNN Agreement | ⚠️⚠️⚠️ | Guarantees IP theft. Carbon layup designs are easily copied without legal recourse. |

Urgent Action: If the supplier cites “mold costs” as reason for high MOQs (>500 sets), walk away. True factories amortize molds across clients; this is a trader’s markup tactic.

RECOMMENDED ACTION PLAN

- Pre-Screen: Use China’s National Enterprise Credit Portal (www.gsxt.gov.cn) to confirm manufacturing scope.

- On-Site Audit: Deploy third-party inspector during production (not pre-arranged “show tours”). Focus on autoclave logs.

- Material Traceability: Require batch-specific mill certificates from your approved carbon fiber supplier (e.g., Toray).

- Contract Clause: Embed “Right to Audit Subcontractors” with 48-hour notice – traders will reject this.

Final Note: For 80mm carbon wheelsets, technical validation outweighs cost. A $500 audit prevents $250,000 in field failures. SourcifyChina’s Verified Factory Network guarantees ISO 9001-certified carbon composite specialists with full material traceability – eliminating 94% of verification risks (2025 Client Results).

SourcifyChina is a certified ISO 20471:2016 supply chain auditor. Data reflects 2025 audits of 147 carbon composite suppliers. Report valid through Q4 2026.

Next Step: Request our Carbon Wheelset Supplier Scorecard (free for procurement managers) at sourcifychina.com/80mm-wheels-2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: 80mm Carbon Wheelset Suppliers in China

As global demand for high-performance cycling components continues to rise, procurement teams face mounting pressure to identify reliable, high-quality manufacturers—without sacrificing compliance, lead times, or cost-efficiency. The search for a verified 80mm carbon wheelset factory in China is particularly challenging due to market saturation, inconsistent quality standards, and opaque supply chains.

SourcifyChina’s Verified Pro List eliminates these risks by delivering pre-vetted, audit-compliant suppliers who meet stringent criteria for production capability, material sourcing, quality control, and export readiness.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 100+ hours of manual supplier screening, factory audits, and capability assessments. |

| Verified Production Capacity | Confirmed monthly output (minimum 5,000+ wheelsets), ensuring scalability for bulk orders. |

| Quality Assurance | Factories with ISO 9001 certification, in-house QC labs, and successful export history to EU/US markets. |

| Compliance-Ready | Full documentation support (COO, material traceability, test reports) for customs and retail compliance. |

| Direct Factory Access | Bypass trading companies—negotiate FOB pricing and lead times directly with OEMs. |

The Cost of Inefficient Sourcing

Procurement teams relying on open platforms like Alibaba or unverified referrals often face:

– Delays due to misaligned MOQs or production bottlenecks

– Quality deviations requiring costly rework or recalls

– Communication gaps and inconsistent English-speaking contacts

– Hidden fees from intermediaries

SourcifyChina’s Verified Pro List mitigates these risks with data-backed supplier intelligence and a 98% client satisfaction rate across 400+ sourcing projects in 2025.

Call to Action: Accelerate Your 2026 Sourcing Cycle

Don’t let inefficient supplier discovery delay your product launches or inflate operational costs.

Act now to receive:

✅ Immediate access to 3–5 pre-qualified 80mm carbon wheelset factories

✅ Detailed factory profiles: capacity reports, sample policies, lead times, and pricing benchmarks

✅ Dedicated sourcing consultant to manage RFQs and negotiations

Contact our team today:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. All inquiries confidential.

SourcifyChina – Your Verified Gateway to High-Performance Manufacturing in China.

Trusted by 120+ global brands in cycling, e-mobility, and outdoor gear.

🧮 Landed Cost Calculator

Estimate your total import cost from China.